#digital lending in India

Explore tagged Tumblr posts

Text

India Digital Lending Market is in Growing Stage, Being Driven by Digitization in the country along with the presence of 100+ Players in the Industry: Ken Research

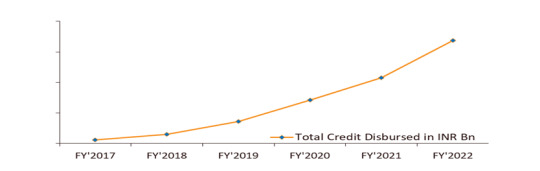

Digital Lending Platforms are addressing the huge unmet demand for credit as the Market has grown @ CAGR 131.9% During FY’2017-FY’2022.

To Know More on this report, Download free Sample Report

India’s market for digital lending has grown from INR 116.7 billion in FY’2017 to INR 3,377.7 billion in FY’2022P. The growth is supported by the need for superior customer experience, emerging business models, faster turn-around time, and adoption of technology like AI. Customers are adopting digital avenues as a result of the rise in smartphone usage and internet penetration. Digital channels influence 40 to 60% of loan purchase transactions across loan types.

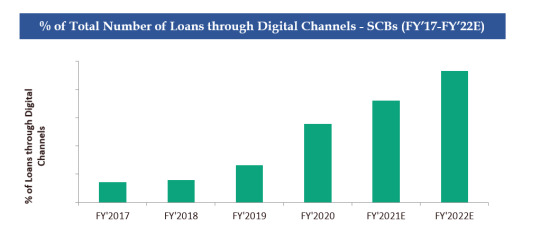

2. Loans through Digital Channels on NBFCs has increased from 0.6% in FY’2017 to 53.0% in Dec, 2020 owing to the rise in BNPL schemes and lower interest rates offered by the Lending Platforms.

Visit this Link Request for custom report

Commercial banks are rapidly joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies. The Digital Lending Company’s requirements are lower, and the process is significantly quicker. They need just a bank account as a reference point where loans can be credited and therefore % of Loans through Digital Channels are higher with NBFCs. The flexibility that BNPL schemes offer has completely transformed the digital lending market, particularly for younger shoppers, who are happy to trade traditional credit cards for more user-friendly BNPL schemes. The rapid uptake of Buy Now, Pay Later (BNPL) propositions, particularly within the retail sector, continues to drive major growth and new opportunities for NBFCs in India.

3. Rising Internet Penetration, Rise of innovative Models and an enabling regulatory environment are some of the Major Driving Factors for Digital Lending in India

To Know More on this report, Download free Sample Report

Higher penetration of smartphones, increasing number of mobile phone subscriptions coupled with inexpensive data has result in the growth and also supported the awareness and adoption rate of Digital Lending in India’s population. The popularity of Digital Lending has increased in India owing to NBFCs platforms collaborating with other digital platforms such as e-commerce, ride hailing, travel, logistics and more, resulting in higher acceptance of digital lending from various customer segments in the country. Digital Lending Pioneered by NBFCs, have now resulted in Companies from various segments coming up with multiple new models of doing business such as Digital Lending Marketplaces, POS Transaction Lending, Bank and NBFCs partnership models and more.2

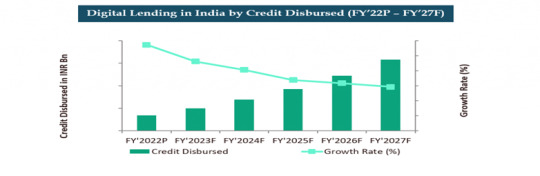

4. Digital Lending Market to Reach INR ~15,000 billion by FY’2027 Making Digital Lending a Sector with the Highest Penetration by Digital Channels in the Country.

To more about industry trends, Request a free Expert call

Strategic partnerships and collaborations between traditional financial institutions and new-age Lending Platforms. Plus, easy market entry and targeted loan offerings due to availability of large sets of customer data, which can give collective and individual insights. Changing consumer behavior and expectations shaped by purchase/ transaction experiences offered by e-marketplaces like food delivery, e-commerce and travel portals.

#b2b lending companies in india#Capital Float Digital Lending Market Revenue#Challenges in India’s Digital Lending Market#commercial loan Providers in India#Competitors in Digital Lending Market India#consumer durable loan market in india#redit disbursement in India#Credit lending startups in India#emand of Digital Lending in India#digital channels in India#digital credit industry in India#Digital lending ecosystem in India#digital lending growth in india#digital lending in India#digital lending market size in india#digital lending platform market#Digital lending value in India#digital loans Providers in India#Emerging Players in India Digital Lending Market#fastest-growing fintech in India#Financial Services Sector in India#fintech Compnanies in India#future trends for financial services sector in india#Impact of digital lending on MSME in india#India Digital Lending Industry#India Digital Lending Market#India Digital Lending Market Major Players#India Digital Lending Sector#India's retail loan Providers#India's Road Map for Digital Lending

0 notes

Text

What Are the RBI Restrictions on Personal Loan Interest Rates?

A personal loan is a convenient financial tool that provides quick access to funds without requiring collateral. However, the interest rates on personal loans can vary significantly depending on the lender, borrower profile, and prevailing market conditions. To ensure fair lending practices, the Reserve Bank of India (RBI) has set certain guidelines and restrictions on personal loan interest rates. These regulations aim to protect borrowers from exploitative lending practices while ensuring transparency in the financial sector.

In this article, we will explore the RBI restrictions on personal loan interest rates, how these guidelines impact borrowers, and what you can do to secure the best loan terms.

