#Federal Realty

Explore tagged Tumblr posts

Text

Drone Light Show to Mark Shopping Center's Completion

A drone light show on Nov. 8 will help mark the completion of the Huntington Shopping Center’s $75 million redevelopment. Federal Realty said that the celebration from 5-7 p.m. will include a DJ, beer, wine and bites from Burger Village and other tenants of the center. The 150-drone light show will center over the Whole Foods Market between 6:45 and 7 p.m. “We’re looking forward to welcoming our…

0 notes

Text

Smart Trading: Expert Signals & Strategy - 16 November 2023

Trading Signals 16 November 2023. Comerica #PEP #PWR #RKT #NEE #AAPL #AI #NI #SIRI #HON #SCHW #DUK #FRT #EL #MAN #SABR #HBI #TLRY #WAT #CAG #INGR #MCD #CPB #EPD #BURL #QCOM #MDT #HBAN #CMA #DBX #IPG #ATAI #ILMN #CLH #WRLD #HD #ALB #TGT #CPMS #DE #UMC

Trading Signals 16 November 2023. Texas Instruments Incorporated, Apple, Pepsico, Rocket Companies, NextEra Energy, Quanta Services, C3 AI, NiSource, Sirius XM Holdings, Honeywell International, Charles Schwab Corporation, Duke Energy Corporation, Federal Realty, Estee Lauder Companies, ManpowerGroup. Continue reading Untitled

View On WordPress

#Albemarle#ATAI Life Sciences#Bridger Aerospace Group Holdings#Bumble#Burlington Stores#C3 AI#Campbell Soup Company#Charles Schwab Corporation#Clean Harbors#Comerica#COMPASS Pathways#ConAgra Brands#Deere & Company#Dropbox#Duke Energy Corporation#Enterprise Products#Estee Lauder Companies#Federal Realty#Hanesbrands#Home Depot#Honeywell International#Huntington Bancshares#Illumina#Interpublic Group of Companies#Johnson Controls International#ManpowerGroup#McDonald&039;s Corporation#Medtronic#NextEra Energy Partners LP#NiSource

0 notes

Text

Maya Yang at The Guardian:

The Trump administration has ordered US states to suspend a $5bn electric vehicle charging station program in a further blow to the environmental movement since the president’s return to the White House. In a memo issued on Thursday to state transportation directors, the transportation department’s Federal Highway Administration (FHWA) ordered states not to spend any funds allocated to them under the Biden administration as part of the national electric vehicle infrastructure (NEVI) program. “The new leadership of the Department of Transportation … has decided to review the policies underlying the implementation of the NEVI Formula Program,” Emily Biondi, the FHWA’s associate administrator for planning, environment and realty, wrote in the memo. “Accordingly, the current NEVI Formula Program Guidance dated June 11, 2024, and all prior versions of this guidance are rescinded,” Biondi added. “As result of the rescission of the NEVI Formula Program Guidance, FHWA is also immediately suspending the approval of all State Electric Vehicle Infrastructure Deployment plans for all fiscal years. Therefore, effective immediately, no new obligations may occur under the NEVI Formula Program until the updated final NEVI Formula Program Guidance is issued and new State plans are submitted and approved,” she wrote.

Biondi added that until new guidance is issued, reimbursements of existing obligations for designing and building charging stations will be allowed in order to prevent the disruption of current financial commitments. According to an existing page on the energy department’s website, the NEVI program provides funding to states to strategically deploy EV chargers. Funding is available for up to 80% of eligible project costs including the acquisition, installation and network connection of EV chargers, proper operation and maintenance of EV chargers, and long-term EV charger data sharing.

Tyrant 47’s petty war on electric vehicles rears its ugly head, as the Trump Misadministration suspends $5BN electric vehicle charging programs.

#Electric Vehicles#Donald Trump#Trump Administration II#Federal Highway Administration#Electric Vehicle Charging Stations#EV Charging Stations#Biden Administration#National Electric Vehicle Infrastructure Formula Program#NEVI Formula Program

23 notes

·

View notes

Text

Well, I've just about finished filling out my ballot and, in order to do so, I had to research all the various ballot propositions (we have ten of them this election cycle in California) and, dude, Props 33 and 34 are weird, weird enough that I had to do a ton of digging and weird enough that I have to tell you what I found if only for the entertainment value.

So Prop 33 is pretty simple, what it does is it repeals a state law from the 90s that prevented localities from enacting rent control measures. Whether you agree or disagree, that at least makes sense, right?

Prop 34 is… yeah, it's not that simple. Prop 34 requires that health care providers that (1) spent over $100 million in any 10 year period on something other than direct patient care and (2) operated multifamily housing with over 500 high-severity health and safety violations (3) spend 98% of revenues from the federal discount prescription drug program on direct patient care.

