#Corteva

Explore tagged Tumblr posts

Text

Corteva Agriscience Pittsburg Operations, CA

#larry shapiro#larryshapiroblog.com#shapirophotography.net#larryshapiro#larryshapiro.tumblr.com#fire truck#firetruck#fire engine#Ferrara#Inferno#industrial fire engine#chemical factory#chemical plant#Corteva#Pittsburg CA

5 notes

·

View notes

Text

Corporate Mergers and Acquisition (M&A) Internship

DescriptionCorteva Agriscience is seeking motivated graduate candidates eager to gain hands-on experience within a dynamic corporate Mergers and Acquisitions function. As an Intern, you will be an integral part of the M&A team and work closely with global Strategy, Finance and Business teams to support the execution of meaningful in-organic growth transactions. Through the summer internship, the…

0 notes

Text

👉🏻 Corteva competitor Inari must face seed patent lawsuit

0 notes

Text

Open for female candidates students only | Corteva Agriscience Scholarship Program 2023-2024 Application link: https://www.buddy4study.com/page/corteva-agriscience-scholarship-program

youtube

#tnsfrbc#careers#dreamjob#corteva#agriscience#scholarship#program#civilservices#student#politics#trending#parasschlorships#diplamoschloarships#ug#pg#bcscholarshipTamil#howtoapplyforbcscholarshipTamil#scholarshiptamilrenewal#Medium#licscholarships#dmk#people#youtube#admk#admkitwing#tamilnadu#india#dmkitwing#Youtube

0 notes

Text

Maximize Your Trades. Trading Signals 17 October 2023 & Strategy Inside

Trading Signals 17 October 2023. Walt Disney, Charles Schwab Corporation, Duke Energy Corporation, Federal Realty #NFLX #NXST #PEP #VZ #PWR #RCL #UGI #PFE #RKT #OKE #MU #NEE #AAPL #AI #ALB #CTVA #NI #DIS #ETR #SIRI #HON #SCHW #DUK #FRT

Trading Signals 17 October 2023. Texas Instruments Incorporated, Apple, Boston Properties, Unity Software, Nexstar Media Group, Pepsico, Verizone, Pfizer, Rocket Companies, UGI Corporation, Netflix, ONEOK, Starbucks, Micron Technology, NextEra Energy, Quanta Services, C3 AI, Albemarle, Corteva, NiSource, Walt Disney, Entergy Corporation, Sirius XM Holdings, Honeywell International, Charles Schwab…

View On WordPress

#Albemarle#C3 AI#Charles Schwab Corporation#Corteva#Duke Energy Corporation#Entergy Corporation#Federal Realty#Honeywell International#Micron Technology#Netflix#Nexstar Media Group#NextEra Energy Partners LP#NiSource#ONEOK#PepsiCo#Quanta Services#Rocket Companies#Sirius XM Holdings#Starbucks#The Kraft Heinz Company#Trading signals#Trading strategy#UGI Corporation#Unity Software#Verizone#Walt Disney

0 notes

Text

buy corteva magister insecticide online - badikheti

buy corteva magister insecticide online at badikheti.com with discounted rate and get delivered to your door step. cash on delivery option available purchase magister insecticide.

0 notes

Text

Story at-a-glance

Chronic disease rates in America have increased dramatically, from 7.5% of the population in the 1930s to 60% today, representing a 700% surge, while obesity now affects 40% of Americans

Four companies (Bayer, Syngenta, BASF, and Corteva) dominate the agricultural market, with Bayer controlling 18.2% of global agrochemicals and, together with Corteva, over half of U.S. retail seed sales for major crops

The concentration ratio (CR4) in U.S. agriculture has reached extreme levels — 85% in beef packing, 70% in pork packing, and 95% control of corn intellectual property by just four companies

In 2024, pharmaceutical companies spent $294 million on lobbying, while agribusinesses spent $32.7 million, with Bayer alone spending $6.46 million in the U.S.

Modern industrial agriculture mimics pharmaceutical business models by creating dependency cycles. Farmers must repeatedly purchase synthetic inputs while patients require ongoing medication rather than cure-focused treatments

24 notes

·

View notes

Text

Know your CEO

According to the UN report this people control 50% of the seeds in the world are

Bayer: Bill Anderson, Leverkusen Germany

Corteva: Chuck Magro, bloombergs NY USA

ChemChina: Ren Jianxin, ?

