#Finance India

Explore tagged Tumblr posts

Text

Unlock Financial Growth with NBFC Certification

Certified NBFCs enjoy unparalleled access to financial resources, allowing them to secure funding through loans, equity, or public deposits. This certification enables businesses to expand operations and cater to larger customer bases. Whether it’s financing small businesses, offering personal loans, or introducing innovative credit schemes, NBFCs with certification can explore diverse revenue streams. This advantage provides the foundation for growth in competitive financial markets, positioning NBFCs as key players in India's financial ecosystem. Learn how NBFC certification facilitates access to capital and boosts your ability to meet growing financial demands effectively and efficiently.

#NBFC#NBFCIndia#NBFC Growth#Certified NBFC#Business Finance#NBFC Opportunities#Financial Services#Finance India

0 notes

Text

AIFs and Stressed Loans: RBI's Vigilance and New Rules

RBI’s concerns about AIFs and stressed loans: The RBI is concerned about the practice of lenders using AIFs(Alternative Investment Funds) as a way to “evergreen” their stressed loans. Evergreening refers to the act of rolling over or restructuring loans to postpone their classification as non-performing assets (NPAs). Here’s how it could work: A borrower has a loan from a bank that is under…

View On WordPress

0 notes

Text

Indian Budget 2023 And Its Impact On the Global Economy

On Wednesday, February 1, Finance Minister Nirmala Sitharaman introduced the Indian Budget 2023. The FM mentioned in her Budget speech that this is the first Budget of the Amrit Kaal. The main goals are inclusion, reaching the last mile, infrastructure and investment, unleashing potential, green growth, young power, and the banking industry.

To spur economic growth, the government increased capital expenditure outlay by 33% in the Indian Budget 2023 to Rs 10 lakh crores. This significant increase represents the government's endeavor to boost growth potential, create jobs, attract private investment, and provide a buffer against global headwinds.

Budget 2023 prioritizes economic growth through capital spending, all-around inclusive development, ongoing legislative and administrative reforms, and lowering individual taxpayers' tax burden. It also sends a strong signal to the global investment and business community by restating the government's stance on fiscal deficit containment.

Private consumption and capital development, aided by an effective immunization policy, have shaped India's growth story in an otherwise unstable global macroeconomic environment. Indian Budget 2023 aims to strengthen India's position as a leading investment destination and will impact it's international image.

A 33% rise in capital investment expenditure to 10 lakh crores, redesigned loan guarantee to MSMEs, and easing the credit cycle would boost capital formation and job development. The government's green growth policy, particularly on energy transition, attempts to account the environmental impact of industrialization.

Furthermore, increasing tax rebates and rationalizing tax bands for individual taxpayers will result in more disposable income in their hands, thereby stimulating domestic spending. The agricultural credit target of 20 lakh crores will also help solve food security problems while positioning India as a leading exporter of food items.

FM’s Views On The Indian Budget 2023 And Global Economy

Smt. Nirmala Sitharaman mentioned while presenting the Union Budget 2023-24 in Parliament that the Indian economy is on the right track and, despite current obstacles, is headed for a bright future. She added that India's rising global profile is due to several accomplishments such as unique World Class Digital Public Infrastructure such as Aadhaar, Co-Win, and UPI.

She also stated that this Indian Budget 2023 aims to build on the foundation laid in the previous Budget as well as the blueprint drawn for India@100, which envisions a prosperous and inclusive India in which the fruits of development reach all regions and citizens, particularly our youth, women, farmers, OBCs, Scheduled Castes, and Scheduled Tribes.

The Finance Minister stated that at these times of global problems, India's G20 presidency provides a unique chance to deepen its role in the global economic system. With the theme 'Vasudhaiva Kutumbakam,' India is leading an ambitious, people-centred agenda to solve global challenges and support long-term economic development, she noted.

She stated that the Indian economy has grown from the 10th to the 5th largest in the world in the last nine years. According to the Finance Minister, our vision for the Amrit Kaal involves a technology-driven and knowledge-based economy with solid public finances and a vibrant financial sector, and Jan Bhagidari through Sabka Saath Sabka Prayas.

She went on to say that the economic program for realizing this vision focuses on three things: giving enough chances for individuals, particularly youth, to achieve their aspirations, providing a strong impetus to growth and job creation, and finally, strengthening macroeconomic stability.

