#Inflation Rates

Explore tagged Tumblr posts

Text

#Politics#Election#Government#Policy changes#Political parties#International relations#Diplomacy#Legislation#Election results#Political crisis#Leaders and candidates#2. Technology#AI (Artificial Intelligence)#5G#Cybersecurity#Tech innovations#Startups#Blockchain#Social media trends#Robotics#VR/AR (Virtual/Augmented Reality)#Software updates#3. Economy#Stock market#Inflation rates#Unemployment#GDP growth#Recession#Cryptocurrency#Interest rates

1 note

·

View note

Text

Wholesale Inflation Rises for Fourth Straight Month in June to 3.36% Due to Costlier Vegetables

Wholesale inflation in India has increased for the fourth consecutive month, reaching 3.36% in June. This rise is primarily attributed to the soaring prices of food articles, especially vegetables, along with manufactured items.

The wholesale price index (WPI)-based inflation stood at 2.61% in May, marking a significant increase from the -4.18% recorded in June 2023.

According to the Ministry of Commerce & Industry, "The positive rate of inflation in June 2024 is primarily due to the increase in prices of food articles, manufacture of food products, crude petroleum & natural gas, mineral oils, other manufacturing, etc."

Key Highlights from the Data:

Food Articles Inflation: Increased to 10.87% in June from 9.82% in May.

Vegetables Inflation: Jumped to 38.76% in June from 32.42% in May.

Onion Inflation: Surged to 93.35%.

Potato Inflation: Rose to 66.37%.

Pulses Inflation: Climbed to 21.64%.

Fuel and Power Basket Inflation: Slightly decreased to 1.03% in June from 1.35% in May.

Manufactured Products Inflation: Increased to 1.43% in June from 0.78% in May.

The rise in wholesale inflation aligns with the retail inflation data for June, which saw retail inflation climb to a four-month high of 5.1%.

The Reserve Bank of India (RBI) primarily considers retail inflation when framing its monetary policy, indicating that the increasing inflation rates could influence future policy decisions.

0 notes

Text

Why is the CAD to INR Exchange Rate Down today on 30th June 2023 (2nd half of June 2023)?

Key points:

Canada Dollar to Indian Rupee Exchange Rate decreases.

The Bank of Canada has recently decided to increase interest rates.

Based on our financial analysis, it is anticipated that the interest rates in India will experience a 25 basis point surge by 2023. This upward movement will increase the current rate of 6.5 percent, aligning it with the projected level.

Both the Indian and Canadian economies have witnessed a notable uptick in inflation and unemployment rates in recent times.

As of the reporting date of June 30, 2023, it is observed that the Canadian dollar has demonstrated a positive trend in value relative to the Indian rupee, as evidenced by the prevailing exchange rate of 1 CAD to 60 INR. The observed appreciation can be ascribed to the sustained upward trajectory of the Canadian dollar's value throughout the years. In the latter part of June 2023, the exchange rate between the two currencies experienced significant volatility, exhibiting fluctuations ranging from a high point of 62.44 to a low end of 61.35. The standard deviation of the trend curve has been determined to be 0.135 rupees. The Canadian dollar has experienced a notable appreciation in response to recent fluctuations in the exchange rate.

The product has experienced a substantial decline in its price, plummeting from 5055 rupees to a mere 60 rupees. The potential for asset overvaluation may be attributed to trade deficits or abrupt increases in demand and pricing for petroleum products. Read More

0 notes

Text

#Amid High Inflation Rates#Amid Inflation Rates#High Inflation Rates#Inflation Rates#Best Alternatives of Fixed Deposits#Alternatives of Fixed Deposits

0 notes

Text

#actually not a bad explanation#remember kids: inflation compounds#so unless the inflation rate is actually negative it's still getting worse even when the number is smaller

557 notes

·

View notes

Text

presented without comment or context

Source

#this stream had it all. feet. toes. piss. sniffing. sonic inflation. naked stream. this. whatever this is.#did i miss anything#i had to watch this over the course of 3 days. 7 hours.#this is not the worst bit. somehow. i think the duke poop rating bit was the worst. overall. in general.#<- do Not ask me for a timestamp or source for that. I never wrote it down. It was an old quake champions stream thats all i know#I AM NOT PUTTING THIS IN THE TAG I CANT DO THAT TO PEOPLE#video

