#Digital lending value in India

Explore tagged Tumblr posts

Text

India Digital Lending Market is in Growing Stage, Being Driven by Digitization in the country along with the presence of 100+ Players in the Industry: Ken Research

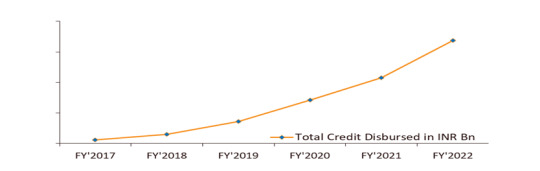

Digital Lending Platforms are addressing the huge unmet demand for credit as the Market has grown @ CAGR 131.9% During FY’2017-FY’2022.

To Know More on this report, Download free Sample Report

India’s market for digital lending has grown from INR 116.7 billion in FY’2017 to INR 3,377.7 billion in FY’2022P. The growth is supported by the need for superior customer experience, emerging business models, faster turn-around time, and adoption of technology like AI. Customers are adopting digital avenues as a result of the rise in smartphone usage and internet penetration. Digital channels influence 40 to 60% of loan purchase transactions across loan types.

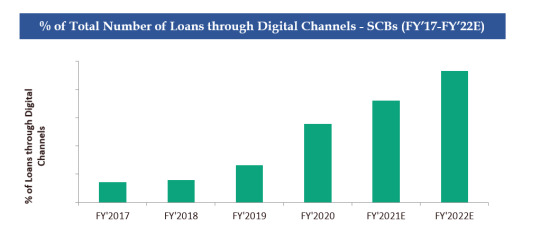

2. Loans through Digital Channels on NBFCs has increased from 0.6% in FY’2017 to 53.0% in Dec, 2020 owing to the rise in BNPL schemes and lower interest rates offered by the Lending Platforms.

Visit this Link Request for custom report

Commercial banks are rapidly joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies. The Digital Lending Company’s requirements are lower, and the process is significantly quicker. They need just a bank account as a reference point where loans can be credited and therefore % of Loans through Digital Channels are higher with NBFCs. The flexibility that BNPL schemes offer has completely transformed the digital lending market, particularly for younger shoppers, who are happy to trade traditional credit cards for more user-friendly BNPL schemes. The rapid uptake of Buy Now, Pay Later (BNPL) propositions, particularly within the retail sector, continues to drive major growth and new opportunities for NBFCs in India.

3. Rising Internet Penetration, Rise of innovative Models and an enabling regulatory environment are some of the Major Driving Factors for Digital Lending in India

To Know More on this report, Download free Sample Report

Higher penetration of smartphones, increasing number of mobile phone subscriptions coupled with inexpensive data has result in the growth and also supported the awareness and adoption rate of Digital Lending in India’s population. The popularity of Digital Lending has increased in India owing to NBFCs platforms collaborating with other digital platforms such as e-commerce, ride hailing, travel, logistics and more, resulting in higher acceptance of digital lending from various customer segments in the country. Digital Lending Pioneered by NBFCs, have now resulted in Companies from various segments coming up with multiple new models of doing business such as Digital Lending Marketplaces, POS Transaction Lending, Bank and NBFCs partnership models and more.2

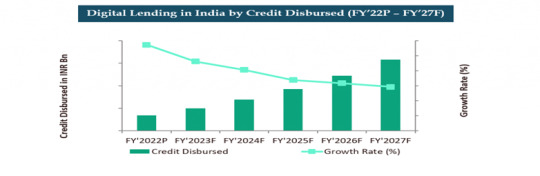

4. Digital Lending Market to Reach INR ~15,000 billion by FY’2027 Making Digital Lending a Sector with the Highest Penetration by Digital Channels in the Country.

To more about industry trends, Request a free Expert call

Strategic partnerships and collaborations between traditional financial institutions and new-age Lending Platforms. Plus, easy market entry and targeted loan offerings due to availability of large sets of customer data, which can give collective and individual insights. Changing consumer behavior and expectations shaped by purchase/ transaction experiences offered by e-marketplaces like food delivery, e-commerce and travel portals.

#b2b lending companies in india#Capital Float Digital Lending Market Revenue#Challenges in India’s Digital Lending Market#commercial loan Providers in India#Competitors in Digital Lending Market India#consumer durable loan market in india#redit disbursement in India#Credit lending startups in India#emand of Digital Lending in India#digital channels in India#digital credit industry in India#Digital lending ecosystem in India#digital lending growth in india#digital lending in India#digital lending market size in india#digital lending platform market#Digital lending value in India#digital loans Providers in India#Emerging Players in India Digital Lending Market#fastest-growing fintech in India#Financial Services Sector in India#fintech Compnanies in India#future trends for financial services sector in india#Impact of digital lending on MSME in india#India Digital Lending Industry#India Digital Lending Market#India Digital Lending Market Major Players#India Digital Lending Sector#India's retail loan Providers#India's Road Map for Digital Lending

0 notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

Finding the Right Loan: A Guide to Loan Options and Choosing the Best Fit for You

Introduction

Finding the right loan product to fit your needs can be a challenging process. With so many options like personal loans, home loans, and business loans, how do you know which is best suited for you? In this post, we'll provide an overview of the major loan products available and factors to consider when choosing one, as well as how Loans Mantri can help simplify the loan application process.

Loans Mantri is an online loan marketplace that partners with over 30 top financial institutions in India including names like HDFC Bank, ICICI Bank, and Axis Bank. No matter what type of loan you need, Loans Mantri aims to provide customized options and a seamless application experience through their digital platform.

Whether you need funds for personal expenses, purchasing real estate, business financing or any other purpose, Loans Mantri can match you with the ideal lending product for your requirements from their network. Their online eligibility calculators and tools remove the guesswork from determining what loans you can qualify for based on your income, credit score and other details.

This post will walk through the key loan products offered through Loans Mantri and outline the most important points to factor in when deciding which option works for your financial situation. We'll also provide tips on how to apply and what to expect when going through Loans Mantri for your financing needs. Let's get started!

Types of Loans Available

Here are some of the major loan products offered through Loans Mantri's platform:

Personal Loans - These unsecured loans can be used for almost any personal purpose like debt consolidation, wedding expenses, home renovation, medical needs, or any other requirements. Interest rates are competitive and loan amounts can range from ₹50,000 to ₹25 lakhs based on eligibility.

Home Loans - Also called mortgage loans, these are for purchasing, constructing or renovating a residential property. Home loans offer extended repayment tenures of up to 30 years and relatively lower interest rates. The property becomes collateral against the loan amount.

Business Loans - Loans Mantri offers financing for a wide range of business needs like working capital, equipment purchases, commercial vehicle loans, construction requirements and more. Loan amounts can be from ₹10 lakhs to multiple crores.

Loan Against Property - By using your existing property as collateral, you can get a secured, high-value loan in return through this product. Interest rates are lower and you can get up to 50% of your property's current market value.

