#Government revenue loss

Explore tagged Tumblr posts

Text

Bridging the Tax Gap: Addressing Middle-Class Tax Evasion in India

India's middle class is vital to the nation's economy. Many express concerns over their substantial income tax burden. Beyond inefficient government services and pervasive corruption, frustration arises from widespread tax evasion within their ranks. While many dutifully pay taxes through transparent channels like cards or UPI, a significant segment remains outside the tax net. This leads to substantial revenue losses for the country...Expand

#Middle-class tax evasion in India#India Income tax compliance#Tax exemptions#Agricultural income tax exemption#Tax net expansion#Direct tax collection#Fiscal policy India#Taxpayer compliance#Government revenue loss#Tax evasion statistics.

0 notes

Text

Ko-fi prompt from @liberwolf:

Could you explain Tariff's , like who pays them and what they do to a country?

Well, I can definitely guess where this question is coming from.

Honestly, I was pretty excited to get this prompt, because it's one I can answer and was part of my studies focus in college. International business was my thing, and the issues of comparative advantage (along with Power Purchasing Parity) were one of the things I liked to explore.

-----------------

At their simplest, tariffs are an import tax. The United States has had tariffs as low as 5%, and at other times as high as 44% on most goods, such as during the Civil War. The purpose of a tariff is in two parts: generating revenue for the government, and protectionism.

Let's first explore how a tariff works. If you want to be confused, then you need to have never taken an economics class, and look at this graph:

(src)

So let's undo that confusion.

The simplest examples are raw or basic materials such as steel, cotton, or wine.

First, without tariffs:

Let us say that Country A and Country B both produce steel, and it is of similar quality, and in both cases cost $100 per unit. Transportation from one country to the other is $50/unit, so you can either buy domestically for $100, or internationally for $150. So you buy domestically.

Now, Country B discovers a new place to mine iron very easily, and so their cost for steel drops to $60/unit due to increased ease of access. Country A can either purchase domestically for $100, or internationally for $110 (incl. shipping), which is much more even. Still, it is more cost-effective to purchase domestically, and so Country A isn't worried.

Transportation technology is improved, dropping the shipping costs to $30/unit. A person from Country A can buy: Domestic: $100 International: $60+$30 = $90 Purchasing steel from Country B is now cheaper than purchasing it from Country A, regardless of where you live.

Citizens in Country A, in order to reduce costs for domestic construction, begin to purchase their steel from Country B. As a result, money flows from Country A to B, and the domestic steel industry in Country A begins to feel the strain as demand dwindles.

In this scenario, with no tariffs, Country A begins to rely on B for their steel, which causes a loss of jobs (steelworkers, miners), loss of infrastructure (closing of mines and factories), and an outflow of funds to another country. As a result, Country A sees itself as losing money to B, while also growing increasingly reliant on their trading partner for the crucial good that is steel. If something happens to drive up the price of B's steel again, like political upheaval or a natural disaster, it will be difficult to quickly ramp up the production of steel in Country A's domestic facilities again.

What if a tariff is introduced early?

Alternately, the dropping of complete costs for purchase of steel from Country B could be counteracted with tariffs. Let's say we do a 25% tariff on that steel. This tariff is placed on the value of the steel, not the end cost, so:

$60 + (0.25 x $60) + $30 = $105/unit

Suddenly, with the implementation of a 25% tariff on steel from Country B, the domestic market is once again competitive. People can still buy from Country B if they would like, but Country A is less worried about the potential impacts to the domestic market.

The above example is done in regards to a mature market that has not yet begun to dwindle. The infrastructure and labor is still present, and is being preemptively protected against possible loss of industry to purchasing abroad.

What happens if the tariff is not implemented until after the market has dwindled?

Let's say that the domestic market was not protected by the tariff until several decades on. Country A's domestic production, in response to increased purchasing from abroad, has dwindled to one third of what it was before the change in pricing incentivized purchase from B. Prices have, for the sake of keeping this example simple, remained at $100(A) and $60(B) in that time. However, transportation has likely become better, so transportation is down to $20, meaning that total cost for steel from B is $80, accelerating the turn from domestic steel to international.

So, what happens if you suddenly implement a tariff on international steel? Shall we say, 40%?

$60 + (0.4 x 60) + 20 = $104

It's more expensive to order from abroad! Wow! Let's purchase domestically instead, because these prices add up!

But the production is only a third of what it used to be, and domestic mines and factories for refining the iron into steel can't keep up. They're scaling, sure, but that takes time. Because demand is suddenly triple of the supply, the cost skyrockets, and so steel in Country A is now $150/unit! The price will hopefully come down eventually, as factories and mines get back in gear, but will the people setting prices let that happen?

So industries that have begun to rely on international steel, which had come to $80/unit prior to the tariff, are facing the sudden impact of a cost increase of at least $25/unit (B with tariff) or the demand-driven price increase of domestic (nearly double the pre-tariff cost of steel from B), which is an increase of at least 30% what they were paying prior to the tariff.

There are possible other aspects here, such as government subsidies to buoy the domestic steel industry until it catches back up, or possibly Country B eating some of the costs so that people still buy from them (selling for $50 instead of $60 to mitigate some of the price hike, and maintain a loyal customer base), but that's not a direct impact of the tariff.

Who pays for tariffs?

Ultimately, this is a tax on a product (as opposed to a tax on profits or capital themselves, which has other effects), which means the majority of the cost is passed on directly to the consume.

As I said, we could see the producers in Country B cut their costs a little bit to maintain a loyal customer base, but depending on their trade relationships with other countries, they are just as likely to stop trading with Country A altogether in order to focus on more profitable markets.

So why do we not put tariffs on everything?

Well... for that, we get into the question of production efficiency, or in this case, comparative advantage.

Let's say we have two small, neighboring countries, C and D, that have negligible transportation costs and similar industries. Both have extensive farmland, and both have a history of growing grapes for wine, and goats for wool. Country C is a little further north than D, so it has more rocky grasses that are good for goats, while D has more fertile plains that are good for growing grapes.

Let's say that they have an equal workforce of 500,000 of people. I'm going to say that 10,000 people working full time for a year is 1 unit of labor. So, Country C and Country D have between the 100 units of labor, and 50 each.

The cost of 1 unit of wool = the cost of 1 unit of wine

Country C, having better land for goats, can produce 4 units of wool for every unit of labor, and 2 units of wine for every unit of labor.

Meanwhile, Country D, having better land for grapes, can produce 2 units of wool per unit of labor, and 4 units of wine per unit of labor.

