#India Buy Now Pay Later Market Growth

Explore tagged Tumblr posts

Text

#India Buy Now Pay Later Market#India Buy Now Pay Later Market Size#India Buy Now Pay Later Market Share#India Buy Now Pay Later Market Trends#India Buy Now Pay Later Market Growth#Market Research

0 notes

Text

Emerging e-commerce trends in developing markets

The landscape of e-commerce in developing markets is rapidly evolving. For a digital marketing agency in India, understanding these trends is crucial. This blog explores the emerging e-commerce trends and their impact on digital marketing strategies.

Mobile-First Shopping Experience

In developing markets, mobile devices are often the primary means of internet access. This trend shapes e-commerce in significant ways:

Mobile-optimized websites

User-friendly mobile apps

Quick loading times

For Shopify website development, focusing on mobile responsiveness is key. It ensures a smooth shopping experience for users on smartphones and tablets.

Rise of Social Commerce

Social media platforms are becoming important e-commerce channels. This trend offers new opportunities for a social media agency:

Shoppable posts on Instagram

Facebook Marketplace integration

Pinterest buyable pins

These features allow users to shop directly from social media platforms. It combines social browsing with easy purchasing options.

Voice Search Optimization

Voice-activated devices are gaining popularity in developing markets. This trend affects how people search for products online. An SEO agency should consider:

Optimizing for conversational keywords

Creating FAQ-style content

Ensuring fast loading speeds for voice results

Voice search optimization can improve visibility and user experience. It caters to the growing number of voice-assisted shoppers.

Augmented Reality (AR) in Shopping

AR technology is making online shopping more interactive. It allows customers to visualize products before buying. For e-commerce businesses:

Virtual try-on for fashion items

AR-powered home decor visualization

3D product models for better understanding

Implementing AR features can reduce return rates and increase customer satisfaction. It bridges the gap between online and in-store experiences.

Growth of Regional E-commerce Platforms

Local e-commerce platforms are gaining traction in developing markets. They cater to specific regional needs and preferences. A digital marketing agency in India should:

Partner with regional platforms

Understand local consumer behavior

Adapt strategies for each platform

This approach helps in reaching a wider audience and building local trust. It taps into the familiarity and comfort of regional platforms.

Sustainable and Ethical E-commerce

Consumers in developing markets are becoming more eco-conscious. This trend is influencing their online shopping choices. For businesses:

Highlight sustainable practices

Offer eco-friendly product options

Implement ethical sourcing policies

Promoting sustainability can attract environmentally conscious consumers. It also helps in building a positive brand image.

Personalization and AI-driven Recommendations

AI-powered personalization is becoming a norm in e-commerce. It enhances the shopping experience by offering relevant suggestions. A performance marketing agency can leverage this by:

Implementing AI-driven product recommendations

Creating personalized email marketing campaigns

Offering customized landing pages

Personalization can significantly improve conversion rates and customer loyalty. It makes the shopping experience more relevant and engaging.

Rise of Video Content in E-commerce

Video content is becoming increasingly important in online shopping. It offers a more engaging way to showcase products. For a social media agency:

Create product demonstration videos

Use live streaming for product launches

Implement video reviews and testimonials

Video content can increase engagement and provide more information to shoppers. It helps in building trust and reducing purchase hesitation.

Growth of Buy Now, Pay Later (BNPL) Options

BNPL services are gaining popularity in developing markets. They offer flexible payment options to consumers. For e-commerce businesses:

Integrate BNPL options at checkout

Highlight BNPL availability in marketing

Educate customers about BNPL benefits

Offering BNPL can increase average order value and reduce cart abandonment. It makes higher-priced items more accessible to consumers.

Emphasis on Cybersecurity and Data Privacy

With the growth of e-commerce, data security concerns are rising. Addressing these concerns is crucial for building trust. A digital marketing agency in India should:

Implement robust security measures

Clearly communicate privacy policies

Obtain necessary security certifications

Prioritizing cybersecurity can enhance customer trust and loyalty. It's essential for long-term success in e-commerce.

Integration of Chatbots and AI Assistants

AI-powered chatbots are improving customer service in e-commerce. They offer instant support and guidance to shoppers. For businesses:

Implement AI chatbots for customer queries

Use chatbots for product recommendations

Offer 24/7 support through AI assistants

Chatbots can enhance customer experience and reduce support costs. They provide quick answers and guide customers through the buying process.

Growth of Cross-border E-commerce

Developing markets are seeing a rise in cross-border online shopping. This opens up new opportunities for businesses. A performance marketing agency can:

Optimize for international SEO

Implement multi-currency support

Offer localized content and customer support

Cross-border e-commerce allows businesses to tap into global markets. It requires understanding of international shipping and customs regulations.

Rise of Voice Commerce

Voice-activated shopping is gaining traction in developing markets. It offers a hands-free and convenient shopping experience. For Shopify website development:

Optimize product descriptions for voice search

Implement voice-activated navigation

Create voice-friendly checkout processes

Voice commerce can improve accessibility and convenience for shoppers. It's particularly useful for repeat purchases and simple orders.

Conclusion: Adapting to E-commerce Trends for Success

The e-commerce landscape in developing markets is dynamic and full of opportunities. For a digital marketing agency in India, staying ahead of these trends is crucial. From Shopify website development to performance marketing, adapting strategies to these trends can drive success.

By embracing mobile-first design, leveraging social commerce, and implementing AI-driven personalization, businesses can enhance their e-commerce presence. Understanding local preferences, prioritizing sustainability, and ensuring robust security measures are equally important.

As these trends continue to shape the e-commerce landscape, digital marketing agencies must remain agile and innovative. By doing so, they can help businesses capitalize on the growing e-commerce opportunities in developing markets.

0 notes

Text

Buy Now Pay Later Platforms Market is Estimated to Witness High Growth Owing to Increasing Consumer Demand

The buy now pay later (BNPL) platforms market allows consumers to purchase goods and pay for them in installments interest-free, without requiring credit checks or long application processes. BNPL platforms provide flexibility and convenience to shoppers and have gained popularity among millennials and Gen Z consumers. Key BNPL players provide various payment plans ranging from 4 interest-free payments over 6 weeks to paying back within 3-6 months with no additional fees. This enables consumers to manage their cash flows effectively and avoid interest charges associated with credit cards. The increasing popularity of e-commerce and growing need for flexible payment solutions among consumers are fueling the demand for BNPL platforms.

The Global Buy Now Pay Later Platforms Market is estimated to be valued at US$ 17.72 Bn in 2024 and is expected to exhibit a CAGR of 10% over the forecast period 2024 to 2031.