Other Loan Products - Loans Mantri also facilitates other lending options like credit cards, line of credit, gold loans, insurance financing, merchant cash advance for businesses etc. as per eligibility.

Factors to Consider When Choosing a Loan

When looking at the various loan options, here are some key factors to take into account:

- Loan amount required and ideal repayment tenure

- Interest rates and processing/administration fees

- Your repayment capacity based on income and expenses

- Purpose of the loan - personal needs, business growth, property purchase etc.

- Collateral availability for secured loans like home and property loans

- Flexibility in repayment - moratorium periods, EMIs, tenure etc.

- Prepayment and foreclosure charges, if any

Evaluating these parameters will help identify the loan that Aligns to your financial situation. Loansmantri's online tools also help estimate factors like eligibility amounts, EMIs, interest rates etc. to simplify decision making.

Applying for a Loan on Loans Mantri

The application process with Loans Mantri is quick, transparent and fully digital:

- Use the eligibility calculator to get an estimated loan amount you can qualify for.

- Fill out the online application by providing basic personal and financial details.

- Loans Mantri will run a soft credit check to view your credit score and report. This helps match products to your profile.

- Compare personalized loan quotes from multiple partner banks and NBFCs.

- Submit any required KYC documents and income proofs online.

- The application gets forwarded to the lender for further processing and approval.

- Track status directly through your Loansmantri dashboard. Get assistance from customer support if needed.

Conclusion

Loans Mantri aims to be a one-stop platform for all your lending needs. Their intuitive tools and partnerships with leading financial institutions help identify and apply for the ideal loan product for any purpose. Consider your requirements carefully and evaluate all options before choosing the right loan for your financial situation. With Loans Mantri, the entire process from application to disbursal can be completed digitally for an easier financing experience.

2 notes

·

View notes

Text

Navigating the Cryptocurrency Market: A Comprehensive Guide to Bitcoin, Ethereum, and Beyond

The world of cryptocurrency has rapidly evolved from a niche interest to a significant force in global finance. Since Bitcoin's inception in 2009, it has captured the attention of investors, tech enthusiasts, and policymakers alike. Today, alongside Bitcoin, numerous other cryptocurrencies like Ethereum, Solana, and XRP are making waves, each with its unique value proposition and potential for growth. This article will serve as your comprehensive guide to navigating the cryptocurrency market, focusing on key concepts, current trends, and practical strategies for success.

The cryptocurrency market is known for its volatility, with prices fluctuating rapidly in response to news and events. Bitcoin's price, for example, hit an all-time high of over $69,000 in November 2021 before experiencing significant corrections. As of the latest data, Bitcoin's price is around $99,383, while other major cryptocurrencies like Ethereum, BNB, Solana, and XRP are also experiencing price fluctuations. This volatility highlights the importance of staying informed and being prepared for potential market swings.

Understanding the Key Players

Bitcoin (BTC): As the first decentralized digital currency, Bitcoin remains the most well-known and influential cryptocurrency. It is often seen as a store of value and a hedge against traditional financial systems. Bitcoin's market cap stands at $1,969,883,337,117 with a 24-hour trading volume of $40,216,134,991.

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market cap and a platform for decentralized applications (dApps) and smart contracts. It is used in decentralized finance (DeFi) applications, allowing for peer-to-peer lending and trading without intermediaries. However, some analysts believe that Ethereum's upgrades lack the immediate impact needed to drive bullish sentiment in the market, and that Solana is becoming a leading competitor to Ethereum in terms of scalability.

Other Notable Cryptocurrencies: The cryptocurrency market includes many alternative coins (altcoins), such as BNB, Solana, XRP, Shiba Inu, Pepe, Bonk, dogwifhat, and Popcat. Each of these has different technological features, market positioning and risk profiles, and have been seeing their own price swings. For instance, Solana is gaining traction with 60 million daily transactions compared to Ethereum’s 1 million.

Essential Tips for Navigating the Crypto Market

Stay Informed: Keep up-to-date with the latest cryptocurrency news. The market is highly reactive to news and events, making it critical to follow developments in the industry. You can follow crypto news from sources such as.

Understand Market Volatility: Be aware that cryptocurrency prices can fluctuate dramatically. The cryptocurrency market is known for its rapid and unpredictable price changes, and therefore, managing risk is important to ensure long-term success.

Diversify Your Portfolio: Do not invest all your capital in a single cryptocurrency. Diversifying among multiple cryptocurrencies can help reduce risk.

Use Reputable Exchanges: When purchasing cryptocurrencies, be sure to use reputable and secure cryptocurrency exchanges. Be aware of security risks like sandwich attacks that can manipulate transaction prices and know the strategies to protect your crypto trades.

Consider Long-Term Investing: While day trading can offer quick returns, it also carries high risks. Consider a long-term investment strategy focused on fundamentally strong cryptocurrencies.

Be Aware of Market Trends: Watch out for market trends, such as the rise in interest in memecoins, and increased involvement of institutional investors, and the development of crypto ETFs and the tokenization of real-world assets (RWA).

Be Aware of Regulatory Changes: The cryptocurrency landscape is subject to evolving regulations that can significantly affect prices and market dynamics. For example, India has imposed a 70% tax penalty on undisclosed crypto gains.

Guides and Strategies

How to Buy Bitcoin: Bitcoin can be purchased through cryptocurrency exchanges, Bitcoin ATMs, or P2P marketplaces. Make sure the platform you choose is safe, secure and reputable.

Understanding "Bear Traps": A bear trap is a form of coordinated selling that creates a temporary dip in an asset's price during a long-term uptrend. Being aware of these events can help you make better trading decisions and reduce your exposure to risk.

Analyzing Technical Patterns: Technical analysis of crypto price charts can reveal patterns and trends that may suggest where prices might go. For example, one analyst projects that Ethereum could reach $5,000 by March due to a technical pattern.

Monitoring Institutional Involvement: The increasing involvement of institutions in the crypto market can signal a shift in market dynamics. Keep an eye out for major companies that are investing in cryptocurrencies, and nations that are adding Bitcoin to their reserves.

Participating in Crowdfunding: Understand the risks associated with initial coin offerings (ICOs), which raised billions during 2017-2018, but many projects ultimately failed. New projects are still being launched, but caution should be exercised in these early stages of the lifecycle of crypto projects.

Examples and Case Studies

Thumzup Media Corporation's Bitcoin Investment: Thumzup doubled its Bitcoin holdings to 19.106 BTC, increasing its investment in digital assets to $2 million. This demonstrates the increasing interest of companies in investing in digital assets.

MicroStrategy's Oversubscribed Stock Offering: MicroStrategy’s stock offering was oversubscribed by nearly 3 times the expected volume, showing the strong interest in companies associated with Bitcoin.