That seems oddly specific, right? How many health care providers spend that much money on something other than patient care, run multifamily housing units with lots of violations, AND participate in federal discount prescription drug programs?

It turns out that the answer is "one", and that one also turns out to be related to Prop 33.

You see, there's a non-profit based out of Los Angeles called the AIDS Healthcare Foundation (AHF). The AHF mostly provides AIDS-related health care stuff like tests, PrEP, and referrals to specialty pharmacies, but they also, starting in 2017, have been creating housing for low-income individuals and, since that time, they've also become politically involved in local and state ballot measures that would block some local development and allow for the expansion of rent control.

AHF is one of the main supporters of Prop 33 and backed Prop 10 in 2018 and Prop 21 in 2020 which would have also expanded rent control (Props 10 and 21 both failed). Prop 34 was backed mostly by landlord and realty groups and seems specifically targeted to stop AHF from spending money on politics.

If you're interested, this is the LA Times piece I found that finally laid the whole thing out.

Gotta love the crazy California ballot proposition system. Stay tuned for more political hilarity.

#politics#us politics#california politics#california ballot propositions#california prop 33#california prop 34#aids healthcare foundation#rent control

31 notes

·

View notes

Text

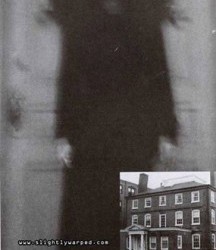

The Witch of the Joshua Ward House

The town of Salem, Massachusetts is no stranger to macabre record and disturbing legends, but for the first time perhaps something belonging to the towns supernatural facet has been caught on camera.

The Joshua Ward House has stood in mute witness to a dark history. The Georgian/Federal style building was constructed by Joshua Ward, a wealthy merchant sea captain, in the late 1780s on the remaining foundations of former sheriff George Corwin’s house on Washington Street. Corwin was a bloody figure whose zeal added to the unfortunate events surrounding Salem in the late 1600s. Nicknamed The Strangler after his preferred torture modus operandi (which included tying his prone victims’ necks to their ankles until the blood ran from their noses), he is said to be responsible for many of the witches deaths, including that of Giles Corey, a man who stood accused of witchcraft who Corey crushed to death by placing heavy stones on his chest in order to extract a confession. Despite the horrific treatment Corey never confessed, indeed he is said to have implored his torturers to pile on more rocks and hasten his departure.

Legend states that just before he died, Corey cursed Corwin and all sheriffs that follow in his wake for his despicable acts of barbarism. It should be noted here that every sheriff since Corey uttered his curse had died while in office or had been forced out of his post as the result of a heart or blood ailment. Corwin himself died of a heart attack in 1696, only about four years after the end of the trials. By the time of his death, Corwin was so despised that his family had to bury him in the cellar of their house to avoid desecration of the corpse by the public.

In the early 1980s a real estate company named Carlson Realty had bought the house with the intention of turning it into their headquarters. After moving in, a realtor by the name of Dale Lewinski began the task of taking photographs of the staff members to add to a welcome display. Lewinski was using a Polaroid camera to snap the head-and-shoulders, passport-style pictures. Upon photographing a colleague by the name of Lorraine St. Peter a peculiar sight greeted Lewinski.

The Polaroid was developed and, instead of showing St. Peter, it appeared to depict a frightening image: a strange, black-haired, feminine figure. St. Peter was nowhere to be seen, the photograph has not been cropped at all; St. Peter has been entirely replaced by the apparition.

This reproduction was originally published in the book Haunted Happenings by Robert Ellis Cahill (himself an ex-sheriff) in which he describes St. Peter as “both genuinely frightened and embarrassed by the picture.”

A hoax is of course, always possible, but unnecessary considering the rich nature of other paranormal occurrences that are reported to take place within the Joshua Ward House: aportation (objects moving of their own accord), candles that leap from their holders and subsequently melt, candles that are found bent into S shapes, alarms that go off by themselves (one alarm was triggered over sixty times in two years), phantom strangulations and the sightings of a myriad spirits including an elderly-looking spirit sitting by a fireplace and along with the photograph in questions subject, another ghostly woman roams the upper floors.

One room in particular seems to be more haunted than the rest. An employee would lock her office door nightly only to return in the morning to find books and papers thrown across the floor, the wastebasket upside down and lamp shades askew.

Sheriff Corwin’s body was eventually moved to the Broad Street Cemetery, but it is said that his spirit too lingers in the Ward House.

It is truly a bizarre photograph, certainly containing a degree of menace and so starkly strange as to create fright in the onlooker, especially upon first viewing.

