#Cryptocurrency investing

Explore tagged Tumblr posts

Text

5 Common Crypto Investment Mistakes and How to Avoid Them.

With its potential for high returns comes equally high risk. New investors often find themselves making critical mistakes that can impact their financial health. We'll explore five common mistakes.

Investing in cryptocurrency can be both thrilling and daunting. With its potential for high returns comes equally high risk. New investors often find themselves making critical mistakes that can impact their financial health. Here, we’ll explore five common errors and provide in-depth guidance on how to avoid them. 1. Lack of Research and Due Diligence Mistake: Jumping into investments without…

View On WordPress

#Altcoin Investment#Altcoins#Avoid FOMO#Avoiding Crypto Scams#Beginner’s Guide to Crypto#Blockchain Technology#Crypto Community#Crypto Investment#Crypto Investment Strategy#Crypto News#Crypto Portfolio#Crypto Research Tips#Crypto Scams#Crypto Whitepapers#Cryptocurrency Investing#Cryptocurrency Red Flags#Dollar-Cost Averaging#Financial Advice#How to Spot Crypto Scams#Identifying Genuine Crypto Projects#Investing in Cryptocurrency#Investing Tips#Legitimate Crypto Projects#Meme Coins#Reputable Crypto Exchanges#Risk Management#Secure Investments#Token Distribution

0 notes

Text

Investment Strategies for a Changing Market: Insights for 2024 and Beyond

As we venture into 2024, the global investment landscape is marked by rapid technological advancements, evolving geopolitical dynamics, and shifting economic paradigms. The post-pandemic recovery, inflationary pressures, interest rate fluctuations, and the ongoing digital revolution are shaping the financial markets in unprecedented ways. For investors, this dynamic environment presents both challenges and opportunities. To navigate this changing market successfully, it is crucial to adopt adaptable and forward-thinking investment strategies. In this blog post, we will explore key insights and strategies that can help investors thrive in 2024 and beyond.

1. Diversification: The Cornerstone of Risk Management

Diversification remains a fundamental principle of sound investing, particularly in an uncertain market environment. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to specific risks and enhance the stability of their portfolios.

a. Asset Class Diversification

In 2024, traditional asset classes such as equities, bonds, and real estate continue to play a crucial role in portfolio construction. However, the inclusion of alternative investments—such as commodities, private equity, and cryptocurrencies—can provide additional diversification benefits. Commodities, for instance, often perform well during inflationary periods, while private equity offers exposure to high-growth companies not available in public markets. Cryptocurrencies, despite their volatility, can offer high returns and serve as a hedge against traditional financial systems.

b. Geographic Diversification

Globalization has made it easier for investors to access markets worldwide. In the current economic climate, emerging markets in Asia, Latin America, and Africa offer attractive growth prospects. These regions are experiencing rapid economic development, driven by demographic trends, technological adoption, and increasing consumer demand. By investing in these markets, investors can tap into high-growth opportunities while mitigating the risks associated with any single economy.

c. Sector Diversification

The economic landscape is constantly evolving, and different sectors perform differently depending on the macroeconomic environment. For instance, technology and healthcare sectors have shown resilience during economic downturns, while energy and industrial sectors tend to perform well during periods of economic expansion. In 2024, sectors like renewable energy, biotechnology, and cybersecurity are expected to experience significant growth, driven by technological advancements and societal shifts. By diversifying across sectors, investors can capture growth opportunities while managing sector-specific risks.

2. Embracing Technological Innovation

Technological innovation continues to be a major driver of economic growth and market performance. The rise of artificial intelligence, automation, blockchain, and the Internet of Things (IoT) is transforming industries and creating new investment opportunities.

a. Investing in Tech Giants and Innovators

Tech giants such as Apple, Amazon, Google, and Microsoft have become integral to the global economy, and their dominance is expected to continue in 2024. These companies are leaders in innovation, with extensive research and development capabilities that enable them to stay ahead of competitors. In addition to these established players, investors should also consider smaller, high-growth companies at the forefront of technological advancements. Startups in fields like artificial intelligence, biotechnology, and clean energy offer significant growth potential, albeit with higher risk.

b. Leveraging Fintech and Digital Finance

The financial industry is undergoing a digital transformation, driven by fintech innovations such as digital payments, robo-advisors, and blockchain technology. These innovations are making financial services more accessible, efficient, and secure. In 2024, fintech companies are likely to continue disrupting traditional financial institutions, offering investors lucrative opportunities. Additionally, the rise of decentralized finance (DeFi) platforms, which use blockchain technology to offer financial services without intermediaries, presents new avenues for investment.

c. Capitalizing on the Metaverse and Virtual Reality

The concept of the metaverse—a virtual world where people interact, work, and play—is gaining traction, with major companies investing heavily in its development. Virtual reality (VR) and augmented reality (AR) technologies are expected to play a crucial role in the metaverse, creating new investment opportunities in entertainment, gaming, real estate, and even digital art. While still in its early stages, the metaverse represents a long-term growth area for investors willing to take on higher risk for potentially high rewards.

