#GOOD DEBT

Explore tagged Tumblr posts

Text

Understanding Good Debt: How Borrowing Wisely Can Help Build Wealth"

Debt can be a scary word, but not all debts are created equal. Some types of debt can actually be beneficial and help you achieve your financial goals. In this blog post, we’ll explore what is good debt and how it can be used to your advantage.

What is Good Debt?

Good debt is any debt that is used to acquire an asset or investment that will increase in value over time or provide long-term benefits. In other words, good debt is debt that helps you build wealth or improve your financial situation.

Examples of Good Debt

Student Loans

Student loans are a type of good debt because they help you invest in your education, which can lead to higher earning potential and career opportunities. Of course, it's important to manage your student loan debt wisely and avoid taking out more than you need.

Mortgages

A mortgage is a type of good debt because it allows you to purchase a home, which can increase in value over time and serve as a valuable asset. Additionally, owning a home provides long-term benefits, such as stability and the ability to build equity.

Small Business Loans

Small business loans can be a good debt if they are used to start or expand a profitable business. A successful business can generate income and provide financial security for years to come.

Car Loans

While a car loan is not typically considered an investment, it can be a type of good debt if it allows you to purchase a reliable vehicle that you need for work or other important activities.

Why is Good Debt Important?

Good debt is important because it can help you achieve your financial goals and build wealth over time. By using debt strategically, you can acquire valuable assets and investments that can provide long-term benefits.

It’s important to note that not all debt is good debt. High-interest credit card debt, for example, can quickly become a burden that eats away at your income and savings. It’s important to be cautious when taking on any type of debt and only borrow what you can afford to repay.

Final Thoughts

Debt can be a valuable tool for achieving your financial goals, but it’s important to use it wisely. Good debt can help you acquire valuable assets and investments that can provide long-term benefits and improve your financial situation. By being strategic and responsible with your debt, you can build wealth and achieve financial security over time.

#good debt#student loans#mortgages#small business loans#car loans#wealth building#financial goals#responsible borrowing

5 notes

·

View notes

Text

Understand the difference between good debt and bad debt for smarter financial decisions in India. Explore how to use debt strategically to build a secure future. Discover debt management strategies tailored for the Indian financial landscape. Learn how to leverage good debt for homeownership, education, and business ventures.

0 notes

Text

you're in the habit of denying yourself things.

if someone asked you directly, you would say that you love a little treat. you like iced coffee and getting the cookie. you drink juice out of a fancy cup sometimes, and often do use your candles until they gutter out helplessly.

but you hesitate about buying the 20 dollar hand mixer because, like. you could just use your arms. you weren't raised rich. you don't get to just spend the 20 dollars (remember when that could cover lunch?), at least - you don't spend that without agonizing over it first, trying to figure out the cost-benefits like you are defending yourself in front of a jury. yes, this rice cooker could seriously help you. but you do know how to make stovetop rice and it really isn't that hard. how many pies or brownies would you actually make, in order to make that hand mixer worthwhile?

what's wild is that if the money was for a friend, it would already be spent. you'd fork over 40 without blinking an eye, just to make them happy. the difference is that it's for you, so you need to justify it.

and it sneaks in. you ration yourself without meaning to - you don't finish the pint of ice cream, even though you want to. the next time you go to the store, you say ah, i really shouldn't, and then you walk away. you save little bits of your precious things - just in case. sometimes you even go so far as putting that one thing in your shopping cart. and then just leaving it there, because maybe-one-day, but not right now, there's other stuff going on.

you do self-care, of course. but you don't do it more than like, 3 days in a row. after that it just feels a little bit over-the-edge. like. you can't live in decadence, the economy is so bad right now, kid.

so you don't buy the rice cooker. you can-and-will spend the time over the stove. you can withstand the little sorrows. denial and discipline are practically synonyms. and you're not spoiled.

it's just - it's not always a rice cooker. sometimes it is a person or a job or a hug. sometimes it is asking for help. sometimes it is the summer and your college degree. sometimes it is looking down at scabbed knees and feeling a strange kind of falling, like you can't even recognize the girl you used to be. sometimes it is your handprint looking unsteady.

sometimes it is tuesday, and you didn't get fired, and you want to celebrate. but what is it you like, even? you search around your little heart and come up empty. you're so used to denying that all your desires draw a blank.

oh fuck. see, this is the perfect opportunity. if you had a mixer, you'd make a cake.

