#Global stocks

Explore tagged Tumblr posts

Text

Global Stocks Fall as Investors Stress Over Recession

cThe S&P 500 file in the US fell 1.1%, the Stoxx Europe 600 list fell 1.2%, and the MSCI Asia Pacific Record fell 1.3%. The auction was set off by various elements, including: Worries about the conflict in Ukraine and its effect on the global economy. Rising expansion and the possibility of additional loan cost climbs from national banks. A stoppage in monetary development in China and other…

View On WordPress

#Asset values#Bear market#Economic crisis#Economic downturn#Equity markets#Financial markets#Global stocks#Investment#Investor concerns#Market sell-off#Market volatility#Recession#Stock Market#Stock prices

0 notes

Text

Been calling this for a while. Things are going to get messy.

Tech stocks are taking a heavy beating.

242 notes

·

View notes

Text

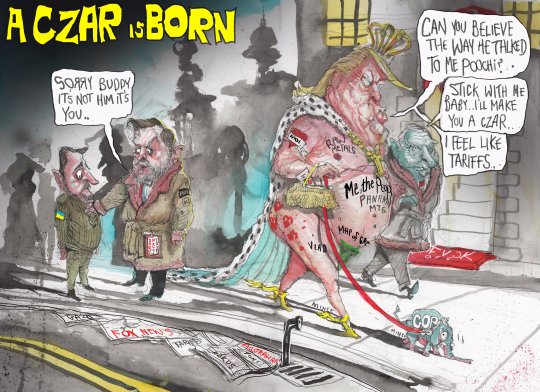

stick with me baby.. @FinancialReview :: [Dave]

* * * *

LETTERS FROM AN AMERICAN

March 3, 2025

Heather Cox Richardson

Mar 04, 2025

As seemed evident even at the time, the ambush of Ukraine president Volodymyr Zelensky in the Oval Office on Friday was a setup to provide justification for cutting off congressionally approved aid to Ukraine as it tries to fight off Russia’s invasion. That “impoundment” of funds Congress has determined should go to Ukraine is illegal under the terms of the 1974 Impoundment Control Act, and it is unconstitutional because the Constitution gives to Congress, not to the president, the power to set government spending and to make laws. The president’s job is to “take Care that the Laws be faithfully executed.”

It was for a similar impoundment of congressionally appropriated funds for Ukraine, holding them back until Zelensky agreed to tilt the 2020 election by smearing Joe Biden, that the House of Representatives impeached Trump in 2019. It is not hard to imagine that Trump chose to repeat that performance, in public this time, as a demonstration of his determination to act as he wishes regardless of laws and Constitution.

On Sunday, Nicholas Enrich, the acting assistant administrator for global health at the United States Agency for International Development (USAID) released a series of memos he and other senior career officials had written, recording in detail how the cuts to “lifesaving humanitarian assistance” at the agency will lead to “preventable death” and make the U.S. less safe. The cuts will “no doubt result in preventable death, destabilization, and threats to national security on a massive scale,” one memo read.

Enrich estimated that without USAID intervention, more than 16 million pregnant women and more than 11 million newborns would not get medical care; more than 14 million children would not get care for pneumonia and diarrhea (among the top causes of preventable deaths for children under the age of 5); 200,000 children would be paralyzed with polio; and 1 million children would not be treated for severe acute malnutrition. There would be an additional 12.5 million or more cases of malaria this year, meaning 71,000 to 166,000 deaths; a 28–32% increase in tuberculosis; as many as 775 million cases of avian flu; 2.3 million additional deaths a year in children who could not be vaccinated against diseases; additional cases of Ebola and mpox. The higher rates of illness will take a toll on economic development in developing countries, and both the diseases and the economic stagnation will spill over into the United States.

Although Secretary of State Marco Rubio promised to create a system for waivers to protect that lifesaving aid, the cuts appear random and the system for reversing them remains unworkable. The programs remain shuttered. Enrich blamed "political leadership at USAID, the Department of State, and DOGE, who have created and continue to create intentional and/or unintentional obstacles that have wholly prevented implementation."

On Sunday, Enrich sent another memo to staff, thanking them for their work and telling them he had been placed on “administrative leave, effective immediately.”