She stated that during Amrit Kaal, the following four possibilities can be transformative in serving these focal areas in our journey to India@100: Economic Empowerment of Women, PM ViKAS, Tourism and Green Growth. According to the Finance Minister, the country has a lot to offer both domestic and foreign tourists, and there is a lot of promise there.

She noted that the industry offers several chances for employment and entrepreneurship, particularly for young people, and that tourist promotion will be undertaken on a mission basis, with active engagement of states, the convergence of government programs, and public-private partnerships.

Speaking about Green Growth, the FM stated that India is implementing several programs for green fuel, green energy, green farming, green mobility, green buildings, and green equipment, as well as regulations for energy efficiency across diverse economic sectors. She noted that these green growth activities serve to reduce the carbon intensity.

"India is at the forefront of popularizing millet, whose consumption promotes nutrition, food security, and farmer welfare," Smt. Sitharaman cited. She stated that India is the world's largest producer and second largest exporter of 'Shree Anna,' growing numerous varieties such as jowar, ragi, bajra, kuttu, ramdana, kangni, kutki, kodo, cheena, and sama.

She said that these millets have a lot of health benefits and have been a vital part of our food for centuries. She added that to make India a global hub for 'Shree Anna,' the Indian Institute of Millet Research in Hyderabad will be supported as the Centre of Excellence for sharing best practices, research, and innovations on an international scale.

Expert Views On Indian Budget 2023

According to Aniruddha Sarkar, Chief Investment Officer, Quest Investment Advisors, "The Indian Budget 2023 has clearly been a tremendous morale booster for middle-class people who would realize large savings. The enormous commitment for capital investment will undoubtedly be the cherry on top of this budget."

He added that, so far, there was nothing negative about that budget announcement, and it would be a game-changer in his opinion. The FM has decided to continue The Make in India campaign. Infrastructure capital investment has increased by 33% over the previous year, demonstrating the government's ongoing emphasis on infrastructure development.

"Inverted duty structure has been handled for several industries too. Customs tax is recommended to be cut from 21% to 13% across industries. It is a refreshing difference. Relief in the form of decreased customs duty on inputs used in manufacturing mobile phones is also particularly proposed," said Mahesh Jaising, Partner, Deloitte India.

"A 33% increase in infrastructure development spending to 10 lac crores could help the sector for overall economic development," said Poonam Kaura, Partner-Government & Public Sector Advisory- Nangia Andersen LLP. According to Debashish Biswas, Partner Deloitte India, this capex push will enable economic growth and create more jobs.

"Huge capital expenditure in infrastructure will have a significant multiplier effect on the economy," Biswas explained. According to Rumki Majumdar, Economist, Deloitte India, with an emphasis on job creation (especially for the youth) and skill and education, Indian budget 2023 aims to create chances for a young, dynamic, and ambitious India.

"A 33% increase in capex spending suggests that the government means business and is willing to go to any length to improve efficiency and competitiveness on par with its competing peers; this effort to build on previous efforts will likely attract more investors and start a virtuous cycle of investments," Majumdar said.

Conclusion

In the 75th year of India's independence, the world has acknowledged the Indian economy as a "bright light," with economic growth estimated at 7%, the highest among major economies, despite the significant global downturn caused by COVID-19. Overall, Indian Budget 2023 is a progressive growth-oriented budget that balances the budget and lays the groundwork for India to become a $5 trillion economy by 2026 and a developed country by 2047.

To Read More Visit Us At, https://myrefers.com/2023/02/02/indian-budget-2023-and-its-impact-on-global-economy/

0 notes

Photo

Self Sufficiency of Indian states in revenue for FY 23-24

by u/Lonesome_Jaat_69

46 notes

·

View notes

Text

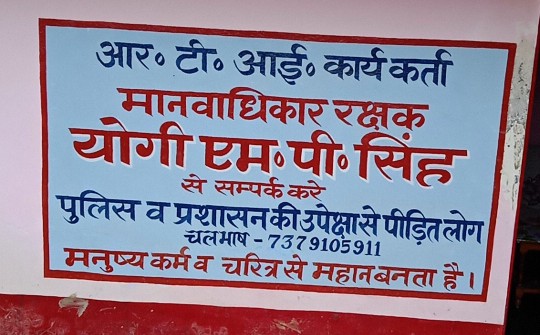

Navigating Tax Misuse: Lessons from Yogi M. P. Singh's Appeal

Appeal Details Appeal Number CBODT/E/A/24/0001791 Name Yogi M. P. Singh Appeal Recieved Date 09/06/2024 Reason Of Appeal The mobile number and email belong to the fraudulent person who opened the account through this email and mobile number. Mobile Number-7024188072, E-mail [email protected] Account Number (PAN)-GSWPS0850Q Info Icon, Aadhaar Number-XXXX XXXX 9009,…

