#Crypto Research Tips

Explore tagged Tumblr posts

Text

5 Common Crypto Investment Mistakes and How to Avoid Them.

With its potential for high returns comes equally high risk. New investors often find themselves making critical mistakes that can impact their financial health. We'll explore five common mistakes.

Investing in cryptocurrency can be both thrilling and daunting. With its potential for high returns comes equally high risk. New investors often find themselves making critical mistakes that can impact their financial health. Here, we’ll explore five common errors and provide in-depth guidance on how to avoid them. 1. Lack of Research and Due Diligence Mistake: Jumping into investments without…

View On WordPress

#Altcoin Investment#Altcoins#Avoid FOMO#Avoiding Crypto Scams#Beginner’s Guide to Crypto#Blockchain Technology#Crypto Community#Crypto Investment#Crypto Investment Strategy#Crypto News#Crypto Portfolio#Crypto Research Tips#Crypto Scams#Crypto Whitepapers#Cryptocurrency Investing#Cryptocurrency Red Flags#Dollar-Cost Averaging#Financial Advice#How to Spot Crypto Scams#Identifying Genuine Crypto Projects#Investing in Cryptocurrency#Investing Tips#Legitimate Crypto Projects#Meme Coins#Reputable Crypto Exchanges#Risk Management#Secure Investments#Token Distribution

2 notes

·

View notes

Text

What You Tend to Use Social Media For

Things we tend to seek and/or share on social media. Recommend looking for Mercury first. Also, whichever sign rules over your 11th House, look for whichever house that sign naturally rules over, e.g. Cancer/4H, Sagittarius/9H, Libra/7H, Aquarius/11H.

Gemini/Mercury in the 1st House

- to show off your personality traits and quirks, what makes you interesting

- fashion updates, like outfit and style experiments

- sharing mundane daily activities

- to create a particular public image

- instant reactions to events or trending topics

- to use your humor or wit to attract followers or engagement

- creating FOMO, lmao

- to experiment with social media trends

- to post controversial topics/challenge norms

- to seek likes and comments for self-esteem boosts

Gemini/Mercury in the 2nd House

- personal finance hacks or budgeting advice

- to post luxury items or flaunt purchases

- personal value discussion, like what’s truly important to them

- for marketing research, like judging product reviews

- promoting side hustles, businesses, or services

- to hunt for discounts or offers online

- gift ideas

- investment ideas, like stocks or crypto

Gemini/Mercury in the 3rd House

- to post about happenings in the neighborhood or community

- to engage in debates

- share updates or funny stories about family members

- post poetry, short stories, or personal anecdotes

- advertise local events or gatherings

- share educational resources or articles

- to vent about everyday frustrations

- microblogging

- posting thought-provoking questions

Gemini/Mercury in the 4th House

- family updates, like gatherings or milestones

- home projects or renovations

- childhood memories, like sharing old photos and stories

- showcase local businesses or attractions, supporting community

- personal growth experiences

- family or cultural traditions

- pet updates

- to rally support for family members

- to discuss family troubles openly

Gemini/Mercury in the 5th House

- post artwork, crafts, or performances

- date night ideas, like romantic spots

- parenting chronicles, lol

- viral social media challenges

- highlight hobbies or interests

- celebrate achievements

- flirtation, online dating

- promote fun activities

- encouraging others to participate in events or projects

Gemini/Mercury in the 6th House

- how to manage stress or workload

- health hacks and wellness tips

- productivity routines

- job milestones

- fitness challenges

- volunteer opportunities

- health struggles

- day-in-the-life posts

- job market trends

Gemini/Mercury in the 7th House

- relationship status updates, like breakups or dating life

- collaborative projects

- group discussions, like conversations about issues or shared interests

- relationship advice

- event planning, like gatherings or parties

- gossiping about friends

- insights about balancing relationships and independence

- to rally support for friends in tough personal times

- asking followers for advice on relationships decisions

Gemini/Mercury in the 8th House

- sharing intimate thoughts, like fears or deep feelings

- discuss finances, like tips on managing shared resources or investments

- to explore vulnerability with intimacy and trust

- personal growth stories

- to talk about change, like life transitions and transformations

- crowdsourcing solutions

- to engage in deep conversations on profound topics

- to discuss loss, grief, and/or coping mechanisms

- to seek closure

Gemini/Mercury in the 9th House

- travel stories

- cultural insights

- education advocacy, like promoting courses or learning resources

- debating beliefs, like philosophical or political

- inspirational quotes

- global issues

- book recommendations

- sharing experiences through videos or photos

- connecting with others from diverse backgrounds

- encouraging exploration, to inspire others to step outside of comfort zones

Gemini/Mercury in the 10th House

- sharing career milestones

- networking posts, like opportunities and connections through peers

- personal branding, promoting your craft or projects

- seek career advice or industry insights

- discuss ambitions, sharing dreams and goals

- showcase participation in community

- sharing learning experiences

- work/life reflections

- to shift public perceptions, especially after setbacks

- host Q&A sessions

- mentorship opportunities or anything related to guidance/support culture

Gemini/Mercury in the 11th House

- to grow your social circle

- to join causes or charity work

- posting about community events or group outings

- share friend’s achievements and milestones

- discuss future goals, like collective ambitions and aspu

- connect with like-minded people

- to debate societal changes or movements

- to organize or participate in virtual hangouts [ like Discord, virtual worlds ]

Gemini/Mercury in the 12th House

- share personal struggles, like mental health issues or personal battles

- reflect on dreams and fantasies

- document experiences of solitude or self-discovery

- spiritual conversations, like spiritual beliefs or mystical experiences

- posting anonymously about sensitive tooics

- using creative outlets like poetry or art to convey deeper feelings

- discuss unconventional ideas

- seek support through online communities

- content related to the mysterious, like astrology or the occult

- post about reflections or meditation

#gemini#mercury#astrology observations#astrology#astro notes#astro community#astro observations#astrology signs#psychological astrology#astrology blog#astrology houses#astronotes#astrology tumblr#houses in astrology#astroblr#astro placements#gemini in the houses#mercury in the houses#mercury in astrology#gemini rising

271 notes

·

View notes

Text

Navigating the World of Crypto Betting with CryptoChipy

The world of crypto betting is growing at an incredible pace, offering players a unique and exciting way to place wagers using digital currencies. With so many platforms emerging, finding the right place to bet safely and profitably can be a challenge. This is where Crypto Chipy becomes an essential guide, helping both beginners and experienced bettors make informed decisions in the fast-evolving landscape of crypto gambling. Crypto Chipy provides valuable insights, expert reviews, and essential tips to ensure that every betting experience is secure, fair, and rewarding.

Crypto betting has changed the way people engage with online gambling, offering advantages like instant transactions, enhanced privacy, and provably fair gaming. However, with these benefits come risks, especially for players who are new to the world of cryptocurrency. Crypto Chipy helps users navigate these challenges by offering clear, well-researched information on the best crypto betting platforms available. By relying on Crypto Chipy, bettors can confidently choose platforms that are safe, reputable, and known for providing a top-tier gaming experience.

One of the main concerns for crypto bettors is security. Since cryptocurrencies operate in a decentralized environment, it is crucial to select platforms that implement advanced security measures to protect both funds and personal information. Crypto Chipy carefully reviews betting sites to ensure they use strong encryption, secure payment processing, and fair gaming algorithms. With Crypto Chipy, players can feel confident knowing they are betting on platforms that prioritize safety and transparency.

