#corporate debt settlement

Explore tagged Tumblr posts

Text

NCLT Kolkata Hears Explosive Allegations in INCAB Case

Advocate claims widespread fraud in resolution process, challenges loan legitimacy The National Company Law Tribunal (NCLT) in Kolkata continues to unravel complex accusations in the INCAB case. JAMSHEDPUR – The NCLT Kolkata bench, led by Members Arvind Devanathan and Bidisa Banerjee, heard startling allegations of fraud and mismanagement in the INCAB case today. Advocate Akhilesh Srivastava…

#Akhilesh Srivastava arguments#बिजनेस#business#corporate debt settlement#corporate fraud allegations#Jamshedpur business news#NCLT Kolkata INCAB case#non-performing assets controversy#resolution process dispute#Resolution Professional misconduct#SARFAESI Act violations#Tata Steel land acquisition

0 notes

Text

If you, or someone you love, has ever received a big stack of medical bills just because you, for example, tripped in a parking lot, this post is for you.

Even if you have excellent insurance, you might want to learn about negotiating fees and charges. MANY fees and charges can be negotiated, but you have to ask and/or talk to more than one person. You can also get better rates by shopping around or asking for "self-pay rates" when you make the appointment.

If you read nothing else here, take note of these websites:

Dollarfor.org for negotiating hospital and other medical bills

Goodrx.org for finding best prices on drugs, shots, etc.

Radiologyassist.com for finding best pricing on X-rays, MRIs, etc

https://www.upmc.com/patients.../paying-bill/services/apply for negotiating UPMC bills (hospitals, providers, etc)

https://ahnneighborhood.org/financialassistance/ for negotiating AHN bills

https://www.healthcare.gov/community-health-centers/ database of low-cost or free clinics, searchable by zip code

https://www.kff.org/statedata/ my favorite website for researching healthcare stats

The following is copied from a health researcher named Timothy Frie, whose business name is "nutritionfortrauma"

https://www.timfrie.com/

------------

"There’s an entire market of health care services that most people don’t seem to know about.

If you don’t have health insurance, you have a high-deductible insurance plan, or you just want to save money on health care costs, here’s several resources you need to know about that could save you tens of thousands of dollars and the stress of unexpected medical bills:

If you need an MRI, x-ray, CT, mammogram, ultrasound, or PET scan, check the cost and availability of RadiologyAssist.com.

You pay one single flat-fee upfront for your scan and you won’t get a bill.

If you need an imaging referral, you can request a virtual consultation for $40.

You can also ask any imaging center for the self-pay rate for the scan you need and compare that to your anticipated out-of-pocket expenses.

If you need blood work, you may be able to pay a lower cost by purchasing the tests from a direct-to-consumer provider like PrivateMD Labs, Ulta Labs, or similar.

Just google “direct to consumer lab testing.”

Personally, I’ve found these services to sometimes be 60-90% cheaper than utilizing the direct-to-consumer options from Quest or Labcorp — even though they’re often the two labs drawing and processing your sample.

You pay one single flat-fee upfront and you won’t get a bill.

If you need more frequent support and care from a primary care provider due to a chronic illness or something else, explore “direct primary care.”

This is not the same as concierge care, which tends to be more expensive in most regions.

These are practices that offer care for a single flat-fee per month that ranges between $30-$100/mo on average.

All of your office visits and most procedures are included.

If you need to visit an urgent care, ask for the self-pay rate up-front.

Many urgent care centers offer an all-inclusive flat-fee option that includes everything that you need while you’re there, excluding medication and third-party lab fees.

This cost can range between $150-$400.

If you need a prescription and it’s more affordable on GoodRx or a similar service, you can ask to pay for it without utilizing your insurance.

I’ve found that some medications are more affordable at privately-owned and operated pharmacies vs. corporate pharmacies.

If your medical debt goes to a collection agency, you can negotiate a settlement to avoid paying the entire fee and/or litigation.

There are tons of resources about this online, including organizations who will support you with this (for a fee).

ALWAYS get and review an itemized bill before paying outstanding medical debt.

You can use HSA and FSA funds to purchase some health-related and wellness products, not just services.

Just Google “HSA shop” and see what you come across.

Review your HSA/FSA restrictions yourself before purchasing anything to ensure you don’t get stuck with an unexpected bill.

In some cases, you may need a letter of medical necessity."

End of Tim Fries

===============

I decided to post this information because although I have been working in healthcare and insurance copywriting and marketing since I was 22 years old, and I knew things were bad, I was reminded just how bad / expensive / confusing the state of US healthcare is after reading story after patient story following the shooting death of the United Healthcare CEO last week.

In May, I fell and broke my arm. It was a serious fracture, both bones, one exposed, and I was in surgery within hours. The good news is my surgeon was awesome and I had zero pain during the rough first 10 weeks of recovery. I took two Tylenol and I didn't even need them.

Because it was unplanned surgery and I spent two days in the hospital, coming through the ER, I got bills from many many different providers. I work in this field so I knew what to expect but it was still a headache and confusing. Especially during a time that I was unable to tie my shoes, pull up my socks, cut my own food, drive, or risk any activity that could lead to me falling. I also had to reduce my work hours since I was typing with one hand.

I'm fine now. I had a LOT of help during the worst of it.

I hope this post reaches someone who needs to see it.

9 notes

·

View notes

Text

2. The Greenback Dollar.

For many years there have not been wanting writers at home and abroad who have sought to obtain a deeper glance into the problem, and have uttered their protest against a further adherence to the metals as a medium of exchange. They have insisted that the time had arrived for a new departure from the outgrown methods of ruder times, and the results of our financial experience during the war has increased this class of writers.

The Greenback was a promise to pay, but as we could get no coin to carry on the war, and much less to pay for the proposed issue, a bond was therefore prepared into which we could fund any excess of currency, said bonds being payable in currency in not less than five, nor more than twenty years at the option of the holder, and bearing interest at six per centum. The amendments of the Senate making the interest payable in coin, and refusing to accept the national money at the national custom houses, thereby depreciating it in advance, the subsequent exemption of the bonds (dead capital) from taxation, and the creation of the National Bank system are well known.

The National Bank bill is based on the bond, and altogether presents an instance of unscrupulous rapacity and class-legislation seldom equalled. Full interest is not only paid to the banks upon the bonds bought—their capital in trade—but there is also returned in notes nine-tenths of the face value of the bonds, together with the exclusive privilege and monopoly of banking. A course of legislation has also been followed by which it has been sought to throw the whole currency of the country into the hands of these private corporations through the enforced retirement of the greenback. To effect this and inaugurate specie payment, the large volume of paper outstanding in 1865 serving the functions of money have been contracted two-thirds, although the business of the country was becoming adapted to the changed condition. The wide-spread misery into which we have since fallen, the almost extinction of our manufacturing prosperity, and the conversion of millions of able-bodied men into homeless Wanderers is well known. That fortunes have been lost, business ruined, industries suspended, and labor starving, is but a repetition in our land of the results of similar methods in England’s financial history.

Has it been necessary? Is a specie basis essential to the commercial exchanges of a nation? Can not a currency be based on the entire wealth of a nation as well as on one or two of its productions? These are the great questions now under popular discussion, and striking at the very roots of the old system. What is money? Judge Kelley says:

“It is that which a government declares shall be legal tender in payment of debts throughout its jurisdiction. It is purely a national and local institution, the crucial test of which is, Is it a legal tender?”

Henry Carey Baird says:

“Anything which freely circulates from hand to hand, as a common acceptable medium of exchange in any country, is in such country money, even though it cease to be so, or to possess any value, in passing into another country. In a word, an article is determined to be money by reason of the performance by it of certain functions, without regard to its form or substance.”

We may with confidence assert that the business of the country has long since outgrown the limited quantity of coin, and the specie, even in specie paying countries, scarcely enters into the settlement of debts. In fact the claim of a specie basis even in England, as we will see, is only a myth, having long since been supplanted by credit to meet the increased requirements of trade. The bank check is the monetary instrument of the age, millions of dollars being settled daily through the Clearing House without the use of either specie or bills. The business of London through “an inflated paper currency” of checks is so great that gold constitutes but one half of one per centum of the entire amount. It is a matter of history that whenever gold has been generally sought on the bills supposed to represent it, it has invariably failed to meet the demand and general bankruptcy and wide-spread ruin has periodically been the result.