Key Takeaways

Key players: Key players operating in the buy now pay later platforms market include Baxter International Inc., ICU Medical. Inc, B. Braun Melsungen Ag, Grifols, S.A., Fresenius Kabi USA, LLC, Vifor Pharma Management Ltd, JW Life Science, Amanta Healthcare, Axa Parenterals Ltd, and Salius Pharma Private Limited, Pfizer, Inc, Otsuka Pharmaceutical Co., Ltd, Ajinomoto Co., Inc., B. Braun Melsungen AG, Soxa Formulations & Research Pvt.Ltd, Sichuan Kelun Pharmaceutical Co Ltd.

Key opportunities: Growing e-commerce sales and social commerce trends are opening Buy Now Pay Later Platforms Market Demand Moreover, opportunities exist in developing nations with increasing internet and smartphone penetration.

Global expansion: Major BNPL players are expanding globally to benefit from the untapped growth potential. For instance, Afterpay and Klarna have extended their services across North America, Europe, Asia, and other regions.

Market drivers: Increasing consumer Buy Now Pay Later Platforms Market Size And Trends In addition, pay later capabilities on shopping apps and buy now pay later at brick and mortar stores are fueling the adoption of BNPL payment methods among consumers.

PEST ANALYSIS

Political: Regulations around consumer lending are constantly evolving with new laws around transparency and responsible lending practices. This affects the operations of buy now pay later platforms.

Economic: A rise in discretionary spending and consumer confidence has positively impacted the buy now pay later market. However, an economic downturn could see a reduction in purchases made using these platforms.

Social: Younger consumers are more comfortable with the idea of paying for purchases over time and instalments. Buy now pay later options address changing consumption patterns and preferences.

Technological: Advancements in payments technology and the rise of smartphones have enabled new platforms in the online and offline space. Real-time approvals, syncing with bank accounts and virtual cards are driving growth.

Geographical concentration

In terms of value, the buy now pay later platform market is currently concentrated in North America and Europe. The US and UK markets have seen strong growth due to a large young population and greater adoption of online shopping in these countries. Australia has also emerged as an important early adoption market.

Fastest growing region

The Asia Pacific region excluding Australia is projected to be the fastest growing market for buy now pay later platforms from 2024 to 2031. Rising incomes, expanding middle class and increasing digital payments penetration in countries like India and China offer significant untapped potential. Buy now pay later also provides these markets an innovative credit access point. Get More Insights On, Buy Now Pay Later Platforms Market

#Buy Now Pay Later Platforms Market Demand#Buy Now Pay Later Platforms Market Trends#Buy Now Pay Later Platforms Market Size#Buy Now Pay Later Platforms#Buy Now Pay Later Platforms Market

0 notes

Text

The Booming World of Buy Now, Pay Later

The Buy Now, Pay Later (BNPL) market is experiencing a global surge, transforming how consumers approach purchases. This financing option allows users to split their payments into installments, often interest-free, for a set period. The global BNPL market size was valued at a significant USD 30.38 billion in 2023, and analysts project it to reach a staggering USD 167.58 billion by 2032, with a healthy Compound Annual Growth Rate (CAGR) of 20.7%. This growth is driven by several key factors.

Consumers Embrace Flexibility: BNPL offers a convenient and accessible way to manage finances. By spreading out payments, consumers can manage their cash flow more effectively, particularly for larger purchases. This flexibility is particularly attractive to younger generations who may be budget-conscious or lack access to traditional credit options.

E-commerce Boom Fuels BNPL: The rise of e-commerce has been a major catalyst for BNPL growth. Many online retailers integrate BNPL options at checkout, creating a seamless purchasing experience. This convenience encourages impulse purchases and increases average order value for merchants.

Technological Innovation: The BNPL industry is driven by technological advancements. Platform providers leverage data analytics and machine learning to assess creditworthiness, personalize offers, and optimize marketing campaigns. This targeted approach fosters customer acquisition and engagement.

The Competitive Landscape: The BNPL market is a dynamic space with established players like Affirm, Afterpay, and PayPal vying for market share. Additionally, traditional financial institutions and tech giants are entering the fray, offering their own BNPL solutions. This competition benefits consumers with a wider range of options and potentially more favorable terms.

Regional Growth Variations: The BNPL market is experiencing significant growth in various regions. Asia Pacific currently holds the highest revenue share, driven by the burgeoning e-commerce sector in countries like India, China, and South Korea. Developed markets like North America and Europe are also witnessing strong adoption.

Looking Ahead: Potential Challenges and Opportunities

Despite its promising future, the BNPL market faces certain challenges. Concerns exist regarding responsible lending practices and potential over-indebtedness among users. Regulatory frameworks are evolving to address these concerns and ensure consumer protection.

Furthermore, the BNPL market is not without its critics. Some argue that BNPL services can encourage impulsive spending habits, leading to financial difficulties. However, responsible use of BNPL can be a valuable financial tool.

View Sample Report for Additional Insights on the BNPL Market Forecast, Download a Free Report Sample

0 notes

Text

#India Buy Now Pay Later Market Report#India Buy Now Pay Later Market#India Buy Now Pay Later#Buy Now Pay Later Market Report#Buy Now Pay Later Market#Buy Now Pay Later

0 notes

Text

Embedded Finance Market Surges with a 16.5% CAGR, Set to Reach US$ 291.3 Billion by 2033

It is projected that the embedded finance industry would grow at a robust 16.5% compound annual growth rate (CAGR) from 2023 to 2033. The market is anticipated to be valued at US$ 63.2 billion in 2023 and to have a market share of US$ 291.3 billion by 2033.

The technical advantages along with the expanding financial services including banking and non-banking options are flourishing the market growth. Furthermore, the rapid automation and adoption of smart platforms of different spaces for high productivity and efficiency are propelling growth.

Financial giants are partnering with technological platforms for innovative solutions. For example, Mastercard and Fabrick have signed a partnership to boost embedded finance. New services like buy now pay later (BNPL) and credit reporting are good examples of embedded finance.

The expanding sales and extended chains of banks and financial companies are expected to adopt these new systems in to improve the services offered. Alongside this, the increased convenience, quick transaction, and highly accessible interface is making embedded finance systems future-ready.

The growing sales of financial services have also increased the importance of data. Thus, the embedded finance systems also deliver a relevant collection of data while adding inclusion and convenience to the end user’s plate.

The other benefits include the generation of additional revenue streams while increasing the product’s stickiness, and enhanced customer experience.

Get an overview of the market from industry experts to evaluate and develop growth strategies. Get your sample report here https://www.futuremarketinsights.com/reports/sample/rep-gb-14548

Key Takeaways:

The United States market leads the embedded finance market in terms of market share in North America. The United States region held a market share of 22.3% in 2023. The growth in this region is attributed to expanding financial firms, and the government’s adoption of the latest technologies. North American region held a significant market share of 32.5% in 2022.