Dangerous cuts are taking place in the United States, as well. On Friday, on Joe Rogan’s podcast, Musk called Social Security, the basis of the U.S. social safety net, a “Ponzi scheme.” Also on Friday, the Social Security Administration announced that it will consolidate the current ten regional offices it maintains into four and cut at least 7,000 jobs from an agency that is already at a 50-year staffing low. Erich Wagner of Government Executive reported that billionaire Elon Musk’s “Department of Government Efficiency” (DOGE) team had canceled the leases for 45 of the agency’s field offices and is urging employees to quit.

The acting commissioner of the agency, Leland Dudek, a mid-level staffer who got his post after sharing sensitive information with DOGE, blamed former president Joe Biden for the cuts. In contrast, Senator Ron Wyden (D-OR) pointed out that the system currently delivers 99.7% of retirement benefits accurately and on time. He warned that the administration is hollowing it out, and when it can no longer function, Republicans will say it needs the private sector to take it over. He called the cuts “a prelude to privatization.”

“The public is going to suffer terribly as a result of this,” a senior official told NPR. “Local field offices will close, hold times will increase, and people will be sicker, hungry, or die when checks don't arrive or a disability hearing is delayed just one month too late.”

In South Carolina, North Carolina, and Georgia, more than 200 wildfires began to burn over the weekend as dry conditions and high winds drove the flames. Firefighters from the Forest Service helped to contain the fires, but they were understaffed even before Trump took office. Now, with the new cuts to the service, prevention measures are impossible and there aren’t enough people to fight fires effectively and safely. South Carolina governor Henry McMaster (R) declared a state of emergency on Sunday.

Josh Marshall at Talking Points Memo picked up something many of us missed, posting today that Trump’s February 11 “workforce optimization” executive order is a clear blueprint for the end goal of all the cuts to the federal government. The order says that departments and agencies must plan to cut all functions and employees who are not designated as essential during a government shutdown. As Marshall notes, this is basically a blueprint for a skeleton crew version of government.

But for all that the administration, led by DOGE, insists that the U.S. has no money for the government services that help ordinary people, it appears to think there is plenty of money to help wealthy supporters. In February, the cryptocurrency bitcoin experienced its biggest monthly drop since June 2022, falling by 17.5%. On Sunday, in a post on his social media site, Trump announced that the government will create a strategic stockpile of five cryptocurrencies, spending tax dollars to buy them.

Supporters say that such an investment could pay off in decades, when that currency has appreciated to become worth trillions of dollars. But, as Zachary B. Wolf of CNN notes, “for every bitcoin evangelist, there is an academic or banker from across the political spectrum who will point out that cryptocurrency investments might just as easily go up in smoke, which would be an unfortunate thing to happen to taxpayer dollars.”

The first three currencies Trump announced were not well known, and the announcement sent their prices soaring. Hours later, he added the names of the two biggest cryptocurrencies, including bitcoin. After the initial surges, by Monday prices for the currencies had fallen roughly back to where they had been before the announcement, making the announcement look like a pump-and-dump scheme. Economist Peter Schiff, a Trump supporter, called for a full congressional investigation, suggesting that someone other than Trump might have written the social media posts that set off the frenzy and wondering who was buying and selling in that short window of time.

Also on Sunday, the administration announced it would stop enforcing anti-money-laundering laws that were put in place over Trump’s veto in 2021 at the end of his first term and required shell companies to identify the people who own or control them. Referring to the law as a “Biden rule,” Trump called the announcement that he would not enforce it “Exciting News!” The Trump Organization frequently uses shell companies.

A world in which the government does not regulate business or address social welfare or infrastructure, claiming instead to promote economic development by funneling resources to wealthy business leaders, looks much like the late-nineteenth-century world that Trump praises. Trump insists that President William McKinley, who was president from 1897 to 1901, created the nation’s most prosperous era by imposing high tariffs on products from foreign countries.

Trump confirmed today that he will go forward with his own 25% tariffs on goods from Mexico and Canada and an additional 10% on goods from China, adding to the 10% tariffs Trump added to Chinese products in February. While President Joe Biden maintained tariffs on only certain products from China to protect specific industries, it appears Trump’s tariffs will cover all products.

