Don't wanna be here? Send us removal request.

Text

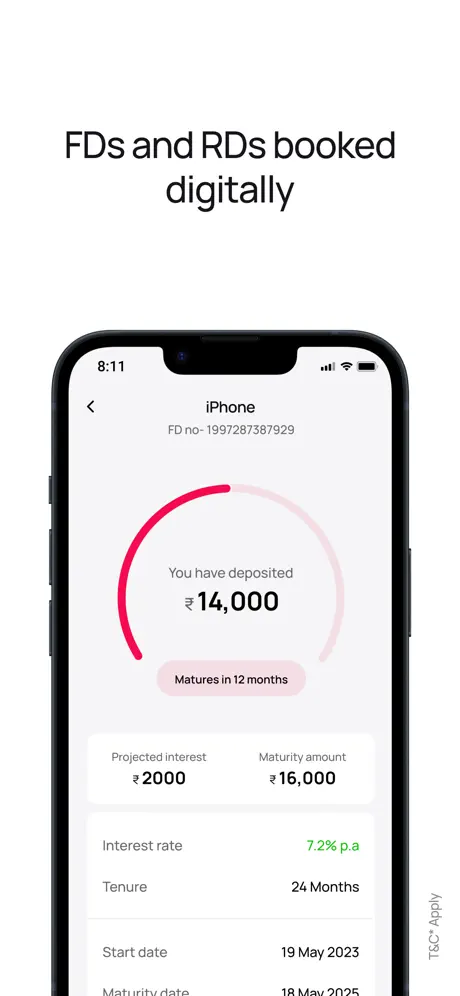

Kotak811 Mobile Banking App: Apply for a Zero Balance Savings Account Instantly

Unlock seamless banking with Kotak811 Mobile Banking, one of the ultimate banking app that helps you to apply for a bank account online in just a few minutes. Whether you're looking to apply for a zero balance account, manage your savings, or explore investment opportunities, our mobile banking app has you covered.

#best fd account interest rate#best fd interest rates#best fd rates#best fd rates in bank#best fixed deposit rates#best interest rate for fixed deposit#best mobile banking app#best online account opening#best rates on fd#bank fd interest rates#bank fd rates#bank fixed deposit rates

0 notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#fixed deposit interest#fixed deposit plans#fixed deposit rate for senior citizens#fixed deposit scheme#flexible fd#flexible fixed deposit#get online upi payments#hide transactions#highest bank fixed deposit rates#highest fd interest rate bank#highest fd rates in bank

1 note

·

View note

Text

Why Opening a Zero Balance Account Online is the Easiest Way to Manage Your Money

Gone are the days when you had to maintain a minimum balance to keep your bank account active. Thanks to the rise of zero balance accounts, you can now manage your finances without worrying about maintaining a minimum balance. Opening a zero balance account is incredibly easy and can be done entirely online through a mobile banking app.

In this article, we’ll explore why zero balance accounts are becoming so popular and how you can easily open one online, without any hassle.

What is a Zero Balance Account?

A zero balance account is a type of savings account that does not require you to maintain a minimum balance. This means you can deposit and withdraw money as needed without worrying about penalties for falling below a certain threshold. Many banks now offer zero balance accounts, making them an ideal choice for students, freelancers, and anyone looking for a no-fuss banking solution.

These accounts also come with the same benefits as a regular savings account, such as easy access to your money, the ability to earn interest, and access to online services like UPI payments and mobile banking.

Key Benefits of Opening a Zero Balance Account

Feature

Benefit

No Minimum Balance

Keep any balance in your account without worrying about penalties.

Free ATM Withdrawals

Enjoy free access to your funds at ATMs without worrying about fees.

Easy Accessibility

Manage your account using mobile banking apps 24/7.

Earn Interest

Your money will earn interest, just like with a regular savings account.

Access to UPI Payments

Make instant payments using UPI apps without fees or hassles.

How to Open a Zero Balance Account Online

Opening a zero balance account online is simple and can be done in just a few steps. Here's how:

Choose the Right Bank: Not all banks offer zero balance accounts, so start by choosing one that does. Look for features like mobile banking, UPI payments, and no annual fees.

Download the Bank’s Mobile App: Most banks offer an app that allows you to open a zero balance account in minutes. Download the app from the App Store or Google Play Store.

Fill in Your Personal Details: You will need to provide basic information such as your name, address, and contact details. You’ll also need to submit your identification documents (Aadhaar, PAN) for KYC verification.

Complete the eKYC Process: The eKYC process is quick and can be done via an OTP or video call. Once verified, your account is activated.

Start Using Your Account: After your account is set up, you can start using it for everyday transactions, like UPI payments, bill payments, and fund transfers.

Why Choose a Zero Balance Account?

No Maintenance Fees: Many traditional savings accounts charge monthly fees if the minimum balance requirement isn’t met. With zero balance accounts, you don’t have to worry about any hidden charges or fees.

Hassle-Free Transactions: You can make payments and transfers anytime using your mobile banking app. Plus, with UPI payments, you can send money instantly without any extra fees.

Great for Students and New Users: If you’re a student or someone new to banking, a zero balance account is the perfect way to start managing your money without the stress of minimum balances.

