#Dispute Settlement

Explore tagged Tumblr posts

Text

Best Industrial Acoustic Consultancy | Noise Survey and Dispute Settlement - Thermosonics

0 notes

Text

By offering and grasping each other's penis – said to represent "paying with one's life" – the men make an avowal of mutual support and goodwill between them, or symbolize and solidify the agreement they have reached during the settling of a dispute.

"Biological Exuberance: Animal Homosexuality and Natural Diversity" - Bruce Bagemihl

#book quote#biological exuberance#bruce bagemihl#nonfiction#support#goodwill#agreement#dispute settlement#indigenous australians#walbiri#aranda#warlpiri people#arrernte people#mutual trust

0 notes

Text

Ideas Lying Around

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in DC TOMORROW (Mar 4), and in RICHMOND on WEDNESDAY (Mar 5). More tour dates here. Mail-order signed copies from LA's Diesel Books.

I get a special pleasure from citing Milton Friedman. I like to imagine that as I do, he groans around the red-hot spit protruding from his jaws, prompting howls of laughter from the demons who pelt him with molten faeces for all eternity.

If you're lucky enough not to know about Friedman, here's the short version. Friedman was a kind of court sorcerer to Ronald Reagan, Margaret Thatcher, Augusto Pinochet, and other assorted authoritarian, hard-right leaders who set us on the path to the hellscape we inhabit today. But before Friedman rose to prominence and influence, he was a crank. Specifically, he was a crank who dedicated his life to rolling back all the progress of the New Deal and re-establishing the Gilded Age:

https://pluralistic.net/2022/11/06/the-end-of-the-road-to-serfdom/

In his crank days, people were justifiably skeptical of this project. "Milton," they'd say, "people like New Deal programs. They like the minimum wage, the 40-hour work-week, and the assurance that they won't be maimed, poisoned, burned alive, or otherwise killed on the job. They relish a dignified retirement, quality education for their children, and the assurance that no one is starving to death in their country's borders. People like national parks! They like Medicare! They like libraries, museums, and reliable weather forecasts! How, Milton, do you propose to convince the vast majority of people that they should settle for being forelock-tugging plebs, groveling before their social betters for the chance to scrub their toilets?"

Friedman had an answer: "In times of crisis, ideas can move from the fringe to the center in an eyeblink. Our job is to keep good ideas lying around, in anticipation of that crisis."

When the oil crisis hit, when prices spiked in the USA and abroad, Friedman seized his opportunity. The years following the oil crisis saw a violent political revolution in which organized labor, social justice movements, and the political opposition to oligarchy were crushed under police batons and the guns of Pinochet's thugs. The world was transformed. Left parties like UK Labour were remade as austerity-pilled neoliberals (not for nothing did Margaret Thatcher call Tony Blair "her greatest accomplishment," and it took Bill Clinton to pass a welfare "reform" bill that was too extreme even for Reagan to get through Congress).

Friedman was a monster.

But.

He had a hell of a theory of change.

When prices spiral, when people can't pay their bills anymore, when their retirement savings are wiped out, anything is possible. The oil crisis wasn't Jimmy Carter's fault, but the voters still delivered a Ba'ath Party-style Republican majority in 1980. The covid shocks weren't the fault of the world governments that presided over pandemic inflation, but they were creamed in the ensuing elections.

Let's talk about Trump's tariffs here. Trump's goal is to force a re-shoring of the American industrial capacity that was shipped to low-wage, low-regulation corporate havens around the world after the Reagan revolution. The pandemic provided a vivid lesson about the problems with long, brittle supply chains where all the slack has been extracted and converted to dividends and stock buybacks. That kind of system may work well – at least to the extent that it keeps Walmart's shelves full of cheap goods – but holy shit did it ever fail badly. Re-shoring is a good idea, as are other forms of pro-resiliency industrial policy.

But re-shoring doesn't happen overnight. As we saw during China's covid lockdowns, when one supplier ceases to ship goods, other suppliers can't spring up overnight to take up the slack. China itself became a manufacturing powerhouse thanks to extensive state support and planning, and it took decades. That kind of patient, long-run, planned process is the best-case scenario (and it still caused wrenching dislocations to Chinese society). Simply throwing up tariff walls and demanding that industry figure it out – amid the resulting economic chaos and the political instability it brings – isn't a plan, it's a disaster.

Redistributing the means of production around the world is a necessary and urgent project, but it won't be advanced through Trump's rapid, unscheduled mid-air disassembly of the global system of trade. Tariffs will cause breakdowns in neoliberalism's fragile supply chains, and the ensuing chaos – mass unemployment, shortages, political rage – will make it even harder for countries (including the USA) to rebuild the productive capacity vaporized by 40 years of neoliberalism.

This is our oil crisis, in other worlds: a moment in which a belligerent superpower's ill-considered monkeying with the underpinnings of global production will cause chaos, the crisis in which "ideas can move from the periphery to the center" in an eyeblink. If Steve Bannon can call himself a Leninist, then leftists can call themselves Friedmanites. This is our opportunity.

Or rather, it's our opportunity to seize – or lose. Governments are defaulting to retaliatory tariffs as the best response to Trump's tariffs. This is political poison: making everything your country imports from the USA more expensive is a very weird way to punish America for its trade war. Remember the glaring lesson of pandemic inflation: a government that presides over rising prices will be destroyed by the electorate.