Limagrain: Emmanuel Goujon, Lyon France

And they manipulate farms in a monopolistic cartel. They limit the way to buy or sell seeds across the world. 80% of poor people are also living on agriculture.

10 notes

·

View notes

Text

Growth Strategies Adopted by Major Players in Turf Protection Market

In the dynamic landscape of the turf protection industry, key players like Syngenta Crop Protection AG (Switzerland), UPL Limited (India), Corteva Agriscience (US), Nufarm (US), Bayer AG (Germany), and BASF SE (Germany) are at the forefront of innovation and market expansion. These industry leaders are driving growth through strategic initiatives such as partnerships, acquisitions, and cutting-edge product developments, solidifying their positions as influential forces in shaping the future of the turf protection industry. Their efforts not only enhance their global presence but also set new benchmarks for industry standards and customer expectations. The global turf protection market size is estimated to reach $8.1 billion by 2028, growing at a 4.9% compound annual growth rate (CAGR). The market size was valued $6.4 billion in 2023.

Top Global Turf Protection Leaders to Watch in 2024

· Syngenta Crop Protection AG (Switzerland)

· UPL Limited (India)

· Corteva Agriscience (US)

· Nufarm (US)

· Bayer AG (Germany)

· BASF SE (Germany)

· SDS Biotech K.K. (Japan)

· AMVAC Chemical Corporation (US)

· Bioceres Crop Solutions (Argentina)

· Colin Campbell (Chemicals) Pty Ltd (Australia)

· ICL Group Ltd. (US)

Investments and Innovations: Key Strategies of Top Turf Protection Companies

🌱 Syngenta Crop Protection AG: Leading the Way in Integrated Pest Management

Syngenta Crop Protection AG, a global agribusiness based in Switzerland, operates prominently in the crop protection and seeds markets. The company offers a comprehensive range of herbicides, insecticides, fungicides, and seed treatments, helping growers worldwide enhance agricultural productivity and food quality. With a presence in over 90 countries, Syngenta’s reach is truly global. In October 2020, Syngenta further strengthened its position by acquiring Valagro, a leading biologicals company. Valagro’s strong presence in Europe, North America, Asia, and Latin America complements Syngenta’s existing crop protection chemicals. This acquisition allows Syngenta to offer more integrated pest management strategies that reduce reliance on synthetic chemicals, while Valagro’s expertise in plant nutrition promotes healthier turfgrass growth and improved soil health.

Know about the assumptions considered for the study

🌍 UPL Limited: Innovating Turf Management Solutions Globally

UPL Limited, formerly known as United Phosphorus Limited, is a global agrochemical company based in India, providing a wide range of agricultural solutions, including crop protection products, seeds, and post-harvest solutions. UPL is a key player in turf management, offering innovative solutions for golf courses, sports fields, and other turf areas. Their product portfolio includes herbicides, fungicides, insecticides, and plant growth regulators, all designed to enhance turf quality and health while effectively controlling pests and diseases. Operating in over 130 countries across North America, South America, Europe, and Asia Pacific, UPL has 28 manufacturing sites worldwide, solidifying its position as a leader in the global turf protection market.

🏆 Bayer AG: Streamlining for a Focused Future in Turf Protection

Bayer AG, a multinational pharmaceutical and life sciences company headquartered in Leverkusen, Germany, operates across three business segments: Pharmaceuticals, Consumer Health, and Crop Science. The company’s Crop Science division caters to the turf protection market, offering products such as herbicides, insecticides, and fungicides. With operations in over 90 countries, including regions like North America, South America, Europe, the Middle East, Africa, and Asia Pacific, Bayer maintains a strong global presence. In March 2022, Bayer sold its Environmental Science Professional business, which includes turf protection products, to private equity firm Cinven for USD 2.6 billion. This strategic divestment is part of Bayer’s ongoing efforts to streamline its portfolio and concentrate on core businesses, ensuring a more focused approach to its future operations.

16 notes

·

View notes

Text

A new study has identified novel insecticidal proteins in ferns. Professor Marilyn Anderson at La Trobe University said the discovery could lead to plant-made protein pest control for crop plants that are essential to global food production. "The structural analysis demonstrates that even though this protein is produced by plants, it has several features in common with known three-domain Cry proteins used extensively in agriculture for insect control," Professor Anderson said. "These proteins protect crops from damage by serious lepidopteran (caterpillar) pests." The discovery of these proteins by Corteva Agriscience holds promise for the development of new tools to combat insect pests that threaten food and fiber production.