#warm up#this isn't good#writeblr#this is complicated by the fact i can't stand up too long or i fuckken pass out and <3 hit my damn head <3#but i did take a deep breath and buy myself the stupid rice cooker#and!!! a very cheap sushi kit!!! i have been wanting to try making sushi for literally YEARS#the kit was only like 15 dollars!!!! and i haven't purchased it bc?!!??!?!?!?!!?#..... i didn't get the mixer tho that felt. like a lot. like too much.#on my list is a kitchenaid. one day when i get a check and i have paid off my student debt#and medical debt#i will put that first little bit of cash#into a kitchenaid 5qt stand mixer (with attachments)#i really do just go into their refurbished section and stare lustily at each option#but yeah i feel guilty about the rice cooker even tho i know for a fact this damn thing is gonna be a lifesaver#oh shit also fuck i forgot to mention . poached eggs

31K notes

·

View notes

Text

Source

Source

Source

Source

Source

More of this

#cancel medical debt#news#current events#health care#health#good news#government#politics#us politics#the left#progressive#democrats

6K notes

·

View notes

Text

"In a major change that could affect millions of Americans' credit scores, the Consumer Financial Protection Bureau on Tuesday [January 7, 2025] finalized a rule to remove medical debt from consumer credit reports.

The rule would erase an estimated $49 billion in unpaid medical bills from the credit reports of roughly 15 million Americans, the CFPB said.

That could help boost those borrowers' credit scores by an average of 20 points, helping them qualify for mortgages and other loans.

"No one should be denied economic opportunity because they got sick or experienced a medical emergency," Vice President Kamala Harris said in a statement touting the new rule.

She announced the proposal for the rule last June alongside CFPB Director Rohit Chopra.

"This will be life-changing for millions of families, making it easier for them to be approved for a car loan, a home loan or a small-business loan," Harris added.

Major credit reporting agencies have already announced voluntary steps to remove medical debt from their reports.

The final rule is set to take effect in March [2025] – but that timeline could be delayed by legal challenges."

-via ABC News, January 7, 2025

#united states#north america#us politics#medical debt#public health#american healthcare#us healthcare#debt#debt relief#credit score#good news#hope

988 notes

·

View notes

Link

Bad debt is a financial burden that can affect individual person and as well as businesses . By understanding the reasons behind bad debt and exploring practical solutions, we can take good decisions to minimize its impact on our financial well-being.

In this article, we are going discuss the concept of bad debt. its causes and effective solutions.

0 notes

Text

Have you seen my little lad?

[First] Prev <–-> Next

#poorly drawn mdzs#mdzs#wei wuxian#jin zixun#Everytime I have to write his name I feel like I'm running outside in a blood rain trying not to get wet. Misspelling it feels so inevitabl#But so far so good! He doesn't have too many more appearances before he gets Cheesed.#Dear god I love it when characters go on the war path for someone they care about.#And I love it even more when you have an ambiguity between personal debt and genuine act of selflessness.#WWX saving WN is purposefully messy! Like a lot of our real life reasons for how we act - there isn't a clear single cause or answer.#Sometimes we forget that we are a collection of experiences and learnt reactions.#Sometimes we forget that what we see on the surface is not the point to address. Everyone is more complex than we think. Even yourself.#And yet...it always comes back to love doesn't it? Attachment styles and self-esteem and bonds and relationships to others.#Everything comes back to love and our perceptions of it.#WWX is on a self-destructive war path and he will absorb as much damage as he can for those he feels obligated and attached to.#Does it make him feel needed? Does it give him purpose? Does it ease anxieties of the past? I do not think there is an answer.

954 notes

·

View notes

Text

Dandelion News - January 15-21

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles!

1. Landmark debt swap to protect Indonesia’s coral reefs

“The government of Indonesia announced this week a deal to redirect more than US$ 35 million it owes to the United States into the conservation of coral reefs in the most biodiverse ocean area on Earth.”

2. [FWS] Provides Over $1.3 Billion to Support Fish and Wildlife Conservation and Outdoor Access

“Through these combined funds, agencies have supported monitoring and management of over 500 species of wild mammals and birds, annual stocking of over 1 billion fish, operations of fish and wildlife disease laboratories around the country, and provided hunter and aquatic education to millions of students.”

