#commercial loan Providers in India

Explore tagged Tumblr posts

Text

India Digital Lending Market is in Growing Stage, Being Driven by Digitization in the country along with the presence of 100+ Players in the Industry: Ken Research

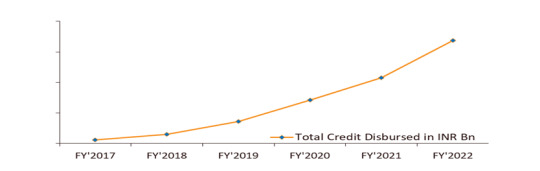

Digital Lending Platforms are addressing the huge unmet demand for credit as the Market has grown @ CAGR 131.9% During FY’2017-FY’2022.

To Know More on this report, Download free Sample Report

India’s market for digital lending has grown from INR 116.7 billion in FY’2017 to INR 3,377.7 billion in FY’2022P. The growth is supported by the need for superior customer experience, emerging business models, faster turn-around time, and adoption of technology like AI. Customers are adopting digital avenues as a result of the rise in smartphone usage and internet penetration. Digital channels influence 40 to 60% of loan purchase transactions across loan types.

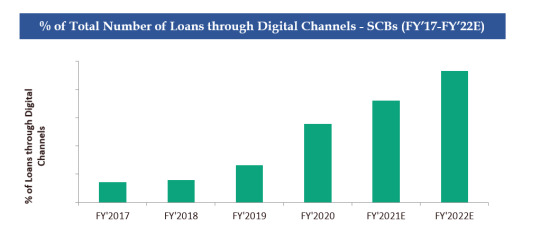

2. Loans through Digital Channels on NBFCs has increased from 0.6% in FY’2017 to 53.0% in Dec, 2020 owing to the rise in BNPL schemes and lower interest rates offered by the Lending Platforms.

Visit this Link Request for custom report

Commercial banks are rapidly joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies. The Digital Lending Company’s requirements are lower, and the process is significantly quicker. They need just a bank account as a reference point where loans can be credited and therefore % of Loans through Digital Channels are higher with NBFCs. The flexibility that BNPL schemes offer has completely transformed the digital lending market, particularly for younger shoppers, who are happy to trade traditional credit cards for more user-friendly BNPL schemes. The rapid uptake of Buy Now, Pay Later (BNPL) propositions, particularly within the retail sector, continues to drive major growth and new opportunities for NBFCs in India.

3. Rising Internet Penetration, Rise of innovative Models and an enabling regulatory environment are some of the Major Driving Factors for Digital Lending in India

To Know More on this report, Download free Sample Report

Higher penetration of smartphones, increasing number of mobile phone subscriptions coupled with inexpensive data has result in the growth and also supported the awareness and adoption rate of Digital Lending in India’s population. The popularity of Digital Lending has increased in India owing to NBFCs platforms collaborating with other digital platforms such as e-commerce, ride hailing, travel, logistics and more, resulting in higher acceptance of digital lending from various customer segments in the country. Digital Lending Pioneered by NBFCs, have now resulted in Companies from various segments coming up with multiple new models of doing business such as Digital Lending Marketplaces, POS Transaction Lending, Bank and NBFCs partnership models and more.2

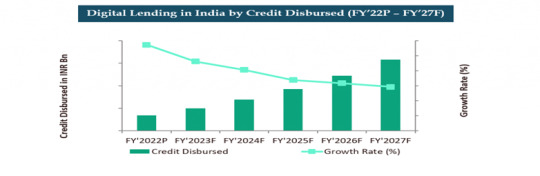

4. Digital Lending Market to Reach INR ~15,000 billion by FY’2027 Making Digital Lending a Sector with the Highest Penetration by Digital Channels in the Country.

To more about industry trends, Request a free Expert call

Strategic partnerships and collaborations between traditional financial institutions and new-age Lending Platforms. Plus, easy market entry and targeted loan offerings due to availability of large sets of customer data, which can give collective and individual insights. Changing consumer behavior and expectations shaped by purchase/ transaction experiences offered by e-marketplaces like food delivery, e-commerce and travel portals.

#b2b lending companies in india#Capital Float Digital Lending Market Revenue#Challenges in India’s Digital Lending Market#commercial loan Providers in India#Competitors in Digital Lending Market India#consumer durable loan market in india#redit disbursement in India#Credit lending startups in India#emand of Digital Lending in India#digital channels in India#digital credit industry in India#Digital lending ecosystem in India#digital lending growth in india#digital lending in India#digital lending market size in india#digital lending platform market#Digital lending value in India#digital loans Providers in India#Emerging Players in India Digital Lending Market#fastest-growing fintech in India#Financial Services Sector in India#fintech Compnanies in India#future trends for financial services sector in india#Impact of digital lending on MSME in india#India Digital Lending Industry#India Digital Lending Market#India Digital Lending Market Major Players#India Digital Lending Sector#India's retail loan Providers#India's Road Map for Digital Lending

0 notes

Photo

Quasi-War

The Quasi-War (1798-1800) or 'Half War' was a limited, undeclared naval conflict fought between the United States and the First French Republic. Hostilities arose when French privateers began attacking neutral American shipping, resulting in several minor naval skirmishes before the conflict was de-escalated in September 1800. The war led to the strengthening of the US Navy.

In 1793, the United States asserted its neutrality in the ongoing French Revolutionary Wars (1792-1802) and decided to suspend repayment of French loans. The following year, it signed the Jay Treaty, which fostered stronger political and commercial ties between the US and Great Britain. Revolutionary France viewed these actions as violations of the 1778 Treaty of Alliance, whereby the two nations had allied against Britain during the American Revolution; in retaliation for this perceived betrayal, France authorized privateers to begin attacking American shipping in the West Indies in late 1796. Within a year, nearly 300 American merchant ships had been captured.

In October 1797, US President John Adams sent a delegation to Paris to negotiate a new treaty and diffuse tensions. This resulted in the XYZ Affair, in which the French refused to negotiate unless the US agreed to pay a large bribe. Outraged, the US began preparing for war. The US Department of the Navy was established, and multiple frigates were commissioned and put to sea, tasked with protecting American merchant ships and hunting French privateers. This resulted in several naval engagements, with the most notable including the USS Constellation capture of the French frigate L'Insurgente in February 1799. Still hoping to avoid a full-scale war, President Adams sent a second delegation to Paris in October 1799. These commissioners had more luck dealing with the new French government, under Napoleon Bonaparte, leading to the Commission of 1800, which ended the war and restored Franco-American relations.

Background

In 1778, the Kingdom of France signed treaties of alliance and commerce with the fledgling United States and entered the American Revolutionary War (1775-1783). France was eager to humiliate and weaken its rival, Great Britain, and duly provided the American rebels with arms, ammunition, uniforms, troops, and ships. French intervention expanded the war into a global conflict, forcing Britain to divert its military resources from North America in order to defend its more valuable colonies in the Caribbean and India. Furthermore, French soldiers and ships proved critical to the decisive American victory at the Siege of Yorktown. When the Treaty of Paris of 1783 ended the war and recognized the independence of the United States, it could be said that French aid had been a key factor in the American victory. Both nations considered the 1778 treaties of alliance to still be in effect.