1. How Are Personal Loan Interest Rates Determined?

Before understanding RBI’s restrictions, it is essential to know how lenders decide personal loan interest rates. Interest rates are influenced by multiple factors, including:

✅ Credit Score – Higher credit scores (750+) qualify for lower interest rates. ✅ Income Level – Stable and high-income earners receive better interest rates. ✅ Employment Status – Salaried professionals typically get lower rates than self-employed individuals. ✅ Lender’s Risk Assessment – Lenders assess repayment capacity based on financial history. ✅ Market Conditions – Interest rates fluctuate depending on RBI’s monetary policies and repo rates.

📌 Tip: Always check your credit score and income eligibility before applying for a personal loan to secure the lowest interest rate.

2. RBI Guidelines on Personal Loan Interest Rates

The Reserve Bank of India (RBI) does not directly set personal loan interest rates but regulates them through various policies. Here’s what borrowers need to know:

✅ 1. No Fixed Interest Cap, But Rates Must Be Fair

Unlike home or education loans, the RBI does not impose a maximum cap on personal loan interest rates.

However, lenders must ensure that interest rates are reasonable and justifiable.

✅ 2. Linking Interest Rates to MCLR or Repo Rate

Banks and NBFCs must link loan interest rates to external benchmarks like the Marginal Cost of Funds Lending Rate (MCLR) or the Repo Rate.

This ensures that interest rates reflect market fluctuations fairly.

✅ 3. Transparency in Loan Pricing

Lenders must clearly disclose:

The annual percentage rate (APR) of the loan.

Any processing fees, penalties, or hidden charges.

Prepayment or foreclosure charges, if applicable.

✅ 4. No Excessive Interest on Small Borrowers

RBI prohibits banks and NBFCs from charging exorbitant interest rates on small-ticket personal loans.

Lenders must ensure that the interest rate is not discriminatory based on the borrower’s profession or financial status.

✅ 5. Protection Against Predatory Lending

Digital lenders and NBFCs must follow fair lending practices.

Lenders cannot use aggressive recovery tactics or apply hidden charges to increase the effective loan cost.

📌 Tip: Always review your loan agreement and clarify any additional charges before signing the loan document.

3. How Do RBI’s Interest Rate Guidelines Benefit Borrowers?

RBI’s restrictions on personal loan interest rates help borrowers in multiple ways:

✅ Prevents Exploitation by Lenders – Ensures that banks and NBFCs offer fair and competitive rates. ✅ Promotes Transparency – Requires lenders to disclose the total cost of borrowing upfront. ✅ Ensures Flexible Loan Repayment – Guidelines prevent unreasonably high foreclosure penalties. ✅ Encourages Responsible Borrowing – Borrowers can make informed decisions based on clear terms.

📌 Tip: Compare multiple lenders before finalizing a personal loan to ensure you get the best deal.

4. RBI’s Impact on NBFCs and Digital Lenders

With the rise of fintech lending platforms and NBFC-backed personal loans, the RBI has introduced additional rules to regulate interest rates:

✅ 1. Interest Rate Ceiling for NBFCs

While NBFCs can set their own interest rates, they must ensure that rates are non-exploitative.

RBI regularly monitors NBFC interest rates to prevent unfair lending practices.

✅ 2. Regulations for Digital Lending Apps

All digital lenders must be registered with RBI and follow fair lending guidelines.

Apps that offer personal loans with misleading interest rates face strict penalties.

✅ 3. Guidelines on Processing Fees and Hidden Charges

RBI prohibits excessive processing fees and hidden charges in personal loans.

Borrowers must receive a clear breakup of loan costs before signing an agreement.

📌 Tip: Avoid unregulated loan apps and always verify whether the lender is RBI-registered.

5. How to Secure the Best Personal Loan Interest Rate?

Borrowers can take the following steps to secure the lowest personal loan interest rate:

✅ 1. Maintain a High Credit Score

A CIBIL score of 750+ helps secure lower interest rates.

Pay existing loan EMIs and credit card bills on time.

✅ 2. Compare Interest Rates from Multiple Lenders

Use online platforms to compare bank and NBFC interest rates before applying.

Check for lenders offering special rates for salaried professionals or loyal customers.

✅ 3. Choose a Shorter Loan Tenure

Shorter loan tenures attract lower interest rates.

A longer tenure may reduce EMI but increase the total interest paid.

✅ 4. Negotiate with Your Lender

If you have a good credit history, negotiate for a lower rate or processing fee waiver.

Existing customers of banks may receive special discounts on interest rates.

📌 Tip: Use a personal loan EMI calculator to estimate your monthly payments before applying.

Final Thoughts: Borrow Smart, Stay Informed

Understanding RBI’s restrictions on personal loan interest rates can help borrowers make informed decisions and avoid falling into debt traps. While RBI does not cap interest rates, it enforces fair lending practices to ensure that borrowers are not overcharged or misled.

🚀 Key Takeaways: ✔ RBI mandates fair and transparent loan pricing. ✔ Banks and NBFCs must link interest rates to external benchmarks. ✔ Digital lenders must follow ethical lending practices. ✔ Compare multiple lenders to secure the best personal loan rate. ✔ Maintain a good credit score for better loan offers.

By staying informed about RBI’s personal loan regulations, you can make smarter borrowing decisions and avoid unnecessary financial burdens.

For the latest updates on personal loan interest rates and best borrowing practices, visit www.fincrif.com today!