If they each devote exactly half their workforce to each product, then:

Country C: 100 units of wool, 50 units of wine Country D: 50 units of wool, 100 units of wine

Totaling 150 units of each product.

However, if each devotes all of their workforce to the product they're better at...

Country C: 200 units of wool, no wine Country D: no wool, 200 units of wine

and when they trade with each other, they each end up with 100 units of each product, which is a doubling of what their less-efficient labor would have resulted in!

The real world is obviously much more complicated, but in this example, we can see the pros of outsourcing some of your production to another country to focus on your own specialties.

Extreme examples of this IRL are countries where most of the economy rests on one product, such as middle-eastern petro-states that are now struggling to diversify their economies in order to not get left behind in the transition to green energy, or Taiwan's role as the world's primary producer of semiconductors being its 'silicon shield' against China.

Comparative advantage can be used well, such as our Unnamed Countries (that are definitely not the classic example of England and Portugal, with goats instead of sheep) up in the example. With each economy focusing on its specialty, there is a greater yield of both products, meaning a greater bounty for both countries.

However, should something happen to Country C up there, like an earthquake that kills half the goats, they are suddenly left with barely enough wool to clothe themselves, and nothing for Country D, which now has a surplus of wine and no wool.

So you do have to keep some domestic industry, because Bad Things Can Happen. And if we want to avoid the steel example of a collapse in the given industry, tariffs might be needed.

Are export tariffs a thing?

Yes, but they are much rarer, and can largely be defined as "oh my god, everyone please stop getting rid of this really important resource by selling it to foreigners for a big buck, we are depleting this crucial resource."

So what's the big confusion right now?

Donald Trump has, on a number of occasions, talked about 'making China pay' tariffs on the goods they import into the US. This has led to a belief that is not entirely unreasonable, that China would be the side paying the tariffs.

The view this statement engenders is that a tariff is a bit like paying a rental fee for a seller's table at an event: the producer or merchant pays the host (or landlord or what have you) a fee to sell their product on the premises. This could be a farmer's market, a renaissance faire, a comic book convention, whatever. If you want to sell at the event, you have to pay a fee to get a space to set up your table.

In the eyes of the people who listened to Trump, the tariff is that fee. China is paying the United States for access to the market.

And, technically, that's not entirely wrong. China is thus paying to enter the US market. It's just the money to pay that fee needs to come from somewhere, and like most taxes on goods, that fee comes from the consumer.

So... what now?

Well, a lot of smaller US companies that rely on cheap goods made in China are buying up non-perishables while they can, before the tariffs hit. Long-term, manufacturers in the US that rely on parts and tools manufactured in China are going to feel the squeeze once that frontloaded stock is depleted.

Some companies are large enough to take the hit on their own end, still selling at cheap rates to the consumer, because they can offset those costs with other parts of their empire... at least until smaller competitors are driven out of business, at which point they can start jacking up their prices since there are no options left. You may look at that and think, "huh, isn't that the modus operandi for Walmart and Amazon already?" and yes. It is. We are very much anticipating a 'rich get richer, poor go out of business' situation with these tariffs.

The tariffs will also impact larger companies, including non-US ones like Zara (Spanish) and H&M (Swedish), if they have a huge reliance on Chinese production to supply their huge market in the United States.

If you're interested in the repercussions that people expect from these proposed tariffs on Chinese goods, I'd suggest listening to or watching the November 8th, 2024 episode of Morning Brew Daily (I linked to YouTube, but it's also available on Spotify, Nebula, the Morning Brew website, and other podcast platforms).

#id in alt text#id in alt#economics#tariffs#import tax#customs#customs duties#ko fi prompts#capitalism#phoenix talks#ko fi#taxes#taxation

2K notes

·

View notes

Note

I read your post about open enrollment for the ACA and was hoping you might expand on why you believe it would take years to dismantle. I've been terrified that with a Republican house/senate, Trump could just snap his fingers and make it go away within months of taking office. I'd love some reassurance that that's not possible.

Hiya, sure I can share some thoughts on the matter! First, it's very important to understand the ACA is a huuuuuuuuuuuuge system with subject matter experts in dozens of places throughout the process. I'm one of those SMEs, but I am at the end of the process where the revenue is generated, so my insight is limited on the public facing pieces.

What this means is that I am professionally embedded in the ACA in a position that exists purely to show what conditions people are treated for and then generate that data into what's called a "risk score". There's about 6 pages I could write on it, but the takeaway is that the ACA is

1) intricately interwoven with the federal government

2) increasingly profitable, sustainable, and growing (it is STILL a for-profit system if you can believe it)

3) wholeheartedly invested in by the largest insurance companies in the country LARGELY due to the fact that they finally learned the rules of how to make the ACA a thriving center of business

4) since the big issuers are arm+leg invested in the ACA, there is a lot of resistance politically and on an industry level to leave it behind (think of the lobbyists, politicians, corporations that will fight tooth and nail to protect their profit + investment)

The process to calculate a risk score takes roughly 2 years. There is an audit for the concurrent year and then a vigorous retro audit for the prev year - - this is a rolling cycle every year. Medicare has a similar process. These are RVP + RADV audits if you would like the jargon.

Eliminating the ACA abruptly is as internally laughable as us finishing the RADV audit ahead of schedule. If Trump were to blow the ACA into smithereens on day 1, he would be drowning in issuer complaints and an economic health sector that is essentially bleeding out. You cut off the RVP early? We have half of next RADV stuck in the gears now. You cut off the RADV early? No issuer will get their "risk adjusted" payments for services rendered in the prev benefit year (to an extent, again very complex multi-process system).

The ACA is GREAT for the public and should be defended on that basis alone. However, the inner capitalistic nature of the ACA is a powerful armor that has conservatives + liberals defending it on a basis of capital + market growth. It's not sexy, but it makes too much money consistently for the system to be easily dismantled.

Or at least that's what I can tell you from the money center of the ACA. they don't bring us up in political conversation because we are confusing to seasoned professionals, boring to industry outsiders, and consistently we are anathema to the anti-ACA talking points.

I am already preparing for next year's RVP for this window of open enrollment. That RVP process will feed into the RADV in 2026. In 2025, we begin the RADV for 2024. If nothing else, the slow fucking gears of CMS will keep the ACA alive until we finish our work at the end of the process. I highly doubt that will be the only reason the ACA is safeguarded, but it is a powerful type of support to pair with people protecting the ACA for other reasons.

