#Indirect tax collection

Text

Celebrating Success: Indirect Tax Collection Surpasses Expectations in FY24

In a recent announcement, the Central Board of Indirect Taxes and Customs (CBIC) has revealed that the indirect tax collections for the Financial Year 2023–24 have surpassed the Revised Estimates (RE) by a significant margin. This achievement, attributed to the diligent efforts of tax officials, has been lauded by CBIC Chairman Sanjay Kumar Agarwal, who described it as a testament to professionalism, teamwork, and perseverance within the CBIC community.

Exceeding the revised estimate of Rs 14.84 lakh crore, the indirect tax collection for FY24 has been described as exceeding expectations. This remarkable feat was made possible by a record Goods and Services Tax (GST) mop-up, marking a milestone in revenue generation for the government.

Chairman Agarwal expressed his appreciation for the relentless efforts of every member of the CBIC, acknowledging their invaluable contributions throughout the year. The gross GST collection for 2023–24 stood at Rs 20.18 lakh crore, representing a substantial increase from the previous year’s figures.

The targets set for central GST, excise duty, and customs were also surpassed, reflecting the robustness of India’s tax revenue system. Despite the challenges posed by the global economic landscape, India’s economy has demonstrated resilience, recording a world-leading growth rate. According to estimates by the National Statistical Office (NSO), India is projected to grow at 7.6% in 2023–24, fueled by domestic consumption and government expenditure.

The consecutive quarters of over 8% growth from April to December underscore the country’s economic momentum. Various agencies, including SBI Research and Moody’s, expect GDP growth for FY24 to be around 8%, while others like Fitch and Barclays have raised their forecasts to 7.8%.

The impressive performance in tax collection reflects the vibrancy of India’s economy and the government’s commitment to fiscal prudence. As we celebrate this success, it’s imperative to recognize the collective efforts that have contributed to this achievement. Moving forward, sustained efforts in tax administration and policy reforms will be crucial in ensuring continued growth and prosperity for the nation.

0 notes

Text

24JAN2024: On Sunday, Israel approved a plan to send taxes earmarked for Gaza to Norway instead of the Palestinian Authority (PA), which exercises limited self-rule in the Israeli-occupied West Bank.

Since November, taxes that would ordinarily be sent to Gaza have been frozen by the Israeli government.

Under the terms of a deal reached in the 1990s, Israel collects tax on behalf of the Palestinians and makes monthly transfers to the PA pending the approval of the Ministry of Finance.

While the PA was ousted from the Gaza Strip in 2007, many of its public sector employees in the enclave kept their jobs and continued to be paid with transferred tax revenues.

Weeks after the Hamas attack on southern Israel on October 7, Israel took the decision to withhold payments earmarked for those employees in the Gaza Strip on the grounds that they could fall into the hands of Hamas.

Now, Israel says it will instead send the frozen funds to Norway. “The frozen funds will not be transferred to the Palestinian Authority, but will remain in the hands of a third country,” the Israeli prime minister’s office said in a statement released on Sunday.

Why does Israel control Palestinian tax revenue?

The system by which taxes and customs duties are collected by Israel on behalf of the PA and transferred to the authority on a monthly basis was agreed in a 1994 accord.

Known as the Paris Protocol, the accord was meant to manage the economic relationship between Israel and the Palestinian territories it occupied until a final peace settlement was reached between the two states.

Approved in the wake of the optimism generated by the Oslo Accords, which were publicly ratified by Israeli Prime Minister Yitzhak Rabin and Palestinian leader Yasser Arafat at the White House in September 1993, this protocol was supposed to end within five years.

However, 30 years later, the financial settlement continues to give the Israeli state what the United Nations Conference on Trade and Development (UNCTAD) has called “a disproportionate influence on the collection of Palestinian fiscal revenue, leading to deficiencies in the structure and collection of customs duties resulting from direct and indirect importing into Palestine”.

How much money is Israel withholding?

The tax revenues collected by Israel on behalf of the PA amount to around $188m each month, and account for 64 percent of the authority’s total revenue.

A large portion of this is used to pay the salaries of the estimated 150,000 PA employees working in the West Bank and Gaza, despite it having no jurisdiction over the Strip.

On November 3, the Israel security cabinet voted to withhold a total of $275m in Palestinian tax revenues, including cash collected for prior months that was still with Tel Aviv.

“The PA is not clear about how much of the tax revenues go to Gaza – it’s a black box,” Rabeh Morrar, director of research at the Palestine Economic Policy Research Institute-MAS, told Al Jazeera. “Sometimes they say 30 percent, sometimes 40, sometimes 50.”

Under terms set by Israel’s cabinet on Sunday, the monthly tax revenue previously allocated to PA staff in Gaza will instead be transferred to a Norwegian-based trust account. However, that money cannot be released by the fund to pay workers in Gaza without permission from Israel.

How does Israel exercise ‘disproportionate influence’ over the PA?

The Israeli state has often used its control of the PA’s tax revenues as a means to blackmail and punish the authority.

In January 2023, for instance, the newly-formed Israeli government – seen as the most far-right coalition government in the country’s history – decided to withhold $39m in tax revenues from the PA following the authority’s decision to ask the International Court of Justice (ICJ) to rule on the legality of Israel’s decades-long occupation.

“Israeli blackmailing of our tax revenues will not stop us from continuing our political and diplomatic struggle,” said Palestinian Prime Minister Mohammad Shtayyeh at the time after Israel’s security cabinet had earlier described the PA’s ICJ move as a “decision to wage political and legal war against the State of Israel”.

What effect has Israel’s withdrawal of public money had on Palestine?

“The PA owes billions in internal debt to local banks, hospitals, medical companies and the private sector,” said Morrar. “There are also debts [owed], for example, for privately owned buildings rented out by the government. They have not been able to pay those back.”

In 2021, the PA’s financial crisis, exacerbated by Israel’s periodic refusal to pay the PA its total tax revenue share pre-October 7, prompted it to reduce all salaries by 25 percent.

(continue reading)

#politics#palestine#gaza#israel#taxes#wage theft#🇵🇸#israel is an apartheid state#israel is a terrorist state#collective punishment#bds#boycott divest sanction

57 notes

·

View notes

Note

I’ve been thinking about drones and just the whole logistics of it all. They’ve got to pick up two contributions from every troll? One after another? So presumably the pails get filled ahead of time. Would a troll have enough time to help out more than one pitch/flush partner if there’s an odd number of trolls total? Or is someone just SOL if they’re on a ship with an odd number of trolls? Oh hell, on the dark carnival there’s sometimes prisoners - and jeez, what about them?? Ah this got kind of dark and now I’m second guessing sending it, but I’m curious about your thoughts, feel free to ignore if you like!