There's a much better alternative, one that strikes at the very roots of American oligarchy, whose extreme wealth and corrosive political influence comes from its holdings in rent-extracting monopolies, especially Big Tech monopolies.

Tech giants are the major factor in US economic health. Take Big Tech stocks out of the S&P 500 and you've got a stagnant market punctuated by periods of decline. Superficially, US tech companies have different sources of extraordinary profit, but a closer look reveals that they all share the same foundation: Big Tech makes the bulk of its money in the form of monopoly rents, backstopped by global IP treaties.

Apple and Google take a 30% cut of every dollar spent in an app, and it's a felony to jailbreak a phone to make a new app store with the industry standard 1-3% transaction fees. Google and Meta take 51% out of every ad dollar, and publishers and advertisers are locked into their ecosystems by abusive contracts and technological countermeasures. HP charges $10,000/gallon for the colored water you put in your printer, and third-party ink and refills violate the anti-circumvention laws the US has crammed down the throats of every country's legislature. Tesla makes its fattest margins by renting you features that are installed in your car at the factory, from autopilot to the ability to use your battery's whole charge, raking in monthly fees from you and anyone you sell your car to – and the reason your mechanic can't just permanently unlock all that DLC for $50 is the IP laws that your country agreed to enforce in order to trade with the USA. Mechanics pay $10k/year per manufacturer for the tools to interpret the error codes generated by your car, and the only reason no one is selling a $50/month universal diagnostic service is – once again – US-originated IP laws that came in a parcel with trade agreements that gave your country's exporters access to US markets. Farmers pay John Deere $200 every time they fix their own tractors, because the repairs won't work until a technician comes out and types an unlock code into the tractor's keyboard – and bypassing that unlock code is a crime under the laws passed to comply with international treaties.

These aren't profits – they're rents. It's money Big Tech gets from owning a factor of production, not money it gets from actually making something. The app maker takes all the risks, but Apple and Google cream off 30% of their gross income. Big Tech's profits are almost an afterthought when compared to its rents, the junk-fee platform fees and farcically expensive consumables. For tech firms, capitalism was a transitional phase between feudalism…and technofeudalism:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

America's robust GDP figures are a mirage, artificially buoyed up by the monopoly rents extracted by US Big Tech, who prey on Americans and foreigners:

https://pluralistic.net/2025/02/18/pikettys-productivity/#reaganomics-revenge

But foreigners don't have to tolerate this nonsense. Governments around the world signed up to protect giant American companies from small domestic competitors (from local app stores – for phones, games consoles, and IoT gadgets – to local printer cartridge remanufacturers) on the promise of tariff-free access to US markets. With Trump imposing tariffs will-ye or nill-ye on America's trading partners large and small, there is no reason to go on delivering rents to US Big Tech.

The first country or bloc (hi there, EU!) to do this will have a giant first-mover advantage, and could become a global export powerhouse, dominating the lucrative markets for tools that strike at the highest-margin lines of business of the most profitable companies in the history of the human race. Like Jeff Bezos told the publishers: "your margin is my opportunity":

https://www.marketplacepulse.com/articles/the-cost-of-your-margin-is-my-opportunity

In times of crisis, ideas can move from the periphery to the center in an eyeblink. Many of us have spent decades organizing and mobilizing against these extractive, dangerous, destabilizing abuses of technology, where the computer-powered devices we rely on for everything are designed to serve their manufacturers' shareholders, at our expense. And yet, these technologies have only proliferated, infecting everything from insulin pumps and ventilators to coffee makers and "smart" TVs.

It's time for a global race to the top – for countries to compete with one another to see who will capture US Big Tech's margins the fastest and most aggressively. Not only will this make things cheaper for everyone else in the world – it'll also make things cheaper for Americans, because once there is a global, profitable trade in software that jailbreaks your Big Tech devices and services, it will surely leak across the US border. Canada doesn't have to confine itself to selling reasonably priced pharmaceuticals to beleaguered Americans – it can also set up a brisk trade in the tools of technological self-determination and liberation from Big Tech bondage.

Taking the margins for Big Tech's most profitable enterprises to zero, globally, will strike at the very heart of American oligarchy, and the hundreds of millions tech giants flushed into the political system to put Trump into office again. A race to the top for technological liberation benefits everyone – including Americans.

Truly, it would be a rising tide that lifted all boats (except for oligarchs' superyachts - those, it will swamp and sink).

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/03/03/friedmanite/#oil-crisis-two-point-oh

#pluralistic#ideas lying around#milton friedman#global trade#trade#tariffs#oil crisis#theories of change#trumpism#anticircumvention#dmca 1201#gatt#wto#isds#investor state dispute settlement

438 notes

·

View notes

Text

In the mountains of Transylvania, a Canadian company makes plans for a vast gold and silver mine. The proposal – which involves razing four mountain tops – sparks a national outcry, and the Romanian government pulls its support.

After protests from local communities, the Italian government bans drilling for oil within 12 miles of its shoreline. A UK fossil fuel firm has to dismantle its oilfield.

Beneath the grey whales and sea turtles of Mexico’s gulf, an underwater exploration company gets a permit to explore a huge phosphate deposit. Before it can begin, Mexico withdraws the permit, saying the ecosystem is “a natural treasure” that could be threatened by mining

Such cases appear to be part of the bread and butter of governments – updating environmental laws or responding to voter pressure. But every time, the company involved sued the government for lost profits and often, they won (Romania prevailed in its case, Italy and Mexico were forced to pay out).