I work every day to show, defend, and educate on how many diagnoses are managed thru my company's ACA plans. My specialty is cancer and I see a lot of it. The revenue drive comes from the Medical Loss Ratio (MLR) rule stating only 20% MAX of profit may go to the issuer + the 80% at a minimum must go back to the customer or be invested in expanding benefits. The more people on the plan using it, the higher that 20% becomes for the issuer and the more impactful that 80% becomes for the next year of benefit growth. It is remarkably profitable once issuers stop seeking out "healthy populations". The ACA is a functional method for issuers to tap into a stable customer base (sick/chronic ill customers) that turns a profit, grows, and builds strong consumer bases in each state.

The industry can never walk away from this overnight - - this is the preferred investment for many big players. Changing the direction of those businesses will be a monumental effort that takes years (at least 2 with the audits). In the meantime, you still have benefits, you still have care, and you still have reason to sign up. Let us deal with the bureaucracy bullshit, go get your care and know you have benefits thru 2025 and we will be working to keep it that way for 2026 and forward. This is a wing of the federal government, it is not a jenga tower like Trump wishes.

1K notes

·

View notes

Text

He’s a f—king madman who has no idea what he’s doing or what kind of harm he’s going to cause. Coffee prices will soar and it won’t’t just be Columbian coffee because it will create a greater demand for coffee from other nations. Then you can expect all the importers and retailers to price gouge on top of that. Pressed flowers will become unaffordable as well. Then gas prices will rise because their cheap crude oil will suddenly cost 25% more and again everyone else in the business will see increased demand and raise their prices and price gouge on top of that. Worse, he’s threatening to Jack the tariffs up to 50% for countries that won’t now to his demands.

Tariffs are meant to be used sparingly to stimulate domestic industry instead of relying on foreign producers. They were never intended to be used across the board on every item from a country. The foreign producers aren’t going to absorb a 25% loss in revenue, that’s never happened and likely never will. Prices for American consumers will rise by 25% plus inconvenience fees and price gouging.

Tariffs aren’t a weapon if you think they are you’re just shooting your own citizens in the foot. This is pretty basic stuff. Most people learned this when studying early American history in elementary school. American leaders in the post-revolutionary years imposed tariffs on European manufactured goods such as tools, guns, furniture, machines, etc to end reliance on imported goods while stimulating American manufacturing and turning us into an exporting nation.

Trump’s sole college degree is a bachelor’s in economics. This dumb ass should know how this works. He the densest mother f—ker alive and is completely incapable of being taught anything. Further he’s suffering cognitive decline due to mental illness and is a raging drug addict on top of that. Coke as an upper and Adderall to come down. His shadow president, Elon Musk, ironically only has a bachelor’s degree as well and surprise it’s also in economics. He should know better but also is suffering from mental illness and the consumption of mass quantities of Ketamine. Two moronic drug addicts.

The Republicants who should be advising Trump aren’t the best and brightest either. Nearly all of them haven’t gone beyond a bachelor’s degree and they certainly didn’t major in anything that would be useful in managing a large country with the largest economy on the planet. They are trying to run a government based on sound bites and talking points they picked up from the uneducated hosts of Fox News and Fox Business.

Once countries get burned by Trump’s tariffs they will seek out trading partners in Russia, Asia, the Middle East, and Africa. Once a trading partner leaves they almost never return. We’ll be forced to seek out more expensive trading partners who will be very cautious dealing with an unreliable USA. Further Columbia will stop cooperating and sharing intelligence in the war against the narco terrorists. Politically all these nations Trump alienates will realign their political goals with BRICS which is growing as an alternative trade and policy for nations not aligned with the Western and first world states. This is an economic and foreign policy disaster that will ripple through the world for decades to come. Trump isn’t just going to crash our economy but likely cause a worldwide depression, or at least recession. When the US catches a cold the rest of the world sneezes.

THIS IS NOT NORMAL AND ITS NOT EVEN RATIONAL.

#trump doesn’t understand tariffs#Trump’s advisers are not intelligent or well educated and certainly are not competent#tariffs are not tools#nobody wins a trade war#an unsuccessful NYC realtor is not qualified to be president#this is self destructive#the US and world economies will suffer#republican assholes#maga morons#traitor trump#crooked donald#traitor#resist#republican values#republican hypocrisy#republican family values

96 notes

·

View notes

Text

As of Monday afternoon the wildfires in California had consumed over 36,000 acres leaving a death toll of 24. When asked in an interview regarding funding for disaster relief, Alabama senator Tommy Tubervill said this “We shouldn’t be [funding California]. They got 30 million people in that state they vote in these imbeciles in to office” former collage football coach and by far the dumbest senator continued, “you go in to California you run in to a lot of Republicans, a lot of good people and I hate it for them. But they are just overwhelmed by these inner city woke policies with people who vote for them. Those people don’t deserve anything unless they show that they’re going to make some changes”.

Notwithstanding the not so subtle racism of ‘inner city woke’ comment, exactly what is the senator from the state ranked 44th out of 50 for living standards, health, education, opportunity, natural environment, ect, saying?

Alabama’s GDP grosses $300 billion, with a population of a little over 5.1 million people, they are the 14th highest recipient of federal welfare assistance, they are 45th in education and 44th in overall health. Over 360,000 residents receive rental assistance and nutritional assistance.

Yes. California ranks number one for dollar amount federal assistance. Although upon further analysis the percentages are far less unbalanced as the numbers would suggest.

California is the WORLDS 5th largest economy, grossing $3,862 billion annually, with a population of nearly 40 million. That is over 10 times the annual revenue Alabama takes in, with almost 10 times the population as well.

Does California have its share of difficult circumstances it deals with, with some questionable solutions to do so? Yes. Yet seeing as it’s the top contributor to federal tax revenue they obviously are functioning beyond the norm.

Overall the states that fund this nation the most are, California, New York, New Jersey, Texas, Pennsylvania and Florida. States such as the Dakotas, Wyoming, Mississippi, Kentucky, and yes, Alabama, contribute a dismal amount in contrast.

Let’s look back to late summer of last year. When two hurricanes devastated the the lower southeastern states, Helene causing monumental destruction and incredible loss of life. Did the Biden administration use these disasters as a political tool? Did he suggest that they shouldn’t get funding until they remedy their bigoted, unconstitutional voter suppression and gerrymandering? No. He said that the United States government is here for you. While right wing politicians and media plastered the victims with false statements and misinformation, confusing and misleading the afflicted Americans, FEMA and the Biden administration begged the survivors to reach out for help. The politically motivated lies even spurred FEMA to create a specific website combating the false claims and offering assistance.