These ARE the questions lol. I've been hammering away and I'm putting together a theory I will call the Tax Fraud Drone Theory and I am figuring pieces of it out as I type this at two AM, lol. CW of course for drone-season/fuck-or-die related discussion because: terrible bug aliens from hellmurder planet.

tl;dr, drones are a basic system that expects to hit up trolls in tribal/village numbers and slowly, methodically iterate their way through. Their system isn't evolved for modern trollish community structures, and often won't have the storage capacity to hit every single troll or couple (especially in a whole city) before they head back to the Mother Grub--so you can gamble and get by with one quadrant. OR even dodge them completely, but the contagious effect of their pheromonal presence will make you real sorry if you do! Further extensive rambling under the cut.

SO: a concept.

The basic function of drones is to follow the pheromonal/scent trail of trolls to a population center and go down the line demanding donations. (Theoretically, hitting different areas of the planet in waves, always coming and going, so the whole population isn't incapacitated at once.)

in situations that would have been natural when trolls were first established as a species, drones would largely find you living in groups ranging from a small travelling clade to a manageably village-sized collection of hives, SO:

In those circumstances, the drones could simply progress logically from iteration to iteration, prioritizing people who haven't contributed and then starting over with the people who have had the longest break since their first contribution, until pitch and flush contributions have been collected from everybody and/or the people who can't keep up have been culled.

(Presumably people who were near the start of the chain and already checked both boxes sometimes find it in their heart/spades to flip pitch or flush with an unlucky straggler, although that's risky if you don't genuinely think you can summon up a compatible enough match to satisfy the drones)

This is part of the reason drone pheromones send trolls into such an altered state, because odds are good you'll have to be in the mood for a hot second while the drones work their way around your community, and also will have to fuck several times.

Plus, I could imagine it's not unheard-of on-planet for one drone to finish up and then another one to show up a day later, attracted by the increased number of trolls and their much "louder" pheromonal signature! If we assume the drones are a semi-sentient purpose-driven messenger evolved to serve the Mother Grub (which I do haha) it's not like they would have a database.

(Drone pheromones would also function as a sort of indirect, auxillary means of reinforcing their purpose--not having quadrants to bone down with when drones are around is harshly physically/ mentally taxing and even if you managed to evade them and/or lock yourself up alone, most trolls will be fucked up enough they'll end up culled shortly afterward anyway.)

While trolls can't produce drone pheromones themselves, they're triggered by it to involuntarily produce a similar substance, which is notably incredibly "contagious" to other trolls around them, so even one drone in an area can have far-reaching ripple effects of Horny Time

BUT: Even prior to the Rebellion of Beasts, in semi-modern Alternia, trolls often lived in much larger cities than the drones' basic biology and capabilities could iterate combinations for, and so they would just continue to fill buckets from the next "fresh" troll they caught a whiff of, preferentially alternating pitch and flush, until all the drones dispatched to the area had reached capacity.

THUS: while it's still crucial to have strong quadrants filled if you want to be relatively safe, not every troll will be necessarily be demanded to consummate both, but WATCH OUT

Basically in the same way that you COULD falsify your taxes, but you could get audited at any time and then you're fucked, you CAN go into drone season with just one quadrant (or even no quadrants at all if you're feeling incredibly lucky and live in a super crowded area). BUT if the drones happen to get to the end of a chain of quadrants and end up next door, and you're the nearest relatively "fresh" troll they sniff out, you're dead meat.

It's also possible to physically lock yourself away from the drones but it requires heavy fortifications--it's also wildly illegal and grounds for immediate culling, and fiercely policed by the community, since every troll that tries that shit makes it that much harder and more deadly for everybody else.

If you get caught by your neighbors building some kind of panic room or something you are IMMEDIATELY under intense scrutiny and you BETTER be seen out and about every single drone season. Or a neighbor is likely to take things into their own hands and take you out of the gene pool themself.

While usually the exponentially-increasing privilege of the hemospectrum makes higher bloods exempt from shit like that, the exponentially decreasing physical numbers of colder bloods means that a different kind of social pressure is leaning on highbloods, a more noblesse oblige expectation that you'll do your part to keep the ruling classes populated with fresh blood from powerful couplings.

That said, a rare few especially powerful or crucial members of the empire can be ruled exempt by the empress, which basically just means she says explicitly that you get to build a bunker and lock your door when the drones come around--along with one or two other trolls For Your Health.

The Grand Highblood, a handful of seadwellers from her court that don't tideally suck, and any especially competent imperial generals of the various divisions of her army tend to fall under exemption, although she'll revoke it off-handed if you fuck up, so there's a lot of impetus to stay on top of your game.

In modern Post-Rebellion Alternia, trolls out on the farthest warfronts have increasing amounts of time between drone seasons, because the drones have to fly out from Alternia, track down ships and then fly all the way back. This is one of the many ways the empire encourages people to get way the fuck out onto the frontlines.

But they could still show up at any time, including to ships actively on the war front, so like. you better watch out you better watch out YOU BETTER WATCH OUT YOU BETTER--

In cases like the Church Fleet as I've written it, where there are prisoners present on-ship, it's just kind of expected that their lives are going to hornily suck absolute shit for several days while the drones are on-board, but the fortifications to keep prisoners secure also do keep the drones out.

In pursuit of not having prisoners die prematurely of dehydration and exhaustion, which is a very real risk if you're just locked up by yourself alone during drone season, I'd guess a lot of ships with prisoners just kind of throw them in groups into cells with extra food/water supplies and come back to pick up the pieces after the drones are gone again.

In some ways, a better way to spend the drone season than most free trolls, because you're locked up and don't have to worry about the drones! But also: kind of a nightmare hahaaa @_@ And also you're still a troll prisoner so like. You're going to die eventually anyway.

It's not good! But like, what about the Alternian empire is tbh. Hell society of the murder-bugs.

Bonus concept I'm chewing on: pheromone trails are a workable sollution on-planet, but basically impossible to follow all the way out into space--the reason the drones can find you no matter how far away you run to set up a colony is that the Mother Grub and her drones actually folded the Glb'golyb into a symbiotic relationship early in Alternian history/troll evolution. Her psychic connection to every troll in the empire means that they can get general positioning data from her and then hone in by smell when they arrive within direct sensory range. The Mother Grub gets to fulfill her purpose, and Glb'golyb basically farms trolls and lusii for food, taking her tithe of flesh from the Mother Grub's worker bees trolls (the general population).