3. Philippine Indigenous communities restore a mountain forest to prevent urban flooding

“Indigenous knowledge systems and practices are considered in the project design, and its leaders and members have been involved throughout the process, from agreeing to participate to identifying suitable land and selecting plant species that naturally grow in the area.”

4. Responsible Offshore Wind Development is a Clear Win for Birds, the U.S. Economy, and our Climate

“[T]he total feasible offshore wind capacity along U.S. coasts is more than three times the total electricity generated nationwide in 2023. […] Proven strategies, such as reducing visible lights on turbines and using perching deterrents on turbines, have been effective in addressing bird impacts.”

5. Illinois awards $100M for electric truck charging corridor, Tesla to get $40M

“The project will facilitate the construction of 345 electric truck charging ports and pull-through truck charging stalls across 14 sites throughout Illinois[…. E]lectrifying [the 30,000 daily long-haul] trucks would make a huge impact in the public health and quality of life along the heavily populated roadways.”

6. Reinventing the South Florida seawall to help marine life, buffer rising seas

“[The new seawall] features raised areas inspired by mangrove roots that are intended to both provide nooks and crannies for fish and crabs and other marine creatures and also better absorb some of the impact from waves and storm surges.”

7. Long Beach Commits to 100% All-Electric Garbage Trucks

“[Diesel garbage trucks] produce around a quarter of all diesel pollution in California and contribute to 1,400 premature deaths every year. Electric options, on the other hand, are quieter than their diesel counterparts and produce zero tailpipe emissions.”

8. ‘This Is a Victory': Biden Affirms ERA Has Been 'Ratified' and Law of the Land

“President Joe Biden on Friday announced his administration's official opinion that the amendment is ratified and its protections against sex-based discrimination are enshrined in the U.S. Constitution.”

9. A Little-Known Clean Energy Solution Could Soon Reach ‘Liftoff’

“Ground source heat pumps could heat and cool the equivalent of 7 million homes by 2035—up from just over 1 million today[…. G]eothermal energy is generally considered to be more popular among Republicans than other forms of clean energy, such as wind and solar.”

10. Researchers combine citizens' help and cutting-edge tech to track biodiversity

“Researchers in the project, which runs from 2022 to 2026, are experimenting with tools like drones, cameras and sensors to collect detailed data on different species, [… and] Observation.org, a global biodiversity platform where people submit pictures of animals and plants, helping to identify and monitor them.”

January 8-14 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#good news#hopepunk#nature#national debt#coral reef#conservation#funding#fish and wildlife#philippines#indigenous#agroforestry#green infrastructure#offshore wind#wind energy#electric vehicles#illinois#florida#sea wall#habitat#california#equal rights#human rights#us politics#geothermal#biodiversity#citizen science#climate change#invasive species#endangered species#clean energy

272 notes

·

View notes

Text

as you can see, i'm a debt collector. and also, a total cat lover.

FIRST KANAPHAN as TIGER pilot trailer of CAT FOR CASH

#first kanaphan#firstkhao#firstkhaotung#gmmtv actors#thai actor#gmmtv boys#gmmtv actor#thai bl actor#cat for cash#gmmtv 2025#cat for cash the series#gmmtv series#thai bl#mlm#th: cat for cash#tigerlynx#bibi gifs#he's a professional debt collector clearly#but also#SOFT FIRST COME BACK#he's looking so good#so fluffy#so everything i've ever dreamed of

278 notes

·

View notes

Note

Can I pay you to make Binghe and SQQ kiss for real in their normal bodies? (They deserve to escape the skin body horror verse for a minute.)

LMAO yes you can!

