#GLD;

Explore tagged Tumblr posts

Text

cw: half monsterfucking(?), throatfucking, sub danheng and dom reader ok too horny brain to write this properly

thinking about danheng in his dragon form….. thinking about his cloaca, throbbing and leaking so much…. waiting to be bred…. waiting for your strap…..

he’s wrapping his lower half around your waist as you’re fucking into him, gripping his hips so tight because of how slippery his hole is, just leaking so much that it’s so easy to slip out of his hole. hearing his whines as his hole stretches out to accommodate the strap…… biting down on his lip and whimpering as he cums so hard around it, squeezing your cock so tightly……

or just using his horns to hold his head in place as you slowly fuck his throat, letting it slowly slide into his throat as he struggles to take you, struggling against your hold on his horns. but it feels so fucking good, his horns are so sensitive, and being used to keep him in place, forced to have his throat stretched out. even better if you have him plugged up, both his holes filled up by you, the poor high elder can only whine and sob around your cock. unable to even comprehend how much he’s enjoying it, even if he never admits it.

#skgknfvkdkxkdnvnks#fuckfuckfuckfckgjvjkfv#FJCKFK GLD#LITERALLY GROWLING AND FOAMING WT TBE MOTHH#i’m going to scuba dive off a mountain#i will not apologise for the person i become when i get him#i will be even worse#six.writes#honkai star rail#sub honkai star rail#sub dan heng#dom!reader

657 notes

·

View notes

Text

non starkid mutuals followers etc i am BEGGING you PLEASE check out a vhs christmas carol! it's a one-act <1hr adaptation of acc, told entirely through 80s style songs (complete with SENSATIONAL outfits, dances, backgrounds, the whole shebang). it's currently running for its fifth year in a row at the apollo theatre in chicago! even if like me you can't STAND A Christmas Carol By Charles Dickens this show is genuinely INCREDIBLE. banger after banger after BANGER! and for a limited time you can also watch 2023's version for free on youtube, which has a whole extra first act of the gift of the magi and the little match girl!! so PLEASE check it out!!!!

youtube

^ 2023's production, with the extra first act

youtube

^ 2021's production, which is available permanently

^ performed live at starkid's jangle ball tour in 2022 (£13)

alternatively, as this is sung-through you can experience it through the original cast recording on spotify, apple music, amazon music, any other music streaming services, or the starkid webstore; also, the live jangle ball recording is available on the starkid webstore here!! please give it a listen it's so worth it!!!!!!

#MY LKVEEE AVHSCC#had to pause writing this a couple of times to do the christmas electricity dance icl#this years first listen through and i am SO HAPPY ABOHT ITTT GOD I LOVE THIS SHOW#I FORGOT HOW MUCH I LOVE THISSSSSS OH MY FUCKING GLD#AAAAGGHHHHHHHHHADJJFWJJSNXNEN#starkid#avhscc#yapping#vhscc#vhsccs#its that time of year. the (a)vhscc(s) autism is back in full force#Youtube

50 notes

·

View notes

Text

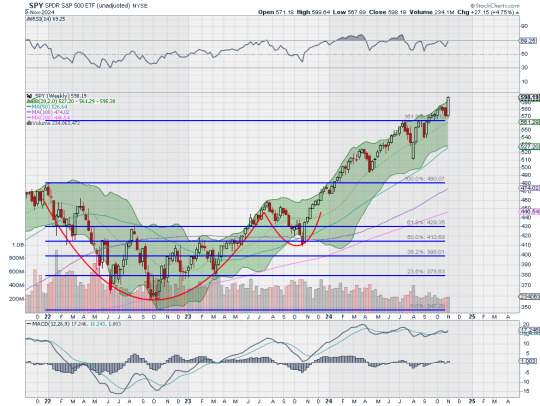

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with October in the books and heading into the election and FOMC meeting, equity markets experienced a Halloween spooking. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to consolidate in its uptrend while US Treasuries ($TLT) pulled back in their consolidation. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) pulled back in their uptrend.

The Volatility Index ($VXX) looked to remain at a neutral level, above the base established this year, and was likely to stay there at least until after the election. This might make for choppy light trading for equity markets to start next week. Their charts looked strong on the longer timeframe though. On the shorter timeframe both the $QQQ and $SPY had reset momentum measures lower and could reverse or turn bearish, likely a couple of days’ time would tell. The $IWM did not seem concerned about an election or Fed policy, churning sideways.

