#Jeff bezos net worth

Explore tagged Tumblr posts

Text

youtube

Jeff Bezos plans to divest 50 million Amazon shares by January 31st Next Year.

#bezos#jeff#bezos jeff#lauren sanchez#elon musk#musk#jeff bezos lauren sanchez#jeff bezos worth#bezos net worth#jeff bezos net worth#bezos amazon#amazon jeff bezos#yacht bezos#bill gates#bezos wife#jeff bezos yacht#jeff bezos wife#bezos girlfriend#bezos and lauren sanchez#jeff bezos girlfriend#jeffrey bezos#jeff bezos and lauren sanchez#zuckerberg#jeff bezos 2023#jeff bezos money#koru yacht#bianca and kanye#dwyane wade gabrielle union#jeff bezos vogue#bezos vogue

0 notes

Text

youtube

Jeff Bezos, the founder of Amazon, has indeed been involved in an extraordinary journey from building Amazon to venturing into space travel with his company Blue Origin. In this video, we'll discuss the story of Jeff Bezos and his extraordinary story of how he founded Amazon and helped to launch the space race.

👉 Subscribe to our channel to stay tuned: https://www.youtube.com/@LimitLessTec...

Jeff Bezos, born Jeffrey Preston Jorgensen on January 12, 1964, in Albuquerque, New Mexico, is a well-known entrepreneur and the founder of Amazon.com one of the world's largest and most successful online retail and technology companies. His life story is one of remarkable innovation and business success.

Jeff Bezos founded Amazon in 1994, initially as an online bookstore. His vision was to create an "everything store" where customers could find and purchase any item online. Over the years, Amazon expanded its offerings to include a wide range of products, services, and technologies, becoming one of the world's largest and most influential e-commerce companies.

In 2000, Jeff Bezos founded Blue Origin, a privately-funded aerospace manufacturer and spaceflight services company. Blue Origin's mission is to make space travel more accessible and affordable. The company focuses on developing technologies to enable commercial space travel and exploration.

Under Bezos' leadership, Amazon pioneered many innovations in the e-commerce industry, such as one-click purchasing, customer reviews, and personalized recommendations. The company's success led it to diversify into various sectors, including Amazon Web Services, Amazon Prime Video, Amazon Echo, and Alexa.

0 notes

Text

youtube

Jeff Bezos, the founder of Amazon, has indeed been involved in an extraordinary journey from building Amazon to venturing into space travel with his company Blue Origin. In this video, we'll discuss the story of Jeff Bezos and his extraordinary story of how he founded Amazon and helped to launch the space race. 👉 Subscribe to our channel to stay tuned: https://www.youtube.com/@LimitLessTec...

Jeff Bezos, born Jeffrey Preston Jorgensen on January 12, 1964, in Albuquerque, New Mexico, is a well-known entrepreneur and the founder of Amazon.com one of the world's largest and most successful online retail and technology companies. His life story is one of remarkable innovation and business success. Jeff Bezos founded Amazon in 1994, initially as an online bookstore. His vision was to create an "everything store" where customers could find and purchase any item online. Over the years, Amazon expanded its offerings to include a wide range of products, services, and technologies, becoming one of the world's largest and most influential e-commerce companies. In 2000, Jeff Bezos founded Blue Origin, a privately-funded aerospace manufacturer and spaceflight services company. Blue Origin's mission is to make space travel more accessible and affordable. The company focuses on developing technologies to enable commercial space travel and exploration.

#jeff bezos#jeff bezos extraordinary amazon to space travel story#from earth to the stars#jeff bezos net worth#jeff bezos amazon#jeff bezos interview#jeff bezos life story#jeff bezos success story#jeff bezos biography#the story of jeff bezos#best motivational video#jeff bezos motivation#jeff bezos documentary#limitless tech 888#Youtube

0 notes

Text

"After farmers, the next biggest group of investors is high net worth individuals, he said.

Bezos, the founder of Amazon, owns about 420,000 acres of U.S. farmland, according to media reports. Gates, co-founder of Microsoft, has nearly 270,000 acres. The United States has more than 895 million acres of land in farms, the USDA has reported.