#Homestuck#drone season#ask time!#this also provides a social pressure for trolls (pretty violent packed into tight spaces together) to live in cities and colonies together#because there's security in numbers both from a war perspective and from a drone perspective.#much to ponder! it's now three thirty in the morning lol I have to stop poking at this. HAVE IT

84 notes

·

View notes

Note

You're not wrong about anything wrt cost of flying, but man is it bracing to wake up to a reminder that I can never ethically see most of my loved ones in-person again.

hmm. i think this is also the wrong way to think about it. flying is not a sin. being in some indirect way responsible for a certain amount of carbon emissions does not Taint Your Soul. and absolutist frameworks for this kind of thing are not helpful to anybody, least of all the people who actually might already be contributing to fixing problems like this through positive behaviors, like voting or political organizing.

the problem with carbon emissions is that they're a difficult to solve collective action problem, where a lot of the incentives point in a harmful direction, not that they are Fundamentally Immoral, and i think that's an important distinction to make, because i think a handful of semi-scrupulous individuals flagellating themselves and depriving themselves of things that would make them happy in the long run has no real effect on big problems like this. you not seeing your family is not going to fix global warming! and there are not enough people who are willing or able to act on guilt alone to refrain from flying that it's going to meaningfully dent emissions from the air transport sector.

what we need are policies that shape collective decisionmaking. this is why a fat carbon tax (especially when coupled with a rebate for lower-income people) can be a useful policy: it might make it harder to fly to visit family, but it won't make it categorically impossible, and it will reduce air travel in general, or encourage finding lower-carbon alternatives that allow people to travel just as much, like high-speed trains or, i don't know, some kind of fancy jet fuel that emits less CO2.

honestly, if you vote consistently for pro-environmental policies and parties, if you donate a bit of spare cash from time to time to the same, and/or if you are minimally politically active in other ways, and you're not, like, the CEO of BP in your professional life, you are fine. go, free from sin. if everyone did that, the problem of carbon emissions could be solved in a few years. now, you might go, "but not everyone is doing that!" well, not everyone is sitting at home miserable because they missed seeing grandma on her deathbed; that won't solve global warming either. in fact, it will do even less to solve global warming, because it is (and i say this with compassion) an anxious, guilt-ridden, useless gesture meant to salve your own spirit, not actually a contribution to solving the problem.

in general, i am really opposed to letting a vast and nebulous sense of guilt on big, systemic problems shape your personal behaviors. none of the behaviors that these feelings of guilt ban ever contribute to significant or systemic improvements in the problem--guilt is not building nuclear plants or preventing oil from being drilled. and in my experience, the kind of people who feel this guilt are prone to anxiety, maybe as kids were made overly responsible for the emotional state of people around them, and thus feel an outsized sense of responsibility in other areas of their life, and they mistakenly think that 1) this is a healthy way to go through life, 2) if they don't go through life this way they're a Bad Person, and 3) most people (or most people they think of as Good People) feel this way.

i wish to free people from this burden. there are no individual solutions to big collective action problems! and if reading about global warming, or racism, or poverty, or any other big social problem fills you with an enormous sense of guilt and has you wracking your brain for ways you can help by cutting/reducing/abstaining from things in your life, congratulations, you are one of many people in this world who can be at least 300% more selfish and still be a certified Good Person. so, uh, chill.

#wait is oil 'drilled' or 'mined' or 'dug up' or what?#what is the verb here to refer to the process of oil extraction#is it just 'extraction'?#you drill *for* oil#but do you *drill* oil?#anyway here's another plug for The Adult Children of Emotionally Immature Parents#because this kind of Eldest Daughter/I Must Fix Everything syndrome#can be a result of a particular kind of emotional immaturity on your parents' part#and i suspect but cannot prove#a lot of people who feel this way had parents whose emotional state#they had to be very sensitive to

151 notes

·

View notes

Text

"[The U.S. Surgeon General] is right to talk about loneliness as an important issue and social bonds as critical for our health and well-being — humans are social creatures, and we all need human support systems to thrive. But ultimately, calls that emphasize individual actions don’t quite work to solve the problem, and we need to promote a culture centered around the individual and the collective well-being.

For people to truly not be lonely or isolated, and to live meaningful lives in which their potentials can be realized, it’ll take more than atomized actors making small-scale connections; we need an entirely new social fabric which fosters social connection, and that has to come about through systemic changes, such as what Goldstein says in the rest of his tweet:

The indirect policy solutions on these things are one that centrist/neoliberals will never call for. Ones that give us time, basic needs met as guarantees. A basic income, a 30 (or 20) hour work week, guarantee health care and paid leave, reducing the scale of corporate power in tech, entertainment, advertising by immensely taxing corporate wealth/revenue (not just profits) and by limiting their ability to take over our public spaces and airwaves, fighting for union power, fighting automakers/car culture, fighting suburban developers, and so many more policies that actually foster and enable genuine social infrastructure.

How can you join a political group when you are working one, two, or three jobs to make ends meet? (Even one full-time job is exhausting enough.) How can you take a break to meet someone for coffee or join a reading group when you don’t have child care? How can you seek out new social connections when social media and streaming services are designed to be addictive and take up a lot of your free time? How can you make a social connection without having to consume something (say, buying food or drinks to get a place to sit) because public spaces for recreation are so limited? How can you meet up with a friend or family member who lives 20 miles away or multiple bus rides away? Or when your loneliness complicates depression or other mental health needs and you don’t have healthcare?

I’m not saying people never get to socialize. The point is that social and economic realities make it too difficult for the vast majority of people to develop healthy social lives. There’s also something cruel about telling people, 'These are the solutions,' but they’re things that many people can’t actually do. This makes it easier for people to then blame themselves when they don’t fix their loneliness — after all, the 'solutions' were available!

... The larger point here is that whenever we are told to 'do more of something,' we should ask whether society is creating the conditions for us to do that thing (assuming that thing is indeed good)."

- Lily Sánchez, from "The Surgeon General Should Stop Telling People to Solve the Loneliness Crisis on Their Own." Current Affairs, 3 May 2023.

#lily sánchez#quote#quotations#community#relationships#mental health#well being#activism#democratic socialism#socializing#adulting#loneliness#neoliberalism#capitalism#individualism

144 notes

·

View notes

Text

Changes to the Tax Collection System in Revolutionary and Napoleonic France

My translation from Le prix de la gloire: Napoléon et l’argent by Pierre Branda.

This part is specifically about the reforms made to the tax collection system. Problems with taxation had been the source of many woes, so it went through major changes.

“The [tax] work of the Consulate mainly concerned the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the ‘tax slips’, to be established by municipal administrations. Their work was complex, because each year it was necessary to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of the contribution to pay. Poorly motivated (or even corrupt), the municipalities had put little care in the execution of their mission since a large part of the taxpayers had not yet received anything for their taxes of year VIII, or even of year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left outstanding). If the sending of tax matrices left something to be desired, the collection of direct contributions was hardly better. The tax collector was also not an agent of the administration: this function was assigned to any person who agreed to collect taxes with the lowest possible commission (otherwise called ‘collecte à la moins-dite’). With such a system, there were numerous inadequacies, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the profits of the collectors were most of the time too low to provide such a service; also, to compensate for their losses, they were ‘forced’ to multiply small and big cheats. In any case, in such a troubled period, letting simple individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.”

“One month after Gaudin’s appointment, on December 13, 1799, the Directorate of Direct Contributions was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely ‘in the hands of the Minister of Finance’ and in this way the taxpayer found himself in direct contact with the administration. The tax system no longer having any obstacles, the beneficial effects of such a measure did not take long to be felt. With ardor, the agents of this new administration carried out considerable work: three series of rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the ministry had not skimped on their pay (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was undoubtedly not unrelated to such success.”