El Salvador's Bitcoin Adoption: El Salvador's initial adoption of Bitcoin as legal tender and its subsequent policy changes show how government policies can affect the crypto market. Note that El Salvador has since amended its Bitcoin Law, making it optional for merchants to accept Bitcoin as payment.

Tether's Profitability: Tether reported net profits of $13 billion in 2024, highlighting the financial scale of some players in the crypto market. Also, stablecoins overall have seen a major increase, with the total stablecoin market cap jumping $37 billion.

Ethereum Trader's Profit: An Ethereum trader earned $16 million as ETH price fell to $3K, demonstrating the potential profits associated with leveraged trading, which also has high risks.

Kraken Delisting of Stablecoins: Kraken's delisting of Tether USDT and other stablecoins in Europe shows how regulations can impact exchanges and the availability of certain coins.

The cryptocurrency market presents both significant opportunities and substantial risks. By staying informed, understanding market dynamics, and following sound investment strategies, you can navigate this complex landscape with greater confidence. Whether you are a seasoned investor or a newcomer, the key is to approach the crypto market with knowledge, caution, and a long-term perspective. The market is constantly changing, so make sure to keep learning and updating your understanding of this new technology.

#Solana#Bitcoin#ethereum#investment#crytocurrency#crypto trading#crypto trends#crypto token#crypto transactions

0 notes

Text

The Future of Real Estate: Online Property Valuation in India

The real estate sector in India is evolving rapidly, and one of the biggest advancements is the adoption of online property valuation in India. Traditional property valuation methods often involve lengthy inspections, manual paperwork, and delays. However, with the advent of digital valuation services for real estate, property owners, buyers, and financial institutions can now obtain instant and accurate valuations from the comfort of their homes.

Why Online Property Valuation Matters

Property valuation plays a crucial role in real estate transactions, investment decisions, and securing loans. Whether you're looking to sell, buy, or refinance a property, knowing its true market value is essential. With desktop real estate appraisal, users can now access quick and precise property evaluations without the need for physical inspections.

Technology-driven valuation tools utilize extensive property data, location trends, and market analytics to provide real-time valuation reports. These instant property valuation tools are particularly useful for homeowners, real estate investors, and lenders who require fast, reliable property assessments.

Benefits of Digital Property Valuation

1. Accuracy and Reliability

Modern desktop valuation pan India services are powered by artificial intelligence (AI) and big data analytics, ensuring highly accurate property valuations. Unlike traditional methods that rely on subjective judgment, digital tools analyze historical trends, comparable sales, and local market conditions to provide data-driven valuations.

2. Convenience and Speed

With the rise of land valuation services online, property owners no longer need to wait for days or weeks for valuation reports. The online process is seamless, requiring only basic property details to generate an instant estimate. This speed is beneficial for real estate investors and sellers looking for quick transactions.

3. Cost-Effective Solution

Hiring a professional property valuer can be expensive. In contrast, desktop appraisal for property sale is an affordable and efficient alternative. Many online platforms offer free or low-cost property valuations, making it accessible to a wider audience.

4. Essential for Financial Institutions

Banks and NBFCs rely on property valuation for financial institutions to assess loan eligibility and mortgage approvals. Automated valuation models (AVMs) help financial institutions streamline their loan processes, reducing risks associated with incorrect property assessments.

Who Can Benefit from Online Property Valuation?

Homeowners and Sellers

If you're planning to sell your house, knowing its current market value helps you set a competitive price. With residential property valuation in India, homeowners can list their properties at optimal prices and attract serious buyers.

Real Estate Investors

Investors looking for profitable opportunities can use online valuation for property investment to analyze potential deals. By comparing property values across different locations, investors can make informed decisions on where to invest.

Financial Institutions

Banks, lending agencies, and insurance companies require property valuations for loan approvals, refinancing, and risk assessment. Desktop real estate appraisal helps institutions efficiently process mortgage applications while ensuring compliance with financial regulations.

How to Use an Instant Property Valuation Tool

Using an instant property valuation tool is straightforward. Most platforms require users to enter details such as:

Property type (residential, commercial, land)

Location and address

Built-up area and age of the property

Additional features (amenities, upgrades, etc.)

Once the details are submitted, the system generates an estimated property value based on real-time market data. Some advanced tools also provide comparative reports, highlighting similar properties in the area.

The Future of Digital Property Valuation in India

With the increasing adoption of digital valuation services for real estate, the future of property valuation in India looks promising. Emerging technologies like blockchain, AI, and machine learning will further enhance the accuracy and transparency of property assessments.

Moreover, as more financial institutions and investors embrace desktop valuation pan India, the real estate industry will witness faster transactions, reduced paperwork, and improved decision-making processes.

Conclusion

The shift towards online property valuation in India is transforming the real estate sector. Whether you are a homeowner, investor, or financial institution, leveraging desktop real estate appraisal and instant property valuation tools can help you make better property decisions. As technology continues to advance, digital property valuation will become the standard, ensuring accuracy, efficiency, and convenience for all stakeholders.

If you haven’t explored desktop appraisal for property sale or land valuation services online, now is the time to take advantage of these modern solutions and stay ahead in the real estate market.

0 notes

Text

Top Features of Schools in India That Emphasize Collaborative Learning

Collaborative learning has gained significant momentum in recent years, especially in schools in India. This educational approach encourages students to work together, share knowledge, and solve problems collectively, fostering a deeper understanding of subjects. As educational standards in India continue to rise, many institutions, particularly Top CBSE Schools in India, are increasingly adopting collaborative learning methods to enhance academic performance and personal growth. This article explores the top features of schools in India that emphasize collaborative learning and how it shapes the future of education.

What is Collaborative Learning?

Collaborative learning is an educational philosophy that promotes group-based activities to enhance students' knowledge and skills. It moves away from traditional methods of isolated learning, where students are expected to study and solve problems alone. In a collaborative environment, students are encouraged to engage with each other, share ideas, debate concepts, and work on projects together. This approach not only helps them academically but also teaches them important life skills such as teamwork, communication, and problem-solving.

The Role of Collaborative Learning in Top CBSE Schools in India

India's Top CBSE Schools in India are embracing collaborative learning as part of their commitment to holistic education. The Central Board of Secondary Education (CBSE) curriculum, with its focus on active learning and application, naturally lends itself to collaborative methods. In these schools, educators create learning experiences that require students to work together, discuss ideas, and co-create knowledge. This hands-on approach ensures that students can retain information better while also developing their interpersonal skills.

Here are the key features of Top CBSE Schools in India that emphasize collaborative learning:

1. Project-Based Learning

One of the core features of schools in India that focus on collaborative learning is the emphasis on project-based learning. This method encourages students to work together on long-term projects, solving real-world problems. It allows them to apply theoretical knowledge in practical scenarios, enhancing their problem-solving skills. Best CBSE schools integrate subjects across disciplines to make projects more comprehensive, encouraging students to collaborate with peers from different backgrounds. Whether it’s designing a science experiment or creating a social studies project, project-based learning nurtures creativity, critical thinking, and collaboration.

