#Alternative investment

Explore tagged Tumblr posts

Text

Maximizing Your Productivity to Explore Alternative Investment Opportunities

Alternative investments are a strategic way of diversifying portfolios beyond traditional stocks and bonds. However, to navigate these options, you need to increase your productivity. Hence, this article explores how to effectively manage your time and resources to capitalize on the unique opportunities presented by alternative investments.

Strategies for Enhancing Productivity in Alternative Investments

Alternative investments represent a class of assets that fall outside the traditional categories of stocks, bonds, and cash. They are vast and varied, each offering distinct characteristics and benefits within a portfolio. For instance, real estate includes investing in residential, commercial, and industrial properties. It is often praised for its low correlation with traditional financial markets, providing a cushion during periods of stock market volatility.

Private equity is another popular alternative to stocks and bonds, and it involves investing in companies not publicly traded on a stock exchange. These include venture capital investments in startups, growth capital for expanding companies, or buyouts. Private equity is known for its potential for high returns, albeit with higher risk and longer investment horizons.

Other alternative investments worth looking at are commodities and hedge funds.

The next step might be knowing where to access these opportunities. Fortunately, digital platforms provide access to a wide range of investment funds previously available only to institutional investors or those with significantly high capital.

Here are ways to maximize productivity so you can reap from the alternative opportunities you find.

Time Management Techniques

Two valuable techniques are prioritization and batching tasks.

Prioritization involves ranking investment activities based on their potential impact and urgency. For instance, you can prioritize due diligence on a new private equity opportunity that’s about to close funding rounds and schedule a routine check of stable, long-term real estate assets later. This technique ensures the most time-sensitive and potentially rewarding tasks receive immediate attention, optimizing the allocation of effort and resources.

On the other hand, batching tasks refers to grouping similar activities to reduce distraction and increase efficiency. You can dedicate specific blocks of time to analyze market trends across various commodities or review performance reports of multiple hedge funds.

It minimizes the mental load and administrative overhead of switching between different tasks. As such, it speeds up the investment analysis process and improves focus, leading to more insightful investment decisions.

Technological Tools

There are comprehensive data analytics and research tools for assessing the viability and performance of complex investment options like hedge funds and private equity. You can use these platforms to gather market data quickly, compare fund performances, and conduct deep dives into financials without manually compiling information from multiple sources.

Another powerful tool is investment management software to consolidate your investment portfolios in one interface. It offers risk assessment features and scenario analysis to help you manage and adjust portfolios easily in response to market changes. For example, you can use these tools to simulate the impact of economic shifts on real estate investments, allowing for proactive strategy adjustments.

Outsourcing

Leveraging external resources can bring specialized expertise and additional capacity to your investment strategies. For instance, consulting firms specialize in market analysis and due diligence, providing deep insights into specific industries or markets.

Further, financial and investment advisors offer personalized advice tailored to individual investment goals. For example, an investor interested in commodities might use an advisory service to understand the timing and scale of investments in precious metals or energy resources, balancing their portfolio based on risk tolerance and market opportunities.

In addition, by joining investment groups, you can access larger, more capital-intensive opportunities that might be beyond your reach independently. This strategy is common in private equity, where investment partnerships pool resources to buy out or invest in larger enterprises. It often leads to higher returns due to economies of scale and shared expertise.

Tips to Maintain High Productivity

The dynamic nature of alternative investments necessitates regular reviews of investment strategies. This periodic assessment allows you to respond to changes in market conditions, regulatory environments, and financial goals.

For example, if you invested in private equity, you can reassess your commitment to various funds based on performance metrics and market outlook and adjust your contributions or exit positions to better align with current objectives. These reviews help you stay proactive rather than reactive, enabling you to manage your portfolio more effectively.

In addition, effective stress management is essential for maintaining productivity and decision-making capacity. Techniques such as mindfulness, structured downtime, and physical activity can help manage stress, leading to clearer thinking and better overall health.

Additionally, the landscape of alternative investments is continually evolving, making continuous learning a critical component of an investor’s strategy. For example, keeping abreast of advancements in blockchain technology might inform decisions regarding investments in digital assets or real estate tokenization.