#The Witch of the Joshua Ward House#joshua ward house#salem massachusetts#ghost and hauntings#ghost and spirits#paranormal#haunted locations#haunted salem#myhauntedsalem

37 notes

·

View notes

Text

July 16 (UPI) -- In a continued crackdown on Mexico's drug cartels, the Treasury Department announced Tuesday it placed sanctions on four Mexican companies and three Mexican nationals allegedly tied to fraudulent timeshare activity used against American citizens and linked to the notorious Cartel de Jalisco Nueva Generacion.

"Cartel fraudsters run sophisticated teams of professionals who seem perfectly normal on paper or on the phone -- but in reality, they're money launderers expertly trained in scamming U.S. citizens," Under Secretary for Terrorism and Financial Intelligence Brian E. Nelson said Tuesday in a news release.

The department's office of Foreign Assets Control alleges the four Mexican companies and three Mexican civilian accountants were directly or indirectly tied to timeshare fraud lead by the Cartel de Jalisco Nueva Generacion, or styled in English as the Jalisco New Generation Cartel.

The criminal organization operates call centers in Mexico with scammers impersonating U.S.-based third-party timeshare brokers, attorneys or sales representatives, the U.S. government contends.

And about 6,000 U.S. citizens reported losing nearly $300 million from 2019 to 2023 via Mexican timeshare fraud crimes by targeting American timeshare owners often in various or complex ways in years-long schemes, according to the FBI, adding that totals what they can track legally as unreported crimes keep on.

Treasury points at four companies in Mexico: Constructora Sandgris, Pacific Axis Real Estate, Realty & Maintenance BJ and Bona Fide Consultores, which the department claims were the front companies doing business on behalf of those linked to Mexican drug cartel.

Nelson says unsolicited calls and emails may look legitimate but actually are made by cartel-backed criminals.

The Treasury claims the thee Puerto Vallarta-based accountants -- Griselda Margarita Arredondo, Xeyda Del Refugio Foubert and Emiliano Sanchez -- had family ties to individuals already cartel-linked and had allegedly aided in fraudulent activities to steal from U.S. citizens.

"If something seems too good to be true, it probably is," Nelson said.

The scam begins when a timeshare owner receives an offer to purchase their property, according to an attorney.

"They call you up and tell you that they have a buyer for your timeshare," Michael Finn of Florida's Finn Law Group, told ABC News. "They will send you documents that look real and tell you that you need to pay taxes before you can get your payment."

The Treasury Department and its partners are taking steps to deploy all available tools "to disrupt this nefarious activity, which funds things like deadly drug trafficking and human smuggling," said Nelson.

Five years ago in 2018 Treasury sanctioned two men it claimed laundered money and ran an international prostitution ring for the cartel.

The transnational CJNG, a violent Jalisco, Mexico-based organized crime syndicate, is known to traffic the large part of illicit fentanyl and other deadly drugs which typically enter via the southern U.S. border, having gone so far as to threaten Mexican journalists it views as giving the CJNG "unfair" news coverage.

And it uses illegal proceeds, like from its timeshare fraud schemes, to diversify its already-illicit revenue streams in order to keep financing other criminal activities, including the manufacturing and trafficking of fentanyl and other synthetic drugs, according to the federal government's Financial Crimes Enforcement Network.

Police seizure of illicit fentanyl pills have skyrocketed in recent years, a new study found. And pills represented 49% of illicit fentanyl seizures in 2023, compared to 10% in 2017.

The U.S. Customs and Border Protection in April launched "Operation Plaza Strike" as an offensive targeting Mexican drug cartels to disrupt the flow of fentanyl and ingredients used to make the synthetic opioid that has become a leading death of young Americans.

However, this is not the first time the CJNG has been accused by the U.S. of similar crimes. Last year in March, the Biden Treasury placed similar sanction on eight other Mexican companies it alleged had took part in a similar timeshare fraud scheme on behalf of the Cartel de Jalisco Nueva Generation.

Even at the time a Treasury official pointed to how in select Mexican tourist destinations the CJNG had already become by that point "heavily engaged" in timeshare fraud in places like Puerto Vallarta where it had gained a strategic foothold.

Last year, the U.S. claimed the accused cartel-backed companies had extracted money from victims by making unsolicited offers to buy their timeshares, and when victims accepted offers, Mexican scammers requested fictitious fees and taxes under the pretense they would facilitate the sale and give reimbursed money after closing.

4 notes

·

View notes

Text

The Current State of the Housing Market

If you've been feeling uncertain about the current state of the housing market and are concerned about a potential housing crash, it's important to understand the data and factors that indicate a different scenario. Let's dive into the facts and dispel any fears or misconceptions.

Stricter Lending Standards Ensure Stability

Before the 2008 housing crisis, it was easier to get a home loan with more lenient lending standards. However, today's lending landscape has changed. Mortgage companies have implemented stricter lending criteria, making it harder to qualify for loans.

This shift in standards has reduced the risk of mass defaults and foreclosures, ensuring greater stability in the housing market.

