#Agriculture Tax

Explore tagged Tumblr posts

Text

زرعی ٹیکس

ساحرلدھیانوی نے کہا تھا زمیں نے کیا اِسی کارن اناج اگلا تھا؟ کہ نسل ِ آدم و حوا بلک بلک کے مرے

چمن کو اس لئے مالی نے خوں سے سینچا تھا؟ کہ اس کی اپنی نگاہیں بہار کو ترسیں

لگتا ہے یہی صورتحال پیدا ہونے والی ہے۔ آئی ایم ایف کی شرائط کے مطابق زرعی ٹیکس کی وصولی کا کام شروع ہو جائے گا۔ پنجاب اسمبلی نے زرعی ٹیکس کا بل منظور کر لیا ہے۔ پنجاب اسمبلی کے اپوزیشن لیڈر نے اس کے متعلق گفتگو کرتے ہوئے کہا کہ ’’یہ ٹیکس پاکستان کے زرعی شعبہ کیلئے معاشی تباہی سے کم نہیں کیونکہ پاکستان ان زرعی ملکوں میں سے ہے جہاں کسان مسلسل بدحالی کا شکار ہیں۔ جہاں اکثر اوقات گندم باہر سے منگوا نی پڑ جاتی ہے۔ زراعت پہلے ہی تباہ تھی زرعی ٹیکس لگا کر اسے مزید تباہ کر دیا گیا ہے۔‘‘ پاکستان کسان اتحاد کے سربراہ کا کہنا ہے کہ زرعی ٹیکس کیخلاف ملک گیر احتجاج کا پلان ترتیب دے رہے ہیں۔ زراعت کی اہمیت کو تسلیم کرتے ہوئے، کچھ ممالک نے ایسی پالیسیاں اپنائی ہیں جو اس شعبے کو براہ راست ٹیکس سے مستثنیٰ کرتی ہیں، جن کا مقصد ترقی کو تیز کرنا، کسانوں کا تحفظ کرنا اور زرعی سرمایہ کاری کی حوصلہ افزائی کرنا ہے۔ جیسے ہندوستان جہاں 1961 کے انکم ٹیکس ایکٹ کے تحت زراعت وفاقی انکم ٹیکس سے مستثنیٰ ہے۔

یہ استثنیٰ تاریخی اور اقتصادی تحفظات پر مبنی ہے، جو ہندوستانی معیشت میں زراعت کی اہم شراکت کو تسلیم کرتا ہے۔ اگرچہ آئین کے تحت ریاستی حکومتوں کے پاس زرعی ٹیکس لگانے کا اختیار موجود ہے، لیکن زیادہ تر ریاستیں سیاسی اور عملی وجوہات کی بنا پر پر زرعی ٹیکس نہیں لگاتیں۔ ایک بار ہندوستان میں زرعی ٹیکس لگانے کی کوشش کی گئی تھی مگر اتنا خوفناک احتجاج ہوا تھا کہ حکومت کو اپنا فیصلہ واپس لینا پڑ گیا تھا۔ پاکستان میں زرعی ٹیکس اُس وقت تک نہیں لگایا جانا چاہئے تھا جب تک کسان کو اس قابل نہ کیا جاتا کہ وہ زرعی ٹیکس ادا کر سکے۔ اس زرعی ٹیکس سے یقیناً کھانے پینے کی اشیا اور مہنگی ہونگی۔ پہلے ہی پاکستان میں مہنگائی اپنے پورے عروج پر ہے۔ اطلاعات کے مطابق پی ٹی آئی کے احتجاج میں کسان بھی شریک ہونے کا پروگرام بنا رہے ہیں۔ نیوزی لینڈ، جو اپنے جدید زرعی شعبے کیلئے جانا جاتا ہے، وہاں بھی زرعی آمدنی پر کوئی ٹیکس نہیں بلکہ زرعی سرمایہ کاری، پائیداری کے منصوبوں اور اختراعات کیلئے اہم چھوٹ اور مراعات دی جاتی ہیں۔ سعودی عرب، متحدہ عرب امارات، اور قطر جیسے ممالک بھی زرعی ٹیکس عائد نہیں کرتے۔

یہ قومیں خوراک کی حفاظت پر توجہ مرکوز کرتی ہیں اور سبسڈی اور مراعات کے ذریعے کاشتکاری کے طریقوں کی حوصلہ افزائی کرتی ہیں۔ اس کے علاوہ کینیا، برما وغیرہ میں بھی زرعی ٹیکس نہیں ہے۔ وہ ممالک جو اپنے کسانوں کو بہت زیادہ سہولیات فراہم کرتے ہیں وہ ضرور ٹیکس لگاتے ہیں مگر دنیا بھرمیں سب سے کم شرح زرعی ٹیکس کی ہے۔ خاص طور پر ترقی پذیر ممالک میں، جہاں اکثر کسان غیر مستحکم منڈیوں، غیر متوقع موسم، اور ��سائل تک محدود رسائی کا سامنا کرتے ہیں۔ ٹیکس کی چھوٹ انہیں اپنی کاشتکاری کی سرگرمیوں میں دوبارہ سرمایہ کاری کرنے کیلئے مزید آمدنی برقرار رکھنے میں مدد کرتی ہے۔ بہت سی حکومتیں خوراک کی پیداوار اور خود کفالت کو ترجیح دیتی ہیں، اس بات کو یقینی بناتے ہوئے کہ کسانوں پر ٹیکسوں کا زیادہ بوجھ نہ پڑے جس سے زرعی سرگرمیوں کی حوصلہ شکنی ہو سکتی ہے۔ ان ممالک میں جہاں آبادی کا ایک بڑا حصہ زرعی کام کرتا ہے، وہاں ٹیکس کی چھوٹ دیہی حلقوں کی معاش بہتر بنانے کا ایک طریقہ سمجھا جاتا ہے۔