£6,000,000 of the Bank of England bills are based, not on specie, but the government credit, representing debt, not coin. Whenever there has been a general demand for coin suspension has invariably resulted and an increased issue of bills been necessary to restore confidence. Yet these bills retain their par value, not because of their assumed redeemability, but of the government credit behind them. Bank deposits in England, that is, bank credits, as well as bills, perform the functions of money as assuredly as the gold on which they are professedly based. These credits are not deposits of coin, but, to use the words of Bonamy Price, “merely represent debts,” yet they aggregate over $5,000,000,000; while against this vast sum of veritable purchasing power we have perhaps $150,000,000 gold as bank reserves.

Specie as a basis being thus confessedly outgrown and its place supplanted by credit, the question arises shall the credit which supplant it be private or that of the nation ? Paper has ceased to be a mere representative of coin, but has become an actual substitute for it—and deriving its value from the confidence we have on its endorsement. But the unlimited inflation of bank credit currency worked by means of checks and kept at par with gold on which it is based, as an inverted pyramid may be said to be based on its apex, is a system whereby the mass is readily enslaved by the few who manipulate it, for it directly increases the power of the few at the expense of the many. A specie basis is thus seen on its face to be a delusion, without warrant in fact, unsafe in practice, and a relic of pre-industrial ages; in fact it might be cited as a glaring instance of what ethnologists would term a case of survival.

In lieu thereof there is demanded a National paper money issued on the authority and credit of the government, representing its entire wealth and made a legal tender in the payment of all debts, public and private. Not an exchange of commodities, but a medium of exchange whereby the products of industry are conveyed from hand to hand and representing the articles exchanged. The heavy tax imposed by the National Bank system would be done away and instead of delegating the credit of the government to private corporations at the expense of the people, the national credit would be behind every dollar issued.

But these bills are to be based on the Government bond, and made convertible into them, offering a depository paying a low rate of interest, based on the whole wealth of the nation. This system would recall our bonds from abroad and have them held at home. Every bill issued by the government represents a portion of its debt; whatever amount is thus held in the form of a circulating medium would entail no interest charge, and by its convertibility into a bond there could result no inflation beyond actual need, for every dollar not required in the channels of trade, not taken up at higher rates, would be presented for redemption in the bond. Our debt would be held at home, we would save the present drain to foreign countries to meet the interest; insolvent savings banks and trust companies would be unknown, and the present stagnation in trade removed. The volume of currency would depend upon the amount which would be required by the wants of trade. When business would be more profitable than the investment in bonds at a low rate of interest, bonds would be converted into money, and vice versa. In the words of Mr. Groom, in such an interchangeability “there is a subtle principle that will regulate the movements of Finance and Commerce as accurately as the motion of the steam engine is regulated by its ‘governor.’”

#currency#economics#money#capitalism#anti capitalism#history#anarchism#anarchy#anarchist society#practical anarchy#practical anarchism#resistance#autonomy#revolution#communism#anti capitalist#late stage capitalism#daily posts#libraries#leftism#social issues#anarchy works#anarchist library#survival#freedom

3 notes

·

View notes

Text

Years later, Luisa Connor and Vanessa Cárdenas would look back ruefully on the day foreigners visited their beachfront village with plans for a development next door. They had no idea the effort was backed by Silicon Valley billionaires who wanted to build a “startup city” or that a relatively new Honduran law would allow them to establish this semiautonomous enclave. They could not foresee they would lead a fight against it that would launch their village into national politics and prompt an international legal dispute, threatening to bankrupt the country. They thought it was just another hotel.

Crawfish Rock is a fishing village of a few hundred people on the island of Roatán. It is the kind of place where children roam free, scouring the forest for iguanas or catching crabs under the Caribbean’s glassy waters.

It is also the site of Próspera ZEDE, a libertarian experiment in market-driven governance whose backers are suing Honduras for up to $10.775 billion. Prospera’s Delaware-based creator, Honduras Próspera Inc., argues its project has a right to continue operating even though the law that enabled it was repealed two years ago, and that it should retain that right for 50 years. To make this claim, Honduras Próspera cited a trade agreement Honduras signed with the United States, where the investors are based, and an unrelated treaty with Kuwait.

Honduras Próspera’s is just one of 15 similar claims against the Honduran government, nearly all of which have been filed since February 2023. Collectively, investors who brought four of the claims are seeking up to $12.3 billion, nearly twice as much as Honduras’ entire public expenditures in 2022. The amount sought in the other 11 claims has not been made public. Should Honduras be ordered to pay any of those judgments, it will have no right of appeal.

How could this be?

The cases were brought under an obscure system in international law known as investor-state dispute settlement, or ISDS. Written into thousands of investment treaties and trade agreements, the system allows foreign investors to bring arbitration claims against states. While it was intended to protect investors against asset seizures or corrupt court judgments, critics say corporations now use ISDS to extract huge sums when governments tighten regulations or levy new taxes.

The cases are heard by ad-hoc tribunals of arbitrators who are generally corporate lawyers. There is no precedent and no appeal. Tribunals have issued billions of dollars in awards even in cases where corporations violated domestic laws, polluted the environment or trampled on basic human rights.

The ISDS system has also emerged as a threat to climate action. Fossil fuel companies have begun suing governments that try to phase out coal, oil and gas. In the case of poor, climate-vulnerable nations like Honduras, multibillion-dollar claims can worsen a poverty trap.

In a cruel cycle, climate change has contributed to Honduras’ soaring debt, according to a recent United Nations report, while more debt hampers the country’s ability to spend money protecting its people from extreme weather. As a result, “significant proportions of the population have been internally displaced or displaced across international borders.”

Honduras’ ISDS saga traces back to 2009, when a military coup toppled the government, and to 2021, when the wife of the deposed president was elected to lead the country, ending 12 years of rightwing authoritarian rule. Xiomara Castro ran for office pledging to reverse and reform many of the policies of the post-coup governments, widely seen as corrupt.

After Castro delivered on these promises—repealing the so-called charter cities law that enabled Próspera, for example, and enacting a law empowering her government to renegotiate electricity contracts—foreign investors brought ISDS claims.

Supporters of this process say companies filing claims are merely enforcing the rights given to them in trade and investment treaties. But many activists campaigning to reform or abolish ISDS say Honduras’ situation, and the Próspera case in particular, highlight the system’s injustices and failures.

“There are a few cases that are so egregious that I think could potentially bring down the system,” said Ladan Mehranvar, a senior legal researcher for the Columbia Center on Sustainable Investment. She noted that key leaders of the government that enacted the charter cities law have since been convicted in US federal court of running the country as a narco-state, and that the case could hobble Honduras’ finances. “I feel like this one is just one of them, because it’s so crazy.”

Dozens of Democrats in Congress have been calling on the Biden administration to intervene in the Próspera case and to remove ISDS from the trade agreement on which the claim is based.

“The ISDS system is a scam snuck into trade deals to allow large multinational corporations to bypass domestic courts and challenge legitimate public policies,” with Honduras Próspera’s claim as a prominent example, US senator Elizabeth Warren, a Massachusetts Democrat, told Inside Climate News in a statement.

While Biden administration officials have pledged that they would not include ISDS in future agreements, they have equivocated on whether they will strip it from the United States’ more than 50 treaties and agreements already in place. They have declined to weigh in publicly on the Próspera case.

Instead, the State Department has issued statements warning that the Castro administration’s policies could discourage foreign investment, comments many read as supportive of Honduras Próspera.

Nicholas C. Dranias, Honduras Próspera’s general counsel, said in a written statement to Inside Climate News that the Honduran government “has committed many illegal and expropriatory acts against residents, businesses, and investors in Próspera ZEDE.” (ZEDE is the Spanish acronym for Zones for Employment and Economic Development.)

He added that the company and its affiliates “remain willing to discuss a negotiated resolution” to its ISDS claim. “Whether the Government of Honduras is ultimately held liable for US$10.775 billion remains entirely in its own hands because it could simply honor the 50-year legal stability guarantee it made to investors in Próspera ZEDE.”

Gerardo Torres, Honduras’ vice minister of foreign affairs, said the country cannot afford to pay what the investors are seeking—nearly two-thirds of its people live in poverty and the nation is already saddled with $16.5 billion in debt. The government has decided to fight the claims rather than negotiate, he said, speaking from a couch in his office, with Tegucigalpa’s hodgepodge development sprawling in the window behind him.

In large part, the country’s strategy relies on an argument that this isn’t just about Honduras.

“If they somehow make us pay all the money that they’re talking right now, then they’re going to break a state,” Torres said. “And then you’re going to see how private corporations can destroy states.”

A 14-Story Tower, $25,000 Gene Therapy, and a Brawl

Crawfish Rock lies at the end of a largely unpaved road that terminates in the village center, within sight of the beach. Pastel wooden houses with corrugated metal roofs surround the clearing, raised high on stilts.