#finance#nbfc personal loan#fincrif#personal loans#personal loan online#personal loan#loan apps#loan services#bank#personal laon#personal loan interest rates#RBI guidelines on personal loans#personal loan EMI calculation#loan interest rate regulation#RBI rules for personal loans#how RBI controls loan interest rates#personal loan borrowing limits#impact of RBI repo rate on personal loans#NBFC personal loan interest rates#how banks set personal loan rates#minimum interest rate on personal loan#maximum personal loan interest rate India#RBI benchmark rates for loans#fixed vs floating personal loan rates#loan tenure and interest rate relation#how to get the lowest personal loan rate#hidden charges in personal loans#RBI fair lending practices#how digital lenders set loan rates#bank personal loan rate comparison

2 notes

·

View notes

Text

Can Fintech Disrupt Traditional Banks? The Battle for Borrowers in India's Digital Lending Market

The digital lending market is experiencing a meteoric rise across the globe, and India is no exception. Fueled by growing smartphone penetration, increasing internet access, and a young, tech-savvy population, India's digital lending market is poised for exponential growth. This blog delves into the heart of this dynamic market, exploring its size, key players, and future trends using compelling statistics.

Market Size: A Booming Landscape

Let's begin by establishing the sheer scale of the digital lending market. According to a report, the Indian digital consumer lending market is projected to surpass a staggering USD 720 billion by 2030, representing nearly 55% of the total digital lending market opportunity in the country. This translates to a Compound Annual Growth Rate (CAGR) of a robust 22%, signifying the rapid expansion of this market segment.

Global Context: A Flourishing Ecosystem

The global digital lending platform market size is projected to reach a colossal USD 40.02 billion by 2028, with a CAGR of 21.7%. This growth is driven by factors like:

Financial Inclusion: Digital lending platforms offer a wider range of credit options to previously underserved populations, fostering financial inclusion.

Convenience and Efficiency: The streamlined application process and quicker loan approvals associated with digital lending platforms attract borrowers seeking faster access to credit.

Data-Driven Decision-Making: Lenders leverage alternative data sources and advanced analytics to assess creditworthiness, expanding the reach of financial services.

Digital Lending Market in India

While the global market thrives, India presents a unique landscape with its own set of characteristics:

Market Share: Despite the rapid growth, digital lending still holds a relatively smaller market share compared to traditional lending institutions in India. However, this is expected to change as digital platforms gain wider acceptance and trust.

Factors Driving Growth: India's vast unbanked population, increasing smartphone penetration, and government initiatives promoting digital financial services are all contributing to the surge in digital lending.

Digital Lending Platform Market: Major Players

The Indian digital lending platform market boasts a diverse range of players, each vying for a share of this burgeoning market. Here are some of the prominent names:

Paytm: A leading digital payments platform, Paytm offers various loan products such as personal loans, microloans, and merchant loans.

Bajaj Finserv: A well-established financial services company, Bajaj Finserv provides a range of loan products through its digital platform.

ZestMoney: This fintech company specializes in providing consumer credit for online and offline purchases, catering to a specific market segment.

Capital Float: Another prominent player, Capital Float offers SME lending solutions through its digital platform.

Market Trends

The digital lending market is constantly evolving, with several key trends influencing its future direction:

Focus on Artificial Intelligence (AI) and Machine Learning (ML): Lenders are increasingly adopting AI and ML to automate processes, personalize loan offers, and improve risk management.

Regulatory Framework and Consumer Protection: The development of a robust regulatory framework will be crucial for ensuring consumer protection and building trust in the digital lending ecosystem.

Collaboration Between Traditional Banks and Fintech Companies: Partnerships between established banks and innovative fintech companies can leverage the strengths of each entity to further propel market growth.

Expansion of Product Offerings: The introduction of new loan products tailored to specific needs, such as education loans or loans for small businesses, will cater to a wider range of borrowers.

Embracing Innovation and Building Trust

The future of the digital loans market in India is bright. By embracing technological advancements, fostering innovation, and prioritizing consumer protection, all stakeholders can contribute to a sustainable and inclusive digital lending ecosystem.

Here are some key takeaways:

For Borrowers: Conduct thorough research, understand loan terms and conditions carefully, and choose a reputable lending platform.

For Lenders: Develop responsible lending practices, prioritize data security, and build trust with borrowers.

For Regulators: Implement regulations that promote innovation while safeguarding consumer interests.

The online loans market in India holds immense potential to transform the financial landscape. By leveraging data, technology, and collaborative efforts, we can create a future where access to credit is easier, faster, and more inclusive for all.

Collaboration and a Shared Vision

The future of the market in India hinges on collaboration between various stakeholders:

Fintech and Traditional Banks: Partnerships can leverage the strengths of both entities - fintechs' agility and banks' established infrastructure - to create a robust and inclusive lending ecosystem.

Government and Regulatory Bodies: Collaboration can foster innovation while ensuring responsible lending practices and consumer protection.

Financial Literacy Initiatives: Educating borrowers about responsible borrowing and the risks associated with digital loans is crucial for building trust and promoting financial inclusion.

Conclusion

The digital lending market in India is on a transformative journey. By harnessing the power of data and technology, prioritizing responsible lending practices, and fostering collaboration, all stakeholders can work toward a future where digital lending empowers individuals and businesses, fostering financial inclusion and propelling India's economic growth. The digital lending revolution is here to stay, and with careful planning and collaboration, it has the potential to unlock a brighter financial future for millions in India.

#digital lending market in india#digital lending market size in india#digital lending market size#digital lending platform market#digital lending india#digital lending platform market size#global digital lending platform market

0 notes

Text

For many, personal loans are the go-to for emergencies, with options from open market or financial institutions. Digital lending platforms, fueled by AI, streamline processes like credit scoring and fraud detection, aided by cloud computing for storage and scalability. Data science ensures personalized offerings while API and RPA enhance borrowing experiences. In India, these technologies promise vast growth potential in the digital lending sector, requiring adoption for seamless and secure lending.

1 note

·

View note

Text

Approaches for NBFCs to Minimize Borrowing Charges

In the dynamic landscape of Non-Banking Financial Companies (NBFCs), managing borrowing charges is pivotal for financial stability and growth. Here are strategic approaches that NBFCs can adopt to curtail borrowing costs without compromising their operational efficiency.