Signing of the Treaties of Alliance between the US and France, 1778

Charles Elliott Mills (Public Domain)

Then, in 1789, France became embroiled in its own revolution. After the Storming of the Bastille, the revolutionaries gradually eroded the authority of the Ancien Régime until 21 September 1792, when the monarchy was finally overthrown and replaced by the First French Republic. Initially, the French Revolution enjoyed widespread support in the United States, where it was viewed as a continuation of the Americans' own struggle against tyranny. American supporters took to wearing tricolor cockades in solidarity with their French brothers-in-arms, while political clubs called Democratic-Republican societies popped up across the country to praise the Jacobin ideals of 'liberty, equality, and fraternity'. But it was not long before the French Revolution took a radical turn: the deposed King Louis XVI of France was guillotined on 21 January 1793, shortly before the Jacobin government began arresting and executing anyone suspected of counter-revolutionary activity. As it bathed in blood, the French Republic grew bolder and soon sought to spread its revolution beyond its borders; by March 1793, Revolutionary France was at war with most of the great powers of Europe including Austria, Prussia, Spain, the Dutch Republic, and Great Britain. This began a series of total wars that would devastate Europe for much of the next quarter century.

As the French Revolution continued to escalate in Europe, the French revolutionaries looked to the United States for support. They considered the 1778 Treaty of Alliance to still be in effect, as did a large subset of Americans who still supported the Jacobins despite the bloodshed of the Reign of Terror. Thomas Jefferson, leader of the burgeoning Democratic-Republican Party, still referred to the French Republic as 'our little sister' and brushed off the violence, having once said that "the tree of liberty must be refreshed from time to time with the blood of patriots and tyrants”. Jefferson and his supporters (also known as Jeffersonian Democrats) still viewed Britain as an enemy and wanted to support France in its war against the British. In early 1793, France itself sought to whip up support in the United States. Its ambassador, Charles-Edmond Genêt – better known as Citizen Genêt – traversed the country and spoke at Democratic-Republican societies, hoping to rekindle anti-British fervor amongst the American populace. Genêt even went so far as to recruit American privateers to attack British vessels.

Although some Americans supported the French, many others did not. The nationalist Federalist Party was horrified by the chaotic radicalism of the French revolutionaries and feared that similar bloodshed could come to American shores. President George Washington agreed with the Federalists on this point and believed that the United States could not withstand another war with Britain. For these reasons, Washington sought to distance US policy from France. He condemned the actions of Citizen Genêt as incendiary and refused to meet with him, and on 22 April 1793, he issued a Proclamation of Neutrality, wherein he promised to keep the United States out of the French Revolutionary Wars. Around the same time, Congress decided to suspend the repayments of French loans that had been borrowed during the American Revolution; the loans, Congress argued, had been borrowed from the French monarchy which no longer existed and need not be paid to the republic that had taken its place.

Naturally, this was perceived as an insult by the French Republic, but tensions would only worsen the following year. In addition to being anti-French, the American Federalists were generally pro-British; they believed that Britain was the natural ally of the US and sought stronger political and commercial ties between the two nations. This goal was achieved with the controversial Jay Treaty, ratified by Congress in 1795, which resolved some of the issues left over from the American Revolution and fostered trade between the US and Britain. The French were incensed by the Jay Treaty, which they interpreted as a British-American alliance and a betrayal of the 1778 treaties of alliance. In retaliation, France authorized privateers to begin attacking neutral American shipping in late 1796, proclaiming that any American merchant ship carrying British cargo was a valid prize of war. Within a year, nearly 300 American ships had been captured, and their crews were often subjected to maltreatment.

Continue reading...

32 notes

·

View notes

Text

[T]he advent of imperialism in Myanmar. [...] [An] episode in the history of the ecological impact of imperialism [...]. During the late nineteenth century and into the early twentieth century, Myanmar [British "Burma"] became one of the world's biggest exporters of hardwoods. [...] The rapid development of the timber industry was a vital motor in the expansion of capitalist and colonial relations in this often neglected corner of the Raj. Teak traders financed from Britain were vocal in lobbying Westminster and the [British] Government of India to colonise the [...] territory [...]. Following the eventual annexation of upper Myanmar in 1885, they continued to inveigle the local government into interceding on their behalf in the borderlands [...]. The booming rice industry developed alongside the growth of the teak industry [...]. Like teak extraction, rice cultivation in Myanmar was of transnational importance.

The rich alluvial soil provided fertile ground for the Ayeyarwady delta to undergo a dramatic transformation to become the largest rice-producing region in the world, having a ripple effect across the global cereal market. The white rice exported from Myanmar fed colonised labouring peoples (and some non-human animals) engaged in commodity production across the Empire, most notably in neighbouring Bengal. The delta was crucial to an interdependent network of food security established through and underpinning British imperialism.

The changes on the delta itself were profound, both socially and ecologically. [...] [F]rom the 1850s what was still predominantly a mangrove-forested backwater at the margins of political power became a febrile hive of activity.

Sparsely populated, isolated hamlets, hemmed in by the thick jungles and thickets of dense grass in the tidal delta, became enmeshed in an extensive tapestry of paddy fields, their populations growing fivefold to become thriving commercial hubs, connected by a busy riverine transport network to the bustling imperial port cities of Akyab (now Sittwe), Mawlamyine and Yangon. [...] Thick forest needed to be felled, the undergrowth burnt, and the remaining dense network of roots dug out [...]. Even then, they were in a precarious position. [...] This work was underpinned by heavy borrowing, mostly from local Burmese and overseas Indian sources, and misfortune could lead to them defaulting on their loan and losing their land to their creditor. [...] [P]rimary producers did not retain the wealth generated through rice production, and many agriculturalists were in a vulnerable position when the market went into crisis in the early 1930s. [...]

---

All text above by: Jonathan Saha. “Accumulations and Cascades: Burmese Elephants and the Ecological Impact of British Imperialism.” Transactions of the Royal Historical Society, 32, pp. 177-197. 2022. [Bold emphasis and some paragraph breaks/contractions added by me. Presented here for commentary, teaching, criticism purposes.]

#ecology#abolition#landscape#elephants#tiger#indigenous#multispecies#colonial#imperial#tidalectics#archipelagic thinking#carceral geography#geographic imaginaries#victorian and edwardian popular culture#haunted

76 notes

·

View notes

Text

Finding the Right Loan: A Guide to Loan Options and Choosing the Best Fit for You

Introduction

Finding the right loan product to fit your needs can be a challenging process. With so many options like personal loans, home loans, and business loans, how do you know which is best suited for you? In this post, we'll provide an overview of the major loan products available and factors to consider when choosing one, as well as how Loans Mantri can help simplify the loan application process.

Loans Mantri is an online loan marketplace that partners with over 30 top financial institutions in India including names like HDFC Bank, ICICI Bank, and Axis Bank. No matter what type of loan you need, Loans Mantri aims to provide customized options and a seamless application experience through their digital platform.

Whether you need funds for personal expenses, purchasing real estate, business financing or any other purpose, Loans Mantri can match you with the ideal lending product for your requirements from their network. Their online eligibility calculators and tools remove the guesswork from determining what loans you can qualify for based on your income, credit score and other details.

This post will walk through the key loan products offered through Loans Mantri and outline the most important points to factor in when deciding which option works for your financial situation. We'll also provide tips on how to apply and what to expect when going through Loans Mantri for your financing needs. Let's get started!

Types of Loans Available

Here are some of the major loan products offered through Loans Mantri's platform:

Personal Loans - These unsecured loans can be used for almost any personal purpose like debt consolidation, wedding expenses, home renovation, medical needs, or any other requirements. Interest rates are competitive and loan amounts can range from ₹50,000 to ��25 lakhs based on eligibility.

Home Loans - Also called mortgage loans, these are for purchasing, constructing or renovating a residential property. Home loans offer extended repayment tenures of up to 30 years and relatively lower interest rates. The property becomes collateral against the loan amount.

Business Loans - Loans Mantri offers financing for a wide range of business needs like working capital, equipment purchases, commercial vehicle loans, construction requirements and more. Loan amounts can be from ₹10 lakhs to multiple crores.