About 60 percent of farmland sales through Halderman Real Estate Services are to farmers, said Howard Halderman, the company’s president. Forty percent are to investors. Of that 40 percent, 38 percent want to own farmland because they grew up on a farm. Two percent are institutional buyers, such as endowments and pensions."

Article by a farm management / real estate firm. I suspect there is more to the story.

#US farm land#investors buying farm land#jeff bezos#bill gates#the billionaires#high net worth individuals#institutional farms

0 notes

Text

जेफ बेजोस ने महज 28 महीनों में बना डाला लॉस का रिकॉर्ड, जानें नेटवर्थ में कितने की आई कमी

Jeff Bezos: दुनिया के दूसरे सबसे अमीर कारोबारी और दुनिया की सबसे बड़ी ई-कॉमर्स कंपनी के मालिक जेफ बेजोस ने करीब 28 महीने के बाद नुकसान का बड़ा रिकॉर्ड बनाया है. कंपनी के शेयरों में बड़ी गिरावट के बाद मार्केट कैपन में 130 अरब डॉलर से ज्यादा का नुकसान हो गया है. वहीं दूसरी ओर दुनिया के दूसरे सबसे अमीर कारोबारी जेफ बेजोस की नेटवर्थ में 15 अरब डॉलर से ज्यादा का नुकसान हुआ है. गौर करने वाली बात तो ये…

0 notes

Text

Jeff Bezos's Net Worth in 2024

Explore Jeff Bezos’s Net Worth in 2024, featuring an in-depth breakdown of his salary—revealing the precise figure that shapes his wealth and also career highlights, income sources, investments, personal life, and prospects. It effectively delves into Jeff Bezos’s background, achievements, and challenges and provides valuable insights into his financial journey. Gain unparalleled insights into…

View On WordPress

#Amazon CEO#Amazon Founder#Bezos Business#Bezos Finances#Bezos Financial News#Bezos Financials#Bezos Wealth#Bezos Wealth Growth#Billionaire Bezos#Jeff Bezos Earnings#Jeff Bezos Economic Impact#Jeff Bezos Fortune#Jeff Bezos Investments#Jeff Bezos Success#Jeff Bezos&039;s Income#Jeff Bezos&039;s Net Worth#Jeff Bezos&039;s Net Worth in 2024#Jeff Bezos&039;s Salary#Net Worth of Jeff Bezos#Wealthy Entrepreneur

1 note

·

View note

Text

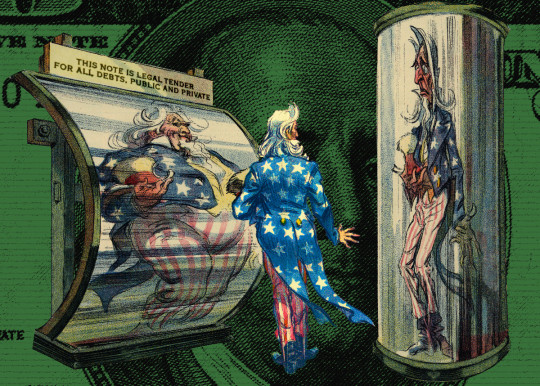

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

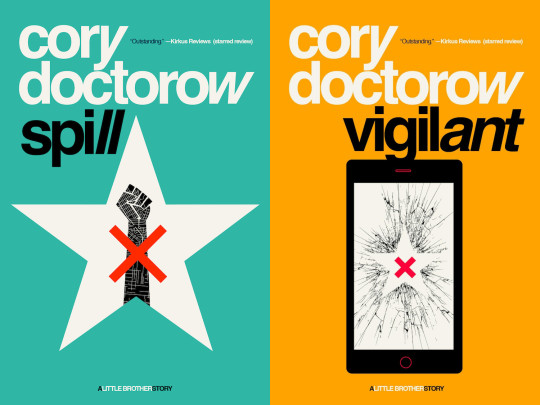

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Link

Amazon's stock took a big hit in the past year, sending Jeff Bezos' net worth down $57 billion, but he's still the third-richest person in the world.

#Jeff Bezos was the biggest net-worth loser in the last year#with his fortune dropping $57 billion#according to Forbes

0 notes

Text

How rich is Tony Stark?