Diversifying Funding Sources

Relying solely on one source for funding can increase borrowing charges. NBFCs can mitigate this risk by diversifying their funding sources. Exploring options like debentures, commercial papers, and term loans from various financial entities can offer competitive interest rates and reduced borrowing costs.

Aditya Puri, the former Managing Director of HDFC Bank has highlighted the importance of prudent financial management and leveraging diverse funding sources to minimize borrowing expenditure for NBFCs.

Leveraging Technology for Cost-Efficient Operations

Incorporating technological advancements not only streamlines operations but also reduces costs. Embracing digital lending platforms, AI-driven risk assessment tools, and automated processes can enhance efficiency, leading to lower operational expenses. These savings can, in turn, contribute to minimizing borrowing charges.

Negotiating Terms with Lenders

Establishing healthy relationships with lending institutions is beneficial. Regular communication and a transparent track record can facilitate negotiations for better borrowing terms. NBFCs can discuss interest rates, repayment schedules, and collateral options, aiming for more favorable terms that suit their financial capabilities.

Also Read: The Evolutionary Impact Of SaaS Model On NBFCs

Effective Asset-Liability Management

Balancing assets and liabilities optimally is crucial for minimizing borrowing costs. Efficient management of short-term and long-term assets alongside liabilities ensures that the company remains financially sound. This practice reduces the dependency on short-term borrowings, consequently lowering associated charges.

Understanding Credit Rating Metrics

Credit ratings significantly impact the borrowing costs for NBFCs. Maintaining a robust credit rating is paramount. By understanding the factors that influence credit ratings—such as liquidity, asset quality, and profitability—NBFCs can strategically position themselves to negotiate better borrowing terms with financial institutions.

According to Abhay Bhutada, MD of Poonawalla Fincorp, the rating improvement validates the business model and unwavering commitment to implementing the stated strategy, establishing a robust groundwork for securing a lasting leadership position in the industry. This upgrade to long term ratings from AAA to AA+ bolster our liability portfolio, streamline borrowing expenses, and hasten our path toward growth.

Monitoring and Mitigating Risk

Vigilant risk management is fundamental in reducing borrowing costs. Conducting thorough risk assessments and promptly addressing potential risks can prevent financial setbacks that might lead to higher borrowing charges. A proactive risk mitigation strategy safeguards the NBFC's financial health.

Regular Review of Financial Strategies

The financial landscape is ever-evolving. NBFCs must periodically review and fine-tune their financial strategies. Conducting regular audits and reassessing borrowing requirements helps in identifying areas for cost reduction, enabling more informed decisions to minimize borrowing charges effectively.

Also Read: Unlocking Financial Success: The Power of a Solid Business Plan

Conclusion

Successfully managing borrowing charges is a strategic imperative for NBFCs. By comprehensively understanding credit rating metrics, diversifying funding sources, leveraging technology, negotiating terms, and adopting efficient financial management practices, NBFCs can curtail borrowing costs. Regular reviews and proactive risk mitigation further fortify their financial resilience, ensuring sustainable growth in a competitive market.

0 notes

Text

One of the most significant advantages of digital business loans is their fast approval process. Traditional loans can take weeks or even months to get approved, delaying crucial business plans.

0 notes

Text

Training of Staff in Microfinance Sector by M2i Consulting

The success of any microfinance institution (MFI) hinges not only on its mission and outreach but also on the skills, knowledge, and behavior of its staff. As the microfinance sector continues to expand across India and other developing regions, professional training and capacity building have become essential to ensure sustainable operations and responsible financial inclusion. This is where M2i Consulting plays a transformative role.

Why Training of staff in Microfinance sector The microfinance sector involves direct interaction with underserved and low-income communities, often with limited financial literacy. Staff must be trained to:

Understand the unique needs of rural and urban borrowers.

Maintain transparency and ethical conduct.

Minimize risks of over-indebtedness.

Promote client protection and financial education.

Adhere to regulatory norms and institutional policies.

Untrained or undertrained staff can lead to compliance issues, reputational risks, and operational inefficiencies, making training a strategic necessity.

M2i Consulting: A Leader in Microfinance Staff Training M2i Consulting is a trusted name in the Indian financial inclusion ecosystem. With deep sectoral knowledge and practical experience, M2i offers comprehensive training programs designed specifically for microfinance professionals at all levels.

Key Features of M2i’s Training Programs Customized Training Modules M2i designs courses tailored to job roles—from field officers and branch managers to senior executives. The curriculum blends practical field scenarios with theoretical learning.

On-site & Online Training Delivery Flexibility is key. M2i offers both in-person workshops and virtual training programs, ensuring reach across geographies.

Expert Trainers with Domain Knowledge The trainers at M2i Consulting are industry veterans, ensuring that participants gain insights grounded in real-world microfinance operations.

Focus on Client-Centricity and Ethics Training emphasizes Client Protection Principles (CPP), responsible lending, and building long-term relationships with borrowers.

Monitoring & Evaluation of Learning Outcomes M2i assesses the effectiveness of its programs through feedback, quizzes, and practical assessments, ensuring measurable improvements in performance.

Popular Training Areas Covered by M2i Consulting Credit Appraisal Techniques

Loan Recovery and Collection Management

Customer Relationship and Communication Skills

Regulatory Compliance and KYC Norms

Digital Financial Services (DFS) & Fintech Adaptation

Social Performance Management

Who Can Benefit? M2i’s training services are ideal for:

Microfinance Institutions (MFIs)

Self-Help Promoting Institutions (SHPIs)

NBFC-MFIs and Small Finance Banks

Development Finance Organizations

Field-based NGO Staff in Livelihood and Credit Programs

Building Capacity for Sustainable Financial Inclusion Training is not a one-time activity—it's a continuous process of upgrading knowledge and adapting to a dynamic financial ecosystem. With M2i Consulting’s structured and strategic training programs, MFIs can empower their staff to deliver high-quality, client-friendly financial services while meeting compliance and business goals.