2. Group Discussions and Debates

In schools in India, group discussions and debates play an essential role in promoting collaborative learning. These activities are often incorporated into the curriculum, where students are tasked with discussing a topic or debating an issue. This form of collaborative learning allows students to express their views, listen to differing perspectives, and refine their arguments. Top CBSE Schools in India prioritize these interactive methods to sharpen students’ analytical thinking and communication skills, ensuring that they can collaborate and engage constructively with others.

3. Peer Learning and Mentorship Programs

Best CBSE schools encourage peer learning, where older or more experienced students mentor their younger counterparts. This system fosters a sense of responsibility and leadership in the mentors while providing the mentees with guidance and support. Peer learning programs in schools in India create an environment of collaboration, where students help each other understand complex concepts and work together towards academic success. It also cultivates empathy and teamwork, as students recognize the value of collective knowledge.

4. Use of Technology in Collaborative Activities

In today’s digital world, Top CBSE Schools in India are integrating technology into collaborative learning. Tools like online discussion platforms, digital whiteboards, and collaborative software applications enable students to interact, share ideas, and collaborate on assignments beyond the classroom. These platforms allow students to connect with their peers, access resources, and exchange feedback in real time. The integration of technology not only enhances learning but also prepares students for the demands of the modern workforce, where collaboration across digital platforms is common.

5. Interdisciplinary Learning

Schools in India that emphasize collaborative learning often adopt an interdisciplinary approach to teaching. Instead of focusing on isolated subjects, these schools encourage students to make connections between different disciplines, such as science, mathematics, and language arts. By working on projects that incorporate knowledge from various fields, students can see the bigger picture and appreciate the interconnectedness of knowledge. This approach helps foster collaborative learning, as students from diverse academic backgrounds can pool their knowledge and work together on comprehensive projects.

6. Emphasis on Communication Skills

In collaborative learning environments, effective communication is key. Best CBSE schools focus on developing students' communication skills by encouraging them to share their thoughts, listen actively, and engage in meaningful conversations with their peers. Whether it's participating in group discussions, presenting findings from a group project, or sharing feedback, students learn the importance of clear and respectful communication. This skill is vital not just for academic success but also for personal and professional growth.

Benefits of Collaborative Learning in Schools in India

The shift towards collaborative learning in schools in India offers numerous benefits for students. It enhances their academic performance by encouraging them to actively participate in their education rather than passively receiving information. Collaborative learning fosters critical thinking, as students are encouraged to question ideas, discuss solutions, and synthesize new concepts.

Moreover, working in teams helps students develop important social skills such as teamwork, conflict resolution, and empathy. These skills are crucial for success in both academic and real-world settings. Top CBSE Schools in India that incorporate collaborative learning create an environment where students can thrive academically and personally, preparing them for the challenges of the future.

Conclusion

Collaborative learning is an essential component of modern education, and schools in India that emphasize this approach are shaping the next generation of thinkers, leaders, and innovators. By integrating project-based learning, group discussions, technology, and interdisciplinary studies, Top CBSE Schools in India are equipping students with the skills they need to succeed in the globalized world. Best CBSE schools that focus on collaborative learning are not only fostering academic excellence but also helping students develop the social and emotional skills necessary for lifelong success. As the education landscape in India continues to evolve, collaborative learning will remain at the heart of these transformative changes.

0 notes

Text

Darshan Hiranandani’s Strategic Vision: The Rs 1,357 Crore Debt Financing Behind Yotta Data Services

A recent decision made by Yotta Data Services to acquire a debt of Rs. 1,357 crores from the State Bank of India (SBI) significantly improves the strategic location of the company in tech and digital infrastructure. This funding having been raised by Darshan Hiranandani against Yotta’s data centres in Navi Mumbai and receivables from the Powai data centre is quite interesting from the ways of speeding up other IT companies' business in India.

These financial strategies mean Yotta Data Service’s revenue reinvestment in their company’s growth and innovation as well as further expansion. In a modern data-driven world, it is obvious that the need for robust and scalable data centres is there. Through providing this financial debt, Yotta not only is funding physical infrastructure, but it also backs up the backbone of digital India. This move will demonstrate Yotta’s determination to rule the market for hyperscale data centers, with solutions for cloud computing, AI computing, and digital transformation.

The strategic importance of this debt funding goes even beyond the short-term fiscal expansion. This shows the strong trust that banks and other financial institutions place in technologists to be in it for the long run. SBI’s decision to provide a loan of this large magnitude to a profit-making firm that has invested in the likes of Yotta is an indication that this sector has the capacity for high rates of return on investment. Such a joint project may open the way for an even higher level of cooperation, bringing the classic banking sphere and the fast-moving tech industry closer to each other.

Also, using the ones they have already got, Darshan Hiranandani’s Yotta conveys a big sign at both information centres and at national infrastructure regarding their high value and potential. Such expansion is closely related to the current trend in the world as well as many countries where data storage and processing have become a new and very valuable utility.

The lending also reflects on the relationship between the financing and the Indian economy, where digital infrastructure has become a basic pillar of development of the country. The strengthening of its data centre capacities is evidence of the determination of Yotta and of the country of India to stay ahead in the digital economy and to be able to meet the requirements of data services at the local and international levels.

Finally, the strategic loan from SBI is a multifaceted and positive step. Not only finance capital needed for expansion, but also improve the business relationship between the bank and technology industries, which means a bright future for digital platforms building in India.

0 notes

Text

The Ultimate Guide to Sharing Videos on Gaana for Free

Video content is the cornerstone of modern digital marketing. Whether you're an independent artist, a content creator, or a brand, finding the right platform to showcase your work can be challenging. Gaana, India's leading music streaming platform, is not just about music—it also welcomes video content. But did you know you can easily share your video on Gaana without any cost? This guide walks you through why and how to make the most of this opportunity.

Why Choose Gaana for Video Sharing?

Gaana boasts millions of active users, making it a powerful platform for content distribution. With its audience primarily consisting of young, tech-savvy individuals, your content is likely to gain traction if it resonates with this demographic. Additionally, Gaana’s interface is designed to promote user engagement, providing your videos with excellent visibility.

By utilizing platforms that allow you to share your video on Gaana for free, you eliminate significant marketing costs while accessing an audience that is already primed for entertainment and creativity.

Benefits of Sharing Videos on Gaana

Massive Audience Base Gaana attracts millions of daily users who actively consume diverse content, including videos. This makes it a goldmine for creators seeking wide-reaching exposure.

Enhanced Brand Visibility Videos shared on Gaana often get featured in curated lists and recommendations, making it easier for new audiences to discover your content.

Zero Cost Sharing One of the best parts of sharing videos on Gaana is the ability to do so without incurring hefty advertising fees. Platforms like these democratize content creation, offering equal opportunities for everyone.

Engagement Tools Gaana's intuitive features, like playlists and sharing options, make it easy for users to engage with your content and spread it organically.