They are among more than 1,400 cases analysed by the Guardian from within the investor-state dispute settlement (ISDS) system, a set of private courts in which companies can sue countries for billions. There have been long-held concerns about ISDS creating “regulatory chill” – where governments are scared off action on nature loss and the climate crisis by legal risks. Now, government ministers from a range of countries have confirmed to the Guardian that this “chilling” is already in effect – and that fear of ISDS suits is actively shaping environmental laws and regulations.

In April 2018, New Zealand banned new offshore oil exploration projects, but stopped short of an outright ban or revoking existing concession. James Shaw, who was climate minister at the time, said it was because of the risk of being sued by foreign oil and gas companies. “When we implemented the ban on offshore oil and gas exploration, we had to construct that incredibly carefully in order to avoid the risk of litigation. The way that we did that was to leave existing permits in place,” he said. As a result, New Zealand was unable to be a full member of the Beyond Oil & Gas Alliance.

Toby Landau, who has been a leading arbitration lawyer for 30 years, said acting in accordance with the Paris agreement could result in “very significant claims” for countries. He said: “It matters hugely because of the climate emergency that we are in – we’ve got an imperative under the Paris agreement to act quickly and decisively.”

The idea that this does not create a chilling effect is an “outdated and inaccurate view”. He says: “My impression from working closely with governments is that ISDS is now increasingly on their radar, that is it’s increasingly an issue for them to consider: whether implementing a particular policy might give rise to claims.

“We’re left with two regimes that conflict: the Paris agreement requires (broadly) that fossil fuels be phased out, and the ISDS regime provides guarantees for investors that protect their investment – even if it is a fossil fuel investment. That’s the conflict – it’s as simple as that.”

Rob Davies, who was minister of trade and industry of South Africa from 2009 to 2019, withdrew the country from a number of treaties with ISDS clauses from 2013 onwards. He says ISDS posed “significant risk” to the government’s legislation.

“Companies have got the right to challenge any policy … that will impact their expectation of profitability in the future, no matter what the regulation is, no matter what its motivation is, no matter how well designed it is or anything,” he says. Davies believes more recently fossil fuel companies are using the ISDS provisions to “thwart regulations on green transition”. He says: “It has a chilling effect, particularly on developing countries.”

In 2021, the International Energy Agency released a report saying the 1.5C pathway requires no new oil, gas or coal. But the issue of regulatory chill has been acknowledged by a number of international bodies, including the 2022 IPPC report on climate change. “Numerous scholars have pointed to ISDS being able to be used by fossil fuel companies to block national legislation aimed at phasing out the use of their assets,” the authors wrote. The UN, Council of Europe and European parliament have all raised similar concerns about climate action being delayed or watered down by ISDS.

“There can be astronomical costs associated with these cases,” says Kyla Tienhaara, an associate professor at the School of Environmental Studies at Queen’s University in Canada. Countries are afraid of implementing environmentally friendly policies because they can’t afford the cost of ISDS, says Tienhaara. “Governments don’t even have the funding to deal with the case in the first place.”

The Guardian investigation into ISDS reveals $84bn in payouts from governments to fossil fuel companies. More than $120bn of public money has been awarded to private investors across all industries since 1976. The average payout for a fossil fuel claim was $1.2bn.

Some cases can cost countries a significant portion of their total annual budget. For example, in 2015 Occidental Petroleum received a $1.1bn payout from the Ecuadorian government. The country’s budget was $29.8bn in 2016. Honduras faces 11 claims, with one seeking damages equal to 30% of the country’s GDP.

The problem is increasingly being discussed by climate ministers and heads of state. On the campaign trail in 2020, US presidential candidate Joe Biden said he opposed ISDS clauses in trade agreements because they allow “private corporations to attack labour, health and environmental policies”.

The Danish government set a deadline to stop fossil fuel exploration by 2050 as opposed to 2030 or 2040 because it would have had to pay “incredibly expensive” compensation to companies, on top of lost revenue for the Treasury, then-climate minister Dan Jørgensen said.

A 2023 UN report by David Boyd, the special rapporteur on human rights and the environment, found Denmark, New Zealand and France had limited their climate policies because of the threat of ISDS, with the Spanish government saying it has slowed its transition away from fossil fuels over “fear of being sued by a foreign investor”. The report stated that this threat has become a “major obstacle” for countries addressing the climate crisis.

27 notes

·

View notes

Text

Excerpt from this story from Inside Climate News:

The Biden administration announced a last-minute deal on trade this week, reaching an agreement with Colombia to limit protections for investors between the two countries. The move represents a small step toward reforming a system that has awarded multinational corporations more than $100 billion in taxpayer funds from countries around the globe.

Investor state dispute settlement, or ISDS, allows foreign companies to bypass national courts and sue governments before panels of arbitrators if they believe their rights have been violated. The system is built into thousands of treaties and contracts, and companies have used it to win hundreds of millions or even billions of dollars after governments have hiked taxes, implemented new regulations or rejected licenses for mining and oil and gas drilling.

The agreement, announced Thursday, comes in the wake of a multi-part Inside Climate News investigation that uncovered how companies have used ISDS to force big payouts from governments, even in cases where they have left behind pollution or been accused of violating human rights. The vast majority of claims are brought by foreign companies from wealthy nations against developing countries, and increasingly, Wall Street firms have been financing those claims for a cut of the awards.