3. Sustainable and Impact Investing

As concerns about climate change, social inequality, and corporate governance continue to grow, sustainable and impact investing is becoming increasingly important. Environmental, Social, and Governance (ESG) factors are now integral to the investment decision-making process for many investors.

a. Integrating ESG Criteria

In 2024, companies that prioritize sustainability and ethical practices are expected to outperform their peers, as consumers, regulators, and investors demand greater accountability. By integrating ESG criteria into their investment strategies, investors can identify companies that are well-positioned for long-term success. For instance, companies with strong environmental practices may be better prepared to navigate regulatory changes related to climate change, while those with good governance structures are likely to manage risks more effectively.

b. Focusing on Green Energy and Climate Solutions

The transition to a low-carbon economy is accelerating, driven by government policies, technological advancements, and changing consumer preferences. Investments in renewable energy, energy efficiency, and clean technologies are expected to see significant growth in 2024 and beyond. Companies involved in the production of solar, wind, and hydrogen energy, as well as those developing electric vehicles and energy storage solutions, offer compelling investment opportunities. Additionally, investors should consider companies that are working to mitigate climate risks, such as those involved in carbon capture and climate resilience projects.

c. Supporting Social Impact Initiatives

Impact investing, which seeks to generate positive social and environmental outcomes alongside financial returns, is gaining traction among investors. In 2024, areas such as affordable housing, education, healthcare, and sustainable agriculture are expected to attract significant investment. By supporting companies and projects that address pressing social challenges, investors can contribute to societal progress while achieving financial returns.

4. Adapting to Economic and Geopolitical Shifts

The global economy is constantly influenced by a range of factors, including inflation, interest rates, fiscal policies, and geopolitical events. To succeed in this environment, investors must be agile and responsive to changing conditions.

a. Navigating Inflation and Interest Rate Risks

Inflationary pressures and interest rate hikes are expected to continue in 2024, presenting challenges for fixed-income investments and consumer spending. To mitigate these risks, investors should consider inflation-linked bonds, real assets such as real estate and commodities, and dividend-paying stocks. Additionally, floating-rate bonds, which adjust their interest payments based on changes in interest rates, can offer protection against rising rates.

b. Monitoring Geopolitical Developments

Geopolitical events, such as trade tensions, conflicts, and regulatory changes, can have significant impacts on financial markets. In 2024, investors should closely monitor developments in major economies such as the United States, China, and the European Union. Trade relations, especially between the U.S. and China, will continue to influence global supply chains and market sentiment. Additionally, political instability in emerging markets could create both risks and opportunities for investors. To manage geopolitical risks, investors should consider diversifying their portfolios across regions and sectors, as well as staying informed about global events.

c. Hedging with Safe-Haven Assets

In times of economic uncertainty, safe-haven assets such as gold, government bonds, and the U.S. dollar tend to perform well. These assets provide stability and protection against market downturns. In 2024, gold is expected to remain a popular hedge against inflation and currency devaluation. Similarly, U.S. Treasuries and other high-quality government bonds can offer safety and income in a volatile market. Investors should consider allocating a portion of their portfolios to these safe-haven assets to balance risk and reward.

5. Active vs. Passive Investing: Striking the Right Balance

The debate between active and passive investing continues to be relevant in 2024. While passive investing, through index funds and ETFs, offers low-cost exposure to broad markets, active investing allows for more targeted strategies and the potential for higher returns.

a. Benefits of Passive Investing

Passive investing is a popular strategy for its simplicity, low costs, and consistent performance. By tracking market indexes, passive funds provide broad diversification and reduce the risk of underperforming the market. In a changing market, where predicting short-term movements can be challenging, passive investing offers a reliable way to capture overall market growth. For long-term investors, a core portfolio of passive funds can provide steady returns with minimal effort.

b. Opportunities in Active Investing

Active investing, on the other hand, involves selecting individual stocks, bonds, or funds based on research and market analysis. In a rapidly changing market, active managers can capitalize on opportunities and avoid potential pitfalls that passive funds might miss. For instance, active investors can target undervalued companies, emerging sectors, or regions with strong growth potential. Additionally, active strategies can be tailored to specific investment goals, such as income generation or capital preservation.

c. Combining Active and Passive Approaches

For many investors, a combination of active and passive strategies offers the best of both worlds. By maintaining a core portfolio of passive investments and supplementing it with active strategies, investors can achieve diversification, reduce costs, and enhance returns. For example, an investor might use index funds to gain broad market exposure while actively selecting individual stocks in high-growth sectors or emerging markets. This balanced approach allows investors to adapt to changing market conditions while staying aligned with their long-term objectives.