“Tax reform was slower. It was not until 1804 that all tax collectors were civil servants. The consular system gradually replaced the collectors of the departments, then of the main cities and finally of all the municipalities whose tax rolls exceeded 15,000 francs. At the end of the Consulate, the entire tax administration was thus entirely dependent on the central government. Subsequently, the one in charge of indirect contributions (taxes on tobacco, alcohol or salt) created on February 25, 1804 and called the Régie des droits réunis was built on the same pyramidal and centralized model. It was the same later for customs.”

“According to Michel Bruguière, historian of public finances, ‘Napoleon and Gaudin can be considered the builders of the French tax administration. [...] They had also developed and codified the essential principles of our tax law, so profoundly derogatory from the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers’. Basically, after having clearly understood the true cause of the ‘financial wound’, Bonaparte wanted an effective, almost ‘despotic’ instrument to avoid experiencing the unfortunate fate of his predecessors. As a good soldier, he created a fiscal ‘army’ responsible for providing the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in everything that concerned public revenue. The time of the farmer generals of the Ancien Régime or the ‘second-hand’ collectors of the Directory was well and truly over. Napoleon Bonaparte, with his fierce desire to centralize power in this area as in many others, undoubtedly gave his regime the means to last.”

French:

Page 208

Page 209

Page 210

#Le prix de la gloire: Napoléon et l’argent#Le prix de la gloire#Napoléon et l’argent#napoleon#napoleonic era#napoleonic#napoleon bonaparte#19th century#first french empire#1800s#french empire#france#history#reforms#finance#economics#french revolution#frev#la révolution française#révolution française#Gaudin#tax#tax collection system#taxation#law#napoleonic code#source#french history#branda#Pierre branda

36 notes

·

View notes

Text

Demystifying the Process of GST Registration

Navigating the world of taxation can often feel like traversing a labyrinth, especially for business owners. However, understanding and complying with the Goods and Services Tax (GST) registration process is crucial for businesses operating in India. In this guide, we'll unravel the complexities surrounding GST registration, making it easy to grasp and implement for your business needs.

1. Introduction to GST Registration

Before we delve into the intricacies of the registration process, let's grasp the fundamentals of GST registration. GST, introduced in India in 2017, aims to streamline the taxation system by amalgamating various indirect taxes. GST registration is the process by which businesses register themselves under this unified tax regime.

2. Importance of GST Registration

2.1 Compliance with Tax Laws

First and foremost, GST registration is a legal requirement for businesses whose turnover exceeds the prescribed threshold. By registering for GST, businesses ensure compliance with tax laws, avoiding penalties and legal consequences.

2.2 Access to Input Tax Credit

One of the significant benefits of GST registration is the ability to claim Input Tax Credit (ITC). Registered businesses can offset the taxes paid on inputs against the taxes collected on outputs, reducing their overall tax liability.

2.3 Legitimacy in Business Operations

GST registration lends credibility and legitimacy to business operations. It provides a unique identification number, known as the GSTIN, which is essential for conducting business transactions seamlessly.

3. Understanding the GST Registration Process

3.1 Eligibility Criteria

Before initiating the registration process, businesses must determine their eligibility for GST registration. Generally, businesses with an annual turnover exceeding the prescribed threshold are required to register for GST.

3.2 Documentation Required

To complete the GST registration process, businesses need to provide certain documents and information, including PAN card, Aadhaar card, proof of business ownership, bank account details, and address proof.

3.3 Step-by-Step Registration Procedure

The registration process involves several steps, including online application submission, verification of documents, and issuance of the GSTIN. Businesses can register for GST through the GST portal by following a simple and user-friendly registration interface.

4. Conclusion

In conclusion, GST registration is a critical aspect of tax compliance for businesses operating in India. By understanding the importance and intricacies of the registration process, businesses can ensure legal compliance, access input tax credit, and foster legitimacy in their business operations.

Follow Our FB Page: https://www.facebook.com/bizadviseconsultancy/

2 notes

·

View notes

Text

Black nurses have shared their experiences of racism in the workplace, as the Royal College of Nursing (RCN) commemorates the 75th anniversary of Windrush at its annual conference this week.

In June 2018, the then home secretary, Sajid Javid, commissioned the Windrush Lessons Learned review – a report reflecting on the causes of the Windrush injustices. The independent review was in response to mounting evidence that members of the Windrush generation were losing jobs, homes and access to benefits, as well as being denied NHS treatment, detained, and forcibly deported to countries they left as children.

The findings, alongside the testimonies of black British citizens affected by the hostile environment, are truly anguishing.

Wendy Williams, the HM inspector of constabularyappointed as the independent reviewer, has examined the key legislative, policy and operational decisions that led to the Windrush injustices, and spoken to those who suffered grave and catastrophic consequences from becoming entangled in the government’s hostile immigration policies.

Williams’ review draws a stark conclusion: the UK’s treatment of the Windrush generation, and approach to immigration more broadly, was caused by institutional failures to understand race and racism. Their failures conform to certain aspects of Lord Macpherson’s definition of institutional racism, enshrined in the Macpherson report into the murder of Stephen Lawrence, published in 1999.

Macpherson defined institutional racism as: “The collective failure of an organisation to provide an appropriate and professional service to people because of their colour, culture, or ethnic origin. It can be seen or detected in processes, attitudes and behaviour which amount to discrimination through unwitting prejudice, ignorance, thoughtlessness and racist stereotyping which disadvantage minority ethnic people.”

The Windrush Lessons Learned review pulls no punches in describing the failure of ministers and officials to understand the nature of racism in Britain. It shows how the government’s hostile environment immigration policies had devastating impacts on the lives and families of black citizens within the UK.

The fact that black British people who had spent much of their lives in Britain, working and paying taxes, were accidental victims of the government’s immigration policies, perfectly illustrates how the coalition and Conservative governments not only failed to adhere to existing race relations legislation, but also showed a complete lack of understanding about “indirect discrimination” – a concept accepted in legislation as far back as the 1976 Race Relations Act.

Neither that lesson of “unintended discrimination”, nor the definition of “institutional racism” from the Macpherson report, seem to have been learned by Britain’s policymakers and politicians. Not only is intent irrelevant for assessing whether policies are racially discriminatory, but race equality laws (including the 2000 Race Relations Amendment Act and the public sector equality duty) appear to have made little difference to immigration and citizenship policies affecting people from different ethnic groups.

This reveals a shocking lack of understanding of what racism is – namely that it’s not solely about intent. In April 2018, the dramatic apology by the then prime minister, Theresa May, showed a failure to understand this lesson, when she insisted it wasn’t her government’s intent to disproportionately affect people from the Caribbean in the operation of hostile environment immigration policy.