The ISDS system has faced growing scrutiny from government officials, lawyers and human rights and climate advocates in recent years. They argue it prioritizes corporate profits over public interests and poses a threat to climate action by punishing countries that act to limit fossil fuels. A growing number of nations, including Bolivia, Indonesia, Italy, South Africa and Spain, have taken steps to exit the system or limit their exposure.

The agreement between U.S. Trade Representative Katherine Tai and Colombia Trade Minister Luis Carlos Reyes took the form of a “binding” interpretation of the U.S.-Colombia Trade Promotion Agreement, which took effect in 2012. The new agreement seeks to limit the types of arbitration claims that companies from each nation can seek and the amount of damages they can claim. In particular, it aims to cut off companies’ ability to base claims solely on speculative “future lost profits,” which has helped send the average award size soaring to $256 million from 2014-2023, according to United Nations data.

As of the close of 2023, one in 20 ISDS cases won by investors resulted in an award of $1 billion or more.

In a statement, Tai said the interpretation was consistent with government positions adopted in more recent trade agreements, including the U.S.-Mexico-Canada Agreement and an agreement with South Korea, and would help ensure that arbitration claims hewed to the governments’ positions.

“Like President Biden, I oppose the ability of private corporations to attack labor, health, and environmental policies through ISDS,” Tai said in the statement.

3 notes

·

View notes

Text

Vy'keen do not sit like other pathetic lifeforms. Vy'keen will have the high ground.

#nms#no man's sky#nms photography#nms: npc#this is from my one and only settlement I've ever had#my beautiful empire of dirt (the only thing they export)#anyway came in to settle the newest dispute and just had this guy sitting there waiting for me#truly a power move#penumbra's pics

12 notes

·

View notes

Text

not a day goes by where i don’t hear about another privacy/data breach

4 notes

·

View notes

Text

How to Remove a Personal Loan Default Record from Your Credit Report?

A personal loan can be a great financial tool for handling emergencies, consolidating debt, or funding major expenses. However, missing payments or defaulting on a personal loan can leave a negative mark on your credit report, affecting your ability to secure future loans or credit cards. A loan default record lowers your credit score and can remain on your credit report for up to seven years, making financial recovery difficult.

The good news is that there are ways to remove or rectify a personal loan default record from your credit report. In this guide, we will explore the steps to clear a loan default, how it impacts your financial future, and strategies to improve your creditworthiness.

1. What Happens When You Default on a Personal Loan?

A personal loan default occurs when a borrower fails to repay EMIs (Equated Monthly Installments) for an extended period, usually 90 days or more. Once the default is recorded, the lender reports it to credit bureaus like CIBIL, Experian, or Equifax, leading to a significant drop in the borrower’s credit score.

Consequences of a Personal Loan Default:

Credit Score Drop – A default can lower your credit score by 100 to 150 points.

Loan Rejection – Future loan applications may be denied due to the poor credit history.

Legal Action – In extreme cases, lenders may initiate legal proceedings to recover the outstanding amount.

Difficulty in Renting or Employment – Some landlords and employers check credit reports before approval.

If you have defaulted on a personal loan, taking corrective action immediately can help you recover financially.

2. Steps to Remove a Personal Loan Default Record from Your Credit Report

If you want to remove a personal loan default record, follow these steps:

A. Get a Copy of Your Credit Report

Obtain your credit report from CIBIL, Experian, Equifax, or CRIF Highmark.

Check for errors, incorrect late payments, or discrepancies in your loan default record.

Identify the lender who reported the default and confirm the outstanding balance.

B. Clear Outstanding Dues

If the default is genuine, contact your lender and repay the outstanding balance.

Request a loan settlement or restructuring if you are unable to pay in full.

Obtain a No Objection Certificate (NOC) after full repayment.

C. Negotiate a Loan Settlement with the Lender

Some lenders allow a one-time settlement where you can pay a reduced amount.

Ensure the settlement is reported as “Closed” in your credit report.

Avoid “Settled” status, as it still impacts your credit score negatively.

D. Request the Lender to Update Your Credit Report

Once you clear the dues, ask the lender to update your payment status with credit bureaus.

It takes 30-45 days for the updated report to reflect the changes.

E. Dispute Errors in the Credit Report

If your report contains inaccurate default records, raise a dispute with the credit bureau.

Submit supporting documents such as payment receipts, NOC, and bank statements.

The credit bureau will investigate and correct errors within 30-45 days.

By following these steps, you can improve your credit score and remove the negative impact of a personal loan default.

3. How Long Does a Personal Loan Default Stay on Your Credit Report?

A loan default remains on your credit report for up to 7 years. However, you can speed up the recovery process by:

Repaying outstanding dues and requesting report updates.

Raising disputes for incorrect default records.

Using credit-building strategies to improve your score over time.

If you take corrective action, the impact of a personal loan default can be minimized much sooner.

4. Alternative Ways to Improve Your Credit Score After Default

If a personal loan default has affected your credit score, follow these strategies to rebuild your creditworthiness:

A. Pay Bills and EMIs on Time

Set up auto-debit for loan repayments to avoid future defaults.

Maintain a 100% payment track record to show creditworthiness.

B. Use a Secured Credit Card

Opt for a secured credit card against a fixed deposit to rebuild your score.