Limited Inventory Supports Price Stability

During the housing crash, there was an oversupply of homes on the market, causing prices to tumble. However, the current housing market has a shortage of available homes for sale. The limited inventory is preventing a repeat of the past crash.

According to data from the National Association of Realtors (NAR) and the Federal Reserve, there is a significantly lower supply of homes today compared to the peak levels seen during the previous crisis. This scarcity of inventory has supported price stability in the market.

Homeowners' Cautious Approach

Another factor contributing to the market's strength is homeowners' cautious behavior. Unlike in the early 2000s, homeowners today are not tapping into their home equity for non-essential expenses.

Black Knight reports that homeowners have more equity available than ever before, but they are not extensively using it. This responsible approach reduces the risk of foreclosure and distressed properties flooding the market.

Conclusion

In conclusion, the current data and analysis provide reassurance that we are not headed for a housing crash. Stricter lending standards, limited inventory, and homeowners' cautious approach all contribute to a stable housing market.

To gain more insights and expert guidance on navigating the real estate landscape, reach out to KM Realty Group LLC, Chicago's top-rated real estate experts.

Learn more about the current state of the housing market and dispel any remaining fear and uncertainty.

2 notes

·

View notes

Photo

Mogil-Kahn Construction Company 1957 (Photo taken by Tim Aarons in March 2023 on Collins St. between Lankersheim and Tujunga).

Kahn was Edwin “Ed” Walter Kahn, born on June 3, 1922 in Pittsburg to “Theodore and Helen H. (Meyers),” and a “construction company executive, engineer” (Who’s who in the West: A Biographical Dictionary of Noteworthy Men and Women of the Pacific Coast and the Western States, A.N. Marquis Company, 1989). In 1935, he lived with is family in Portland, Oregon. He was still with his family in Portland in 1940 (per the 1940 U.S. Federal Census). However, he attended Fairfax Senior High School in Los Angeles, CA. Before WWII, he also attended UCLA, where he played soccer and baseball. In WWII, he was a lieutenant pilot in the USA Air Force - a B-24 bomber pilot in the 89th and as a flight instructor. He was later a civil engineer and, if I understand the abbreviations correctly, he had gotten a B.S. degree in civil engineering from the University of California in 1948 (assuming Berkeley).

According to his obituary, he was a “Registered Professional Engineer and a licensed General Contractor.”

He married Arleen Barbara Rudolph on December 23, 1951, and they had two children - Gregory Michael and Julia Fran. He was the chief structural designer for General Engineering Service Company in Los Angeles in 1948 and then a partner in Pollak-Kahn & Associates, engineers, also in Los Angeles in 1949. and Mogil-Kahn Construction Company (World Who’s who in Commerce and Industry, Volume 10, Marquis-Who’s Who., 1957). He died February 5, 2016 and is buried in the Hollywood Hills Forest Lawn Memorial Park.

Pollak-Kahn was located at 1106 S. La Cienega Boulevard, now LB4LB Boxing Gym (Glaziers Journal - Volume 35, pg. 60, 1956). One project they had was the design and engineering of “a fully integrated community for light industry” on a 100-acre “tract of industrial buildings and plant sites” (Industrial Development, Volumes 3-4, Conway Publications, 1956).

According to the realty company, Crisby Doe Associates, “it is clear that Pollack & Kahn fully mastered the now classic post & beam glass house style pioneered by the U.S.C. School of Architecture just after war. Their work seems most closely aligned with that of Richard Dorman’s designs of the period. The living spaces are lifted, and set above the carport to allow maximum light and views from the close-in hillside setting.”

Some more info from his obituary: “He retired after 40 years as a real estate developer and as President of Kahn Construction Co., Contractors and Engineers. He had a commercial pilot's license and served as a docent at the original Museum of Flying in Santa Monica. Ed was a member of the Masons, Scottish Rites, Shriners, Commemorative Air Force, Air Force Association, and the American Society of Civil Engineers. Ed is survived by his wife and best friend, Mariko, sons Greg and Winston, daughter Julie, stepdaughters Pam (Harry) Kraushaar and Andrea (Jeffrey) Lustgarten, stepson Mitchell Barnow (Dale Leininger) and step grandchildren, Shelby Powell (Brian), Kimberley Kraushaar, Brandon and Rachel Lustgarten.” (No mention of Arleen?) They also had two pets named Maya and Corey.

I have no idea who Mogil is. Really strange how I could find out so easily who Kahn was but not Mogil. Mogil may be Norbert V Mogil, who was located at 6517 W Olympic Blvd according to the Los Angeles Street Address Directory, 1956, May (Los Angeles Public Library).

Additional source:

Who’s Who in Steel and Metals, pg. 209, Atlas Publishing Co, 1964

2 notes

·

View notes

Text

Explore Homes for Sale in Boston, MA — Your Next Home Awaits!