Conclusion

Alternative investments offer a compelling avenue for diversifying your portfolio and accessing potential high returns that are generally uncorrelated with traditional stock and bond markets.

However, the benefits of alternative investments come with the necessity for proactive management and continuous engagement. You can navigate the complexities of these diverse asset classes by implementing the strategies discussed, such as regular strategy reviews and leveraging technological tools.

Pin or save this post for later!

Share in the comments below: Questions go here

#productivity tips#productivity#investment opportunities#time management#optimize time management#investments#alternative investment#technological tools#investment advisors#stress management#mindfulness#structured downtime#physical activity

0 notes

Text

Discover the lucrative world of whisky cask investments with our comprehensive guide.

Learn about the impressive returns, portfolio diversification benefits, and expert tips for success.

Unlock the potential of tangible assets and preserve wealth with whisky cask investments today.

#whisky cask investment#alternative investment#invest in whisky cask#how to invest in whisky#invest in whiskey

0 notes

Text

Evolution of the Investment Ecosystem and the Rise of Alternative Asset Classes

Here’s an interesting fact though: Just 5 years ago, the AUM was less than half of this, at roughly 18 lakh crores!2

Yes. That’s the kind of phenomenal growth that Mutual Funds have seen in India.

A lot of new investors may not know this, but Mutual Funds are not a recent product. The Mutual Fund industry in India started way back in 1963 with the formation of UTI – that’s about 60 years ago. But Mutual Funds as an investment product didn’t catch up with retail investors until recently. In fact, the last decade itself saw a 5X growth in the industry’s AUM.

For retail investors, Mutual Funds are a good way to start their investment journey. They’re simple products, where you give your money to the Mutual Fund house, which professionally manages it and invests it across debt, equity and other products, depending on your goal and the fund house’s objective. Taking the SIP mode is a great option when it comes to Mutual Funds since regular, periodic investments take care of volatility in the market and average out your returns. And over the long term, most equity funds tend to give average annual returns between 12-20%, which are great numbers to look at!

Click here to know more about

0 notes

Text

The Peace that Comes with Planning Your Inheritance

The feeling of knowing your tomorrow is secured brings a lot of relief. Fortune favors those who are prepared, and writing a will is a vital step in the life preparedness drill to safeguard the interest of your loved ones.

Let’s read the story of Mr. Raghav Malhotra who seeks the peace that comes with being prepared.

Raghav is a successful investment banker who has built a diverse portfolio that spans various asset classes such as stocks, mutual funds, bonds, and alternative investments. He has thoughtfully named his wife and sister as nominees to ensure their financial security across the various asset classes he owns. He is also a proud owner of two beautiful flats in Navi Mumbai. Recognizing the importance of comprehensive financial planning, he has taken the proactive step of drafting a will. Raghav’s commitment to securing his assets, coupled with his thoughtful consideration of his family’s financial future, showcases his responsible approach to wealth management.

Click here to know more about

0 notes

Text

Wine Investment Redefined: Uncorking the Potential

When it comes to investments, the usual suspects like stocks, real estate, and precious metals often steal the limelight. However, there's a hidden gem in the world of investments that's been gaining momentum and redefining the game - wine. Yes, you heard it right. Wine investment is not just for sommeliers and connoisseurs; it's a dynamic and lucrative avenue that's capturing the attention of savvy investors across the United States. In this article, we'll uncork the potential of Alternative Investment and explore why it's time to raise a glass to this unique opportunity.

A Toast to Tangible Assets

Imagine having an investment that not only appreciates over time but also allows you to indulge in a little luxury along the way. Wine investment is like having your cake and eating it too, or should I say, having your wine and drinking it too? Unlike stocks or bonds, which are mere pieces of paper or electronic entries, wine is a tangible asset. It's a living, breathing (or should I say fermenting?) entity that ages gracefully in a bottle, increasing in value as it matures.

Diversification, the Wine Way

Diversification is the cornerstone of any solid investment strategy. It's like a well-curated playlist that balances different genres to create a harmonious experience. Wine, with its myriad of varieties, regions, and vintages, offers a unique dimension to diversification. It's like having a symphony of investments, each note playing its part in creating a beautiful composition. Whether you prefer the bold crescendo of a Cabernet Sauvignon or the delicate nuances of a Chardonnay, there's a wine investment for every palate.

