#DEBT CONSOLIDATION

Explore tagged Tumblr posts

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

981 notes

·

View notes

Text

#donald trump#trump 2024#trump#democrats#president trump#donald j. trump#debt consolidation#government spending#congress#senate#washington dc#republicans#elon musk#vivek ramaswamy#matt gaetz#ukraine#ukrainian#nato#budget#money management#money#military spending#spending#dan bongino#tucker carlson#illegal immigration#immigration#ebt#immigrants#kamala harris

54 notes

·

View notes

Text

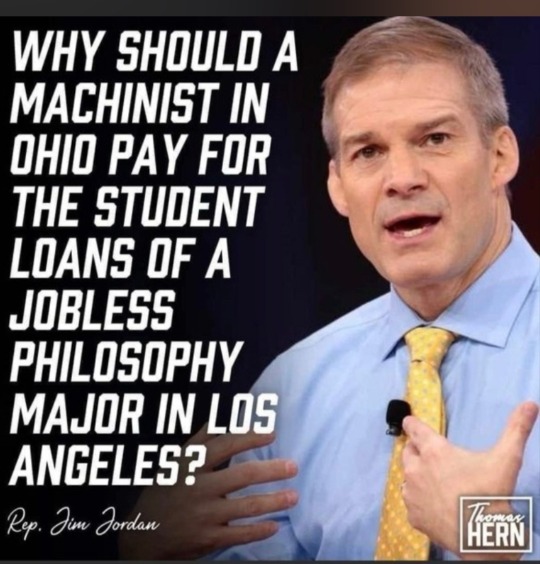

Student loan debt is still our country problem

#Student loan debt is still our country problem#student loans#debt relief#student debt#debt consolidation#debt recovery#debt#utas#university#universities#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#class war#eat the rich#eat the fucking rich#anti capitalism#antifascist#antinazi#anticapitalista#anti colonialism#anti cop#anti colonization

50 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

194 notes

·

View notes

Video

youtube

How to make money using other people's money!

3 notes

·

View notes

Text

Hello Friends! I am starting a journey to pay off my student debt! This blog will still include book reviews, don't you worry! However I will also be discussing my debt journey and how I plan to pay off my debt. One way I am trying is through Amazon affiliate marketing, meaning if you like the things I will be reviewing, please click on the link and if you buy the book or whatever it is I post, then I will get a commission and that will help me toward my debt repayment journey! I am also thinking about starting a YouTube channel but I am unsure if anybody would have any interest in that.

That being said! I want to discuss one way I am saving money this year is by using websites such as bookbub, and freebooksy to invest only in free kindle books to use on my kindle paperwhite! I highly recommend buying a kindle if you have not already and looking into similar websites as well as Libby, an app that connects to libraries and allows you to borrow books for free! My goal for this year is to not spend any money purchasing books!

If you are interested in a kindle here is a handy link to purchase one!

#kindle#book blog#book review#bookworm#reading#literature#academia#authors#college#books#ao3#kindle unlimited#new books#debt#debt relief#debtmanagement#debt consolidation#debtfreejourney#taxes#economics#debt management#911 abc#911 show#911 spoilers#911 lone star#oliver stark#amazon#sales#deals#discount

4 notes

·

View notes

Text

Beginners guide to Financial Planning

Introduction

It is the process of managing your own and your household personal finances, or it is the most valuable point you will have to understand about the data that advice how a single manage his/her personal finance. It Include Financial planning which one person makes over time. That means you establish goals and benchmarks and track your progress. With that said, now let's pretty much get into the basics of how to kick-start your financial journey.

1. What is Financial Planning?

The purpose of financial planning is to assess your financial status, identify the goals you would like to achieve, and come up with a way in which these goals can be possible. This includes budgeting, saving, investing, and managing debt/loans to maintain financial security and well-being as well as planning for life events.

2. Setting Financial Goals

Set clear, achievable goals:

Short-term (rough guideline: build a 3-6 month emergency fund or pay off > 7% interest debt

– Medium Term: Save for a down payment or large expenditure

Long-term — for retirement or your child's education.