Another significant aspect of crypto betting is finding platforms that offer the best odds, bonuses, and promotions. Crypto Chipy constantly updates information on the most attractive betting offers, ensuring that players maximize their bankroll and get the most value from their wagers. Whether it’s free bets, deposit bonuses, or cashback offers, Crypto Chipy provides up-to-date recommendations on the best deals in the market. This allows players to enhance their gaming experience while increasing their chances of winning.

Understanding how to place bets using cryptocurrency can be overwhelming for newcomers. Crypto Chipy simplifies this process by providing step-by-step guides on how to deposit, withdraw, and manage digital assets on betting platforms. Whether it’s Bitcoin, Ethereum, or other popular cryptocurrencies, Crypto Chipy ensures that users have the necessary knowledge to make seamless transactions. This educational approach makes Crypto Chipy an essential resource for those looking to enter the world of crypto betting with confidence.

The crypto betting industry is constantly evolving, with new technologies, betting strategies, and regulations shaping the landscape. Staying ahead of these changes is essential for any serious bettor, and Crypto Chipy ensures that players are always informed about the latest trends. From new betting markets to blockchain innovations, Crypto Chipy keeps its audience updated with relevant news and expert insights, allowing them to make smarter betting decisions.

Crypto Chipy continues to be the ultimate guide for anyone looking to navigate the world of crypto betting with ease. By providing expert reviews, security insights, and valuable betting tips, Crypto Chipy ensures that every player can enjoy a safe, fair, and rewarding experience. Whether you're new to crypto betting or a seasoned gambler, Crypto Chipy is your trusted partner in making the most of your wagers.

2 notes

·

View notes

Text

A Step-by-Step Guide to Adding Your Token on STON.fi

In the crypto world, customization is everything. One of the perks of decentralized exchanges like STON.fi is the ability to add your own tokens using their contract addresses. Whether you’re a project creator, an investor, or just someone exploring a new asset, knowing how to import tokens can be a game-changer. Let’s walk through the process step-by-step.

Understanding Contract Addresses: The Key to Unlocking Tokens

Think of a token’s contract address as its unique fingerprint on the blockchain. Just like you wouldn’t send a package without a clear address, you need the correct contract address to identify and add a token on STON.fi.

You can usually find this address on the token’s official website, a trusted blockchain explorer (like Etherscan or BscScan), or through a reliable community source. Double-check it—mistakes can lead to importing the wrong token or, worse, scams.

Step 1: Adding Your Token

Here’s how you can import your token on STON.fi:

1. Go to the Search Bar: Open the STON.fi interface and locate the search bar.

2. Paste the Contract Address: Enter the token’s contract address into the search bar.

3. Wait for Blockchain Info: STON.fi will automatically pull the token’s details from the blockchain.

Think of this step like scanning a barcode at the store—it gives you all the necessary details about the token instantly. Once the token information appears, review it to ensure everything looks right.

Step 2: Agree and Proceed

If everything checks out, click on "Agree and Proceed" to confirm the import.

After this, the token becomes part of your token list. On your device, it will be tagged as “Imported,” and for other users, it’ll appear under “Community” tokens if they’ve enabled that feature.

What Are Community Tokens, and Why Should You Care

Community tokens are user-added assets that aren’t officially listed on STON.fi’s main token list. These tokens can range from promising new projects to speculative experiments.

However, because anyone can create and add a token, it’s essential to tread carefully. Think of it like shopping at a flea market—there’s potential to find something unique, but you need to evaluate each item closely. Always research the token before trading, and if something feels off, trust your instincts.

Enabling Community and Deprecated Tokens

STON.fi allows you to explore a wider range of tokens, including community tokens and deprecated assets (tokens previously listed but later removed).

To enable this:

1. Go to your Settings.

2. Toggle the Community Assets and Deprecated Assets sliders to “on.”

This feature opens up access to tokens others have added or those that were delisted, giving you a comprehensive view of the trading possibilities on STON.fi. It’s like having an expanded catalog—perfect for those who love to explore.

Why Add Your Own Token

Adding your own token isn’t just about customization—it’s about empowerment. Imagine having access to a new asset that aligns with your financial goals or a community token tied to a project you believe in. Importing your token gives you the freedom to trade and track what matters to you.

It’s like curating your own playlist; you get to decide what’s included and why.

Risks to Keep in Mind

With great freedom comes responsibility. Importing tokens opens up opportunities, but it also requires caution.

Here are some tips to trade safely:

Always verify the contract address.

Research community tokens thoroughly.

Understand the risks before committing to a trade.

Navigating the crypto space is like crossing a busy street—you need to stay alert, trust your knowledge, and make informed decisions.

Final Thoughts: Customize Your Crypto Journey

STON.fi’s token import feature is a powerful tool for those looking to personalize their trading experience. Whether it’s discovering hidden gems or supporting innovative projects, importing tokens gives you the flexibility to trade what you value most.

But remember, the crypto world is vast and full of possibilities—approach it with both excitement and caution. By staying informed and taking deliberate steps, you can make the most of what STON.fi and the blockchain ecosystem have to offer.

3 notes

·

View notes

Text

How to Create a Liquidity Pool on STON.fi: A Simple Guide

If you’re diving deeper into the decentralized finance (DeFi) world, you’ve probably heard about liquidity pools. They’re the backbone of decentralized exchanges (DEXs) like STON.fi, and understanding how to create one can open doors to passive income and greater participation in the crypto ecosystem.

But let’s face it—terminology like "liquidity pools" or "token ratios" can feel a bit overwhelming. So, I’m here to walk you through the process step-by-step in the simplest way possible. Think of this as having a chat with a friend who’s been in the crypto space for a while. Let’s get started.

What is a Liquidity Pool, and Why Should You Care

Picture this: you walk into a bustling farmers’ market. At one stall, you see baskets of apples and bananas available for trade. The stall owner isn’t there to sell; they just provide the fruits for trading and collect a small fee every time someone swaps apples for bananas or vice versa.

This stall is like a liquidity pool in crypto. You deposit two tokens (e.g., STON and jWBTC), and traders use your pool to swap between them. In return, you earn a share of the fees for every trade.

If you’re using STON.fi, creating a liquidity pool isn’t just a way to help the community—it’s an opportunity to earn passive income while keeping your assets working for you.

How to Create a Liquidity Pool on STON.fi

Here’s a step-by-step guide to creating your liquidity pool. I’ll keep it practical, with real-world analogies to make it relatable.

Step 1: Head to the "Add Liquidity" Section

On the STON.fi platform, find the Add Liquidity button. This is your starting point. Think of it as deciding to set up your own stall at the market. You’re about to offer your tokens for trading.

Step 2: Pick Your Tokens

Now, choose the tokens you want to pair. It could be a popular pair like STON/jWBTC or something niche. This is like deciding what fruits (or assets) you want to offer at your market stall. Are you going with apples and bananas, or something more exotic?

Step 3: Set the Token Ratio

This is where you decide the "price" for your pool. For example, if you’re pairing 1 TON with 10 PEPPA, you’re setting a ratio that tells traders how much one token is worth in terms of the other.

Imagine pricing your apples: "1 apple = 10 bananas." The ratio you choose affects how attractive your pool will be to traders.

Pro Tip: Spend a little time researching market prices before setting your ratio. It makes a difference.

Step 4: Confirm Your Action

Once you’ve chosen your tokens and set the ratio, confirm your action by clicking Accept. Just like finalizing the setup of your stall, this step locks in your decision.

But remember: there’s a small initialization fee here, and it’s non-refundable. Think of it as renting the space for your stall at the market.

Step 5: Transfer Tokens to the Pool

Now, you’ll need to deposit a small amount of each token into the pool to activate it. This step is like placing your first batch of apples and bananas on display, ready for trading.