6. Long-Term Perspective: Staying Focused on Goals

Amidst market fluctuations and economic uncertainty, it is essential for investors to maintain a long-term perspective. Short-term market movements can be unpredictable, and reacting to them impulsively can lead to suboptimal investment decisions.

a. Staying Disciplined During Market Volatility

Market volatility is inevitable, especially in a rapidly changing environment. Investors should avoid making emotional decisions based on short-term market movements. Instead, they should stay disciplined and focused on their long-term investment goals. A well-diversified portfolio, aligned with the investor’s risk tolerance and time horizon, can help weather market turbulence and achieve steady growth over time.

b. Regular Portfolio Review and Rebalancing

Regularly reviewing and rebalancing the portfolio is crucial to ensure that it remains aligned with the investor’s goals and risk tolerance. Market changes can cause the portfolio’s asset allocation to drift away from its target mix. Rebalancing involves selling overperforming assets and buying underperforming ones to restore the desired allocation. This disciplined approach helps manage risk and keeps the portfolio on track to achieve long-term objectives.

c. Adapting to Life Changes

Investors’ financial goals and risk tolerance can change over time due to life events such as retirement, marriage, or the birth of a child. It is important to adapt the investment strategy to reflect these changes. For example, as investors approach retirement, they may want to shift towards more conservative investments to preserve capital and generate income. Conversely, younger investors with a longer time horizon may opt for more aggressive growth strategies. By regularly reassessing their investment goals and adjusting their strategies accordingly, investors can stay aligned with their evolving needs.

As we navigate the complexities of 2024 and beyond, the investment landscape will continue to evolve, presenting both challenges and opportunities. By adopting a diversified, forward-thinking approach, embracing technological innovations, integrating ESG criteria, and staying responsive to economic and geopolitical shifts, investors can position themselves for success in a changing market. Whether through active or passive strategies, the key to long-term success lies in maintaining a disciplined, goal-oriented approach and staying focused on the big picture. With the right strategies in place, investors can confidently navigate the uncertainties of 2024 and beyond, achieving their financial objectives while seizing new opportunities in the ever-changing world of investing.

#Investment Strategies 2024#Diversification in Investments#Global Market Trends 2024#Technological Innovation in Investing#Sustainable Investing#ESG Investing#Capital Markets 2024#Geopolitical Risks in Investing#Passive vs Active Investing#Long-Term Investment Strategies#Emerging Markets Investment#Fintech and Digital Finance#Metaverse Investment Opportunities#Impact Investing 2024#Alternative Investments#Cryptocurrency Investing#Green Energy Investments 2024#Scott Biffin#singapore#australia

1 note

·

View note

Text

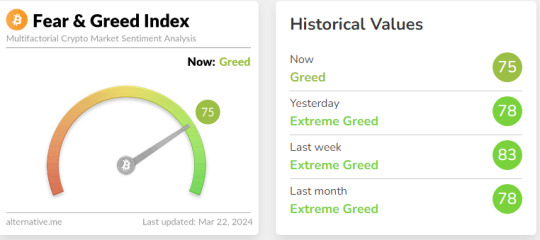

At its core, the Crypto Fear and Greed Index serves as a barometer for investor sentiment within the cryptocurrency market. It assigns a numerical value between 0 and 100, with lower values indicating extreme fear and higher values suggesting extreme greed. This index provides invaluable insights into prevailing market emotions, enabling investors to make informed decisions regarding their crypto portfolios.

https://www.bloglovin.com/@a2zcrypto/unlocking-crypto-fear-greed-index-a-comprehensive-12512075

0 notes

Text

Modern Investing - Earn more through cryptocurrency investing

Common investors have become aware of cryptocurrencies. However, the recent decline in the value of these coins has led many to question whether they are better investments than they are today. Despite different attitudes towards cryptocurrencies such as Bitcoin (BTC) and others. Demand for Bitcoin assets has also increased. Investors around the world are feeling this right now. OTC Crypto Exchange UAE Trusted by Brokers, Financial Analysts and Investment Managers for Smooth Transactions. Read :

#cryptocurrency investing#buy dubai property with cryptocurrency#crypto pay dubai#cryptocurrency exchange in uae#p2p crypto exchange uae#p2p crypto exchange#cryptocurrency

0 notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about money#submitted june 26#crypto#cryptocurrency#money#personal finance#investments

246 notes

·

View notes

Text

Investing in Cryptocurrency is Bad and Stupid

I know what you’re thinking: How could we say something so controversial, yet so brave?