For policymakers and politicians to learn the profound lessons of the Windrush review, they must not only “right the wrongs” suffered by the Windrush generation (as well as those from other ethnic minority groups), but they must also understand how and why immigration and citizenship policies, and Home Office culture, have repeatedly discriminated against black and ethnic minority citizens over the decades.

The Windrush generation are owed a full apology – an apology that is based on understanding that their treatment wasn’t an accidental misfortune, but the result of institutional failure to understand the role of race and racism in Britain.

#Black nurses question how much has changed 75 years after Windrush#windrush#british immigration#british racism#Nurses of the Windrush#Black Nurses in UK#english racism#immigration iies#The Windrush review is unequivocal: institutional racism played its part#sajid javid

19 notes

·

View notes

Text

Availment of ITC under GST

GST (Goods and Services Tax) is a comprehensive indirect tax levied on the supply of goods and services in India. It is a destination-based tax, which means that the tax is collected by the state where the goods or services are consumed. Under GST, the input tax credit (ITC) is an important concept that allows businesses to reduce their tax liability by claiming credit for the taxes paid on their purchases.

In this article, we will discuss everything you need to know about the availment of ITC under GST. We will cover the basics of input tax credit, the conditions to claim ITC, the documentation required, and the time limit for claiming ITC.

What is Input Tax Credit (ITC)?

Input tax credit (ITC) is the credit that a business can claim for the tax paid on its purchases used for business purposes. The tax paid on input goods or services can be set off against the output tax liability (i.e. tax payable on sales) of the business. This helps businesses reduce their tax burden and improve their cash flow.

For example, if a manufacturer,

To continue reading click here

For more detailed inofrmation, visit Swipe Blogs

2 notes

·

View notes

Text

Eurofighter will guarantee 26,000 jobs in Spain by 2060

The program should contribute about €1.7 billion to Spanish GDP and create almost 700 jobs in Spain per year.

Fernando Valduga By Fernando Valduga 29/03/2023 - 16:00 in Military

The Eurofighter program will cumulatively guarantee 26,000 jobs in Spain by 2060, according to a recent study by the consultancy PricewaterhouseCoopers (PWC) on the economic impact of the 'Halcon' and 'Quadriga' contracts for the country.

The study, funded by Airbus, with the technical support of ITP Aero, and carried out independently by PWC over a period of six months until March 2023, estimates that, during its life cycle, the manufacturing phase (2020-2030) and maintenance phase (2023-2060) of the Halcon and Quadriga programs will create an average of 657 jobs - direct, indirect and induced - This is equivalent to a total annual impact on employment of 2.7% direct jobs in the Spanish aerospace sector.

Both Eurofighter Tranche 4 contracts are expected to contribute almost €1.7 billion to Spanish GDP, with the manufacture and maintenance of Halcon generating approximately €1.5 billion and Quadriga production composing the remaining €200 million.

Employment and economic contribution during both phases will generate a total tax collection of €430 million, of which €151 million will be a direct contribution. In addition, for every euro collected directly, 2.8 euros of total tax revenues will be generated in the Spanish economy.

Signed in June 2022, Halcon's contract consists of the acquisition of 20 state-of-the-art Eurofighter jets to replace the aging F-18 fleet operated by the Spanish Air Force in the Canary Islands.

The Halcon program followed Quadriga's contract, signed in 2020, to deliver 38 new Eurofighter aircraft to the German Air Force (Luftwaffe), making Germany the country with the highest number of orders for the largest defense program in Europe.

The Halcon program will see the Spanish Eurofighter fleet grow to 90 aircraft, with the first delivery scheduled for 2026, ensuring industrial production activity by 2030. Quadriga guarantees the production of the new Tranche 4 Eurofighter - currently the most modern combat aircraft built in Europe - by 2030, with a useful life well beyond 2060. Both programs are decisive in ensuring national and European strategic autonomy in defense, when it matters most.

In total, the Eurofighter program guarantees more than 100,000 jobs in Europe, which will be driven by state-of-the-art aircraft, such as Tranche 4, as well as, in the future, through technological advances in the development of Eurofighter.

To download the complete PWC study and additional material to complement this notice access the link here.

Tags: airbusMilitary AviationEurofighter

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

COMMERCIAL

A321XLR program concludes second test campaign in cold weather

29/03/2023 - 10:30

HELICOPTERS

South Korea approves CH-47F Chinook helicopter purchase plan

29/03/2023 - 09:59

MILITARY

U.S. Navy and Boeing discuss unapproved purchase of 20 Super Hornets

29/03/2023 - 08:44

MILITARY

VIDEO: Airbus A310 guides and takes control in flight of a drone

28/03/2023 - 19:00

COMMERCIAL

China Southern Airlines plans to increase orders for Boeing and Airbus

28/03/2023 - 17:00

MILITARY

VIDEO: Prototypes of the South Korean KF-21 fighter fire weapons for the first time

28/03/2023 - 14:25

10 notes

·

View notes

Text

609 PSA

this is a PSA i guess..

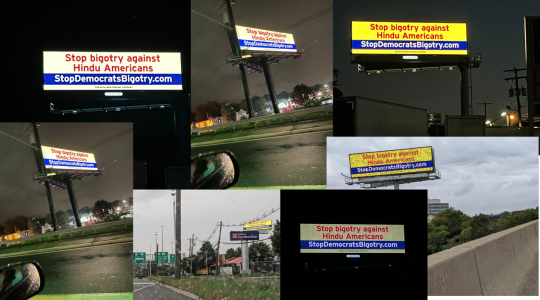

If you drive down the new jersey turnpike, right at Exit 10 you will see a billboard that says "Stop bigotry against Hindu Americans." The first time I saw this billboard I was with my parents, and I explained to them what I summarize below.

a collage of various billboards around the state. from stopdemocratsbigotry.com

This past August, during the India Day parade in Edison, a bulldozer rolled down the street.

It was decorated with pictures of Modi and Yogi Adityanath, Chief Minister of Uttar Pradesh. The bulldozer is a known symbol of anti-Muslim hate, ever since Adityanath used them to destroy Muslims' homes in UP in 2014 and again as recently as April 2022. Adityanath is a known fascist who has blood on his hands. It's worth googling him.

After the bulldozer was seen in Edison, The New Jersey chapter of the Council on American-Islamic Relations (CAIR-NJ) and the Indian American Muslim Council (IAMC) issued a public statement against the bulldozer and Anti-Islamic Hindu nationalist ideology, in general. New Jersey Democrats Bob Menendez and Cory Booker spoke publicly in support of CAIR. Then, a group called the Teaneck Democratic Municipal Committee issued a resolution against "Hindu National Hate Groups Operating in New Jersey and Across the United States." In their resolution, they named specific tax-exempt organizations with "direct and indirect" ties to the RSS. The groups that they named were:

Hindu American Foundation

Sewa International

Infinity Foundation

Ekal Vidyalaya Foundation

Vishva Hindu Parishad of America

These RSS-affiliated groups responded to the Teaneck resolution with this billboard campaign and website. They re-framed the issue as the Democratic Party discriminating against "Hindu Americans;" completely obstructing their original anti-Muslim act, and their overall violent ideology. Soon after the billboards went live, the New Jersey Democratic State Committee (what even are these groups?) issued an asinine statement about unity and inclusion that dismissed the Teaneck resolution without naming any of the relevant issues of Islamophobia or Hindu fascism.