337 notes

·

View notes

Text

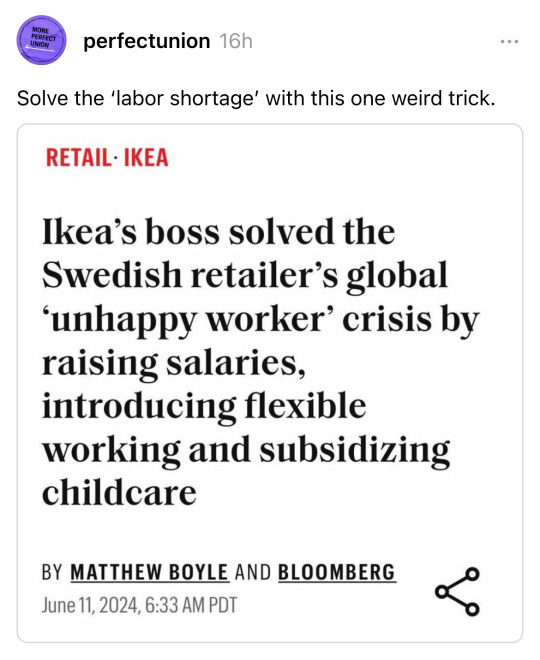

#employee turnover#increasing wages#worker flexibility#staff workflow#ikea#employee retention#retail industry#covid-19 pandemic#inflation impact#union conflicts#employee benefits#jon abrahamsson ring#inter ikea group#employee satisfaction#global quit rate#childcare benefits#labor market#labor disputes#retail sector#workplace changes

147 notes

·

View notes

Text

delayed side effects 🍬

everyone goes a little crazy for me drawing her so this is for you guys, even though i've also been brainrotting over them for awhile

#belly kink#stuffing kink#inflation kink#body expansion#biggening over the course of a few days is severally under rated imo#also everyone should watch episode 21 of i.mpulse's h.c season 8#them <333#prlscntmn#hrmtcrft

511 notes

·

View notes

Text

fucking HECS debt…

#my student loans are gonna increase by over 4% this year bc Australias inflation rate is spiralling way out of control#and I’m so so livid about it I swear to fucking god

63 notes

·

View notes

Text

yeah i don't think this is the kind of advertising rachel needs right now-

#again rachel doesn't really have anything to do directly with this situation BUT#cait still included LO as one of the series she inflated the rating of with 5 stars alongside her own book#correlation doesn't equal causation#but it's still really telling that these are the kinds of works cait simps for to the point of RATING THEM HIGHLY IN HER REVIEW BOMBING#when they're really so problematic and controversial at their core#and are laced with so much casual misogyny and racism#the latter of which cait has a LOT of#though 'casual' racism is really understating it#she promoted herself from casual to competitive ranked racism#and yeah that includes touch of darkness as well which she also rated high with her alts and it's literally just LO: The Wattpad Novel#cait corrain#oh and sidenote#her 'apology' was not a real apology at ALL lmao#it literally opened up IMMEDIATELY with her using her medication as an excuse#for RACISM#watch out y'all you don't wanna take the depression meds that come with racism as a side effect /s#lore olympus critical#lo critical#anti lore olympus

142 notes

·

View notes

Text

Deborah Seymour, from Scarborough, has been diagnosed with illnesses including Long Covid and ME, but despite tests no physical cause has been found for other symptoms including severe head and neck pain.

[...]

Ms Seymour's family said her health has been deteriorating since she first caught Covid-19 in December 2020 and for the past two years has been confined to bed in a darkened room at her mother's house. The family said she lives in constant pain, is unable to sit or stand and is so hypersensitive to light that she wears a blindfold.

Yup, that sounds like severe/very severe ME alright.

Ms Seymour had two emergency admissions to Scarborough Hospital last year but doctors were unable to find a physical cause for her symptoms on each occasion.

Following the first admission in April 2023, for shaking, back pain and sensitivity to light and sound, it was suggested some of her symptoms might have a psychological element – but her family say she was assessed and discharged by the mental health team.

Then in September 2023, following the second hospital admission for headaches and neck pain, doctors diagnosed "functional symptoms", stating there was "no clear evidence of a medical pathology".

Doctor pro-tip: people do not become and remain bedbound for months to years on account of "functional symptoms" you dense motherfuckers. Do you really think people are just doing this? That they just need to snap out of it? Fuck you.

Someone really needs to write a history on how functional symptoms went from being widely thought of as transitory, temporary conditions (e.g. temporary paralysis/loss of function, hysterical blindness/deafness) typically brought on by extreme acute stress which either spontaneously resolved themselves within weeks or responded rapidly to treatment, to how they are perceived of and used now, as a chronic condition and a punishment diagnosis for any patient deemed too difficult. I mean, I started to write a little bit on that, but frankly, no one is paying me to write it and my energy and focus for anything outside of essentials (bathing, cooking/eating, cleaning, cuddling my girlfriend) is pretty limited so my motivation is pretty low.