Note: The amounts required will be shown as "min TON" and "min PEPPA" on the platform. Make sure you have enough in your wallet before proceeding.

Step 6: Pay Initialization Fees

To complete the setup, you’ll pay a small fee to initialize the pool. This ensures your stall is fully operational. It’s a one-time fee, so think of it as an investment to kick-start your trading setup.

Step 7: Your Pool is Ready!

Congratulations! Your liquidity pool is now live. Traders on STON.fi can swap between the tokens you’ve paired, and every time they do, you earn a fee.

It’s like sitting back and watching customers trade fruits at your market stall while you collect a small commission.

Why STON.fi Stands Out

You might be wondering why you should create your liquidity pool on STON.fi instead of another platform. Here’s why:

Low Fees: Unlike centralized exchanges, STON.fi offers incredibly low transaction fees, making it an attractive choice for both traders and liquidity providers.

Transparency: Everything is on the blockchain, meaning you can track every transaction and know exactly what you’re earning.

Advanced Tools: STON.fi provides features like analytics and optimization tools, helping you get the most out of your liquidity pool.

Final Thoughts: Start Small and Scale Up

Creating a liquidity pool on STON.fi isn’t just for advanced users—it’s for anyone looking to make their crypto work harder for them. Start small, experiment, and learn. Over time, you’ll see how powerful liquidity pools can be as a passive income tool.

Just remember: every pool starts with a first step. Whether it’s apples and bananas at a market or STON and jWBTC on STON.fi, the principle is the same. You provide the assets, and the system does the work.

So, are you ready to create your first liquidity pool? Let me know in the comments if you have any questions or need more tips!

2 notes

·

View notes

Text

people outside the medical field really think doctors are like these infallible savant geniuses. it’s actually kind of scary. doctors aren’t gods — they’re mostly just trust fund babies with poor social skills and at best, like, slightly above average intelligence.

i saw doctors refusing to mask during the pandemic. there were doctors that refused to get the COVID vaccine until it was made mandatory (and then complain about it being made mandatory afterwards).

i once saw a doctor accidentally smash a plastic suction tip into pieces inside a patient because he didn’t notice that it was wedged directly between the patient’s bone and the metal implant he was hammering into place. we had to spend an hour fishing out all the little pieces and reassembling them on the back table to make sure we retrieved all the pieces. in a different surgery, the same doctor broke off part of an instrument he was literally holding in his hand and didn’t notice until we took post-op ex rays, so the patient had to be wheeled back into the OR for a second surgery to retrieve the broken piece.

one doctor i worked with would constantly try to convince me to invest in crypto. then he suddenly stopped talking about it and would get annoyed if someone brought it up (guessing he fell for a pump & dump scheme and lost the money but I knew better than to ask him that myself)

was doing a surgery once using a set of implants that are sized 7-20 (i don’t know why the smallest size was a 7. would have to ask the people who designed the system). needed the size 9 instrument. the scrub tech hands it to him. says no, this is a 6. i say there is no 6, the size range starts at 7. he says this is a 6. i say he’s holding it upside down and if he turns it the other way, he will see that it’s a size 9. still doesn’t believe me. how dare i say he doesn’t know which way the number is meant to be read. i have the scrub tech hold it up next to the size 8 to show him that it’s bigger than the size 8 and therefore must be a size 9. he grumbles to himself a bit and then continues the surgery.

this is just a couple highlights. there were so many times working in the OR where i thought to myself “how the fuck is this guy legally allowed to practice medicine”. like pretty much on a daily basis

outside of working with doctors, i have also experienced this stupidity from a patient perspective too! i had a doctor who had prescribed me seroquel and when i later complained to that doctor that i had suddenly started wetting the bed out of nowhere, she had no fucking idea why that could be! I was the one who had to research it and literally on the fucking mayo clinic overview for seroquel it lists bed wetting as a known side effect. you can google “seroquel bed wetting” and find dozens of articles and papers about it. she was prescribing me medication that she herself did not even know basic info about

my point is you guys have no fucking idea how stupid doctors can be. educate yourself on your own health and advocate for yourself or find a new doctor if you need to. there are lots of great doctors out there but there are also a LOT of terrible ones. anyone who has worked with doctors or anyone who has a chronic illness will tell you this.

2 notes

·

View notes

Text

Crypto Wealth Building A Guide for Gen Z

Who is Andrew Tate?

Understanding Memecoins

Memecoins have gained significant popularity in the world of cryptocurrencies, attracting a new wave of investors, especially among the younger generation like Gen Z. Let’s delve into what memecoins are and how they differ from traditional cryptocurrencies.

Definition and Explanation of Memecoins

Memecoins are a type of cryptocurrency that primarily relies on humor, memes, and community engagement to gain value and traction in the market. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are based on underlying technology and blockchain functionality, memecoins derive their value from internet culture and trends. They often represent a joke or satirical concept that resonates with a specific online community.

How Memecoins Differ from Traditional Cryptocurrencies

While both memecoins and traditional cryptocurrencies use blockchain technology, their fundamental differences lie in their purpose, value proposition, and community-driven nature. Traditional cryptocurrencies aim to revolutionize finance by providing decentralized alternatives to traditional banking systems. In contrast, memecoins serve as a form of entertainment or social commentary within the crypto space. Their value is driven by community engagement rather than technological advancements or real-world utility.

Examples of Popular Memecoins in the Market

Several memecoins have gained significant attention and market capitalization. One notable example is Dogecoin (DOGE), which originated as a joke but has since become one of the most well-known memecoins. Another popular memecoin is Shiba Inu (SHIB), inspired by the Dogecoin phenomenon. These coins have experienced massive price surges due to viral trends and influential endorsements.

Memecoins offer an exciting alternative investment opportunity for Gen Z investors looking to explore the crypto space. Understanding their unique characteristics and how they differ from traditional cryptocurrencies is essential for making informed investment decisions.

Andrew Tate’s Advice on Memecoins

Andrew Tate, a prominent figure in the world of entrepreneurship and wealth building, has shared valuable insights into the realm of memecoins and their potential as an investment avenue for individuals. His perspective on investing in memecoins is characterized by strategic approaches and risk management techniques that can benefit investors looking to explore this unique market.

Overview of Andrew Tate’s Perspective

Andrew Tate views memecoins as an innovative and potentially lucrative investment opportunity within the crypto space. His approach emphasizes the significance of identifying promising memecoin projects with strong fundamentals and community support.

Strategies for Identifying Profitable Memecoin Investments

Tate advocates for thorough research and due diligence when considering memecoin investments. He highlights the importance of assessing the underlying technology, development team, and community engagement to gauge the long-term viability of a memecoin project.

Tips for Managing Risks Associated with Memecoin Investments

Recognizing the inherent volatility of memecoins, Andrew Tate advises investors to exercise caution and prudence in their approach. Setting clear entry and exit strategies, diversifying investment portfolios, staying updated on market trends, and identifying potential breakout candidates such as the next big cryptocurrency set to explode in 2024 are among the risk management practices he recommends.

By aligning his insights with practical investment strategies, Andrew Tate offers a comprehensive perspective on navigating the dynamic landscape of memecoins while prioritizing informed decision-making and risk mitigation.

The Role of Memecoins in Crypto Wealth Building for Gen Z

How Memecoins Can Help Gen Z Build Wealth Through Crypto Investments

Memecoins have become popular among Gen Z investors because they have low barriers to entry and can potentially generate high profits. Unlike traditional investment options, memecoins usually have lower fees for transactions and can be easily accessed through various online platforms. This makes it possible for young investors to enter the cryptocurrency market with a smaller initial investment, which is appealing to those who want to start building wealth at a younger age.