“Growing up in a community like Crawfish was really something desirous,” said Connor, whose first language is the Caribbean English known in Roatán as “island English.” Like many other villages in Roatán, Crawfish Rock is a community of Black Caribbean descendants.

Connor has spent her entire life here and she roams the village as if it were one large home, plucking wild almonds from trees lining the beach and mangos from an unruly orchard next to Cárdenas’ house. At a relative’s home off the village center, Connor emerged from the back with a length of sugar cane, which she peeled with a machete before chewing, then stopped to talk with her siblings, who were leaning against a blue wooden boat nearby, about to head out fishing.

“We have everything that a human needs to survive,” she said.

Connor and Cárdenas have been friends since childhood and now serve as president and vice president of the village patronato, or community council, positions they assumed when they realized that Próspera wasn’t just another tourism development.

By September 2020, villagers had learned that the project was operating under a law that allowed for a type of special economic zone known as a ZEDE. The ZEDE law drew on the ideas of Paul Romer, an American who would later serve as chief economist at the World Bank and who had been promoting the idea of charter cities as models of development. In 2011, the Honduran Congress passed a law based on Romer’s ideas, but the law was ruled unconstitutional by the country’s Supreme Court the following year. The president of the congress at the time then used a disputed legislative maneuver to replace four judges who had ruled against the law, and lawmakers enacted a new, slightly modified version in 2013.

The law allowed private investors to create their own, largely self-governing zones, with authorities far beyond other economic zones in Honduras and around the world that offer incentives for foreign investment. ZEDEs were empowered to write their own civil laws, enact their own regulations and building codes and create their own courts. Businesses would pay taxes not to municipal or national governments but to the ZEDE, which could set its own rates. Only a small portion of the revenue collected would be passed on to the central government.

The ZEDEs were overseen not directly by the government but by a committee appointed by Honduras’ president, and the initial members were stocked with foreigners, many American conservatives, including the son of former US President Ronald Reagan and the anti-tax crusader Grover Norquist.

Próspera became the first ZEDE in December 2017, funded by a venture capital firm founded to help launch charter cities around the world. The firm, Pronomos Capital, was backed by prominent billionaires, including Peter Thiel and Marc Andreessen. Próspera began attracting biotechnology companies and other businesses by promising a “flexible and incentive-based regulatory environment designed to foster innovation while ensuring optimal levels of safety.” Companies could choose from a number of regulatory frameworks or propose their own. Próspera’s advertising promised “a favorable tax regime.” The company says it has registered more than 220 businesses, which can be established by “(e)Residents,” who do not necessarily live or work in Roatán.

Today, not far from Crawfish Rock’s wooden houses and unpaved paths, in a country where more than half the population lives on less than $7 a day, visitors can spend $25,000 to inject themselves with a gene therapy that aims to delay aging, available only on Roatán and in Dubai. A Bitcoin center perched on a ridge overlooking the Caribbean teaches locals about the benefits of cryptocurrency and how to use it—Próspera ZEDE has adopted the digital coin as one of its currencies. Another company offers “subdermal implantation services and a variety of cybernetic upgrades,” saying: “We help people become self-sovereign cyborgs.”

About 1,000 feet from the center of Crawfish Rock, a developer has cleared a section of forested hillside in the ZEDE and erected a 14-story mixed-use tower unlike anything else on the island. The developer did not obtain permits from the local or national government for the building but instead from Próspera ZEDE, which Honduras Próspera said “is a Honduran government authority” similar to a municipality.

Perhaps most alarming for people in Crawfish Rock, the law created a process for Honduras to expropriate land on behalf of the ZEDEs through eminent domain in order to expand. Honduras has a dark history of land conflict, including the forced sale of farmers’ land to large corporations and violent attacks on those who resisted.

Honduras Próspera says its ZEDE has forbidden itself from expropriating land with a resolution it passed in August 2020, and the ZEDE has assured residents that it “will not, and cannot, legally expropriate properties to expand its boundaries.” But Connor and Cárdenas do not trust them.

As the two women began fighting Próspera and organizing against the ZEDEs, their relationship with the company grew increasingly contentious. In September 2020, as Honduras was grappling with the Covid-19 pandemic, the company’s chief executive Erick Brimen sent Cárdenas’ mother a voice message. Brimen wanted to hold a public meeting in the village, but the patronato had sent him a letter urging him not to, in light of social distancing requirements. The women were violating his rights, Brimen said in the message, adding, “they can end up in jail.” If Connor and Cárdenas didn’t retract their letter within hours, he said, “we’re going to take action, which again could result in legal action against your daughter.”

Brimen held the meeting, and it ended in a scuffle with him being ushered off the stage as police arrived, video shows.

Honduras Próspera said “the informational meeting, with appropriate social distancing, was essential to present a project that currently provides opportunities to the community, ensuring their rights are exercised in a safe, outdoor environment.”

Próspera employs residents in the village and has drawn some local support. Ariel Webster, who grew up in Crawfish Rock and does not work in the ZEDE, said Próspera has helped people there.

The situation has caused division within Crawfish Rock, pitting local employees against Connor, Cárdenas and those who support their fight. Last year, when the patronato hosted a group of ministers and delegates from the capital without inviting representatives from Próspera, some of the company’s supporters arrived at the meeting and clashed with those in attendance. The meeting ended in a brawl and a bloodied nose for Cárdenas.

Most concerning for Connor is that with the ISDS case filed, even a government that supposedly supports their fight against Próspera has done little to stop it from operating. She wonders if anything will stand in the way of the ZEDE’s expansion.

“If they don’t obey the central government,” Connor said, “what would they do to us?”

A Violent History

When the ZEDE law passed in 2013, Honduras was in crisis. The post-coup administrations cracked down violently on dissent. Protesters and dissidents were kidnapped, raped and murdered. In some cases, gunmen killed the children of activists rather than dissidents themselves, to inflict maximum fear.

These crimes were rarely investigated. With the homicide rate soaring, Honduras became one of the most violent countries in the world.

At the same time, the rightwing governments accelerated a trend begun in the 1990s, at the urging of the International Monetary Fund and World Bank, of privatizing state services and cutting public expenditures. Congress broke up the national energy company and began contracting with private enterprises to build new power generation, especially dams and solar farms. A new law eased the approval process for mines.

The flurry of private contracts became part of a “kleptocratic” regime, according to one 2017 report by the Carnegie Endowment for International Peace. Nearly all of the ISDS claims have their roots in contracts, laws or other agreements made during this period.

For the farmers and villagers being pushed off their land, or having their water resources privatized, the development rush converged with spiraling violence.

“Nowhere are you more likely to be killed for standing up to companies that grab land and trash the environment,” the international watchdog group Global Witness wrote in 2017, “than in Honduras.”

An opponent of a project that became the subject of two ISDS claims was murdered the following year.

At the center of these new laws and contracts was Juan Orlando Hernández, who was president of the congress when the ZEDE law was passed and was elected president of Honduras later in 2013. Hernández would serve two terms as president—a step prohibited by the Constitution. The US Department of Justice would later charge that Hernández used millions of dollars in payments from drug cartels to help buy off local officials to secure his electoral victories.

Eventually, Hernández, his brother and his chief of the national police would be extradited to the United States and convicted of drug trafficking and weapons charges. Hernández, US Attorney General Merrick B. Garland said, used his time in power to run “one of the largest and most violent drug-trafficking conspiracies in the world.”

Hernández was convicted in March of this year and sentenced to 45 years in prison, while the former national police chief was sentenced to 19 years. His brother is serving a life sentence. Hernández did not reply to a request for an interview from prison.

Brimen, Honduras Próspera’s CEO, who immigrated to the United States from Venezuela, has said his goal is to provide a model that would foster prosperity, helping alleviate poverty by streamlining unnecessary bureaucracies that hobble governments, especially in parts of Latin America.

Honduras Próspera said it “has no connection to any corruption in Honduras whatsoever.” The company has not been publicly accused of being involved in corruption or in passing the ZEDE law. But some residents, activists and members of the current government criticize the company for taking advantage of the law, given how it was passed, and for working with Hernández’s administration.

“They came and did business with the darkest side of our country,” said Rosa Danelia Hendrix, speaking in Spanish. Hendrix serves as president of the federation of patronatos for Roatán and the other Bay Islands, and helped lead the fight against the ZEDEs.

Up Against an Economic Superpower

The Castro administration’s fight against the ZEDEs is being waged from Tegucigalpa’s Government Civic Center, a set of gleaming buildings erected by Hernández’s government. The neat, modern plaza sits next to the presidential palace and houses many government offices, but its pedestrian entrance opens onto a busy street without a turn-off, resulting in a chaotic scene of double-parked taxis and honking, as if its architects failed to imagine that citizens would visit.