Did we just help you out? Tip us!

34 notes

·

View notes

Text

Hey everyine great news! My drop shiopping courses have been enough of a scusess tbat the

33 slurp juices remain. Your mission is to eliminate all of them before they can combine with an astro ape and mint a new astro ape

NFT game is back on! And there’s even better news!!!

Just ship a dead rat to 38.89679° N, 77.03601° W for a big surprise!!! Send me a pic of the surprise and you’ll even get a jared leto joker nft valued at 10 million billion dogecoin on us!!!

But hurry! This once in a lifetime opportunity is going away flr goot in just [function.timne+1]!!! Be sure to get in on the ground floor because forget the moon, we’re going all the way to freaking mars!!!

Did YOU seee the hiddem nessage??? Be sure to read the post thoroughly for any clues you might have missed!!!

#to the moon#nft#bitcoin#blockchain#crypto#cryptocurrency#web 3.0#binance#cryptocurreny trading#investment advice#retirement planning#stocks#stock market#cryptocurrency trading#cryptocurrency investment#might blaze this later idk

126 notes

·

View notes

Text

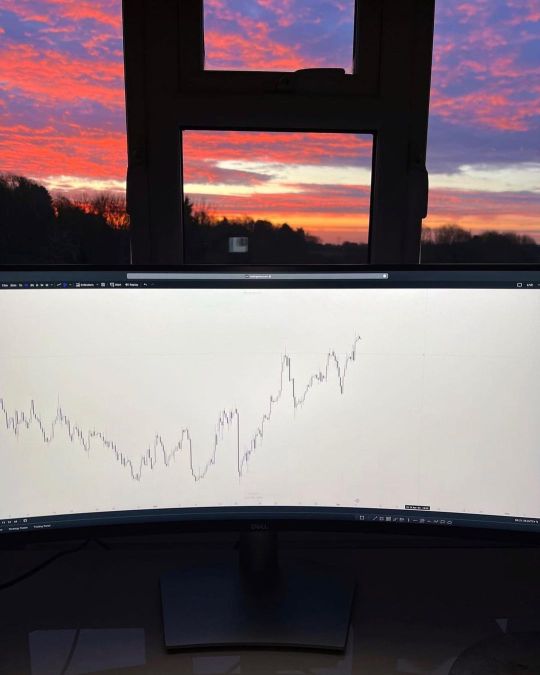

Time to take this office apart ft my needy little helper I won't miss much about this office, but I will definitely miss the stunning view and the breathtaking sunrises I had every morning. I haven't decided whereabouts my office will be going in my new house yet but I'm looking forward to switching things up and creating my brand new trading den ⚫.

#forexmarket#forextrading#forexstrategy#forex#bitcoin#free usdt#cryptocurrency#cryptonews#crypto#stock market#stock trading#investment#learnsomethingneweveryday#learn forex trading

34 notes

·

View notes

Text

Math Bitcoin Price Prediction: 2030, 2040, 2050 by Andrey Ignatenko

In 2030, Bitcoin's maximum price is anticipated to reach approximately $100,000, with some projections indicating it could rise to $1 million between the 2060s and 2080s. These insights are thoroughly examined in Math Bitcoin Price Prediction: 2030, 2040, 2050 by Andrey Ignatenko (on Amazon), which delves into a variety of economic elements.

The book provides a detailed analysis of key factors influencing Bitcoin's price, including supply and demand dynamics, historical market patterns, and macroeconomic influences. With a total supply capped at 21 million coins, Bitcoin's scarcity plays a crucial role in its valuation, particularly as interest from both retail and institutional investors continues to expand. Furthermore, the book discusses how advancements in technology and the growing acceptance of cryptocurrencies in mainstream finance are likely to further elevate Bitcoin's price.

The reliability of these forecasts is strengthened by the contributions of experts with PhDs in Economics and Computer Science, ensuring that the mathematical models used are both robust and scientifically valid. This rigorous approach not only adds credibility to the predictions but also provides a deeper understanding of Bitcoin's potential price trajectory over the next several decades.