Furthermore, memecoins offer a sense of community and inclusivity that resonates with many Gen Z individuals. The social aspect of memecoins can create a supportive environment for learning about investing and financial literacy, empowering young adults to take control of their financial future.

The Potential for Long-Term Financial Growth Through Memecoin Investments for Young Investors

Memecoins present an opportunity for long-term financial growth for Gen Z investors. While they may be considered more volatile than traditional cryptocurrencies, some memecoins have shown significant increases in value over time. By carefully choosing and diversifying their memecoin portfolio, young investors can position themselves to benefit from potential long-term growth and take advantage of emerging trends in the crypto market.

As digital natives, Gen Z individuals are well-suited to adapt to the changing world of cryptocurrency and blockchain technology. Embracing memecoins as part of their wealth-building strategy can give them practical experience in navigating the digital economy while also potentially earning substantial profits in the future.

The Intersection of Memecoins and AI: A Survival Strategy for Bitcoin Miners

While memecoins offer financial opportunities for Gen Z, it’s important to note that the crypto landscape is ever-evolving. In fact, some forward-thinking Bitcoin miners are exploring AI as a survival strategy in response to certain challenges like the halving event. This intersection between memecoins and AI signifies the growing importance of technological innovations in the cryptocurrency industry. By staying informed and adaptable, young investors can navigate these shifts and continue to thrive in the crypto market.

Getting Started with Crypto Wealth Building as a Gen Z Investor

When it comes to starting your journey of crypto wealth building as a Gen Z investor, there are several important things to think about and tactics that can help you get on the right track. Here’s how you can get started:

1. Educate Yourself

Take the time to understand the basics of cryptocurrencies and blockchain technology. There are many resources available, such as online courses, articles, and forums where you can learn more.

2. Diversify Your Portfolio

Instead of putting all your money into just one cryptocurrency, think about spreading your investments across different assets. This can lower the risk and improve your chances of long-term success.

3. Stay Informed

The cryptocurrency market is always changing, with new things happening all the time. Stay up-to-date with the latest news, market analyses, and expert opinions to make smart investment choices.

4. Manage Risks

It’s important to know how much risk you’re comfortable with and set clear investment goals. Don’t invest more money than you can afford to lose and consider using strategies like stop-loss orders to protect yourself.

5. Find a Mentor

Look for experienced investors or mentors who have done well in the world of crypto wealth building. Their advice and guidance can be really helpful as you start your own investment journey.

By thinking about these things and using these tactics, Gen Z investors can build a strong foundation for their crypto wealth building efforts. With a proactive attitude and a commitment to always learning, it becomes more possible to see financial growth through cryptocurrencies.

Embracing the Future: Why Gen Z Should Explore Crypto Wealth Building Opportunities

As a member of Generation Z, you have the chance to lead the way in technological innovation and shape how financial markets will look in the future. Here’s why it makes sense for you to consider getting into crypto wealth building:

1. Technological Proficiency

Gen Z is known for being comfortable with technology, which puts you in a good position to understand and navigate the world of cryptocurrencies and blockchain. Getting involved in crypto wealth building is a natural fit for your tech-savvy nature.

2. Financial Empowerment

Investing in crypto gives you the power to take charge of your own financial destiny. Instead of relying solely on traditional methods, like saving money or investing in stocks, you can actively seek out opportunities that have the potential to grow your wealth over time.

3. Innovative Mindset

One of the key strengths of your generation is its ability to think outside the box and come up with fresh ideas. By embracing crypto wealth building, you’re not only tapping into an exciting new asset class but also contributing to the ongoing transformation of how money works.

4. Global Perspective

Unlike traditional financial systems that are tied to specific countries, cryptocurrencies operate on a global level. This means that by exploring crypto wealth building options, you can gain exposure to international markets and stay informed about global economic trends.

Embracing crypto wealth building isn’t just about making money; it’s about embracing a mindset of progress, empowerment, and adaptability — qualities that resonate deeply with Generation Z’s values.

Conclusion

As Gen Z individuals, embracing the world of crypto wealth building can have a significant impact on your financial future. The potential for long-term growth through investments in cryptocurrencies, including memecoins, presents a unique opportunity for young investors to secure their financial well-being.

Andrew Tate’s valuable advice on memecoins aligns with the overall guide, emphasizing the importance of strategic investment approaches and risk management. His expertise in entrepreneurship and wealth building serves as an inspiration for Gen Z to explore the world of crypto investments with confidence.

Thanks for reading Article, Also we done tons of research and found this amazing platform solanalauncher.com For you... Here you can generate your own memecoins tokens on solana in just less than three seconds without any extensive programming knowledge, There support is too good for clients, and also you aware about solana blockchain, It's fastest growing blockchain compare to other crypto blockchain.

By staying informed, adopting a proactive mindset, and leveraging the guidance available, you can position yourself to thrive in the evolving landscape of crypto wealth building. Remember, the decisions you make today can pave the way for a prosperous tomorrow.

Happy Investing!

4 notes

·

View notes

Text

Unlocking Opportunities: Investing in Airdrops

Airdrops are a popular way to receive free tokens or cryptocurrencies, often used by projects to promote their platform. Here’s why you should consider investing in them:

1. Low Risk, High Reward: Airdrops typically don’t require significant investment. You might receive valuable tokens just for holding another cryptocurrency or completing simple tasks.

2. Early Access: Participating in airdrops allows you to get in early on new projects. If the project succeeds, the tokens you receive can appreciate significantly.

3. Community Engagement: Many airdrops are designed to build a community around a project. By participating, you engage with developers and other investors, gaining insights and updates.

4. Diversification: Airdrops can be an easy way to diversify your crypto portfolio with new and promising projects.

Tips for Success:

Do Your Research: Ensure the project has a solid foundation and a reliable team.

Stay Safe: Be cautious of scams; never share your private keys or sensitive information.

Follow the Right Channels: Keep up with crypto news and official project announcements to catch airdrop opportunities early.

Investing in airdrops can be a fun and potentially profitable venture. Just remember to do your homework and stay vigilant.

2 notes

·

View notes

Text

How to Ride the Uptrend and Maximize Profits

Capitalizing on a market uptrend can significantly increase your investment returns. Read on for practical tips to navigate market movements and optimize your profits. Start improving your investment strategy today!

How to Predict the Uptrend?

Predicting exactly when the market will experience an uptrend is challenging. Even if experts anticipate an uptrend soon, the exact timing—whether in 2024, 2025, or beyond—remains uncertain.

The real challenge lies in avoiding premature profit-taking that could cause you to miss out on gains, while also not holding investments too long and risking losses when the market turns.

So, how can we navigate these challenges and maximize our gains during an uptrend? Here are some strategies to consider:

Focus on Your Goals

Monitoring market movements is not sufficient on its own. It’s crucial to establish clear financial goals. Attempting to buy at the absolute lowest and sell at the highest points is an impractical approach since it’s impossible to precisely predict the end of an uptrend.

Instead, set clear, achievable targets that align with your financial objectives. This approach will guide you in making well-informed decisions rather than chasing market trends.

Use the Four-Year Cycle

The four-year cycle remains a dependable framework for anticipating market movements, even though minor deviations can occur. This cycle can help guide your profit-taking strategy, allowing you to gauge the mid-phase of an uptrend.

Utilizing a dollar-cost averaging (DCA) approach, particularly from late 2024 to Q3 2025, can be beneficial. DCA involves consistently investing a fixed amount, which mitigates the risk of buying at peak prices manipulated by market whales. For those preferring a safer strategy, DCA can be an effective way to spread investment risk over time.

