#BailOut

Explore tagged Tumblr posts

Text

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

32 notes

·

View notes

Text

#jerktrillionaires#jerkbillionaires#jerkmillionaires#airline news#aeroplane#united airlines#facts#bailout#alaska airlines#american airlines#airlinetickets#airlines#airport#airports#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#aeroplanes#class war#eat the rich#eat the fucking rich#oppression#repression

50 notes

·

View notes

Text

Three, four years ago I could have told you, and did tell people, that inflation would start steadily going up, and I said even then that it would likely be stubborn, meaning it wasn't going to be an easy fix.

I knew this back then because it was obvious, even years ago, that the BRICS countries, along with many African and South Asian countries and elsewhere were looking for ways to get around using the US Dollar for trade.

They were making moves to expand trade relations outside US dollar transactions and were for many years planning and building the infrastructure for a future Multipolar world.

And that process began rapidly picking up pace three or four years ago.

I began to say then, what I'm still saying now, as that process goes on and trade outside the US Dollar system grows exponentially year-on-year, that's going to begin to have an effect on inflation.

Why? Well, Imperialism really. Because the US for decades has depended on the steady demand for US Dollars to hold down inflation, allowing the US to use debt spending to finance wars, military bases and imperialistic ventures like Syria.

Remember, it was the US in its massively dominant position after WWII that built the Bretton Woods System that made the US Dollar the world reserve currency pegged to gold, and it was the US that unilaterally abandoned Bretton Woods 1 and took the dollar off Gold, allowing for the US to finance wars through debt spending, and created the Petro-Dollar with Saudi Arabia in the 1970's.

This debt spending is essentially the surplus value from the Global South and other poorer countries that must buy US Dollars to fund infrastructure projects, energy consumption, food and medicine imports, etc since it's the world reserve currency and if you wish to use the US Financial System at all, such as the World Bank, or SWIFT messaging system, well you have to use US Dollars.

Basically, it's the sucking of the wealth out of poorer countries to finance their own economic oppression.

But as these countries catch on and with new rising global powers like Russia, China and Iran building the infrastructure for an alternative system, the US Dollar is being abandoned faster than ever.

In 2000, more than 70% of Foreign Exchange Reserves were held in US Dollars. By 2020, that figure had dropped considerably to 59%. And the rate at which it's dropping is only increasing.

Knowing this, I said back in 2019 and 2020 that inflation was likely to become a problem. And if it did become a problem, then we knew exactly what the Fed would do as a result: dramatically increase benchmark Interest rates.

This didn't take any particularly specialized or secretive sources to figure out. It's been obvious for years to anyone seriously interested in economics and geopolitics.

And what happens when interest rates go up? The value of the bonds bought under lower interest rates suddenly go way down, while debts become more expensive. It's like gravity in economics.

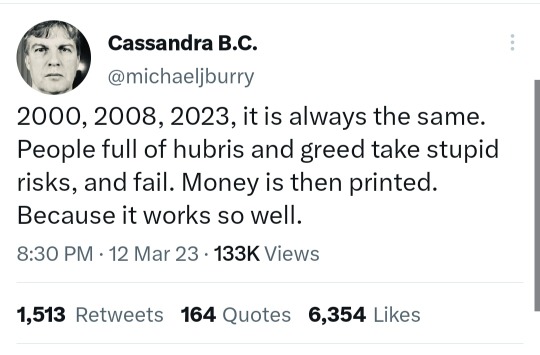

So with all that being said, why then did all these banks (Signature Bank, First Republic Bank, and Silicon Valley Bank) continue buying troubled assets and Treasury bonds if they're so smart and educated and knew all this?

I mean, these guys are supposed to be the best of the best corporate bankers, right? On the cutting edge of investment banking, right? That's what everyone said even just months before Silicon Valley Bank failed. (CNBC host and moron of the year Jim Cramer literally praised Silicon Valley Bank less than a month before its failure)

So one of two things must be true here and neither one is good for YOU the average worker.

Either these bankers are idiots; complete morons who have little to no understanding of basic economics, geopolitics, and monetary policy, something that should be of concern to all of us.

I mean, I'm just a dude working for a small retailer in New Orleans and even I knew this inflation and higher interest rates were coming.

So why exactly are these people paid such exorbitant salaries? If I can understand the basics of their job better than they can, why am I a retailer, and he, a millionaire banker???

So that's one possibility, one I'm virtually certain is actually true, that our ruling Elite isn't particularly smart or well educated in reality, anymore than ordinary people I meet everyday, and any one of us could easily do their jobs just as well or better than they do given the opportunities afforded to them.

But even if in this case, that's not what happened. That these weren't idiots. Well then the alternative is something that should also be deeply disturbing to you: that these bankers knew they would be facing this situation, that they were well aware of the coming inflationary pressures and equally aware what the Feds response would be, interest rate hikes.