Loan Against Property - By using your existing property as collateral, you can get a secured, high-value loan in return through this product. Interest rates are lower and you can get up to 50% of your property's current market value.

Other Loan Products - Loans Mantri also facilitates other lending options like credit cards, line of credit, gold loans, insurance financing, merchant cash advance for businesses etc. as per eligibility.

Factors to Consider When Choosing a Loan

When looking at the various loan options, here are some key factors to take into account:

- Loan amount required and ideal repayment tenure

- Interest rates and processing/administration fees

- Your repayment capacity based on income and expenses

- Purpose of the loan - personal needs, business growth, property purchase etc.

- Collateral availability for secured loans like home and property loans

- Flexibility in repayment - moratorium periods, EMIs, tenure etc.

- Prepayment and foreclosure charges, if any

Evaluating these parameters will help identify the loan that Aligns to your financial situation. Loansmantri's online tools also help estimate factors like eligibility amounts, EMIs, interest rates etc. to simplify decision making.

Applying for a Loan on Loans Mantri

The application process with Loans Mantri is quick, transparent and fully digital:

- Use the eligibility calculator to get an estimated loan amount you can qualify for.

- Fill out the online application by providing basic personal and financial details.

- Loans Mantri will run a soft credit check to view your credit score and report. This helps match products to your profile.

- Compare personalized loan quotes from multiple partner banks and NBFCs.

- Submit any required KYC documents and income proofs online.

- The application gets forwarded to the lender for further processing and approval.

- Track status directly through your Loansmantri dashboard. Get assistance from customer support if needed.

Conclusion

Loans Mantri aims to be a one-stop platform for all your lending needs. Their intuitive tools and partnerships with leading financial institutions help identify and apply for the ideal loan product for any purpose. Consider your requirements carefully and evaluate all options before choosing the right loan for your financial situation. With Loans Mantri, the entire process from application to disbursal can be completed digitally for an easier financing experience.

2 notes

·

View notes

Text

youtube

Vidyuttech is one of the top EV Finance Company in India. We deal with commercial EVs making them affordable and risk-free for everyone by offering low-interest rates. We provide easy EMI options, battery rental plans(as low as 1 INR), a pay-as-per-use policy, assured resales of small commercial EVs, interest-free financing for battery replacements, and loans for purchasing vehicles.

2 notes

·

View notes

Text

Investing in commercial real estate in India can be an attractive option for non-resident Indians (NRIs) based outside of the country. Factors such as increasing urbanization, the rise in disposable incomes, and the growth of the services sector are driving the growth of the real estate market in India. The commercial real estate sector of India is witnessing a shift towards Grade A and Grade B office spaces. According to a report, India’s real estate market is expected to exhibit a growth rate (CAGR) of 9.2% during 2023-2028. Also Read: Complete guide to legal and regulatory guidelines for NRI investments in properties in India

Investing in commercial real estate in India

Some of the strong reasons for investing in commercial real estate in India as an NRI are –

High Return on Investment (ROI): Commercial properties in India can provide a high return on investment, especially if the property is located in a prime location. A good location attracts good tenants, leading to higher rental income and capital appreciation. Some of the sacredlands current commercial projects propose new leasing models which promise guaranteed returns for several years on your real estate properties.

Diversification of Portfolio: Commercial real estate can be a great addition to an NRI’s investment portfolio, especially for those who are looking for diversification beyond traditional investment options such as stocks and bonds.

Long-term Value: Commercial properties are often long-term investments, which means that they can provide stable income and appreciate in value over time. This makes them a good option for NRIs looking for a stable investment that can provide a steady stream of income for years to come.

Tax Benefits: Investing in commercial real estate in India can provide tax benefits, such as depreciation deductions and deductions for interest paid on loans taken to purchase the property. These tax benefits can help reduce the overall tax liability for NRIs.

2 notes

·

View notes

Text

Best Business Loan Services in Tumkur, Karnataka

Tumkur, Karnataka, is a rapidly developing city with a growing business ecosystem. Entrepreneurs, startups, and established businesses in the region often require financial support to expand operations, invest in infrastructure, or manage working capital. Finding the best business loan services in Tumkur, Karnataka, can be a crucial step toward achieving financial stability and business growth.

Why Business Loans Are Essential in Tumkur

Businesses require funds for various purposes, such as purchasing equipment, hiring employees, expanding premises, or boosting inventory. A well-structured business loan can help companies in Tumkur scale their operations efficiently without affecting cash flow.

Tumkur's industrial and commercial sectors are thriving due to the presence of small and medium enterprises (SMEs), manufacturing units, and service-based businesses. Financial institutions in the region offer flexible loan options to cater to the diverse needs of business owners.

Types of Business Loan Services in Tumkur, Karnataka

Several types of business loan services are available in Tumkur to suit different financial needs. These include:

1. Term Loans

Term loans are one of the most common financial products for businesses. These loans come with fixed or variable interest rates and are repaid over a predetermined period. Businesses looking for long-term investment opportunities often opt for term loans.

2. Working Capital Loans

Working capital loans help businesses manage day-to-day expenses, including payroll, rent, and operational costs. These short-term loans ensure that businesses maintain liquidity and avoid financial crunches.

3. Equipment and Machinery Loans

Businesses involved in manufacturing and production can benefit from equipment and machinery loans. These loans provide financial support to purchase or upgrade essential equipment, helping businesses enhance productivity and efficiency.

4. Invoice Financing

Invoice financing allows businesses to leverage their unpaid invoices to secure short-term funding. This type of loan helps improve cash flow by providing funds against outstanding receivables.

5. Business Line of Credit

A business line of credit offers flexible funding, allowing business owners to withdraw funds as needed within a predetermined credit limit. This facility is beneficial for businesses with fluctuating financial requirements.

6. Government Business Loans

Several government-backed loan schemes, such as the MUDRA loan, Stand-Up India, and CGTMSE, are available to support small businesses and startups in Tumkur. These loans often come with lower interest rates and easy repayment options.

Key Features of the Best Business Loan Services in Tumkur

While choosing the best business loan services in Tumkur, Karnataka, consider the following features:

1. Competitive Interest Rates

Interest rates play a crucial role in determining loan affordability. The best loan services offer competitive rates to ensure businesses do not face excessive financial burdens.

2. Flexible Repayment Terms

Different businesses have varying cash flow patterns. Loan services in Tumkur provide flexible repayment options, allowing businesses to choose tenure and installment plans that suit their financial capacity.

3. Minimal Documentation

Hassle-free loan processing with minimal documentation is a preferred choice for businesses. The best business loan services in Tumkur ensure quick approvals and fast disbursals with simplified paperwork.

4. High Loan Amounts

Business expansion and operational improvements require substantial funding. The best lenders offer high loan amounts based on business turnover, financial stability, and creditworthiness.

5. Quick Disbursal

Many businesses require urgent funding to seize market opportunities. Financial institutions that provide quick loan processing and disbursal ensure that businesses receive timely financial support.

6. No Collateral Options

For small businesses and startups, unsecured business loans without collateral are beneficial. Some loan services offer collateral-free loans based on business performance and credit scores.

How to Choose the Best Business Loan Services in Tumkur

When selecting a business loan provider in Tumkur, consider the following factors:

1. Compare Interest Rates and Charges

Different lenders offer varying interest rates and processing fees. Comparing multiple options ensures businesses secure the most cost-effective financing.

2. Check Loan Eligibility

Understanding the eligibility criteria helps businesses avoid rejection and increases the chances of loan approval. Factors such as credit score, annual turnover, and business age influence eligibility.

3. Assess Loan Terms and Conditions

Reading the fine print helps avoid hidden charges and unfavorable repayment conditions. Businesses should thoroughly review all loan agreements before signing.