Germany’s market is another successful market in the Europe region. The market holds a market share of 12.3% in 2022. The growth is attributed to the presence of new embedded finance platforms such as Plaid, and Alviere Hive. Europe region held a market share of 25.4% in 2022

India embedded finance market booms at a CAGR of 19.5% during the forecast period. The market’s growth is attributed to the new banking policies, enlarged non-banking policies, and high penetration of non-banking platforms.

China’s market also thrives at a CAGR of 17.7% between 2023 and 2033. The growth is caused by the banking reforms and increased focus on consumer inclusivity.

Based on type, the embedded banking segment held a leading market share of 32.1% in 2022.

Based on end-user type, the investment banks and investments company segment perform well as it held a leading market share of 27.2% in 2022.

Competitive Landscape:

The key vendors focus on adding value to the embedded finance systems and easy deployment procedures. Moreover, key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Major Players in this Market:

Bankable

Banxware

Cross River

Resolve

Parafin

TreviPay

Balance

Stripe

Speak to Our Research Expert https://www.futuremarketinsights.com/ask-question/rep-gb-14548

Recent Market Developments:

Finix has introduced embedded payments and the vertical SaaS conundrum. The addition of embedded payments is increasing revenue, reducing the payment strike, and easy customer engagement.

Flywire embedded experience is using smart technologies to secure payments without leaving the website.

Key Segments Covered are:

By Type:

Embedded Banking

Embedded Insurance

Embedded Investments

Embedded Lending

Embedded Payment

By End User:

Loans Associations

Investment Banks & Investment Companies

Brokerage Firms

Insurance Companies

Mortgage Companies

By Key Regions:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

India digital lending platform market size at USD 62.55 million in 2022. During the forecast period between 2023 and 2029, BlueWeave expects the India digital lending platform market size to boom at a robust CAGR of 15.44% reaching a value of USD 148 million by 2029. Major growth drivers for the India digital lending platform market include the deepening internet and smartphone penetration and increasing adoption of digital channels. As more customers use digital channels via smartphones and increased internet access, these platforms are essential for 40–60% of loan acquisition transactions across various loan categories. Commercial banks are also actively participating, offering digital lending services or collaborating with Non-Banking Financial Companies (NBFCs) to create synergies. Digital lending companies streamline processes, requiring only a reference bank account for loan disbursement, leading to a significant increase in loans processed through digital channels. The popularity of Buy Now Pay Later (BNPL) schemes, especially among younger consumers, is contributing to substantial growth in the India digital lending platform market. However, cybersecurity threats is anticipated to restrain the overall market growth during the forecast period.

India Digital Lending Platform Market – Overview

The India digital lending platform market refers to the sector within India's financial industry that specializes in providing digital solutions and platforms for the lending and borrowing funds. These platforms leverage technology, such as mobile apps and web-based applications, to facilitate the entire lending process, from loan application and approval to disbursement and repayment. They may offer a wide range of financial products, including personal loans, business loans, consumer credit, and more, often using data analytics and innovative business models to assess creditworthiness and streamline the lending experience. The market is characterized by its rapid growth, driven by the increasing use of smartphones, internet penetration, and the adoption of advanced technologies like Artificial Intelligence (AI).

Sample Request @ https://www.blueweaveconsulting.com/report/india-digital-lending-platform-market/report-sample

0 notes

Text

Investing for Beginners: A Step-by-Step Guide to Building Wealth Investing is a crucial aspect of building long-term wealth, and it's a financial journey anyone can embark upon, even if you're a beginner in the world of finance. In this blog, we will explore the fundamentals of investing for beginners, offering a step-by-step guide to help you make informed decisions and secure your financial future. ## Step 1: Clear Your Debts Before you start investing, it's essential to address any high-interest debts you may have, such as credit card balances and personal loans. Paying off these debts should be a top priority as they often have interest rates that exceed the returns you might gain from investments. ## Step 2: Create an Emergency Fund Building an emergency fund is the foundation of financial security. Aim to save at least three to six months' worth of living expenses in a readily accessible account. Apps like Axio can assist with personal finance management, helping you track your progress toward this goal. ## Step 3: Understand Your Financial Goals Determine what you're investing for, whether it's retirement, a down payment on a house, or your child's education. Having clear financial goals will guide your investment decisions. ## Step 4: Educate Yourself Investing requires knowledge. Spend time learning about different investment options, including stocks, bonds, mutual funds, and real estate. You can find plenty of resources online or consider taking a course on investing. ## Step 5: Start with a Daily Budget Tracker App Managing your daily expenses is crucial. Use a daily budget tracker app to keep an eye on your spending and ensure you have money to invest. Axio, for instance, is a personal finance management app that can help you keep your expenses in check. ## Step 6: Choose Your Investment Strategy There are several investment strategies to consider: - *Passive Investing*: This involves low-cost index funds or exchange-traded funds (ETFs) that track the overall market's performance. - *Active Investing*: This approach involves individual stock picking or actively managed mutual funds. - *Diversification*: Spread your investments across different asset classes to manage risk. ## Step 7: Open an Investment Account To buy and sell investments, you'll need to open an investment account with a brokerage or a financial institution. Research different platforms and choose one that aligns with your investment strategy. ## Step 8: Invest Regularly Consistency is key to successful investing. Set up automatic contributions to your investment account, so you invest a portion of your income regularly. This strategy, known as dollar-cost averaging, helps you benefit from market fluctuations over time. ## Step 9: Monitor and Adjust Regularly review your investment portfolio. Rebalance it as necessary to maintain your target asset allocation and ensure it aligns with your financial goals. ## Step 10: Stay Informed Continue your financial education and stay informed about market trends and economic developments. Knowledge is a valuable asset in the world of investing. In conclusion, investing is a journey that begins with careful planning and a commitment to financial growth. Alongside your investment endeavors, consider using budget tracking and personal finance management apps like Axio to keep your finances in order. With dedication and knowledge, you can start building wealth and working towards your financial dreams. As a bonus, in today's digital age, some Buy Now, Pay Later apps, like those available in India, offer investment options or allow you to pay for purchases in EMI, making them a unique bridge between spending and saving. When used thoughtfully, these apps can complement your investment strategy and overall financial planning.

#monthly expenses app#online personal finance management#personal finance management app#expenses app

0 notes

Text

Understanding to Trading in Financial Market

If we talk about trading, trading is the simple and equivalent term to exchange. The exchange can be of any of two things, either it can be exchange of two ideas. If we provide a particular service and in exchange, we get any service or amount, that is also called trading. If we talk about stock market, bonds, fixed deposits in the context of financial instrument, if any person, institution or government pay money and that particular instrument is kept or purchased in the intention of the growth or increment of the valuation of the particular instrument, is called trading. So, if we are buying any instrument and that instrument is being bought in the intention that the value of the instrument will increase, so this is called trading in order to sale. Now if we have to earn benefit in trading, we will have to always buy the instrument in less price and sell it at higher prices, but if there is any risk involved, so risk can be positive and negative. Instead of increasing the price, if the price falls and we sell that instrument so this is negative risk, so this is also a trading, means trading doesn’t means that we are always in profit , trading means we are In loss as well. Trading can be barter, trading can be in the context of services, physical instruments, advices or ideas or anything.