Simple Access to Funds: Whether you want to withdraw money at an ATM, use mobile banking for transfers, or access other banking services, a zero balance account offers easy and quick access.

Managing Your Zero Balance Account with Mobile Banking

Your zero balance account is fully accessible through the mobile banking app. Here’s what you can do:

Check Your Balance: View your available balance at any time and keep track of your transactions.

Send Money: Make UPI payments, transfer funds, or pay bills directly from your mobile app.

Track Savings: Monitor your savings growth and check if your account is earning interest.

Withdraw Cash: Use the ATM card linked to your account to withdraw funds at no extra charge.

Get Instant Alerts: Receive real-time notifications for all transactions, ensuring you’re always in the loop.

Security Features to Protect Your Zero Balance Account

Banks use several security measures to ensure your zero balance account is protected:

Two-Factor Authentication: Protect your account with OTPs and biometric login for extra security.

Encryption: Your personal and financial data is encrypted to prevent unauthorized access.

Fraud Detection: Banks monitor all accounts for fraudulent activity and send alerts if something suspicious happens.

Instant Notifications: Receive instant updates on all transactions, so you can monitor your account and detect any unauthorized activity.

Final Thoughts

Opening a zero balance account online is a quick and easy way to manage your money without the burden of maintaining a minimum balance. Whether you're a student, freelancer, or someone who prefers to avoid traditional banking fees, a zero balance account offers the perfect solution.

With access to mobile banking and the ability to make UPI payments easily, a zero balance account makes managing your finances more convenient than ever.

Start today by opening your zero balance account and take the first step towards smarter banking!

#mobile banking application#मोबाइल बैंकिंग#new bank account online#bank online#0 account opening bank#0 balance account opening#0 balance account opening bank#0 bank account opening#account balance check#account check karne wala app#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata

0 notes

Text

Benefits of handling Digital Payments by using UPI

In ancient times, people used some types of coins for purchasing purposes. Then, they used the commodity exchange method. After that, we are using money in the form of paper and coins. We used to give cash in a physical form for every purchase, even if it was a single penny or a large amount. To give or receive money from someone, we have to appear physically. Then only we can get the amount if you want to send money to anyone through the bank, which also takes some time. But now we have an option for quick money transferthrough UPI transfer. Let’s look at the benefits of UPI transactions in the post.

UPI

UPI stands for Unified Payments Interface. The UPI method was introduced by the National Payments Corporation of India (NPCI) in 2016. UPI is a digital payment platform, even though you can use banks to send money to anyone by deposit into their account. However, it needs the account number, name, and IFSC, and you have to wait and spend your most valuable time in the bank. We must wait to take the Demand Draft, deposit the checks, and all. By using UPI money transfer,we made money transactions easy.

Digital Payment

Digital payments make our transactions more efficient through UPI money transfer. UPI is nothing but sending or receiving money using any mobile application. Now, it is more effective for everyone. To make a UPI payment, we don’t need to register the secondary person’s account details on our own. We just need the phone number linked to their bank account. One more way of digital payment is scanning the QR code to send money.

Benefits of UPI Payment

There is no need to carry cash, card, or wallet everywhere.

Caring for a mobile phone as a digital wallet is enough to make our payments.

You can instantly send money to anyone by using mobile phones.

It provides 24/7 support for money transactions.

It helps us to reduce the transaction fees from banks.

Can integrate more than one bank account under one UPI ID.

Can pay all bills by the use of UPI Payment.

You can shop for anything online by using it.

Many digital platforms provide cashback and offer reward points by using UPI Payment.

Everyone can use UPI Payment as it is a user-friendly platform.

It helps to save our time.

The Bottom line

After the UPI Payment's introduction, most payments are paid as digital payments. Everyone highly welcomes this payment method. Malls, Cinema Theaters, Department Stores, Showrooms, Educational Institutions, Hotels, Hospitals, and even very small merchandise shops also now have the digital payment method. Given the easy accessibility of the platform, the usage of UPI Payment is becoming more common nowadays. The UPI Paymenthas made a big change and created a revolution in Indian payment, making it more accessible to non-residential Indians. Now, this quick money transfermade us feel a stress-free life.

#upi apps#upi enabled app#payment app upi#upi by credit card#upi debit card#secured upi payments#upi transaction tracking#secured upi#account upi payments#upi khata#finance upi#new upi payment app#secure upi#my upi#upi download app#upi transfer to bank account#upi bank transfer#upi fund transfer#bank app upi#upi money transfer#secure upi payment#secure upi payments#upi registration#download upi app#upi application#upi pay#upi transfer

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#fd account#upi account#fixed deposit account#contactless banking#upi bank app#upi bank#secure net banking#safe mobile banking#mobile app#e banking app#mobile banking apps in india#internet banking app#e banking#kyc bank account#ebanking#digital banking india#paise check karne wala app#bank fd rates#account check karne wala app#khata check karne wala app#finance application#upi mobile banking#banking mobile upi#mobile banking upi#mobilebanking app upi#app upi mobile banking#net banking app upi#upi mobile banking app#upi net banking app#upi transaction app

2 notes

·

View notes