The Vintage Advantage

One of the most intriguing aspects of wine investment is the concept of vintages. Just as every year has its own story to tell, so does every vintage. It's akin to collecting rare books, each with its own narrative, transporting you to a different era. Certain years produce exceptional wines due to favorable weather conditions, skilled winemaking, or other unique factors. These sought-after vintages can appreciate significantly over time, making them prized possessions for investors.

The Pleasure of Patience

Investing in wine teaches us the art of patience, akin to nurturing a bonsai tree or waiting for a masterpiece to unfold on canvas. It's a slow dance between time and transformation, where the rewards are savored over the years. As wine ages, its flavors evolve, often becoming more complex and refined. This transformation mirrors the growth of your investment, culminating in a potentially lucrative return.

The Market Dynamics

Now, you might be wondering, "Is wine investment a niche market?" Far from it! The wine investment market is a dynamic arena, constantly evolving and adapting to global trends. In recent years, the United States has emerged as a formidable player in this space. The demand for fine wines, both domestically and internationally, has been on a steady rise. It's like discovering a hidden gem in your backyard that the world is clamoring to possess.

Accessibility in the Digital Age

Gone are the days when investing in fine wines required an extensive network or a private cellar. The digital age has democratized wine investment, making it accessible to a wider audience. Online platforms and specialized investment firms now facilitate the process, providing a seamless experience for both seasoned investors and those dipping their toes for the first time.

Uncorking the Risks

Of course, no investment venture is without its risks, and wine investment is no exception. The wine market, like the liquid within its bottles, can be subject to fluctuations. Factors such as changing consumer preferences, economic conditions, and global events can influence prices. However, with proper research, guidance, and a diversified portfolio, these risks can be mitigated.

Savoring the Experience

In the world of investments, wine stands out as a unique and delightful option. It offers not only financial potential but also the pleasure of savoring a timeless tradition. So, whether you're a seasoned investor looking to diversify or someone intrigued by the allure of wine, consider raising a glass to this redefined approach to investing. After all, as they say, "In wine, there's wisdom."

In conclusion, wine investment is not just an alternative; it's a revelation. It brings a touch of elegance and tradition to the world of finance, offering a truly unique investment experience. So, as you contemplate your investment portfolio, why not add a dash of sophistication with a bottle or two of fine wine? Cheers to new horizons and a fruitful journey in wine investment!

1 note

·

View note

Text

Alternative Investment Fund: Diversifying Your Portfolio for Better Returns

Investing has progressed far beyond the old ways of purchasing stocks and bonds. In recent times, experienced investors have become intrigued by alternative investment funds as a means to diversify their investments and potentially enhance their financial gains.

This article thoroughly explores the world of alternative funds, revealing their characteristics, potential advantages, and how they can smoothly fit into your larger investment strategy.

Table of Contents

Introduction

Understanding Alternative Investment Funds

Defining Alternative Investments

Types of Alternative Investment Funds

Benefits of Alternative Investment Funds

Portfolio Diversification

Potential for Higher Returns

Reduced Market Correlation

How to Invest in Alternative Investment Funds

Working with Fund Managers

Minimum Investment Requirements

Accessing Fund Performance Data

Real-World Example of Alternative Investments

Real Estate Investment Trusts (REITs)

Challenges of Alternative Investments

Lack of Liquidity

Complexities in Valuation

Regulatory Considerations

Conclusion

Introduction

Alternative investment funds have become popular among people looking to diversify their investment portfolios. This is important because the financial world keeps changing. These funds offer more options and ways to invest compared to usual methods. Regular ways of investing have restrictions in terms of diversification and potential profits. So, alternative investment funds allow you to expand your investments and try different strategies for potentially higher returns.

Understanding Alternative Investment Funds

Defining Alternative Investments

Alternative investments encompass a wide range of assets that extend beyond the typical choices such as stocks and bonds. They can encompass things like real estate, commodities, private equity, and hedge funds. What makes them distinct is their lesser correlation with traditional stock market trends. This quality can make them valuable for safeguarding against abrupt fluctuations in the market.