Now if we come directly to the sector of stock market, here are three segments Cash, Future and options. This all starts from the regulation of SEBI, which regulates the market. There is total 8 active stock exchanges in India, however two are very popular NSE and BSE. So, the NSE and BSE has their own stories, BSE is the oldest and NSE is the biggest one. If we have to trade in stock market, we can become investor or intraday trader. To become an intraday trader, we need to know the all the process of intraday trading. In intraday, if we are buying the particular instrument and selling that particular instrument in the same day, is called Intraday Trading.

Cash Market Trading:

A market known as a cash market is one where commodities, currencies, and securities are traded for immediate settlement and delivery in return for cash or another form of payment. A credit facility is not present in such marketplaces. Trading of cash market is kind of physical, means we buy shares and directly shares come into our account. Means we gave money and shares came in our account, then this type of trading is called cash market trading.

This is done in two ways, (i) Intraday and (ii) Positional. Intraday means that today itself we will buy those shares and sell them today itself. If we are doing intraday trading then we do not have any restrictions. Meaning, even if we buy those shares first and sell them later, but the shares which we do not have, we sold them in the morning and bought them in the evening, even then the account is equal. Just at the end of the day our account should be equal. The number of shares that we have bought, the same number of shares should be sold from our account. So, any work we can do first, buy and sell.

If you want to learn more about trading then join India's best community classes from Investing Daddy.

If we have done positional trading, then we cannot sell again because the rule in trading is that if we do intraday trading then those shares do not come in our Demat. We traded that. But if we invest, then if we invest, then instead the shares come in our Demat. The work of bringing these shares in Demat is done by companies like NSDL and SDSL in the securities market. These are depositories and their work is of settlement as well as counter party risk management. Now, how about the settlement? We paid, in return we bought shares, the money is ours, we will not know the name of the person who sold those shares. Maybe we bought ten shares, and maybe we bought those ten shares from ten different people and maybe we bought ten shares from the same person, so it depends, so wherever these shares came from, who It is the job of the depositories to take the money out of his Demat and transfer it to our Demat and the money we have paid along with it. Now what is counter party risk management, during this duration there is a TAT in it which we call T+2 days. Means those shares will come in our Demat within trading day + 2 trading and that money will reach it, total time is two days. Saturday and Sunday holidays do not count. Now, during the period we are at risk, risk means risk of loss and profit. Suppose we have bought a share, the person who has sold us shares, those shares are not there in the Demat of that particular person, then from where will we get the shares. So, for this we do not have to find that person, our counter party is this depository only. For which the depository takes money from us. Even, in many cases, we will not even be aware that something like this has happened to us. Because in this T+2 days, suppose Person A bought some shares from Person B and Person A does not know who Person B is, there is a depository between Person A and Person B, Person A bought shares, And there is no money in Person B's Demat, NSDL CDSL will go to Person B's Demat, see that there is no shares in Person B's Demat, NSDL will react, will go to auction, will purchase those shares from those who have those shares available . Here at the time of purchasing, their prices can be anything, depending on auctions. Suppose a person sold some shares of Reliance, he sold one share for 3000 rupees and that share is not in his Demat. In the auction that went to the depository, that day no broker has those shares in the auction, no one has held Reliance, a man was found, who has one share of Reliance, he says that I have this one share for Rs 1,00,000 If I sell it, NSDL will buy it for Rs 1,00,000 and deliver it to this person. Now a loss of 1,00,000 - 3,000 = 97,000. This money will be recovered from Person B, it will be the loss of Person B, who sold the shares. So, in earlier times it used to be very dangerous. When there were no automated systems. There was a period under During when people used to forget to sell shares and a lot of people's money used to get drowned in the auction. But now since automated systems have come, now brokers do not allow that if we want to sell then we cannot take normal delivery trade and if we want to buy then we can take normal delivery trade, then sell In case we will take intraday trade. In case of intraday trade, now the broker has made this rule, if we do not square up the held position within 3:10 minutes, then our position will automatically square up. Means automatically those shares will be bought in our account. So, this is how the intraday and positional cash market trading happens. When bought or sold in intraday, NSDL or CDSL will not tell us why we sold first and why we bought, even they will not go to check the time, their work is to match that 100 shares were bought and 100 shares were sold and the matter is over, the account is equal. Whatever the profit is, whatever the loss is, under that would be calculated. When we call the same as positional, then we are called investors because we did not trade, then we invested in that share.

There is also some margin in intraday trading, it is decided by the margin regulator that how much margin can be given. And slowly our regulator is coming to the concept that non-margin trading is also possible in intraday. Because margin increases our risk. How does it increase, suppose it is 5,000 rupees and we get a margin of 10 times, so our 5,000 becomes 50,000. Means in intraday we can buy 50000 and sell 50,000. So, it would be great fun for a common man to see that I can trade for Rs.50,000, and if we make a profit, it will be Rs.50,000. We have 5,000 rupees and there is a share of 500 rupees, we bought 10 shares, bought 5 rupees for the target, then it can be a profit of 5 rupees in 10 shares or it can be a loss. If 10 shares are bought then 10 x 5 means profit of Rs.50 and loss of Rs.50. Which if we see according to 5,000, then just 1% profit and 1% loss.

But if we trade with 50,000 instead of 5,000 with margin, then instead of 10 shares of 500, we got 100 shares, now we will have a profit of 500 or a loss of 500, that means our risk was 1% In trading without margin, now it has directly increased to 10%. So, our positive risk also increased and negative risk also increased. That's why we should always keep in mind that even though we have margin available in intraday trading, but still if we want to become a good trader then margin should be used sparingly. Sometimes a position got stuck, sometimes it happened that we took a trade during the day, we had to average it, then we used margin, but if we are always trading with margin, then under this kind of we are putting ourselves in high risk. are involved. So this is how cash market trading is being done. Here we do not have any restriction on the number of shares we will buy, we can buy as many shares as we want. 1, 100, 1000, 100000 whatever the number of shares to buy, they can buy.

youtube

Derivative Future Market:

The term derivative refers to a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark. A derivative is set between two or more parties that can trade on an exchange or over-the-counter (OTC). These contracts can be used to trade any number of assets and carry their own risks. Prices for derivatives derive from fluctuations in the underlying asset. These financial securities are commonly used to access certain markets and may be traded to hedge against risk. Derivatives can be used to either mitigate risk (hedging) or assume risk with the expectation of commensurate reward (speculation). Derivatives can move risk (and the accompanying rewards) from the risk-averse to the risk seekers.