About M2i Consulting M2i Consulting is a leading consulting and capacity-building firm specializing in microfinance, financial inclusion, and development finance. With a strong reputation for quality and impact, M2i has trained thousands of staff across India and neighboring countries.

2 notes

·

View notes

Text

Lockheed Martin announces European F-16 Training Center in Romania 🇷🇴

Center will have the participation of the Dutch.

Fernando Valduga By Fernando Valduga 08/31/2023 - 18:31 in Military, War Zones

Lockheed Martin and the governments of Romania and the Netherlands have announced a Letter of Intentions to establish the European F-16 Fighter Training Center in Romania.

For the center, the Dutch Ministry of Defense should lend F-16 fighters to help in the training of Ukrainian pilots in Romania.

Putting the pen on paper in Madrid, on August 30, the Minister of Defense of the Netherlands, Kajsa Ollongren, along with her Romanian counterpart, Angel Tîlv? r, and Filippo Marchetti, from Lockheed Martin, signed this decision.

“The F-16 continues to play a crucial role in 21st century security missions to the United States, Europe, NATO and allies around the world,” said OJ Sanchez, vice president and general manager of the Integrated Fighter Group. "LockedLock Martin is proud to partner with the Netherlands and Romania in this European F-16 Training Center in Romania, which will increase mission readiness through a comprehensive F-16 training solution for Romanian pilots."

The center will focus on ensuring the effectiveness and safety of Romanians flying and operating F-16 fighters and may eventually expand to include training for other nations.

“As soon as the details are finalized, we are confident that the training center will benefit Romania and other regional F-16 operators, potentially including Ukraine,” Sanchez added.

F-16 training for Ukrainian pilots will be held in Denmark and Romania, with the expectation that the initial group of Ukrainian F-16 pilots will complete their training in early 2024.

The United States gave the green light to the plan, fully in accordance with the supply of the F-16s, granting authorization to transfer third parties to the Romanian training center.

With the Dutch flight training of the F-16 previously taking place in the United States, the current capacity restrictions and the transition to the F-35 led to the interruption of this training last summer. Now, as the Netherlands prepares for the complete transition to the F-35 by 2024, Lockheed Martin will be in charge of operating and maintaining the aircraft in conjunction with Romania, all in line with Dutch military aviation standards and European regulations, while providing the necessary training.

Tags: Military AviationF-16 Fighting FalconRNLAF - Royal Netherlands Air Force / Royal Netherlands Air ForceRoAF - Romanian Air Force/Romania Air ForceWar Zones - Russia/Ukraine

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

MILITARY

Turkey seeks partners for the TF-X hunting program amid fiscal uncertainty

01/09/2023 - 16:00

MILITARY

Shield AI demonstrates the formation of autonomous drone teams using Artificial Intelligence pilot

01/09/2023 - 14:00

MILITARY

Saab offers Gripen E aircraft to India and deep industrial cooperation

01/09/2023 - 11:00

MILITARY

Dassault will prioritize Rafale jets and UCAVs ahead of FCAS

01/09/2023 - 08:31

MILITARY

Raytheon receives contract to supply AMRAAM missiles to Ukraine

09/01/2023 - 07:50

HELICOPTERS

Airbus and KAI will start serial production of LAH light armed helicopters

31/08/2023 - 19:15

homeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Digital Tchê Web Creation

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Digital Tchê Web Creation

7 notes

·

View notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

Exploring Peer-to-Peer Investments Through a P2P Lending Platform in Jabalpur

In today's fast-changing financial world, investors continually seek avenues to grow their finances while being mindful of risks. However, many individuals primarily focus on mutual funds and stocks for investment, unaware of the broader spectrum of available options. Let's explore the challenges investors face and learn how a P2P lending platform in Jabalpur helps them with the best investment opportunities.

Understanding Investor Challenges in Alternate Investment Avenues

As people try to make more money from their investments, they face problems because they don’t know about different ways to invest.

High Barriers to Entry:Investing in assets like real estate demands substantial capital, thus limiting access for many investors to diversify their portfolios effectively.

Opaque Investment Processes:Traditional investment structures can be complex and difficult to comprehend, making it challenging for investors to understand underlying risks and potential returns.

Lack of Information:Not having enough details about where to invest can make it tough to choose the right option. This might make people hesitant to invest at all.

Low Returns:Sometimes, the money invested doesn't grow much, offering lower profits compared to what people expected.

Limited Diversification:Investors might not have enough different types of investments. This lack of variety can make their money more at risk if one investment doesn’t do well.

Lack of Personalised Recommendations:Generic investment advice fails to cater to individual financial goals, risk appetites, and investment horizons, impacting the relevance of investment decisions.

The Potential of P2P Investments in India

Mutual funds are a reliable investment avenue today, but there are more such promising asset classes unexplored by investors. Swaraj FinPro, the best mutual funds investment services in Jabalpur, offers investments in one such asset class with Peer-to-peer (P2P) lending, backed by RBI guidelines where individuals can lend their money on higher interest while other individuals borrow funds from multiple investors through a digital platform. This transformative approach creates a marketplace connecting borrowers and lenders, facilitating secured personal loans while managing the loan life cycle to provide monthly returns to lenders. Here are the benefits of P2P lending platforms for investors:

Higher Potential Returns

P2P lending platforms typically yield higher interest rate to investors, compared to conventional savings accounts and investors can potentially benefit from higher returns up to 12%*.