It's gross seeing these billboards around, it's pathetic seeing the Democratic Party take a non-stance. It's also an accurate representation of how strong the grip of Hindutva ideology is on the Indian community here in New Jersey, and how out of touch municipalities and politicians can be. Just 10 days ago, for example, the Plainsboro library hosted the traveling exhibit "Darshana: A Glimpse into Hindu Civilization." I love the Plainsboro library. In 2022 they got rid of overdue fines, and they have one of the best, open spaces in our community. I guess nobody told them that the organization responsible for the exhibit is directly linked to Hindutva groups. Or worse, the programming was intentional. Either way, creative, generative interventions, achieved through grassroots and collective organizing, are much needed as Hindu nationalism becomes more visible and influential here in Jersey.

8 notes

·

View notes

Text

Indirect Tax

Recent changes in Indirect Tax

Indirect taxes are taxes that are assessed by Government on goods and services, rather than on individualities or businesses directly. These taxes are collected by businesses from consumer when they buy goods or services, and also remitted to the government. Indirect taxes are often referred to as consumption taxes because they are based on consumption of goods and services rather than income or wealth. Indirect taxes can take many forms, including sales taxes, value-added taxes (VAT), excise taxes, and tariffs.

During the Union Budget of 2023 “Amrit Kaal”, It was the very first time when the indirect tax proposals were presented before the direct tax proposals. In the Proposal of indirect tax Presented in the Union Budget of 2023 there were 4 major changes which caught the attention of the citizens.

Following are the 4 major changes:

Customs Perspective: In the Union Budget, to promote the ‘Make in India’ campaign and give to a boost to domestic manufacturing and enhance exports, the government and our FM has proposed few changes in the rate of import duties. The import duties on electric chimneys and cigarettes will now be more expensive, while on the other hand import of gold, silver, platinum, coin, etc., will be cheaper. Also, some exemption has been proposed towards goods or machinery used for manufacturing of lithium-ion battery.

GST Returns To Be Filed Within Three Years: GSTR 1, GSTR 3B and GSTR 9and GSTR 9C would now be restricted for filing, post expiry of three years from the due date of filing of the relevant GST return. Until now, there was no threshold on time for filing GST return and any taxpayer could file belated returns along with interest and late fees. However, going forward, in future these dates have been locked so as to have clarity on the timelines for litigation.

Widening of Scope of OIDAR: The Online Information and Database Access and Retrieval (OIDAR) services were brought under the tax bracket in the service tax regime and subsequently, in the GST regime. However, due to some exceptions in OIDAR and non-taxable online recipient, multiple services were escaping tax. In order to remove those exceptions, the Budget proposes to amend both the definitions and make OIDAR a wider segment for taxability purpose.

Taxability of High Sea Sales and Out-And-Out Sales: Out-and-out sales and high-sea sales were inserted in schedule III of the CGST Act, 2017 with effect from Feb. 1, 2019. However, the GST authorities were demanding GST from July 1, 2017 to Jan. 31, 2019. So to clarify this ambiguity and confusion, the budget has stated that such insertion will be with retrospective effect from July 1, 2017. This is a relief for taxpayers who are undergoing a litigation on these aspects. However, if the taxpayer has already paid the taxes for such period on the specified sales, the Budget has clearly specified that no refund of such tax can be claimed.

Although there are other changes as well but from Tax perspective the above 4 are major changes.

2 notes

·

View notes

Text

My Plant Journey

Wow, no topic? I’ve been sitting at my computer trying to think of what to write about. I don’t want to talk about future environmental jobs, it stresses me out. I don’t want to talk about school or post-grad learning, it stresses me out. What types of nature interpretation that I’m currently involved don’t stress me out? Why is it that as I’ve gotten older, my interaction with nature has shrunk into my computer screen, valued by grades and money? I sit here trying to think of one way I interact with the environment every day that isn’t for academic or professional goals, but for my personal ones. A-ha, my plants!

I don’t know about you guys, but growing up I have never had a green thumb. My mom always joked that our family has red thumbs because every plant that entered our house would die. During COVID when I really lived in Guelph for the first time off residence, I decided to get my first actual plant. My roommate has half the amazon rainforest in her room and reassured me she’d help me get started.

My roommates room above.

So we went over to Walmart and got a plant that she was an avid fan of: the pilea.

The pilea, also known as the Chinese Money Plant, is super cool. My favourite thing about it is that it has unique circular leaves that you normally wouldn’t imagine for plants to have. They’re made this way to absorb the maximal amount of sunlight that they can because they usually only grow in indirect sunlight. I have fond memories of my roommate bottom-watering her pilea in our grimey Chancellors kitchen with all of us huddled around the plant to listen to it absorb the water. So when I got this plant, I figured it would be no different. Not sure what happened, but this is my pilea two years later:

You think that’s bad? Below is the second plant I ever got:

Obviously I gave it to my roommate.

But you know what? I never gave up! After several more premature and unfortunate plant deaths, I finally kind of got a grip on the whole plant thing. We had left Chancellors and moved into a cozy little house. I was basically living alone for the summer and needed a new hobby. I worked as a receptionist at a car dealership and boy was it boring. I sat at that desk for hours at a time scrolling through facebook marketplace looking for some ideas. One hot summer afternoon, I saw that a woman was selling her pathos plant. I decided to stop by after work and pick it up.

This was the start of my addiction. Since then, I have collected roughly 15-25 more plants. It’s gotten so bad, I have plants on the floor of my bedroom because I don’t have space for them on any more shelves. Of course several of my plant predecessors have passed away, but hey, there’s still a few that are kickin’ it! I feel like although this hobby can be taxing at times due to the constant upkeep, it is really rewarding to have nature in my bedroom with me. It makes me really happy to nurture my plants. I have learned to understand their cues, giving them water, light, shade, or humidity as they need. I also enjoy decorating my plants by painting their pots or putting crystals into the soil.

I really love seeing the afternoon sun hit their leaves, it makes me really happy. It has also helped me become interested in horticulture and ecology- I’ve both volunteered and worked as a horticulturist around the Kitchener-Guelph-Waterloo area over the past few summers!

I guess the moral of the story is that it’s important to maintain some level of personal conenction to nature outside of school and work. Don’t be scared to get some plants, it can be daunting but with trial and error, you’ll learn!

What’s your guys’ favourite plants? I’d love to see some pictures and hear your story about them! Thanks so much!!