Boston, MA, is one of the most sought-after real estate markets in the United States, offering a blend of historical charm, modern convenience, and a vibrant urban lifestyle. Whether you are a first-time homebuyer, an investor, or looking to relocate, there is an abundance of options when it comes to boston houses for sale. From historic brownstones in Back Bay to contemporary high-rises in the Seaport District, Boston has something for everyone.

Why Invest in Boston, MA Real Estate?

Boston’s real estate market remains strong due to its world-class universities, thriving job market, and rich cultural heritage. The demand for houses for sale in Boston, MA continues to grow, making it an excellent place for long-term investment. The city’s diverse neighborhoods offer distinct architectural styles and amenities, ensuring that buyers can find the perfect home to suit their lifestyle.

Popular Neighborhoods for Homebuyers

Back Bay — Known for its historic brownstones and upscale condos, Back Bay offers a luxurious urban living experience.

South Boston — A rapidly growing area with waterfront views, perfect for young professionals and families alike.

Cambridge — Home to Harvard and MIT, this area is great for those looking for a vibrant, intellectual community.

Beacon Hill — One of Boston’s oldest and most picturesque neighborhoods, featuring cobblestone streets and Federal-style homes.

Seaport District — A modern, fast-growing neighborhood with stunning waterfront properties and contemporary condos.

Finding the Right Home

If you are searching for homes for sale in Boston, MA, you will find a wide range of options, including single-family homes, townhouses, and luxury condos. Buyers looking for condos for sale in Boston, MA will be pleased with the variety of high-end residences offering state-of-the-art amenities, breathtaking views, and prime locations.

Boston’s Condo Market

For those who prefer a low-maintenance lifestyle with luxury amenities, Boston’s condo market is thriving. Many buyers are opting for condos for sale in Boston due to their convenience, security, and access to urban conveniences. Neighborhoods such as Downtown, Fenway, and the Seaport District feature a variety of modern condominiums catering to different lifestyles and budgets.

Tips for Homebuyers

Get Pre-Approved: Before starting your search, obtain pre-approval for a mortgage to understand your budget.

Work with a Local Expert: The Boston market is competitive. A knowledgeable real estate professional can help you navigate it effectively.

Consider Your Lifestyle Needs: Whether you prefer a bustling downtown experience or a quiet suburban retreat, Boston offers something for everyone.

Let Key Prime Realty Help You Find Your Dream Home

At Key Prime Realty (www.keyprimerealty.com 📞781 790 4440), we specialize in helping buyers and sellers navigate the Boston, MA real estate market. Whether you’re looking for houses for sale in Boston, USA, or high-end luxury condos, we are here to assist you every step of the way.

Your dream home is just a search away! Explore the best Boston homes for sale today and make the city your next home. Contact us at Key Prime Realty for expert guidance and personalized real estate solutions.

Are you ready to find your perfect home in Boston? Reach out to Key Prime Realty and let us help you make your home-buying journey smooth and successful!

1 note

·

View note

Text

More Stores Moving Into Huntington Shopping Center

Several new, smaller stores have taken spots at the Huntington Shopping Center, becoming neighbors of the Whole Foods market that will open July 17. Federal Realty Investment Trust announced that Clothes Horse, European Wax, Pacfe Nails, Häagen-Dazs and Street to Table have all signed leases to join the center as part of the $75 million redevelopment of the center. The redevelopment is set to…

View On WordPress

#Clothes Horse#European Wax#Federal Realty#Haagen-Dazs#Huntington Shopping Center#Pacfe Nails#Street to Table#Whole Foods

0 notes

Text

Smart Trading: Expert Signals & Strategy - 15 November 2023

Trading Signals 15 November 2023. Comerica, Dropbox, #PEP #PWR #RKT #NEE #AAPL #AI #NI #SIRI #HON #SCHW #DUK #FRT #EL #MAN #SABR #HBI #TLRY #WAT #CAG #INGR #MCD #CPB #EPD #BURL #QCOM #MDT #HBAN #CMA #DBX #IPG #ATAI #ILMN #CLH #WRLD #HD #ALB #TGT

Trading Signals 15 November 2023. Texas Instruments Incorporated, Apple, Pepsico, Rocket Companies, NextEra Energy, Quanta Services, C3 AI, NiSource, Sirius XM Holdings, Honeywell International, Charles Schwab Corporation, Duke Energy Corporation, Federal Realty, Estee Lauder Companies, ManpowerGroup. Continue reading Untitled