3. Understanding Your Finances

Understand your finances by:

Net worth (Assets – Liabilities)- Tracking income and expenses

- Evaluating debt.

4. Creating a Budget

A budget is how you spend your income on expenses, saving, and investments.

- List income sources.

So, the things you got to do are: — Expense characterization (fixed and variable)

- Set spending limits.

- Regularly review and adjust.

5. Building an Emergency Fund

Have three to six months living expenses set aside in a liquid account for medical problems or loss of job.

6. Managing Debt

Reduce debt by:

Focusing on high interest debt

- Consolidating debt.

- Creating a repayment plan.

7. Investing for the Future

Invest to grow wealth:

Stocks- high returns, risk also higher.

– Bonds: Consistent income, lower risk.

Diversified portfolio — mutual funds

Real estate: rental income and appreciation

8. Retirement Planning

Redefining goal retirement savings with retire Expense

401(k) — Employer-sponsored plans

– IRA (Individual Retirement Accounts)

Pension plans:

Steady income after retirement.

9. Insurance and Risk Management

Protect assets with:

— Health/Life/Disability/Property Insurance

10. Reviewing Your Financial Plan

Be sure to revise and fine-tune your plan over time to reflect the goals you are working towards.

Conclusion

Financial planning gives you clear control over your financial future. Establish goals, financial plan, manage debt and invest in interest of stability and wealth creation. Persevere and be able to adapt.

#economy#investing#entrepreneur#investment#startup#insurance#retirement#retireearly#finance#personal finance#debt#debt recovery#debt relief#debt consolidation#income

4 notes

·

View notes

Text

Please help me overcome my financial crisis and secure my future

I am struggling with my finances for a while now. Despite my best efforts, unable to generate enough income to cover my expenses as my bills have passed my income. I have been forced to rely on credit cards and loans to meet the bills, and my debt has been growing steadily. I am now at a point where I am struggling to make even the minimum payments on my debts, and I am facing the very real possibility of bankruptcy.

I am reaching out to you today because I am in urgent need of $50,000 or INR 45 lakhs(4,500,000) so that i can do partial payment of my debt and my total debt with various banks is $98000 or INR 84 Lakhs(total debt with banks).This will help me pay off my existing debts, cover my basic living expenses. With your help, I can get back on my feet and start building a better future for myself and my family.

I run a website called My Finance Managers (https://myfinancemanagers.com/), where I manage funds for my clients. Unfortunately, due to my own mistake in hiring the wrong people to manage the funds, I incurred huge losses from the stock market in the last 6 months. These losses wiped out all my savings and the entire loan taken from banks. I lost some of the amounts in crypto currencies which are out of trading now. As a result, I am currently living off credit cards and only able to pay the minimum due. The loan taken from the banks to pay off the losses has now become unmanageable, and the bank executives are chasing me for the money. I am left with no other option but to seek help online or face dire consequences. This has been a very bad experience for me, and I am struggling to stay afloat. However, I am determined to turn my situation around and get back on my feet. With your help, I can pay off my debts and start fresh.

If I am able to secure this amount, I will use it to pay off my existing debts and cover my basic living expenses. This will allow me to get out of the cycle of debt and start building a solid financial foundation.

There are several ways that you can help support me:

1. Donate: If you are in a position to do so, please consider making donation via various methods. Every little bit helps, and your support could make a huge difference in my life.

2. Share: Even if you are not able to donate, you can still help by sharing my campaign with your friends and networks. The more people who see my story, the more likely I am to reach my goal.

3. Encourage: Finally, your words of encouragement and support mean the world to me. Knowing that there are people out there who believe in me and my dreams gives me the strength and motivation to keep going, even when times are tough.

Any help financially or any opportunity to clear my debt i am looking to take. My situation is very worst that i have tried to negotiate with the bankers and try to extend the moratorium period but as the payments are delayed they are helpless.