There, Fernando Garcia and a team of half-a-dozen young staffers compile documents and compose fervent social media posts denouncing the ZEDEs—there are two others apart from Próspera, focused on agricultural exports and mixed-use development, neither of which has filed an ISDS claim.

Garcia operates from a glass-walled conference room on a mostly empty floor, surrounded by stacks of folders, articles and books, including heavily earmarked copies of the Honduran Constitution and the Bible. He speaks passionately of his decades of service to the Honduran people—he served as economy minister and in other positions before the coup and is now presidential commissioner against the ZEDEs.

Garcia began his ZEDE fight as a member of the opposition to the post-coup administrations, soon after the law was enacted. He spent his time driving around the country to raise awareness and round up opposition, he said, mortgaging his home to help pay for gas and hotel rooms.

People would look at him in disbelief when he described what the ZEDEs were, “like I was a weirdo, or some strange animal,” he said in Spanish.

It was only once he was back in government that he realized how difficult the fight would be. Garcia said he met with leaders of the ZEDEs and requested information detailing their relationships with the government, but received little beyond heavily redacted documents. He said he asked what concessions they would like to continue operating in the country to replace the special status afforded by the repealed ZEDE law, but got nowhere.

Honduras Próspera said it sought negotiations with the government but received no response and has not received offers to switch to an alternative type of special economic zone. It added, “None of the other special regimes in Honduras offer similar levels of stability, international competitiveness, or compatibility” with the company’s business model.

Garcia said he does not even know whether there is still a commission in place to manage the ZEDEs. Próspera and the other ZEDEs would need such a commission to oversee their operations, yet Garcia and his team have been unable to uncover any documents indicating the existence of such a commission or identifying its current members.

Today, the ZEDEs appear to be operating in a cloud of legal uncertainty. The law that enabled them was repealed in April 2022, yet that law contained language providing a minimum 10-year transition if such a repeal were to take place. This month, Honduras’ Supreme Court ruled that the law and a set of constitutional amendments that accompanied it were unconstitutional and that the decision would affect existing ZEDEs. But it has yet to publish the ruling so the full implications remain unclear.

Honduras Próspera argues the ZEDE has the right to continue operating for decades. That claim is based on the 2014 investment treaty Honduras signed with Kuwait, which included language that guarantees the legal status of the ZEDEs for 50 years in the event their enabling law was repealed. Honduras Próspera says it gained access to this through the Dominican Republic-Central America Free Trade Agreement, signed by the United States and Honduras, which includes a so-called “most-favored-nation” clause. The controversial clause allows foreign investors like Honduras Próspera to cut and paste more favorable provisions from other investment treaties, regardless of whether their home governments are parties to the other agreements.

The full nature of Honduras Próspera’s ISDS claim remains unclear because the pleading is confidential, as are those for each of the other 14 cases against the country. But Honduras Próspera told Inside Climate News that the government has acted illegally by pressuring banks to close accounts for businesses registered in the ZEDE and forcing companies in the zone to pay taxes and fees on goods they purchase or import, among other steps.

In other ways, however, the ZEDE keeps operating, collecting its own taxes, allowing construction according to its own regulations, baffling and frustrating officials and residents of the country in which it is located.

Many of the people who made the fight against the ZEDEs a national issue blame not only Próspera but the Castro administration, too.

“We feel a great abandonment,” said Christopher Castillo, an environmental and human rights activist in Tegucigalpa, who said Castro and many others owe their electoral victories in part to the ZEDE fight. Speaking in Spanish, Castillo said the government should block companies from running clinical trials at Próspera, for example, or order construction halted at the 14-story tower, built largely after the ZEDE law was repealed.

Garcia, the presidential commissioner, insisted the ZEDEs are operating without legal authorization, but he acknowledged that the government has done little to enforce that perspective. He argued that Honduras is outmatched and needs to proceed cautiously.

“We are up against the greatest economic power in the world,” he said. Beyond the billionaires backing Próspera, he said, “you need to recognize that the United States government always protects two groups: Its soldiers and its businesspeople.”

Two weeks after Honduras Próspera notified Honduras of its intent to file its ISDS claim, in September 2022, its executives met with Roy Perrin, deputy chief of mission at the US embassy in Tegucigalpa “to talk about the investment climate in Honduras, the legal guaranties that allow entrepreneurs to create jobs and how sustainable investment can create economic opportunities for all Hondurans,” according to an embassy post on X written in Spanish.

The following month, Laura Dogu, the US ambassador to Honduras, gave a speech to the Honduran American Chamber of Commerce in Tegucigalpa in which she criticized some of the Castro administration’s policies on investment: “Without a doubt, all these actions are sending a clear message to companies that they should invest elsewhere, not in Honduras.” She added that the United States “will continue to exercise our right to meet with US investors and advocate for the resolution of trade disputes in accordance with the state of trade law.”

Honduras Próspera began rounding up support back home, too, spending hundreds of thousands of dollars to lobby Congress and the White House, according to filings. The State Department issued an investment climate statement for Honduras in 2022 saying new policies, including the repeal of the ZEDE law, an energy law and an employment law, “have dramatically increased the uncertainty of investment returns.”

Senators Bill Hagerty (R-Tenn.) and Ben Cardin (D-Md.) sent a letter in October 2022 to Secretary of State Antony Blinken asking him to “encourage the Republic of Honduras to honor legal guarantees with respect to US investments made” in the ZEDEs.

Rep. Paul Gosar (R-Ariz.) introduced a bill that would have directed the US president to suspend foreign assistance to any government that failed to “engage in good faith consultations” with any US national who sought negotiations with that government, a reference to Honduras, according to one of Honduras Próspera’s lobbying reports.

The State Department declined to make anyone available for an interview for this article but issued a written statement saying it “seeks fair treatment of US investors and encourages adherence to the rule of law in Honduras as a key enabling factor for its economic development.”

Garcia said that even apart from the US government’s economic and diplomatic heft, Honduran officials are wary of taking action against Próspera because of the ISDS claim. Under the arcane rules of international arbitration, Garcia noted, companies can claim “indirect expropriation” when governments take actions that harm an investment’s profitability.

“We have to act very carefully,” Garcia said.

This outcome may be no accident. It speaks to what critics of ISDS call “regulatory chill,” where a claim or even the threat of a claim can intimidate a government into reconsidering the policies in question. Dranias, Honduras Próspera’s general counsel, said in a recent podcast interview that ISDS “can be very effective to, let’s just say, create the right incentives for good behavior.”

“An Example for the World”

ISDS was meant to remove disputes from the political realm, but claims often become deeply partisan. Honduras has long been dominated by the United States and its commercial interests—it is where the term “Banana Republic” was coined to describe the domination of the United Fruit and Standard Fruit companies—and the country’s fight against international arbitration comes as part of the leftist government’s larger orientation away from its neighbor to the north.

In response to the ISDS claims, Honduras withdrew from a World Bank treaty that helps govern the system, though that decision does not affect existing claims and foreign investors can still lodge ISDS cases using separate, similar rules overseen by the UN and others. The country has been negotiating a new trade agreement with China and strengthening ties with Cuba, Nicaragua and Venezuela.

Torres, the vice foreign minister, said the government has been revising and ending contracts that gave private corporations overly favorable terms, saddling the Honduran state and its people with high costs.

The previous administrations, Torres said, were not simply privatizing state assets but funneling public wealth to corporations and banks. Now that the Castro administration is trying to take that wealth back, he said, investors have turned to ISDS.

Torres’ large office is decorated with memorabilia and books that reflect an odd mix of Anglo pop culture and leftist politics. Framed prints of the album cover for Sergeant Pepper’s Lonely Hearts Club Band and The Godfather share space with books like “Capitalism’s Deadly Threat” and “Xi Jinping: The Governance and Administration of China.”

The Castro administration’s critics—in Honduras and the United States—say it is turning toward communism and demonizing foreign investors. The country’s largest business group called the government’s withdrawal from the World Bank convention “economic self-sabotage,” a position that was recently printed across the front page of the country’s largest newspaper.

The business group’s manager of legal affairs, Gustavo Solorzano Diaz, said in an interview in Spanish that investors have turned to ISDS because they don’t trust the Honduran legal system and because the government’s new policies in the energy sector and others threaten to expropriate assets.

The Castro administration has been plagued with its own corruption scandals, alleged ties to drug traffickers and accusations of nepotism. While overall violence in the country has declined, violence against women, human rights defenders and journalists increased last year, according to the UN High Commissioner for Human Rights. The administration has also been accused of suppressing dissent and using the military to fight crime.