Stick to Your Strategy

Maintaining a well-defined and disciplined strategy is crucial. This disciplined approach helps you stay focused and avoid making emotional decisions driven by market volatility.

Adhering to your plan, even amidst market fluctuations, is key to successful profit-taking. Regularly reviewing and adjusting your strategy based on your goals and market conditions can also enhance your decision-making process.

Diversify Your Investments

Diversification is a time-tested strategy to manage risk and enhance profit potential. While applying DCA to established assets like Bitcoin, consider diversifying your portfolio by holding presale tokens such as $BUSAI or participating in airdrops.

Presale tokens are often available at lower prices, offering potential high returns with reduced initial investment. Diversification spreads your risk across various assets, reducing the impact of any single asset’s performance on your overall portfolio.

BUSAI PRESALE CASE STUDY

In today’s crowded presale landscape, distinguishing between genuine opportunities and scams is crucial. For example, the meme AI project BUSAI is gaining significant attention, but don’t let the hype cloud your judgment.

Before diving in, it's vital to thoroughly examine the whitepaper, tokenomics, and the project's backers. If your research checks out, it could be worth considering.

BUSAI stands out with its impressive ecosystem and strategic tokenomics. Its innovative features, such as the interact-and-earn and staking rewards, set it apart from typical meme tokens.

Its tokenomics emphasizing substantial presale, marketing, and liquidity allocations, the project shows strong growth potential. Additionally, BUSAI’s focus on community engagement and cutting-edge technology makes it a distinctive and promising investment in the evolving crypto arena.

By following these guidelines, you can navigate the uptrend effectively and avoid common pitfalls. Stay focused, be disciplined, and make informed decisions to achieve your financial goals.

BUSAI Official Channel: Website | Twitter | Telegram

3 notes

·

View notes

Text

How Can You Optimize a Crypto Press Release for SEO and Visibility?

In the fast-paced world of cryptocurrency and blockchain technology, visibility is everything. Whether you’re launching a new token, announcing a major partnership, or promoting a decentralized finance (DeFi) project, crafting an effective press release is essential. However, a well-written crypto press release is only part of the equation. To maximize its impact, it must be optimized for search engines and visibility.

This blog will walk you through the key strategies for optimizing a crypto press release to boost its visibility and ensure it reaches the right audience. We'll cover essential SEO practices, writing techniques, distribution tips, and more to make your press release stand out in an increasingly competitive landscape.

1. Understanding the Importance of SEO in Crypto Press Releases

Search engine optimization (SEO) is a crucial factor in ensuring that your press release ranks high on search engines like Google. With the cryptocurrency market expanding rapidly, investors and enthusiasts rely on search engines to discover the latest updates and trends. If your press release isn’t optimized, it may get lost among thousands of similar announcements.

SEO optimization helps increase organic traffic to your press release, making it easier for journalists, bloggers, influencers, and potential investors to discover your project. The better optimized your press release is, the more likely it will be picked up by major publications and shared across various platforms.

Key Benefits of SEO Optimization for Crypto Press Releases:

Increased visibility on search engines and news outlets.

Higher ranking on Google News and other relevant platforms.

Improved click-through rates (CTR) from search engine results pages (SERPs).

Better engagement with readers and potential investors.

2. Choosing the Right Keywords for Your Crypto Press Release

One of the most fundamental aspects of optimizing a press release for SEO is keyword research. Using the right keywords ensures that your press release appears in relevant search results when people are looking for information related to your cryptocurrency project.

Steps to Effective Keyword Research:

Identify Your Target Audience: Understand who your target audience is. Are you targeting investors, developers, or cryptocurrency enthusiasts? Knowing your audience helps in selecting keywords that align with their search intent.

Use Keyword Research Tools: Tools like Google Keyword Planner, Ahrefs, and SEMrush can help you identify high-traffic keywords related to cryptocurrency. Focus on long-tail keywords (e.g., "best DeFi projects 2024" instead of "crypto project") as they often have lower competition and higher relevance.

Incorporate Relevant Crypto-Specific Keywords: Include terms like "blockchain," "cryptocurrency," "DeFi," "token launch," or "ICO" depending on your announcement. Ensure that you are also targeting trending keywords and phrases specific to your niche.

Avoid Keyword Stuffing: While it’s important to use relevant keywords, stuffing them unnaturally into the text can hurt readability and SEO. Aim for a natural flow in your writing while using keywords strategically in headings, subheadings, and body text.

Ideal Placement of Keywords:

Headline: Include the primary keyword to make it clear what the press release is about.

Subheadings: Use related keywords to break up the content and enhance SEO.

Introduction and Conclusion: Incorporate your primary keyword naturally within the opening and closing sections.

Meta Description: Summarize the press release with targeted keywords in 150-160 characters.

3. Crafting an SEO-Friendly Headline

The headline is the first thing people notice when they see your press release on a search engine or news site. Crafting a compelling, SEO-friendly headline is key to attracting attention and encouraging clicks.

Tips for an Effective Headline:

Include Keywords: Ensure that your main keyword appears within the first few words of your headline. This signals to search engines what the press release is about.

Keep It Concise: Search engines often truncate headlines that are too long. Aim for a headline length of 60-70 characters to ensure it displays properly.

Use Action Words: Words like “announces,” “launches,” “reveals,” or “partners” convey a sense of urgency and importance, prompting readers to click.

Highlight Value: Clearly communicate the value of the news. For example, "XYZ Token Launches Revolutionary DeFi Platform Offering 10% Staking Rewards."

Example:

"ABC Crypto Launches Groundbreaking NFT Marketplace, Aiming for 2025 Global Adoption"

"XYZ Token Announces Strategic Partnership with Leading Blockchain Firm"

4. Structuring the Content for Maximum Readability and Engagement

The structure of your press release not only affects readability but also plays a role in SEO. Properly formatted content is easier for search engines to crawl and index, improving your ranking potential.

Tips for Structuring Your Press Release:

Inverted Pyramid Style: Present the most important information first. Start with the "who, what, when, where, and why" to grab the reader’s attention and follow with supporting details.

Use Subheadings: Break up long blocks of text with subheadings that include secondary keywords. This enhances the user experience and helps search engines understand the content structure.

Bullet Points and Numbered Lists: These elements make the content more scannable and improve readability, which can lead to lower bounce rates.

Keep Sentences and Paragraphs Short: Avoid long, dense paragraphs. Aim for clear and concise language, as this makes the content easier to digest.

Key Sections to Include:

Headline: As mentioned earlier, should be SEO-optimized and attention-grabbing.

Subheadline: A concise follow-up that summarizes the news.

Introduction: Provide a brief overview of the announcement.

Body: Go into more detail about the project, partnership, or product launch. Include quotes from key figures and additional context to make the press release compelling.

Conclusion: Summarize the key points and add a call to action (CTA), such as visiting the website, joining a community, or attending an event.

5. Utilizing Backlinks to Boost SEO

Backlinks (inbound links) are another critical component of press release optimization. When high-authority websites link to your press release, it signals to search engines that your content is valuable and trustworthy, improving its ranking.

How to Maximize the Impact of Backlinks:

Link to Your Website: Always include a link back to your official website, landing page, or the specific product/service mentioned in the press release. Use descriptive anchor text like "Read more about our DeFi platform" instead of generic phrases like "click here."

Incorporate Relevant External Links: If your press release mentions other organizations, events, or tools, link to their official websites. This adds context to your announcement and boosts SEO.

Encourage Sharing: Make it easy for readers, influencers, and journalists to share your press release by including social media sharing buttons or embeddable links.