#link#article#me/cfs#chronic illness#remember that episode of band of brothers where pvt. blithe suddenly can't see? but then it resolves after rest + psychological support?#that's what was traditionally known as a functional symptom.#“FND” as it's commonly defined does not exist. studies on prevalence rates inflated prevalence over eightfold.#FND diagnostic criteria are garbage. something like two-thirds of patients diagnosed with FND go on to receive a biomedical diagnosis.#the remaining third are the patients who drink the kool-aid and they are saddest and most pathetic people on the planet.

15 notes

·

View notes

Text

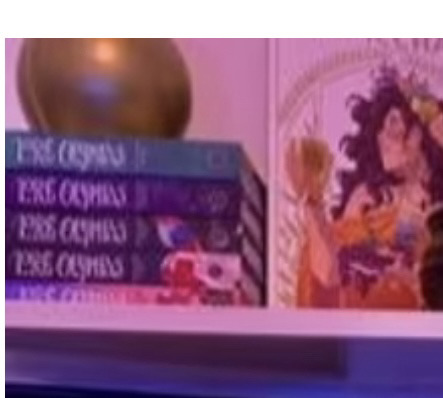

Why the Fed wants to crush workers

The US Federal Reserve has two imperatives: keeping employment high and inflation low. But when these come into conflict — when unemployment falls to near-zero — the Fed forgets all about full employment and cranks up interest rates to “cool the economy” (that is, “to destroy jobs and increase unemployment”).

An economy “cools down” when workers have less money, which means that the prices offered for goods and services go down, as fewer workers have less money to spend. As with every macroeconomic policy, raising interest rates has “distributional effects,” which is economist-speak for “winners and losers.”

Predicting who wins and who loses when interest rates go up requires that we understand the economic relations between different kinds of rich people, as well as relations between rich people and working people. Writing today for The American Prospect’s superb Great Inflation Myths series, Gerald Epstein and Aaron Medlin break it down:

https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

Recall that the Fed has two priorities: full employment and low interest rates. But when it weighs these priorities, it does so through “finance colored” glasses: as an institution, the Fed requires help from banks to carry out its policies, while Fed employees rely on those banks for cushy, high-paid jobs when they rotate out of public service.

Inflation is bad for banks, whose fortunes rise and fall based on the value of the interest payments they collect from debtors. When the value of the dollar declines, lenders lose and borrowers win. Think of it this way: say you borrow $10,000 to buy a car, at a moment when $10k is two months’ wages for the average US worker. Then inflation hits: prices go up, workers demand higher pay to keep pace, and a couple years later, $10k is one month’s wages.

If your wages kept pace with inflation, you’re now getting twice as many dollars as you were when you took out the loan. Don’t get too excited: these dollars buy the same quantity of goods as your pre-inflation salary. However, the share of your income that’s eaten by that monthly car-loan payment has been cut in half. You just got a real-terms 50% discount on your car loan!

Inflation is great news for borrowers, bad news for lenders, and any given financial institution is more likely to be a lender than a borrower. The finance sector is the creditor sector, and the Fed is institutionally and personally loyal to the finance sector. When creditors and debtors have opposing interests, the Fed helps creditors win.

The US is a debtor nation. Not the national debt — federal debt and deficits are just scorekeeping. The US government spends money into existence and taxes it out of existence, every single day. If the USG has a deficit, that means it spent more than than it taxed, which is another way of saying that it left more dollars in the economy this year than it took out of it. If the US runs a “balanced budget,” then every dollar that was created this year was matched by another dollar that was annihilated. If the US runs a “surplus,” then there are fewer dollars left for us to use than there were at the start of the year.

The US debt that matters isn’t the federal debt, it’s the private sector’s debt. Your debt and mine. We are a debtor nation. Half of Americans have less than $400 in the bank.

https://www.fool.com/the-ascent/personal-finance/articles/49-of-americans-couldnt-cover-a-400-emergency-expense-today-up-from-32-in-november/

Most Americans have little to no retirement savings. Decades of wage stagnation has left Americans with less buying power, and the economy has been running on consumer debt for a generation. Meanwhile, working Americans have been burdened with forms of inflation the Fed doesn’t give a shit about, like skyrocketing costs for housing and higher education.