View On WordPress

#Albemarle#ATAI Life Sciences#Bridger Aerospace Group Holdings#Bumble#Burlington Stores#C3 AI#Campbell Soup Company#Charles Schwab Corporation#Clean Harbors#Comerica#ConAgra Brands#Dropbox#Duke Energy Corporation#Enterprise Products#Estee Lauder Companies#Federal Realty#Hanesbrands#Home Depot#Honeywell International#Huntington Bancshares#Illumina#Interpublic Group of Companies#Johnson Controls International#ManpowerGroup#McDonald&039;s Corporation#Medtronic#NextEra Energy Partners LP#NiSource#PepsiCo#Quanta Services

0 notes

Text

Assembly Row

Exploring Assembly Row in Somerville, MA: A Premier Shopping, Dining, and Entertainment Destination

Assembly Row in Somerville, Massachusetts, is a premier destination for shopping, dining, and entertainment. Located just a few miles north of downtown Boston, Assembly Row has undergone a remarkable transformation over the past decade, evolving from an underutilized industrial site to one of the most vibrant urban spaces in the Greater Boston area. Whether you're a local resident, a visitor, or someone considering moving to the area, Assembly Row offers a unique blend of modern living, shopping, and recreation. This article will explore what makes Assembly Row a must-visit location in Somerville, from its diverse retail options to its thriving food scene and exciting entertainment choices.

The Evolution of Assembly Row

Assembly Row’s history dates back to the early 20th century when it was originally an industrial area dominated by manufacturing and warehouses. Over the years, however, as industries declined and the city of Somerville sought to revitalize its neighborhoods, Assembly Row was identified as a key location for urban development.

The transformation began in the mid-2000s, when Federal Realty and other developers saw the potential of this once-forgotten industrial district. They envisioned a mixed-use space that would combine retail, dining, and residential elements, along with ample green spaces and easy access to public transportation. The development of Assembly Row was a significant part of Somerville’s larger revitalization efforts, and over time, the area has blossomed into a modern and desirable destination.

Today, Assembly Row is home to high-end retail stores, top-tier restaurants, office spaces, luxury apartments, and entertainment venues. It is a perfect example of how urban redevelopment can breathe new life into a community while maintaining its accessibility and charm.

Shopping at Assembly Row

One of the standout features of Assembly Row is its incredible shopping options. The shopping district offers a range of retail experiences that appeal to a variety of tastes and budgets. Whether you're a fashionista looking for the latest trends, a home décor enthusiast, or someone on the hunt for unique gifts, Assembly Row has something for everyone.

The Assembly Row Mall features an impressive lineup of popular brands, including Nike Factory Store, Levi’s Outlet Store, Coach Factory Store, and J.Crew Factory, providing visitors with a fantastic selection of clothing, accessories, and footwear at discounted prices. For those looking for upscale shopping, The Paper Store offers a curated selection of gifts, cards, and stationery, while Brooks Brothers Factory Store provides classic and stylish clothing options.

In addition to national brands, Assembly Row also features boutique stores that offer unique and one-of-a-kind items. T.J. Maxx and Marshalls are popular retail spots where shoppers can find quality merchandise at discounted prices. The combination of high-end brands, popular retailers, and local boutiques makes Assembly Row an ideal shopping destination for every style and budget.

Dining and Culinary Delights

After a day of shopping, Assembly Row offers an impressive array of dining options that are perfect for grabbing a bite to eat with friends or enjoying a casual meal with family. Whether you’re craving international cuisine, classic American comfort food, or innovative cocktails, you’ll find a restaurant to satisfy your appetite.

Some of the most popular dining spots at Assembly Row include Davio’s Northern Italian Steakhouse, which offers a sophisticated menu of steaks, seafood, and pasta dishes. Legal On the Mystic, a waterfront seafood restaurant, provides a picturesque setting for dining while serving up fresh seafood and signature cocktails. For those who prefer international flavors, Mexican eatery La Isla offers delicious Puerto Rican dishes, and Bistro du Midi provides authentic French cuisine in a chic and stylish atmosphere.

For more casual fare, Fried Chicken offers a Southern-inspired menu that features crispy fried chicken and flavorful sides, while Serafina delivers classic Italian dishes in a modern setting. Those in the mood for a quick snack or coffee can also visit Starbucks or J.P. Licks, a local ice cream shop with a cult following. The diversity in Assembly Row’s food scene ensures there is something for everyone, no matter what type of dining experience you’re looking for.

Entertainment and Recreation

Assembly Row isn’t just about shopping and dining; it’s also a prime spot for entertainment and recreation. The development includes several entertainment venues that attract visitors from all over the Greater Boston area.

Legoland Discovery Center Boston, located at Assembly Row, is one of the neighborhood’s premier family attractions. This interactive indoor theme park is perfect for children and features a variety of Lego-themed exhibits, rides, and play zones. It’s a great destination for families looking to spend an afternoon having fun and exploring.

For moviegoers, AMC Assembly Row 12 offers a state-of-the-art movie theater where you can catch the latest blockbusters in comfort and style. With plush seating, advanced audio-visual systems, and a wide selection of films, it’s an ideal place to enjoy a night out with friends or family.