View On WordPress

#corruption in income tax#crime#DG Income tax#finance#human rights#income tax#india#law#news#politics#supreme-court#tax#taxes

7 notes

·

View notes

Text

URGENT fundraising: 17 year old in my village needs leukemia treatment, please help/reblog

Hi all! I'm asking you to take a moment to please help my village. In all my 10 years of being on Tumblr, this is the first time I'm making a post myself. I'm doing this out of desperation, so please read if you get a chance. I'm an Anthropology student from Kerala (South India) currently working in in Kerala for a few years to do ethnographic study on agrarian life, and during my fieldwork I met 17 year old Gokul and his widowed mother in my village. Gokul has Refractory Acute Lymphoblastic Leukemia and his mother earns around $3 a day (£2.7) in Indian rupees. He is suddenly in CRITICAL condition and there's no way his family can afford the cost of his treatment. DOCUMENT EVIDENCE GDRIVE LINK ... As a student, I'm doing as much as I can but it's not enoguh. And we are a small village and we can't do much. I've started a fundraiser so that we can go beyond this village make a difference to save this child's life. I adore Gokul and I know how much he's struggling while prepping for his high school exams. He has hopes that he will live a long life, but we can't make this happen it without your help. PLEASE Tumblr, I need your help in spreading this word. If you cannot donate, AT LEAST share the word! PLEASE THE PRICE YOU PAY FOR ONE CUP OF COFFEE IS ENOUGH TO SAVE THIS CHILD FROM THE MOUTH OF DEATH

EVEN 1 CENT COUNTS. ALL FUNDS ARE RECEIVED IN INR, SO ANY AMOUNT HELPS, PLEASE

You can DM me for any alternative payment methods or questions. I will give you regular updates. My email is [email protected], you can find me on LinkedIn here. Please help, Gokul is the light and love of our village

#help#cancer#fundraising#fundraiser#india#kerala#delhi#bombay#US#united states#finance#child cancer#childhood#donation#GoFundMe#please#donate#aid#mutual aid#leukemia#people helping people#send help#artists on tumblr#support#boost#boosting#cancer awareness#oncology#cancerresearch#cancertreatment

4 notes

·

View notes

Text

on god, if the government flips and things somehow become worse i will take to the streets.

this entire election is just giving me such a weird emotional strain??? like i am turning 18 this year, this is the country where i have to live in, will get a job in, will roam around the streets, i should have the right to feel safe and i should have the right to support who i want,

india has so many fucking issues and somehow the only thing people focus on is it's caste during voting???

#what the fuck do you mean you will get a religion on top but won't make education affordable???#the fuck is “greatest economy banegi” AT WHAT COST???? selling cheap labour to companies who exploit us??????#literally get economists and finance people in a room come up with “how to country”#and then get actual people with some morals tp address your shit views#“gay log ew” FUCK OFF?????#india#desiblr#2024 elections#dhruv rathee#pm modi#narendra modi#politics#democracy#desi tag

10 notes

·

View notes

Text

2 notes

·

View notes

Text

Certified financial manager

Certified Financial Manager: Empowering Financial Success

In today’s fast-paced world, managing personal and professional finances effectively is not just a skill; it’s a necessity. A Certified Financial Manager (CFM) plays a pivotal role in helping individuals and businesses achieve their financial goals, ensuring financial stability, and fostering growth. Platforms like WealthMunshi.com are at the forefront of delivering expert financial guidance, making wealth management accessible to everyone.

Who is a Certified Financial Manager?

A Certified Financial Manager is a financial professional with specialized training and certification to provide expert advice on managing finances, investments, and wealth-building strategies. They are well-versed in budgeting, tax planning, investment strategies, risk assessment, and retirement planning, ensuring clients make informed financial decisions.

Why Choose a Certified Financial Manager?

Expert Financial Guidance: CFMs offer deep insights into financial markets, helping clients optimize their investment portfolios.