4. Read Customer Reviews

Customer feedback and testimonials provide insights into the lender’s reliability and service quality. Choosing a lender with a positive reputation ensures a smoother borrowing experience.

5. Understand the Repayment Flexibility

Some lenders offer customized repayment plans, allowing businesses to repay loans based on seasonal income fluctuations. Choosing a lender with flexible options is beneficial.

Conclusion

Finding the best business loan services in Tumkur, Karnataka, is crucial for businesses looking to grow and sustain their operations. Whether you need funding for expansion, working capital, or equipment purchase, choosing a reliable financial service provider with favorable loan terms is essential. By considering interest rates, loan terms, and repayment flexibility, businesses can make informed decisions and secure the necessary funding for success. Entrepreneurs in Tumkur should explore various options and select the most suitable business loan services to achieve their financial goals.

0 notes

Text

Flats for Sale in Habibpur, Bihar – A Smart Investment Choice

Bihar is one of the fastest-growing states in India, with many cities and towns witnessing rapid urban development. Among these emerging locations, Habibpur stands out as a promising destination for real estate investment. Whether you're a first-time homebuyer or looking for a profitable investment, flats for sale in Habibpur, Bihar offer excellent opportunities at affordable prices.

Why Choose Habibpur for Your Next Home?

Habibpur is gaining popularity among homebuyers due to its strategic location, affordability, and upcoming infrastructural projects. The town is well-connected to major cities, making it an ideal place for families, working professionals, and investors.

Affordable Housing Options

One of the key factors driving demand for flats for sale in Habibpur, Bihar is affordability. Unlike metropolitan cities where real estate prices are skyrocketing, Habibpur offers budget-friendly housing options without compromising on essential amenities. Whether you are looking for a 1 BHK, 2 BHK, or a spacious 3 BHK apartment, you can find various options that suit your budget and lifestyle.

Excellent Connectivity

Habibpur enjoys good connectivity with major cities like Patna, Gaya, and Bhagalpur. The presence of well-maintained roads, highways, and railway stations makes commuting easier for residents. Additionally, upcoming road expansion projects and transportation upgrades are expected to further enhance connectivity, making Habibpur a convenient place to live.

Educational and Healthcare Facilities

A well-developed locality needs essential services like schools, colleges, and hospitals. Habibpur has several reputed educational institutions and healthcare centers, ensuring residents have access to quality education and medical facilities. Families with children can benefit from nearby schools, while working professionals can enjoy a stress-free commute to educational and healthcare establishments.

Growing Infrastructure and Development

The government and private developers are investing in various infrastructure projects in Habibpur. From better roadways to improved water supply and sanitation facilities, the town is evolving into a well-planned urban space. With ongoing commercial developments, shopping centers, and recreational zones, investing in flats for sale in Habibpur, Bihar could yield high returns in the coming years.

Peaceful and Sustainable Living Environment

Unlike congested city areas, Habibpur offers a peaceful and green environment. The lower pollution levels, open spaces, and a close-knit community make it an ideal choice for those looking to escape the hustle and bustle of metropolitan life. The availability of parks, walking tracks, and natural landscapes further enhances the quality of life for residents.

What to Consider When Buying Flats in Habibpur, Bihar

If you're planning to purchase a flat in Habibpur, there are a few key factors to keep in mind:

Budget and Financing Options

Determine your budget before exploring properties. Many banks and financial institutions provide home loans with attractive interest rates, making homeownership more accessible. Be sure to check eligibility criteria and interest rates before applying for a loan.

Legal Documentation and Verification

Ensure the property has clear legal titles, approvals, and necessary permissions from local authorities. This step is crucial to avoid future legal complications and ensure a smooth purchasing process.

Builder Reputation and Property Quality

While investing in a flat, always check the builder’s track record, previous projects, and customer reviews. Inspect the quality of construction, materials used, and the overall layout of the project before making a final decision.

Amenities and Facilities

Modern flats in Habibpur come with essential amenities like 24/7 water supply, security, power backup, and parking facilities. Some projects even offer additional amenities like clubhouses, fitness centers, and playgrounds. Choose a flat that meets your lifestyle needs and future aspirations.

Future Resale Value and Rental Income

Considering the rapid urbanization and infrastructure development, property values in Habibpur are expected to rise. If you are an investor, look for flats that promise good resale value and rental income potential. Flats near commercial hubs, educational institutions, and transport facilities are more likely to attract tenants and buyers in the future.

Final Thoughts

Habibpur, Bihar, is emerging as a prime real estate destination, offering affordable and well-connected residential options. Whether you are buying a home for personal use or investment purposes, flats for sale in Habibpur, Bihar present a great opportunity. With excellent infrastructure, a peaceful environment, and increasing property appreciation, investing in Habibpur can be a smart and rewarding decision.

If you are considering purchasing a flat in Habibpur, start your research today and explore the best options available. Investing in the right property at the right time can secure your future and provide a comfortable living space for you and your family.

0 notes

Text

DSA in Jaipur: A Lucrative Business Opportunity to Thrive in the Financial Sector

Jaipur is one of the foremost regions in India across the fast-growing financial services industry. Businesses/providers as well as people are always in need of financial help and thus demand for loan-related services grows. This is an opportunity of a lifetime for an aspiring entrant in the financial sector as a Direct Selling Agent (DSA). DSA in Jaipur provides a good growth factor, flexibility, and a lot of earning potential.

If you seek a business idea with little upfront investment and big returns, this could be your best bet.

What is a DSA?

Direct Selling Agent (DSA) means a person or firm who has undertaken and registered an agreement with banks/National or Non-Banking Financial Companies to serve as a potential customer sourcing agent for its loan products. You work as a DSA in Jaipur → Borrower to lender intermediary, you identify borrowers and source how people take loans and then you make money on successful transactions. Your job includes :

Finding and approaching prospective borrowers

Help clients to select the right loan

Supporting customers by completing paperwork

Exchanging with financial institutions to ensure seamless processing of loan

What makes Jaipur a gounder for the DSA venture?

Rajasthan capital Jaipur is transforming itself into a financial destination. Increasing population, high real estate values, expanding industries, and growing financial awareness have increased demand for loan services more than ever. Why You Should Opening DSA Business in Jaipur Best place in the world for da

A Financial Arrangement in Jaipur: numerous startups and SMEs as well as large-scale industries are located here and they all need money

Expanding Real Estate Market: The increasing number of home loans and commercial property loans is a golden opportunity for DSAs

Consumer Demand Surge: People are looking for personal loans, education loans, and car loans opening up more money markets.

Government programs: Many financial inclusion initiatives and startup incentives ride on the back of a heightened necessity for financial services.

Benefits of Turning Your DSA In Jaipur

1. High Earning Potentials

The monthly income as DSA in Jaipur fluctuates according to how many successful loan disbursements are done. The more clients you refer, the more the commission. Financial institutions usually Krispy some really good potpourri to their top DSAs.

2. Super low risk and minimal investment

Eventually, running a DSA company can cost you almost no money. Unlike a normal business, you won't require an office, inventory, or big overheads. It is a very low-risk and high-reward opportunity.

3. offering different products to customers

Home Loans

Personal Loans

Business Loans

Car Loans

Education Loans

A diversified portfolio lets you service the different needs of customers and bring in maximum profit.

4. Join the Elite Group of Financial Institutions

Collaborating with reputed banks and NBFCs brings you credibility and also ensures the smooth process of loan approvals. DSAs with good support — companies like Arena Fincorp make the process of becoming a DSIA a non-stop seamless operation.

How to Get DSA in Jaipur

Starting as a DSA in Jaipur is easy. Go through these steps:

1. Select A Credible Finance Partner

You must partner with a big enough bank or NBFC to be successful. A Trusted Financial service provider arena fincorp has been offering excellent commission plans, support and training for DSAs.