#mushyrt#asks#svsss#tw: body horror#as a broke college student#I’ll gladly take a good bribe#I gotta pay for those atrocious fees somehow 🤡#I’M KIDDINGNHFDHJ#I’M NOT IN DEBT#college fees are atrocious but I’ve paid them off so far 😭#but I also love the idea that you pay me for a regular Binqiu smooch#have to pay me*#I’ve been having too much fun giving skin creatures smooches#sv creature

306 notes

·

View notes

Text

since 3DS online services are shutting down soon here's a quick little comic about one of my favourite interactions i had in new leaf like almost 10 years ago probably that i still think about + some photos i had saved

#i don't know where yume is now but i hope they're doing good#animal crossing new leaf#acnl#comic#my art#animal crossing#animal crossing furniture used to be so fun... new horizons would never...#for context: the crown is like a million bells and my broke animal crossing self could never afford that i was always in debt#i also didn't know how turnips worked until new horizons :)

435 notes

·

View notes

Text

Source

Source

Let’s go

#medical debt#health#health care#politics#us politics#government#the left#progressive#current events#news#good news#capitalism

398 notes

·

View notes

Text

Article

"Australian Prime Minister Anthony Albanese said on Sunday that his government planned to cut student loans for around three million Australians by 20%, wiping off around A$16 billion ($10 billion) in debts.

The move builds on May's budget, which attacked cost of living pressures in Australia and gave debt relief for students, as well as more investment to make medicines cheaper, and a boost to a rent assistance programme.

"This will help everyone with a student debt right now, whilst we work hard to deliver a better deal for every student in the years ahead," Albanese said in a statement announcing the cut to student loans for tertiary education.

The changes would mean the average graduate with a loan of A$27,600 would have A$5,520 wiped, the government said, adding that they would take effect from June 1, 2025.

The government said it already planned to cut the amount that Australians with a student debt have to repay per year and raise the threshold to start repayments.

If reelected at the next general election, due in 2025, Labor would also legislate to guarantee 100,000 free places each year at the country's Technical and Further Education institutes, Albanese said.

"This is a time for building, building better education for all," he said in a speech to supporters in South Australia state capital Adelaide.

Cost of living pressures, stoked by stubbornly high inflation, have a special resonance with a federal election looming and the centre-left Labor government now polling behind their conservative opponents.

(US$1 = 1.5246 Australian dollars)

-via Reuters, November 2, 2024

#australia#cost of living#labor government#college#student loans#student debt#student debt relief#good news#hope#auspol#australian politics

339 notes

·

View notes

Text

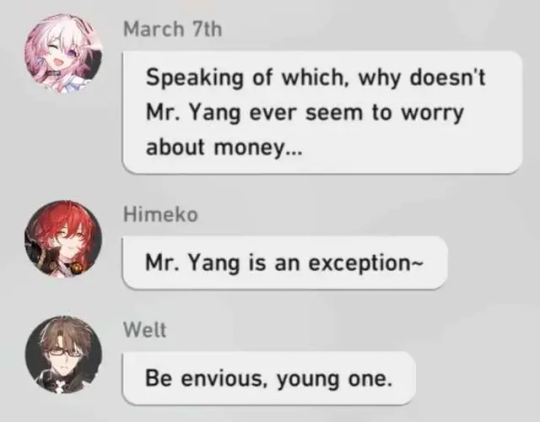

never not thinking about "be envious, young one" honestly

#he worked his way out of his initial debt like a good little old man#and now he gets to spend his hard earned trailblaze credits on whatever he wants#(mostly collectors figurines and weirdly niche books)#my tag#welt yang#welt yang posting

100 notes

·

View notes

Text

Dandelion News - January 1-7

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles!

1. Homes built with clay, grass, plastic and glass: How a Caribbean island is shying away from concrete

“[… Clay] traps moisture which then evaporates and pulls heat from the surface as it goes. […] The roof is covered in old recycled advertising banners and piece of a water tank, the other half of which is used to house some of Rahaman-Noronha's fish [… and] multi-coloured glass bottles inset into walls provide an avenue for streams of light and colour.”

2. To Combat Phoenix’s Extreme Heat, a New Program Provides Sustainable Shade

“The neighborhood workshops allow residents to get a shade plan tailored to their community’s needs and identify the locations where officials can plant trees. Meanwhile, the workforce-development side of the program creates the jobs needed to keep the trees alive for generations[….]”

3. Conservation corridors provide hope for Latin America’s felines

“[… S]cience has shown that to maintain healthy populations there needs to be connection between individuals. [… A] protected area that is close to another has more species and more potential for their survival.”

4. Social program cuts tuberculosis cases among Brazil's poorest by more than half

“The decrease [“in TB cases and deaths”] was over 50% in extremely poor people and more than 60% among the Indigenous populations. […] "We know that the program improves access to food [… and healthcare…] and strengthens people's immune defenses as a result.””