A derivative is a complex type of financial security that is set between two or more parties. Traders use derivatives to access specific markets and trade different assets. Typically, derivatives are considered a form of advanced investing. The most common underlaying assets for derivatives are stocks, bonds, commodities, currencies, interest rates and market indexes. Contract values depend on changes in the prices of the underlying asset.

0 notes

Text

Buy Now, Pay Later: Changing the Game in E-Commerce

The main purpose of buy now pay later is to eliminate the need to make payment for items at the buying time. In addition, numerous benefits provided by buy now pay later include, high security, hassle free transaction, faster transaction processing speed and others. Furthermore, rise in penetration of online payment across the globe and growth in the e-commerce industry in emerging countries are the major factors driving the buy now pay later market growth.

The Buy Now Pay Later Market study by Allied Market Research includes an overview of business trends, competitor analysis, and a future market and technical analysis forecast. In addition, the study gave an illustration of the global value and key regional trends in terms of Earthquake InsurMark size, share and growth opportunities. All information about the global market has been carefully analyzed and verified by industry professionals after being gathered from very reliable sources.

Download PDF Sample Copy: https://www.alliedmarketresearch.com/request-sample/12893

A comprehensive and detailed method that combined primary and secondary research was used to thoroughly investigate the global E-Banking Market. While secondary research gave a broad overview of the products and services, primary research involved a thorough examination of many factors that influence the market. A process of searching is done using a variety of sources, such as press releases, professional journals, and government websites, to gain insights into the industry. This approach has made it possible to acquire a clear, extensive understanding of the global E-Banking Market.

Analysis of Key Players:

The market is fragmented, with many large and medium-scale vendors controlling minority shares. Vendors actively engage in product development by making significant investments in R&D initiatives. Through a variety of growth strategies, including alliances, partnerships, mergers, and acquisitions, they are increasing their Shop Insurance Marketshare.

Purchase this Report@ https://www.alliedmarketresearch.com/buy-now-pay-later-market/purchase-options

Major players operating in the Buy Now Pay Later Market industry include Affirm Holdings Inc., Afterpay ,Klarna Bank AB , Laybuy Group Holdings Limited, PayPal Holdings Inc., Payl8r (Social Money Ltd.), Perpay , Quadpay, Sezzle, Splitit.

By Channel

Online Channel

POS Channel

By Technology

Retail Goods

Media & Entertainment

Healthcare & Wellness

Automotive

Home Improvement

Others

By End User

Generation X

Generation Z/Millennials

Baby Boomers

By Region

North America (U.S, Canada, and Mexico),

Europe (UK, Italy, Germany, France, Spain, Netherlands, Switzerland, and the Rest of Europe),

Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Thailand, and Rest of Asia-Pacific),

LAMEA (Latin America, Middle East, and Africa).

The expert team at Allied Market Research continuously analyzes the market environment by making precise predictions about the necessary driving and restraining factors. On these factors, the stakeholders can base their business plans.

Key Benefits for Stakeholders:

This report offers a quantitative examination of the market segments, estimations, recent trends, and dynamics of the Buy Now Pay Later Market: analysis from 2023 to 2032 to specify the key competitive advantages.

An in-depth analysis of Market segmentation helps in determining current market opportunities.

Porter’s five forces analysis places a strong emphasis on consumers’ and vendors’ capacity to develop their supplier-buyer networks and come to profitable business decisions.

The report examines regional and global market segmentation, LAMEA Travel Insurance MarkeTrends, leading players, market growth strategies, and application areas.

Market participants’ positioning encourages comparative analysis and provides a clear understanding of the player’s current position.

The major countries in each region are mapped based on their revenue contribution to the global market.

The report provides in-depth details of the business tactics used by the major market participants in Buy Now Pay Later Market: growth.

Customization Before Buying, Visit @ https://www.alliedmarketresearch.com/request-for-customization/12893

Key Questions Answered in the Research Report-

What are the market sizes and rates of growth for the various market segments in the global and regional market?

What are the key benefits of the Buy Now Pay Later Market: report?

What are the driving factors, restraints, and opportunities in the global Market?

Which region has the largest share of the global Market?

Who are the key players in the global Market?

Top Trending Reports:

1) credit default swap market: https://www.einpresswire.com/article/661062015/credit-default-swap-market-expected-with-companies-offerings-by-end-user-segments-2032

2) Corporate Banking Market: Corporate Banking Market Evolves to Meehttps://www.openpr.com/news/3241671/corporate-banking-market-evolves-to-meet-changing-businesst Changing Business (openpr.com)

3) Debt Financing Market: https://www.openpr.com/news/3242822/debt-financing-market-dynamics-challenges-and-opportunities

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.��� AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1–503–894–6022 Toll Free: +1–800–792–5285

UK: +44–845–528–1300

India (Pune): +91–20–66346060 Fax: +1–800–792–5285 [email protected]

0 notes

Text

Understanding to Trading in Financial Market

If we talk about trading, trading is the simple and equivalent term to exchange. The exchange can be of any of two things, either it can be exchange of two ideas. If we provide a particular service and in exchange, we get any service or amount, that is also called trading. If we talk about stock market, bonds, fixed deposits in the context of financial instrument, if any person, institution or government pay money and that particular instrument is kept or purchased in the intention of the growth or increment of the valuation of the particular instrument, is called trading. So, if we are buying any instrument and that instrument is being bought in the intention that the value of the instrument will increase, so this is called trading in order to sale.

Now if we have to earn benefit in trading, we will have to always buy the instrument in less price and sell it at higher prices, but if there is any risk involved, so risk can be positive and negative. Instead of increasing the price, if the price falls and we sell that instrument so this is negative risk, so this is also a trading, means trading doesn’t means that we are always in profit , trading means we are In loss as well. Trading can be barter, trading can be in the context of services, physical instruments, advices or ideas or anything.

Now if we come directly to the sector of stock market, here are three segments Cash, Future and options. This all starts from the regulation of SEBI, which regulates the market. There is total 8 active stock exchanges in India, however two are very popular NSE and BSE. So, the NSE and BSE has their own stories, BSE is the oldest and NSE is the biggest one. If we have to trade in stock market, we can become investor or intraday trader. To become an intraday trader, we need to know the all the process of intraday trading. In intraday, if we are buying the particular instrument and selling that particular instrument in the same day, is called Intraday Trading.

LTP Calculator India's No.1 Trading tool

Cash Market Trading:

A market known as a cash market is one where commodities, currencies, and securities are traded for immediate settlement and delivery in return for cash or another form of payment. A credit facility is not present in such marketplaces.

Trading of cash market is kind of physical, means we buy shares and directly shares come into our account. Means we gave money and shares came in our account, then this type of trading is called cash market trading.