And even some on the left have criticized the Castro administration’s handling of the ISDS claims. Castillo, the human rights activist, noted that the government failed to appoint an arbitrator in the Próspera case, leaving the spot to be filled by the World Bank.

Honduras’ solicitor general, Manuel Díaz-Galeas, who is handling the cases, declined to be interviewed or answer questions for this article. “I don’t care what the opponents and the plaintiffs’ spokespeople say,” Díaz-Galeas said in Spanish in a text message to Inside Climate News. “Tell them, if possible, that we will meet in court.”

All of this background, while deeply important to Honduras’ political leaders and many of its citizens, could prove largely irrelevant when and if the tribunals start hearing the ISDS claims.

“There is no rule that requires a law to be adopted in a democratic or transparent process,” said Yarik Kryvoi, a lawyer who specializes in international dispute resolution, including ISDS.

Torres said Honduras is prepared to lose some of the ISDS claims, even expects to, but that the country will use them to expose what he calls the hypocrisy of developed nations, especially on climate change.

“They’re talking about climate change and the impact of climate change, but when a government or a community or a population tries to defend their resources, they most likely are defeated in international courts that always prioritize the interests of the private companies,” Torres said.

Multimillion- or billion-dollar ISDS awards would inflate Honduras’ debt, and if it tried to avoid paying, investors could move to seize any foreign assets the country holds and close it off from capital markets.

“We cannot go to more environment summits without talking about the economics behind that,” Torres said.

He added, “The only strategy we have is to make our case an example for the world: ‘This is what they’re trying to do to a poor country that is one of the most vulnerable to climate change.’”

Back in Roatán, where rising seas are nibbling away at the coastline and heavy rains recently flooded parts of Crawfish Rock, the central government’s defiance is hard to see. If the country loses the ISDS cases, it would be taxpayers—the people of Crawfish Rock among them—who would pay, Cárdenas observed. Meanwhile, workers put the finishing touches on the 14-story tower. Próspera continues to hold weekly bonfires at its beach club, with live music and mixed drinks. And Connor and Cárdenas wonder what will happen next.

5 notes

·

View notes

Note

GODDD YOUR BRAIN. a lot of what you said is stuff ive been thinking about for literal years and esp now with my most recent playthrough of 1 and 2. the video was great and i also found a pdf for orientalism that i will be picking through as i have the time for it. ive had a post in my drafts ive been working on for a few days. specifically about how the crimson raider leadership (excluding moxxi and including the vault hunters) is comprised entirely of corporate settlers and how that still absolutely fuels their ideology when it comes to the bandit clans. tannis, zed, and pierce are all dahl, marcus has been both siding every conflict since the beginning of mankind, and roland and the ENTIRE military force of the crimson raiders (excluding the vhs) are atlas leftovers. and ofc its seen as necessary because there needs to be bodies between them and hyperion so every injustice against the planet is forgiven. its hardly even mentioned. even moxxi, who is pandoran born, profits in just. outright massacring the population with her fighting rings. (the underdome was sponsored by every corporation, including the shield manufacturers.) the desire that the raiders have to protect pandora just feel like protecting the. thirty or so people who live with them because everyone else is seen as not worthy to the point where mass execution and displacement is encouraged. im not going to talk about bl3 because im a bit rustier on it at this point but in FFS thats an issue brought up at the very start of the dlc: the crimson raiders are losing power and arent needed anymore because jack is gone. like they arent doing any great help to the planet. theyre not even wanted by the end of 2. side tangent but the two things that stand out to me the most on first thoughts are: destroying the eridium mine supplying sledges men in one (after already killing him and half the settlement) and doing straight up environmental warfare in 2 when freezing out the bloodshots. its just unnecessary cruelty. im sorry for taking so long to type this out i have. untreated adhd 😔

No no no it's okay speak your mind!!!

Also some additional things I didn't have the place to say in my answer:

One, you could very easily interpret bl1 and particularly bl2 as an extended metaphor for American destabilization and subsequent media treatment of the Middle East. Except Gearbox themselves is parroting the in-universe perception of Pandora as a "barren wasteland where nobody lives", i.e. the myth of terra nullius. Despite all evidence to the contrary.

Two, 2 specifically has an anti-colonialist narrative. Handsome Jack is a colonizer and you oppose him. But within this opposition is a DISTINCT subtext of "yeah he wants to kill off the bandits of Pandora but he also considers the Normal People, like Salvador and your friends to be bandits!", not "bandits are also humans with dignity". I'm not sure if the former is the conclusion the writers want you to arrive at, but it kind of feels like it.

Three, if I remember correctly the first time a tink (xenohuman/mutant) was not presented as part of the subhuman orientalized faction was fucking New Tales. And I think there was one in Debt or Alive as well (including a tongue in cheek joke about how calling your enemies slurs is kinda bad actually). Yet again, either the writers can't comprehend someone disabled in a not-"cool scifi" way being human, or the Borderlands universe has ridiculous amounts of ableism and baseliner supremacist (can you tell I love Rimworld's terminology for this sort of stuff) sentiment. But homophobia isn't real so that's funny haha right guys??????

As for 3... yeah there isn't much there. Ellie tells us that Pandora has been drained of all resources, Tyreen tells us what I already addressed, fucking Vaughn man. I'm sure I could say smth more coherent on all that but I can't rn, brain fried.

Then there's the Looters and Frostbiters and Devil Riders, who for gameplay purposes are reskinned bandits for the DLCs, but they aren't stated to be bandits for... what reason exactly, aside from geographic isolation (all the other bandits across the galaxy are universally homogenized so...)? I mean, frostbiters even associate into clans like bandits do...

And I do highly suggest you read Orientalism, it's a foundational text in post-colonial studies for a reason, but I find that it also applies incredibly well to media analysis :)

3 notes

·

View notes

Text

character essay: topaz from honkai star rail

strap your seat belt in, we're going for a ride.

topaz is a debt collector.

now you may start thinking: did belobog commit a tax fraud? if so, how? i thought this was a very interesting thought process. because have you ever considered interplanar debt or financial settlements in sci-fi media? unless if they were sky pirates or very simple transactions of sale and purchase - it is often not explored and perhaps, most might even consider it not interesting.

for those who played the game and dedicated their time to the events, you'll find and agree that the influence of the interastral peace corporation (ipc) is wide - considering they hold a stake in an underused freight vehicle for the aurum alley business event. the ipc was also painted as calculating, for wanting to take back not only the freight vehicle, but any semblance of a bustling city. the ipc is a capitalist loaning body, driven by its "philanthropy", until it's time to reap the benefits."

when topaz walked into the story, that painting proves to have more details - more than just freight vehicles, the ipc could do more than just assistance in business, but repairing an entire planet.

topaz's exterior personality leaves readers with quite literally no hint to who she is or where is she from, aside from her love for animals, but playing the story leaves you to find out that she came from a heavily polluted planet that the only choice left was to leave everything to the ipc. however, it was also because of this upbringing and story that topaz would prioritise survival, more than its people's freedom. after all, protection from natural disaster as well resource allocation for a planet's rebuilding is a tempting deal - especially for belobog, that had only recently been cleared from its stellaron crisis.

not only that, belobog had also borrowed funds from the ipc prior to the planet's isolation from the rest of the world due to its extreme weather. the contract topaz offered to rebuild belobog and employ its citizens under the ipc would clear the arrears owed for over seven centuries.

despite the ipc's opportunistic nature as a body, topaz came to belobog and spoke to bronya with unmatched sincerity. topaz was a character that did not come from a privileged place, yet took the steps to dance alongside the work opportunity she was provided with. even if the contract offered by the ipc was tempting, even she was amazed by the thriving spirit of belobogians, looking toward a future with their intelligence and enduring the coldest blizzards. she could no longer compare the environment between jarilo-vi and her home planet.

despite having objectively failed her mission, she was humble, and did not assert her task more than necessary. if this was what the people of belobog wanted, then she would not force it upon them.

which comes at the cost of her current position, and she was demoted by one rank. even so, she still found beauty on this planet.

as a character, one would assume that her position meant she was always out for money, but she herself said that she was past working for the money, and thus did not mind the pay cut that came with her demotion. but more than that, she maintains a headstrong personality through it all - a marketing expert who knew how to use her story to resonate with potential clients, yet endearing for her love of animals.

she is also noted to be very capable and places the interest of the planet's ahead of work - the probability of success among her planet projects stood at 80%, higher than the ipc's average of 60%.

topaz is a multifaceted businesswoman: friendly with her network, assertive with her staff, a marketing expert and most of all, good-natured. as an experienced businesswoman, her story clashes at the differences in culture and ideals against bronya, a fresh-faced leader trusted by her subjects.

this blog entry was originally posted on stormofblood.