There’s the old saying, Rome wasn’t made in a day, the recovery from these massive events unfortunately takes time also. Yet NEVER did Democrats or Biden lead folks astray, exploit their vulnerability, or abandon them. I know, I reside in a county that was declared a disaster area after Helene. The federal response was quick, and thorough.

What did the right do? Lie. Mislead. Frighten. Contrive a self serving narrative. Enrage those impacted and scrambling to piece their lives back together.

The void of compassion, the insufficiency of truth, the lack of maturity from much of the right is astounding. When did we begin using the suffering of Americans as a tool to advance your political agenda? When did it become the status quo to segregate assistance to only those who align with your political views? What was the moment when helping your fellow American out in a time of need was tethered to conditions?

In my just over 40 years on this earth I’ve seen the GOP go from being a party of fiscal responsibility, “Christian family values”, the party of law and order, and the party of high moral standards, to now where over a quarter of the current deficit was created in one Republican presidential term, a party of nominating, elected and confirming sexual assailants and predators (not just Trump), a party that not only backs and supports a felonious insurrectionist, but tiptoes, if not flat out violates the Constitution and rule of law, and a party that has no self awareness of its own misgivings.

Personally. I want leaders who are far more intelligent and far more qualified than me to be in charge. I want leaders who harbor self restraint and possess an extraordinary sense of moral fortitude. I want leaders with grace and maturity running the various aspects of this country. I want leaders who care and hold reverence to their values and to the oath of office they swear to.

Can we go back to a time where those who represent us were adults? Can we go back to a time where government was beholden to you as an American citizen regardless if you reside in a blue state or red state? Can we go back to a time where leadership wasn’t a popularity, tribalist, culture war crusade?

We are all humans. We all feel pain. We all feel joy. We all bleed red. Most importantly we are all citizens of the United States of America, key word united.

This shouldn’t be this hard. It shouldn’t be this controversial or complicated. We are one nation, we all want to see it flourish. We all do better when we are all doing better.

So please! Let’s return to decency. To compassion. To respect. To some mild form of social adhesion.

#california#california wildfires#fema#decency#war on democracy#democracy#trump is a threat to democracy#united states#United#traitor trump#republicans#donald trump#politics#news#compassion#help#democrats#togetherness#the left#liberal#hope#u.s. house of representatives#truth#trump circus#freedom#free speech#vote democrat#we the people#pride#trump is a russian asset

91 notes

·

View notes

Text

As always: sales companies feel they should have gotten are being conflated with losses, which is not and never has been the case. Piracy is the media commons refused to us outside of paltry library offerings (not the fault of libraries but the greed of copyright holders and shortsightedness of local governments) in the imperial core. Outside of it the options are far slimmer without piracy.

126 notes

·

View notes

Text

Kamala Harris’s ‘Joyful’ War on Entrepreneurs

When Democrats talk about boosting the middle class, what they mean is government employees.

By Allysia Finley Wall Street Journal

Americans who tuned in to Kamala Harris’s coronation last week heard from plenty of celebrities, labor leaders and politicians. Missing from the “joyous” celebration, however, were entrepreneurs who generate middle-class jobs.

No surprise. Cheered on by the crowd, Democrats took turns whacking “oligarchs” and “corporate monopolists.” By the time Ms. Harris took the stage, the pinatas’ pickings had been splattered around. This is what Democrats plan to do if they win: destroy wealth creators so they can spread the booty among their own.

Corporate greed is “the one true enemy,” United Auto Workers President Shawn Fain proclaimed. Vermont Sen. Bernie Sanders insisted the party “must take on Big Pharma, Big Oil, Big Ag, Big Tech, and all the other corporate monopolists whose greed is denying progress for working people.” Pennsylvania Sen. Bob Casey railed against “greedflation” and accused corporations of “extorting families.”

Barack Obama lambasted Donald Trump and his “well-heeled donors.” “For them, one group’s gains is necessarily another group’s loss,” Mr. Obama said. “For them, freedom means that the powerful can do pretty much what they please, whether it’s fire workers trying to organize a union or put poison in our rivers or avoid paying taxes like everybody else has to do.”

Democrats treat wealth as a zero-sum game, and so Mr. Obama’s straw men are rich. They get richer by making everyone else poorer—and taking away from the well-off is the only way to enhance the lives of the poor and middle class. Hence, the left’s plans to raise taxes on “billionaires” and businesses to finance more welfare.

It isn’t enough that the top 1% of earners already pay 45.8% of federal income tax, which funds government services and welfare for the bottom half. As for poisoning rivers, perhaps Mr. Obama forgot that his own Environmental Protection Agency caused the 2015 Gold King Mine disaster, which spilled toxic waste into Colorado’s Animas River.

Quoting Abraham Lincoln, the former president invoked “the better angels of our nature” even as he appealed to America’s darker angels. His speech brought to mind a recent homily by my local parish priest about the dangers of class warfare and envy, one of the seven deadly sins.

Success, the priest explained, isn’t a zero-sum game. When a businessman succeeds, he creates jobs that help the poor. Envying and tearing down the successful makes everyone poorer. Rather than plunder the wealthy, society should celebrate success and try to help everyone prosper.

Democrats derisively refer to such ideas as “trickle-down economics.” They denounce and diminish business success, and claim the wealthy have profited from greed and government support. Who can forget Mr. Obama’s line in 2012 that “if you’ve got a business, you didn’t build that”?

Rather than try to make it easier for businesses to succeed—say, by reducing taxes or easing regulations—Democrats want to do the opposite. They call for “leveling the playing field” and “growing the middle class out,” euphemisms for taxing success so government can hand out money. But government doesn’t create wealth. People do.

While business success isn’t zero-sum, government growth can be. Its expansion makes it more difficult for business to thrive. The result is fewer jobs, lower wages and less tax revenue, which finances essential public services such as law enforcement and the “safety net” for the indigent.

Mr. Trump’s appeal in 2016 partly stemmed from slow economic growth during Mr. Obama’s presidency. The Republican promised to make all Americans richer by liberating businesses from government’s shackles. Mr. Trump’s deregulation and tax cuts worked: Average real wages increased nearly 70% faster during his first three years than during Mr. Obama’s presidency.

Yet most Americans have become poorer under Mr. Biden, as government spending has fueled inflation, which has eroded wages. Job growth has become increasingly concentrated in sectors that depend on government spending. When Democrats talk about boosting the middle class, they mean the class of government workers.