Throughout his superhero career, Tony's net worth in the MCU has always been between $10 and $20 billion. How much is that? Let's talk about Tony Stark's real financial resources and purchasing power.

The numbers themselves don't tell us anything, so we'll compare. Some real billionaires are much richer than him (Elon Musk - $210 billion, Jeff Bezos - $195 billion, Bill Gates - $129 billion). Huge difference, don't you think?

Let's list Tony's expenses: he founded and funded Damage Control. He covered the cost of the destruction caused not only by the Avengers, but by everyone they fought. He funded scientific projects and charitable foundations. He covered all the Avengers' expenses (compound, equipment, tech, vehicles, quinjets, food, medical and legal services, staff, team members' salaries, etc.). He made Iron Man suits and equipment for himself, Peter, Rhodey, and later Pepper. It takes a LOT of money to cover all of this. And it's all pure expense. He didn't make any profit from it.

Reminder: He's not nearly as rich as Musk, Bezos or Gates. How much can these guys do, buy and finance? Less than you think. Now divide by 10 to get an idea of how much Tony could.

I'll help you: we'll count in Helicarriers. Let's say Tony had $20 billion (that's max). The price of one real aircraft carrier is 13 billion dollars. Helicarriers, even the basic ones (from The Avengers and AoU), are much more advanced (they fly, have retro-reflective panels that cover them entirely, and have a fancy interior with expensive equipment on board). It will cost much more. Let's give it a price tag of $20 billion. That is - Tony could only buy 1 Helicarrier and get $0 in his bank accounts.

Or another example: how much did the Battle of New York cost? Secretary Ross showed us - $88 billion in property damage. Tony would need another $70 billion to cover the cost of this one battle.

BUT let me tell you, his $10-20 billion isn't even real money. It's net worth. He would never have seen that $10-20 billion in cash or been able to use it. Because these are assets: shares and property he had. He would have to sell them, then pay taxes, and only then would he see the actual amount of money he could use. Which is about half of the net worth - $5-10 billion. Thus, his purchasing power would amount to a small insignificant fraction of the Battle of New York, or 0 Helicarriers, or even 0 real-life aircraft carriers. That's it. This is why the Avengers never had their own Helicarrier - Tony COULD NOT AFFORD ONE.

He didn't have unlimited resources. He couldn't buy everything. Stop imagining him as Scrooge McDuck. He had to work several jobs to provide for the team and protect the Earth. Alone. Where were Thor and Black Panther's resources?

Conclusion: no, Tony wasn't that rich. He worked his butt off to be a wallet of Earth's protection, in addition to being its shield. Remember that.

104 notes

·

View notes

Text

youtube

Jeff Bezos, the founder of Amazon, has indeed been involved in an extraordinary journey from building Amazon to venturing into space travel with his company Blue Origin. In this video, we'll discuss the story of Jeff Bezos and his extraordinary story of how he founded Amazon and helped to launch the space race.

From Earth to The Stars: Jeff Bezos Extraordinary Amazon to Space Travel Story

#jeff bezos#jeff bezos extraordinary amazon to space travel story#from earth to the stars#jeff bezos net worth#jeff bezos amazon#jeff bezos interview#jeff bezos life story#jeff bezos success story#jeff bezos biography#jeff bezos lifestyle#story of jeff bezos#blue origin#the story of jeff bezos#amazon empire#best motivational video#jeff bezos motivation#jeff bezos documentary#limitless tech 888#jeff bezos story#life story of jeff bezos#jeff bezos journey#Youtube

0 notes

Text

We think the richest people on Earth are tech people (true) and celebrities but in reality the ranks of billionaires are made up mainly of people who own random ass companies you've never heard of, or rarely think of. Whenever I tell someone that there are tech-CEO-level billionaires who own regional chain stores I get disbelief but like

The seventy-ninth richest man in the world is John Menard Jr. His net worth is slightly higher than the head of Alibaba. John Menard is a major player in conservative politics. And he owns a chain of 300 some regional home improvement stores that have yet to expand out of the Midwest. When you picture A Billionaire, a lot more of them look like John Menard than look like Jeff Bezos

131 notes

·

View notes

Text

NGL, I come from a place of privilege, given that I am under 25 and have no debt.