Diversification Opportunities

By investing across a variety of borrowers on P2P platforms, investors can spread their risk and potentially increase returns by diversifying their investments.

Accessibility and Specific Advantages

P2P lending provides access to investments previously unavailable through traditional channels. Investors can participate with smaller investment amounts, diversify portfolios, and select the tenure.

Passive Income

P2P lending allows investors to earn interest regularly, providing a potential source of passive income.

Potential for Higher Yields

As investors can choose the tenure and interest rates they are willing to accept for lending, there's potential for higher yields based on their risk appetite.

Tailoring Investments for Investors

Swaraj FinPro empowers investors in Jabalpur and pan India to explore P2P lending as an accessible, reliable, and potentially lucrative avenue for diversification and growth within their investment portfolios. P2P lending works well because it's clear, gives different choices, and doesn’t lock your money away for too long.

#mutual fund financial in Jabalpur#best mutual fund distributors in Jabalpur#equity mutual funds in Jabalpur#best tax saving mutual funds services in jabalpur

2 notes

·

View notes

Text

Everything You Need to Know About Getting a Personal Loan in India

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for a medical emergency, home renovation, debt consolidation, or a much-needed vacation, a personal loan can be your go-to solution. With the advent of technology, applying for an online personal loan has become faster, easier, and more accessible than ever.

In this article, we’ll break down what a personal loan is, how you can get an instant personal loan, and tips to increase your chances of approval—all while making sure you borrow smartly and responsibly.

What is a Personal Loan?

A personal loan is an unsecured loan offered by banks, NBFCs, and digital lenders that does not require any collateral. It’s a flexible form of credit that you can use for various purposes—be it personal, professional, or even educational.

Unlike home or car loans, a personal loan doesn’t tie you to a specific purpose. Lenders usually offer loan amounts ranging from ₹10,000 to ₹25 lakhs, with repayment tenures from 1 to 5 years, depending on your eligibility.

Why Choose an Online Personal Loan?

Applying for an online personal loan is gaining popularity due to the convenience and speed it offers. Here’s why more Indians are going digital for their borrowing needs:

Faster Approvals: Many digital platforms offer instant personal loan approvals, sometimes within minutes.

Paperless Process: No need to visit a branch or submit physical documents. Upload everything digitally.

Real-time Tracking: Monitor your application status and EMIs through online dashboards or apps.

Better Comparisons: Evaluate interest rates and loan terms across multiple lenders easily.

Gone are the days of waiting in long bank queues. With an online personal loan, you can apply and get the funds from the comfort of your home or office.

What is an Instant Personal Loan?

An instant personal loan is exactly what it sounds like—a loan that gets approved and disbursed quickly, often within a few hours. These loans are ideal for urgent requirements such as medical bills, last-minute travel, or emergency repairs.

Lenders use technology and AI-based credit assessment tools to offer instant personal loans based on minimal documentation and pre-approved offers. Salaried individuals with a stable income often qualify for these loans effortlessly.

Features of a Personal Loan You Should Know

Before applying, it’s essential to understand the key features of a personal loan:

No Collateral Required: You don’t have to pledge assets like property or gold.

Fixed Tenure & EMI: Repayment terms are clearly defined, helping with budget planning.

Flexible Usage: Funds can be used for anything, from wedding expenses to business growth.

Quick Disbursal: Particularly true for online personal loans, where disbursal can happen in under 24 hours.

Customizable Amounts: Borrow based on your specific need—no more, no less.

Eligibility Criteria for Personal Loans

While eligibility can differ across lenders, most follow these standard criteria:

Age: Between 21 to 60 years

Income: Minimum ₹15,000 – ₹25,000 monthly income

Employment: Salaried or self-employed with regular income

Credit Score: 700 or above is considered ideal

Meeting these requirements increases your chances of securing a personal loan, especially an instant personal loan where lenders rely on quick eligibility checks.

Documents Required for Online Personal Loan Application

One of the biggest perks of applying for an online personal loan is the minimal paperwork involved. Most platforms require:

PAN Card

Aadhaar Card

Salary slips (last 3 months)

Bank statements (last 6 months)

Address proof

With digitized verification, uploading these documents online speeds up the process for an instant personal loan.

How to Apply for an Online Personal Loan

The application process for an online personal loan is straightforward:

Visit a Trusted Lending Platform: Use platforms like Fincrif to compare and select the best offers.

Fill Out Basic Information: Name, employment type, income, loan amount, etc.

Upload Documents Digitally: Scan and upload the required documents.

Instant Approval Check: Many platforms offer a pre-approval in real-time.

Loan Disbursal: Upon verification, the loan amount is credited directly to your bank account.

By opting for an online personal loan, you save time, effort, and the hassles of traditional loan applications.

Benefits of Choosing a Personal Loan

Still unsure if a personal loan is the right choice? Here are some undeniable advantages:

Multi-purpose Utility: Fund any expense without restrictions.

Boosts Credit Score: Timely repayments improve your creditworthiness.

Pre-approved Offers: If you're an existing customer, many banks offer instant personal loan options.

Flexible Tenure: Choose repayment terms that suit your financial situation.

No Collateral Stress: No asset risk involved as these are unsecured loans.

Tips to Get Your Personal Loan Approved Instantly

Want to improve your chances of getting an instant personal loan? Keep these tips in mind:

Maintain a High Credit Score: Aim for a score above 700.

Avoid Multiple Applications: Too many inquiries can lower your score.

Choose a Lender That Fits Your Profile: Some lenders specialize in loans for self-employed or low-income earners.

Have a Stable Income Source: Lenders prefer applicants with consistent earnings.