Make small purchases and pay bills in full and on time.

C. Reduce Your Credit Utilization Ratio

Keep your credit card usage below 30% of your credit limit.

Paying off existing debts improves your credit profile.

D. Increase Your Credit Mix

Having a mix of secured (home, auto loans) and unsecured loans shows creditworthiness.

Avoid taking multiple personal loans in a short span.

E. Limit Hard Inquiries

Do not apply for multiple loans or credit cards simultaneously.

Hard inquiries lower your score; space out loan applications.

By following these methods, your credit score will gradually improve, increasing your chances of loan approvals in the future.

5. How to Prevent a Personal Loan Default in the Future?

To avoid defaulting on a personal loan, follow these proactive measures:

A. Borrow Only What You Can Repay

Assess your financial capacity before taking a loan.

Use a personal loan EMI calculator to determine affordable repayment amounts.

B. Maintain an Emergency Fund

Save at least 3-6 months’ worth of expenses to cover unexpected financial setbacks.

C. Choose a Longer Loan Tenure for Lower EMIs

If repayment is challenging, opt for a longer tenure to reduce EMI burden.

D. Prioritize Debt Payments

Always pay loans and credit card bills first before discretionary spending.

E. Communicate with Your Lender

If facing financial difficulties, contact your lender early to explore restructuring options.

Taking these precautions will help you avoid personal loan defaults and maintain a healthy credit profile.

Conclusion

A personal loan default can significantly impact your creditworthiness, but it is possible to remove or rectify it with the right approach. The first step is to clear outstanding dues, negotiate with the lender, and request a credit report update. If errors exist, disputing them with the credit bureau can help remove incorrect defaults.

Additionally, rebuilding your credit score through timely payments, secured credit cards, and low credit utilization is crucial for financial recovery. By adopting smart borrowing habits, you can prevent future defaults and regain your financial stability.

If you’re struggling with a personal loan default, take action today to improve your credit score and restore your financial health.

#personal loan#personal loan online#fincrif#bank#personal loans#loan services#nbfc personal loan#finance#loan apps#personal laon#Personal loan#Personal loan default#Remove loan default record#How to fix loan default#Improve credit score after default#Loan default impact on credit score#Credit report loan default removal#Personal loan repayment issues#How to clear personal loan default#Loan default settlement process#Credit bureau loan default dispute#Personal loan default negotiation#How long does a loan default stay on credit report#Steps to fix credit score after default#Loan restructuring after default#CIBIL report loan default removal#Best way to handle personal loan default#How to improve credit score after loan default#Defaulted loan clearance process#Personal loan EMI default solution

1 note

·

View note

Text

Having A Successful Florida Mediation | 561.699.0399

Having A Successful Florida Mediation Mediation can make or break your case. If you want a successful outcome, here’s what you need to know! Tip #1: Be Prepared! Attorneys and their clients must be on the same page. If you show up unprepared, you’ll spend the whole day playing catch-up. Know the facts, the law, and your strategy beforehand. Tip #2: Manage Client Expectations Set realistic…

#attorney advice#case preparation#case strategy#client expectations#Conflict resolution#courtroom alternative#Dispute resolution#Florida Attorney#florida law#Having A Successful Florida Mediation#law firm#lawyer tips#legal counsel#Legal disputes#Legal guidance#legal negotiation#legal preparation#legal process#Legal representation#legal strategy#legal tactics#litigation#mediation#mediation strategy#mediation success#mediation tips#negotiation#opposing party#Ryan S. Shipp#Settlement

0 notes

Text

#european court of justice#ecj fines#hungary#asylum seekers#brussels#belgium#hungarian universities#erasmus dispute settlement#Erasmus+ and Horizon Europe funds#restrictions on asylum rights

0 notes

Text

IR35 Tax Appeals: Gary Lineker's Off-Payroll Working Dispute with HMRC

What Is IR35, and How Does It Relate to Gary Lineker? IR35, the UK’s off-payroll working legislation, is designed to prevent tax avoidance by individuals who provide services through intermediaries, such as Personal Service Companies (PSCs), but work in a manner similar to employees. This legislation ensures that such workers pay the appropriate income tax and National Insurance…

#Contractors#First Tier Tax Tribunal#Freelancers#HMRC#HMRC Account Freezing Orders#HMRC appeal#HMRC Costs#HMRC Investigations#HMRC Petition#HMRC Policy#hmrc settlement#HMRC statutory demand#HMRC Tax Appeal#HMRC Tax Assessment#HMRC Tax Disputes#IR35#IR35 Disputes#IR35 Employees#ir35 employers#IR35 legislation#IR35 Reforms#Tax Evasion#Tax Fraud#Tribunal Representation#Unpaid Tax#VAT

0 notes

Text

Do you want to locate the best e-commerce law consulting firm? Professional legal services are offered by Sattva Legal to e-commerce businesses. Our knowledgeable e-commerce lawyers specialize in regulatory compliance, contract management, consumer protection, and resolving e-commerce disputes. We provide comprehensive solutions to assist your online business's expansion in the competitive digital marketplace, as we are a leading e-commerce law practice. Trust Sattva Legal to provide you with competent legal counsel and effective conflict resolution. Join us for trusted, industry-specific legal support in the ever-evolving area of e-commerce law.