Additionally, Assembly Row’s open-air spaces and green areas make it a wonderful location for outdoor activities. The Assembly Row Park, which is centrally located in the district, features lush lawns and plenty of seating, making it an excellent spot to relax or enjoy a picnic during the warmer months. The park often hosts live events, outdoor movies, and seasonal markets, adding to the area’s vibrant atmosphere.

Residential Living at Assembly Row

In addition to its retail, dining, and entertainment options, Assembly Row also offers a variety of residential properties. The Avery, The Chelsea, and The Artistry are just a few of the luxury apartment complexes that have been developed in the area, offering residents modern amenities, beautiful interiors, and easy access to the best that Somerville and the Greater Boston area have to offer.

Living at Assembly Row provides residents with the unique opportunity to be part of a thriving urban community. With everything from high-end apartments to a wide range of amenities within walking distance, Assembly Row is an ideal location for people who want to live in a dynamic and convenient neighborhood. The development of new residential spaces has helped further establish Assembly Row as a true live-work-play destination.

Accessibility and Transportation

One of the major advantages of Assembly Row is its excellent access to public transportation. The Assembly Square MBTA Orange Line station, which is just steps away from the district, provides easy and convenient access to downtown Boston and other key areas of the city. For those who prefer to drive, Assembly Row is also well-connected to major highways, including Interstate 93 and Route 28, making it easy to get to and from the neighborhood by car.

In addition, Assembly Row is incredibly walkable, with pedestrian-friendly streets and plenty of bike lanes for cyclists. The proximity to major public transit options and roadways ensures that Assembly Row is easily accessible for both residents and visitors.

Future Developments and Growth

Assembly Row continues to grow and evolve, with additional residential, retail, and office spaces in the works. The neighborhood is expected to see further expansion in the coming years, with new businesses, public spaces, and recreational areas planned to further enhance the community. As the development of the Green Line Extension progresses, Assembly Row’s connection to Boston will only become stronger, further solidifying its role as a key destination in the region.

Conclusion

Assembly Row in Somerville, MA, is a dynamic and thriving neighborhood that has transformed into one of the region’s top destinations for shopping, dining, entertainment, and residential living. With its exceptional retail options, diverse dining scene, family-friendly attractions, and easy access to public transportation, Assembly Row offers something for everyone. Whether you’re a visitor spending a day exploring the area or a resident enjoying the conveniences of urban living, Assembly Row is an exciting place to be. Its continued growth and development ensure that this vibrant neighborhood will remain one of Somerville’s most sought-after locations for years to come.

Here is another local business to support.

355 Artisan Way, Somerville, MA 02145, United States

Check out this next place.

0 notes

Text

Federal Realty Investment Trust (NYSE:FRT) and Its Role in Retail and Mixed-Use Real Estate

Federal Realty Investment Trust (NYSE:FRT) is a real estate investment trust (REIT) specializing in retail and mixed-use properties across high-demand markets. With a strong focus on long-term value creation, the company develops and manages shopping centers and mixed-use communities that integrate residential, office, and entertainment spaces.

Portfolio and Strategic Focus

(NYSE:FRT) owns and operates a diverse portfolio of retail and mixed-use properties across densely populated regions. The company’s developments are positioned in areas with strong consumer demand, ensuring stability and consistent occupancy. Key properties include large-scale mixed-use developments that combine shopping, dining, and residential spaces, catering to modern urban living trends.

The company emphasizes sustainable growth through property enhancements and redevelopment, aiming to maintain high-quality assets that align with evolving consumer preferences. By integrating residential and office spaces within its retail hubs, (NYSE:FRT) strengthens its long-term value proposition.

Financial Performance and Dividend Strength

(NYSE:FRT) has a track record of financial stability, supported by its strategic asset locations and tenant diversification. The company has maintained a strong history of dividend payments, emphasizing steady cash flow generation. Its disciplined approach to capital management and asset expansion contributes to sustained growth in its real estate holdings.

Market Presence and Development Strategy

With a focus on high-density metropolitan areas, (NYSE:FRT) continues to expand through redevelopment projects and property acquisitions. The company’s strategy includes revitalizing existing properties and creating mixed-use environments that attract businesses and residents alike. This approach positions it as a key player in shaping modern commercial and residential spaces.

Sustainable Growth and Community Impact

(NYSE:FRT) integrates sustainability into its real estate development, focusing on energy efficiency and environmentally responsible building practices. By fostering vibrant communities through well-planned developments, the company enhances long-term asset value while supporting local economic growth.

Federal Realty Investment Trust (NYSE:FRT) remains a strong presence in the retail and mixed-use real estate sector. With a focus on high-quality properties, consistent financial performance, and a long-term commitment to sustainable development, the company continues to play a significant role in shaping the future of commercial real estate.