Customized Wealth Plans: They provide tailored financial plans based on individual goals, risk tolerance, and time horizons.

Comprehensive Support: From estate planning to debt management, CFMs address a wide range of financial needs.

Risk Mitigation: With a clear understanding of market risks, CFMs help clients safeguard their wealth while pursuing growth opportunities.

The WealthMunshi Difference

At WealthMunshi.com, financial management is not just a service; it’s a mission to empower individuals and families to take control of their financial future. Here’s how WealthMunshi.com stands out:

1. Certified Expertise

WealthMunshi.com collaborates with highly qualified CFMs who bring years of experience in wealth management and financial planning. Their in-depth knowledge ensures clients receive actionable and effective strategies.

2. Holistic Financial Planning

The platform offers end-to-end financial solutions, covering investment planning, retirement strategies, tax optimization, and more. Whether you're starting your financial journey or looking to diversify your portfolio, WealthMunshi.com has you covered.

3. Client-Centric Approach

WealthMunshi.com believes in personalized solutions. Every client is unique, and their financial strategy should reflect their goals, lifestyle, and aspirations.

4. Cutting-Edge Tools and Resources

The platform integrates advanced financial tools and analytics to provide real-time insights, empowering clients to make data-driven decisions.

5. Educational Resources

Financial literacy is at the heart of WealthMunshi’s philosophy. The platform provides educational content, webinars, and one-on-one consultations to help clients understand and navigate their financial options.

Benefits of Working with WealthMunshi.com

Clarity and Confidence: Simplifying complex financial concepts.

Long-Term Security: Building a robust financial foundation for the future.

Maximized Wealth Potential: Identifying and leveraging growth opportunities.

Stress-Free Financial Management: Delegating the complexities to seasoned professionals.

Key Services at WealthMunshi.com

Investment Planning: Strategic advice to grow your wealth.

Retirement Solutions: Secure your golden years with tailored plans.

Tax Planning: Optimize your finances with effective tax strategies.

Debt Management: Create a roadmap to achieve a debt-free lifestyle.

Estate Planning: Ensure your legacy is preserved for future generations.

Steps to Financial Freedom with WealthMunshi.com

Initial Consultation: Discuss your financial goals and challenges.

Financial Assessment: Analyze your current financial situation.

Strategy Development: Create a customized plan to meet your objectives.

Implementation: Execute the plan with expert guidance.

Ongoing Support: Monitor and adapt strategies to evolving financial needs.

Conclusion

A Certified Financial Manager is a trusted partner in achieving financial success, and WealthMunshi.com is a reliable platform to connect with these experts. Whether you're looking to save for the future, grow your investments, or achieve financial independence, the right guidance can make all the difference.

Take the first step towards a secure and prosperous financial future with WealthMunshi.com, where expertise meets commitment to help you turn your dreams into reality.

Visit WealthMunshi.com today and embark on your journey to financial excellence!

#certified financial manager#financial planning planner#certified financial planner#financial planner#financial advisors#wealth management#wealth management companies#personal financial advisor near me#personal financial planner#financial advisors near me#financial planner near me#wealth management co#company wealth management#certified financial planner certification#best retirement planners#need financial planning#financial planning personal finance#need for financial planning#certified financial planner cfp certification#best financial planners#financial planners in hyderabad#registered investment advisor near me#best financial advisors near me#best financial advisor in hyderabad#nri wealth management#financial advisor for nri in india#nri financial advisor#nri financial planning#online investment advisor india#certified financial planner in hyderabad

2 notes

·

View notes

Text

Customer Service Grievance Against Aryavart Bank

Grievance Status for registration number : DEABD/E/2024/0084759Grievance Concerns ToName Of ComplainantYogi M. P. SinghDate of Receipt06/12/2024Received By Ministry/DepartmentFinancial Services (Banking Division)Grievance DescriptionFinancial Services (Banking Division) >> Deficiency in Customer Service Related >> Others Bank : Other / Private Sector Bank.Branch / Name of Bank and Branch :…

#Aryavart Bank#banking#Consumer protection acts#CPA#finance#india#news#nigeria#security of transactions#SMS alerts

3 notes

·

View notes

Text

Opportunities and Risks for Stock Market Investors

Investing in the stock exchange is a very emotional business, some people find it thrilling yet scary at once. However one must consider the associated dangers to succeed at this risky venture. This article will show you all that can be derived from investing in stocks and what losses may follow. In light of these, we can improve our investment choices.