I am also willing to repay the amount when i am financially strong. If anyone has any guidance or advice on how to handle this situation, it would be greatly appreciated. I am determined to turn things around and get back on track, but I cannot do it alone. Any help or support would be greatly appreciated.

I kindly request you to donate any amount possible to you.

Thank you for taking your time for me. With your help, I know that I can turn my financial struggles into success.

Please help with kind heart!!

Pay krishna surya using PayPal.Me

Go to paypal.me/krishnav556 and type in the amount. Since it's PayPal, it's easier and more secure. Don't have a PayPal…

paypal.me

You can contact/WhatsApp me on +918977426208 to know more details of my financial situation or you need more information to help.

From the bottom of my heart i thank all the persons who have come forward help me. Your help would save a family.

#finance#financial help#help help help#bankrupt#debt consolidation#funding#stock market#crypto currency#urgent funds#please donate#anything helps#urgent

7 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Credit and Credit Cards

Understanding credit

Dafuq Is Credit and How Do You Bend It to Your Will?

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Ask the Bitches: What’s the Difference Between Credit Checks and Credit Monitoring?

When (And How) To Try Refinancing or Consolidating Student Loans

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Using credit

How to Instantly Increase Your Credit Score…For Free

How to Build Good Credit Without Going Into Debt

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Season 1, Episode 3: “My Parents Have Bad Credit. Should I Help by Co-signing Their Mortgage?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

Credit cards

A Hand-holding Guide To Getting Your First Credit Card

63% of Millennials Are Making a Big Mistake With Credit Cards

Let’s End This Damaging Misconception About Credit Cards

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Here’s What to Do With Those Credit Card Pre-approval Offers You Get in the Mail

We’ll periodically update this masterpost as we continue to write tutorials and answer questions on credit. So if there’s anything you’re confused about, keep the questions coming!

And if we’ve helped you increase your credit score or pay off your credit card debt, consider tossing a coin to your Bitches through our PayPal. It ensures we can pay our lovely assistant and keep bringing you free articles and episodes like those above.

Toss a coin to your Bitches on PayPal

#credit#credit score#credit history#credit report#credit card#credit card debt#good credit#personal finance#money tips#debt management#debt consolidation#debt

366 notes

·

View notes

Text

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

39 notes

·

View notes

Text

Consolidation Expert

At Consolidation Expert, we’re all about helping people simplify their finances to get back on the right track. As a consolidation loan broker, we specialise in helping people to find the right consolidation loan for their financial situation. A consolidation loan can allow people in debt to repay multiple creditors and combine multiple payments into one manageable loan. We have many years of experience in the industry and are committed to providing a personalised service to every one of our clients. Therefore, every loan offer is tailored to suit your unique situation. We believe that with the right help, everyone can conquer debt and regain control of their finances. That’s why we work with a large panel of lenders who consider a range of credit histories.

If you are looking to find the right type of Consolidation Loans look no further other than Consolidation Expert.

Contact Us

Consolidation Expert

86 Ashley Rd, Hale, Altrincham, Greater Manchester, WA14 2UN, United Kingdom

+44 161 359 8205

https://consolidationexpert.co.uk/

To know More

Brand Map

youtube

#Consolidation Loans#Debt Consolidation Loans#Consolidation Expert Altrincham#Debt Consolidation#Credit Card Consolidation

2 notes

·

View notes

Text

Debt Consolidation -

Debt Consolidation can be a lifesaver for many homeowners struggling with multiple high-interest debts. This process combines all your outstanding debts into a single, more manageable payment, usually with a lower interest rate. Consolidate your debts today with Real Estate Assist's property solutions

Debt Consolidation in Cape Town

2 notes

·

View notes

Text

How to Get Debt Relief: Best Options to Regain Financial Control

Struggling with debt can be overwhelming — but you’re not alone, and there are proven ways to get back on track. Whether you’re facing credit card bills, personal loans, or medical expenses, there are debt relief options that can help you reduce what you owe, simplify payments, and even become debt-free. The right solution depends on your financial situation, the type of debt you have, and your credit score.