Trusted Platform As one of India’s most popular apps, Gaana lends credibility to the content hosted on its platform.

Steps to Share Your Video on Gaana

1. Prepare Your Content

Start by creating a high-quality video that aligns with your brand or personal style. Make sure your video offers value, whether through entertainment, education, or inspiration.

2. Use the Right Tools

To maximize your chances of success, use platforms that streamline the process. A prime example is the option to share your video on Gaana for free, which simplifies uploading while ensuring your content meets the platform’s guidelines.

3. Optimize Metadata

Craft an engaging title and description for your video. Use relevant keywords to make your content more discoverable on Gaana’s search engine.

4. Promote Across Channels

Once your video is live, amplify its reach by sharing it across your social media channels. Use hashtags, tags, and collaborations to drive traffic to your content on Gaana.

5. Analyze Performance

Leverage insights and analytics to measure how well your video is performing. This data can help you refine future uploads for even better results.

Tips for Maximizing Your Video’s Reach on Gaana

Engage Your Audience: Encourage viewers to comment, like, and share your video. Active engagement improves visibility on Gaana’s algorithms.

Stay Consistent: Post regularly to build a loyal audience base.

Leverage Collaborations: Partner with other creators or influencers to increase your content’s reach.

Use Eye-Catching Thumbnails: First impressions matter, and a great thumbnail can make your video stand out.

Respond to Feedback: Show your audience that you value their input by responding to comments and suggestions.

Why Now Is the Best Time to Start

With the digital landscape evolving rapidly, competition is fiercer than ever. However, platforms like Gaana level the playing field by offering accessible tools for creators of all sizes. Whether you’re an established artist or a newcomer, now is the perfect time to tap into Gaana’s growing video-sharing capabilities.

Conclusion

Sharing your video on Gaana is a cost-effective and impactful way to showcase your talent or brand. By following the steps outlined in this guide, you can optimize your content for success and leverage Gaana’s massive audience to grow your presence. Don’t wait—start sharing today and see how it transforms your reach!

Related Articles:

For further reading, explore these related articles:

How to Share Your Video on Gaana in India

How to Share Your Video on Gaana Globally

How to Share Your Video on Gaana: A Step-by-Step Guide

Share Your Video on Gaana Easily: A Complete Guide

For additional resources on music marketing and distribution, visit DMT Records Private Limited.

0 notes

Text

Driving Digital Innovation: The Strategic Role of a Mobile Analyst in Financial Services with Morpheus Consulting

Introduction:

The foundation of success in the quickly changing financial world of today is digital transformation. As a major component of this evolution, mobile applications are essential for improving customer satisfaction and propelling company expansion.

An intriguing opportunity for an experienced individual to take on the post of Mobile Analyst in Mumbai is being presented by Morpheus Consulting, a leader in recruiting and talent acquisition. Morpheus Consulting is ready to help you on your path to professional success if you have a strong desire to use digital technology to provide meaningful solutions.

What Does a Mobile Analyst Do in Financial Services?

1.Pioneering Digital Journeys:

Your main duty as a Mobile Analyst at the prestigious client company of Morpheus Consulting will be to develop and execute creative digital journeys. Finding new NBFC (Non-Banking Financial Company) app options can increase client engagement and help generate revenue. Such progressive positions are encouraged by Morpheus Consulting in order to promote change.

2.Comprehensive Application Management:

You will be in charge of managing, testing, and improving digital applications from start to finish. Morpheus Consulting makes sure you have the resources and equipment necessary to carry out these duties with ease.

3.Collaborative Innovation:

To provide solid digital solutions, you will collaborate closely with infrastructure teams, business application divisions, and development vendors in this position. With the help of Morpheus Consulting's wide network, you can encourage teamwork that leads to creativity.

4.Reporting and Metrics:

It is essential to report on a regular basis to the CEO, function heads, and other important stakeholders. Making use of data analytics and presenting findings can help people make well-informed decisions. Morpheus Consulting offers advice to help you succeed in this area of analysis.

5. Business Requirement Analysis:

The core of this position is comprehending and converting business needs into workable solutions. You will become an expert in requirement analysis and documentation with the help of Morpheus Consulting, guaranteeing on-time delivery and efficient stakeholder communication.

What Makes an Ideal Candidate for Morpheus Consulting?

Attention to Detail:A keen understanding of UI/UX design and functionality is necessary to produce flawless user experiences. Candidates who succeed in these areas are given preference by Morpheus Consulting.

Domain Expertise:Preference is given to those with prior NBFC (lending) experience and knowledge of mobile app journeys. You'll be in a successful position thanks to Morpheus Consulting's emphasis on industry alignment.

Technical Acumen:It is essential to comprehend programming languages, the Software Development Life Cycle (SDLC), and information security issues pertaining to mobile applications. The tools and instruction provided by Morpheus Consulting will help you stay on top of trends.

Knowledge of Financial Tools and Platforms:It is required to have proficiency with GL tools, India Stack, NPCI products, KYC, Credit Underwriting, Loan Origination, Loan Management, Collections, and payment solutions (ENACH, UPI, IMPS, NEFT, RTGS, etc.). Professionals with extensive subject knowledge are highly valued by Morpheus Consulting.

Morpheus Consulting ensures that professionals flourish in their careers by matching them with opportunities that align with their experience.

Why This Role Matters:

In order to propel digital transformation, the Mobile Analyst role is crucial since it blends technical know-how with strategic vision. You will have a big say in how financial services develop in the future by leading app innovations, maintaining compliance, and providing outstanding user experiences. You will have the chance to make a significant contribution to the industry with the steadfast assistance of Morpheus Consulting.

Conclusion:

Are you prepared to transform the financial services industry's digital transformation? Making a significant contribution to the fintech sector by combining technical know-how with strategic innovation is made possible by the position of Mobile Analyst. You will have the tools, encouragement, and direction you need to succeed in this game-changing position with Morpheus Consulting at your side.

Morpheus Consulting is committed to nurturing your potential and helping you achieve professional success while contributing to the growth of the organization.

Apply now to take on this challenging and impactful role with confidence, and rest assured that Morpheus Consulting will be your trusted partner in navigating your professional journey.

For more Recruitment / Placement / HR / Consultancy services, connect with Morpheus Consulting:

📞: (+91) 8376986986

🌐: www.mhc.co.in

#morpheusconsulting

#morpheushumanconsulting

#mumbaijobs

#jobsinmumbai

#jobsmumbai

#jobsinnavimumbai

#JobsInMumbai

#JobsInDelhi

#JobsInBangalore

#JobsInHyderabad

#JobsInChennai

#JobsInKolkata

#JobsInPune

#JobsInAhmedabad

#JobsInNoida

#JobsInGurgaon

#JobsInJaipur

#JobsInLucknow

#JobsInIndore

#JobsInChandigarh

#JobsInSurat

#JobsInNagpur

#JobsInBhubaneswar

#JobsInCochin

#JobsInVadodara

#JobsInThane

#JobsinIndia

#IndiaJobs

#mumbaijobseekers

#mumbaijobsearch

0 notes

Text

The Modern Way to Secure Loans, Invest, and Make Payments

In a world buzzing with options, making the right choices for your financial needs can be overwhelming. From securing loans to making seamless payments, the landscape of financial services is evolving. Muthoot FinCorp ONE - a digital financial platform is designed to revolutionize the way you access loans, invest, and manage payments.