ٹیکس میں چھوٹ کسانوں کو کاشتکاری کے جدید طریقوں کو اپنانے، انفراسٹرکچر میں سرمایہ کاری کرنے اور پائیدار تکنیکوں کو اپنانے کی ترغیب دے سکتی ہے۔زرعی ٹیکس کی چھوٹ پر تنقید کرنے والے کہتے ہیں کہ حکومتیں ممکنہ ٹیکس ریونیو کو چھوڑ دیتی ہیں جسے عوامی خدمات کیلئے استعمال کیا جا سکتا ہے۔ کچھ ممالک میں، مالدار زمیندار یا بڑے زرعی ادارے ان چھوٹوں سے غیر متناسب فائدہ اٹھاتے ہیں۔ ٹیکس کی چھوٹ پر حد سے زیادہ انحصار بعض اوقات ناکارہ ہونے یا آمدنی کے تنوع کی حوصلہ شکنی کا باعث بن سکتا ہے۔ وہ ممالک جو زراعت کو ٹیکس سے مستثنیٰ رکھتے ہیں ان کا مقصد کاشتکاری کی سرگرمیوں کو فروغ دینا، خوراک کی حفاظت کو یقینی بنانا اور دیہی معاش کی حمایت کرنا ہے۔ اگرچہ یہ پالیسیاں نیک نیتی پر مبنی ہیں، لیکن ان کی تاثیر کا انحصار مناسب نفاذ اور متعلقہ چیلنجوں سے نمٹنے پر ہے۔ اپنے زرعی شعبوں کو ترقی دینے کی کوشش کرنے والی قوموں کیلئے، وسیع تر اقتصادی مقاصد کے ساتھ ٹیکس مراعات میں توازن رکھنا بہت ضروری ہے مگر پاکستان میں زرعی ٹیکس صرف آئی ایم ایف کے دبائو میں لگایا گیا ہے۔

اگر حکومت سمجھتی ہے کہ یہ ٹیکس لگانا اس کی مجبوری تھی تو پھر اسے کسانوں کوفری مارکیٹ دینی چاہئے، انہیں بجلی اور ڈیزل کم قیمت پر ملنا چاہئے، کھاد، بیج اور کیڑے مار ادویات پر بھی سبسڈی فراہم کی جائے۔ باہر سے ہر قسم کے بیجوں کی درآمد پر کوئی پابندی نہیں ہونی چاہئے۔

منصور آفاق

بشکریہ روزنامہ جنگ

0 notes

Text

کیا کاشت کاروں سے انکم ٹیکس وصول کیا جانا چاہیے؟

ریونیو بڑھانے میں ناکامی کی وجہ سے پاکستان خود کو ہمیشہ بین الاقوامی قرض دہندگان کے رحم وکرم پر پاتا ہے۔ فی الحال ہم ایک آئی ایم ایف معاہدے میں شامل ہیں جو حکومت کو ریونیو میں اضافہ کرنے اور ٹیکس ٹو جی ڈی پی کے تناسب کو بہتر بنانے کا پابند کرتا ہے۔ ایسا اس وقت تک ممکن نہیں ہوسکتا جب تک ریاست معیشت کے تمام شعبوں پر یکساں طور پر ٹیکس عائد نہ کرے۔ ان شعبہ جات میں زرعی شعبہ بھی شامل ہے جہاں زرعی پیداوار پر مؤثر ٹیکس لگانے کی گنجائ�� موجود ہے۔ پاکستان کی 350 ارب ڈالرز کی مجموعی معیشت میں تقریباً پانچواں حصہ زراعت کا ہے۔ اگر یہ شعبہ معیشت میں اپنا منصفانہ حصہ ڈال رہا ہے تو موجودہ سال کے 9 ہزار 415 ارب روپے کی ٹیکس وصولی کے طے شدہ ہدف کا پانچواں حصہ زرعی پیداوار سے آنا چاہیے۔ تاہم متوقع رقم کا چھوٹا سا حصہ ہی حاصل ہو پاتا ہے۔ لوگوں میں اس عام غلط فہمی کو دور کرنے کی ضرورت ہے کہ زراعت کو انکم ٹیکس سے مستثنیٰ قرار دیا گیا ہے کیونکہ ایسا نہیں ہے۔ انکم ٹیکس آرڈیننس 2001ء کے مطابق زراعت سے حاصل ہونے والی آمدنی پر دیگر کسی بھی آمدنی کی طرح ٹیکس عائد کیا جاتا ہے لیکن فرق صرف اتنا ہے کہ یہ ٹیکس فیڈرل بورڈ آف ریونیو نہیں بلکہ صوبائی حکام وصول کرتے ہیں۔