And instead of using the last couple of years to shed possibly dangerous assets and shore up the money the banks kept on hand, they continued to do what was personally making them so much profit, at the expense of tax payers, because they were absolutely certain that the government these bankers spend so much money on campaigns for, would swoop in regardless of the recklessness of their behavior, and bail them out no matter what.

These are not the signs of a healthy political, economic or banking system.

#bailout#bank bailout#bank bailouts#us corruption#economic corruption#political corruption#us imperialism#us hegemony#wall street#bankers and bailouts#fuck capitalism#neoliberal capitalism#neoliberalism#fuck neoliberalism#socialism#communism#marxism leninism#socialist politics#socialist worker#socialist news#socialist#communist#marxism#marxist leninist#progressive politics#politics#us banking crisis#us banking system#recession#economics

189 notes

·

View notes

Text

32 notes

·

View notes

Text

Silicon Valley Bank Bailout

youtube

SVB's Risk Management 🙄🙄🙄

#biden collapse#build back better#banking crisis#fraud#Biden's broken brain#margin call#alphabet hire#risk management#bailout

38 notes

·

View notes

Text

"$2 trillion dollars" fuck off. that's not a real number (a frustrated shitpost)

You can't put two trillion dollars' worth of goods into a room.

You can barely even put two billion dollars' worth of goods into a room.

It is an actual exploit of our economic system that you can turn real goods into tokens that allow you to cram more ""value"" into a room than its referents would naturally allow.

No, fuck off. If you try to stack more than a million dollars, it should refuse like it's Minecraft or something. A million dollars plus one should still be a miilion dollars for rules purposes. A million dollars plus a further million dollars should still equal one million dollars.

At some point we have to admit that the numbers themselves are violent - that the nature of our economic system allows for distortions that are obscene and inhumane.

A human being should not be able to have ""a billion dollars"". If Elongated Muskrat or Jeffrey Bezos tried to cram a billion dollars worth of real value into a treasure chest, do you think he could even close the lid, let alone meaningfully "own" the contents of that treasure chest? No, and furthermore, fuck off!

Here is my rage-inspired proposal for a rules patch. If you put more than a million dollars into a pile, the value of the pile is instantly reduced to zero and the paper (or the digital medium holding the sum) spontaneously combusts. Numbers over a million dollars are just Metaphysically Banned. This affects larger sums first and is fairly broad as to what constitutes a pile.

"But that'd break the economy!" For all human purposes, our economy is already broken. Capitalism is the existential-risk paperclip maximizer AI that is already here, taking over everything.

The planet is dying for the sake of Number Go Up. In my desperation, is it really so unreasonable that part of me wishes the numbers themselves could break down, could rebel against this additive and multiplicatory madness?

#shitposting#economy#billionaires#cosmic horror#capitalism#ai risk#jeff bezos#elon musk#warren buffett#bill gates#bailout#madness#inequality#wealth inequality#wealth tax#taxation#i'm tempted to tag this ''poetry'' or ''fiction'' so you understand that the semantic content of this post is not entirely serious#like obviously if this actually happened it probably wouldn't fix anything at all#but it would bring things to a grinding halt as we'd be forced to figure something else out#and maybe that something else would be better or at least less horrible

46 notes

·

View notes

Link

By Gary Wilson

In the current crisis, the banks hold the government hostage. They demand anything and everything to "bail us out, or we will take you down with us." As long as capitalism rules, the bankers are not lying when they say this. On March 12, the Federal Reserve, Treasury Department and the Federal Deposit Insurance Corporation unveiled a plan to rescue uninsured depositors, Semafor reports. Only customers with deposits $250,000 and below are insured by the FDIC. But by invoking a “systemic risk exception,” they’ll now be able to cover larger accounts, which make up a much higher percentage of SVB’s deposits than most banks.

#bailout#banking crisis#big banks#Silicon Valley Bank#FDIC#Federal Reserve#Joe Biden#interest rates#recession#capitalism#imperialism#workers#class struggle#billionaires#Big Tech#Marxism#Struggle La Lucha

29 notes

·

View notes

Text

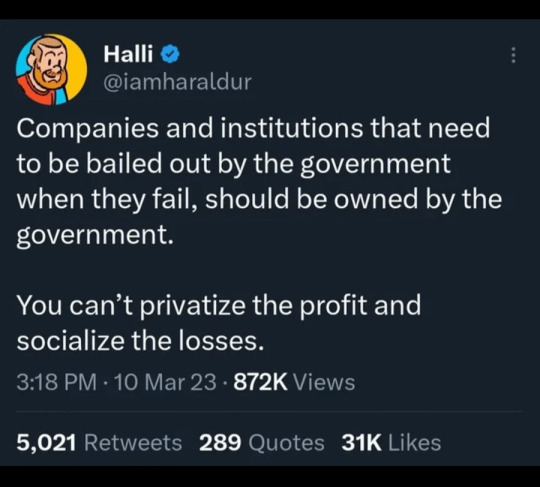

Too big to fail means it should have failed and gone to the public. Worker owned businesses, locally owned and controlled utilities and banking/currency.