This is done in two ways, (i) Intraday and (ii) Positional. Intraday means that today itself we will buy those shares and sell them today itself. If we are doing intraday trading then we do not have any restrictions. Meaning, even if we buy those shares first and sell them later, but the shares which we do not have, we sold them in the morning and bought them in the evening, even then the account is equal. Just at the end of the day our account should be equal. The number of shares that we have bought, the same number of shares should be sold from our account. So, any work we can do first, buy and sell.

If we have done positional trading, then we cannot sell again because the rule in trading is that if we do intraday trading then those shares do not come in our Demat. We traded that. But if we invest, then if we invest, then instead the shares come in our Demat. The work of bringing these shares in Demat is done by companies like NSDL and SDSL in the securities market. These are depositories and their work is of settlement as well as counter party risk management. Now, how about the settlement? We paid, in return we bought shares, the money is ours, we will not know the name of the person who sold those shares. Maybe we bought ten shares, and maybe we bought those ten shares from ten different people and maybe we bought ten shares from the same person, so it depends, so wherever these shares came from, who It is the job of the depositories to take the money out of his Demat and transfer it to our Demat and the money we have paid along with it. Now what is counter party risk management, during this duration there is a TAT in it which we call T+2 days. Means those shares will come in our Demat within trading day + 2 trading and that money will reach it, total time is two days. Saturday and Sunday holidays do not count. Now, during the period we are at risk, risk means risk of loss and profit. Suppose we have bought a share, the person who has sold us shares, those shares are not there in the Demat of that particular person, then from where will we get the shares. So, for this we do not have to find that person, our counter party is this depository only. For which the depository takes money from us. Even, in many cases, we will not even be aware that something like this has happened to us. Because in this T+2 days, suppose Person A bought some shares from Person B and Person A does not know who Person B is, there is a depository between Person A and Person B, Person A bought shares, And there is no money in Person B's Demat, NSDL CDSL will go to Person B's Demat, see that there is no shares in Person B's Demat, NSDL will react, will go to auction, will purchase those shares from those who have those shares available . Here at the time of purchasing, their prices can be anything, depending on auctions. Suppose a person sold some shares of Reliance, he sold one share for 3000 rupees and that share is not in his Demat. In the auction that went to the depository, that day no broker has those shares in the auction, no one has held Reliance, a man was found, who has one share of Reliance, he says that I have this one share for Rs 1,00,000 If I sell it, NSDL will buy it for Rs 1,00,000 and deliver it to this person. Now a loss of 1,00,000 - 3,000 = 97,000. This money will be recovered from Person B, it will be the loss of Person B, who sold the shares. So, in earlier times it used to be very dangerous. When there were no automated systems. There was a period under During when people used to forget to sell shares and a lot of people's money used to get drowned in the auction. But now since automated systems have come, now brokers do not allow that if we want to sell then we cannot take normal delivery trade and if we want to buy then we can take normal delivery trade, then sell In case we will take intraday trade. In case of intraday trade, now the broker has made this rule, if we do not square up the held position within 3:10 minutes, then our position will automatically square up. Means automatically those shares will be bought in our account. So, this is how the intraday and positional cash market trading happens. When bought or sold in intraday, NSDL or CDSL will not tell us why we sold first and why we bought, even they will not go to check the time, their work is to match that 100 shares were bought and 100 shares were sold and the matter is over, the account is equal. Whatever the profit is, whatever the loss is, under that would be calculated. When we call the same as positional, then we are called investors because we did not trade, then we invested in that share.

There is also some margin in intraday trading, it is decided by the margin regulator that how much margin can be given. And slowly our regulator is coming to the concept that non-margin trading is also possible in intraday.

Because margin increases our risk. How does it increase, suppose it is 5,000 rupees and we get a margin of 10 times, so our 5,000 becomes 50,000. Means in intraday we can buy 50000 and sell 50,000. So, it would be great fun for a common man to see that I can trade for Rs.50,000, and if we make a profit, it will be Rs.50,000. We have 5,000 rupees and there is a share of 500 rupees, we bought 10 shares, bought 5 rupees for the target, then it can be a profit of 5 rupees in 10 shares or it can be a loss. If 10 shares are bought then 10 x 5 means profit of Rs.50 and loss of Rs.50. Which if we see according to 5,000, then just 1% profit and 1% loss.

But if we trade with 50,000 instead of 5,000 with margin, then instead of 10 shares of 500, we got 100 shares, now we will have a profit of 500 or a loss of 500, that means our risk was 1% In trading without margin, now it has directly increased to 10%. So, our positive risk also increased and negative risk also increased.

That's why we should always keep in mind that even though we have margin available in intraday trading, but still if we want to become a good trader then margin should be used sparingly. Sometimes a position got stuck, sometimes it happened that we took a trade during the day, we had to average it, then we used margin, but if we are always trading with margin, then under this kind of we are putting ourselves in high risk. are involved. So this is how cash market trading is being done. Here we do not have any restriction on the number of shares we will buy, we can buy as many shares as we want. 1, 100, 1000, 100000 whatever the number of shares to buy, they can buy.

If you want to learn more about trading then join India's best community classes from Investing Daddy.

Derivative Future Market:

The term derivative refers to a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark. A derivative is set between two or more parties that can trade on an exchange or over-the-counter (OTC).

These contracts can be used to trade any number of assets and carry their own risks. Prices for derivatives derive from fluctuations in the underlying asset. These financial securities are commonly used to access certain markets and may be traded to hedge against risk. Derivatives can be used to either mitigate risk (hedging) or assume risk with the expectation of commensurate reward (speculation). Derivatives can move risk (and the accompanying rewards) from the risk-averse to the risk seekers.

A derivative is a complex type of financial security that is set between two or more parties. Traders use derivatives to access specific markets and trade different assets. Typically, derivatives are considered a form of advanced investing. The most common underlaying assets for derivatives are stocks, bonds, commodities, currencies, interest rates and market indexes. Contract values depend on changes in the prices of the underlying asset.

STOCK MARKET BEST TEACHER

0 notes

Text

India Digital Lending Market is in Growing Stage, Being Driven by Digitization in the country along with the presence of 100+ Players in the Industry: Ken Research

Digital Lending Platforms are addressing the huge unmet demand for credit as the Market has grown @ CAGR 131.9% During FY’2017-FY’2022.

To Know More on this report, Download free Sample Report

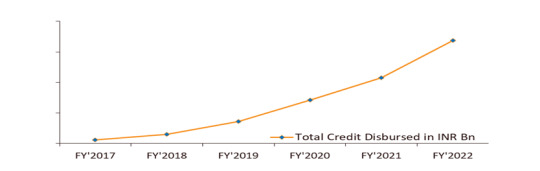

India’s market for digital lending has grown from INR 116.7 billion in FY’2017 to INR 3,377.7 billion in FY’2022P. The growth is supported by the need for superior customer experience, emerging business models, faster turn-around time, and adoption of technology like AI. Customers are adopting digital avenues as a result of the rise in smartphone usage and internet penetration. Digital channels influence 40 to 60% of loan purchase transactions across loan types.