کاشت کار اور دیگر مفاد پرست گروہ زرعی انکم ٹیکس کے خلاف مختلف دلائل پیش کرتے ہیں۔ وہ عام طور پر محسوس کرتے ہیں کہ چونکہ ان پر پہلے سے ہی بالواسطہ طور پر بھاری ٹیکس عائد کیا جاتا ہے اس لیے ان سے انکم ٹیکس وصول نہیں کیا جانا چاہیے۔ وہ اشیا کی قیمتوں پر کنٹرول کی شکایت بھی کرتے ہیں جوکہ ان کی آمدنی پر بالواسطہ ٹیکس جیسا ہے۔ اگرچہ ایسی شکایات غلط نہیں ہیں لیکن 2022ء میں گندم کی قیمتوں میں دگنا اضافہ ہونے سے قیمتوں پر حکومتی کنٹرول غیر موثر ہو گیا ہے۔ البتہ دیگر اجناس جیسے کپاس اور چاول کو برآمد کرنے کی آزادی ہے بلکہ حکومتی پالیسی کے تحت چاول کی برآمدات کی حوصلہ افزائی کی جاتی ہے۔ دیگر اہم اجناس میں چینی وہ واحد شے ہے جو اس سے مستثنیٰ ہے۔ چینی سخت حکومتی کنٹرول کے تابع ہے اور اسے عام طور پر برآمدی پابندیوں کا سامنا کرنا پڑتا ہے۔ ان پابندیوں کو پورا کرنے اور مقامی صنعتوں اور بڑے کاشت کاروں کو فائدہ پہنچانے کے لیے چینی کی درآمدات پر بھاری ٹیکس لگایا جاتا ہے۔ بہت سے ٹیکس ماہرین کا خیال ہے کہ محدود دستاویزی معیشت اور وسیع جغرافیائی رقبے پر زراعت کی وجہ سے اس پر زرعی ٹیکس کا نفاذ ممکن نہیں۔

شاید یہی وجہ ہے کہ ہمارے برطانوی نوآبادیاتی حکمرانوں نے زرعی ریونیو پر فرضی ٹیکس عائد کیا اور اس ٹیکس کی بنیاد اصل پیداوار یا پیداواری صلاحیت کے بجائے زمین کے کرائے پر رکھی۔ تاہم اگر یہ تصور کر لیا جائے کہ اب پالیسی سطح پر اس کام کو کرنے کا عزم موجود ہے تو سیٹلائٹ تصاویر اور مشین لرننگ ٹیکنالوجیز کے دور میں زراعت پر ٹیکس لگانا کوئی مسئلہ نہیں ہونا چاہیے۔ درحقیقت اگر کسان چاہتے ہیں کہ پاکستان میں زراعت کو باضا��طہ طور پر بڑی معیشت کا حصہ سمجھا جائے اور قومی سپلائی چین کے حصے کے طور پر دستاویزی شکل دی جائے تو انہیں اس طرح کے خیال کی وکالت کرنی چاہیے۔ یہ بہت ہی مضحکہ خیز بات ہے کہ ریونیو اسٹاف اب بھی اپنے ہاتھوں سے زرعی ریونیو وصول کرتے ہیں بالکل ویسے ہی جیسے وہ گزشتہ 100 سالوں سے کرتے آرہے ہیں۔ مروجہ نظام میں اگر کوئی ادائیگی نہیں کرتا ہے یا اس سے زیادہ ٹیکس لیا جاتا ہے تو نگرانی یا ناانصافی کا ازالے کرنے کا کوئی طریقہ نہیں ہے اس لیے اب وقت آگیا ہے کہ پورے نظام کو جدید بنایا جائے۔ اس سلسلے میں آئی ایم ایف اور دیگر قرض یا عطیہ دہندگان کو قیادت کرنا ہو گی کیونکہ ہمارا ملکی نظام ذاتی مفادات کے ماتحت نظر آتا ہے جس کی وجہ سے زراعت اور دیہی معیشتوں میں ٹیکنالوجی کے ذریعے شفافیت لانے کا امکان موجود نہیں ہے۔

بین الاقوامی قرض دہندگان اور ترقیاتی شراکت داروں کو چاہیے کہ وہ زرعی زمینوں کو ڈیجیٹل بنانے اور زمین کے ریکارڈز کو آسانی سے تلاش کرنے کے قابل بنانے کے لیے گرانٹ فراہم کریں۔ دوسرے مرحلے کے طور پر زرعی زمینوں کی تمام تصاویر سال بھر انفرادی کاشت کاروں (ان کی ملکیت میں موجود رقبے سے قطع نظر) کے ساتھ ساتھ حکومت کو فراہم کی جائیں۔ ان تصاویر کے ذریعے کسانوں کو وقتاً فوقتاً اپنی فصلوں کا جائزہ لینے کے قابل بنانا چاہیے (روزانہ جائزہ لینا بہترین ہو گا) جبکہ حکومت کو فصل کے حوالے سے اعدادوشمار کی نگرانی اور اسے جمع کرنے میں آسانی ہو گی۔ اس سے حکومت کو ٹیکس وصولی میں بہت حد تک مدد ملے گی کیونکہ ڈیجیٹل دور میں کچھ چھپایا نہیں جا سکتا۔ مشین لرننگ حکومت اور کسانوں کو سیٹلائٹ تصاویرکو سمجھنے میں مدد کر سکتی ہے اور یہاں تک کہ اگر تصویر کا تجزیہ کرنے کے لیے استعمال کیے جانے والے نظام، اس کام میں مکمل تربیت یافتہ ہوں تو کٹائی کے وقت مشین لرننگ مختلف فصلوں کی پیداواری صلاحیت کا اندازہ بھی لگا سکتی ہے۔