3 notes

·

View notes

Text

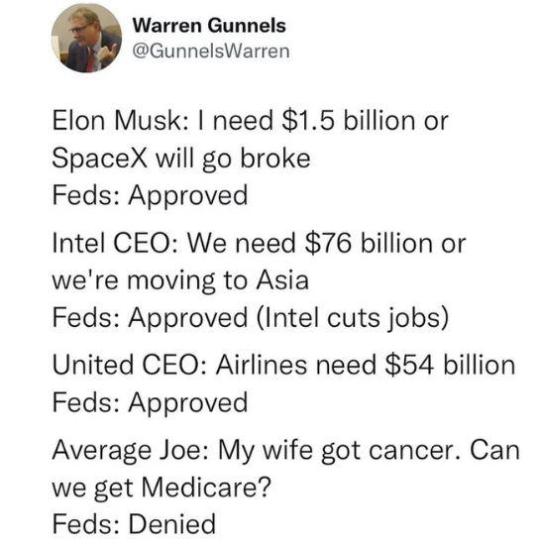

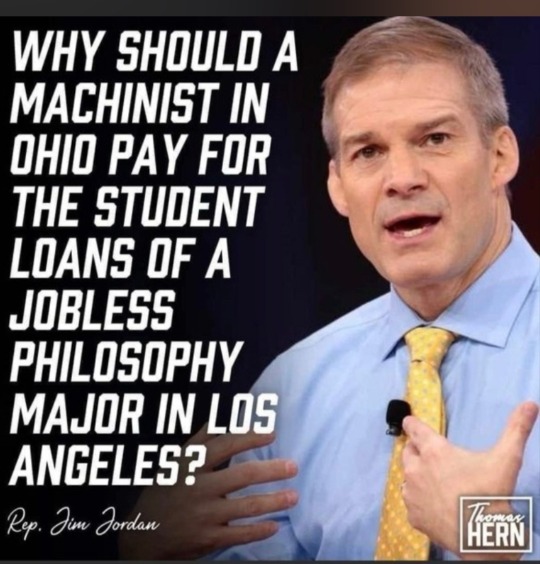

Guys am I dreaming or did a CONSERVATIVE page just perfectly sum up leftist economic and political ideology POSITIVELY!

It was turning point usa that shared this! That means that even conservatives do agree with left wing thoughts on these issues! If we can just communicate we can build a bigger more inclusive movement and actually do something about this system the conservatives also disagree with!

Never forget that both the left and right hate authoritarianism, poverty, war, a predatory and corrupt economic system, etc.

#turning point usa#politics#political#leftist#leftism#conservatives#solidarity#activism#war machine#anti capitalist#anti capitalism#anti war#anti militarism#war what is it good for#war pigs#war mongers#abolish landlords#housing market#give peace a chance#bailout

5 notes

·

View notes

Text

Should I post more helluva boss art? |:Fizzarolli

3 notes

·

View notes

Text

#capitalism#bailout#easing#fed#federal reserve#government#austrian economics#economy#capitalism cicle

3 notes

·

View notes

Text

More than half the country can’t afford housing and then we have this POS

#anti elon musk#elon musk#elongated muskrat#elon twitter#elongated man#fuck elon#bailout#jerktrillionaires#jerkbillionaires#jerkmillionaires#teslamodely#teslamotors#teslacars#tesla#delaware#government corruption#usa news#usa#america#twitter#x#spacex#space x#elon mask#elon musty#elonmusk#homeless#poverty#eat the rich#eat the fucking rich

22 notes

·

View notes

Photo

#Info - Is the bank system sound?

The institutions that are deemed “too big to fail” will always be bailed out. In his book, “Conspiracy of the Rich: The 8 New Rules of Money,” Robert Kiyosaki wrote that “bailouts are the name of the game.”

#gentlemans code#info#central banking#bank system#svb failure#finance#silicon valley bank#banking#moral hazard#economic crisis#robert kiyosaki#rich dad education#rich dad poor dad#bailout#lehman brothers#bear sterns

2 notes

·

View notes

Text

Silly Con Bank

The same crowd of tech bro wannabe libertarians who pushed de-regulation and balked loudly at student loan forgiveness now want a government bailout of their speculative bubble. Capitalize the profits, socialize the losses.

And while pontificating about “what should have been done” none, I do mean none are mentioning the obvious elephant in the room:

Fractional Reserve Banking

Which is basically a socially acceptable institutionalized ponzi scheme under which there WILL be bank runs, intentional or accidental.

https://www.youtube.com/watch?v=o2n9maL2bO0

3 notes

·

View notes