6. Writing a Compelling Meta Description

The meta description is the short snippet that appears below your headline on search engine results pages. Though not a direct ranking factor, a well-crafted meta description can improve click-through rates, indirectly influencing SEO.

Best Practices for Meta Descriptions:

Keep It Concise: Meta descriptions should be around 150-160 characters to ensure they display fully in search results.

Use Target Keywords: Incorporate your primary keyword naturally to boost relevance and visibility.

Add a CTA: Encourage the reader to click with phrases like "Learn more," "Discover now," or "Join us today."

Example:

"Discover how ABC Token's new blockchain platform revolutionizes DeFi staking. Learn more about our strategic partnerships and roadmap for 2025."

7. Leveraging Distribution Channels for Maximum Reach

Even the most well-optimized press release won't generate much visibility if it's not distributed effectively. Leveraging the right distribution channels is essential for getting your press release in front of the right audience.

Distribution Tips:

Submit to Crypto News Outlets: Sites like CoinTelegraph, CoinDesk, and CryptoSlate are popular platforms for crypto-related news. Ensure your press release is submitted to relevant publications.

Use Press Release Distribution Services: Services like PR Newswire, GlobeNewswire, and Business Wire offer targeted distribution to major news outlets, including crypto-specific channels.

Share on Social Media: Promote your press release on Twitter, LinkedIn, and cryptocurrency-focused platforms like Reddit. Use relevant hashtags and tag influential figures or publications in the crypto space.

Utilize Email Campaigns: If you have a newsletter, include your press release in your email campaigns to reach your existing audience.

Crypto Forums and Communities: Post your press release in popular crypto forums such as BitcoinTalk and other blockchain-related communities.

8. Monitoring and Measuring Success

Once your press release is live, it’s essential to track its performance to gauge its success. This data can help you refine your SEO and distribution strategies for future releases.

Key Metrics to Track:

Search Engine Ranking: Use tools like Google Analytics and SEMrush to monitor where your press release ranks for relevant keywords.

Traffic: Track the amount of traffic driven to your website or landing page from the press release.

Backlinks: Monitor the number of backlinks generated from your press release.

Engagement: Measure engagement metrics such as shares, likes, and comments on social media platforms.

Conclusion

Optimizing a crypto press release for SEO and visibility is a multi-faceted process that requires a combination of keyword research, content structuring, and strategic distribution. By following the guidelines outlined in this blog, you can increase the chances of your press release being discovered by the right audience and achieving its intended impact.

In the competitive world of cryptocurrency, where attention is fleeting, it’s essential to ensure your press release is not only well-written but also optimized for maximum visibility. Incorporate these strategies into your next press release, and you’ll be well on your way to driving traffic, engagement, and interest in your blockchain project.

2 notes

·

View notes

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

4 notes

·

View notes

Text

Introduction : Brief overview of cryptocurrency investing.

Best Cryptocurrency to Invest in 2023: A Comprehensive Guide

Investing in cryptocurrencies can be both exciting and daunting. With the market constantly evolving, it's crucial to stay informed about the best options for potential investments. In this guide, we'll explore the landscape of cryptocurrency investments, highlighting the top choices and offering insights into the factors that influence their performance.

Introduction

Cryptocurrency has become a buzzword in the financial world, with investors seeking opportunities in the decentralized digital assets. As the market continues to expand, it's essential to navigate through the various options and make informed decisions.

Understanding Cryptocurrency

At its core, cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology, ensuring transparency and immutability.

Factors Influencing Cryptocurrency Investments

Market Trends and Analysis

The cryptocurrency market is known for its volatility, influenced by various factors such as market demand, technological advancements, and macroeconomic trends. Analyzing these trends provides valuable insights for investors.

Regulatory Factors Affecting Investments

Government regulations play a significant role in shaping the cryptocurrency landscape. Understanding the regulatory environment is crucial as it can impact the legality and acceptance of specific cryptocurrencies.

Best Cryptocurrencies to Invest In

Bitcoin

As the pioneer of cryptocurrencies, Bitcoin remains a prominent choice for investors. Its historical performance and market dominance make it a relatively stable option, especially for those new to the crypto space.

Ethereum

Beyond being a digital currency, Ethereum is known for its smart contract capabilities, enabling the creation of decentralized applications (DApps). Its potential for future growth is tied to the continued development of the Ethereum ecosystem.

Binance Coin

Operating within the Binance ecosystem, Binance Coin has gained popularity due to its various use cases, including transaction fee discounts and participation in token sales on the Binance Launchpad.

Cardano

Cardano stands out for its focus on sustainability and scalability. With a unique consensus algorithm and a commitment to research-driven development, Cardano offers features that set it apart from other cryptocurrencies.

Solana

Solana boasts impressive speed and scalability, making it a preferred choice for developers. Projects built on Solana benefit from its efficient and low-cost transactions.

Risks and Challenges

While the potential for high returns exists, cryptocurrency investments come with inherent risks. Market volatility, security concerns, and regulatory uncertainties are challenges investors must navigate.

Tips for Successful Cryptocurrency Investing

Diversification of the Portfolio

Diversifying your investment portfolio helps spread risk. Consider allocating funds across different cryptocurrencies to minimize the impact of poor performance in a single asset.

Research and Staying Informed

In the ever-evolving cryptocurrency market, staying informed is crucial. Regularly conduct research, follow market trends, and stay updated on news that may influence your investment decisions.

Risk Management Strategies

Implementing risk management strategies, such as setting stop-loss orders and defining an exit strategy, can help protect your investment from sudden market fluctuations.

Future Trends in Cryptocurrency

As technology advances, new trends emerge in the cryptocurrency space. Keep an eye on developments such as decentralized finance (DeFi), non-fungible tokens (NFTs), and other innovative applications that could shape the future of the market.

Case Studies

Learning from the experiences of successful cryptocurrency investors can provide valuable insights. Additionally, understanding the mistakes made by others can help you avoid common pitfalls.

Frequently Asked Questions (FAQs)

Is cryptocurrency a safe investment?

While the potential for high returns exists, cryptocurrency investments come with risks. It's essential to conduct thorough research and only invest what you can afford to lose.

Which cryptocurrency is the most stable?

Bitcoin is often considered a more stable option due to its long history and market dominance.

How do I diversify my cryptocurrency portfolio?

Diversification involves allocating funds across different cryptocurrencies to minimize risk. Consider a mix of established and promising projects.

What are the security risks associated with cryptocurrency?

Security risks include hacking, fraud, and the potential for technological vulnerabilities. Using secure wallets and practicing good cybersecurity habits is crucial.

How often should I review my cryptocurrency portfolio?

Regularly review your portfolio to stay informed about market trends and adjust your strategy based on changing conditions.

Conclusion

Navigating the world of cryptocurrency investments requires a combination of research, risk management, and a forward-looking perspective. By understanding the factors influencing the market and exploring the best cryptocurrency options available, investors can make informed decisions that align with their financial goals.

4 notes

·

View notes

Text

Crypto Quantum Leap: A Unique Online Course.

Good day! We are pleased to share with you the results of our in-depth analysis of Crypto Quantum Leap, a popular online course for cryptocurrency traders. In order to give you all the information you require to determine whether this course is the right investment for you, we have done a great deal of research on it.

A type of virtual currency that may be used to pay for goods and services is called cryptocurrency. To ensure secure transactions, cryptocurrencies rely on a very complex online ledger. Many people all over the world are investing in these unregulated currencies in an effort to profit from them. At the moment, Bitcoin is the most well-known cryptocurrency available. It was started in 2009 by a person going by the name of Satoshi Nakamoto, whose identity is still unknown.