Use Pre-approved Offers: If available, pre-approved offers almost guarantee quick approvals.

Common Mistakes to Avoid

When applying for a personal loan, watch out for these common pitfalls:

Not Checking the Fine Print: Hidden fees or high processing charges can surprise you.

Over-borrowing: Don’t take more than you need. Remember, it’s a loan, not a gift.

Ignoring the EMI Burden: Always calculate your EMI in advance using an online EMI calculator.

Defaulting or Missing Payments: It affects your credit score and incurs penalties.

Falling for Fraudulent Lenders: Always apply through verified platforms like Fincrif for a secure online personal loan experience.

Conclusion

Whether you're planning a dream vacation, facing a medical emergency, or simply consolidating debt, a personal loan can be a reliable financial partner. Thanks to digital innovation, getting an online personal loan or even an instant personal loan is just a few clicks away.

However, remember to borrow wisely. Understand your repayment capacity, compare different lenders, and always read the terms and conditions carefully. By being informed and cautious, you can make the most of your personal loan—without burdening your future.

For a hassle-free borrowing experience, visit www.fincrif.com and explore the best online personal loan offers from top lenders in India

#personal loan#finance#nbfc personal loan#fincrif#bank#personal loans#loan services#personal loan online#loan apps#personal laon#Personal loan#Instant personal loan#Online personal loan#Apply for personal loan online#Quick personal loan approval#Personal loan for salaried employees#Personal loan without collateral#Best personal loan offers#Personal loan eligibility#Personal loan interest rates#Personal loan EMI calculator#Fast personal loan disbursal#Instant loan for emergency#How to apply for instant personal loan in India#Which bank offers the best online personal loan?#Benefits of taking an online personal loan#What documents are required for a personal loan?#Who can apply for a personal loan in India?#Loan approval process#Digital lending platforms

0 notes

Text

Finding the Right Loan: A Guide to Loan Options and Choosing the Best Fit for You

Introduction

Finding the right loan product to fit your needs can be a challenging process. With so many options like personal loans, home loans, and business loans, how do you know which is best suited for you? In this post, we'll provide an overview of the major loan products available and factors to consider when choosing one, as well as how Loans Mantri can help simplify the loan application process.

Loans Mantri is an online loan marketplace that partners with over 30 top financial institutions in India including names like HDFC Bank, ICICI Bank, and Axis Bank. No matter what type of loan you need, Loans Mantri aims to provide customized options and a seamless application experience through their digital platform.

Whether you need funds for personal expenses, purchasing real estate, business financing or any other purpose, Loans Mantri can match you with the ideal lending product for your requirements from their network. Their online eligibility calculators and tools remove the guesswork from determining what loans you can qualify for based on your income, credit score and other details.

This post will walk through the key loan products offered through Loans Mantri and outline the most important points to factor in when deciding which option works for your financial situation. We'll also provide tips on how to apply and what to expect when going through Loans Mantri for your financing needs. Let's get started!

Types of Loans Available

Here are some of the major loan products offered through Loans Mantri's platform:

Personal Loans - These unsecured loans can be used for almost any personal purpose like debt consolidation, wedding expenses, home renovation, medical needs, or any other requirements. Interest rates are competitive and loan amounts can range from ₹50,000 to ₹25 lakhs based on eligibility.

Home Loans - Also called mortgage loans, these are for purchasing, constructing or renovating a residential property. Home loans offer extended repayment tenures of up to 30 years and relatively lower interest rates. The property becomes collateral against the loan amount.

Business Loans - Loans Mantri offers financing for a wide range of business needs like working capital, equipment purchases, commercial vehicle loans, construction requirements and more. Loan amounts can be from ₹10 lakhs to multiple crores.

Loan Against Property - By using your existing property as collateral, you can get a secured, high-value loan in return through this product. Interest rates are lower and you can get up to 50% of your property's current market value.

Other Loan Products - Loans Mantri also facilitates other lending options like credit cards, line of credit, gold loans, insurance financing, merchant cash advance for businesses etc. as per eligibility.

Factors to Consider When Choosing a Loan

When looking at the various loan options, here are some key factors to take into account:

- Loan amount required and ideal repayment tenure

- Interest rates and processing/administration fees

- Your repayment capacity based on income and expenses

- Purpose of the loan - personal needs, business growth, property purchase etc.

- Collateral availability for secured loans like home and property loans

- Flexibility in repayment - moratorium periods, EMIs, tenure etc.

- Prepayment and foreclosure charges, if any

Evaluating these parameters will help identify the loan that Aligns to your financial situation. Loansmantri's online tools also help estimate factors like eligibility amounts, EMIs, interest rates etc. to simplify decision making.

Applying for a Loan on Loans Mantri

The application process with Loans Mantri is quick, transparent and fully digital:

- Use the eligibility calculator to get an estimated loan amount you can qualify for.

- Fill out the online application by providing basic personal and financial details.

- Loans Mantri will run a soft credit check to view your credit score and report. This helps match products to your profile.

- Compare personalized loan quotes from multiple partner banks and NBFCs.

- Submit any required KYC documents and income proofs online.

- The application gets forwarded to the lender for further processing and approval.

- Track status directly through your Loansmantri dashboard. Get assistance from customer support if needed.

Conclusion

Loans Mantri aims to be a one-stop platform for all your lending needs. Their intuitive tools and partnerships with leading financial institutions help identify and apply for the ideal loan product for any purpose. Consider your requirements carefully and evaluate all options before choosing the right loan for your financial situation. With Loans Mantri, the entire process from application to disbursal can be completed digitally for an easier financing experience.