Types of Alternative Investment Funds

There are a bunch of different types of alternative investment funds. Private equity funds put money into businesses that aren't public, which can make a lot of money but also have more risk. Hedge funds are like tricky money experts; they use different ways to make profits and can be complicated. Then there are real estate investment trusts (REITs) that let you be part of the real estate world without owning actual properties. It's like owning a slice of property without the hassles.

Benefits of Alternative Investment Funds

Portfolio Diversification

For successful investing, it's smart to spread your investments. Alternative funds help by including different assets with different risk levels, making your overall risk lower.

Potential for Higher Returns

These funds can make you more money than regular investments because they use unique methods and invest in less common things.

Reduced Market Correlation.

When the stock market goes down, alternative investments often do better. This helps prevent big losses in your investments when the market isn't doing well.

How to Invest in Alternative Investment Funds

Choosing Skilled Managers: Good fund managers are key for these investments. Look for managers who have a history of doing well and a clear plan for investing.

Investment Minimums: Some funds need a bigger starting investment. Make sure the fund fits what you can afford.

Checking Past Performance: It's important that the fund's past performance is open and clear. See how it did in different market situations.

Real-World Examples of Alternative Investments

Real Estate Investment Trusts (REITs):

REITs let you invest in real estate without the headaches of managing properties. They usually give you monthly profits from rental income.

Challenges of Alternative Investments

Lack of Liquidity

Alternative investments are not always as liquid as conventional assets such as equities. Be prepared to go longer without rapid access to your invested assets.

Complexities in Valuation

Because of their unique character, alternative assets may be difficult to value. This may make it difficult to appropriately analyse the fund's performance.

Regulatory Considerations

Depending on their nature, alternative investment funds are regulated differently. To make informed investment decisions, it is essential to comprehend the regulatory climate in your jurisdiction.

Conclusion:

Adding alternative investment funds to your portfolio offers diversification and the chance for better returns in today's complex financial world. Understanding different types of alternatives, considering your risk tolerance, and doing thorough research can lead to informed choices that match your financial goals.

OR

Consider including alternative investment funds in your portfolio for diversification and potentially higher returns. Check out the ARKA INDIA REALTY FUND by Sepulveda Fund Management, offering a well-managed way to enter the real estate market.

FAQs:

Can Alternatives Protect My Wealth in Market Downturns? Yes, alternative investments can act as a shield during market volatility because they're not as connected to regular assets, reducing potential losses.

What Does Sepulveda Fund Management Do? Sepulveda Fund Management, through the ARKA INDIA REALTY FUND, offers a well-structured chance to benefit from alternative investments and their expertise.

Can Alternatives Help Reach Long-Term Goals? Yes, they can by diversifying your portfolio and possibly providing higher returns over time.

Have Investors Gained from Sepulveda Fund Management? Absolutely, many investors have achieved their financial goals with Sepulveda Fund Management's smart advice and specialized knowledge.

1 note

·

View note

Text

#real estate investment#alternative investment#real estate funds#private equity real estate funds#multifamily investing#private real estate funds#investing in real estate

1 note

·

View note

Text

Alternative Investments: Everything You Need to Know in 2023

If you’ve got some financial liquidity, act smart and take advantage of alternative investments— the best way to save and grow money is to invest it. With the current economic climate, investing is one of the best things you can do to protect your finances (whether you’re investing as part of a business, or as an individual investor. Having a diverse investment portfolio is one of the best things…

View On WordPress

0 notes

Text

The Role of Technology in AIF Investing

Rapidly changing investor expectations and industry requirements are motivating the industry to meet the impetus provided by advanced technologies.

Across most value chains and capital markets, technology has driven efficiency and cost reduction.

Alternative asset management firms are increasingly recognizing the changing dynamics, driven by digitalization, in terms of customer expectations and personalization. Customers are being acquired, served, and maintained using new age technologies. Firms that assimilate new age technologies will have a significant advantage over those that don’t.

The alternative investment funds value chain in India has been analysed for technology touchpoints, taking into account prominent technology disruptors like Big Data, Advanced Analytics, Blockchain, Cloud, Customer Experience Technology, Intelligent Automation and API/Microservices .