11 notes

·

View notes

Text

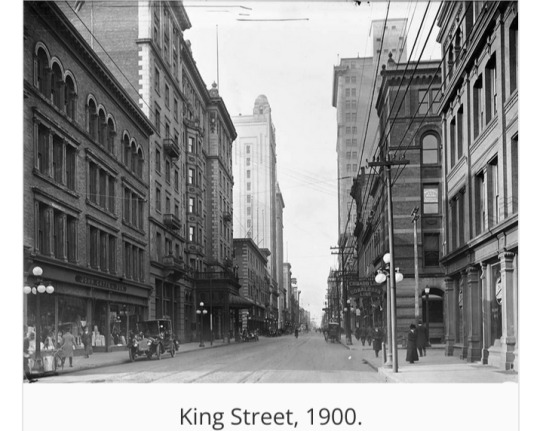

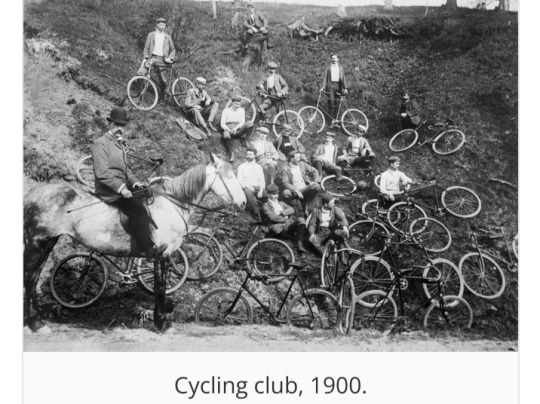

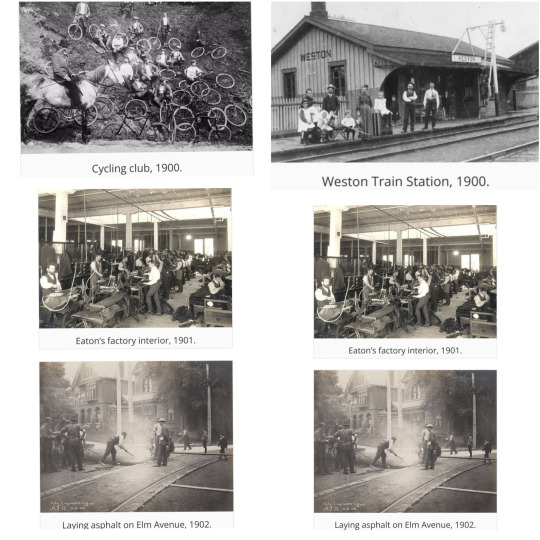

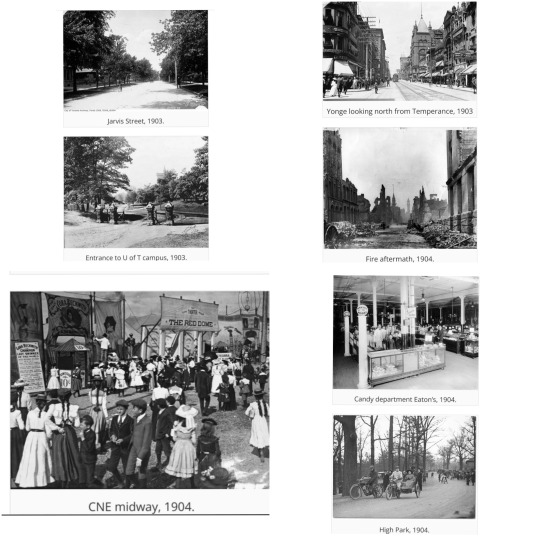

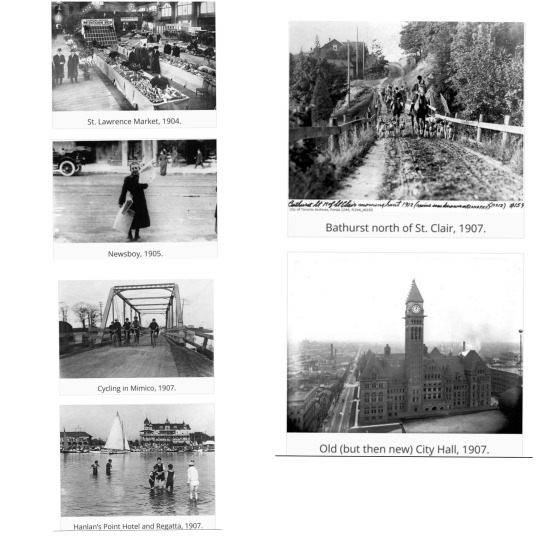

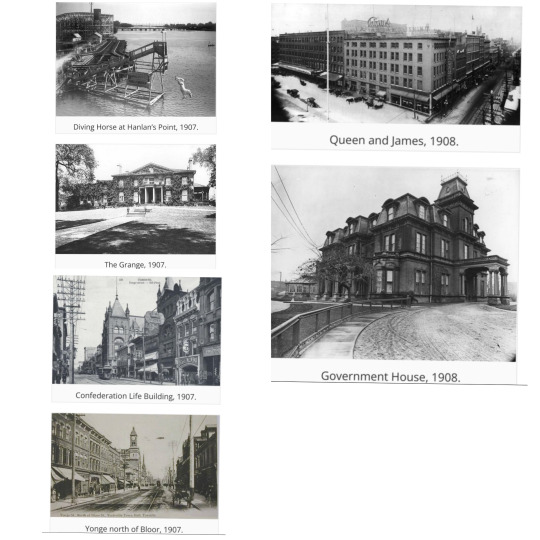

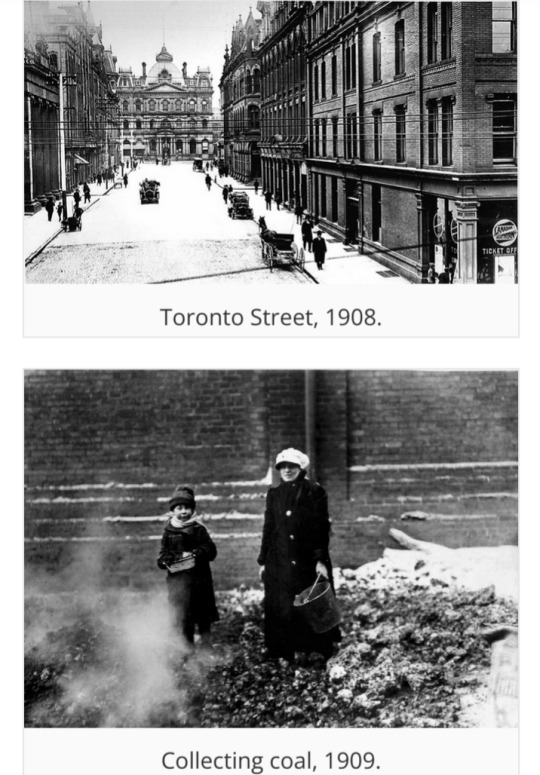

Toronto in the 1900s was a different city from the one we know today.

The center of business had moved west of the historical Town of York site and the skyline was undeveloped.

The tallest structures were the Temple Building at 10 stories and the Trader’s Bank Building at 15 stories.

A new downtown to the west of Yonge and King Streets was built. The City of Toronto moved into a new City Hall, built at the head of Bay Street at Queen Street.

Much of this new downtown was destroyed in the Great Toronto Fire of 1904, but it was quickly rebuilt, with new taller buildings.

South of downtown, the railways dominated most of the lands. A new viaduct was built to carry the main lines and eliminate the many at-level crossings.

A single Union Station was built to replace the several railway stations of the rail lines. It sat empty for a while over disagreements between the government and the rail companies.

In the late nineteenth century, Toronto welcomed the rise of Victorian architecture, as well as many of its revival styles.

This style of architecture was thought to be more modern, unique and creative than its successor, characterized by steep gabled roofs, round angles, towers, turrets and dormers, shapely bay windows, stained glass, centric carved woodwork, and bright colored paneling.

This style lent itself well to narrower lots, and thus, Victorian-style housing was most abundant in the city’s traditionally middle-class neighborhoods where individual properties were smaller, most notably Cabbagetown, Trinity-Bellwoods, Parkdale, and The Annex.

These neighborhoods held some of the largest collections of Victorian houses in North America.