What Is Debt Relief?

Debt relief refers to strategies or services that reduce or restructure the amount you owe to make it easier to repay. While some methods can eliminate your debt entirely, others lower your interest rates or consolidate multiple debts into one. All methods can affect your credit score, so it’s important to evaluate the long-term impact before committing.

Popular Debt Relief Options

1. Debt Consolidation Loans

If you're managing several unsecured debts (like credit cards or personal loans), a debt consolidation loan allows you to combine them into a single loan with one monthly payment — ideally at a lower interest rate.

Pros:

Simplifies repayment

Potentially lower interest rates

Fixed end date for debt payoff

Cons:

Requires a decent credit score (600+)

May involve fees or collateral

2. Balance Transfer Credit Cards

A balance transfer card lets you move existing debt onto a new credit card that offers an introductory 0% APR for a set period (usually 6–21 months). This can save a significant amount on interest if you can pay off the balance before the promotional period ends.

Pros:

0% APR promotional periods

No impact on your credit if used responsibly

Cons:

Requires good credit (670+)

High interest after the intro period

Possible 3–5% transfer fee

3. Debt Management Plans (DMPs)

Offered by credit counseling agencies, a DMP involves working with a counselor to create a structured repayment plan. They may negotiate lower interest rates or fees with creditors and help you pay off debt in 3 to 5 years.

Pros:

No credit score minimum

Professional guidance

Structured payoff timeline

Cons:

Setup and monthly fees

Requires discipline and commitment

4. Debt Settlement

Debt settlement involves negotiating with creditors to pay less than you owe. This is typically done through a debt settlement company and is most effective if you owe over $7,500 in unsecured debt.

Pros:

Can significantly reduce total debt

No need for high credit score

Cons:

Major negative impact on credit

Fees up to 25% of settled debt

Risk of scams

How to Apply for Debt Relief

1. List All Your Debts

Include account types, balances, interest rates, and monthly payments. This helps determine which option fits best.

2. Check Your Credit Score

You can get a free report at AnnualCreditReport.com. Your score will impact which options are available and how favorable the terms are.

3. Choose the Right Option

Evaluate the pros and cons of each debt relief strategy based on your debt amount, credit standing, and financial goals.

4. Prepare Your Documents

Lenders or counselors may require:

ID and proof of address

Tax documents and pay stubs

Account statements

Social Security number or ITIN

Debt Relief Options to Avoid

Bankruptcy: Should be a last resort due to its 10-year credit impact.

Early Retirement Withdrawals: Drains future savings and limits investment growth.

Final Thoughts

Debt relief can be a powerful tool to regain control of your finances. Whether you choose consolidation, a credit counseling service, or settlement, each approach comes with risks and benefits. Take time to assess your needs and choose the strategy that puts you on the path toward long-term financial stability — and freedom from debt.

#debt relief#financial planning#debt consolidation#balance transfer#credit counseling#debt management#personal finance#credit score#debt settlement#money management

0 notes

Text

How Debt Consolidation Can Help Brampton Homeowners

Debt consolidation helps Brampton homeowners regain stability by merging debts into one low-interest payment, reducing stress. Click here to learn more.

#Debt Consolidation#best debt consolidation mortgage#debt consolidation mississauga#debt consolidation calculator

0 notes

Video

youtube

How to utilize debt to make money

0 notes

Text

Debt Consolidation in 2025: What It Is and How to Use It to Get Out of Debt Faster

Keywords: debt consolidation, how to consolidate debt, best debt consolidation loans, credit card consolidation, debt relief, debt management, personal loan for debt consolidation

✅ What is Debt Consolidation?

Debt consolidation is the process of combining multiple debts into one single payment—usually with a lower interest rate. This helps make debt more manageable, reduces monthly payments, and can even boost your credit score over time.

💡 How Does Debt Consolidation Work?