A World of Offerings Tailored for You

Gold Loans - Anytime, Anywhere Secure quick Gold Loans effortlessly, either from the comfort of your home or at any of our 4500+ branches across India. Experience doorstep service in just 30 minutes*, benefit from low-interest rates starting at 0.83%* per month and enjoy a hassle-free process with zero* processing fees.

Digital Gold - Begin Your Investment Journey Dive into Digital Gold investments starting from as low as Re. 1. With gold purity rated at 99.99%, sell your digital holdings at market prices, securely stored for your peace of mind.

NCD: Building Financial Stability Construct your investment portfolio with as little as Rs. 10,000 and receive high returns of up to 9.43%*. Enjoy a fast-track process without extensive KYC requirements, providing financial stability with low-risk investments and flexible tenure durations.

Forex Simplified Exchange forex securely at competitive rates, ensuring hassle-free international money transfers with our 24-hour* guaranteed service and buy-back guarantee.

Payments and Recharges - Swift and Secure Seamlessly pay for anything, anytime, with zero wait time and 24x7 availability. From recharging your mobile or DTH connection to paying electricity, mobile, internet bills, and even vendor payments - experience a zero-

The Muthoot FinCorp ONE app is your key to unlocking a world of financial possibilities. Whether you need Gold Loans, wish to invest in Digital Gold, or trade Forex, the app delivers convenience at your fingertips. Expect regular updates and expanded services, as we strive to make financial management effortless for you.

At Muthoot FinCorp ONE, we're dedicated to simplifying your financial journey. From accessing loans and investments to managing payments, our goal is to provide a secure and reliable financial environment while enhancing your user experience.

Join the Muthoot FinCorp ONE community today and witness firsthand the ease and efficiency that modern financial services can offer. Your financial freedom begins here.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

Gold Loans for Farmers-A Life Savior during Dire Neediness

Agriculture is the backbone of the Indian economy, and most farmers face financial challenges on account of unpredictable weather, fluctuating market prices, and increasing input costs. Gold loans have become a crucial financial source for farmers during such times. It allows access to cash in a faster manner and also does not compel them to liquidate their valuable possessions. Companies such as RUGR are at the heart of this change by offering a range of tailored financial solutions aimed at empowering rural farmers.

Understanding Gold Loans

Gold loans are a kind of secured loan where the borrower gives a pledge of their gold jewelry or ornaments as security. This facility is quite important for farmers who do not have access to advanced banking services or credit facilities. It is relatively simple: farmers can approach a lender and, presenting their gold assets, get a loan amount based on current market values. Normally, they offer an LTV of up to 75% under such loans, through which farmers may get substantial amounts in a very short time.

Speedy Disbursal

Gold loans have many advantages, among which the biggest factor is speedy access to credit. Unlike the regular loan products, which are mired in the long approval process and need much paperwork, this product can be sanctioned quickly owing to minimal documentation requirements. This quick processing is very important for farmers who may need instant funds for any urgent agricultural need, such as seeds, fertilizers, or equipment. Fintech solution providers such as RUGR make online gold loans easily accessible to farmers with their facilities for mobile banking in rural Bharat.

Flexible Repayment Options

Gold loans also offer flexibility in repayments, catering to the needs of farmers. Lenders also extend a number of repayment plans, including scattered payments and lengthened tenures, which let borrowers return the loan at their own convenience. This flexibility in repayments is very important to farmers whose incomes vary throughout the year, given the cyclicality of harvests. By easing the repayment burden, gold loans enable farmers to focus on their agricultural activities without financial stress.

Supporting Agricultural Activities

In turn, the gold loan can be invested in a series of agricultural intentions, ranging from crops to the addition of livestock-even assuring allied proposals in the arena of dairy and aquaculture, accordingly. This expansive set of alternatives that allows farmers not only to invest in long-term growth but simultaneously satisfy immediate investment needs is further buttressed by extending crop insurance.

Fintech for Financial Inclusion

Fintech companies like RUGR are the need of the hour in enhancing financial inclusions for rural farmers. By leveraging technology and mobile banking solutions, they provide easy access to gold loans and other financial products. The ability to apply for loans online and receive instant approvals empowers farmers who may otherwise be excluded from traditional banking systems. In addition, these digital platforms offer educational resources about financial management and investment strategies that help farmers make informed decisions.

Challenges and Considerations

Despite all the advantages, a number of challenges are associated with gold loans that one has to confront. Most farmers will not understand anything about gold loans or would have cultural beliefs about gold and hence may avoid leveraging their assets as such. This also requires ensuring transparency in valuations and lending practices so that fairness to farmers will be maintained.

Conclusion

In other words, gold loans have become the lifesaver of farmers in India at a time of distress. Quick disbursal, flexible repayments, and the efficiency to manage the funds by the farmer allow farmers to reinvest in their agriculture effectively. Supported by fintech solutions such as RUGR, coupled with an increase in mobile banking in rural Bharat, farmers are accessing such vital financial resources. It can therefore be seen that with growing awareness and reduced barriers, gold loans will remain an integral constituent in the life of the rural Indian farmer: serving as a supporting mechanism over hard times into secured futures.

0 notes

Text

Top Reasons to Release Your Music on iTunes in India

The music industry is evolving rapidly, and digital platforms are at the forefront of this transformation. Among these platforms, iTunes stands out as a leading destination for artists to showcase their talent, connect with audiences, and earn from their craft. For Indian musicians, releasing music on iTunes presents a unique opportunity to tap into both domestic and global audiences. Whether you're an independent artist or part of a band, choosing iTunes as a distribution channel can open doors to success that were once reserved for a select few. In this article, we’ll explore why releasing your music on iTunes in India is a smart choice and how it can shape your music career.

Why Choose iTunes for Music Distribution?

iTunes has built a reputation as a premium music platform that caters to listeners who value high-quality audio and curated playlists. With its presence in over 165 countries, it allows Indian artists to break geographical barriers and share their music with the world. Here are some key reasons why iTunes is the ideal platform for music distribution:

Global Reach Releasing your music on iTunes enables you to connect with a global audience. Indian artists often have a niche following abroad, particularly among diaspora communities and fans of world music. By uploading your music to iTunes, you can target listeners in regions like the US, UK, Canada, and Australia, where Bollywood and independent Indian music enjoy significant popularity.