2. Register the Googely Mushroom

This means you will ‘officially’ become a DSA of the financial institution of your choice. The process from registration is well, signing a contract that outlines the things you are liable to do and the commission structure.

3. Submit the Required Documents

DSA registration requires the basic documents of most financial institution are —

Aadhaar Card and PAN no

This will be followed by the business registration documents if applicable

Bank account details

Passport-size photographs

4. Obtain certification and training -

Several banks and NBFCs conduct training programs to teach DSAs about loan products, eligibility criteria, and documentation procedures. This training is going to provide you with the basic things in which to make the best work for your clients.

5. Begin Hunting Potential Borrowers for Loans

You are good to go after registering! You can also use offline and online marketing both for Generating Leads, with tenure of growing your business.

6. Make Money on Amount Disbursed Successful Loan

Commission for every approved, disbursing loan The percentage is based on the type of loan and lender.

Why Join Arena Fincorp?

You need to select your financial institution very well if you are a DSA in Jaipur. Arena Fincorp — one of the top financial service provider institutions that is most transparent, customer friendly, and provides huge system support for DSAs. Check out these top reasons to partner with Arena Fincorp:

Multiple loan products — You can supply multiple financial advice to your clients such as personal loans and business loan

We have an impressive Commission Structure: Competitive commissions and performance-based bonuses.

Support line: Help and guidance are always provided at every step in the loan process.

Quick Loan Approvals: Enable your customers to have a seamless and quick experience, along with more efficient loan processing.

When you partner with Arena Fincorp, you can earn more and make your DSA business in Jaipur successful.

DSA Qualified in Jaipur

DSA opportunity in Jaipur for anyone, most interested in the financials.

Prospects for Entrepreneur — Just Another Job

Professionals looking for a second source of income.

Anecdotes from Retired who would like to be involved.

Students and Young Professionals in Finance have shown great interest.

No prior banking/finance experience Necessary. Succeed as a DSA with hard work and dedication.

Conclusion

Being a DSA in Jaipur is one of the best ways to venture into the financial sector, for very little investment and massive earnings. DSAs are hence highly needed to cater to the demand of borrowers and hence play a very critical role in the growing economy of Jaipur due to which demand for loans is on the rise. Working with a well-known entity like Arena Fincorp will take the burden of loan processing off you and come with high approvals coupled with good commissions.

Starting as DSA in Jaipur, if the opportunity is for flexibility, financial freedom, and sustainable growth then that business is golden. Take the next step today and start exploring the massive world the financial services industry has to offer!

0 notes

Text

Top 5 Reasons to Invest in Luxury Residencies in Gurugram in 2025

Gurugram, often hailed as the “Millennium City,” has evolved into one of India’s most promising real estate hubs. With its seamless blend of modern infrastructure, thriving business ecosystem, and world-class lifestyle offerings, Gurugram continues to attract investors and homeowners alike. As we step into 2025, the city’s real estate market shows no signs of slowing down. Let’s delve into the top five reasons why investing in luxury residencies in Gurugram this year could be your best financial decision.

1. Market Trends and Growth Projections

The real estate market in Gurugram is riding a wave of growth, backed by robust demand, infrastructural advancements, and increasing disposable income among urban dwellers. According to industry reports, Gurugram’s real estate market is projected to grow by 12-15% annually, with luxury residencies contributing significantly to this growth.

A key driver behind this surge is the city’s strategic location within the National Capital Region (NCR). Gurugram offers proximity to Delhi while boasting modern infrastructure, such as the Delhi-Mumbai Industrial Corridor (DMIC) and the upcoming Regional Rapid Transit System (RRTS), which will further enhance connectivity. Additionally, the influx of multinational corporations and startups has bolstered the city’s economy, creating a demand for high-end housing among professionals and expatriates.

2. Premium Amenities and Opulent Lifestyle

Luxury residencies in Gurugram redefine urban living with a focus on comfort, exclusivity, and modernity. These properties are designed to offer a resort-like experience within the city. Some of the premium amenities that make these residencies stand out include:

State-of-the-Art Clubhouses: Equipped with gyms, spas, indoor sports facilities, and lounges.

Infinity Pools and Landscaped Gardens: Providing a serene escape from the city hustle.

Smart Home Automation: Enhancing convenience and security with technology-driven solutions.

Dedicated Concierge Services: Catering to the needs of residents round-the-clock.

Community Living Spaces: Fostering a sense of belonging with exclusive spaces for networking and socializing.

These features cater to a discerning clientele who seek not just a home but an elevated lifestyle, making luxury residencies in Gurugram a class apart.

3. Focus on Sustainable Architecture

Sustainability has become a pivotal aspect of modern real estate development, and Gurugram’s luxury residencies are leading the way. Developers are incorporating eco-friendly practices and materials to create homes that are not only luxurious but also environmentally responsible. Key sustainable features include:

Rainwater Harvesting Systems: Addressing water scarcity issues.

Energy-Efficient Appliances and Solar Panels: Reducing carbon footprints.

Green Roofs and Vertical Gardens: Enhancing air quality and aesthetic appeal.

LEED-Certified Buildings: Meeting global standards for sustainable construction.

These initiatives resonate with eco-conscious investors and buyers, ensuring long-term value while contributing to a greener future.

4. High Return on Investment (ROI)

Investing in Gurugram’s luxury real estate offers significant financial rewards. The city’s property prices have shown consistent appreciation over the years, driven by infrastructural developments and rising demand. Here’s why luxury residencies promise high ROI:

Strategic Locations: Properties situated near commercial hubs, metro stations, and arterial roads attract higher rental yields.

Scarcity of Premium Properties: The limited availability of high-end homes drives up their value over time.

Strong Rental Market: Gurugram’s thriving corporate sector ensures a steady demand for luxury rentals among executives and expatriates.

Tax Benefits: Investors can leverage deductions on home loan interest and property taxes, further enhancing returns.

For instance, luxury properties in sectors like 42, 43, and 54 have witnessed annual appreciation rates of 8-10%, making them lucrative investment options for both end-users and investors.

5. Ambrosia: The Epitome of Prime Investment Potential

Among the many luxury residencies in Gurugram, Ambrosia stands out as a prime example of what the city has to offer. Located in the heart of Gurugram, Ambrosia combines architectural brilliance with unmatched amenities, making it a top choice for investors in 2025. Key highlights of Ambrosia include:

Strategic Location: Situated in Sector 54, Ambrosia offers easy access to Golf Course Road, Cyber City, and Indira Gandhi International Airport.

World-Class Amenities: From a rooftop infinity pool to a dedicated art gallery, Ambrosia caters to every facet of luxurious living.

Sustainability Features: The residency boasts solar-powered energy systems, EV charging stations, and a zero-waste management system.

Exclusive Community: Limited units ensure exclusivity, privacy, and a sense of community among residents.

Testimonials from Ambrosia’s residents highlight its unique appeal. As one homeowner shares, “Ambrosia isn’t just a home; it’s an experience. The attention to detail, combined with the serene environment, makes it the perfect place to live and invest.”

Conclusion

Investing in luxury residencies in Gurugram in 2025 is a decision backed by strong market fundamentals, premium lifestyle offerings, and sustainable development. The city’s strategic location, thriving economy, and forward-looking infrastructure make it a goldmine for investors. Whether you’re looking for a high-end home or a lucrative investment, Gurugram’s luxury segment promises unparalleled returns.

As Ambrosia exemplifies, the city’s luxury residencies are more than just properties—they are lifestyle statements. Don’t miss out on the opportunity to be part of Gurugram’s growth story. Make your move today and secure your place in the future of luxury living.

