#Hyatt Hotels

Explore tagged Tumblr posts

Text

❤❤❤ (tweet ❤)

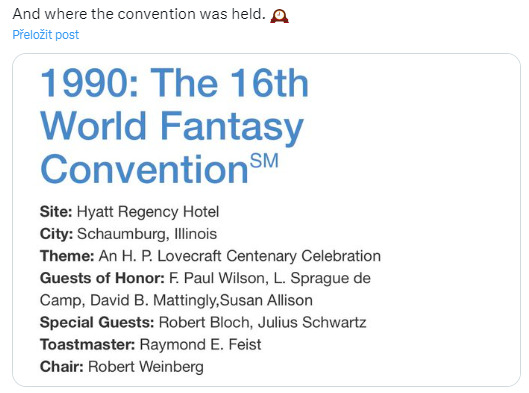

#good omens#terry pratchett#neil gaiman#photos#terry and neil#btb#16th world fantasy convention#hyatt regency hotel#fun fact

20K notes

·

View notes

Text

At the heart of Pune’s vibrant cityscape lies the majestic Hyatt Regency Pune, a symbol of luxury and elegance. Renowned for impeccable service and unparalleled hospitality, this exquisite hotel offers the perfect setting for couples celebrating their special day.

#5-Star Hotels#5-Star Wedding Venues#5-Star Wedding Venues In Pune#Dream Wedding Venue#Hyatt As Wedding Venue#Hyatt Hotels#Hyatt Pune#Hyatt Regency#Hyatt Regency Pune#luxury hotels#Luxury Wedding Venues#Pune Wedding Venues#Pune Weddings#Venue#Wedding Destination#Wedding Venue#Wedding Venues In Pune#shaadiwish

0 notes

Text

Cyan Brasserie - Andaz Capital Gate - Iftar Review

Highly recommended! For a sophisticated Iftar with gorgeous views and exquisite food, Cyan Brasserie is a fantastic choice.

View On WordPress

0 notes

Text

youtube

0 notes

Text

Feel Like a Celebrity at Dream Hollywood During and After Awards Season

One of the premier hotels located in the Vinyl District in Hollywood is the Dream Hollywood. It’s within walking distance to the Dolby Theatre, home to the Academy Awards Oscars, and is also one of the sexiest celebrity destinations in Los Angeles. Known for its progressive design, the soul of the hotel is its vibrant dining and nightlife venues. TAO Asian Bistro and Beauty & Essex are adjacent…

View On WordPress

0 notes

Text

5 Reasons To Visit Hyatt Centric Gran Vía

Smack in the middle of Madrid’s most vibrant and tourist-favored shopping streets, Gran Vía, sits Hyatt Centric Gran Vía. This relatively new brand for Hyatt places an important focus on being in the neighborhoods that draw visitors and local energy. In Madrid, this Hyatt Centric fits the mark. Its historic building and interior design story add to the experience. Here are five reasons it’s worth…

View On WordPress

#European hotels#Four Seasons Hotel Madrid#Hyatt#hyatt centric#hyatt centric gran via#Hyatt Hotels#Madrid#madrid hotels#Spain#World of Hyatt

0 notes

Text

LE PRISTINE

The hotel's breakfast buffet was amazing and appetizing. The sukiyaki udon was delicious.

183 notes

·

View notes

Text

The Andaz Toranomon Hills in Tokyo, Japan with my Mamiya C330 on Kodak Portra 160.

@kevintadge

#photography#film#photo#photographers on tumblr#japan#120#art#analog#hotel#city#cityscape#toranomon#toranomon hills#andaz#mirror#interior design#architecture#hyatt#mamiya#c330#kodak#portra#travel photography

28 notes

·

View notes

Text

Park Hyatt. Vienna.

12 notes

·

View notes

Text

Vacation time again......🥰

#guitar#photography#collection#gas#love#guitars#travelerguitar#vacation#hotel#koh samui#hyatt regency#travel guitar

7 notes

·

View notes

Text

The pool situation at the Grand Kauai Hyatt is really nice as it has multiple layers and features. The highest pool is the adult-only pool that’s also connected to a lazy river. I did my first swim in this pool Sunday afternoon, using the mostly-empty lazy river to do some resistance work from time to time but mainly just enjoying the adult-only pool’s features, like swimming under a footbridge.

Since these pools are pretty big, I relied on the files stored on my swimming headphones to entertain me; that said, of the three, it was possible to get a decent swim in while using my Bluetooth.

#travel#travel photography#hawaii#kauai#kauai hawaii#grand hyatt kauai#hotel pools#resort pool#pools of the world#swimming

2 notes

·

View notes

Video

Just Smile All the Time by Thomas Hawk

#America#Atlanta#Georgia#Hotel#Hyatt#Hyatt Regency#Hyatt Regency Atlanta#John Portman#USA#United States#United States of America#architecture#elevator#flickr

4 notes

·

View notes

Text

#2009 #press conference #Japan #premiere #Public Enemies #Tokyo #December 9, 2009 #Grand Hyatt Hotel

#2009#interview#premiere#public enemies#Tokyo Japan#Tokyo#Japan#press conference#grand hyatt#hotel#December 9 2009#December 2009

2 notes

·

View notes

Text

youtube

#phoenix arizona#royal palms resort and spa#hyatt hotels#black travel#luxury#desert#walkthrough#wedding destination#Youtube

1 note

·

View note

Text

Tokyo was packed full of so many amazing memories.

#Hyatt Regency Tokyo#Hotel#Truck#Isuzu 810#Vintage Cars#Classic Cars#Toyota Soarer#Toyota Mark II#Tokyo City Hall#Tocho#Tokyo to Chosha#Nishi Shinjuku#Shinjuku#Tokyo#Tokyo Metropolitan Government Building#Japan

14 notes

·

View notes