محدود وسائل کے پیش نظر زرعی ٹیکس کے ساتھ ساتھ مالیاتی منتقلی بھی ٹیکنالوجی کے تابع کرنے کی ضرورت ہے۔ کاشت کاروں کی سطح پر جو لوگ ٹیکس ادا کرنے سے انکار کرتے ہیں ان پر جرمانہ عائد کیا جانا چاہیے جیسے حکومت کو واجبات کی ادائیگی کے بغیر اپنی جائیداد کو خاندان کے افراد کو فروخت کرنے یا تحفے میں دینے پر پابندی ہونی چاہیے۔ یہ سب تب ہی ممکن ہے جب زمین کے ریکارڈ کو ڈیجیٹلائز کیا جائے۔ ٹیکنالوجی بڑے کاشت کاروں کو بھی ٹیکس نیٹ میں لانے میں مدد کرے گی جو ویسے تو تمام کاشت کاروں کا محض چار فیصد ہیں لیکن تقریباً 40 فیصد زرعی زمینوں کے مالک ہیں۔ اس سے زرعی انکم ٹیکس کی مد میں سیکڑوں ارب روپے کی وصولی ہو گی جبکہ کاشت کاری کے طریقوں کو جدید بنانے میں بھی مدد حاصل ہو گی۔

اعجاز اے نظامانی یہ مضمون 11 دسمبر 2023ء کو ڈان اخبار میں شائع ہوا۔

بشکریہ ڈان نیوز

0 notes

Text

GERMAN FARMERS HAVE GATHERED IN THEIR TRACTORS

Unless Scholz abolishes his plan to cut subsidies for agricultural diesel & introduce a vehicle tax for agricultural vehicles, nationwide protests will start on 8 Jan 2024.

GOD, Family & Community

No Farms - No Food

No Farmers - No Food - No Future

Freedom - is the sound of Truck & Locomotive air horns

Freedom - is the smell of Diesel Fuel

Freedom - is the sight of a Truck Convoy moving in unison

Freedom - is the touch of a man with Rough Calloused Hands making contact with a soft weak liberal politician & leaving a lasting impression on the civil servant

Freedom - is the taste of Hope for a better Future.

#Germany#Farmers & Truckers#Tax#Protest#activism#truth#human rights#Food Security#Advocate for Agriculture#Support Local Farmers#No Farms - No Food#No Farmers - No Food - No Future#Like Minded People#Make Tumblr ★ Great Again

139 notes

·

View notes

Text

#SCOTUS#Supreme Court Decision#EPA#FDA#OSHA#Federal Regulations#Billionaires#POWER GRAB#Deadbeat Billionaires#TAX the RICH#BRIDES#THOMAS#ALITO#KAVANAUGH#KOCH#BIG OIL#BIG PHARMA#BIG AGRICULTURE

36 notes

·

View notes

Text

Charlotte Clymer at Charlotte's Web Thoughts (10.15.2024):

This morning, the Harris-Walz campaign announced an extensive economic plan for rural communities. It’s a deeply impressive vision for working class families in these parts of the country. Given that much—perhaps, most—of political media will not adequately report on this and inform voters of what Vice President Harris plans to do for Rural America, I’m gonna take the rare step of publishing her plan, in full, as a blog post. I’m doing this because Lord knows we’re all more likely to see an intellectually dishonest column in The New York Times about Vice President Harris ignoring rural voters than we are to see significant reporting and analysis on her proposed policies for rural voters.

[...]

Vice President Harris and Governor Walz believe in rural communities and understand that supporting locally led solutions is key to rural prosperity. Their administration will make it a priority to equip the nearly 50 million rural Americans with the tools and resources they need not just to get by, but get ahead. Today, Vice President Harris and Governor Walz are announcing a plan for rural America. The key elements will:

Increase access to affordable and high-quality health care in rural communities—by adding 10,000 health care professionals, expanding telemedicine, cutting the number of ambulance deserts in half.

Support the sandwich generation to care for elders at home, lowering the cost of childcare and increasing the number of providers, and expanding the Child Tax Credit to provide tax cuts up to $6,000 for families with newborns.

Lower the costs of buying a home, starting and expanding a business, and raising a family—by sparking the construction of 3 million new housing units, providing up to $25,000 in down payment assistance for first-time homebuyers, increasing the small business tax deduction for startup expenses 10-fold to $50,000.

Invest in the future of American agriculture by boosting access to credit, land, and markets, building new markets and streams of income for small- and mid-sized farmers and producers, and supporting the rise of the next generation of American farmers and ranchers.

Donald Trump will turn back the hard-earned progress that rural communities are making. As President, he tried to repeal the Affordable Care Act and vows to terminate it if reelected, stripping protections from people with pre-existing conditions and devastating rural hospitals and care services. He will ban abortion nationwide, threaten access to contraception and IVF, and force states to monitor women’s pregnancies and report women’s miscarriages and abortions to the federal government.

Want a candidate who has real plans to help Rural Americans instead of bluster and grievances? The Kamala Harris and Tim Walz ticket have lots of great plans to help rural folk.