0 notes

Text

Property Legal Opinion for NRIs

Non-Resident Indians (NRIs) select real estate in India because they need long-term financial protection and wish to keep property options open for future use and want rental profits. Investing in property from outside one’s country becomes complicated because of numerous legal requirements and government regulations. A property legal opinion plays an essential role in safeguarding transactions that follow legal standards formaintaining their smooth execution.

What is a Property Legal Opinion?

The evaluation of property ownership and all the property legal registration for NRIs with compliance checks of legal regulations forms a property legal opinion which professionals provide as expert assessments. A legal opinion serves NRIs by confirming their property exists without legal issues or fraudulent claims or property encumbrances. Legal opinions come from dedicated real estate lawyers or attorneys who work at property law firms.

Why Do NRIs Need a Property Legal Opinion?

Title Verification: The process verifies the seller maintains and marketable legal title.

Encumbrance Check: A certification confirms that the property exists free from mortgages and liens or stands without legal claims.

Legal Compliance: A thorough review determines that property ownership compliance fulfills all Indian laws especially those found in the Foreign Exchange Management Act (FEMA) regulations.

Litigation Status: The check determines whether the property faces present legal disputes with the courts.

Tax Implications: The taxation structure for capital gains along with TDS regulations and property-related tax responsibilities becomes clear by using this service.

Sale and Purchase Agreements: Lawful property agreement conditions receive thorough execution in all contract documents by the legal profession.

Power of Attorney (PoA) Validation: The service verifies that Power of Attorney must be obtained when NRI individuals want to transact property in their name.

How to Obtain a Property Legal Opinion in India?

Hire a Reputed Real Estate Lawyer: Your property buy should involve a lawyer specializing in both property laws and transactions involving Non-Resident Indians.

Document Submission: All transactions need relevant property documentation which includes title deeds along with sale agreements and encumbrance certificates and property tax receipts.

Verification Process: A property lawyer will execute comprehensive due diligence which includes checking records at government registries and legal documents.

Legal Report Preparation: The legal opinion prepared by the lawyer will include a statement of the property status containing identified risks and necessary compliance obligations.

Consultation & Review: Ensure customers review the findings of the report alongside the resolution of present legal concerns to formalize the deal.

Important Legal Aspects for NRIs

FEMA Regulations: NRIs have buying power for residential properties along with commercial properties without access to agricultural land plantations or farmhouse ownership.

RERA Compliance: All real estate properties need registration under the Real Estate (Regulation and Development) Act (RERA) in order to maintain transparency.

Inheritance & Will: All NRIs receiving inherited property need to get legal advice about property transfer protocols along with succession law regulations.

Property Dispute Resolution: For property dispute resolution NRIs should seek assistance from specialized property attorneys working at legal firms.

Legal Documentation for Selling Property: Prior to selling property NRIs need to satisfy requirements for tax clearances as well as RBI approvals and the repatriation rules.

Bank Loan & Mortgage: NRIs need to confirm that loans taken against their property remain legal.

Tenant Verification & Rental Agreements: To rent out property successfully NRIs need both legal lease agreements and proper tenant verification.

Common Challenges Faced by NRIs in Property Transactions

Title Fraud & Illegal Possession: New Residency Indians (NRIs) often deal with phony property assertions together with unauthorized building intrusions on their land holdings.

Legal Disputes & Delays: The resolution of property ownership court cases stretches beyond multiple years.

Lack of Legal Representation: Many individuals find remote property administration challenging when they lack legal professional assistance.

Complex Taxation & Repatriation Issues: Resourceful Individuals who live abroad encounter multiple tax problems regarding property sales and delivery of arising profits overseas.

Difficulty in Monitoring Property: NRIs find it difficult to perform effective supervision of their property maintenance needs and tenant management activities.

0 notes

Text

Government Initiatives Promoting Solar Assam Projects

Introduction

The use of solar energy is rapidly increasing all over India, including Assam. The government has introduced many initiatives to promote solar power in the state. These initiatives aim to reduce dependence on traditional energy sources and encourage people to use clean and renewable energy. Solar Prabha is committed to supporting these efforts by providing information and solutions for solar energy adoption.

Importance of Solar Energy in Assam

Assam has great potential for solar energy due to its geographical location. By using Solar Panels, the state can reduce electricity shortages, decrease pollution, and provide energy to remote areas. Solar energy is not only eco-friendly but also helps in saving electricity costs in the long run.

Key Government Initiatives for Solar Power in Assam

1. Jawaharlal Nehru National Solar Mission (JNNSM)

The Jawaharlal Nehru National Solar Mission is one of the most important programs for promoting solar energy in India. It aims to increase solar power capacity and make it affordable for everyone. Assam has benefited from this mission as it has helped set up many solar power plants in the state.

2. Solar Rooftop Subsidy Scheme

The government provides subsidies to encourage homeowners and businesses to install solar panels on rooftops. Under this scheme:

Residential consumers can get up to a 40% subsidy for solar panel installations.

Commercial and industrial users can also receive incentives.

People can sell excess electricity to the grid and earn money.

This scheme has made solar energy more affordable and attractive for the people of Assam.

3. Assam Solar Policy

The Assam government has introduced a special policy to promote solar energy in the state. The key features of this policy include:

Encouraging private investments in solar projects.

Setting up large-scale solar parks.

Supporting solar panel installation in government buildings.

Providing incentives for solar manufacturing units in Assam.

4. PM-KUSUM Scheme

The PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan) scheme is designed to help farmers by providing solar-powered irrigation pumps. The scheme includes:

Subsidies for solar pumps to replace diesel pumps.

Support for installing grid-connected solar power plants on unused land.

Helping farmers sell surplus electricity to power companies.

This initiative is improving agricultural productivity while reducing dependence on fossil fuels.

5. Solar Mini-Grids for Remote Areas

Many villages in Assam still lack proper electricity connections. To solve this issue, the government is promoting the use of solar mini-grids. These are small solar power stations that provide electricity to local communities.

Benefits of solar mini-grids include:

Reliable electricity in off-grid areas.

Support for schools, hospitals, and businesses.

Reduction in the use of kerosene and diesel generators.

6. Net Metering Policy

The Assam Electricity Regulatory Commission (AERC) has introduced a net metering policy. This policy allows people to install solar panels and connect them to the grid. They can use solar power for their needs and send extra electricity back to the grid. In return, they get credits on their electricity bills. This encourages more people to switch to solar energy.

7. Renewable Energy Service Companies (RESCO) Model

The RESCO model is an innovative approach where solar energy companies install solar panels for consumers without any upfront cost. Consumers pay a fixed monthly charge or a per-unit charge for the solar electricity they use. This model is useful for schools, hospitals, and industries that cannot afford the high initial investment in solar systems.

8. Financial Support and Bank Loans

The government is working with banks to provide easy loans for solar projects. Some of the financial benefits include:

Low-interest loans for solar panel installation.

Priority sector lending for renewable energy projects.

Tax benefits for businesses investing in solar energy.

Impact of Government Initiatives

The various initiatives taken by the government have resulted in a positive impact on Assam’s solar energy sector. Some of the key achievements include:

Increase in solar energy production.

More households and businesses using solar power.

Growth of the solar energy industry, creating new jobs.

Reduction in pollution and carbon emissions.

Improvement in rural electrification.

Challenges and the Way Forward

Despite the progress, there are still some challenges in promoting solar energy in Assam. These include:

High initial cost for solar panel installations.

Lack of awareness about solar energy benefits.

Issues with land availability for large solar projects.

Maintenance and technical support challenges.

To overcome these challenges, the government and private sector must work together. Solar Prabha is playing a crucial role in spreading awareness and providing affordable solar solutions to individuals and businesses.