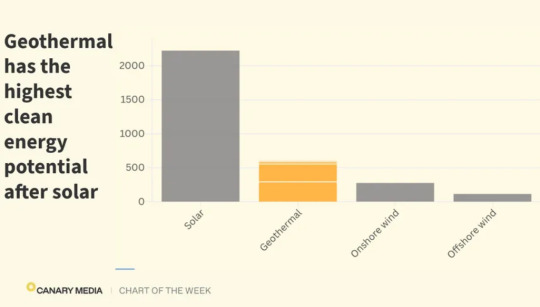

5. Geothermal has vast potential to meet the world’s power needs

“New geothermal systems could technically provide as much as 600 terawatts of carbon-free power capacity by 2050[…. C]ountries could cost-effectively deploy over 800 GW of geothermal power capacity using technology that’s in development today[….]”

6. New D.C. Catholic archbishop is pro-LGBTQ+ and anti-Trump

“In 2018, he objected to the blaming of gay priests for the clergy sexual abuse crisis, “saying that such abuse was a matter of power, not sexual orientation[….]” “We must disrupt those who portray refugees as enemies [… and] seek to rob our medical care, especially from the poor.””

7. Chesapeake Bay Will Gain New Wildlife Refuge

“The Chesapeake Bay area will have a new wildlife refuge for the first time in a quarter century. […] “This new refuge offers an opportunity to halt and even reverse biodiversity loss in this important place, and in a way that fully integrates and respects the leadership and rights of Indigenous peoples and local communities.””

8. Inside Svalbard seed vault’s critical mission to stop our favourite fruit and veg from going extinct

“[… T]he world’s largest secure seed storage […] sits proudly in a massive former coal mine[….] Right now, there are over 1,331,458 samples of 6,297 crop species. […] “During 2024, 61 seed genebanks deposited 64,331 seed samples, including 21 from institutes that deposited seeds for the first time this year[….]””

9. Medical debt will be erased from credit reports for all Americans under new federal rule

“The rule will affect more than 15 million Americans, raising their credit scores by an estimated average of 20 points. [… S]tates and localities have already utilized American Rescue Plan (ARP) funds to support the elimination of over $1 billion in medical debt for more than 700,000 Americans[….]”

10. 'Forgotten' water harvesting system transforms 'barren wasteland' into thriving farmland

“"The process started with the community-based participatory planning[….]” 10% to 15% of the water will actually soak into the ground to replenish the water table, creating a more sustainable agricultural process.”

December 22-28 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#recycling#upcycling#climate change#climate action#trees#habitat restoration#habitat#big cats#cats#latin america#brazil#tuberculosis#poverty#geothermal#clean energy#renewableenergy#catholic#lgbt+#lgbt#lgbtq#religion#christianity#wildlife refuge#wildlife#seed saving#seed bank#medical debt#anti capitalism

297 notes

·

View notes

Text

But HP is still in business. Apple is still in business. Google is still in business. Microsoft is still in business. IBM is still in business. Facebook is still in business.

We don’t have those controlled burns anymore. Yesterday’s giants tower over all, forming a thick canopy. The internet is “five giant websites, each filled with screenshots of the other four.”

These tech companies have produced a lot of fire-debt. Over and over, they erupt in flames—in this short decade alone, every one of our tech giants has experienced a privacy scandal that should have permanently disqualified it from continuing to enjoy our patronage (and I do mean every one of them, including the one that spends millions telling you that it’s the pro-privacy alternative to the others).

Privacy is just one way that these firms are enshittifying themselves. There are the ghastly moderation failures, the community betrayals, the frauds and the billions squandered on follies.

We hate these companies. We hate their products. They are always on fire. They can’t help it. It’s the curse of bigness.

Companies cannot unilaterally mediate the lives of hundreds of millions — or even billions — of people, speaking thousands of languages, living in hundreds of countries.

- Let the Platforms Burn: The Opposite of Good Fires is Wildfires

#platform decay#fire debt#good fire#threads#interoperability#privacy without monopoly#fediverse#zuck's empire of oily rags#wildland–urban interface#network effects#switching costs#network effects vs switching costs#adversarial interoperability#comcom#competitive compatibility#enshittification#twiddling

1K notes

·

View notes