#Kamala Harris#Rural#2024 Presidential Election#2024 Elections#Rural Hospitals#Child Tax Credit#Agriculture

8 notes

·

View notes

Text

also gfs been making me read haladriel fics all day long, and it is SO FUNNY how sauron’s goal in every single one of them is to just pretend to be a normal guy so he can do king of the southlands shit. forever presumably.

you’re always like “oh he’ll def go dark lord now” and he’s like no here’s my 5 step finance plan to support the local shoe makers. and also then galadriel is like “holy fuck this guy is so twisted I cannot believe he would manipulate me w the shoe makers. he knows I love shoe makers” and there’s like 40 chapters of this

#my main exposure to sauron before this was everyone being like HES SATAN HES THE DEVIL HES EVIL HES CRAZY#and then like you get to fan writings and he’s like#I have created an orc tax. u and me are the same galadriel. we love power and taxes#galadriel I have created a foolproof plan to offer asylum to the people who’s mountain just exploded#watch me negotiate urban agricultural projects with this wizard galadriel

10 notes

·

View notes

Text

Farmers can benefit from the Work Opportunity Tax Credit (WOTC) program in several ways.

Labor challenges: The farming industry faces unique labor challenges, including a tight labor market and high turnover rates. WOTC can help attract and retain qualified workers from diverse backgrounds.

Tax savings: By hiring eligible candidates, farmers can claim a tax credit of up to $9,600 per qualified hire, which can help offset labor costs and improve profitability.

Eligible candidates: Farmers can benefit from hiring candidates from the following target groups:

*Veterans: Bring valuable skills and work ethic to the farm

*Youth: Can be trained and developed for future leadership roles

*Individuals with disabilities: Can contribute to the farm's success with accommodations

*Ex-felons: Can be rehabilitated and become productive members of the team

How to claim WOTC: Visit GMG.me/143863 and answer 3 simple questions, then activate your benefits right there!!

By participating in WOTC, farmers can improve their bottom line, enhance their workforce, and contribute to the community by providing job opportunities to diverse candidates.

10 notes

·

View notes

Text

ive got a new plan btw im gonna finish my degree this year and then im gonna study to become a pastry chef im not gonna matyr myself anymore

#like yeah this job is giving me so many oppirtunities like where else will i get co autorship in a paper like that but at the same time#i just dont care like its not the direction i wanna take in life and i can always study agriculture later on#also they fucked up my contract and. ow i have to pay way too much taxes as a student.. hello?

7 notes

·

View notes

Text

This is disgusting and disheartening, these people have entered our nation legally and yet are treated no better than slaves. The federal program is rife with loopholes and a severe lack of oversight and enforcement that allows these abused and exploitation to be widespread. For example employers can provide food at a cost but it must not charge the workers beyond a certain amount (around $11 or $12) yet these employers flagrantly ignore these regulations and charge up to $200 which can total half a paycheck from supremely subpar food. Employers are also supposed to allow workers access to stoves and fridges for the purpose of cooking and storing food yet pictures and videos have circulated of locked fridges and cabinets in these farms and labor camps. If a worker tries to report violations or speak out retaliation is common, a simple punishment is abusing the worker to another camp or simply discharging them from the program often without legal recourse or ability to challenge the actions. and to the people who go 'well they aren't US citizens so why should we care?' this is almost no better than slavery, to condine inaction or resisting reform is to invite an 'acceptable' form of slavery which pollutes and rots our nation just like it did during the 18th century. Plus it also creates economic disadvantages for American labor, this isn't a mandatory program these farms and the national associations that help run this program simply want dirt cheap labor that they can exploit and abuse with little hassle. If they could they would enslave fellow US citizens to do the labor for free, that's why it's imperative to end the loopholes and make sure everyone in our nation citizens or not aren't being exploited!!

#politics#the left#culture#tax the rich#progressive#eat the rich#us politics#communism#corporate greed#leftism#migrants#immigrants#immigration#usa#biden#refugees#migrant labour#migrant workers#migrant rights#Food#agriculture#US agriculture#slavery#oligarchy#usa news#usa politics#united states#americans#north carolina#north america

3 notes

·

View notes

Photo

Commerce équitable et bio

J’entends plein de bonnes idées sur le commerce équitable ou bio mais il m’en vient une réaction et une réflexion.

Tout d’abord, je pense qu’il est excessif d’imaginer un changement substantiel reposant sur le consommateur payant plus. Dans la majorité des pays d’Europe, nos producteurs sont payés une misère par les intermédiaires car ils vont pouvoir vivre des subventions, donc d’argent public qui vient justement de la poche des consommateurs qui paient aussi pour les frais de santé conséquents de la nourriture industrielle des pollutions et du chômage. En définitif, le consommateur a déjà payé via les taxes, les 3/4 du produit bon marché sur l’étagère avant même de l’acheter. Dur dans ces conditions de lui demander de choisir le produit “équitable” et plus cher d’à côté qui lui n’est pas subventionné.

Maintenant une réflexion plus générale:

Mon point de vue est que la révolution néo-libérale de la fin des années 70 est venue avec un corpus idéologique comprenant que l’Etat devait réglementer le moins possible mais subventionner plus. Un chèque pour l’essence, un autre pour la nourriture, des subventions aux producteurs comme aux consommateurs permettant des prix bas. Cet abandon du rôle de l’Etat protecteur permet aux industriels de ne pas subir les conséquence (pauvreté, santé, chômage) de leur modèle. Ce même principe s’applique dans les pays “à bas coûts”. En effet ce n’est pas par amour du Bangladesh qu’une marque produit là-bas mais parce que cet état comme d’autres ne joue pas son rôle de protecteur pour sa population ( ne pas polluer, ne pas faire travailler ses enfants, ne pas détruire ses ressources naturelles).