You take out a new loan or line of credit to pay off all your existing debts. Instead of juggling multiple due dates and interest rates, you make one simplified monthly payment—ideally at a lower interest rate.

Common Ways to Consolidate Debt:

✅ Personal loan for debt consolidation

✅ Balance transfer credit cards

✅ Home equity loan or HELOC

✅ Debt consolidation programs (through a nonprofit or debt management agency)

🚨 When Should You Consider Debt Consolidation?

You should consider debt consolidation in 2025 if:

🔺 You have multiple high-interest debts

🔺 Your credit score is strong enough to qualify for a lower-rate loan

🔺 You're struggling to keep up with minimum monthly payments

🔺 You want to simplify your finances and avoid missed payments

🔺 You're committed to staying out of debt moving forward

🔎 Best Debt Consolidation Options in 2025

1. Personal Loans

Fixed interest rates and terms

Good for consolidating $5,000 to $50,000 in unsecured debt

Top lenders in 2025: SoFi, LightStream, LendingClub, Marcus by Goldman Sachs

2. Balance Transfer Credit Cards

0% APR promotional period (usually 12–21 months)

Great for credit card consolidation under $10,000

Best for people with excellent credit scores (700+)

3. Home Equity Loan or HELOC

Use your home as collateral

Lower interest rates than unsecured loans

Risk: You could lose your home if you can’t repay

4. Debt Management Plans (DMPs)

Offered through credit counseling agencies

Can help negotiate lower interest rates

Best for people with poor credit who can't qualify for new credit

📈 Benefits of Debt Consolidation

✅ Lower interest rates ✅ Simplified payments ✅ Improved credit score (over time) ✅ Reduced stress and anxiety ✅ Pay off debt faster with a structured plan

🧠 Debt Consolidation vs. Debt Settlement

FeatureDebt ConsolidationDebt SettlementCredit ImpactPositive (if managed well)Negative (initial hit)GoalSimplify & reduce interestReduce total debt owedFeesUsually none or lowHigh fees (15–25%)Who It’s ForPeople who can still payPeople in financial hardship

🔥 Trending FAQs About Debt Consolidation (2025)

❓ Is Debt Consolidation Bad for Your Credit?

No — if you make on-time payments, it can improve your credit score by lowering credit utilization and eliminating missed payments.

❓ How Long Does It Take to Pay Off Consolidated Debt?

Most consolidation loans range from 24 to 60 months. The faster you pay, the less interest you’ll pay overall.

❓ Can I Consolidate Debt With Bad Credit?

Yes, but your options may be limited. You may need a cosigner or work with a credit counseling agency.

❓ Will I Save Money With Debt Consolidation?

If you qualify for a lower interest rate or shorter repayment term, you could save thousands over the life of your loan.

📝 How to Get Started with Debt Consolidation in 2025

Step 1: Check Your Credit Score

You’ll need a minimum score of 600–640 for most personal loans.

Step 2: Calculate Your Total Debt

List out balances, interest rates, and monthly payments.

Step 3: Compare Consolidation Options

Use loan marketplaces or financial tools to compare lenders and credit cards.

Step 4: Apply and Use Funds to Pay Off Old Debt

Use your new loan or credit line only to pay off existing debts.

Step 5: Commit to Your New Payment Plan

Avoid taking on new debt while repaying your consolidated balance.

🚀 Pro Tips for Success

📅 Set up automatic payments to avoid late fees

💳 Avoid using old credit cards after consolidation

📉 Create a realistic budget to stay out of debt

💬 Talk to a financial advisor if you're unsure where to start

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

✅ Final Takeaway: Is Debt Consolidation Right for You?

If you're overwhelmed by multiple payments or drowning in credit card debt, debt consolidation in 2025 could be your smart path to freedom. With the right strategy, you can lower your payments, pay off debt faster, and finally breathe again.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More and Decrease Your Debt!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#debt consolidation#how to consolidate debt#best debt consolidation loans#credit card consolidation#debt relief#debt management#personal loan for debt consolidation

1 note

·

View note