When politicians jawbone about “inflation,” they’re talking about the inflation that matters to creditors. Debtors — the bottom 90% — have been burdened with three decades’ worth of steadily mounting inflation that no one talks about. Yesterday, the Prospect ran Nancy Folbre’s outstanding piece on “care inflation” — the skyrocketing costs of day-care, nursing homes, eldercare, etc:

https://prospect.org/economy/2023-01-18-inflation-unfair-costs-of-care/

As Folbre wrote, these costs are doubly burdensome, because they fall on family members (almost entirely women), who have to sacrifice their own earning potential to care for children, or aging people, or disabled family members. The cost of care has increased every year since 1997:

https://pluralistic.net/2023/01/18/wages-for-housework/#low-wage-workers-vs-poor-consumers

So while politicians and economists talk about rescuing “savers” from having their nest-eggs whittled away by inflation, these savers represent a minuscule and dwindling proportion of the public. The real beneficiaries of interest rate hikes isn’t savers, it’s lenders.

Full employment is bad for the wealthy. When everyone has a job, wages go up, because bosses can’t threaten workers with “exile to the reserve army of the unemployed.” If workers are afraid of ending up jobless and homeless, then executives seeking to increase their own firms’ profits can shift money from workers to shareholders without their workers quitting (and if the workers do quit, there are plenty more desperate for their jobs).

What’s more, those same executives own huge portfolios of “financialized” assets — that is, they own claims on the interest payments that borrowers in the economy pay to creditors.

The purpose of raising interest rates is to “cool the economy,” a euphemism for increasing unemployment and reducing wages. Fighting inflation helps creditors and hurts debtors. The same people who benefit from increased unemployment also benefit from low inflation.

Thus: “the current Fed policy of rapidly raising interest rates to fight inflation by throwing people out of work serves as a wealth protection device for the top one percent.”

Now, it’s also true that high interest rates tend to tank the stock market, and rich people also own a lot of stock. This is where it’s important to draw distinctions within the capital class: the merely rich do things for a living (and thus care about companies’ productive capacity), while the super-rich own things for a living, and care about debt service.

Epstein and Medlin are economists at UMass Amherst, and they built a model that looks at the distributional outcomes (that is, the winners and losers) from interest rate hikes, using data from 40 years’ worth of Fed rate hikes:

https://peri.umass.edu/images/Medlin_Epstein_PERI_inflation_conf_WP.pdf

They concluded that “The net impact of the Fed’s restrictive monetary policy on the wealth of the top one percent depends on the timing and balance of [lower inflation and higher interest]. It turns out that in recent decades the outcome has, on balance, worked out quite well for the wealthy.”

How well? “Without intervention by the Fed, a 6 percent acceleration of inflation would erode their wealth by around 30 percent in real terms after three years…when the Fed intervenes with an aggressive tightening, the 1%’s wealth only declines about 16 percent after three years. That is a 14 percent net gain in real terms.”

This is why you see a split between the one-percenters and the ten-percenters in whether the Fed should continue to jack interest rates up. For the 1%, inflation hikes produce massive, long term gains. For the 10%, those gains are smaller and take longer to materialize.

Meanwhile, when there is mass unemployment, both groups benefit from lower wages and are happy to keep interest rates at zero, a rate that (in the absence of a wealth tax) creates massive asset bubbles that drive up the value of houses, stocks and other things that rich people own lots more of than everyone else.

This explains a lot about the current enthusiasm for high interest rates, despite high interest rates’ ability to cause inflation, as Joseph Stiglitz and Ira Regmi wrote in their recent Roosevelt Institute paper:

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdf

The two esteemed economists compared interest rate hikes to medieval bloodletting, where “doctors” did “more of the same when their therapy failed until the patient either had a miraculous recovery (for which the bloodletters took credit) or died (which was more likely).”

As they document, workers today aren’t recreating the dread “wage-price spiral” of the 1970s: despite low levels of unemployment, workers wages still aren’t keeping up with inflation. Inflation itself is falling, for the fairly obvious reason that covid supply-chain shocks are dwindling and substitutes for Russian gas are coming online.

Economic activity is “largely below trend,” and with healthy levels of sales in “non-traded goods” (imports), meaning that the stuff that American workers are consuming isn’t coming out of America’s pool of resources or manufactured goods, and that spending is leaving the US economy, rather than contributing to an American firm’s buying power.

Despite this, the Fed has a substantial cheering section for continued interest rates, composed of the ultra-rich and their lickspittle Renfields. While the specifics are quite modern, the underlying dynamic is as old as civilization itself.