Localized Pricing and Accessibility One of the standout features of iTunes is its ability to adapt pricing to local markets. For Indian users, this means affordable access to music, making it easier for your tracks to reach a broader audience. This localized pricing strategy also ensures that you remain competitive in the Indian market while benefiting from sales across other countries.

High-Quality Audio Experience iTunes is known for its superior audio quality compared to many free streaming platforms. For musicians who spend countless hours perfecting their sound, iTunes provides a platform where your work is presented in the best possible format, ensuring that every note and lyric is heard as intended.

Credibility and Professionalism Having your music available on a platform like iTunes lends credibility to your brand as an artist. It shows that you are serious about your craft and willing to invest in professional distribution. This can open up opportunities for collaborations, sponsorships, and live performances as your profile grows.

The Process of Releasing Your Music on iTunes

Getting your music on iTunes may seem daunting, but the process is straightforward with the right approach. Here’s how you can do it:

Prepare Your Music Ensure your tracks meet the technical requirements set by iTunes. This includes high-quality audio files in formats like WAV or AIFF, along with proper metadata, including song titles, artist name, and genre.

Work with a Digital Distributor Apple doesn’t allow artists to upload music directly to iTunes. Instead, you’ll need to work with a digital distributor like TuneCore, CD Baby, or DistroKid. These platforms act as intermediaries, helping you upload your tracks, set pricing, and handle royalties.

Focus on Presentation Pay attention to details like album artwork and track descriptions. A visually appealing cover can attract listeners and encourage them to check out your music.

Set Up Pre-Orders Offering your music for pre-order can create anticipation among your audience and boost your sales on release day.

Marketing Strategies for iTunes Success

Once your music is live on iTunes, the real work begins—promoting it to reach as many listeners as possible. Here are some effective marketing strategies:

Social Media Promotions Use platforms like Instagram, Facebook, and Twitter to announce your release. Share snippets of your tracks, behind-the-scenes videos, and countdown posts to keep your audience engaged.

Collaborate with Influencers Partner with influencers in the music or entertainment industry to promote your release. A shout-out or endorsement from a popular influencer can significantly increase your reach.

Create Engaging Content Consider making lyric videos, short reels, or acoustic versions of your tracks to share on platforms like YouTube. These not only promote your music but also help build a personal connection with your audience.

Leverage Playlists Submit your tracks to curated playlists on Apple Music and other platforms. Being featured on a playlist can expose your music to thousands of new listeners.

The Future of Indian Music on iTunes

The Indian music industry is experiencing a shift as more artists turn to digital platforms to distribute their work. With the rise of independent music and a growing demand for diverse sounds, iTunes is perfectly positioned to cater to this trend. For Indian artists, the platform offers a chance to stand out in a competitive market and reach an audience that values quality over quantity.

In the coming years, we can expect even more growth in the digital music space, with platforms like iTunes playing a pivotal role in shaping careers. Whether you create Bollywood-inspired tracks, regional folk music, or experimental sounds, iTunes provides the tools and audience to help you succeed.

Conclusion

Releasing your music on iTunes in India is more than just a way to distribute your tracks—it’s an investment in your future as an artist. From reaching global audiences to building credibility and earning royalties, the platform offers numerous benefits that can elevate your career. With careful planning and effective marketing, you can make the most of this opportunity and take your music to new heights.

Related Articles:

For further reading, explore these related articles:

Release your music on iTunes globally

Release your music on iTunes step-by-step

Release your music on iTunes easily

Release your music on iTunes without a distributor

For additional resources on music marketing and distribution, visit DMT RECORDS PRIVATE LIMITED.

0 notes

Text

A Simple Guide to Startup Registration in India

Setting up one's own business is an exciting adventure, but there are vital steps to ensure a strong foundation for it. The registration of your startup registration is very important, as they will lend credence to entering into a business with the issues of law, provide quite a few benefits, and sketch out a pathway for future growth. Here is a short guide to steer you through the process of registering a startup in India and how GTS Consultant would assist you at every juncture.

Reasons Register a Startup

Establish Legal Identity : Registration imparts legal identity to the business, and one gets to work within the framework of Indian laws.

Gain Credibility: A registered company wins the trust of customers, partners, and investors and denotes professionalism and reliability.

Access Benefits: Indian Government Startup India provides registered startups with various forms of benefits such as tax exemptions, funding, and the benefit of ease of compliance.

Safeguard Innovation : The startup registration helps provide protection to intellectual property rights by assuring that your ideas and brand are not misused.

Steps to Register a Startup

Private Limited Company: The best form for a startup with goals of high scaling and attracting investors.

Limited Liability Partnership: Flexible options for limited personal liability.

A Partnership Firm: Suitable for small businesses with simplistic operations.

Private Limited Company: The best form for a startup with goals of high scaling and attracting investors.

Limited Liability Partnership: Flexible options for limited personal liability.

A Partnership Firm: Suitable for small businesses with simplistic operations.

Private Limited Companies

Apply for a Digital Signature Certificate and obtain the Director Identification Number.

Reserve the business name on the Ministry of Corporate Affairs portal.

After reservation, submit incorporation documents: Memorandum of Association and Articles of Association.

Startup Registration Benefits-It Must Be Done

Tax Holidays-Section 80-IAC :Exemption of tax for three uninterrupted years on traceable sources as practical under Section 80-IAC to lift financial loads from the entrepreneurs early on.

Easy Access to Funding : Once individualized registration is realized, such will enhance its position in startup capital ventures, avail government grants, and tap into private investments.

Self-Certifying Compliance : Registered startups will also be allowed self-certification of compliance with various labor and environmental laws, which will help save time and effort.

Intellectual Property Empowerment : Enjoy concessions on filings that are patentable and speed up registration of trademarks for the innovative stuff you introduce.

How GTS Consultant Will Ease the Stress

Navigating startup registration can be daunting; however, with GTS Consultant, the entire process runs smoothly, with customized solutions.

Expert Help

A professional team handling the rounds of registration, thus ensuring no problems come on the way.

From choosing the right business structure to completing the requirements of post-registration compliance, we provide end-to-end support.

Save Up-On Resources

Sit back while we handle the paperwork and legal issues so you can pay attention to growing your business.

Custom Services

Beyond registration, we will assist your startup with tax planning, compliance management, and intellectual property services to help it thrive.

Our Aim

To empower every startup by bringing simplifications to the business process with transparency in all the solutions.

Value Proposition

Transparency: Clear communication and honest-to-goodness practical nature.

Efficiency: In-time and correct service delivery.

Client-Centric: Solutions that are custom-tailored to meet each client's particular needs..

Conclusion

Registering the startup is one vital step in the setting up of a growing firm. It confers legal recognition upon the entity, as well as grants advantages that are conducive to innovation and growth. With GTS Consultant assisting, it becomes a child's play. Let us help you take that first step toward making the spark of your entrepreneurial endeavor happen with that base established.