Big Data

Large-scale data has been critical in altering how alternative investment fund managers take decisions. Because there is no standardised or benchmarked market data across alternative asset categories, big data usage is crucial. In addition to collecting data from various sources like social media, satellite imagery, news feeds (in different formats), and policy decisions (which include pdf inputs or voice recordings), alternative asset analyses require data processing.

More sophisticated analytical techniques

Alternative assets require advanced analytics to help differentiate insights across the investment lifecycle. IoT images, patterns, sentiment/intent, and voice/text data will be increasingly analysed as part of this process. Big data technologies are used to capture new data sources and enrich data in order to generate actionable insights, whereas advanced analytics employs advanced algorithms to do the same thing with aggregated data.

Cloud computing

Cloud technology is now a hygiene feature rather than a differentiator for organisations. The importance of cloud has been re-established during the COVID-19 disaster like never before. In the private equity and alternative assets industry, legacy technologies and manual procedures cause problems, as they are inefficient and time consuming. Therefore, cloud provides a chance to transform and adopt new SaaS offerings.

It has been argued that technology that improves investor experience is underdeveloped in alternative asset management firms. Since most of these investments last for a long time, the early focus on a limited number of assets may be justified. As mainstream asset managers enter the space, and the size of assets and revenue share increases, customers’ needs must be fulfilled to ensure satisfaction.

Intelligent automation systems

Robotic Process Automation (RPA) has been extensively utilised in numerous industries to automate repetitive tasks or enhance human labour in order to enhance efficiency. RPA combined with AI allows for the next level of automation by allowing processes to go beyond human performance indicators, orchestrating and executing decisions based on AI insights. Alternative investment funds India managers should include Intelligent automation in their business procedures.

Great returns can be achieved through investing in technology.

The alternative investment funds sector has become an integral part of the investment management business. Investors are seeking out new asset classes and investment opportunities under this category. Players are assessing their businesses, operations, and growth prospects in addition to how they can satisfy ever-increasing investor demands and governmental regulations. Technology investment is taking precedence.

If an alternative investment company ignores leveraging advanced technologies as investors’ expectations and industry requirements rapidly change, industry growth will be elusive. The industry will require enhanced user experiences, agility, and effective risk management to win over demanding consumers, and technology will be the enabler.

KFintech’s AIF Solution

KFintech’s K-ALT, a proprietary technology service helps you navigate the alternative asset investment spectrum, resolve complexities in fund administration with the highest quality and provides the most cost-effective solutions.

Alternative Asset managers are often challenged by fragmented markets, legacy tech, disparate systems, and cost pressures. K-ALT suit of services provides comprehensive cutting-edge solutions helping asset managers entangle their fund administrative complexities.

0 notes

Text

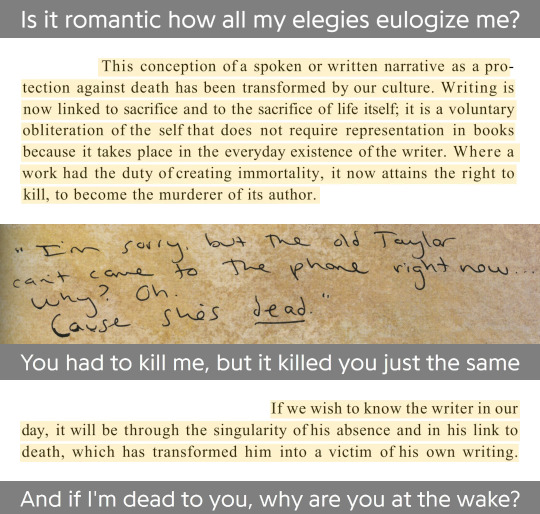

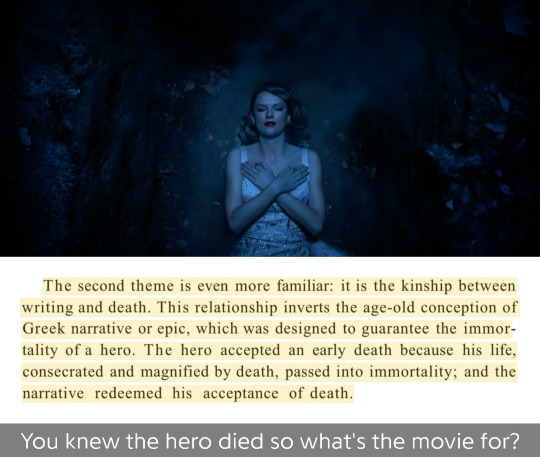

Death of the Tortured Poet

Taylor Swift and other poets in conversation with Roland Barthes's "The Death of the Author" (1967) and Michel Foucault's "What is an Author?" (1969)