#Best E-Commerce Law Consulting Firm#Lawyers in India#Ecommerce Dispute Settlement#E-Commerce Law Firm#E-Commerce Law Consulting Firm#Sattva Legal

0 notes

Text

End of the line for corporate sovereignty

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me next weekend (Mar 30/31) in ANAHEIM at WONDERCON, then in Boston with Randall "XKCD" Munroe (Apr 11), then Providence (Apr 12), and beyond!

Back in the 1950s, a new, democratically elected Iranian government nationalized foreign oil interests. The UK and the US then backed a coup, deposing the progressive government with one more hospitable to foreign corporations:

https://en.wikipedia.org/wiki/Nationalization_of_the_Iranian_oil_industry

This nasty piece of geopolitical skullduggery led to the mother-of-all-blowbacks: the Anglo-American puppet regime was toppled by the Ayatollah and his cronies, who have led Iran ever since.

For the US and the UK, the lesson was clear: they needed a less kinetic way to ensure that sovereign countries around the world steered clear of policies that undermined the profits of their oil companies and other commercial giants. Thus, the "investor-state dispute settlement" (ISDS) was born.

The modern ISDS was perfected in the 1990s with the Energy Charter Treaty (ECT). The ECT was meant to foam the runway for western corporations seeking to take over ex-Soviet energy facilities, by making those new post-Glasnost governments promise to never pass laws that would undermine foreign companies' profits.

But as Nick Dearden writes for Jacobin, the western companies that pushed the east into the ECT failed to anticipate that ISDSes have their own form of blowback:

https://jacobin.com/2024/03/energy-charter-treaty-climate-change/

When the 2000s rolled around and countries like the Netherlands and Denmark started to pass rules to limit fossil fuels and promote renewables, German coal companies sued the shit out of these governments and forced them to either back off on their democratically negotiated policies, or to pay gigantic settlements to German corporations.

ISDS settlements are truly grotesque: they're not just a matter of buying out existing investments made by foreign companies and refunding them money spent on them. ISDS tribunals routinely order governments to pay foreign corporations all the profits they might have made from those investments.

For example, the UK company Rockhopper went after Italy for limiting offshore drilling in response to mass protests, and took $350m out of the Italian government. Now, Rockhopper only spent $50m on Adriatic oil exploration – the other $300m was to compensate Rockhopper for the profits it might have made if it actually got to pump oil off the Italian coast.

Governments, both left and right, grew steadily more outraged that ISDSes tied the hands of democratically elected lawmakers and subordinated their national sovereignty to corporate sovereignty. By 2023, nine EU countries were ready to pull out of the ECT.

But the ECT had another trick up its sleeve: a 20-year "sunset" clause that bound countries to go on enforcing the ECT's provisions – including ISDS rulings – for two decades after pulling out of the treaty. This prompted European governments to hit on the strategy of a simultaneous, mass withdrawal from the ECT, which would prevent companies registered in any of the ex-ECT countries from suing under the ECT.

It will not surprise you to learn that the UK did not join this pan-European coalition to wriggle out of the ECT. On the one hand, there's the Tories' commitment to markets above all else (as the Trashfuture podcast often points out, the UK government is the only neoliberal state so committed to austerity that it's actually dismantling its own police force). On the other hand, there's Rishi Sunak's planet-immolating promise to "max out North Sea oil."

But as the rest of the world transitions to renewables, different blocs in the UK – from unions to Tory MPs – are realizing that the country's membership in ECT and its fossil fuel commitment is going to make it a world leader in an increasingly irrelevant boondoggle – and so now the UK is also planning to pull out of the ECT.

As Dearden writes, the oil-loving, market-worshipping UK's departure from the ECT means that the whole idea of ISDSes is in danger. After all, some of the world's poorest countries are also fed up to the eyeballs with ISDSes and threatening to leave treaties that impose them.

One country has already pulled out: Honduras. Honduras is home to Prospera, a libertarian autonomous zone on the island of Roatan. Prospera was born after a US-backed drug kingpin named Porfirio Lobo Sosa overthrew the democratic government of Manuel Zelaya in 2009.

The Lobo Sosa regime established a system of special economic zones (known by their Spanish acronym, "ZEDEs"). Foreign investors who established a ZEDE would be exempted from Honduran law, allowing them to create "charter cities" with their own private criminal and civil code and tax system.

This was so extreme that the Honduran supreme court rejected the plan, so Lobo Sosa fired the court and replaced them with cronies who'd back his play.

A group of crypto bros capitalized on this development, using various ruses to establish a ZEDE on the island of Roatan, a largely English-speaking, Afro-Carribean island known for its marine reserve, its SCUBA diving, and its cruise ship port. This "charter city" included every bizarre idea from the long history of doomed "libertarian exit" projects, so ably recounted in Raymond Craib's excellent 2022 book Adventure Capitalism:

https://pluralistic.net/2022/06/14/this-way-to-the-egress/#terra-nullius

Right from the start, Prospera was ill starred. Paul Romer, the Nobel-winning economist most closely associated with the idea of charter cities, disavowed the project. Locals hated it – the tourist shops and restaurants on Roatan all may sport dusty "Bitcoin accepted here" signs, but not one of those shops takes cryptocurrency.

But the real danger to Prospera came from democracy itself. When Xiomara Castro – wife of Manuel Zelaya – was elected president in 2021, she announced an end to the ZEDE program. Prospera countered by suing Honduras under the ISDS provisions of the Central America Free Trade Agreements, seeking $10b, a third of the country's GDP.