Continue Reading.

75 notes

·

View notes

Text

Trump administration’s cuts halt vital agricultural research

President Donald Trump administration’s dismantling of the US Agency for International Development (USAID) has brought work to a standstill at a network of farm research laboratories located at land-grant universities across 13 states, impacting the scientific world, according to Reuters.

The closures mark another blow to US agriculture under President Donald Trump’s sweeping overhaul of the federal government, stalling research aimed at advancing seed and equipment technology and expanding international markets for US agricultural products.

Farmers are already grappling with disruptions to government food aid purchases, as well as delays in agricultural grants and loan programs. Land-grant universities, established on federal land donated to states, are at the heart of this research network.

Global research partnerships in jeopardy

The network of 17 laboratories, funded by USAID through the Feed the Future Innovation Labs programme, has been conducting research in collaboration with countries such as Malawi, Tanzania, Bangladesh, and Rwanda. The research not only benefits partner nations but also supports US farmers by developing production practices that could be applied domestically and providing early warnings about pest threats.

David Tschirley, who leads a USAID-funded lab at Michigan State University and chairs the Feed the Future Innovation Lab Council, noted that the labs employ around 300 people and collaborate with as many as 4,000 international partners.

It presents an American face to the world that is a very appreciated face.

The reduction of USAID’s work also generated many accusations among European politicians and activists, as the programme supported initiatives including cooperation with European companies in scientific development. Former Catalan President Carles Puigdemont expressed astonishment at the impact the closure of the US programme had on global science.

The new regime promoted by Trump, Musk, and Vance is not a democratic shift towards the radical right. It is much worse. It is an amendment to the democratic system driven by the Enlightenment, which linked knowledge with progress, equality, and freedom. Only in this way can one understand that the new American administration is putting scientific research under surveillance and cutting off its funding (one of the strengths of US global leadership). It is frightening to read the impact it is having on the scientific world when it has not even been a month since the administration was inaugurated…

Stop-work orders and layoffs

All 17 labs received stop-work orders at the end of January following President Trump’s freeze on most foreign aid. Since then, they have received no further guidance or responses to their queries from the State Department, which oversees USAID, Tschirley explained. Some labs are appealing to their host universities to cover costs, with varying degrees of success.

Michigan State University has allowed Tschirley’s lab to retain staff, anticipating that USAID will eventually approve the expenses. However, Peter Goldsmith’s Soybean Innovation Lab at the University of Illinois has not been as fortunate.

Goldsmith laid off all 30 staff members last week and plans to close the lab by 15 April. His lab had been providing technical support to African farmers planting soy and to companies building soy-processing plants.

According to a 2020 report on the lab’s website, its partners included major agribusiness firms such as Bayer, Corteva, BASF, and Archer-Daniels-Midland. Bayer, a global leader in crop seeds and chemicals, stated it is assessing the impact of the funding halt, while the other companies declined to comment or did not respond to inquiries.

Broader impact on US agriculture

The freeze on foreign aid is not the only Trump administration policy affecting US farmers. Tens of millions of dollars in US commodity purchases were temporarily halted after the 24 January order freezing most foreign aid.

Additionally, farmers nationwide report delays in receiving payments from federal farm programs due to Trump’s directive to freeze federal loans and grants, which has since been blocked in court.

As the agricultural sector faces mounting challenges, the suspension of critical research and international partnerships further complicates the path forward for US farmers and their global counterparts.

Read more HERE

#world news#news#world politics#usa#usa news#usa politics#us politics#us news#america#politics#donald trump#donald trump news#trump administration#trump#president trump#usaid

3 notes

·

View notes

Text

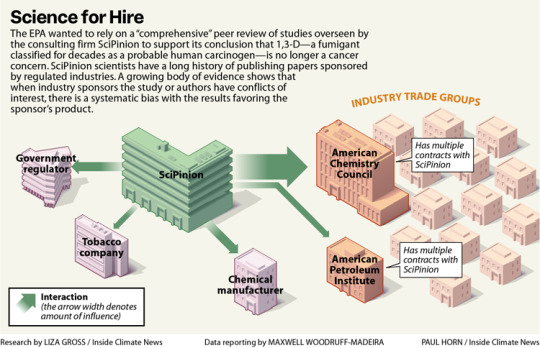

Note that the studies that were released by companies affiliated with polluters happened in 2019, during the trump administration.