#RealEstate#NYSE#RetailREIT#MixedUse#CommercialRealEstate#Sustainability#UrbanDevelopment#PropertyManagement#FederalRealty#RetailSpaces

0 notes

Text

Federal Realty Acquires 674,000-Square-Foot Retail Development in Monterey, California for $123.5 Million

4 Monterey, Calif. — Federal Realty Investment Trust has acquired Del Monte Shopping Center, a 674,000-square-foot retail development located in Monterey, for $123.5 million. Originally built in 1967 and renovated in 2007, the center is situated on 47 acres. Whole Foods Market anchors the property, which was 83 percent leased at the time of sale. Other tenants at the center include Sephora,…

0 notes

Text

The Joshua Ward House

Salem, Massachusetts

Stately in its federal-style architecture, the Joshua Ward House, a historical landmark since 1978 is one that can actually claim relation to the Witch Trials. While Joshua Ward himself made his wealth from Salem’s port and sea business, it’s the location of the house, not the man who gave it its name which inspires the home’s notoriety. The Joshua Ward House is built over the site of the original home of George Corwin, the High Sheriff of Essex County in 1692. Corwin is notorious in Salem’s history as the man whose signature brought the arrest and execution of those in Salem village accused of witchcraft. Corwin also dis-seized many of the accused and condemned of their land, leading to his massive unpopularity following the hysteria. While this may not make him less culpable than the accusers and the ruling judges of the trials, Corwin is known for his cruelty in gaining confessions from the accused, most notably in the case of Giles Corey.

George Corwin died at age 30 (a fairly decent life expectancy for the time and place) of a heart attack. Curse-wise, it is said that every High Sheriff since Corwin has either died in office of a heart or blood condition or left on the same grounds. On the subject of the curse, I’ll refer anyone interested to Robert Ellis Cahill, a folklorist and former High Sheriff of Essex County who investigated the topic personally and professionally.

Following his death, Corwin’s body was not buried, a lien had been placed on it until one of the accused, Phillip English, had is dis-seized property returned to him. It was interred in the basement of his home on Washington Street by his family who feared reprisals from the townsfolk who reviled Corwin and other collaborators after the hysteria passed. His body was quietly buried later in the town cemetery. Both surviving evidence and local folklore suggest that Corwin had used the dis-seized properties to house prisoners.

Today the house, now a historical landmark and home to Higgins Book Company has been the site of unexplained phenomenon for some years. While it is not the subject of inspiration and tourism as the House of Seven Gables, the Joshua Ward house has seen its own fame in books on the collective hauntings of Salem and a comprehensive segment on the History Channel series Haunted History.

Reports testify to cold hands put on the backs of house employees, candles knocked over and twisted into S shapes, mysteriously locked doors, overturned furniture and cold spots. Pretty standard fare for many ghostly activities. Perhaps the most compelling piece of supernatural evidence comes from a Polaroid taken of a new agent when the house served as a real estate office in the 1990’s. The new associate posed for a head shot at the bottom of the stairs. A few minutes later when the picture developed, a black-dressed figure of a woman was clearly visible standing at the top of the stairs.

Without proof of no photographic tampering, it’s hard to call this evidence. One has to decide for themselves.

__________________________________

There are two entities who reside here who were innocent victims of the witch trials, perhaps looking for Sheriff George.

Entity of a woman with black, rather wild hair style. She is thought to be one of the victims unjustly executed. She isn’t a happy camper.

Her apparition has been reported roaming the hallways throughout the building.

When a photograph was taken of a Realtor for a publicity shot for the Carlson Realty, the angry image of this malevolent female spirit was caught on film, standing in one of the mansions hallways.

The male entity of Giles Corey A man falsely accused of being a warlock who was tortured and killed by the crushing rocks method of interrogation. Apparently, he isn’t happy either. He isn’t satisfied that his final curse has stayed with not only Sheriff George but has affected many sheriffs who followed in the years after his horrendous death.

Trash cans are found, turned over, books are pulled from shelves and rooms found in disarray.

Candles are taken out and melted.

Cold spots are felt in certain corners of certain rooms.

The entity of Sheriff George

An older male entity has been seen sitting in a rocking chair by a fireplace.

Back in the mid-1980’s, people have reported being choked by an unseen entity. This could be Sheriff George, trying to reclaim his authority or it could be one of his victims trying to show the living what they suffered.

Items are moved around the mansion.

Candles are bent into the shape of an S.

#joshua ward house#salem massachusetts#paranormal#haunted locations#ghost and hauntings#ghost and spirits#haunted salem#myhauntedsalem

9 notes

·

View notes

Photo

Federal Realty Acquires Monterey’s Del Monte Center for $123.5M

0 notes