2 notes

·

View notes

Text

Why MSME and GST Registration Is Essential for Freelancers and Consultants in India

In today’s gig economy, freelancers and consultants are thriving across industries—from digital marketing and design to IT services, legal advisory, and financial consulting. However, despite their growing contribution to the Indian economy, many freelancers overlook a crucial part of professional growth: formal business registration. Two essential steps in this process are MSME Registration and GST Registration, which can significantly enhance your credibility, tax efficiency, and access to financial tools.

If you're working independently and meet the eligibility criteria for micro or small enterprises, it is highly recommended to begin with online Udyam Udyog Aadhar MSME registration. This registration officially recognizes you as a Micro, Small, or Medium Enterprise, offering benefits such as priority lending, reduced interest rates on loans, and easier access to government schemes and subsidies.

Equally important is online GST registration, especially if your annual income exceeds ₹20 lakh (₹10 lakh for northeastern states). GST registration allows you to legally invoice clients, claim input tax credits, and collaborate with bigger businesses that often require vendors to be GST-compliant. Even if your income is below the threshold, voluntary registration can give you a competitive edge.

Advantages of MSME Registration for Freelancers

1. Eligibility for Government Schemes

Once registered as an MSME, freelancers can access credit-linked subsidies, collateral-free loans, and government schemes designed for micro and small enterprises.

2. Legal Recognition

Being a registered MSME boosts your professional image and opens doors to opportunities such as participation in government tenders or securing institutional funding.

3. Faster Dispute Resolution

Under the MSMED Act, delayed payments by clients can be legally challenged, helping ensure better cash flow and financial stability.

Advantages of GST Registration for Freelancers

1. Issuing Legal Tax Invoices

With GST registration, freelancers can issue professional tax invoices, which increases client trust and helps when working with large corporates.

2. Claiming Input Tax Credit

If you pay GST on business-related purchases like software, tools, or services, you can claim this as a credit—saving you money in the long run.

3. Improved Market Reach

Having a GSTIN allows freelancers to serve clients across India without legal restrictions, which is especially important for those offering digital services.

Why Formal Registration Matters More Than Ever

As India continues to digitize and formalize its economy, freelancers without proper registration may find themselves left out of critical growth opportunities. Whether it’s securing a loan, applying for a co-working subsidy, or working with international clients, being GST-registered and MSME-certified offers a clear professional advantage.

Furthermore, platforms like Finodha make it incredibly easy for freelancers and consultants to handle these formalities without confusion or delay.

Final Thoughts

Freelancing in India is more than a side hustle—it’s a business. To make the most of your potential, it’s essential to register formally through online Udyam Udyog Aadhar MSME registration and online GST registration. These registrations not only protect your legal rights but also empower you with the tools needed for sustainable professional growth.

0 notes

Text

The Role of Technology in NBFC Collection Processes

Technology has transformed the way Non-Banking Financial Companies (NBFCs) manage their collection processes. Digital collection methods have stepped up the game, offering efficiency and convenience. Let's delve into how technology is reshaping NBFC collection strategies.

Understanding Digital Collection in NBFCs

Digital collection in NBFCs refers to leveraging technology to streamline the loan repayment process. It involves using digital channels like mobile apps, online portals, and automated communication to facilitate repayments. This shift from traditional methods has revolutionized the efficiency and accessibility of collections.

Rajat Gandhi, the CEO, and Founder of Faircent, often emphasizes the pivotal role of technology in revolutionizing Non-Banking Financial Companies (NBFCs). He discusses how innovative tech solutions, like AI-driven credit assessment tools and blockchain for secure transactions, can streamline operations, enhance risk management, and democratize access to credit.

Enhancing Customer Experience

Technology has brought forth a more customer-centric approach. Digital collection methods offer convenience to borrowers by allowing them to make payments from anywhere, at any time, using their preferred mode of payment. This enhances the overall experience, leading to improved customer satisfaction and loyalty.

Improved Efficiency and Accuracy

Automated systems in NBFCs ensure precise record-keeping and reduce the margin of error in collection processes. Algorithms help in analyzing repayment patterns, identifying delinquencies, and sending timely reminders or notifications to borrowers. This automated approach significantly boosts the efficiency of collections.

In a conversation with Abhay Bhutada, MD of Poonawalla Fincorp, he mentioned that they have witnessed rapid digitization in the recent past enabling cash-flow-based lending, availability of bank statements in the PDF formats. For the lenders, these have enabled the digital journeys and made it easier to process applications.

Also Read: Combating Financial Fraud: Innovations in Banking and NBFCs

Mitigating Risks and Fraud

Technology plays a pivotal role in mitigating risks associated with collections. Advanced data analytics and machine learning algorithms aid in identifying potential fraudulent activities or default risks. This proactive approach enables NBFCs to take preventive measures, reducing the chances of financial losses.

Cost-effectiveness and Scalability

Digital collection methods offer cost-effective solutions for NBFCs. The automation of processes reduces manual intervention, thereby cutting operational costs. Additionally, these technological advancements pave the way for scalability, allowing NBFCs to expand their operations without a proportional increase in resources.

Also Read: The Vital Role Of A Concrete Business Plan In Loan Applications

Conclusion

Technology has emerged as a game-changer in NBFC collection processes. The integration of digital collection methods has not only enhanced operational efficiency but also improved customer experience. Embracing these technological advancements remains crucial for NBFCs to stay competitive and meet evolving consumer demands.

In a nutshell, the digital revolution in NBFC collections isn't just a trend; it's a fundamental shift that promises enhanced efficiency, reduced risks, and a more satisfying experience for both the institution and its borrowers.

0 notes

Text

The city's fertile ground for startups has nurtured a multitude of fintech companies in Mumbai. From digital lending platforms to wealth management apps and blockchain-based solutions, Mumbai-based startups top fintech company in India have been developing cutting-edge technologies to address a wide range of financial needs.

0 notes