Excerpt from this story from Inside Climate News:

On a Southern California spring morning in 1973, a tanker truck driver jackknifed his rig and dumped the agricultural fumigant he was transporting onto a city street. A Los Angeles Fire Department emergency response team spent four hours cleaning up the chemical, 1,3-dichloropropene, or 1,3-D, a fumigant sold as Telone that farmers use to kill nematodes and other soil-dwelling organisms before planting.

Seven years after the spill, two emergency responders developed the same rare, aggressive blood cancer—histiocytic lymphoma—and died within two months of each other. In 1975, a farmer who’d accidentally exposed himself to 1,3-D repeatedly through a broken hose was diagnosed with another blood cancer, leukemia, and died the next year.

Within a decade of the men’s deaths, described as case studies in JAMA Internal Medicine, the National Toxicology Program, or NTP, reported “clear evidence” that 1,3-D causes cancer in both rats and mice. The finding led the U.S. Environmental Protection Agency to classify the chemical as “likely to be carcinogenic to humans” the same year, 1985. So it wasn’t a surprise when researchers at the University of California, Los Angeles reported in 2003 that Californians who’d lived at least two decades in areas with the highest applications of 1,3-D faced a heightened risk of dying from pancreatic cancer.

Yet EPA’s Office of Pesticide Programs’ Cancer Assessment Review Committee, or CARC, concluded in 2019 that 1,3-D—originally embraced by tobacco companies for its unparalleled ability to kill anything in soil that might harm their plants—isn’t likely to cause cancer after all.

In doing so, EPA, whose mission is to protect human health and the environment, rejected the human evidence, calling the UCLA study “low quality.” It also dismissed the authoritative NTP study and studies in lab animals that documented 1,3-D’s ability to damage DNA, a quintessential hallmark of cancer.

Instead, EPA’s CARC relied on studies provided by Dow AgroSciences (now called Corteva), the primary manufacturer of 1,3-D, and proposed a review of evidence linking the fumigant to cancer by SciPinion, a consulting firm hired by Dow, as an external peer review of its work. The decision to entrust external review to a Dow contractor has drawn repeated criticism, including from the agency’s watchdog, the Office of Inspector General, or OIG.

“During EPA’s search of the open literature, a comprehensive third-party peer review of the cancer weight-of-evidence assessment that considered toxicokinetics, genotoxicity and carcinogenicity data for 1,3-D was conducted and published in 2020 by SciPinion,” said agency spokesperson Timothy Carroll. EPA argued that the SciPinion review satisfied the criteria for an external review, Carroll said, and that another panel would have arrived at the same conclusion, given the specialized expertise required.

The OIG had recommended EPA conduct an external peer review of its 1,3-D cancer risk assessment in a 2022 report that outlined several problems with the agency’s process. An external review, the OIG said, requires “independence from the regulated business,” again noting the deficiency in a new report released in early August.

The scientists who run SciPinion have long consulted for manufacturers of harmful products, often publishing studies that deploy computer models to question the need for more protective health standards.

4 notes

·

View notes

Text

As we head into 2025, you can make a unique impact. A gift to GMO/Toxin Free USA helps combat GMOs and harmful synthetic chemicals, promote organic solutions, and protect consumers from corporate deception.

Through December 31, donations will be matched up to $20,000. Would you pitch in to help us take advantage of this incredible opportunity? Your gift of $15 will become $30. Your gift of $25 will become $50. Time is running out.

For over a decade, GMO/Toxin Free USA has been a leader in public education on GMOs, synthetic pesticides and toxins in our food system and environment. We’ve reached millions of people through our unique social media efforts, generating awareness, informing, fostering individual change and civic action.

The billionaire-owned corporations and media continue to work against us. But with your gift today , we can make a difference and secure the future that we all deserve.

In November of 2019, we broke the news that the Food and Drug Administration (FDA) had just approved the first-ever genetically engineered animal for human consumption, AquaBounty’s GMO salmon. This social media post was shared by over 29,000 people and seen by over 2 million.

In fact, we had been generating awareness and campaigning against AquaBounty’s GMO salmon since 2012, knowing that the federal “regulatory” agencies are rarely on our side.