Conclusion

The government of India and Assam are making great efforts to promote solar energy through various initiatives. With financial support, subsidies, and new policies, more people are adopting solar power. Organizations like Solar Prabha are helping people understand and benefit from these programs. By working together, Assam can move towards a cleaner and greener future with solar energy.

1 note

·

View note

Text

[T]he advent of British imperialism in Myanmar. Elephants in their thousands were conscripted into the timber industry. [...] [An] episode in the history of the ecological impact of imperialism [...]. Accumulation in colonial Myanmar took several different forms, but there were two that had the greatest impact on the country's elephant populations. One was the extractive teak industry [...]. The other was the rice industry [...].

---

During the late nineteenth century and into the early twentieth century, Myanmar became one of the world's biggest exporters of hardwoods. Teak was particularly desirable for its use in the production of ships, railway sleepers and luxury furniture. The rapid development of the timber industry was a vital motor in the expansion of capitalist and colonial relations in this often neglected corner of the Raj. Teak traders financed from Britain were vocal in lobbying Westminster and the Government of India to colonise the landlocked rump of territory [...]. Following the eventual annexation of upper Myanmar in 1885, they continued to inveigle the local government into interceding on their behalf in the borderlands with Siam [...]. Extractive logging operations [...] came into conflict with the shifting subsistence farming of some indigenous Karen communities. [...] Vital to the industry were elephants. [...] [T]he British regime asserted that elephants were the property of the state. [...] Moreover, elephants in the colony were not readily amenable to being controlled; officials were alarmed by herds of hundreds of elephants periodically wreaking destruction on freshly cleared agricultural lands, particularly as rice cultivation accelerated in the 1880s.

---

The booming rice industry developed alongside the growth of the teak industry and had direct effects on elephant populations.

Like teak extraction, rice cultivation in Myanmar was of transnational importance. The rich alluvial soil provided fertile ground for the Ayeyarwady delta to undergo a dramatic transformation to become the largest rice-producing region in the world, having a ripple effect across the global cereal market.

The white rice exported from Myanmar fed colonised labouring peoples (and some non-human animals) engaged in commodity production across the Empire, most notably in neighbouring Bengal. The delta was crucial to an interdependent network of food security established through and underpinning British imperialism.

The changes on the delta itself were profound, both socially and ecologically. [...] [F]rom the 1850s what was still predominantly a mangrove-forested backwater at the margins of political power became a febrile hive of activity. Sparsely populated, isolated hamlets, hemmed in by the thick jungles and thickets of dense grass in the tidal delta, became enmeshed in an extensive tapestry of paddy fields, their populations growing fivefold to become thriving commercial hubs, connected by a busy riverine transport network to the bustling imperial port cities of Akyab (now Sittwe), Mawlamyine and Yangon. [...]

Thick forest needed to be felled, the undergrowth burnt, and the remaining dense network of roots dug out [...]. This work was underpinned by heavy borrowing, mostly from local Burmese and overseas Indian sources, and misfortune could lead to them defaulting on their loan and losing their land to their creditor. [...]

The ecological transformation was rapid, and from an elephant's perspective at least, profound. Focusing in on one of the fastest-growing deltaic areas between 1880 and 1920, around the townships of Thôngwa and Myaungmya, the impact is pronounced. Correspondence in 1886 identified 230 elephants living in the local forests. They would frequently raid freshly cultivated paddy fields, destroying crops [...]. However, just thirty years later, the local settlement report recorded that there were no longer any elephants left in the area. [...] [T]he rapid deforestation of the area to make way for paddy is likely to have been what displaced the local elephant populations. [...]

---

[T]he government explored the prospect of organising official kheddahs [...] to solve two problems at once: to eliminate the problem of these rapacious elephants’ raids while meeting growing demands for elephant labour. [...]

At the same time, elephants became more important, indeed indispensable, for commercial teak extraction. In the analysis of former employees turned historians of the Bombay Burmah Trading Corporation, the largest teak firm operating in Myanmar, the acquisition of large herds of working elephants was pivotal in enabling imperial companies to dominate logging. [...]

The kheddah is a large stockade into which elephants are corralled after being chased down by humans [...]. [T]he Government of India was moved to sanction the establishment of kheddah operations in the colony in 1902, although the move was quickly exposed as an expensive, ill-fated folly. The scheme resulted in an appalling mortality rate, with roughly half the over 500 elephants captured in its first four years of operation dying of disease, neglect and trauma-induced breakdowns. To make matters worse, the superintendent, Ian Hew Warrender Dalrymple-Clark, was exposed in a dramatic court case as having adopted an alter ego, Mr Green, for the purposes of faking the deaths of elephants through forged paperwork, and selling them directly to timber firms, leaving the state out of pocket. The British regime, never entirely successful in realising its claim to Myanmar's elephants, left the capture of elephants mostly to colonised peoples through a licensing scheme.

These arrangements enabled the large timber firms, such as the Bombay Burmah Trading Corporation, to establish considerable herds of captive elephants [...]. By 1914 the Corporation had amassed a herd of 1,753 elephants. [...] Estimates for the overall number of timber elephants employed by the 1940s vary, but a figure of around 7,000, or 10,000 including calves, would seem plausible. [...]

---

Elephants in Myanmar were caught between two modes of accumulation. The timber industry demanded their labour [...]. Meanwhile, the expansion of the rice industry was enabled [...] by cultivating more and more land. The resulting deforestation meant significant habitat loss and fragmentation for elephant populations. [...] Nevertheless, the history of elephants contains multitudes. Creatures, such as dung beetles and frogs, who rarely make it into archival collections in their own right, were intertwined and implicated in the lives of Myanmar's forest-dwelling giants. The transformations in elephant demographics and behaviour wrought by their mobilisation for teak production, the destruction of much of their habitats, [...] cascaded.

---

All text above by: Jonathan Saha. “Accumulations and Cascades: Burmese Elephants and the Ecological Impact of British Imperialism.” Transactions of the Royal Historical Society, 32, pp. 177-197. 2022. [Bold emphasis and some paragraph breaks added by me.]

35 notes

·

View notes

Text

Nirmala Sitharaman’s New Budget to Accelerate Desun Academy’s Mission for Educational Reform by FY 2030–31

Education in India is at a critical juncture, with commercialization overshadowing its true essence. Desun Academy was founded to challenge this trend, aiming to bring about a transformative change in the sector. Our mission is to eliminate at least 85% of the business-driven mentality from education and restore its core purpose — empowering individuals with knowledge and skills.

Desun Academy: Redefining Education

The current academic landscape prioritizes profit over genuine learning, especially in the IT and engineering sectors, where institutions often mislead students with false promises. Desun Academy stands apart with a clear principle — “Get Placed by Skills.”

We do not guarantee placements but equip students with the competencies required to succeed. With a decade of entrepreneurial experience leading Desun Technology, we firmly believe that skills and attitude outweigh mere references in today’s job market.

Empowering Society: Our Broader Mission

Beyond education, we are committed to social impact. Many senior citizens today are deprived of family care and warmth. Our vision includes establishing a dedicated living space for them, integrated with a family-friendly resort. This initiative will foster intergenerational bonding and create a balanced support system for the elderly.

How the New Budget Reduces Our Timeline by 3 Years

The recent budget announcement by Finance Minister Nirmala Sitharaman has significantly accelerated our mission. The increased allocation towards education, skill development, and social infrastructure offers financial incentives, tax benefits, and funding opportunities that directly align with our objectives.