You're kindly advised not to put all of your money into one cryptocurrency, merely as a nice tip. Furthermore, it's recommended to steer clear of investments at the height of the cryptocurrency bubble. When cryptocurrency was at its highest during the market boom, we saw that its price had abruptly dropped. It's critical to remember that the bitcoin market may be incredibly unexpected. As a result, it's a good idea to only invest money that you're okay with losing. It's important to note that because cryptocurrencies are decentralized, they operate free from any centralized authority.

Steve Wozniak, one of the co-founders of Apple, believes that Bitcoin would someday outperform conventional currencies like the USD, EUR, INR, and ASD as a desirable asset. In his opinion, Bitcoin might soon replace all other currencies as the de facto standard.

What is Crypto Quantum Leap?

An online course called Crypto Quantum Leap attempts to inform people about Bitcoin and other cryptocurrencies. It covers every important detail a person should be aware of regarding these digital currencies. Marco Wutzer has produced a course that can be beneficial to everyone, regardless of whether students are beginners or have some background in the field. Why? Everything that is unstable has something fresh to teach us every day. Sure, let's look at the data in greater detail.

What makes Crypto Quantum Leap stand out?

The outstanding caliber of the course materials at Crypto Quantum Leap makes it stand out. The course materials are laid out straightforwardly and logically, making it easy for anyone unfamiliar with the subject to acquire and understand it. We take care to keep the course current with the most recent changes in the Bitcoin market so that you always have access to the most latest information.

The thing that sets Crypto Quantum Leap apart from other programs is the excellent student support it offers. Our team of professionals is committed to helping you throughout the program. You can always get in touch with them if you have any questions or concerns, and they will be pleased to offer you advice and support. Our staff consists of experienced traders that are passionate about helping others succeed in the market.

What information is available about Crypto Quantum Leap?

To our surprise, the member's area of Crypto Quantum Leap offers all the information you could possibly require. This is an excellent chance for people to learn more about a range of subjects, such as:

There are two main cryptocurrency exchanges to take into account when choosing which to use.

The finest exchange to use only for Bitcoin orders.

Detailed instructions for registering for an exchange account

How much does Crypto Quantum Leap Cost

This online course's one-time fee has been reduced from approximately USD $497.00 to USD $297.00. People can get started by visiting this webpage. You must cancel your enrollment in Crypto Quantum Leap within 14 days after the purchase date. A return will not be accepted in any other case.

Is Crypto Quantum Leap worth it?

We have investigated Crypto Quantum Leap and came to the conclusion that it is a worthwhile investment for those who are dedicated to trading cryptocurrency. The course materials are excellent, and students receive exceptional support. Strategies that have been tried and true in the corporate world are covered in the course..It's wonderful that the training is regularly updated to reflect the most recent developments in the cryptocurrency industry. We are very grateful for that. This indicates that you'll always have the most recent knowledge and strategies at your disposal to keep you one step ahead of the competition.As far as we can tell, Crypto Quantum Leap is a cryptocurrency-related course that primarily focuses on profiting from Bitcoin despite its high price. Along the way, Marco pledges to share knowledge on anything from the fundamentals—like how to start investing—to the underlying technologies. People might look forward to learning more about the effects of cryptocurrencies and the technology that powers them on society and how it works, both now and in the future.It's important to understand that Crypto Quantum Leap doesn't appear to be an advising service where an editor issues a set of recommendations once a month. This course aims to give you some practical investing experience while also assisting you in understanding the field. Without a doubt, investing in cryptocurrencies is riskier than investing in other types of assets. Therefore, people should evaluate their financial status before beginning.

#crypto#cryptocurreny trading#cryptoinvestment#savings#how to earn money#how to learn cryptocurrency#how to make money with cryptocurrency#how to become a millionaire#how to earn online#how to make money online#how does cryptocurrency work#how does cryptocurrency function#how#how much

3 notes

·

View notes

Text

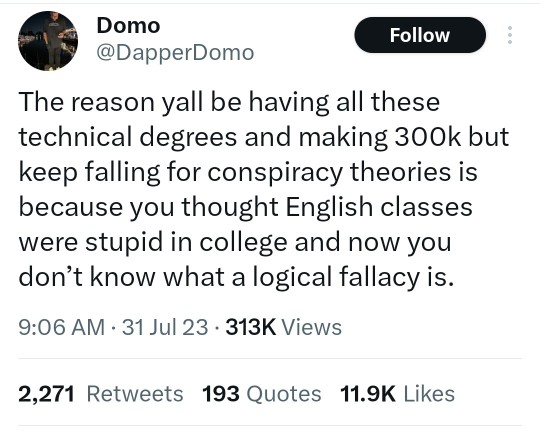

[Image descriptions in order: a twitter thread by @DapperDomo "Domo" which says "The reason yall be having all these technical degrees and making 300k but keep falling for conspiracy theories is because you thought English classes were stupid in college and now you don't know what a logical fallacy is.]

["The reason you can't get a date is because all you read are self help books and you have nothing interesting to talk to about so you end up mansplaining investment crypto (which is a scam) to a a girl who could give less of a fuck then ghosts you after an expensive dinner.

"Somebody, prolly your dumb uncle or older brother, told you that women like men with money so you thought that your investment banker salary and Patagonia vest would fine you love. Now you rage about feminism on Reddit because you gotta pay for escorts. Loser.]

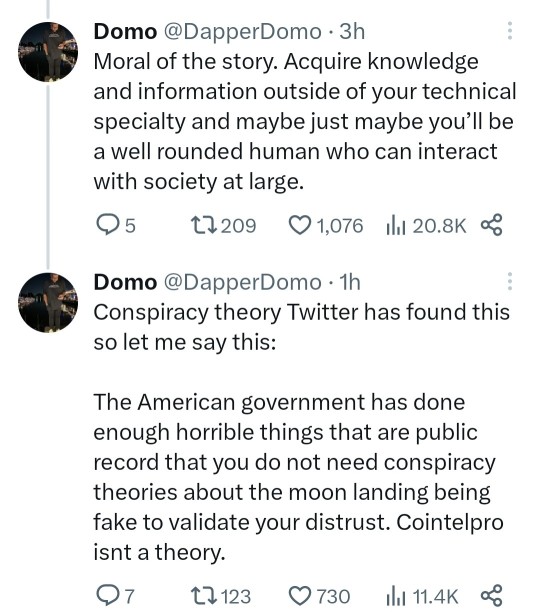

["Moral of the story. Acquire knowledge and information outside of your technical specialty and maybe just maybe you'll be a well rounded human who can interact with society at large.

"Conspiracy theory Twitter has found this so let me say this:

The American government has done enough horrible things that are public record that you do not need conspiracy theories about the moon landing being fake to validate your distrust. Cointelpro isnt a theory."]

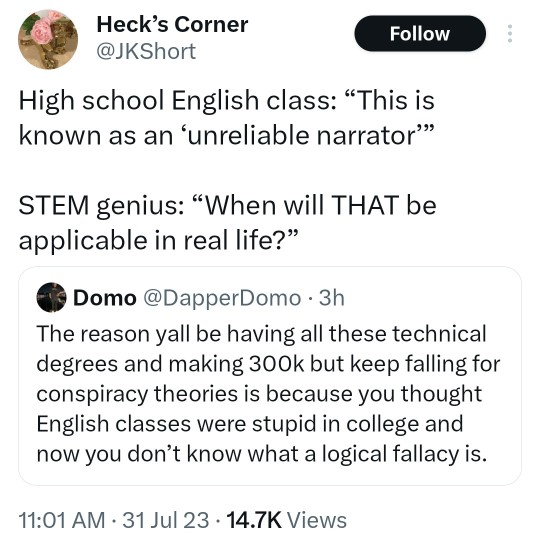

[A response to the thread by @JKShort "Heck's Corner" which says "High school English class: "This is known as an ‘unreliable narrator"

STEM genius: “When will THAT be applicable in real life?""]