Mishell

3 notes

·

View notes

Text

UAE VAT Registration in 2021 – A Step-by-Step Guide

Since the UAE introduced the VAT on Value Added Tax (VAT) on January 1st, 2018, business owners are required to follow the rules, including UAE VAT Registration and tax filings.

Companies operating in the UAE must ensure that VAT is correctly collected and properly accounted for so that it can be paid back to Federal Tax Authority (FTA).

UAE VAT Registration means that your business is recognized by government authorities to take VAT from your customers and then transfer this to the government.

As a business owner, you must be aware of the critical aspects of VAT in the UAE.

These are step-by-step guides.

What is VAT?

Taxes on VAT are applied to the exchange of services and goods. It that is used at every stage in the chain of supply. It is calculated based on the value added at each step. This indirect tax is imposed on the Government of UAE at 5 percent on most businesses and products. However, food, education, and healthcare items are exempt from VAT.

VAT Registration UAE

If you need to declare VAT depends on your business’s turnover per year.

Exclusive from Registration for VAT Value of supplies that are less than Dh187,500

Voluntary UAE VAT Registration, The value of reserves is between Dh187.500 to Dh375,000.

Mandatory VAT Registration Value of supplies above Dh375,000

Your registered business will receive a unique tax identification number (TRN) when the UAE VAT registration is accepted. The VAT invoices on all VAT invoices will include the TRN.

UAE mainland businesses, as well as free zone companies, are taxed on VAT. The only ‘designated zones’ designated by Cabinet members of the UAE Cabinet are outside the scope of UAE VAT taxation. Moving goods within areas are free of tax.

It typically takes between 3 and 5 days for the tax registration process to complete.

VAT Return Filing

VAT-registered companies (taxable individuals) are required to submit an annual VAT return to the FTA.

A VAT return is a summary of the supplies and purchases that a tax-paying person makes during tax time to calculate the tax liability of VAT.

You can file your VAT return online every month or every quarter by visiting FTA’s official website – https://www.tax.gov.ae/.

Tax returns should be filed on time, usually by the 28-day deadline. The tax period is the time in which taxes are due and due. The tax period:

* Monthly for businesses with annual revenue of Dh150 million or greater. * Quarterly rate for companies with an annual turnover of less than Dh150 million

VAT Liability

In contrast to customer business revenues, VAT is not part of your company’s income. Instead, the VAT you collect is known as VAT liability & has to be paid to the government of the UAE.

Vat liability is the gap between the output tax to be paid (VAT applied to supplies of services and goods) and the tax on input (VAT incurred when purchasing) which is recoverable for a specific tax time.

If output taxes are more significant than input taxes, the excess must be paid to FTA. However, if there is an excess of output tax and input tax, the taxable person can recuperate the quantity and apply it to future payments to FTA.

Documents Required for VAT Registration in UAE

You must provide duplicates of these documents to register for UAE VAT Registration.

Certificate of registration or incorporation.

Trade license

Passport and visa, or Emirates ID of director/manager

A partnership contract, memorandum association, or another document that provides information on the business’s ownership.

The profile of the named company director.

Bank account details;

Contact details;

Physical office;

List of business directories or partners in the UAE over the last five years

The Federal Tax Authority would also need to declare the following:

The actual or estimated value of transactions in the financial sector;

The registered business activities of the applicant;

Information on the anticipated turnover of the company over the next thirty days;

The turnover of the business over the last 12 months (supporting documents are required);

Information about the business’ anticipated exempt supply;

All details about the business exports and imports of the company;

Information on the customs registration process;

The business activities that take place in the GCC

The taxpayer or VAT-registered company is also required by the tax authorities to maintain the following records/documents:

Tax invoices and any other document pertinent to the receipt of the goods or services you need;

Notes on the tax credit, in addition to any other documents that the company receives about the purchasing of products or services

Record of tax-deductible products received or manufactured;

Tax invoices and any other document that is the issue concerning products or services;

Notes on the tax credit and any other type of document issued to purchase items or services

Documents of services or goods that are disposed of or used by the company to deal with matters not connected with the business, as in the tax paid for these;

Record of the imports and supply of goods or other products;

Documents of corrections or adjustments applied to tax invoices or any other account

Record of products or goods which are shipped to another country

Tax records must be kept by any tax-paying individual and include the following details:

Taxes that can be recovered on imports or supplies;

Tax recoverable subsequent adjustment or correction of error;

Tax due following adjustment or error correction

Taxes owing on all tax-deductible products

UAE VAT Registration Process

If you have your soft copies of the previously mentioned documents in hand, you’re in good shape to begin the registration procedure.

First of all,

Log in to e-service, and establish an account. Input the UAE VAT registration form

FTA (Federal Tax Authority) authorized e-service account is required to register VAT. However, it is easy to create an account through their official site.

VAT Rates in UAE

The rates of VAT in the UAE differ from product to product. The standard rate of the government is 5%, and you should charge this amount unless your product or service is in”zero-rated,” or “zero-rated” or VAT exemption.

Zero-rated rates are available on tax-exempt products; however, the buyer is not liable for VAT. Your VAT account must record and report the VAT zero-rated transactions, too.

Certain goods and services, including the construction of residential structures and land and financial services, are exempt from VAT.

#vat refund#vat registration#VAT Registration in Dubai#VAT Return Filing#vat registration uae#vat registration services in dubai

2 notes

·

View notes

Text

UAE VAT Registration in 2021 – A Step-by-Step Guide

Since the UAE introduced the VAT on Value Added Tax (VAT) on January 1st, 2018, business owners are required to follow the rules, including UAE VAT Registration and tax filings.

Companies operating in the UAE must ensure that VAT is correctly collected and properly accounted for so that it can be paid back to Federal Tax Authority (FTA).

UAE VAT Registration means that your business is recognized by government authorities to take VAT from your customers and then transfer this to the government.

As a business owner, you must be aware of the critical aspects of VAT in the UAE.

These are step-by-step guides.

What is VAT?

Taxes on VAT are applied to the exchange of services and goods. It that is used at every stage in the chain of supply. It is calculated based on the value added at each step. This indirect tax is imposed on the Government of UAE at 5 percent on most businesses and products. However, food, education, and healthcare items are exempt from VAT.

VAT Registration UAE

If you need to declare VAT depends on your business’s turnover per year.

Exclusive from Registration for VAT Value of supplies that are less than Dh187,500

Voluntary UAE VAT Registration, The value of reserves is between Dh187.500 to Dh375,000.

Mandatory VAT Registration Value of supplies above Dh375,000

Your registered business will receive a unique tax identification number (TRN) when the UAE VAT registration is accepted. The VAT invoices on all VAT invoices will include the TRN.

UAE mainland businesses, as well as free zone companies, are taxed on VAT. The only ‘designated zones’ designated by Cabinet members of the UAE Cabinet are outside the scope of UAE VAT taxation. Moving goods within areas are free of tax.

It typically takes between 3 and 5 days for the tax registration process to complete.

VAT Return Filing

VAT-registered companies (taxable individuals) are required to submit an annual VAT return to the FTA.

