#Advance communication and payment products

Text

#Customer Communication and Engagement Platform#global digital payment system#Utility Bill Payment#Utilities Customer Experience#TilliCX software#Advance communication and payment products

0 notes

Text

So I don't know how people on this app feel about the shit-house that is TikTok but in the US right now the ban they're trying to implement on it is a complete red herring and it needs to be stopped.

They are quite literally trying to implement Patriot Act 2.0 with the RESTRICT Act and using TikTok and China to scare the American public into buying into it wholesale when this shit will change the face of the internet. Here are some excerpts from what the bill would cover on the Infrastructure side:

SEC. 5. Considerations.

(a) Priority information and communications technology areas.—In carrying out sections 3 and 4, the Secretary shall prioritize evaluation of—

(1) information and communications technology products or services used by a party to a covered transaction in a sector designated as critical infrastructure in Policy Directive 21 (February 12, 2013; relating to critical infrastructure security and resilience);

(2) software, hardware, or any other product or service integral to telecommunications products and services, including—

(A) wireless local area networks;

(B) mobile networks;

(C) satellite payloads;

(D) satellite operations and control;

(E) cable access points;

(F) wireline access points;

(G) core networking systems;

(H) long-, short-, and back-haul networks; or

(I) edge computer platforms;

(3) any software, hardware, or any other product or service integral to data hosting or computing service that uses, processes, or retains, or is expected to use, process, or retain, sensitive personal data with respect to greater than 1,000,000 persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction, including—

(A) internet hosting services;

(B) cloud-based or distributed computing and data storage;

(C) machine learning, predictive analytics, and data science products and services, including those involving the provision of services to assist a party utilize, manage, or maintain open-source software;

(D) managed services; and

(E) content delivery services;

(4) internet- or network-enabled sensors, webcams, end-point surveillance or monitoring devices, modems and home networking devices if greater than 1,000,000 units have been sold to persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction;

(5) unmanned vehicles, including drones and other aerials systems, autonomous or semi-autonomous vehicles, or any other product or service integral to the provision, maintenance, or management of such products or services;

(6) software designed or used primarily for connecting with and communicating via the internet that is in use by greater than 1,000,000 persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction, including—

(A) desktop applications;

(B) mobile applications;

(C) gaming applications;

(D) payment applications; or

(E) web-based applications; or

(7) information and communications technology products and services integral to—

(A) artificial intelligence and machine learning;

(B) quantum key distribution;

(C) quantum communications;

(D) quantum computing;

(E) post-quantum cryptography;

(F) autonomous systems;

(G) advanced robotics;

(H) biotechnology;

(I) synthetic biology;

(J) computational biology; and

(K) e-commerce technology and services, including any electronic techniques for accomplishing business transactions, online retail, internet-enabled logistics, internet-enabled payment technology, and online marketplaces.

(b) Considerations relating to undue and unacceptable risks.—In determining whether a covered transaction poses an undue or unacceptable risk under section 3(a) or 4(a), the Secretary—

(1) shall, as the Secretary determines appropriate and in consultation with appropriate agency heads, consider, where available—

(A) any removal or exclusion order issued by the Secretary of Homeland Security, the Secretary of Defense, or the Director of National Intelligence pursuant to recommendations of the Federal Acquisition Security Council pursuant to section 1323 of title 41, United States Code;

(B) any order or license revocation issued by the Federal Communications Commission with respect to a transacting party, or any consent decree imposed by the Federal Trade Commission with respect to a transacting party;

(C) any relevant provision of the Defense Federal Acquisition Regulation and the Federal Acquisition Regulation, and the respective supplements to those regulations;

(D) any actual or potential threats to the execution of a national critical function identified by the Director of the Cybersecurity and Infrastructure Security Agency;

(E) the nature, degree, and likelihood of consequence to the public and private sectors of the United States that would occur if vulnerabilities of the information and communications technologies services supply chain were to be exploited; and

(F) any other source of information that the Secretary determines appropriate; and

(2) may consider, where available, any relevant threat assessment or report prepared by the Director of National Intelligence completed or conducted at the request of the Secretary.

Look at that, does that look like it just covers the one app? NO! This would cover EVERYTHING that so much as LOOKS at the internet from the point this bill goes live.