Specifically, houses constructed in the Annex developed an individual iteration of the Victorian style, called the “Annex Style House.”

This style contained a variety of diverse and eclectic elements borrowed from many different styles.

Most distinctively, these houses were built of a mix of brick and sandstone, turrets, domes, and decorative ornamentation.

The city received new European immigrant groups beginning in the late 19th century into the early 20th century, particularly Germans, French, Italians, and Jews.

They were soon followed by Russians, Poles, and other Eastern European nations, in addition to the Chinese entering from the West.

As the Irish before them, many of these migrants lived in overcrowded shanty-type slums, such as “the Ward,” which was centered on Bay Street, now the heart of the country’s Financial District.

As new migrants began to prosper, they moved to better housing in other areas, in what is now understood to be succession waves of settlement.

Despite its fast-paced growth by the 1920s, Toronto’s population and economic importance in Canada remained second to the much longer-established Montreal, Quebec.

The Great Depression of the 1930s reversed the employment trend, with approximately one-fourth of the Toronto population unemployed and caused severe financial problems for suburban Toronto.

Capital debt payments could not be met and expenditure on public services—sewage and piped water supply in places remote from the lake, for example—had to be postponed.

However, World War II’s demands for war supplies and soldiers soon changed the employment picture.

Following the war, and into the 1960s, times were prosperous throughout North America.

Toronto’s economy diversified and boomed, greatly altering the cultural and spatial pattern of the city.

Other factors after the war included the baby boom, demand for single-family dwellings, and the proliferation of the automobile.

Suburban sprawl was assisted by the increase in road networks and freeways, thereby consuming some of the best agricultural land in the region.

By 1953, a reorganization of local government had been created, along with the Corporation of Metropolitan Toronto, in an attempt to control development in the surrounding regions.

Suburban growth continued. In 1966, new City of Toronto boundaries were drawn, amalgamating 13 communities, with the Metropolitan government still in place.

By the 1976 census, Toronto passed Montreal to become the largest city in Canada, and the gap between these two cities continued to grow.

(Photo credit: City of Toronto Archives / BlogTO / Wikimedia Commons / Britannica / Flickr).

Updated on: February 6, 2023

#Toronto#1900s#20th century#Great Toronto Fire of 1904#Victorian architecture#Annex Style House#19th century#Great Depression of the 1930s#Rare Historical Photos#vintage photos#Victorian houses

14 notes

·

View notes

Text

Manifesto for an Ecosocial Energy Transition from the Peoples of the South

An appeal to leaders, institutions, and our brothers and sisters

More than two years after the outbreak of the COVID-19 pandemic—and now alongside the catastrophic consequences of Russia’s invasion of Ukraine—a “new normal” has emerged. This new global status quo reflects a worsening of various crises: social, economic, political, ecological, bio-medical, and geopolitical.

Environmental collapse approaches. Everyday life has become ever more militarized. Access to good food, clean water, and affordable health care has become even more restricted. More governments have turned autocratic. The wealthy have become wealthier, the powerful more powerful, and unregulated technology has only accelerated these trends.

The engines of this unjust status quo—capitalism, patriarchy, colonialism, and various fundamentalisms—are making a bad situation worse. Therefore, we must urgently debate and implement new visions of ecosocial transition and transformation that are gender-just, regenerative, and popular, that are at once local and international.

In this Manifesto for an Ecosocial Energy Transition from the Peoples of the South, we hold that the problems of the Global – geopolitical – South are different from those of the Global North and rising powers such as China. An imbalance of power between these two realms not only persists because of a colonial legacy but has deepened because of a neocolonial energy model. In the context of climate change, ever rising energy needs, and biodiversity loss, the capitalist centers have stepped up the pressure to extract natural wealth and rely on cheap labor from the countries on the periphery. Not only is the well-known extractive paradigm still in place but the North’s ecological debt to the South is rising.

What’s new about this current moment are the “clean energy transitions” of the North that have put even more pressure on the Global South to yield up cobalt and lithium for the production of high-tech batteries, balsa wood for wind turbines, land for large solar arrays, and new infrastructure for hydrogen megaprojects. This decarbonization of the rich, which is market-based and export-oriented, depends on a new phase of environmental despoliation of the Global South, which affects the lives of millions of women, men, and children, not to mention non-human life. Women, especially from agrarian societies, are amongst the most impacted. In this way, the Global South has once again become a zone of sacrifice, a basket of purportedly inexhaustible resources for the countries of the North.

A priority for the Global North has been to secure global supply chains, especially of critical raw materials, and prevent certain countries, like China, from monopolizing access. The G7 trade ministers, for instance, recently championed a responsible, sustainable, and transparent supply chain for critical minerals via international cooperation‚ policy, and finance, including the facilitation of trade in environmental goods and services through the WTO. The Global North has pushed for more trade and investment agreements with the Global South to satisfy its need for resources, particularly those integral to “clean energy transitions.” These agreements, designed to reduce barriers to trade and investment, protect and enhance corporate power and rights by subjecting states to potential legal suits according to investor-state dispute settlement (ISDS) mechanisms. The Global North is using these agreements to control the “clean energy transition” and create a new colonialism.

Governments of the South, meanwhile, have fallen into a debt trap, borrowing money to build up industries and large-scale agriculture to supply the North. To repay these debts, governments have felt compelled to extract more resources from the ground, creating a vicious circle of inequality. Today, the imperative to move beyond fossil fuels without any significant reduction in consumption in the North has only increased the pressure to exploit these natural resources. Moreover, as it moves ahead with its own energy transitions, the North has paid only lip service to its responsibility to address its historical and rising ecological debt to the South.

Minor changes in the energy matrix are not enough. The entire energy system must be transformed, from production and distribution to consumption and waste. Substituting electric vehicles for internal-combustion cars is insufficient, for the entire transportation model needs changing, with a reduction of energy consumption and the promotion of sustainable options.

In this way, relations must become more equitable not only between the center and periphery countries but also within countries between the elite and the public. Corrupt elites in the Global South have also collaborated in this unjust system by profiting from extraction, repressing human rights and environmental defenders, and perpetuating economic inequality.

Rather than solely technological, the solutions to these interlocked crises are above all political.

As activists, intellectuals, and organizations from different countries of the South, we call on change agents from different parts of the world to commit to a radical, democratic, gender-just, regenerative, and popular ecosocial transition that transforms both the energy sector and the industrial and agricultural spheres that depend on large-scale energy inputs. According to the different movements for climate justice, “transition is inevitable, but justice is not.”

We still have time to start a just and democratic transition. We can transition away from the neoliberal economic system in a direction that sustains life, combines social justice with environmental justice, brings together egalitarian and democratic values with a resilient, holistic social policy, and restores an ecological balance necessary for a healthy planet. But for that we need more political imagination and more utopian visions of another society that is socially just and respects our planetary common house.

The energy transition should be part of a comprehensive vision that addresses radical inequality in the distribution of energy resources and advances energy democracy. It should de-emphasize large-scale institutions—corporate agriculture, huge energy companies—as well as market-based solutions. Instead, it must strengthen the resilience of civil society and social organizations. Therefore, we make the following 8 demands:

We warn that an energy transition led by corporate megaprojects, coming from the Global North and accepted by numerous governments in the South, entails the enlargement of the zones of sacrifice throughout the Global South, the persistence of the colonial legacy, patriarchy, and the debt trap. Energy is an elemental and inalienable human right, and energy democracy should be our goal.

We call on the peoples of the South to reject false solutions that come with new forms of energy colonialism, now in the name of a Green transition. We make an explicit call to continue political coordination among the peoples of the south while also pursuing strategic alliances with critical sectors in the North.

To mitigate the havoc of the climate crisis and advance a just and popular ecosocial transition, we demand the payment of the ecological debt. This means, in the face of the disproportionate Global North responsibility for the climate crisis and ecological collapse, the real implementation of a system of compensation to the global South. This system should include a considerable transfer of funds and appropriate technology, and should consider sovereign debt cancellation for the countries of the South. We support reparations for loss and damage experienced by Indigenous peoples, vulnerable groups and local communities due to mining, big dams, and dirty energy projects.

We reject the expansion of the hydrocarbon border in our countries—through fracking and offshore projects—and repudiate the hypocritical discourse of the European Union, which recently declared natural gas and nuclear energy to be “clean energies.” As already proposed in the Yasuni Initiative in Ecuador in 2007 and today supported by many social sectors and organizations, we endorse leaving fossil fuels underground and generating the social and labor conditions necessary to abandon extractivism and move toward a post-fossil-fuel future.