Government, education, healthcare and social assistance account for more than 60% of the new jobs added in the last year. In the 17 states where Democrats boast a “trifecta”—control of the governorship and both legislative chambers—the share is 98%. In the 23 states with Republican trifectas, it’s 47%.

Likewise, average wage growth since the start of the pandemic has been lower in high-tax states such as Illinois (13.6%), New York (14.4%) and California (17.2%) than in low-tax Florida (22.5%), Texas (23.3%) and South Dakota (26.9%). If middle-class Americans want to get richer, they ought to move to Miami, Dallas or Sioux Falls.

“As long as we look to legislation to cure poverty, or to abolish special privilege,” Henry Ford once observed, “we are going to see poverty spread and special privilege grow.” That’s the joyous future Americans can expect during a Harris presidency.

Appeared in the August 26, 2024, print edition as 'Kamala Harris’s ‘Joyful’ War on Entrepreneurs'.

#wall street journal#kamala harris#tim walz#obama#schumer#pelosi#AOC#Democrats#Biden#trump 2024#trump#president trump#repost#america first#americans first#america#donald trump#ivanka

86 notes

·

View notes

Text

Excerpt from this story from the New York Times:

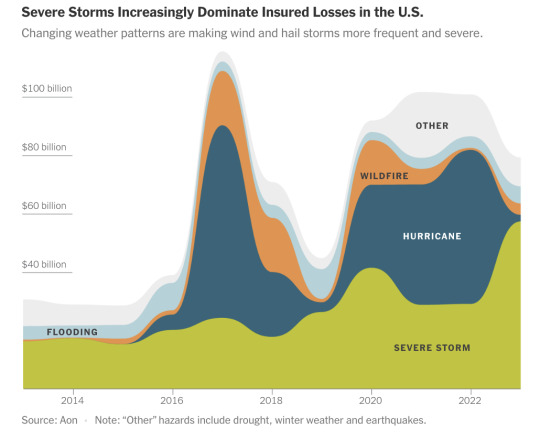

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

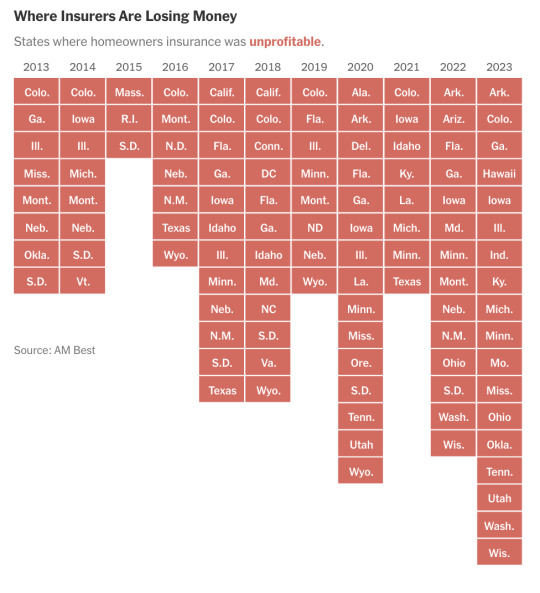

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

136 notes

·

View notes

Text

Missouri! It's the last day to register to vote! do it today (RIGHT NOW!!) so you can make a difference on Nov. 5th!

OCTOBER 9TH (TODAY!!!) IS THE LAST DAY THAT YOU CAN REGISTER TO VOTE IN MISSOURI FOR THE NOVEMBER 2024 ELECTION

Click here ^ to register! It's easy!

Once you're registered you can check your polling location (the place you go to vote), learn about absentee voting, the election machines, acceptable forms of ID for voting, and when polls are open on this page. After you register, I highly recommend checking in with the local county clerk's office to ensure your registration was filed properly (this can take up to 10 days, iirc) once a week or so until they confirm it.

Once you're registered you can check your polling location (the place you go to vote), learn about absentee voting, the election machines, acceptable forms of ID for voting, and when polls are open.

PLEASE CHECK BELOW ABOUT WHAT WILL BE ON THE MISSOURI BALLOT!

Ballot Measures and Issues are as follows: PLEASE READ CAREFULLY!

-Amendment 2 (Amend Missouri Constitution to: allow Missouri Gaming Commission to regulate sports wagering online) (the "sports betting" amendment)

Do you want to amend the Missouri Constitution to: State governmental entities estimate onetime costs of $660,000, ongoing annual costs of at least $5.2 million, and initial license fee revenue of $11.75 million. Because the proposal allows for deductions against sports gaming revenues, they estimate unknown tax revenue ranging from $0 to $28.9 million annually. Local governments estimate unknown revenue.

Fair Ballot Language:

A “yes” vote will amend the Missouri Constitution to permit licensed sports wagering regulated by the Missouri Gaming Commission and restrict sports betting to individuals physically located in the state and over the age of 21. The amendment includes a 10% wagering tax on revenues received to be appropriated for educational institutions in Missouri. A “no” vote will not amend the Missouri Constitution regarding licensed regulated sports wagering. If passed, this measure will have no impact on taxes.

READ MOR ON AMENDMENT 2 HERE

-Amendment 3 (the "abortion amendment", removes Missouri's ban on abortion as well "require the government not to discriminate, in government programs, funding and other activities, against persons providing or obtaining reproductive health care"-full text that will be on the ballot can be found on this page under Amendment 3.

Do you want to amend the Missouri Constitution to: State governmental entities estimate no costs or savings, but unknown impact. Local governmental entities estimate costs of at least $51,000 annually in reduced tax revenues. Opponents estimate a potentially significant loss to state revenue.

Fair Ballot Language:

A “yes” vote establishes a constitutional right to make decisions about reproductive health care, including abortion and contraceptives, with any governmental interference of that right presumed invalid; removes Missouri's ban on abortion; allows regulation of reproductive health care to improve or maintain the health of the patient; requires the government not to discriminate, in government programs, funding, and other activities, against persons providing or obtaining reproductive health care; and allows abortion to be restricted or banned after Fetal Viability except to protect the life or health of the woman. A “no” vote will continue the statutory prohibition of abortion in Missouri. If passed, this measure may reduce local taxes while the impact to state taxes is unknown. --DO NOT LET THIS SCARE YOU! A YES ON 3 GIVES REPRODUCTIVE FREEDOM BACK TO THE MISSOURI PEOPLE! PLEASE PROTECT WOMAN'S RIGHT TO CHOOSE! PLEASE PROTECT THEIR HEALTH AND SAFETY!