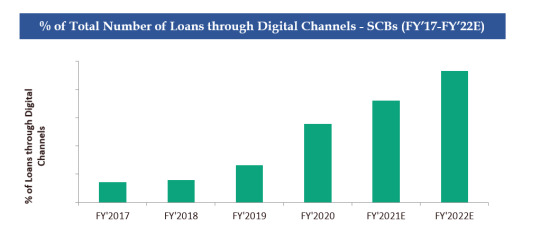

2. Loans through Digital Channels on NBFCs has increased from 0.6% in FY’2017 to 53.0% in Dec, 2020 owing to the rise in BNPL schemes and lower interest rates offered by the Lending Platforms.

Visit this Link Request for custom report

Commercial banks are rapidly joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies. The Digital Lending Company’s requirements are lower, and the process is significantly quicker. They need just a bank account as a reference point where loans can be credited and therefore % of Loans through Digital Channels are higher with NBFCs. The flexibility that BNPL schemes offer has completely transformed the digital lending market, particularly for younger shoppers, who are happy to trade traditional credit cards for more user-friendly BNPL schemes. The rapid uptake of Buy Now, Pay Later (BNPL) propositions, particularly within the retail sector, continues to drive major growth and new opportunities for NBFCs in India.

3. Rising Internet Penetration, Rise of innovative Models and an enabling regulatory environment are some of the Major Driving Factors for Digital Lending in India

To Know More on this report, Download free Sample Report

Higher penetration of smartphones, increasing number of mobile phone subscriptions coupled with inexpensive data has result in the growth and also supported the awareness and adoption rate of Digital Lending in India’s population. The popularity of Digital Lending has increased in India owing to NBFCs platforms collaborating with other digital platforms such as e-commerce, ride hailing, travel, logistics and more, resulting in higher acceptance of digital lending from various customer segments in the country. Digital Lending Pioneered by NBFCs, have now resulted in Companies from various segments coming up with multiple new models of doing business such as Digital Lending Marketplaces, POS Transaction Lending, Bank and NBFCs partnership models and more.2

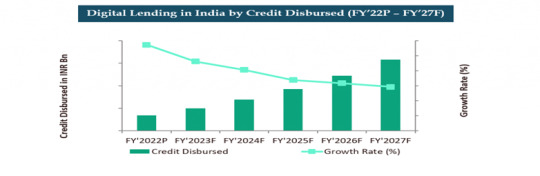

4. Digital Lending Market to Reach INR ~15,000 billion by FY’2027 Making Digital Lending a Sector with the Highest Penetration by Digital Channels in the Country.

To more about industry trends, Request a free Expert call

Strategic partnerships and collaborations between traditional financial institutions and new-age Lending Platforms. Plus, easy market entry and targeted loan offerings due to availability of large sets of customer data, which can give collective and individual insights. Changing consumer behavior and expectations shaped by purchase/ transaction experiences offered by e-marketplaces like food delivery, e-commerce and travel portals.

#b2b lending companies in india#Capital Float Digital Lending Market Revenue#Challenges in India’s Digital Lending Market#commercial loan Providers in India#Competitors in Digital Lending Market India#consumer durable loan market in india#redit disbursement in India#Credit lending startups in India#emand of Digital Lending in India#digital channels in India#digital credit industry in India#Digital lending ecosystem in India#digital lending growth in india#digital lending in India#digital lending market size in india#digital lending platform market#Digital lending value in India#digital loans Providers in India#Emerging Players in India Digital Lending Market#fastest-growing fintech in India#Financial Services Sector in India#fintech Compnanies in India#future trends for financial services sector in india#Impact of digital lending on MSME in india#India Digital Lending Industry#India Digital Lending Market#India Digital Lending Market Major Players#India Digital Lending Sector#India's retail loan Providers#India's Road Map for Digital Lending

0 notes

Text

Rapid Investment Growth with 400+ banks and Government Digitalization Initiatives Fuel Philippines Retail Deposit Market's Expansion: Ken Research

A booming banking sector alongside government aid to be the backbone of Philippines Retail Deposits Market, says a report by ken Research

The India Construction Chemicals market is moderately fragmented in nature, with the presence of many international players as well as local players. Some of the major players in the industry, are Citi Bank, Union bank, Metro Bank & Sterling Bank of Asia.

Business Bank Philippines Market Revenue

1. Government Initiatives to Increase Financial Inclusion, promote digital Payments and Enhance Consumer Security are giving confidence to customers to make more deposits.

https://www.kenresearch.com/blog/wp-content/uploads/2023/08/Security-Bank-Philippines-Annual-Revenue.jpeg.png

To learn more about this report Download a Free Sample Report

Government initiatives in the Philippines are playing a crucial role in shaping the retail deposit market. With a focus on increasing financial inclusion, promoting digital payments, and enhancing consumer security, these initiatives have instilled confidence among customers to make more deposits. The inclusion of digital wallets and e-payments has provided consumers with convenient and easy-to-use options, enabling them to make better choices. Furthermore, the implementation of enhanced consumer protection measures, such as Circular No. 1048 or the BSP Regulations on Financial Consumer Protection, has strengthened the existing infrastructure and executed processes more effectively. Overall, government policies are driving positive transformations in the Philippines retail deposit market, fostering innovation and improving the banking experience for customers.

2. Investment Scenario Bolsters Growth of Philippines Retail Deposit Market

Visit this Link: – Request For Custom Report

The retail deposit market in the Philippines is experiencing a significant boost due to a favorable investment scenario. The country's growing economy and increasing investor confidence have led to a surge in investments, thereby contributing to the expansion of the retail deposit market. Investors are actively seeking secure and reliable avenues to park their funds, and retail deposits have emerged as a popular choice. The stability of the banking system, coupled with attractive interest rates and various investment options, has attracted individuals and businesses to deposit their savings in banks. This influx of investments has not only fueled the growth of the retail deposit market but also provided banks with a stable source of funding to support lending activities.

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors

Risk-Averse Individuals

Fixed Income Seekers

Small Business Owners

Non-Profit Organizations

Fixed-Time Investors

Time Period Captured in the Report:

Historical Period: 2016-2022

Base Year: 2022

Forecast Period: 2022-2027

For More Insights On Market Intelligence, Refer To The Link Below: –

Philippines Retail Deposit Market Outlook to 2027

Related Reports By Ken Research:-

KSA Lending Market Outlook to 2027

India ATM Managed Services Market Outlook to FY’2027

South Africa Buy Now Pay Later Market Outlook to 2027F

0 notes

Text

#India Buy Now Pay Later Market Report#India Buy Now Pay Later Market#India Buy Now Pay Later#Buy Now Pay Later#Buy Now Pay Later Market

0 notes

Text

IoT Integration: Exploring the Intersection of Embedded Finance and Technology

The embedded finance market is anticipated to expand its roots at a strong CAGR of 16.5% between 2023 and 2033. The market is expected to have a market share of US$ 291.3 billion by 2033 while it is projected to be valued at US$ 63.2 billion in 2023.