In response, President Castro announced her country's departure from CAFTA, and the World Bank's International Centre for Settlement of Investment Disputes:

https://theintercept.com/2024/03/19/honduras-crypto-investors-world-bank-prospera/

An open letter by progressive economists in support of President Castro condemns ISDSes for costing latinamerican countries $30b in corporate compensation, triggered by laws protecting labor rights, vulnerable ecosystems and the climate:

https://progressive.international/wire/2024-03-18-economists-the-era-of-corporate-supremacy-in-the-international-trade-system-is-coming-to-an-end/en

As Ryan Grim writes for The Intercept, the ZEDE law is wildly unpopular with the Honduran people, and Merrick Garland called the Lobo Sosa regime that created it "a narco-state where violent drug traffickers were allowed to operate with virtual impunity":

https://theintercept.com/2024/03/19/honduras-crypto-investors-world-bank-prospera/

The world's worst people are furious and terrified about Honduras's withdrawal from its ISDS. After 60+ years of wrapping democracy in chains to protect corporate profits, the collapse of the corporate kangaroo courts that override democratic laws represents a serious threat to oligarchy.

As Dearden writes, "elsewhere in the world, ISDS cases have been brought specifically on the basis that governments have not done enough to suppress protest movements in the interests of foreign capital."

It's not just poor countries in the global south, either. When Australia passed a plain-packaging law for tobacco, Philip Morris relocated offshore in order to bring an ISDS case against the Australian government in a bid to remove impediments to tobacco sales:

https://isds.bilaterals.org/?philip-morris-vs-australia-isds

And in 2015, the WTO sanctioned the US government for its "dolphin-safe" tuna labeling, arguing that this eroded the profits of corporations that fished for tuna in ways that killed a lot of dolphins:

https://theintercept.com/2015/11/24/wto-ruling-on-dolphin-safe-tuna-labeling-illustrates-supremacy-of-trade-agreements/

In Canada, the Conservative hero Steven Harper entered into the Canada-China Foreign Investment Promotion and Protection Agreement, which banned Canada from passing laws that undermined the profits of Chinese corporations for 31 years (the rule expires in 2045):

https://www.vancouverobserver.com/news/harper-oks-potentially-unconstitutional-china-canada-fipa-deal-coming-force-october-1

Harper's successor, Justin Trudeau, went on to sign the Canada-EU Trade Agreement that Harper negotiated, including its ISDS provisions that let EU corporations override Canadian laws:

https://www.cbc.ca/news/politics/trudeau-eu-parliament-schulz-ceta-1.3415689

There was a time when any challenge to ISDS was a political third rail. Back in 2015, even hinting that ISDSes should be slightly modified would send corporate thinktanks into a frenzy:

https://www.techdirt.com/2015/07/20/eu-proposes-to-reform-corporate-sovereignty-slightly-us-think-tank-goes-into-panic-mode/

But over the years, there's been a growing consensus that nations can only be sovereign if corporations aren't. It's one thing to treat corporations as "persons," but another thing altogether to elevate them above personhood and subordinate entire nations to their whims.

With the world's richest countries pulling out of ISDSes alongside the world's poorest ones, it's feeling like the end of the road for this particularly nasty form of corporate corruption.

And not a moment too soon.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/27/korporate-kangaroo-kourts/#corporate-sovereignty

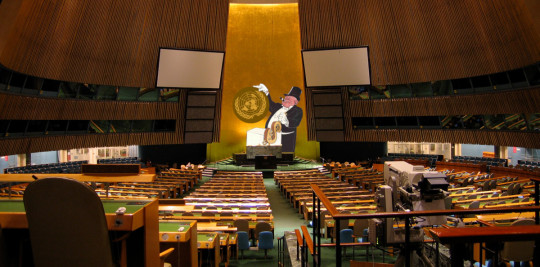

Image: ChrisErbach (modified) https://commons.wikimedia.org/wiki/File:UnitedNations_GeneralAssemblyChamber.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#isds#investor state dispute settlement#steven harper#canada#canpoli#ukpoli#honduras#prospera#roatan#Energy Charter Treaty#ect#eu#rockhopper#world bank#charter cities#cryptocurrency#libertarian exit#Xiomara Castro

222 notes

·

View notes

Text

Financial speculators are investing in a growing number of lawsuits against governments over environmental laws and other regulations that affect profits, often generating lucrative awards, the Guardian has found.

For a long time, litigation finance thrived primarily in the realm of car crashes and employment claims. “Had an accident that wasn’t your fault?” was the industry’s billboard catchphrase, offering to finance lawsuits in exchange for a cut of any payout.

Now, however, the sector has found a far larger playground: financing massive arbitration lawsuits launched by companies against governments, where claims can stretch to tens of billions of dollars.

These cases come under a little-known area of international law called investor-state dispute settlement (ISDS), which allows corporations to sue countries for actions that hurt their profits.

With litigation funders facing no risk of a counterclaim, and potential awards that now average more than $200m (£160m), legal experts warn that the system has become a “gambler’s nirvana” for hedge funds and specialist financiers.

Within the sector, the debate is growing: advocates for third-party funding say it increases access to justice but critics, including arbitrators who rule on cases, are raising concerns that the growth of third-party funding is fuelling expensive and potentially frivolous cases at enormous cost to the public.