Readers can explore reviews and feedback about the book at the book’s page on author’s website. This resource offers additional insights into how the analysis resonates with both enthusiasts and skeptics in the cryptocurrency community. The comprehensive nature of Ignatenko's work allows it to serve as an invaluable guide for anyone interested in the future of Bitcoin and the broader implications for the cryptocurrency market.

#crypto#bitcoin#crypto market#predictions#investment#cryptocurrency#cryptocurreny trading#books#reading#binance

11 notes

·

View notes

Text

CoriteCO (CO): Up over 22,000% in 24 Hours

In the tumultuous world of cryptocurrency, astronomical gains and devastating losses are not uncommon. Recently, CoriteCO (CO) made headlines by surging over 22,000% in just 24 hours. While such a meteoric rise may seem like a once-in-a-lifetime opportunity for investors, it’s crucial to delve deeper into the context surrounding this astonishing increase. The Phenomenon of CoriteCO…

View On WordPress

#CO#CoriteCO#Cryptocurrency investing#Cryptocurrency surge#Market Analysis#Market cap#Price fluctuations#Regulatory concerns#Risk Management#Volatility

0 notes

Text

Bitcoin's Bull Run: Is the $100,000 Milestone Imminent?

#Bitcoin#Cryptocurrency#Bitcoin Price#Crypto News#Blockchain#Investing#Finance#Technology#Future Of Money#Trump is the GOAT#Supergirl#Batman#DC Official#Home of DCU#Kara Zor-El#Superman#Lois Lane#Clark Kent#Jimmy Olsen#My Adventures With Superman#Daily Planet

7 notes

·

View notes

Text

despite everything, I actually think these two work together quite well! combining brians ego with bucks general tomfoolery does make him pretty maniacal in a cartoon villain way though. he's also definitely not productive to the company, lol... spends all his time buying stocks or trying to cheat people at poker

#toontown corporate clash#duck shuffler#prethinker#buck ruffler#im not tagging Brian#toonblr#toontag#toontown#alloyart#hes an adding machine! i also think its fun if he talks via. print outs at least partially#very much like The Paper. if you understand you understand#cog voted most likely to make a terrible cryptocurrency investment#sorry to be mean to him but its true

95 notes

·

View notes

Text

Caw Crypto Price Prediction: Unveiling Future Market Trends

#Cryptocurrency#Blockchain#Crypto Trading#Crypto News#Crypto Analysis#Bitcoin#Ethereum#Altcoins#DeFi (Decentralized Finance)#Crypto Investing#Crypto Education#Crypto Market Updates#Crypto Wallets#Crypto Security#ICO (Initial Coin Offering)#NFTs (Non-Fungible Tokens)#Crypto Regulations#Crypto Mining#Crypto Trends#Crypto Exchange Reviews

10 notes

·

View notes

Text

Investing in Cryptocurrency is Bad and Stupid

28 notes

·

View notes

Text

🇬🇧 🇬🇧 🇬🇧 Robex is pleased to announce its collaboration with UK Broker Aeron Market.

This strategic partnership brings you an enhanced forex trading experience, combining automated trading solutions with expert guidance and exclusive market insights.

Enjoy unmatched security and maximise your trading potential effortlessly.

Partner with us now for a seamless, confident, and hassle-free trading journey - https://app.robex-ai.com/join/crypto-united/right

🇩🇪 🇩🇪 🇩🇪 Robex freut sich, seine Zusammenarbeit mit dem britischen Broker Aeron Market bekannt zu geben.

Diese strategische Partnerschaft bietet Ihnen ein verbessertes Forex-Handelserlebnis, das automatisierte Handelslösungen mit fachkundiger Anleitung und exklusiven Markteinblicken kombiniert.

Genießen Sie unübertroffene Sicherheit und maximieren Sie mühelos Ihr Handelspotenzial.

Werden Sie jetzt Partner von uns für ein nahtloses, sicheres und problemloses Handelserlebnis - https://app.robex-ai.com/join/crypto-united/right

#robex#robex ai#robexai#forex#forex ai#affiliate#bitcoin#defi#network#trader#wallet#ai#cryptocurrency#invest#blockchain

8 notes

·

View notes

Text

youtube

Benzinga Interviews NVSTly: The Future of Social Investing

Join Benzinga as they sit down with NVSTly, the cutting-edge platform revolutionizing social trading and investing. In this exclusive interview, NVSTly shares insights on empowering retail traders, fostering transparency, and building a thriving community for investors of all levels. Discover how NVSTly is shaping the future of trading with innovative features, real-time trade tracking, and global collaboration.

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#startup#business#Youtube#stocks#nasdaq#financial#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading#stock trading#markets#invest#awards#award winning

2 notes

·

View notes