The week saw major movements happen following the election. It played out with Gold pulling back from its high Wednesday before a partial recovery while Crude Oil found some strength and moved higher in a choppy range. The US Dollar jumped to a 4 month high while Treasuries fell back to a 5½ month low Wednesday before a recovery. The Shanghai Composite continued the move to the upside while Emerging Markets chopped in a wide range.

Volatility crashed down to the low end of the range since August. This put a stiff breeze at the backs of equities and they started to move up Tuesday and then accelerated Wednesday through the end of the week. This resulted in the SPY and QQQ printing a new all-time highs Wednesday, Thursday and Friday and the IWM gapping up to a 1 year high. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week at the 50 day SMA on the daily chart in a pullback from the top. It had a gap left open from the end of the week. It held there on Monday and then started higher Tuesday, into the gap. It gapped up Wednesday to finish at a new all-time high and leaving an island below. It followed that up with new all-time highs Thursday and Friday. The Bollinger Bands® are open to the upside. The RSI is rising deep in the bullish zone with the MACD positive and rising.

The weekly chart shows a strong, long bullish candle rising from the 161.8% extension of the retracement of the 2022 drop. The 200% extension is now within view at 614 above. The RSI is rising near overbought territory in the bullish zone with the MACD drifting up and positive. There is no resistance above 599.60. Support lower sits at 585 and 580 then 574.50 and 571.50 before 565.50 and 556.50. Uptrend.

With the Presidential Election and November FOMC meeting in the rearview mirror, equity markets showed jubilation as they vaulted higher. Elsewhere look for Gold to in its uptrend while Crude Oil consolidates in a broad range. The US Dollar Index continues to move to the upside while US Treasuries consolidate in their pullback. The Shanghai Composite looks to continue the move higher while Emerging Markets chop in their short term uptrend.

The Volatility Index looks to remain low and drifting lower following the election making it easier for equity markets to continue higher. Their charts look strong on both timeframes, especially the SPY and QQQ. The IWM has now joined the party, a stone’s throw away from making its first new all-time high in 2 years. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview November 8, 2024

43 notes

·

View notes

Text

used to be one of the rotten ones and i liked you for that

#mcyt#dreamsmp#dsmp#tommyinnit#c!tommy#ctommy#c!wilbur#cwilbur#supposed to be c not cc. wll gld fans LEAVE! blasts everything with psychic powers#tubbo#c!tubbo#ctubbo#dream smp#is there a difference on whether or not you put a space between dream and smp#subtledrawings#is it cheesy to have song lyrics for captions on your art posts... who is to say....

54 notes

·

View notes

Text

Rattling at my cage cause I'm pretty sure Swansea kept the cryopod secret from Jimmy and the others after the talk with Anya to try and get her into the cryopod??? so she'd have a chance to survive with the baby????? I'm going hhhhhhhhhh

#that's the vibe I got ??#and then when she died well hhhhhhhhhh#AAAHHHH I love this game but gld#mouthwashing#mouthwashing game#spoilers#just in case idk#blah blah

22 notes

·

View notes

Text

today’s verse ✨

“Whether therefore ye eat, or drink, or whatsoever ye do, do all to the glory of God.”

1 Corinthians 10:31 KJV

#christian blog#christianity#bible#scripture#bibleverse#bible verse#king james bible#king james version#kjv#gospel#share the gospel#daily verse#holy bible#verse#bible verse of the day#verseoftheday#verse of the day#scriptureoftheday#scripture of the day#word of Gld#word of Christ#word of thr day#word of the Lord#1 corinthians#glory#glory of God#God#new testament#christian#bible scripture

47 notes

·

View notes

Text

you think you can Iris message the goddess Iris?

#pjo#pjo fandom#pjo series#percy jackson#percy jackon and the olympians#percy pjo#percy series#glds#gods#greek gods#greek goddess#greek mythology#goddess#goddess Iris#Iris

23 notes

·

View notes

Text

Psalm 16:8-9 (NASB1995) - I have set the LORD continually before me; Because He is at my right hand, I will not be shaken. Therefore my heart is glad and my glory rejoices; My flesh also will dwell securely.