I want to say thank you to @ttpds @youmeetyourself and @ohdorothea. This post would not exist were it not for your musings on the topic, our conversations, and your encouragement. Seriously, thank y'all.

Sources:

Unless otherwise noted, lyrics are from Genius and screenshots/scans/etc are from taylorpictures.net

Barthes, Roland. "The Death of the Author"

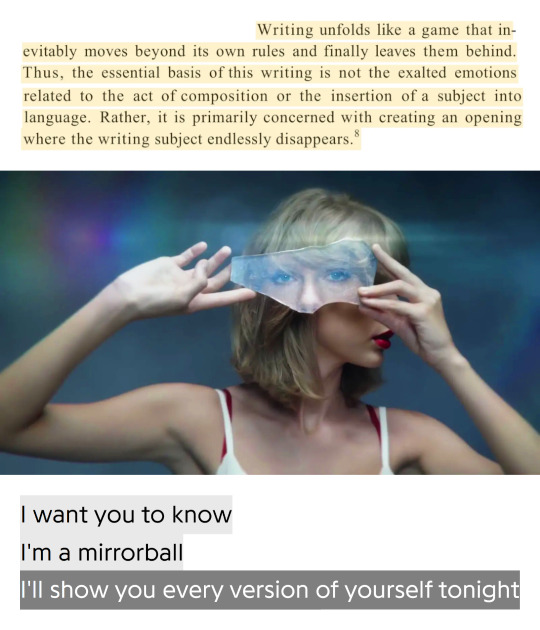

"delicate" music video

"Dear Reader" lyrics

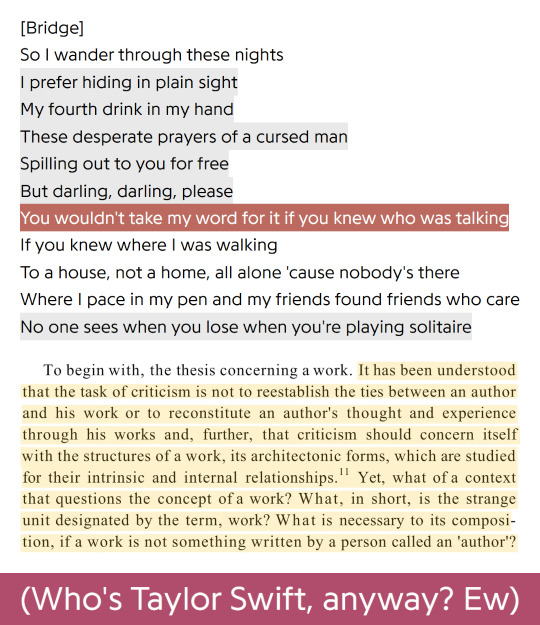

Foucault, Michel. "What is an Author?"

"Style" music video

"mirrorball" lyrics

Barthes

Taylor Swift before singing "betty" on the Eras Tour in Glendale, AZ on March 17, 2023 (text from @cages-boxes-hunters-foxes)

Siken, Richard. "The Torn-up Road" in The Iowa Review

Promotional image for The Tortured Poets Department from Swift's social media

Savage, Mark "Midnights: What we know about Taylor Swift's songwriting" for BBC.com