READ MORE ON AMENDMENT 3 HERE

-Amendment 5 (allows the addition of exactly one more gambling boat license on a specific portion of the Osage River)

Do you want to amend the Missouri Constitution to: State governmental entities estimate one-time costs of $763,000, ongoing costs of $2.2 million annually, initial fee revenue of $271,000, ongoing admission and other fee revenue of $2.1 million annually, and annual gaming tax revenue of $14.3 million. Local governments estimate unknown revenue.

Fair Ballot Language:

A “yes” vote will amend the Missouri Constitution to allow the Missouri Gaming Commission to issue an additional gambling boat license to operate an excursion gambling boat on the Osage River, between the Missouri River and the Bagnell Dam. All state revenue derived from the issuance of the gambling boat license shall be appropriated to early-childhood literacy programs in public institutions of elementary education. A “no” vote will not amend the Missouri Constitution regarding gambling boat licensure. If passed, this measure will have no impact on taxes. -- THOUGH I WONDER IF THERE IS ANYTHING IN WRITING THAT GUARANTEES THAT MONEY WILL GO TO THE SCHOOLS?

READ MORE ON AMENDMENT 5 HERE

-Amendment 6 ("Shall the Missouri Constitution be amended to provide that the administration of justice shall include the levying of costs and fees to support salaries and benefits for certain current and former law enforcement personnel? State and local governmental entities estimate an unknown fiscal impact."

Shall the Missouri Constitution be amended to provide that the administration of justice shall include the levying of costs and fees to support salaries and benefits for certain current and former law enforcement personnel? State and local governmental entities estimate an unknown fiscal impact.

Fair Ballot Language:

A “yes” vote will amend the Missouri Constitution to levy costs and fees to support salaries and benefits for current and former sheriffs, prosecuting attorneys, and circuit attorneys to ensure all Missourians have access to the courts of justice. A “no” vote will not amend the Missouri Constitution to levy costs and fees related to current or former sheriffs, prosecuting attorneys and circuit attorneys. If passed, this measure will have no impact on taxes.

READ MORE ON AMENDMENT 6 HERE

-Amendment 7 (the "ranked choice voting" amendment; "make the Constitution consistent with state law by allowing only citizens of the US to vote, prohibit ranking of candidates by limiting voters to a single vote per candidate or issue, and require the plurality winner of a political party primary to be the single candidate at the general election")

Shall the Missouri Constitution be amended to: State and local governmental entities estimate no costs or savings.

Fair Ballot Language:

A “yes” vote will amend the Missouri Constitution to specify that only United States citizens are entitled to vote, voters shall only have a single vote for each candidate or issue, restrict any type of ranking of candidates for a particular office and require the person receiving the greatest number of votes at the primary election as a party candidate for an office shall be the only candidate for that party at the general election, and require the person receiving the greatest number of votes for each office at the general election shall be declared the winner. This provision does not apply to any nonpartisan municipal election held in a city that had an ordinance in effect as of November 5, 2024, that requires a preliminary election at which more than one candidate advances to a subsequent election. A “no” vote will not amend the Missouri Constitution to make any changes to how voters vote in primary and general elections. If passed, this measure will have no impact on taxes.

READ MORE ON AMENDMENT 7 HERE. THERE IS SOMETHING VERY STRANGE ABOUT THE WORDING!

-Proposition A (minimum wage increase to $15/hr, by incremental yearly increases until 2026 where it will reach $15/hr) (edited)

Do you want to amend Missouri law to: State governmental entities estimate one-time costs ranging from $0 to $53,000, and ongoing costs ranging from $0 to at least $256,000 per year by 2027. State and local government tax revenue could change by an unknown annual amount depending on business decisions.

Fair Ballot Language:

A “yes” vote will amend Missouri statutes to increase the state minimum wage beginning January 1, 2025 to $13.75 per hour and increase the hourly rate $1.25, to $15.00 per hour beginning January 2026. Annually the minimum wage will be adjusted based on the Consumer Price Index. The law will require employers with fifteen or more employees to provide one hour of paid sick leave for every thirty hours worked. The amendment will exempt governmental entities, political subdivisions, school districts and education institutions from the minimum wage increase. A “no” vote will not amend Missouri law to make changes to the state minimum wage law. If passed, this measure will have no impact on taxes.

READ MORE ON PROP A HERE

Practice makes perfect! Click here to view the Sample Ballot so you know what you're looking at on November 5th!

I know it seems like this is a LOT of information (and it is! I'm tired of looking at it!!) but it's *designed* to be a lot of information to scare regular folks like you and me from voting in our best interests!

THIS ELECTION IS NOT ONE TO SLEEP ON! WE NEED EVERY VOTE, EVERY VOICE TO ENSURE THE PROTECTION OF OUR FREEDOMS! PLEASE VOTE NOT JUST FOR YOURSELF, BUT FOR YOUR FRIENDS, YOUR FAMILY, YOUR COMMUNITY AND YOUR FUTURE!

WHEN AMERICA COUGHS THE WHOLE WORLD WILL CATCH A COLD!

VOTE BLUE! VOTE DEMOCRATS!

Worried about remembering everything? Take an index card and write down all the measures you're voting for! Keep it in your pocket and use it to help you remember when you're at the polls!

Worried about your conservative family finding out? That's the neat thing! They don't have to know! You don't have to tell them! It's private!

#vote#election 2024#us election#missouri#missouri ballot#ballots#ballotpedia#democrats#vote blue#all the way through#Kamala Harris#Tim Walz#Crystal Quade#2024 presidential election#Yes On 3#reproductive health#reproductive rights#reproductive freedom#voting#voting matters#voter registration#voter rights#america#usa#united states of america#let your voice be heard#president kamala harris#freedom#liberalism#politics

43 notes

·

View notes

Quote

Musk's ownership of the site – which he calls “X” – has led to a 52% loss in advertising revenue and a 73% decrease in the app’s value since 2022. But he doesn’t see this as a loss. Instead, it’s an investment in his desire to create a world governed by “strict father” morality.

Beware Trump's secret weapon: Elon Musk's X-Twitter

68 notes

·

View notes

Text

Just a gentle reminder: weight loss is not inherently good. Fatness is not inherently bad. Losing weight is not always medically necessary or even advisable.

I'm a little concerned about the number of people I know who are suddenly on a GLP-1 injection for weight-loss purposes. Remember, you have been conditioned by decades of "feel bad about yourself, feel like you're too fat to belong, be ashamed of what you look like" propaganda. That's from advertisers, the fashion industry, the make-up industry, doctors, the government... the list goes on. That message absolutely impacts everyone, but it is heavily targeted toward anyone presenting as female.