Prime Minister Justin Trudeau of Canada called the tariffs “unjustified” and announced that Canada will put retaliatory tariffs on $20.8 billion worth of U.S. products made primarily in Republican-dominated states, including spirits, beer, wine, cosmetics, appliances, orange juice, peanut butter, clothing, footwear, and paper. A second set of tariffs in a few weeks will target about $90 billion worth of products, including cars and trucks, EVs, products made of steel and aluminum, fruits and vegetables, beef, pork, and dairy products.

Mexico’s president Claudia Sheinbaum did not provide details of what her country would do but told reporters today: “We have a plan B, C, D.” Chinese officials say that China, too, will impose retaliatory tariffs, singling out agricultural products and placing tariffs of 15% on corn and 10% on soybeans. It also says it will restrict exports to 15 U.S. companies.

The tariffs in place in the U.S. at the end of the nineteenth century were less important for the explosive growth of the economy in that era than the flood of foreign capital into private businesses: railroad, mining, cattle, department stores, and finance. By the end of the century, investing in America was such a busy trade that the London Stock Exchange had a separate section for American railroad transactions alone.

And the economic growth of the country did not help everyone equally. While industrialists like Cornelius Vanderbilt II could build 70-room summer homes in Newport, Rhode Island, the workers whose labor kept the mines and factories producing toiled fourteen to sixteen hours a day in dangerous conditions for little money, with no workmen’s compensation or disability insurance if they were injured. The era has become known as the Gilded Age, dominated by so-called robber barons.

Today, the stock market dropped dramatically upon news that Trump intended to go through with his tariffs. The Dow Jones Industrial Average dropped 650 points, down 1.48%. The S&P fell 1.76%, and the Nasdaq Composite, which focuses on technology stocks, fell 2.64%. Meanwhile, shares of European defense companies jumped to record highs as Europe moves to replace the U.S. support for Ukraine.

Also today, the Federal Reserve Bank of Atlanta forecast a dramatic contraction in the economy in the first quarter of 2025. Evaluating current data according to a mathematical model, it moved from an expected 2.9% growth in gross domestic product at the end of January to –2.8% today. That is just a prediction and there is still room for those numbers to turn around, but they might help to explain why Commerce Secretary Howard Lutnick is talking about changing the way the U.S. calculates economic growth.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters From An American#Dave#Financial Times#Social Security#stock market#Federal Reserve Bank#The economy#tariffs#DOGE#USAID#Global Health

56 notes

·

View notes

Text

Most diseases can already be erradicated by concerted efforts like it was done with smallpox and will soon be done with polio and perhaps rabies. It's just that those efforts involve helping third world countries, and nobody's stocks get filled by that unless they extract something in return

#people look at me like I'm crazy when I say there will be and there must be a socialist world republic#but imagine what a global state might accomplish when it's not beholden to stock prices#cosas mias

149 notes

·

View notes

Text

#i hate my son#i hate stock loss#yucky you#dale dimmadome owner of dimmadome global and dimmazon is so hot

9 notes

·

View notes

Text

#stock market#youtube#picoftheday#investing#news#yahoo finance#msnbc#msnbc news#yahoo#yahoo.com#facebook#linkedin#whatsapp#forums#google#market#world news#marketing#hot pink#pink#pinkcore#pink blog#light pink#advertising#marketplace#global#stock#bank of america#america#american

10 notes

·

View notes

Text

#CANDLE FLICKERS#STEPHAN MOCCIO#WAYLAND ANDERSON#GLOBAL NEWS#BREAKING NEWS#TRENDING NEWS#WORLD NEWS#POLITICAL NEWS#BUSINESS NEWS#ECONOMIC NEWS#SOCIAL NEWS#CRPTO NEWS#BITCOM NEWS#REAL ESTATE NEWS#INVESTMENT NEWS#TRADING NEWS#STOCK NEWS#TRENDONG NEWS#MEN OF BALLET#BALLET MEN#BALLET#DANCE#DANSEUR#SOCCER#FOOTBALL#BASEBALL#HOCKEY#MAN#MEN#MALE

3 notes

·

View notes

Text

The United States’ stock market has taken another tumble following US President Donald Trump’s threat to impose steep tariffs on wine and other alcoholic products from the European Union. The benchmark S&P 500 fell 1.39 percent on Thursday, dragging the index into a correction – Wall Street lingo for a decline of 10 percent or more from the peak.

Continue Reading.