Earlier this month, December 2024, we were happy to announce that AquaBounty was shutting down operations, unable to secure a market for their GMO salmon. This couldn’t have happened without your support and the tireless dedication and work of our staff.

We’ve helped to ensure that GMO salmon will not be on the plate of any American. But as you probably know, the fight is far from over.

Biotech corporations are lining up to sneak gene-edited GMO fruits and vegetables onto our plates. A company called Pairwise has teamed up with Bayer-Monsanto to bring gene-edited leafy greens, blackberries, cherries and more, to market. This new wave of GMOs, made using newer genetic engineering techniques like gene-editing and Synthetic Biology, are not required to be labeled.

And there are corporations that are targeting home gardeners and small market farmers with GMO seeds. This is something we’ve not seen before. As far back as 2014, we began raising awareness about the development of a GMO Purple Tomato. But in the spring of this year, Norfolk Plant Sciences began selling seeds directly to consumers, branded as the Empress Purple Tomato or simply The Purple Tomato.

Just four corporations control and sell over half of all seeds globally, both GMO and non-GMO – Bayer-Monsanto, Corteva, ChemChina-Syngenta, and BASF. The number of independent seed companies is declining due to consolidation. This is a dangerous trend.

That's why GMO/Toxin Free USA recently launched the Seed Integrity Pledge for Safe Seeds, a website dedicated to educating the public and supporting independent seed companies that have taken the Safe Seed Pledge to not sell genetically engineered seeds.

Projects like these require knowledge, time, and staff.

This December, several of our historical donors have pooled resources and pledged to match donations up to $20,000. Would you help us reach this milestone? A gift of any amount will go twice as far.

And don’t forget. There are other ways to give that may provide you with increased tax savings. Learn more on our Ways to Give page.

Thank you so much for your support. We hope you have a safe, healthy and Happy New Year!

Let’s make 2025 a year with more victories.

@upontheshelfreviews

@greenwingspino

@one-time-i-dreamt

@tenaflyviper

@akron-squirrel

@ifihadaworldofmyown

@justice-for-jacob-marley

@voicetalentbrendan

@thebigdeepcheatsy

@what-is-my-aesthetic

@ravenlynclemens

@writerofweird

@bogleech

3 notes

·

View notes

Text

Maximize Your Trades. Trading Signals 13 October 2023 & Strategy Inside

Trading Signals 13 October 2023. Texas Instruments Incorporated, Apple, Boston Properties, Unity Software, Nexstar Media Group, Pepsico #ADBE #NFLX #FB #NXST #PEP #VZ #PWR #RCL #UGI #PFE #RCL #GBLE #RKT #TTD #PLTR #OKE #MU #NEE #KHC #AAPL #AI #ALB #CTVA

Trading Signals 13 October 2023. Texas Instruments Incorporated, Apple, Boston Properties, Unity Software, Nexstar Media Group, Pepsico, Verizone, Pfizer, Rocket Companies, UGI Corporation, The Trade Desk, Netflix, Meta Platforms. Palantir Technologies, ONEOK, Starbucks, BILL Holdings, Micron Technology, NextEra Energy, Adobe, Quanta Services, The Kraft Heinz Company, C3 AI, Albemarle, Corteva,…

View On WordPress

#Adobe#Albemarle#BILL Holdings#C3 AI#Corteva#Meta Platforms#Micron Technology#Netflix#Nexstar Media Group#NextEra Energy Partners LP#NiSource#ONEOK#Palantir Technologies#PepsiCo#Quanta Services#Rocket Companies#Starbucks#The Kraft Heinz Company#The Trade Desk#Trading signals#Trading strategy#UGI Corporation#Unity Software#Verizone

0 notes

Text

The big data conglomerates, including Amazon, Microsoft, Facebook and Google, have joined traditional agribusiness giants, such as Corteva, Bayer, Cargill and Syngenta, in a quest to impose their model of food and agriculture on the world.

Read More: https://thefreethoughtproject.com/technology/from-agrarianism-to-transhumanism-the-long-march-to-dystopia

#TheFreeThoughtProject

6 notes

·

View notes

Text

buy corteva kocide fungicide online - badikheti

buy corteva kocide fungicide online at badikheti.com with discounted rate and get delivered to your door step. cash on delivery option available purchase kocide fungicide.

0 notes