Historian Michael Hudson specializes in the role that debt and credit played in different societies. As he’s written, ancient civilizations long ago discovered that without periodic debt cancellation, an ever larger share of a societies’ productive capacity gets diverted to the whims of a small elite of lenders, until civilization itself collapses:

https://www.nakedcapitalism.com/2022/07/michael-hudson-from-junk-economics-to-a-false-view-of-history-where-western-civilization-took-a-wrong-turn.html

Here’s how that dynamic goes: to produce things, you need inputs. Farmers need seed, fertilizer, and farm-hands to produce crops. Crucially, you need to acquire these inputs before the crops come in — which means you need to be able to buy inputs before you sell the crops. You have to borrow.

In good years, this works out fine. You borrow money, buy your inputs, produce and sell your goods, and repay the debt. But even the best-prepared producer can get a bad beat: floods, droughts, blights, pandemics…Play the game long enough and eventually you’ll find yourself unable to repay the debt.

In the next round, you go into things owing more money than you can cover, even if you have a bumper crop. You sell your crop, pay as much of the debt as you can, and go into the next season having to borrow more on top of the overhang from the last crisis. This continues over time, until you get another crisis, which you have no reserves to cover because they’ve all been eaten up paying off the last crisis. You go further into debt.

Over the long run, this dynamic produces a society of creditors whose wealth increases every year, who can make coercive claims on the productive labor of everyone else, who not only owes them money, but will owe even more as a result of doing the work that is demanded of them.

Successful ancient civilizations fought this with Jubilee: periodic festivals of debt-forgiveness, which were announced when new monarchs assumed their thrones, or after successful wars, or just whenever the creditor class was getting too powerful and threatened the crown.

Of course, creditors hated this and fought it bitterly, just as our modern one-percenters do. When rulers managed to hold them at bay, their nations prospered. But when creditors captured the state and abolished Jubilee, as happened in ancient Rome, the state collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Are we speedrunning the collapse of Rome? It’s not for me to say, but I strongly recommend reading Margaret Coker’s in-depth Propublica investigation on how title lenders (loansharks that hit desperate, low-income borrowers with triple-digit interest loans) fired any employee who explained to a borrower that they needed to make more than the minimum payment, or they’d never pay off their debts:

https://www.propublica.org/article/inside-sales-practices-of-biggest-title-lender-in-us

[Image ID: A vintage postcard illustration of the Federal Reserve building in Washington, DC. The building is spattered with blood. In the foreground is a medieval woodcut of a physician bleeding a woman into a bowl while another woman holds a bowl to catch the blood. The physician's head has been replaced with that of Federal Reserve Chairman Jerome Powell.]

#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters

463 notes

·

View notes

Text

Thinking about how disgustingly rich Jack Harkness is

#doctor who#torchwood#jack harkness#captain jack harkness#he is just exploiting the inflation rate#not only does he get the paycheck from the queen herself#but has been since that queen was queen victoria

22 notes

·

View notes

Text

WAWAWAWAWAAAAAA!?!??!?!?!??!

THANK YOU SO MUCH ?!?!??!???!?!?!

I JUST WOKE UP AND ALL AND IM JUST SO ?!??!?! 💕💕💕💕 THANK YOU SO MUCH TO EVERYONE WHO DONATED !!!! IM JUST SO GRATEFUL FOR YOU ALL !!!!

#after classes today i'll head to the supermarket !!! and get some food 🥺🥺#hopefully i can get enough food to feed me for the rest of the week and a bit of next week!!!!#although the goal is $30 - its an estimation without taking into account of inflation rate BJHREFJBHERF#SO I DO HOPE ITS ENOUGH BUT EVEN SO THANK YOU THANK YOU !!!#dean rambles#important updates#IM LITERALLY ON THE FLOOR I LOVE YOU ALL

13 notes

·

View notes

Text

dream is the funniest man alive argue with the wall

8 notes

·

View notes

Text

biannual post ranting about everskies' economy 💔

#i swear to god they need to either improve the framework or ux or literally anything because the community part is not salvageable#releasing every new set as time-limited with paid currency so rich people can bulk buy it to resell it to even richer people in 3 months#AND blocking off the only way to get paid currency f2p so now everyone is begging for money and doing obvious sockpuppet money laundering#AND THE INFLATIONNNNNNNN in 2022 i wrote down a 1:100 exchange rate and it is currently 1:350 thats 250 PERCENT INFLATION OVER 2 YEARS#and im still not over them capping the amount of free currency you can get per game that literally halved my income and wasted so much time#with the amount of people with the paid pass going around you would think they could hire an economist. just print more money

5 notes

·

View notes