Cette idéologie a aussi été le compas d’organisation comme l’OMC (Organisation mondiale du commerce) qui a ouvert le commerce international en partant du principe que le simple fait de commercer et s’enrichir mutuellement produirait le développement pour tous. En conséquence, même si nous en venions à mieux “protéger” en Europe, la justice pour nos producteurs serait de ne plus importer de pays qui ne sont pas engagés dans la protection de leur propre population et environnement.

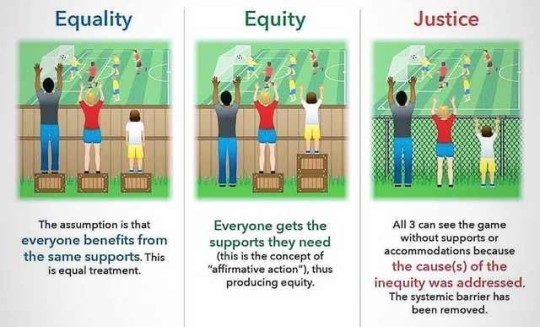

Je pense que cette réflexion va au-delà des biens de consommation. Par exemple, l’Etat providence va fournir une aide à un handicapé pour surmonter une marche, au lieu de se demander en premier lieu pourquoi ne pas lever l’obstacle et permettre à la personne de vivre dignement. Bien sûr il y aura toujours besoin que la communauté aide ses plus vulnérables mais aujourd’hui cet argument est exploité pour le profit des intermédiaires.

Il faudrait imposer des critères respectueux de l’environnement à l’interne comme à l’import car ils sont moins coûteux pour les citoyens et garantissent un respect des sols nécessaires à la pérennité de l’exploitation et à la régulation climatique. En effet, les exploitations industrielles appauvrissent les sols et à terme les rendent infertiles et sans eau qui régule la température.

#agriculture#bio#équitable#aurianneor#consommateur#durable#impôts#no nonsense#real food#subventions#taxes

2 notes

·

View notes

Text

And basic finances, how credit works, how to do interviews and fill out applications.

#I think I was in the last generation who had agriculture for a class#but mostly we just swept the area and did worksheets. it was a bullshit class and I wish we learned more#we also had a class with taxes- checks- balancing a check book etc etc in HS and iirc it was like#a weird little extracurricular when they needed to flll in half a semester#but dammit I learned to fill out forms and do interviews

41K notes

·

View notes

Text

Farmers Rally Across the UK in Historic Protest Against Labour's Tax Policies

Today, the fields and roads of Britain witnessed an unprecedented scene as farmers from various regions converged in a coordinated protest, marking a pivotal moment in the ongoing debate over agricultural policies. This movement, spearheaded by the Farmers Union, isn’t just about financial burdens; it’s a statement on the survival of rural communities and the heritage of farming in the UK. The…

#agricultural policy#British politics#farmers union#farming industry#inheritance tax#Labour seats#political protest#rural communities#tax protest#UK protest

0 notes

Text

Denmark confirms plan for world-first livestock CO2 tax by 2030

Denmark has solidified its plans to introduce the world’s first tax on agricultural emissions, including greenhouse gases emitted by livestock. The plans were first announced as part of the Green Tripartite agreement in June 2024, aiming to pave the way for the green transformation of Denmark’s food and agricultural sector. Following months of negotiations between the Danish government, farmers…

View On WordPress

0 notes

Text

love telling trumpies that complain about food prices that it's gonna get worse

and it definitely will like fuck exploitation of immigrants in agriculture but like if you deport them and hire on born citizens you think they'll take $3/hour to pick vegetables for 12 hours? hell fucking no

#the obvious fix is to just make food a right and free#and taxes go to paying agriculture workers fairly instead of killing innocents overseas#but white men dont wanna hear that no sir

0 notes

Text

Government Policies for a Green Economy: Incentives and Regulations

Green Economy A successful transition to a green economy requires a combination of public and private sector efforts, Green Economy with governments playing a crucial role in setting the framework for this transformation. Policies often target sectors such as energy, transportation, agriculture, waste management, and construction, which are significant contributors to environmental impacts. In this context, incentives and regulations serve as two sides of the policy coin, ensuring both the encouragement of sustainable practices and the enforcement of environmental protection.

One of the main goals of government policies for a green economy is to shift economic activity toward more sustainable practices. This involves reducing greenhouse gas emissions, promoting renewable energy, and ensuring that economic growth is decoupled from environmental degradation. To achieve these goals, governments employ a wide range of tools, including tax breaks, subsidies, grants, carbon pricing mechanisms, and strict environmental regulations.

A green economy also emphasizes social inclusiveness, Green Economy ensuring that the transition to sustainability benefits all members of society, particularly vulnerable groups who are most affected by environmental degradation. Green Economy Government policies often include provisions for job creation in green industries, education and training for new skills, and social protection measures to ensure that no one is left behind in the transition.

This section will delve into six key areas of government policies for a green economy: renewable energy incentives, carbon pricing mechanisms, green transportation policies, sustainable agriculture support, waste management and recycling regulations, and financial incentives for green innovation.