A VAT return is a summary of the supplies and purchases that a tax-paying person makes during tax time to calculate the tax liability of VAT.

You can file your VAT return online every month or every quarter by visiting FTA’s official website – https://www.tax.gov.ae/.

Tax returns should be filed on time, usually by the 28-day deadline. The tax period is the time in which taxes are due and due. The tax period:

* Monthly for businesses with annual revenue of Dh150 million or greater. * Quarterly rate for companies with an annual turnover of less than Dh150 million

VAT Liability

In contrast to customer business revenues, VAT is not part of your company’s income. Instead, the VAT you collect is known as VAT liability & has to be paid to the government of the UAE.

Vat liability is the gap between the output tax to be paid (VAT applied to supplies of services and goods) and the tax on input (VAT incurred when purchasing) which is recoverable for a specific tax time.

If output taxes are more significant than input taxes, the excess must be paid to FTA. However, if there is an excess of output tax and input tax, the taxable person can recuperate the quantity and apply it to future payments to FTA.

Documents Required for VAT Registration in UAE

You must provide duplicates of these documents to register for UAE VAT Registration.

Certificate of registration or incorporation.

Trade license

Passport and visa, or Emirates ID of director/manager

A partnership contract, memorandum association, or another document that provides information on the business’s ownership.

The profile of the named company director.

Bank account details;

Contact details;

Physical office;

List of business directories or partners in the UAE over the last five years

The Federal Tax Authority would also need to declare the following:

The actual or estimated value of transactions in the financial sector;

The registered business activities of the applicant;

Information on the anticipated turnover of the company over the next thirty days;

The turnover of the business over the last 12 months (supporting documents are required);

Information about the business’ anticipated exempt supply;

All details about the business exports and imports of the company;

Information on the customs registration process;

The business activities that take place in the GCC

The taxpayer or VAT-registered company is also required by the tax authorities to maintain the following records/documents:

Tax invoices and any other document pertinent to the receipt of the goods or services you need;

Notes on the tax credit, in addition to any other documents that the company receives about the purchasing of products or services

Record of tax-deductible products received or manufactured;

Tax invoices and any other document that is the issue concerning products or services;

Notes on the tax credit and any other type of document issued to purchase items or services

Documents of services or goods that are disposed of or used by the company to deal with matters not connected with the business, as in the tax paid for these;

Record of the imports and supply of goods or other products;

Documents of corrections or adjustments applied to tax invoices or any other account

Record of products or goods which are shipped to another country

Tax records must be kept by any tax-paying individual and include the following details:

Taxes that can be recovered on imports or supplies;

Tax recoverable subsequent adjustment or correction of error;

Tax due following adjustment or error correction

Taxes owing on all tax-deductible products

UAE VAT Registration Process

If you have your soft copies of the previously mentioned documents in hand, you’re in good shape to begin the registration procedure.

First of all,

Log in to e-service, and establish an account. Input the UAE VAT registration form

FTA (Federal Tax Authority) authorized e-service account is required to register VAT. However, it is easy to create an account through their official site.

VAT Rates in UAE

The rates of VAT in the UAE differ from product to product. The standard rate of the government is 5%, and you should charge this amount unless your product or service is in”zero-rated,” or “zero-rated” or VAT exemption.

Zero-rated rates are available on tax-exempt products; however, the buyer is not liable for VAT. Your VAT account must record and report the VAT zero-rated transactions, too.

Certain goods and services, including the construction of residential structures and land and financial services, are exempt from VAT.

#vat registration uae#VAT Registration in Dubai#uae vat registration#vat registration#vat registration services in dubai

3 notes

·

View notes

Text

Napoleon & the creation of the tax collection system

Not wanting to impose new taxes on the people, the tax work under Napoleon was focused on reforming tax collection by creating a system which was more efficient, complete and equitable. He also worked to destroy the link which existed between private interests and state service concerning public revenue.

From Le prix de la gloire: Napoléon et l'argent by Pierre Branda. Translated by me, so any mistakes are my own 🙂

The [financial] work of the Consulate mainly concerns the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the “tax sheets”, to be established by municipal administrations. Their work was complex, since each year they had to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of contribution to be paid. Unmotivated (or even corrupt), the municipalities had taken little care in the execution of their mission, since a large proportion of taxpayers had not yet received their tax assessments for Year VIII, or even from Year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left in abeyance). If the mailing of tax matrices left much to be desired, the collection of direct contributions was not much better. The tax collector was not an agent of the administration either: this function was assigned to any person who was willing to collect taxes with the lowest possible commission (otherwise called “least collected”). With such a system, failures were numerous, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the collectors’ profits were most of the time too low to provide such a service; so to compensate for their losses, they were “forced” to increase the number of small and big cheats. In any case, in such a troubled period, letting private individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.

One month after Gaudin’s appointment, on 13 December 1799, the Direction des contributions directes was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely “in the hands of the Minister of Finance” putting the taxpayer in direct contact with the administration. With the tax system now free of obstacles, the beneficial effects of such a measure were soon felt. With ardor, the agents of this new administration carried out considerable work: three series of tax rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the Ministry had not skimped on their salaries (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was no doubt a factor in their success.

Reform of tax collection was slower. It wasn’t until 1804 that all tax collectors became civil servants. Under the Consulate, tax collectors were gradually replaced in the departments, then in the main towns, and finally in all communes whose tax rolls exceeded 15,000 francs. By the end of the Consulate, the entire tax administration was entirely dependent on the central government. Subsequently, the administration in charge of indirect taxation (taxes on tobacco, alcohol or salt), created on 25 February 1804 and known as the Régie des droits réunis, was built on the same pyramidal, centralized model. It was the same, later, for customs.

According to Michel Bruguière, historian of public finances, “Napoleon and Gaudin can be considered the builders of French tax administration. They had also developed and codified the essential principles of our tax law, so profoundly at variance with the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers.” Having understood the true cause of the “financial plague”, Bonaparte wanted an effective, almost “despotic” instrument to avoid the unfortunate fate of his predecessors. As a good military man, he created a fiscal “army” to provide the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in all matters concerning public revenue. The days of the fermiers généraux of the Ancien Régime and the “second-hand” tax collectors of the Directory were well and truly over. Napoleon Bonaparte’s fierce determination to centralize power in this area, as in many others, undoubtedly gave his regime the means to last.

———

French:

Pg. 208

Pg. 209

Pg. 210

#Le prix de la gloire: Napoléon et l'argent#Pierre Branda#Branda#Le prix de la gloire#Napoleon’s reforms#history#napoleon#napoleonic era#napoleonic#napoleon bonaparte#first french empire#money#french empire#economics#financial#finance#Economic history#financial history#france#19th century#tax collection#tax collection system#french history#Michel Bruguière#Constituent Assembly#gaudin#Martin-Michel-Charles Gaudin#french revolution#directory#the directory

6 notes

·

View notes