Take a second to remember that your weight has nothing to do with anything but your weight. It is not an indicator of your self-control, your willingness to exercise, or your morality.

Studies linking obesity with negative health outcomes are being questioned in a way they never have before. There is very likely no medical reason that you need to lose weight. And if there is a medical reason, it is far healthier to take a close look at your eating and exercise habits. (And sleep, and water consumption, and, and, and). Even if you're doing everything right, not everyone is going to be a size 0. Most of us just aren't built that way.

GLP-1 injections commonly cause nausea, vomiting, and constipation. In extreme cases, it has been known to cause blockages in the intestines. There are risks to using them.

Also, not gonna lie, I think it's weird that GLP-1s were fast-tracked to be part of the prescription drug price negotiations. Everything else on the list for 2025 is for cancer, COPD, pulmonary fibrosis, asthma, etc. (https://www.cms.gov/newsroom/press-releases/hhs-announces-15-additional-drugs-selected-medicare-drug-price-negotiations-continued-effort-lower)

Eli Lilly, one of the main providers of GLP-1s, posted revenue of 45 billion dollars last year. Billion. That's a 32% growth over 2023's revenue.

I think I've lost my point in writing all of this, but... Please, friends. PLEASE remember that there is nothing wrong with being fat. It is in several dozen companies' best interest to convince you that there is something wrong with being fat and that they have the cure.

Don't fall for it.

#fat positvity#prescription drugs#body positivity#health#health and wellness#ink thinks#anti advertising

17 notes

·

View notes

Photo

Cicero & the Catiline Conspiracy

The Roman Republic was in death's throes. Within a few short years, the “dictator for life” Julius Caesar would be assassinated, and, as a result, the government would descend into chaos. The consequence of a long civil war would bring the birth of an empire under the watchful eye of an emperor; however, it would also witness the loss of many personal liberties - liberties that were the pride of the people and the result of a long history of struggle and strife. Nevertheless, that was in the future - the year is 63 BCE and the city of Rome and the foundation of the Republic is being threatened. Luckily, one man would rise amidst the disorder, at least in his mind, to save it.

Rome's Economic Crisis

The year 63 BCE saw Rome as a city of almost one million residents, governing an empire that ranged from Hispania in the west to Syria in Middle East and from Gaul in the north to the deserts of Africa. Outside the eternal city, in the provinces, the next few decades would bring a strengthening of the borders - Pompey battling King Mithridates of Pontus in the East while Julius Caesar fought the assorted tribes of Gaul and Germany to the north, but at home Rome was facing an internal threat. The difficulties on the home front stemmed from troubles developing in the eastern provinces.

A significant decrease in trade and the resulting loss of tax revenue resulted in an increase in debt among many of the more affluent Romans. Unemployment in the city was high. The Roman Senate stood silent, unable or unwilling to come to a solution. The people longed for a hero, namely the ever-popular Pompey, to return and bring a remedy. In the meantime, however, there was serious - or so it appeared - unrest, an unrest that led to a conspiracy, a supposed conspiracy that threatened not only the lives of the people who lived within the walls of Rome but also the city itself.

Continue reading...

42 notes

·

View notes

Text

On the picket line the other day, I saw a former lecturer of mine, and we got talking. Part of the whole dispute we in UCU are involved in is around the fact that Higher Education as a sector has over £40 billion in reserves nationwide, and many universities have chosen to dump that into vanity projects like shiny new buildings (many of which are both exorbitantly expensive and also not fit-for-purpose), rather than invest in staff during the biggest cost of living crisis in living memory.

My former lecturer, a staunch liberal, intimated that £40 billion seems like a lot, so who knows if that money even exists. So I told him, here’s what I do know: three years ago, my managers, who were responsible for allocating a £5 million bid of government funding, ignored the advice of me and another expert on practical teaching equipment, and chose instead to spend more on products from existing contracts. This could be seen as corruption, but technically I think it’s just laziness. But it also amounts to a mutual agreement among university management and external contractors and suppliers to continue to profit off government funds, rather than invest in staff.

Over the last ten years, workers across Higher Education are being paid 25% less in real terms, due to stagnating wages, due to inflation, due to increased cost of living. This is to say nothing of the fallout from covid, or the arguably substantial decline in education standards new students receive (in spite of all the money dumped into new buildings and equipment).

Meanwhile, my institution’s student intake has nearly doubled in the past five years, which both means greater workload and, in theory, greater revenue. But who sees that money? Not me, nor even the lecturers who make twice as much as me, but you can bet that money is going somewhere.

Initially we had no offer of increased pay, then we went on strike and got an offer of 3% (again, in the face of a loss of 25% over the last decade in real terms), and then 5%. These ‘offers’ have been overwhelmingly rejected by UCU members, in part because they prove that that money does exist, and is available for our employers to give us our due. But more importantly, this is not just about pay, and the problems of workloads, pensions, mismanagement, and discrimination, which sparked the current strikes, won’t be solved by throwing money at them.

Nevertheless, slowly but surely, we are making advances. Industrial action works. Support the Unions and support the strikes!

Solidarity forever.

#UCUrising#UCU#UK politics#strikes#strike action#industrial action#original#University & College Union#trade union#labour union#up the union!

520 notes

·

View notes

Text

They are trying to illegally fire tens of thousands of Federal workers at the worst possible time of year. These are middle class to lower middle class people in DC and probably about a third or so of them voted for Trump. Contrary to publican opinion nobody gets rich working for the Federal government, especially in a major city where the cost of living is very high as are mortgages and rents. A disproportionate number of them are African-American, women, and other marginalized people since government employment is a safe haven for them with the added safety of being largely Unionized. To be honest there aren’t a lot of jobs open in the DC area with the pay and benefits of a unionized government job.

Musk is trying to run the government as if it were a business and that model does not apply. Government is not supposed to make a profit or pay dividends to shareholders. The primary purpose of government is to SPEND money to improve the lives and safety of all Americans.

Mass firings will not only ruin the lives of those removed from employment but it will have a ripple effect throughout the greater DC, Virginia, and Maryland area. All retail outlets will suffer immediately from lost business. Community and social services will be strained to the breaking point by hordes of people becoming unemployed all at once. The housing and rental market will collapse. Banks and Credit Unions will be stressed by loss of revenue. Families will dissolve and suicides will increase and so on. For those of you who don’t have sympathy for Federal employees, wait until the inconvenience of having almost no government services available to you strikes home. Think of the benefits that will be cut off. Think of the aid you won’t be able to receive when something goes wrong in your. Wait until you try to call a government agency to correct something to find out it doesn’t exist or is run by a skeleton crew.