1. Enhanced Skill Development Grants — The budget introduces expanded grants for skill-based programs, allowing us to scale our training initiatives more rapidly. 2. Tax Incentives for Educational Startups — With reduced financial burdens, we can reinvest more efficiently into infrastructure and faculty development. 3. Subsidized Loans for Infrastructure Expansion — This helps fast-track the establishment of our senior citizen care ecosystem alongside our academic facilities. 4. Public-Private Partnerships (PPP) for EdTech and Training — Access to government-backed partnerships will accelerate industry collaborations, providing students with more real-world exposure.

Originally, our roadmap aimed for an 8-year completion. With these policy advantages, we are now confident in achieving our objectives within 5 years — saving 3 years in execution time.

Looking Ahead

With strategic government support, Desun Academy is set to revolutionize education by making skill-based learning the priority. We envision a future where placements are based on merit, and elder care is seamlessly integrated into a nurturing community.

Education must shift from profit-driven motives to meaningful impact, and with these new policies, we are ready to make this vision a reality.

0 notes

Text

The Ultimate Guide to Pilot Training: How to Become a Professional Pilot

Introduction

Becoming a pilot is a dream for many, but the journey requires dedication, training, and the right guidance. Whether you aim to fly commercial airliners, private jets, or cargo planes, pilot training is the first step to achieving your aviation goals. In this blog, we will explore everything you need to know about pilot training, from eligibility requirements to career opportunities.

What is Pilot Training?

Pilot training is a structured program that teaches aspiring aviators the skills required to operate an aircraft safely and efficiently. It includes both theoretical knowledge and practical flying experience under expert supervision. The training process follows international aviation standards to ensure pilots are well-prepared for their roles.

Eligibility for Pilot Training

Before enrolling in a pilot training program, candidates must meet the following requirements:

Minimum age: 17-18 years

Educational qualification: 10+2 with Physics and Mathematics

Medical fitness: Class 1 medical certificate

Proficiency in English

For those who didn’t study Physics or Math in school, some institutions offer bridge courses to qualify for training.

Steps to Become a Pilot

1. Choose the Right Pilot Training Program

There are different types of pilot licenses, including:

Private Pilot License (PPL) – For non-commercial flying

Commercial Pilot License (CPL) – Required for airline and commercial pilots

Airline Transport Pilot License (ATPL) – Advanced license for senior pilots

2. Enroll in a DGCA-Approved Flight School

Selecting a DGCA (Directorate General of Civil Aviation) approved flight school is crucial for obtaining a valid license. Training includes:

Ground school (theory lessons)

Simulator training

Flight training with experienced instructors

3. Complete Required Flight Hours

To earn a Commercial Pilot License (CPL), candidates must log at least 200 flying hours as per DGCA regulations. These hours include solo flights, cross-country flights, and night flying.

4. Clear DGCA Examinations

Aspiring pilots must pass written exams and practical flight tests covering:

Air Navigation

Meteorology

Air Regulations

Technical and Flight Performance

5. Obtain a Commercial Pilot License (CPL)

Once training is complete and exams are cleared, candidates receive their CPL, allowing them to apply for airline jobs.

6. Apply for Airline Jobs or Type Rating Training

To fly specific aircraft models, pilots must complete Type Rating Training, which provides hands-on experience with commercial jets like the Boeing 737 or Airbus A320.

Cost of Pilot Training

The cost of pilot training varies based on the country, flight school, and aircraft used. In India, commercial pilot training costs range from INR 35-50 lakh. Financial aid, scholarships, and education loans are available to help aspiring pilots fund their training.

Career Opportunities After Pilot Training

After completing pilot training, candidates can explore various career paths:

Commercial Airline Pilot (fly for major airlines like Air India, IndiGo, etc.)

Cargo Pilot (operate freight aircraft for logistics companies)

Charter Pilot (fly private and business jets)

Flight Instructor (train future pilots)

Military Pilot (join the Air Force or defense aviation)

With increasing air travel demand, the aviation industry offers high-paying jobs and exciting career growth for qualified pilots.

Conclusion

Pilot training is the foundation of a successful aviation career. Whether you want to fly commercial airlines or private aircraft, following the right steps will help you achieve your dream. Choosing a reputed flight school, completing required flying hours, and obtaining the necessary certifications will put you on the path to success.

Click here for more information on pilot training.

1 note

·

View note

Text

Best Business Loan Services in Mangalore, Karnataka

Mangalore, Karnataka, is one of the fastest-growing business hubs in South India. With its thriving economy, well-developed infrastructure, and strategic location, the city offers an excellent environment for businesses to flourish. Whether you are an entrepreneur, a startup, or an established business owner, securing the right business loan is crucial for expansion, operational needs, or working capital requirements.

If you are looking for the best business loan services in Mangalore, Karnataka, you have numerous options available. Banks, NBFCs, and private lenders provide various loan schemes tailored to meet business needs. However, finding the right service that suits your financial requirements and business goals can be a challenge. Here’s everything you need to know about business loans in Mangalore and how to choose the best service for your needs.

Types of Business Loans Available in Mangalore

Term Loans – These are long-term loans used for business expansion, purchasing machinery, or acquiring commercial property.

Working Capital Loans – Designed to cover daily operational expenses such as payroll, rent, and inventory.

Machinery Loans – Ideal for businesses looking to upgrade or purchase new equipment.

Invoice Financing – Helps businesses improve cash flow by borrowing against unpaid invoices.

Business Line of Credit – Offers a revolving credit facility that businesses can draw from as needed.

MSME Loans – Specifically designed for Micro, Small, and Medium Enterprises to support their growth.

Startup Loans – Special financing options for new businesses that may not have an extensive credit history.

Factors to Consider When Choosing a Business Loan Service

Before applying for a business loan, it is essential to evaluate different aspects to ensure you get the best possible deal. Some key factors include:

Interest Rates & Charges – Compare different lenders to find competitive interest rates and minimal processing fees.

Loan Tenure – Choose a loan with a repayment period that aligns with your business’s cash flow.

Eligibility Criteria – Check the lender’s requirements regarding credit score, turnover, and business history.

Documentation Process – Opt for a lender with a hassle-free and transparent documentation process.

Loan Amount – Ensure that the loan amount being offered meets your business needs without unnecessary restrictions.

Repayment Flexibility – Look for services that provide flexible repayment options, including EMI customization and moratorium periods.

How to Apply for a Business Loan in Mangalore

The loan application process has become more streamlined in recent years, allowing business owners to apply easily. Here are the steps to follow:

Assess Your Loan Requirements – Determine the amount required and the type of loan that suits your business.

Compare Lenders – Research and compare different loan services based on interest rates, tenure, and terms.

Check Eligibility – Ensure you meet the minimum criteria set by the lender.

Prepare Documents – Gather essential documents, including business registration proof, financial statements, income tax returns, and bank statements.

Submit Application – Apply online or visit the lender’s branch with the necessary paperwork.

Loan Approval & Disbursement – After verification, the lender processes the application and disburses the loan within a specified timeframe.

Benefits of Availing Business Loan Services in Mangalore

Easy Access to Funds – Business loans provide quick and hassle-free financing options to meet urgent capital requirements.

Competitive Interest Rates – Many lenders in Mangalore offer competitive rates tailored to different business profiles.

Flexible Repayment Options – Customizable EMI options help businesses manage cash flow efficiently.

No Collateral for Unsecured Loans – Startups and small businesses can avail loans without pledging assets.

Improved Business Growth – Funds can be used for expansion, inventory management, hiring employees, or upgrading technology.

Conclusion

Finding the best business loan services in Mangalore, Karnataka, requires thorough research and an understanding of different loan products. By evaluating factors like interest rates, eligibility criteria, loan tenure, and repayment flexibility, you can choose a financing solution that aligns with your business goals. Whether you need capital for expansion, working capital support, or new equipment purchases, the right business loan can empower your venture to achieve sustained growth and success.

0 notes