Foucault

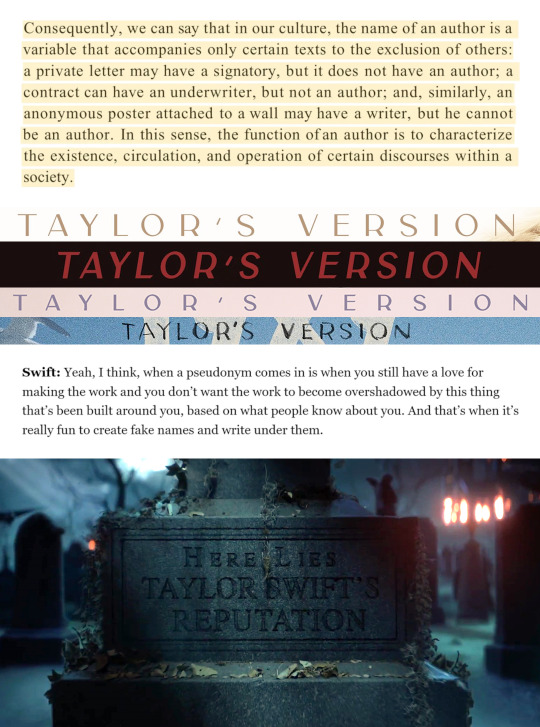

reputation prologue

Barthes

Promotional image for The Tortured Poets Department

Barthes

Halsey. "Gasoline" lyrics

"mirrorball" lyrics

Barthes

Florence & the Machine. "King" lyrics

"Dear Reader" lyrics

Foucault

"22" lyrics

Foucault

"Out of the Woods" music video

"...ready for it?" music video

"Anti-Hero" music video

"look what you made me do" music video

"if you're anything like me" from the reputation magazines

Foucault

Album covers for the Taylor's Versions of Fearless, Red, Speak Now, and 1989

Taylor Swift in Musicians on Musicians: Taylor Swift & Paul McCartney for Rolling Stone

"look what you made me do" music video

"the lakes" lyrics

Foucault

"look what you made me do" handwritten lyrics from the reputation magazines

"my tears ricochet" lyrics

Foucault

"my tears ricochet" lyrics

"look what you made me do" music video

Foucault

"hoax" lyrics

"why she disappeared" from the reputation magazines

Barthes

1989 prologue

Foucault

#alternate title: what if you got so invested in fandom discourse that you read literary theory and got really weird about it#alternate alternate title: oh michel we're really in it now#taylor swift#the tortured poets department#sydposting

805 notes

·

View notes

Text

LIBERTINE !

Fuck the rushed dogshit ending, Wee John and Izzy continued to do drag together, sailing on the revenge from town to town. Don't miss their new "libertine" show !!

[PRINT] - [COMMISSIONS]

Ok after more than a week of reflexion, and a chat with my evil advisor @quijicroix (who is a genius)... Izzy Hands should have sang "libertine" by mylène farmer instead of la fucking vie en rose. Why ? 1) mylène farmer is a very famous french queer artist 2) her songs (especially libertine) are used all the time in drag shows in france 3) la vie en rose as taken other the years a very bougie parisian conotation, so to have a PIRATE sing it ?? Wtf ? 4) she often performed with drag queens on stage- and I could go on.

But all I have to say is, please please please if you've never heard it or seen the clip- Go watch it right now ! It's so fucking good !!! (cw nudity and a bit of blood. Also old ass guns)

Wee john gets to be cunt and play the vilain, Izzy (who is more of a drag king) gets to play the gender protag <3 the show of course include a choreographed fight scene at the end

Process + other famous french songs rec vvv

VERY rough colors

Sketch

And just to be petty, here are other famous french songs that would have been way better than la vie en rose :

- Le bien qui fait mal (Mozart l'opera rock) ("I have joy in pain, I get drunk on this poison until I loose my sanity". The most izzy ass song you can get, it's horny kinky angsty BDSM themed song what more do you want ? Ok to be fair it's more s1 Izzy, but still !)

- Mourir sur scène (Dalida) ("I want to die on stage". well it's less a love song and more foreshadowing for the end, but if Izzy's death had been better written, less rushed, or happenned in an hypothetical s3 (I really don't think they'll have one tho-), it would have been so good.)