[An infographic titled "Should I use this resource?" The information says:

Very Few Resources Are 100% Good or 100% Bad. Most are somewhere in between.

Research question: "How can I make sure I use quality information if so many resources have a weakness or two?"

Research Solutions for Evaluation Weaknesses:

Weakness: Source Isn't Very Current. Solution: Make sure the other resources you use are current.

Weakness: Author Isn't an Expert. Solution: Back up your facts with other sources written by experts.

Weakness: The Resource is Biased. Solution: Find biased resources from various perspectives so that you examine ALL sides of the issue.

Important point! While most resources will have a weakness, consider your sources collectively. With all of your sources combined, you want to have Yeses in each category on your checklist.

Research question: "What if I have trouble finding answers to some of the PAUSE questions?"

Evaluation Tips & Tricks:

Is the Source Current? If no date is listed for the source, Check the dates listed for the sources in the bibliography (if provided) or dates of statistics mentioned in the text.

If a source doesn't provide the author's credentials, Google them! You can learn a lot about an author by simply searching for them online.

If a source was published by an organization you're unfamiliar with, Google it! Most organization websites have an About section which provides details about their work AND any biases they might have.

Final notes:

Evaluating resources is not an exact science. It requires judgment and gets easier with practice.

Evaluation takes time. Give yourself enough time to find the best resources.

If you need help; ask! Librarians & your professor are available for assistance.]

[Another infographic, which says: how to spot fake news:

Consider the source: Click away from the story to investigate the site, its mission and its contact info.

Read beyond: Headlines can be outrageous in an effort to get clicks. What's the whole story?

Check the author: Do a quick search on the author. Are they credible? Are they real?

Supporting sources? Click on those links. Determine if the info given actually supports the story.

Check the date: Reposting old news stories doesn't mean they're relevant to current events.

Is it a joke? If it is too outlandish, it might be satire. Research the site and author to be sure.

Check your biases: Consider if your own beliefs could affect your judgement.

Ask the experts: Ask a librarian, or consult a fact-checking site.

End ID]

46K notes

·

View notes

Text

Why Every Crypto Investor Needs Cryptoscampolice in Their Toolkit

The cryptocurrency market is booming, attracting millions of investors from around the world. However, with this rapid growth comes a rise in scams, frauds, and malicious schemes. From rug pulls and phishing sites to fake exchanges and Ponzi schemes, crypto scams have become increasingly sophisticated. This is where Cryptoscampolice comes in—a powerful tool every crypto investor should have in their arsenal.

The Rising Threat of Crypto Scams

The decentralized nature of blockchain technology makes it both a blessing and a curse. While it offers transparency and security, it also makes it easier for scammers to operate without oversight. In 2023 alone, billions of dollars were lost to crypto scams, with new fraud tactics emerging almost daily.

Investors—especially those new to the crypto world—are often easy targets. Many scams mimic legitimate projects, use deepfake videos, or create social media hype to lure in unsuspecting users. Even experienced traders can fall victim to these elaborate schemes. That's why having a scam detection and prevention tool like Cryptoscampolice is not just a good idea—it’s essential.

What Is Cryptoscampolice?

Cryptoscampolice is an innovative platform designed to protect crypto investors from scams and fraudulent activities. It offers a wide range of features that help users identify suspicious behavior, report scams, and stay updated on the latest threats in the crypto ecosystem.

At its core, Cryptoscampolice provides real-time scam alerts, user-generated reports, and a growing database of blacklisted wallets, domains, and projects. It acts as both a warning system and a resource hub, enabling users to research before investing.

Key Features That Make Cryptoscampolice a Must-Have

1. Real-Time Scam Alerts

Cryptoscampolice constantly monitors blockchain activities, social platforms, and crypto forums to detect potential threats. Users receive instant notifications when new scams are identified—helping them avoid dangerous projects before it's too late.

2. Community-Driven Intelligence

One of the platform’s greatest strengths is its community. Users can report scams, suspicious projects, or fraudulent actors, creating a collaborative environment where investors help protect one another.

3. Verified Blacklists and Scam Databases

Before investing in any project, users can check Cryptoscampolice’s database to see if a wallet address, domain, or project has been reported. This can prevent users from getting involved with blacklisted or known scam operations.

4. Educational Resources

In addition to detection tools, Cryptoscampolice offers guides, tips, and news updates to educate investors. From learning how to spot red flags to understanding common scam techniques, users can build their knowledge and confidence.

5. User-Friendly Interface

Even if you're not tech-savvy, Cryptoscampolice’s clean and intuitive interface makes it easy to navigate. Whether you're checking a project’s credibility or submitting a scam report, everything is designed for accessibility and ease of use.

Why It Matters More Than Ever

As crypto adoption continues to grow, so does the incentive for bad actors to exploit the system. New investors, driven by the promise of quick returns, often overlook due diligence. Cryptoscampolice bridges that gap by providing immediate, actionable information that can save users from making costly mistakes.

Moreover, relying solely on social media, Reddit threads, or word-of-mouth can be risky. Scammers are adept at faking legitimacy. Cryptoscampolice offers a more reliable and centralized approach to scam prevention in the crypto space.

Conclusion

The crypto world holds incredible potential for profit and innovation—but also carries significant risks. In this fast-moving landscape, staying informed and protected is non-negotiable.

0 notes

Text

Which Memecoins Could Make You a Millionaire This Year?

Introduction

The cryptocurrency market is no stranger to wild fluctuations and incredible stories of overnight wealth. Among the many types of digital assets, memecoins have carved out a unique niche. Born from internet memes and cultural phenomena, these tokens often start as jokes but can transform into serious investments. This year, several memecoins have captured the market’s attention with their potential to generate substantial returns. In this blog, we’ll explore which memecoins could potentially make you a millionaire in 2023 and why they are worth considering.

Understanding Memecoins

What Are Memecoins?

Memecoins are a type of cryptocurrency that typically derives value from their association with internet memes or cultural trends. Unlike traditional cryptocurrencies that often have strong use cases or technological foundations, memecoins thrive on community engagement and viral marketing. Their success is driven largely by social media buzz and the collective enthusiasm of their communities.

Why Invest in Memecoins?

While memecoins are often viewed as high-risk, high-reward investments, they offer unique opportunities. Their low initial cost allows for substantial holdings, and their potential for rapid, viral growth can lead to significant returns. However, it’s crucial to approach these investments with caution and conduct thorough research.

Top Memecoins to Watch in 2023

Dogecoin (DOGE)

The Original Memecoin

Dogecoin started as a joke in 2013, inspired by the popular “Doge” meme featuring a Shiba Inu dog. Despite its humorous origins, Dogecoin has become a staple in the crypto community, known for its active and loyal fan base.

Why Dogecoin?

Celebrity Endorsements: High-profile endorsements from figures like Elon Musk have boosted Dogecoin’s visibility and credibility.

Community Support: Dogecoin has a large and engaged community that drives its adoption and use.

Real-World Use Cases: Increasing acceptance of Dogecoin for transactions and tipping in various platforms adds to its value proposition.

Shiba Inu (SHIB)

The Dogecoin Killer?

Shiba Inu was created as a direct competitor to Dogecoin, often dubbed the “Dogecoin Killer.” It has quickly risen in popularity and amassed a significant following.

Why Shiba Inu?