Renewable Energy Incentives Green Economy

One of the cornerstones of any green economy policy framework is the promotion of renewable energy sources. Governments have introduced a range of incentives to encourage the production and consumption of renewable energy, such as wind, solar, and hydropower. These incentives are critical for reducing reliance on fossil fuels, which are the primary source of greenhouse gas emissions.

Renewable energy incentives often take the form of subsidies and tax breaks. For instance, many governments offer production tax credits (PTCs) and investment tax credits (ITCs) to companies that generate renewable energy or invest in renewable energy infrastructure. These financial incentives lower the cost of renewable energy projects, making them more competitive with traditional fossil fuel-based energy sources.

Feed-in tariffs (FITs) are another common incentive mechanism. Green Economy Under a FIT program, renewable energy producers are guaranteed a fixed price for the electricity they generate, often over a long-term contract. This provides a stable revenue stream and reduces the financial risk associated with renewable energy investments. Net metering programs, which allow individuals and businesses to sell excess renewable energy back to the grid, are another way governments encourage the adoption of renewable technologies.

Governments also support renewable energy through research and development (R&D) funding. Green Economy By investing in the development of new technologies, governments can help bring down the cost of renewable energy and make it more accessible. Many governments also provide grants and low-interest loans for renewable energy projects, particularly for smaller-scale projects such as rooftop solar installations.

In addition to financial incentives, governments often mandate the use of renewable energy through renewable portfolio standards (RPS). An RPS requires utilities to obtain a certain percentage of their electricity from renewable sources, creating a guaranteed market for renewable energy. This not only supports the growth of the renewable energy industry but also helps reduce the overall carbon footprint of the energy sector.

Green Economy The combination of financial incentives and regulatory mandates has been instrumental in driving the rapid growth of renewable energy in many parts of the world. Countries such as Germany, Denmark, and China have become global leaders in renewable energy production, thanks in large part to strong government policies that promote green energy development.

Carbon Pricing Mechanisms

Carbon pricing is a critical tool in the fight against climate change and a key component of government policies for a green economy. By putting a price on carbon emissions, governments create an economic incentive for businesses and individuals to reduce their carbon footprint. There are two main types of carbon pricing mechanisms: carbon taxes and cap-and-trade systems.

A carbon tax directly sets a price on carbon by levying a tax on the carbon content of fossil fuels. This encourages businesses and consumers to reduce their use of carbon-intensive energy sources and shift toward cleaner alternatives. The revenue generated from carbon taxes is often used to fund green initiatives, such as renewable energy projects or energy efficiency programs, or to provide rebates to low-income households to offset higher energy costs.

Cap-and-trade systems, also known as emissions trading schemes (ETS), work by setting a limit (or cap) on the total amount of greenhouse gas emissions that can be emitted by covered entities, such as power plants or industrial facilities. Companies are issued emission allowances, which they can trade with one another. Companies that can reduce their emissions at a lower cost can sell their excess allowances to companies that face higher costs for reducing emissions. This creates a market for carbon allowances and incentivizes businesses to invest in cleaner technologies.

Both carbon taxes and cap-and-trade systems are designed to internalize the environmental cost of carbon emissions, making it more expensive to pollute and more profitable to invest in sustainable practices. These mechanisms can drive innovation, as businesses seek out new technologies and processes to reduce their carbon liabilities.

Several countries and regions have implemented carbon pricing policies with varying degrees of success. The European Union’s Emissions Trading System (EU ETS) is one of the largest and most established cap-and-trade programs in the world. Canada has implemented a nationwide carbon tax, with revenue returned to households through rebates. In the United States, some states, such as California, have implemented their own cap-and-trade programs in the absence of a national carbon pricing policy.

However, carbon pricing mechanisms face challenges, including political opposition and concerns about economic competitiveness. In some cases, businesses argue that carbon pricing increases costs and puts them at a disadvantage compared to competitors in countries without similar policies. To address these concerns, governments often include provisions to protect industries that are vulnerable to international competition, such as offering rebates or exemptions for certain sectors.

Green Transportation Policies

Transportation is a major source of greenhouse gas emissions, particularly in urban areas. To promote a green economy, governments are implementing a range of policies aimed at reducing emissions from the transportation sector. These policies focus on promoting the use of public transportation, encouraging the adoption of electric vehicles (EVs), and improving fuel efficiency standards.

One of the most effective ways to reduce transportation emissions is to encourage the use of public transportation. Governments invest in expanding and improving public transit systems, such as buses, trains, and subways, to make them more accessible and attractive to commuters. By providing reliable and affordable public transportation options, governments can reduce the number of cars on the road and lower overall emissions.

In addition to improving public transportation, governments are offering incentives for the purchase of electric vehicles (EVs). These incentives often take the form of tax credits or rebates for EV buyers, which help offset the higher upfront cost of electric vehicles compared to traditional gasoline-powered cars. Some governments also offer additional perks for EV owners, such as access to carpool lanes or free parking in city centers.

Governments are also investing in the infrastructure needed to support electric vehicles, such as building charging stations. A lack of charging infrastructure is often cited as a barrier to EV adoption, so governments play a critical role in addressing this challenge. By providing grants or partnering with private companies, governments can help build a network of charging stations that makes EVs a more convenient option for drivers.