Worries over Investment in the Stock Market

The Potential for Exceptional Gains

One thing that draws investors to the share market is that they have a chance to earn huge amounts of money. Normally, statistically speaking, shares tend to surpass all other forms of investment such as bonds or saving accounts over time. If one picks good stocks, she/he stands to earn high returns if their prices rise in line with the development of companies being represented by those shares

Risk Reduction Through Variety

There’s a huge variety available when investing on shares; hence, diversification is possible. This means putting your money into different types of assets as well as sectors and industries in order to avoid being affected by risks related to only one asset class. Hence, diversification protects one against massive losses that follow underperformance by one sector alone which may cause havoc during market downturns such as when comparing technology sector performance with that of healthcare or consumer goods sectors respectively.

Dividends

Some stocks provide dividends, which are bascially payments from a company’s earnings made at regular intervals to the shareholders. Even if there is no significant growth in stock prices, dividends can still be dependable sources of income. This may be more advantageous if you are looking for an additional reliable income stream aside from possible capital gain.

Ownership and Influence

Whenever one buys stocks, he/she acquires partial ownership of that particular corporation. This type of ownership gives certain advantages such as having the right to vote on specific company decisions as well as accessing various reports on its finances and earnings. While your influence may be minimal when owning only a few shares; but it brings about some uniqueness in investing through stocks.

Liquidity

Typically, stocks rank high on the liquidity scale meaning they can be bought or sold with relative ease compared to other investments like real estate. Therefore, this liquidity allows for quick access of cash when needed or adjustments made on portfolios according to changing market circumstances.

Risks in Stock Market Investing

The Fluctuations In The Market

The most important risk that comes with stock market investing is fluctuating prices.

There are unpredictable changes in prices as well as rapid ones in stock markets which can cause stress because of potential losses. Economic events, political developments or investor sentiment shifts may also drive market-wide swings. It is important to be prepared for these ups and downs and avoid hasty decisions based on short term fluctuations.

Risks That Are Specific To The Company

Investing in individual stocks exposes you to how specific companies perform. For instance, if a company hits financial problems or faces regulatory issues its price may drop. In this case this company-specific risk could lead to huge losses when its performance worsens. Diversification can help to some extent in dealing with this risk though care must be taken while researching and picking firms.

Economic And Political Risks

The stock market can be adversely influenced by economic downturns and political instability for instance; during periods of recession, inflation or shifts in government policies there occurs depreciation in stock prices. However, these greater economic/political issues often lie outside of your control but keeping an eye on key indicators related to the economy as well as polities enables one to expect possible effects on their investments.

Risk of Bad Investment Choices

In order to invest in the share market one has to engage themselves in research and make wise selections. If you do not understand, you can invest poorly and lose money. Thus, it is vital that you learn about market trends, stock fundamentals and investment techniques. Moreover, you may want to seek financial advisors or reliable sources to help guide your investment decisions.

Making Decisions Based on Emotion

One of the largest dangers of stock market investing is making decisions based on emotions. For example, when a stock price drops, fear and greed can make an individual sell stocks that they shouldn’t otherwise sell, or instead pursue rapidly appreciating stocks regardless of their fundamentals. Emotional investing results in buying high while selling low thus eroding your returns. A practical way to avoid emotional investing is by creating a sound investment plan and adhere to it.

Balancing Risks with Opportunities

Making money in the stock market requires a balance between the opportunities that are available and the dangers which are involved. Below are tips on how this balance can be achieved:

Educate Yourself: Knowledge is key when it comes to investing. Investing in other vehicles, such as stocks and other related areas, is worth your time. The more information you have on these areas the more informed decisions you will be making.

Set Clear Goals: Know your objectives and risk acceptance level. Is it for long-term gains, income, or for both. Knowing what you want going forward will make choosing instruments easier hence developing suitable plans which are in line with such objectives.

Diversify Your Portfolio: Never depend on one source. Conduct portfolio analysis. By varying the types of investments among many sectors, industries and asset classes, you minimize risk and maximize chances for favorable results. Invest in dividing paying stocks, bonus providing stocks and also blue chip companies in order to reduce the risk

Stay Informed: Track news on the market, economic progress, and performance by companies. A well -informed investor can then make informed decisions about investing and adjust accordingly.