13 notes

·

View notes

Text

A weighted harness worn constantly under one's clothes to get the body used to the added weight of plate armor? Not an uncommon training method at the Gladiators' Guild

_

(I just wanted an excuse to put Aryaille in this port by @oneiroy)

#yes I know that's not really what this is but shhhh it looks cool#also its not that out of place with some of the actual early GLD gear dklfaksldjkasdj#aryaille nox#elezen#elezen wol#ffxiv gpose#aryaille nox: images

45 notes

·

View notes

Text

hi…. i’m back to talk about batman

16 notes

·

View notes

Text

actually. it hit me. kagrenac and bthemetz had revelations about their past lives through contact with the heart of lorkhan, but did they actually tell each other what they saw?

does bthemetz even know her past life straight up murdered kagrenac's past incarnation for threatening her authority?

#i feel like kagrenac probably knows bthemetz is a shezarrine and has a splinter of lorkhan in her#but i dont think bthemetz would necessarily recognise the spirit koht in kagrenac#because she only carries fragments of lorkhan and the fragments she primarily knows are that of dying while laughing.#and her grinning rivalry with trinimac#not of how she quashed a spirit that refused to be cowed by glds

12 notes

·

View notes

Text

new upd8! jesus fucking CHRIST

7 notes

·

View notes

Text

nevermind everyone im never thinking of chris thile again

#desire mona#im so upset i got dizzy#words cant describe the hatred i hold in my heart for pewdiepie btw.#WHY WOULD YOU SAY THATTTTT#and after i got your too specific post for u. this is a slight not only against me but against gld#i should get a housewifemd tag.. do u have suggestions#thoughtsing

7 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the inflation reports behind us, equity markets showed strength with the SPY ending at an all-time high. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated in a broad range. The US Dollar Index ($DXY) continued to move to the upside while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to reverse lower while Emerging Markets ($EEM) consolidate the start of an uptrend.

The Volatility Index ($VXX) looked to remain low making the path easier for equity markets to the upside. Their charts looked strong, especially the $SPY and $QQQ on the longer timeframe. On the shorter timeframe both the QQQ and SPY were now ready to resume the move higher. The $IWM looked a bit less powerful but was holding near resistance, a good show of relative strength for the small caps.

The week played out with Gold chugging higher and ending at a new all-time high while Crude Oil fell back in the broad consolidation. The US Dollar met resistance at a lower high at the end of the week while Treasuries printed a Dead Cat Bounce after finding support Monday. The Shanghai Composite continued lower toward the September month end gap while Emerging Markets turned consolidation into a falling wedge.

Volatility drifted down to the lowest close of the month. This gave equities some breathing room and they rose to to start the week with the SPY printing a new all-time high Monday. All gave back some gains midweek before recovering to finish the week strong. This left the SPY back at the high, the QQQ near the October high and the IWM holding at nearly 3 year highs. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week at a new all-time high. It started off on the right foot making another one on Monday but ended out of the Bollinger Bands® on the daily chart. That led to a pullback on Tuesday and small reversal higher on Wednesday. Thursday broke higher as well with a gap up at the open, but it did not hold and then another gap up Friday held with the SPY ending at a new all-time high. The RSI is rising in the bullish zone with the MACD positive and climbing as those Bollinger Bands point higher.

The weekly chart shows a 6th consecutive move higher as it makes some separation from the 161.8% extension of the retracement of the 2022 drop. The RSI is making a higher high, negating a possible momentum divergence with the MACD crossed up and rising. There is resistance at 585 above. Support comes at 580 and 574.50 then 571.50 and 565.50 before 561.50 and 556.50. Uptrend.

SPY Weekly, $SPY

With the October Options Expiration in the books, equity markets showed some strength battling against a narrative of slower Fed cuts. Elsewhere look for Gold to continue its uptrend while Crude Oil drops in consolidation. The US Dollar Index may reverse the short term uptrend while US Treasuries pullback in consolidation. The Shanghai Composite looks to drop back from its spike while Emerging Markets stall in their move higher.

The Volatility Index looks to remain low making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe. On the shorter timeframe the SPY is leading the way higher with the QQQ slowly battling back to its high and the IWM poking its head up perhaps to make another attempt at a run higher. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview October 18, 2024

48 notes

·

View notes

Text

So, so, so depressed that we havn't had any news on this since last year.

Please. Just give me a crumb of new info!

10 notes

·

View notes

Text

we are FINALLY getting the uh..... stomach issues that nearly killed me tested and

I really am a ghoul, huh. Also, I'm planning to call them soon to tell them I cannot eat jelly and they should consider irradiating butter for me instead.

#mad scrawl#I'm gld they clarified that about the jelly so Ic an Correct lol#....what would they do were you vegan I wonder#or allergic to eggs? huh.

7 notes

·

View notes