I have about $30,000 in assets - just my savings, car, tech, jewelry, and all my worldly goods that could be resold put together, at their current value. If I lost that 30k, which is really just (one) medical emergency away from bankruptcy, I would have to strip everything for the cash. In just cash alone, I'm not even close enough for a downpayment on a starter home, a multi year endeavor.

By comparison, millionaires such as Lady Gaga (130 million) and Keanu Reeves (380 million) are far above me. To be on the same level, I would have to earn and retain in financial or asset form, $129,970,000 or $379,970,000 respectively. Anything I spent on rent, insurance, gas, food, medicine, and other consumables that can't be resold doesn't count towards that net worth total.

That's a lot. But this pales in comparison to billionaires such as Jeff Bezos (117 billion) and Elon Musk (191 billion). I would have to retain $116,999,970,000 and $190,999,970,000 respectively. At my current income of $50k, which is above the median income for people with my level of education, assuming I magically don't need to spend any money on consumables and can just bank it all:

It would take me 2,599 years and 146 days to obtain Lady Gaga's wealth, or almost 26 CENTURIES.

It would take me 7,599 years and 146 days to obtain Keanu Reeve's wealth, or almost 76 CENTURIES.

It would take me 2,339,999 years and 146 days to obtain Jeff Bezo's wealth, or almost 2,340 MILLENIA.

It would take me 3,899,999 years to obtain Elon Musk's wealth. It would take me nearly 3,900 MILLENIA.

Oh, this is after having paid off all my debt and with my existing assets, by the way. For even Lady Gaga, the least wealthy of this list, I would have to work tirelessly from before the Roman Empire was even founded.

But that's just me, a college-educated middle-class American citizen who is both debt and child-free.

It's much more fascinating to compare these to each other.

Lady Gaga makes $25 million a year.

Keanu Reeves makes $40 million a year.

So, if I deduct what these millionaires already have in assets and divide the total of the billionaire's assets by their income to find how many years of just banking money (no consumables):

Lady Gaga would have to bank another $116,870,000,000 to have Jeff Bezo's wealth. Assuming she stops spending on consumables like food or whatever and every penny of her $25 million income goes into future asset wealth, it would still take Lady Gaga 4,674 years and 293 days for her to obtain Bezo's wealth.

Keanu Reeves would have to bank another $190,620,000,000 to achieve Elon Musk's wealth. Again, in a fantasy world where Keanu doesn't have to feed and clothe himself, it would take him 4,765 years and 6 months to obtain Elon Musk's wealth.

The gap between the assets of famous multimillionaires like Lady Gaga and Keanu Reeves (who make MILLIONS every year) and that of famous multi-billionaires is a little less than HALF what it would take me to become as wealthy as Lady Gaga at my income level, which is, again, above the median. I could never achieve that wealth in my entire fucking lifetime, because, even if I assumed my income would go up and actually outpace inflation, I still need to eat and I can only use my body for labor until I'm 80, tops, which is only 56 years of work and nowhere near the thousands.

This sounds very conspiracy-brain, but sometimes I think the United States deliberately undermines math education and the corresponding understanding of how to problem-solve and comprehend magnitude of these kinds of numbers. Because if kids sat down and did the math, they just might realize that there is no way to become this rich on your own hard work.

Sure, you can invest in the stock market - but that's gambling. Most people might be able to hamper the effects of inflation on their asset values with stock investment.

The American dream is a lie.

The middle class is closer to becoming homeless than they are to becoming multimillionaires.

Even multimillionaires are closer to becoming middle class or even homeless than they are to becoming multi-billionaires.

Don't fucking tell me to budget and I'll become a millionaire. It's more likely I'll get hit by lightning or lose it all to medical bills.

If this doesn't radicalize you, I don't know what will.