Another important component of green transportation policies is improving fuel efficiency standards for cars and trucks. Governments set regulations that require automakers to produce vehicles that meet certain fuel efficiency targets, which helps reduce the amount of fuel consumed and the emissions produced by the transportation sector. Some governments also implement vehicle emissions standards, which limit the amount of pollutants that cars and trucks can emit.

In addition to these policies, governments are encouraging the use of alternative modes of transportation, such as biking and walking. Investments in bike lanes, pedestrian infrastructure, and bike-sharing programs make it easier for people to choose low-emission forms of transportation. These efforts not only reduce emissions but also improve public health by promoting physical activity.

Sustainable Agriculture Support

Agriculture is both a contributor to and a victim of environmental degradation. It is responsible for significant greenhouse gas emissions, deforestation, water use, and pollution from fertilizers and pesticides. At the same time, agriculture is highly vulnerable to the impacts of climate change, including more frequent droughts, floods, and changing weather patterns. As a result, governments are increasingly focusing on promoting sustainable agricultural practices as part of their green economy policies.

One of the key ways governments support sustainable agriculture is through financial incentives for farmers who adopt environmentally friendly practices. These incentives can take the form of subsidies, grants, or low-interest loans for practices such as organic farming, agroforestry, and conservation tillage. By providing financial support, governments encourage farmers to invest in sustainable practices that might otherwise be cost-prohibitive.

Governments also provide technical assistance and education to help farmers transition to more sustainable practices. This can include training programs on topics such as water conservation, soil health, and pest management, as well as access to research and technology that supports sustainable farming. Extension services, which provide hands-on assistance to farmers, are another important tool for promoting sustainable agriculture.

In addition to financial and technical support, governments implement regulations to reduce the environmental impact of agriculture. These regulations can include restrictions on the use of certain pesticides and fertilizers, requirements for buffer zones to protect water sources from agricultural runoff, and mandates for the reduction of greenhouse gas emissions from livestock and manure management.

Governments are also working to promote more sustainable food systems by encouraging the consumption of locally produced and organic foods. Public procurement policies, which require government institutions such as schools and hospitals to purchase a certain percentage of their food from sustainable sources, are one way governments support the development of local, sustainable food systems.

Another important aspect of sustainable agriculture policies is protecting biodiversity and promoting ecosystem services. Governments often provide incentives for farmers to preserve natural habitats on their land, such as wetlands, forests, and grasslands, which provide important ecosystem services such as carbon sequestration, water filtration, and pollination. By promoting biodiversity and ecosystem health, governments help ensure that agricultural systems are more resilient to environmental changes.

Waste Management and Recycling Regulations

Effective waste management is a critical component of a green economy. Governments play a key role in regulating waste disposal, promoting recycling, and encouraging the reduction of waste generation. These efforts are aimed at reducing the environmental impact of waste, including greenhouse gas emissions from landfills, pollution from improper disposal, and the depletion of natural resources through excessive consumption.

One of the main ways governments regulate waste is by setting standards for waste disposal. This includes regulating landfills, incinerators, and hazardous waste facilities to ensure that they operate in an environmentally responsible manner. Governments also implement bans or restrictions on certain types of waste, such as single-use plastics, to reduce the amount of waste that ends up in landfills or the environment.

In addition to regulating waste disposal, governments are increasingly focusing on promoting recycling and waste reduction. Many governments have implemented extended producer responsibility (EPR) programs, which require manufacturers to take responsibility for the disposal of the products they produce. This can include requirements for companies to fund recycling programs or take back products at the end of their life cycle.

Governments also implement policies to encourage households and businesses to recycle more. This can include providing curbside recycling services, setting recycling targets, and offering incentives for recycling, such as deposit return schemes for beverage containers. Public awareness campaigns and education programs are also important tools for promoting recycling and waste reduction.

In some cases, governments use economic instruments to promote waste reduction, such as charging fees for waste disposal or providing financial incentives for businesses that reduce waste. Pay-as-you-throw programs, which charge households based on the amount of waste they generate, are one example of how governments use pricing mechanisms to encourage waste reduction.

Another important component of waste management policies is promoting the circular economy, which focuses on keeping materials in use for as long as possible through recycling, reusing, and remanufacturing. Governments support the circular economy by providing incentives for businesses that adopt circular practices, such as designing products for durability and recyclability, and by setting targets for reducing waste and increasing recycling rates.

Source :

Government Policies for a Green Economy: Incentives and Regulations

#Carbon Pricing Mechanisms#Circular Economy Policies#Clean Energy Subsidies#Climate Change Mitigation Strategies#Climate Resilience Planning#Community Sustainability Programs#Eco-Friendly Transportation Initiatives#Eco-Tourism Development Strategies#Energy Efficiency Standards#Environmental Policy Frameworks#Environmental Protection Regulations#Government Grants For Green Projects#Government Policies For A Green Economy#Green Building Regulations#Green Job Creation Initiatives#Green Tax Incentives#Incentives For Energy Audits#Incentives For Sustainable Development#Investment In Green Technologies#Low-Emission Vehicle Incentives#Pollution Control Policies#Public Transport Expansion Regulations#Regulations Promoting Renewable Energy#Renewable Energy Certificates#Smart City Regulations#Sustainable Agriculture Policies#Sustainable Forestry Practices#Sustainable Urban Development Policies#Waste Management Policies#Water Conservation Regulations

1 note

·

View note