You can look up the salaries of the rank and file workers and see it’s not great especially for one of the priciest markets in the country. This is a cold and heartless move which will have a devastating impact on large numbers of real people. It won’t just be in DC because they plan on spreading to field offices around the country so the pain will begin to seep into every county in the nation.

Government is not as simplistic as a business and can’t be run like one or by business people, entrepreneurs, oligarchs, CEO’s etc. Republicans, and other thoughtless people, need to separate themselves from the notion that someone who runs a business can run a country, or even a government agency. Diplomacy for example is much more complicated than a simple business deal. Diplomats spend lifetimes working on treaties and international agreements that will be in effect for decades or even centuries. It takes detailed knowledge of the past, current demographics and their needs, and years of forethought to play out every possible outcome of a treaty. Each word and phrase is excruciatingly analyzed for months or even years to achieve the desired effect and avoid any misinterpretations, misunderstandings, or vagaries of translation.

Treaties and national policy can’t be rationally drawn up by amateurs over a drunken round of golf, or a drunken steak dinner, or an amateurish conference call with the complexities of foreign languages which required highly skilled diplomatic translators who know the particularities of not only the mother tongue but each regional accent and dialect to avoid any posssible faux pas.

Trump and his henchmen are arrogant, poorly educated, unqualified, and often inebriated bigots and racists trying to run the world’s largest and most complex governing body as if it were a chain restaurant franchise.

Have you noticed yet nobody is talking about cutting aid to big energy companies, airlines, big pharma, or virtually any big corporate enterprise. Felon Muskrat says he’s uncovered billions in corruption and waste at every federal agency, in only a week. Felon hasn’t offered one scrap of documentation or proof though and neither had Trump. The media reports their claims of billions in waste and the Republican voters accept it as true. After a few weeks of hearing it in the news many of you will accept the lie as truth simply because you’ve heard it so often.

They are deliberately trying to overwhelm you, distract you, and wear you out. Democratic lawmakers trying to enter the very Federal agencies they fund have been locked out and kept at bay by armed private security wearing no identification and unwilling to state their names. Unwilling to say anything except you can’t enter.

They are pushing back but most of you seem to have forgotten that they became the minority party in both houses of Congress and the minority doesn’t have the ability to win a vote and pass anything or do anything other than protest and try to delay. Fortunately majority labor unions are out protesting in front of all the major agencies being targeted so far. Protests are also happing in some big cities but you’d never know it because it is virtually ignored as always by tv news.

#USAID#dismantling American government#this only benefits oligarchs and foreign adversaries#causing widespread unemployment and lack of services#republican assholes#maga morons#crooked donald#traitor trump#Felon Musk#republican family values

71 notes

·

View notes

Text

The new tariffs imposed by the U.S. on China, Mexico, and Canada will have widespread effects on American goods and services. Here’s how they are likely to impact different aspects of the economy:

1. Higher Costs for Businesses and Consumers

Many American businesses rely on imported materials, components, and products from these countries. Tariffs increase the cost of these imports, forcing companies to either absorb the costs (reducing profits) or pass them on to consumers.

Industries such as automotive, electronics, manufacturing, and retail will see price hikes, making everyday goods more expensive for American consumers.

2. Inflationary Pressure

Tariffs function like a tax on imported goods, leading to higher prices across the board.

If companies pass increased costs to consumers, inflation could rise, making goods and services more expensive and potentially prompting the Federal Reserve to reconsider interest rate policies.

3. Supply Chain Disruptions & Business Uncertainty

Companies that rely on raw materials, electronics, and auto parts from these countries may face delays and shortages, forcing them to find alternative suppliers or move production, which takes time and money.

Some businesses might restructure their supply chains by sourcing materials from other countries or increasing domestic production, but this transition isn't immediate and could further increase costs.

4. Retaliation from Trading Partners

Canada, Mexico, and China have signaled that they may impose their own tariffs on U.S. exports, which could hurt American industries that depend on international trade, such as agriculture, aerospace, and manufacturing.

Farmers, in particular, could face declining demand for crops like soybeans, corn, and dairy products, which were previously targeted in retaliatory tariffs during the Trump-era trade war.

5. Impact on the Stock Market & Business Investment

Investors dislike uncertainty. If businesses anticipate lower profits due to higher costs or potential trade disruptions, stock markets may react negatively.

Companies may delay hiring or expansion plans due to concerns over higher operational costs and shifting trade dynamics.

6. Possible Job Losses in Affected Industries

If businesses face significantly higher costs and declining demand due to retaliatory tariffs, some industries could see layoffs or reduced hiring.

Manufacturing and export-dependent sectors, such as automotive, steel, and agriculture, may be hit the hardest.

Potential Silver Linings

Some industries, like domestic manufacturing and steel production, could see short-term gains if companies decide to shift production back to the U.S. instead of relying on imports.

The government may use tariff revenues to invest in domestic industries or subsidies, potentially offsetting some negative effects.

Bottom Line

The new tariffs will likely increase costs for businesses and consumers, contribute to inflation, and create uncertainty in financial markets and supply chains. While some domestic industries might benefit, the risk of retaliatory tariffs and economic slowdown poses a challenge for the broader U.S. economy.

13 notes

·

View notes

Text

Brazilian Floods Are Inflicting Billions in Economic Devastation

The floods and severe rainfall that ravaged Southern Brazil are hurting the nation’s powerhouse agricultural sector, with industries from auto manufacturing to banking and insurance also bracing for disruption.

Heavy rains in Rio Grande do Sul, Brazil’s southernmost state, left entire cities under water and shut down its main airport indefinitely. More than 400 municipalities and 1.5 million people have been affected, according to the latest government data. About 164,000 residents have been displaced and 100 died as a result of the downpour, which started April 28.

Initial estimates from Enki Research suggest an economic impact of at least $2.5 billion in the state. That preliminary number, based on research models and satellite data, is expected to grow as water levels are still high and more storms are expected for the region in coming days.

“That is physical damage to infrastructure and agriculture, along with business revenue losses not recovered within six months,” said Enki’s Chuck Watson. “More rain is forecast over the next week so unfortunately it will probably get worse.”

Continue reading.

#brazil#brazilian politics#politics#environmental justice#economy#rio grande do sul floods 2024#mod nise da silveira#image description in alt

38 notes

·

View notes