#anti capitalism#late stage capitalism#billionaires should not exist#elongated muskrat#fuck jeff bezos#us politics#economics#math#budget#yip speaks

772 notes

·

View notes

Text

Judd Legum at Popular Information:

Jeff Bezos is the second-richest person in the world, with a net worth of approximately $211 billion. Most of Bezos' wealth is derived from his 9% stake in Amazon, the company he founded. Bezos also founded and owns Blue Origin, a private space exploration company worth billions. Bezos also owns the Washington Post, which he purchased in 2013 for $250 million in cash. Is Bezos now making decisions at the Washington Post to protect and enhance the value of his other enterprises? Many current and former employees of the Washington Post believe so.

[...] The Washington Post, unlike Amazon and Blue Origin, has been a money loser for Bezos, reportedly running a deficit of $100 million last year. More importantly, Bezos believes that former President Trump's hostility toward the Washington Post, which produced critical coverage of Trump's presidency, cost his companies billions in government contracts.

[...] On Friday, days before the election, Washington Post publisher William Lewis — installed by Bezos earlier this year — announced that "the Washington Post will not be making an endorsement of a presidential candidate in this election." The announcement, less than 2 weeks before Election Day, was a break from decades of precedent. Bezos made the decision, according to the New York Times, after the Washington Post "editorial board had already drafted an endorsement of Vice President Kamala Harris." Marty Baron, the former Executive Editor of the Washington Post, slammed Bezos' decision as "cowardice" and linked it to Bezos' desire to appease Trump. Baron said it would backfire, and Trump would "see this as an invitation to further intimidate owner [Bezos]." Hours after Lewis published the announcement, Trump was seen meeting with Blue Origin CEO David Limp. Steven Cheung, the Trump campaign's chief spokesman, embraced the suggestion that the meeting and the announcement of the non-endorsement were linked.

[...]

The billionaire owner of the LA Times

Patrick Soon-Shiong, the billionaire owner of the LA Times, also abruptly demanded his publication stay neutral in the presidential election. Soon-Shiong bought the paper for $500 million in 2018. Soon-Shiong is a healthcare and biotech entrepreneur whose companies rely on the federal government. His companies regularly seek FDA approval for new drugs, vaccines and therapies and federal funding for research.

The editorial board had planned to endorse Kamala Harris and publish a series of columns tentatively titled "The Case Against Trump." But in a post on X, Soon-Shiong said he offered the LA Times editorial board "the opportunity to draft a factual analysis of all the POSITIVE AND NEGATIVE policies by EACH candidate during their tenures at the White House, and how these policies affected the nation." Soon-Shiong said that "[i]nstead of adopting this path as suggested, the Editorial Board chose to remain silent and I accepted their decision." Soon-Shiong did not explain why he did not demand a similar approach for U.S. House and Senate races, state ballot initiatives, and many other contests facing California voters. Beginning in September, the LA Times has endorsed in dozens of races up and down the ballot.

In response to the spiking of the presidential endorsement, 200 LA Times staff members signed an open letter calling on Soon-Shiong to "provide readers with an explanation for not issuing an endorsement, along with clarity about the broader endorsement process." Three members of the paper's editorial board have resigned. "I am resigning because I want to make it clear that I am not okay with us being silent," Mariel Garza, the LA Times editorials editor, said. "In dangerous times, honest people need to stand up. This is how I’m standing up."

Cowardly billionaire media owners have shunned common sense by taking a pass on endorsing Kamala Harris, such as the Washington Post and LA Times.

#Jeff Bezos#Blue Origin#Amazon#The Washington Post#Media Ethics#Endorsements#Media Bias#Newspapers#Editorials#2024 Presidential Election#2024 Elections#William Lewis#Marty Baron#Patrick Soon Shiong#Los Angeles Times

9 notes

·

View notes

Text

jeff bezos should just personally give me 10,000 dollars . it would be less than 0.000005% of his net worth.

#yes i did the calculation#and then i just stared at it for like 5 minutes because that is INSANE#literally why am i working 7 days a week to make 13-15 dollars an hour#that is one (1) trip to dunkin per hour#maybe two if i don’t get food.#actually fucking ridiculous. i hate capitalism

15 notes

·

View notes

Text

The statute of limitations on theft should be (percent of the victim’s net worth that you stole) x (50 years). Stole Jeff Bezos’s car? You better run fast, he’s got about 6 seconds to take you to trial

18 notes

·

View notes