Emotional Investing Must Be Avoided: Unless it is a part of your investment strategy, do not allow feelings to influence your choices. Regardless of price changes in shares, be disciplined and stick to the approach you have set.

Conclusion

While there are many opportunities in the stock market, there are also risks involved. Understanding these variables, along with having a measure of balance in your approach increases your chances of success as well as avoiding losses. Remember that patience, research and discipline are crucial to a successful investing journey. Stay informed, make wise choices while keeping in mind your long term objectives as you navigate the exciting world of stock market investing.

3 notes

·

View notes

Text

#finance#stockmarket#bse#banking#invest#investing#100 days of productivity#memes#ipo#mensfashion#BSE#NSE#Equity#India

2 notes

·

View notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#fd account#upi account#fixed deposit account#contactless banking#upi bank app#upi bank#secure net banking#safe mobile banking#mobile app#e banking app#mobile banking apps in india#internet banking app#e banking#kyc bank account#ebanking#digital banking india#paise check karne wala app#bank fd rates#account check karne wala app#khata check karne wala app#finance application#upi mobile banking#banking mobile upi#mobile banking upi#mobilebanking app upi#app upi mobile banking#net banking app upi#upi mobile banking app#upi net banking app#upi transaction app

2 notes

·

View notes

Text

Why do we need Financial Literacy

What do you understand by the term Financial Literacy

Financial literacy, in simple terms, is about understanding how to manage your money. It means knowing how to budget, save, invest, and handle debt. Here’s a breakdown:

Budgeting: Planning your spending so you don’t run out of money before your next salary.

Saving: Storing money for future needs or emergencies.

Investing: Putting your money into things like stocks or bonds to help it grow

Why We Need Financial Literacy

n today's fast-paced world, knowing how to handle money is more vital than ever. Financial literacy is more than simply statistics; it is about making correct decisions that improve our lives. Here's why this matters:

Empowering Personal Financial Management Consider being able to confidently manage your money. Financial literacy enables you to budget, save, invest, and fully understand credit. This means you can avoid common traps like debt, scams,carding, Insufficient Future Savings

Promoting Economic Stability

Individuals that are financially literate help to maintain financial security. People who handle their money wisely are less likely to fail on debts or declare bankruptcy, which benefits the economy and contribute to grow and reach heights.

Preparing for Emergencies

Unexpected costs, like medical bills or auto repairs, often come up in life. Having sound financial knowledge enables you to create an emergency fund, which might calm your mind and lessen the worry in the event of unexpected situations.

Planning for the Future

Although it might be scary to think about the future, being knowledgeable about finances makes it simpler. Understanding financial principles is essential for making sensible choices and making successful plans, be it for owning a home, saving for retirement, or paying for your kids' school fees.

Avoiding Financial Fraud

Fraud and scams are common, but you may be safe if you understand the basic principles of money management. By being aware of the warning signs, you can stay clear of scams that might result in you to face large financial losses.

Enhancing Quality of Life

Both your mental and physical health may be harmed as a result of financial issues. Being aware of your finances can help you live a better, more stress-free life. Without being worried about money all the time, you'll feel more in maintain and able to enjoy life more.

Encouraging Responsible Spending Financial literacy supports logical spending habits by teaching you to differentiate between necessities and wants. This helps in achieving greater financial independence, avoiding unnecessary debt, and setting priorities for spending

Conclusion

Financial literacy is about making choices that affect your overall well-being, not just about controlling money. Through understanding of financial principles, you can create a safe and stress-free future. A better life can be attained by spending time to financial literacy, whether through formal education or self-studies.

2 notes

·

View notes

Text

#income tax#india#investment#taxation#financial#money#financialplanning#accounting#economy#finance#financial freedom#financial planning#investing#personal finance

3 notes

·

View notes

Text

Complaint Against HostGator: Refund Not Processed in 24 Hours

Last Login Time : 2024-11-03 18:50:39 Assured to refund the payment within 24 hours but promises were not made Grievance Details Grievance Number: 6479820 Grievance Reg Date: 2024-11-11 16:05:47 Complainant Name :Yogi M. P. Singh Mahesh Pratap SinghComplainant Contact No :7379105911Mode :By WebComplaint Type :ComplaintState :UTTAR PRADESHPurchase City :MirzapurSector :E- CommerceCategory…

#Consumer services#Corruption in government#finance#HostGator#human rights#india#news#promises not kept#supreme-court#travel

7 notes

·

View notes