6 notes

·

View notes

Text

Mixed start for global markets today! Explore: https://markets.tradermade.com/forex/forex-newsletter-mixed-start-with-kiwi-nok-gaining. Forex: $NZD & $NOK shine, $JPY & $CHF lag. Asia-Pac surges, Europe flat, US markets up. The energy picks up, and precious metals are mixed.

4 notes

·

View notes

Text

A raw chicken would be more prepared than what I am for tomorrow's exam.

#please pray for me#ab to rona bhi nahi aa rha#itni halat khasta hai#MAY THE STOCK MARKETS GLOBALLY ALL BLAST#/j obviously

2 notes

·

View notes

Text

Global markets doing fine. US markets not at all. Wonder what that's about?

23 notes

·

View notes

Text

#1. Global Politics#“2024 US Election”#“Russia Ukraine conflict”#“China Taiwan tensions”#“Israel Palestine ceasefire”#“NATO expansion”#2. Technology & Innovation#“AI advancements”#“Quantum computing breakthroughs”#“ChatGPT updates”#“5G technology”#“Electric vehicles news”#3. Climate & Environment#“Climate change summit”#“Carbon capture technology”#“Wildfires 2024”#“Renewable energy news”#“Green energy investments”#4. Business & Economy#“Stock market news”#“Global inflation rates”#“Cryptocurrency market trends”#“Tech IPOs 2024”#“Supply chain disruptions”#5. Health & Wellness#“COVID-19 variants”#“Mental health awareness”#“Vaccine development”#“Obesity treatment breakthroughs”#“Telemedicine growth”

2 notes

·

View notes

Note

Have you considered going into politics? I'm certain you can buy your way into the oval office and gain even more power. Imagine the profits!

Hmm, more profits... That sounds like a wonderful idea! Which one of you drones- slaves- I mean wallets, would like to help me achieve this endeavour?

#dale answers#i hate my son#i love the stock market#money is great#dale dimmadome owner of dimmadome global and dimmazon is so hot

7 notes

·

View notes

Video

youtube

Protestors target Tesla as backlash to Elon Musk's political power grows

#youtube#stock#stock market#politics#republicans#democrats#cspan#wall street#global#boycott tesla#tesla takedown#us politics

4 notes

·

View notes

Text

I know we’ve been propping up the global economy but I did not expect this much of a panic.

4 notes

·

View notes

Text

[Monday August 5th] The Global Market Crash: What Just Happened?

In recent weeks, the world’s financial markets took a huge hit, causing a lot of panic and confusion. This big drop, or "crash," has people worried about what it means for their money and the economy. So, what caused this, and what should we know about it?

What Caused the Crash? Rising Interest Rates: Central banks, like the Federal Reserve in the U.S., have been increasing interest rates to control inflation. Inflation is when prices for things like food and gas go up a lot. Higher interest rates make borrowing money more expensive, so people and businesses spend less. This decrease in spending can slow down the economy, leading to drops in stock prices.

Geopolitical Issues: Ongoing conflicts between countries and trade wars have made the global economy unstable. When countries impose sanctions or stop trading with each other, it can mess up supply chains and make investors nervous. Nervous investors often pull their money out of stocks, causing prices to fall even more.

Economic Slowdown: Lately, some of the world’s biggest economies, like the U.S. and China, have shown signs of slowing down. When the economy slows, businesses earn less money, and this often causes their stock prices to drop.

Tech Stocks Falling: Tech companies have been super popular with investors, but their stock prices got really high—maybe too high. When interest rates started going up, people began to worry that these companies might not be worth as much as they thought, leading to a big sell-off in tech stocks.

What Does This Mean? The market crash has caused a lot of people to lose money, especially those who have investments in stocks. While it’s normal to feel worried, it’s important to remember that markets have ups and downs. Some experts think this might just be a temporary setback, while others are more cautious and think the downturn could last a while.

For anyone investing, this crash is a reminder of how important it is to not put all your money in one place. Diversifying, or spreading out your investments, can help protect you from big losses. Even though it’s tempting to chase after the hottest stocks, having a balanced portfolio is usually a smarter move.

In the end, while this market crash is unsettling, it’s part of the natural cycle of the economy. Markets tend to recover over time, so staying calm and thinking long-term is the best strategy.

2 notes

·

View notes