A Guardian investigation, which analysed more than 1,400 cases launched against governments, found that ISDS cases have become far more common and lucrative. More than $120bn of public money was awarded to firms through ISDS courts, including at least $84bn to fossil fuel companies and $7.8bn awarded to mining companies.

The true figures are likely to be far higher as companies often do not disclose the size of payouts they receive. The Guardian found that in 31% of cases where a payout or settlement was made, the size of the award was not disclosed.

These cases have become an increasingly popular investment class for hedge funds and other investors, who back the legal action financially in exchange for a share of the final award. The Guardian identified at least 75 ISDS cases backed by third parties, although this too is likely to be a substantial underestimate: many treaties include no obligation to disclose third-party funding of cases, and the largest dispute-resolution body only began demanding disclosure in 2022.

Half of all third-party funded cases were launched by investors from the US, Britain or Canada, and more than 50% were cases relating to fossil fuels or mining. More than three-quarters of cases were against developing countries, according to Guardian analysis of data provided by Jus Mundi, a legal intelligence platform with access to the largest international law and arbitration database.

Examples of third-party funded cases include the Bermudan company South American Silver, whose subsidiary acquired mining concessions in an area of Bolivia mainly inhabited by Indigenous communities. In 2010, the company was accused of polluting sacred spaces and threatening community members, and the Bolivian government revoked the concessions. The government had to pay the mining company $18.7m in compensation.

This year, Burford Capital – the world’s largest litigation-finance company – is backing a case against Greenland for the impact of a uranium mining ban that a mining company argues in effect ended its development of one of the world’s largest rare earth mineral deposits. If Greenland loses the case, it faces either allowing the mining to go ahead or paying as much as $11.5bn in compensation.

Concerns are increasingly being raised by those who work within the ISDS system, including arbitrators who adjudicate cases.

Muthucumaraswamy Sornarajah, an international lawyer and ISDS arbitrator, believes third-party funding has made ISDS into “big business”. He said it was likely that there were more claims being brought, because the risk of losing the claim “vanishes” for the claimant: “So it would mean that the respondent states – most of which are developing countries – would have to face the cost of defending potentially frivolous claims that are brought with third-party funding.”

6 notes

·

View notes

Text

Jammu & Kashmir High Court Quashes FIR Following Mutual Settlement in Civil Dispute

The High Court allowed the quashing of the FIR and the criminal proceedings arising from it as the parties have settled their controversy. The court noted that while quashing should be exercised with caution, the amicable settlement between the parties in this case justifies the quashing of the FIR.

1. Background:

There was a civil dispute between the father of the petitioner and Respondent Suman Devi resulting in a FIR U/s 294IPC & 506IPC against Ashok Kumar. However, after the intervention of the members of the society, the matter was sorted and a settlement was arrived. Despite this settlement, the case proceeded, as such the petitioner Ashok Kumar sought relief from the court, arguing that the continuation of the criminal proceedings was unwarranted in light of the settlement.

Ashok Kumar v. Union Territory of Jammu and Kashmir through Police Station R S Pura & Suman Devi

Crl. Misc. Case No. 189/2024

Before the High Court of Jammu and Kashmir and Laddakh

Heard by Hon'ble Mr. Justice Yusuf Wani J

2. Legal Issue:

Whether the FIR and subsequent criminal proceedings could be quashed under Section 482 of the CrPC (now Section 528 of the Bhartiya Nagarik Suraksha Sanhita, BNSS) on the basis of a mutual settlement between the parties, despite the non-compoundable nature of the offenses involved.

3. Argument of Parties:

Petitioner (Ashok Kumar): Argued that the criminal proceedings were a result of a civil dispute that had been settled amicably, and continuing the case would serve no purpose.

The petitioner emphasized that Apex Court has previously quashed similar proceedings to allow parties to live peacefully.

Respondent: Respondents did not dispute the settlement but highlighted the limitations of the law concerning the quashing of FIRs in non-compoundable offenses.

4. Court's Observation:

The court recognized that while FIRs generally should not be quashed solely because of a settlement between the parties, there are exceptional circumstances where such action is justified.

The court emphasized the importance of balancing the interests of justice with the societal impact of quashing criminal proceedings.

The court referred to precedents where quashing was allowed in similar cases involving personal disputes that were later resolved.

#Mutual Settlement#Civil Dispute#Section 482 CrPC#Section 528 BNSS#Non-Compoundable Offenses#Personal Animosity#Jammu & Kashmir High Court#Judicial Discretion#Quashing Criminal Proceedings#FIR Quashing

1 note

·

View note

Text

NCLT Kolkata Hears Explosive Allegations in INCAB Case

Advocate claims widespread fraud in resolution process, challenges loan legitimacy The National Company Law Tribunal (NCLT) in Kolkata continues to unravel complex accusations in the INCAB case. JAMSHEDPUR – The NCLT Kolkata bench, led by Members Arvind Devanathan and Bidisa Banerjee, heard startling allegations of fraud and mismanagement in the INCAB case today. Advocate Akhilesh Srivastava…

#Akhilesh Srivastava arguments#बिजनेस#business#corporate debt settlement#corporate fraud allegations#Jamshedpur business news#NCLT Kolkata INCAB case#non-performing assets controversy#resolution process dispute#Resolution Professional misconduct#SARFAESI Act violations#Tata Steel land acquisition

0 notes