We similarly reject “green colonialism” in the form of land grabs for solar and wind farms, the indiscriminate mining of critical minerals, and the promotion of technological “fixes” such as blue or grey hydrogen. Enclosure, exclusion, violence, encroachment, and entrenchment have characterized past and current North-South energy relations and are not acceptable in an era of ecosocial transitions.

We demand the genuine protection of environment and human rights defenders, particularly indigenous peoples and women at the forefront of resisting extractivism.

The elimination of energy poverty in the countries of the South should be among our fundamental objectives—as well as the energy poverty of parts of the Global North—through alternative, decentralized, equitably distributed projects of renewable energy that are owned and operated by communities themselves.

We denounce international trade agreements that penalize countries that want to curb fossil fuel extraction. We must stop the use of trade and investment agreements controlled by multinational corporations that ultimately promote more extraction and reinforce a new colonialism.

Our ecosocial alternative is based on countless struggles, strategies, proposals, and community-based initiatives. Our Manifesto connects with the lived experience and critical perspectives of Indigenous peoples and other local communities, women, and youth throughout the Global South. It is inspired by the work done on the rights of nature, buen vivir, vivir sabroso, sumac kawsay, ubuntu, swaraj, the commons, the care economy, agroecology, food sovereignty, post-extractivism, the pluriverse, autonomy, and energy sovereignty. Above all, we call for a radical, democratic, popular, gender-just, regenerative, and comprehensive ecosocial transition.

Following the steps of the Ecosocial and Intercultural Pact of the South, this Manifesto proposes a dynamic platform that invites you to join our shared struggle for transformation by helping to create collective visions and collective solutions.

We invite you to endorse this manifesto with your signature.

9 notes

·

View notes

Text

Eat Your Young

Gallen | Suunaq Industrial Complex | Present Night

A sprawling industrial complex covered the plain, its buildings and roads nearly equaling the size of a small town.

It had stood there longer than some of the actual settlements in the surrounding area, growing piece by piece over several millennia. Power plants and offices jostled for space, interspersed with streets that had been paved and patched more times than anyone could count. Everything was kept in a state of high repair; the finest quality droids maintained the infrastructure, though there were no imperial drones to be seen.

Ever since its earliest nights, the complex had been filled white butterflies that did not seem to feed from or pollinate any flowers; not that there were many to be found in such a place. Any attempts to catch and study them ended in the insects dissolving to nothing, so trolls let them be.

Most didn’t have the time or energy to wonder about what little wildlife surrounded them to begin with.

For marked over each of the complex’s entrances, on the identification cards of all the trolls who worked in that place, was the jade symbol of QPIN - each and every troll there in the corporation-gang’s debt.

Debts paid - in part - by blood.

Debts paid to one of the Queenpin’s right-hand executives, Inshii Suunaq.

—

Three tall figures gathered under the glare of a street lamp, all coming from different directions.

A woman, hourglass-shaped with a band covering her eyes and a cowgirl hat on her head, dressed in a crop top and shorts. A man, broad and powerfully built, wearing only knee-length shorts and no shirt. A person dressed in a beautiful violet sherwani, the tallest of all, wide with soft roundness instead of the man’s dense bulk.

The woman spoke first as they faced each other on the sidewalk, the night air quiet around them.

“Damn, I hate this place.” Rhyssa complained, hands on her hips. “I can’t even see it proper and I still hate it. Would it kill ya to decorate a bit, Shii? The vibes are just awful.”

“I don’t have time for excessive frivolity.” Responded the false violet in a deadpan as they led the other two away. “Trolls can put up ornamentation if they like; I don’t forbid them. Excessive levels of depression are unproductive.”

Rhyssa groaned as she followed, her boots’ spurs jingling softly. “Sugar, you’ve been contributin’ to depression in trolls for a long time without tryin’. I love you, but ya are kind of a robot when it comes to fixin’ a place up.”

Gallen hung back a few steps as the three of them made their way down the sidewalk, letting the other two banter. He was grateful he couldn’t speak, and that he likely wouldn’t be asked to sign very much, or type; if his siblings picked up on his dread, everything was over.

Everything might still be over if he couldn’t carry out the plan Klirro and Tuuya had concocted for him. All his isopods wriggled anxiously in his skin, though he tried not to let it show.

Rhyssa hung back, head tilted, the wasps fluttering around her to serve as her eyes buzzing in concern.

“What’s eatin’ ya, Gal?”

Oops.

I don’t know how things are going to be from now on, he signed honestly.

I hope this makes mother better, but what if it makes her worse? What will we do? How can we care for her? For once, I wish we were more like trolls. Trolls know how to tend to their lusii and quadrants.

All we were ever meant to do was serve her.

We were never taught anything else. Unlike Lleios, we weren’t given the ability to learn much beyond what we were made to do.

I think she did that on purpose, he signed, suddenly angry as he had the thought, eyes narrowing, gestures sharper. I think she wanted to keep us dependent.

She let me learn about religion, she let me watch trolls come to my altar all those sweeps, but she knew I could never truly understand them.

Only Lleios could.

Gallen looked at Rhyssa, whose hand touched her mouth in shock at his words, and he saw that Inshii had stopped walking, looking back at the pair of them as their fins flicked.

The isopod swarm folded his broad arms, blue eyes hard. He wasn’t backing down.

Even if it weren’t for the mission, even if Klirro had never found him, even if he had wound up killing Tuuya after all - these doubts had brewed for centuries, and he was done ignoring his problems.

“Gal! What’s all this hullabaloo?” Rhyssa protested, her own hands flapping in distress as she buzzed with worry. “Where’d this come from all of a sudden, huh? You’ve never - never said a blessed thing - ”

“Now is not the time for such topics.” Cut in Inshii, hard enough that their sister’s hands dropped and her buzzing quieted. She folded her arms, sullenly silent, and Gallen stared the butterfly swarm down, their violet eyes hard.

“Gallen…we will discuss this later.” His oldest sibling’s tone held a practiced neutrality, one he knew was barely holding back anger. Their fins twitched almost imperceptibly, but he caught it.

“Mother needs us now, and she needs us united.”

As if they’d been properly united for sweeps. As if they’d really acted together since Lleios had died.

Killed by a troll, of all things. A troll they had loved. A troll who betrayed them…yet they had wanted him to, so they could die.

Gallen’s fists clenched at the way his youngest sibling had chosen to leave the rest of them behind. If they hadn’t done that, none of this would have happened.

The cold pavement cut his bare feet repeatedly, as it usually did. What did he care? He regenerated his skin nigh instantly, barely noticing as the three swarms drew closer to Inshii’s laboratory.

The thick glass doors slid open with a slight hiss as the false violet led the way in after flashing their ID to a scanner, barely making any sound despite their size. Gallen squinted as they walked into the harsh lighting and gray-white walls and floors, the smell of disinfectant prominent.

There were a few trolls to be seen, but most of Inshii’s staff here were highly specialized robots. The ones that were present shied away from the trio automatically. There wasn’t any fear on their faces or in their movements; they did it instinctively, knowing better than to be close.

“Can we at least eat before this?” Commented Rhyssa, slightly impatient. “I’m assumin’ those ain’t snacks, and I’m peckish.”

“Obviously those aren’t snacks.” Said Inshii in a slightly weary tone of voice. “Food doesn’t work in the laboratory. If you knew anything about science you’d understand just how intensive and time consuming this process has been to replicate. I’ve needed my finest staff on this and had to hire a few extras, which is not kind to my payroll.”

“Ooh, lemme play ya a song on m’banjo, saddest one in the history of the empire, Shishi.” Said Rhyssa, singsong and mocking, actually taking out her instrument as if she was about to start strumming.

Inshii rolled their eyes and ignored her, so Rhyssa pouted and put it away.

Gallen stopped and looked around, not in any hurry to get to what came next. He put his hands in his shorts’ pockets, feeling for the hundredth time that the vial of cloudy liquid was still there.

“Come on.” Called Inshii impatiently. “You’d think we were dragging you to an atheist convention.”

He opened his mouth to huff silently, not wanting to let himself feel amused, and kept walking.

He couldn’t. He had to…he had to…

Gallen twisted inside, hundreds of small legs wriggling and grasping at each other.

He followed his oldest sibling, just like he always had for millennia.

Obedient Gallen. Peaceable Gallen.

Even before mother had taken his tongue, he’d always been like that.

Inshii led him and Rhyssa down a narrow hallway, their precise steps echoing in the near-silence. The faint buzz of electric illumination was the only sound.

Then the lights flickered for a second.

Gallen blinked, looking at his sibling inquiringly. Inshii sighed, their brightly colored fins flicking.