- Les demons de minuit (Images) (sillier for sure, but horny and iconic. Alas it's very het)

My final note on this will be, why french ?? Because Abba Lay all your love on me or the winner takes it all would have been so fucking good-

PS : I did most of the rendering very tired and a bit drunk after a party hfrifgruigfrui I had so much to correct after that what a nightmare

#not me investing hours in this hyper specific alternate ending hrifhirfhiurgf#I'm on vacation so it took me a lot of time to do this but I had to the ending was so shitty I just had to do this#our flag means death#ofmd#ofmd s2#ofmd season 2#izzy hands#israel hands#wee john feeney#izzy hands ofmd#wee john ofmd#drag show#drag queens#pirates#digital painting#illustration#art#my art#digital art#fanart#ofmd fanart#izzy hands fanart#prints#poster#sketch#cw guns#mylene farmer

430 notes

·

View notes

Text

Bowser clutching a win because his troops love him and are loyal to him...

#death battle#eggman vs bowser#Bowser vs Eggman#spoilers#death battle spoilers#gotta be honest this was the one I had least emotional investment in going in so far#but it might be the best of the 3 so far#the animation and story were really good#also the alternate scenes in the post analysis! that was also really cool

56 notes

·

View notes

Text

Canon Alejandro and Role Swap!Noah. They probably would not be able to stand each other, lmao. Fake recognizes fake.

Bonus: MK and his young father (Thank you, time shenanigans fanfiction I do not remember your name of)

#total drama#td noah#td alejandro#alenoah#alternate universe#role swap au#man i got invested in canon alejandro and swap noah interacting and hating each other#what is up with my freaking life

362 notes

·

View notes

Text

What is Invoice Discounting?

It is a form of financing chosen by businesses to tap into their unpaid invoices so that they can meet their working capital requirements.

Essentially, it is post-sales funding. Businesses avail financing towards unpaid invoices for the goods already delivered at a pre-determined cost. Jiraaf is one of the invoice discounting platforms in India.

0 notes

Note

Look, I know it's supposed to end badly. But I need to admit that in my head, they declared a mutual "fuck this shit" to the world and society. Packed all the stuff they could one late night and escaped to a remote open plain in the middle of some thick woods where they spent the rest of their lives healing and living freely in nature.

I've been having a lot of intense feelings about them as well. The tragical elements are so baked in to their story and setting, it's hard to imagine a happy ending for them. But every now and then I find myself thinking of scenarios and AUs where they both live and grow old together. For coping purposes, I suppose.

#for real though I've had several crying sessions over them during the past couple of weeks I'm not kidding#that's how you know you've perhaps gotten a little too emotionally invested in your characters#two entirely fictional dog men whose fates I have complete control over have reduced me to shambles#the unfortunate truth is that from a storytelling point the whole thing works better as a tragedy#the sadness makes the happy moments more significant and the happy moments feel bittersweet because of the sadness#for all intents and purposes they're classic star-crossed lovers#neither of them have done anything to justify such a wretched end though and I just want good things for them#I think I might have to come up with an alternate ending where Machete has the sense and chance to resign before it's too late#and move to Florence to be closer to Vasco#or maybe they both go back to Venice where they originally met that might be nice#maybe not realistic but it'd be nice#answered#dragonfoxgirl

297 notes

·

View notes

Note

If you still like jax after this last episode i think there's something fundamentally wrong with you

Y'all are WEAK

The guy known for being an absolute menace does something fucked up and y'all lose your minds. Like, what did you expect? Were you thinking he was going to suddenly become nice and be kind to everyone? lmao

Plus, Gooseworx said herself that he was going to get worse to a point he was unlikeable, so you should've expected it. Did you think she was joking?

Personally, I love him precisely because he's an absolute menace and I live for the chaos. I hope he gets worse. <3

#anon ask#shinxey's asks#the amazing digital circus#tadc jax#you can't say you like the fucked up little rabbit guy#only to then get mad when the fucked up little rabbit guy does something fucked up#you should've expected him to!#Episode 1 already established him as an asshole#he was a lot meaner and brattier than he was in E1 but still#I think some of you guys got too invested in fanon to the point you thought it was real#and now you're upset that canon Jax is nothing like fanon Jax#(not all of you but still some)#and this isn't to say to not get involved in fanon or do alternate interpretations#like making an AU where he's not as big of an asshole for example#but just don't get upset when those ideas aren't canon

65 notes

·

View notes