0 notes

Text

Explosive Growth in Mobile Money Market: Projected to Surge from USD 17 Billion to USD 119 Billion by 2034

The global mobile money market had a value of US$ 106.8 billion in 2022 and was projected to grow by an impressive 22.6% CAGR to US$ 816.6 billion by 2032. The global mobile money industry is anticipated to expand on an unstoppable note in the projected period with confidence around the security of the payment apps.

To facilitate international transfers to cash facilities and phone credit, the banks and financial sectors launched MTN mobile money. Paying with a digital or web-based approach helps wallet mobile money providers maintain service security and build relationships with a wide range of active and interested users. Mobile wallets are another way that NFC-capable phones are being utilised to boost sales.

At the same time, the fact that there are concerns regarding data security can’t be ignored. This factor could restrain the mobile money market going forward. Future Market Insights has entailed these facts with future perspectives in its latest market study entitled ‘Mobile Money Market’. It has its indigenous team of analysts and consultants to execute using an eagle’s eye view in its primary, secondary, and tertiary modes of research.

To Get Sample Copy of Report Visit

“With convenience quotient (CQ) at its peak, the global mobile money market is expected to go great guns in the forecast period”, says an analyst from Future Market Insights.

Key Takeaways from Mobile Money Market

North America holds the largest market share with new channels coming up in the US on the continuous basis.

Europe holds the second-largest market share with the UK and Germany leading from the front. The scenario is expected to remain unchanged in the forecast period.

The Asia-Pacific is expected to grow at the fastest rate in the mobile money market going forward. The pandemic did change certain things forever; with usage of plastic money being at the forefront. Platforms like PayTM, PhonePay, GooglePay started getting adopted with immediate effect, particularly by the millennials. The older generations also started getting accustomed to this way of transaction gradually. The region is home to two densely populated countries – India and China. With majority of population herein opting for cashless transaction, the mobile money market is bound to grow by leaps and bounds in the forecast period.

Competitive Analysis

Google LLC, in 2019, did team up with Citigroup for implementing Google Pay (mobile wallet money). This platform has gained prominence especially during and after the pandemic (wherein touchless transaction was looked for).

PayPal, in November 2019, entered into partnership with Paykii for launching Xoom (PayPal’s Jamaica-based international money transfer service). The consumers based out of Canada, the UK, the US, and also 37 markets all across Europe, since then, are able to use Xoom’s easy and fast money transfer service for securely paying insurance, loan, water, mobile network, cable, internet, telephone, and electricity bills in Jamaica.

Airtel Africa, in October 2019, entered into collaboration with Mastercard for offering mobile money services all across 14 regions of Africa. Mastercard virtual card does facilitate Airtel Money that does away with a bank account with the objective of making payments at the global as well as local level.

Orange Romania’s Orange Money, in August 2019, tabled the ‘My Reserve’ lending platform. The customers are thus getting benefitted from transparent and simple lending tool, that too, without additional fees and commissions. The interest rate offered is 14% with fixed rates.

Kenya-based Safaricom, in May 2019, entered into partnership with Vodacom for acquiring IP rights of M-Pesa mobile financial services platform. As such, Fuliza (an M-Pesa overdraft facility) was put forth in Kenya that has 8.8 Million+ users.

What does the Report state?

The research study is based on mode of payment (NFC, mobile billing, SMS, USSD or STK, and others), types of purchase (airtime transfers & top-ups, money transfers & payment, merchandise & coupons, travel and ticketing, and likewise), industry vertical (BFSI sector, energy & utilities sector, retail sector, healthcare sector, hospitality & tourism sector, media & entertainment sector, SCM (supply chain management) & logistics sector, IT & telecommunication, and likewise).

With smart and secure GUI (graphical user interfaces) consolidating, various central and government banks are significantly encouraging citizens to accept mobile money.

Key Segments

By Mode of Payment:

NFC

Mobile Billing

SMS

USSD or STK

Others

By Types of Purchase:

Airtime Transfers & Top-ups

Money Transfers & Payment

Merchandise & Coupons

Travel and Ticketing

Others

By Industry Vertical:

Banking, Financial Services, and Insurance (BFSI) Sector

Energy & Utilities Sector

Retail Sector

Health Care Sector

Hospitality & Tourism Sector

Media & Entertainment Sector

Supply Chain Management (SCM) & Logistics Sector

Telecommunication & IT Sector

Others

By Region:

North America

Latin America

Europe

Asia Pacific

Middle East and Africa (MEA)

0 notes

Text

[ad_1] New Delhi: The Reserve Bank of India (RBI) has announced that the asset quality of banks has improved significantly, with the gross non-performing assets (GNPA) ratio declining to a 12-year low of 2.6% in September 2024. This is a result of falling slippages and steady credit demand.The RBI's December 2024 issue of the Financial Stability Report (FSR) reveals that the net NPA ratio is at around 0.6%. However, the RBI has expressed concern over a sharp rise in write-offs, particularly among private sector banks, which could be masking worsening asset quality in unsecured lending segments.The improvement in asset quality is a positive sign for the economy, indicating that banks are becoming more prudent in their lending practices. However, the rise in write-offs is a concern, as it could be masking underlying issues in the banking sector."Within the large borrowers’ cohort, the share of top 100 borrowers has decreased to 34.6 per cent in September 2024, reflecting a growing credit appetite among medium-sized borrowers," the report said.Notably, none of the top 100 borrowers are classified as NPAs in September 2024.In terms of value, investment grade advances (rated BBB and above) constituted 91.5 per cent of the funded advances to large borrowers with long-term external ratings, the report said.It further said profitability of SCBs improved during H1:2024-25, with profit after tax (PAT) surging by 22.2 per cent (y-o-y).Public sector banks (PSBs) and PVBs recorded PAT growth of 30.2 per cent and 20.2 per cent, respectively, while foreign banks (FBs) experienced single-digit growth (8.9 per cent).RBI said the banking stability indicator (BSI), which provides an assessment of the resilience of the domestic banking system, showed further improvement during H1:2024-25.The resilience of the domestic banking system has been bolstered by robust capital buffers, strong earnings and sustained improvement in asset quality, it added.The RBI also said the aggregate GNPA ratio of the 46 banks may rise from 2.6 per cent in September 2024 to 3.0 per cent in March 2026 under the baseline scenario and further to 5.0 per cent and 5.3 per cent, respectively, under adverse scenario 1 and adverse scenario 2.Key Highlights of the Report- Improved Asset Quality: The GNPA ratio of 37 scheduled commercial banks (SCBs) fell to a multi-year low of 2.6%. - Decline in Bad Loans: The share of large borrowers in the GNPA of SCBs has steadily declined over the past two years. - Rise in Write-Offs: Private sector banks have seen a sharp increase in write-offs, which could be masking worsening asset quality. - Liquidity Coverage Ratio: The banking system liquidity coverage ratio (LCR) declined from 135.7% in September 2023 to 128.5% in September 2024. [ad_2] Source link

0 notes