The technical advantages along with the expanding financial services including banking and non-banking options are flourishing the market growth. Furthermore, the rapid automation and adoption of smart platforms of different spaces for high productivity and efficiency are propelling growth.

Financial giants are partnering with technological platforms for innovative solutions. For example, Mastercard and Fabrick have signed a partnership to boost embedded finance. New services like buy now pay later (BNPL) and credit reporting are good examples of embedded finance.

The expanding sales and extended chains of banks and financial companies are expected to adopt these new systems in to improve the services offered. Alongside this, the increased convenience, quick transaction, and highly accessible interface is making embedded finance systems future-ready.

The growing sales of financial services have also increased the importance of data. Thus, the embedded finance systems also deliver a relevant collection of data while adding inclusion and convenience to the end user’s plate.

The other benefits include the generation of additional revenue streams while increasing the product’s stickiness, and enhanced customer experience.

Get an overview of the market from industry experts to evaluate and develop growth strategies. Get your sample report here @ https://www.futuremarketinsights.com/reports/sample/rep-gb-14548

Key Takeaways:

The United States market leads the embedded finance market in terms of market share in North America. The United States region held a market share of 22.3% in 2023. The growth in this region is attributed to expanding financial firms, and the government’s adoption of the latest technologies. North American region held a significant market share of 32.5% in 2022.

Germany’s market is another successful market in the Europe region. The market holds a market share of 12.3% in 2022. The growth is attributed to the presence of new embedded finance platforms such as Plaid, and Alviere Hive. Europe region held a market share of 25.4% in 2022

India embedded finance market booms at a CAGR of 19.5% during the forecast period. The market’s growth is attributed to the new banking policies, enlarged non-banking policies, and high penetration of non-banking platforms.

China’s market also thrives at a CAGR of 17.7% between 2023 and 2033. The growth is caused by the banking reforms and increased focus on consumer inclusivity.

Based on type, the embedded banking segment held a leading market share of 32.1% in 2022.

Based on end-user type, the investment banks and investments company segment perform well as it held a leading market share of 27.2% in 2022.

Competitive Landscape:

The key vendors focus on adding value to the embedded finance systems and easy deployment procedures. Moreover, key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Major Players in this Market:

Bankable

Banxware

Cross River

Resolve

Parafin

TreviPay

Balance

Stripe

Request Methodology @ https://www.futuremarketinsights.com/request-report-methodology/rep-gb-14548

Recent Market Developments:

Finix has introduced embedded payments and the vertical SaaS conundrum. The addition of embedded payments is increasing revenue, reducing the payment strike, and easy customer engagement.

Flywire embedded experience is using smart technologies to secure payments without leaving the website.

Key Segments Covered are:

By Type:

Embedded Banking

Embedded Insurance

Embedded Investments

Embedded Lending

Embedded Payment

By End User:

Loans Associations

Investment Banks & Investment Companies

Brokerage Firms

Insurance Companies

Mortgage Companies

By Key Regions:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

Achieving Mastery in Smart Loans Management Techniques

Mastering smart loan management techniques can save you from stress and financial burdens. Whether you're starting a dream business or buying a dream home, it's crucial for young professionals and families alike. In this article, let’s explore some simple yet powerful strategies to achieve mastery in handling loans.

Understanding Your Loan

Before diving headfirst into the sea of loans, take a moment to understand the loan you're opting for. Be it a personal loan, home loan, or any other type, grasp the terms and conditions, interest rates, and repayment plans. Ignorance is not bliss when it comes to loans, so ask questions and clarify doubts with your lender.

Also Read: Travel Now, Pay Later: How Travel Loans Can Make Wanderlust a Reality

Setting a Realistic Budget

Hey, we get it – splurging on that new gadget or designer bag is tempting, but remember, loans are not free money. It's necessary to set a realistic budget and stick to it. Understand your income, expenses, and the EMI you can comfortably afford. Striking this balance will keep you on track to repay your loan without compromising your financial stability.

Choosing the Right Lender

In India's diverse financial market, lenders are aplenty, each with enticing offers. But hold your horses and do your homework! Opt for a reputable lender who provides competitive interest rates, favorable repayment options, and excellent customer service. This ensures you get the best deal and support throughout your loan journey.

Embracing Technology

Namaste, digital age! Embrace technology to streamline your loan management process. Many financial institutions offer user-friendly mobile apps and websites that enable you to track your loan status, make payments, and access important information. By leveraging these digital tools, you can conveniently stay on top of your loan game.

Building an Emergency Fund

Life in India can be unpredictable, and emergencies might crop up when you least expect them. While repaying your loan, it's wise to simultaneously build an emergency fund. This safety net will prevent you from falling into a debt spiral if unforeseen circumstances arise, such as medical emergencies or sudden job loss.

Avoiding Multiple Loans

Sometimes, too much of a good thing can backfire. While it may be tempting to take multiple loans simultaneously, it's essential to weigh the consequences. Managing multiple EMIs can become overwhelming, leading to unnecessary stress. Opt for one loan at a time, and once you've successfully repaid it, then consider taking another.

Prepayment Benefits

Did you know you can be an Indian loan management wizard by making prepayments? If you come across some extra cash or receive a hefty bonus, consider making partial prepayments on your loan. Not only does this reduce your principal amount, but it also saves you on interest payments. Smart, right?

Regularly Reviewing Finances

In the hustle and bustle of daily life, it's easy to forget to review your finances regularly. But remember, financial growth is a journey that demands consistent attention. Set aside time every month to review your loan status, track expenses, and analyze your progress. This habit will help you make informed decisions and adapt your loan management strategies as needed.

Also Read: Why You Should Get a Pre-Owned Car in India

Seeking Professional Advice

When in doubt, seek the wisdom of financial experts. India has a pool of talented financial advisors who can provide valuable insights into your loan management plan. Their expertise can assist you in optimizing your loan repayment strategy, helping you navigate through financial challenges effectively.

Conclusion

Mastering smart loan management techniques in India requires a combination of knowledge, discipline, and embracing technology. By understanding your loan, budgeting wisely, and making informed decisions, you can become a pro at managing loans effectively. So, take charge of your financial journey, and let smart loan management lead you to a prosperous future!

#Reviewing Finances#Prepayment Benefits#Multiple Loans#emergency fund#technology#loan management system

0 notes