It gets worse though, you wanna see what the penalties are?

(b) Civil penalties.—The Secretary may impose the following civil penalties on a person for each violation by that person of this Act or any regulation, order, direction, mitigation measure, prohibition, or other authorization issued under this Act:

(1) A fine of not more than $250,000 or an amount that is twice the value of the transaction that is the basis of the violation with respect to which the penalty is imposed, whichever is greater.

(2) Revocation of any mitigation measure or authorization issued under this Act to the person.

(c) Criminal penalties.—

(1) IN GENERAL.—A person who willfully commits, willfully attempts to commit, or willfully conspires to commit, or aids or abets in the commission of an unlawful act described in subsection (a) shall, upon conviction, be fined not more than $1,000,000, or if a natural person, may be imprisoned for not more than 20 years, or both.

(2) CIVIL FORFEITURE.—

(A) FORFEITURE.—

(i) IN GENERAL.—Any property, real or personal, tangible or intangible, used or intended to be used, in any manner, to commit or facilitate a violation or attempted violation described in paragraph (1) shall be subject to forfeiture to the United States.

(ii) PROCEEDS.—Any property, real or personal, tangible or intangible, constituting or traceable to the gross proceeds taken, obtained, or retained, in connection with or as a result of a violation or attempted violation described in paragraph (1) shall be subject to forfeiture to the United States.

(B) PROCEDURE.—Seizures and forfeitures under this subsection shall be governed by the provisions of chapter 46 of title 18, United States Code, relating to civil forfeitures, except that such duties as are imposed on the Secretary of Treasury under the customs laws described in section 981(d) of title 18, United States Code, shall be performed by such officers, agents, and other persons as may be designated for that purpose by the Secretary of Homeland Security or the Attorney General.

(3) CRIMINAL FORFEITURE.—

(A) FORFEITURE.—Any person who is convicted under paragraph (1) shall, in addition to any other penalty, forfeit to the United States—

(i) any property, real or personal, tangible or intangible, used or intended to be used, in any manner, to commit or facilitate the violation or attempted violation of paragraph (1); and

(ii) any property, real or personal, tangible or intangible, constituting or traceable to the gross proceeds taken, obtained, or retained, in connection with or as a result of the violation.

(B) PROCEDURE.—The criminal forfeiture of property under this paragraph, including any seizure and disposition of the property, and any related judicial proceeding, shall be governed by the provisions of section 413 of the Controlled Substances Act (21 U.S.C. 853), except subsections (a) and (d) of that section.

You read that right, you could be fined up to A MILLION FUCKING DOLLARS for knowingly violating the restrict act, so all those people telling you to "just use a VPN" to keep using TikTok? Guess what? That falls under the criminal guidelines of this bill and they're giving you some horrible fucking advice.

Also, VPN's as a whole, if this bill passes, will take a goddamn nose dive in this country because they are another thing that will be covered in this bill.

They chose the perfect name for it, RESTRICT, because that's what it's going to do to our freedoms in this so called "land of the free".

Please, if you are a United States citizen of voting age reach out to your legislature and tell them you do not want this to pass and you will vote against them in the next primary if it does. This is a make or break moment for you if you're younger. Do not allow your generation to suffer a second Patriot Act like those of us that unfortunately allowed for the first one to happen.

And if you support this, I can only assume you're delusional or a paid shill, either way I hope you rot in whatever hell you believe in.

#politics#restrict bill#tiktok#tiktok ban#s.686#us politics#tiktok senate hearing#land of the free i guess#patriot act#patriot act 2.0

896 notes

·

View notes

Text

The Communist Manifesto - Part 2

[ ◁ First | ◃Prev | Table of Contents | Next ▹ ]

The feudal system of industry, in which industrial production was monopolised by closed guilds, now no longer sufficed for the growing wants of the new markets. The manufacturing system took its place. The guild-masters were pushed on one side by the manufacturing middle class; division of labour between the different corporate guilds vanished in the face of division of labour in each single workshop.

Meantime the markets kept ever growing, the demand ever rising. Even manufacturer no longer sufficed. Thereupon, steam and machinery revolutionised industrial production. The place of manufacture was taken by the giant, Modern Industry; the place of the industrial middle class by industrial millionaires, the leaders of the whole industrial armies, the modern bourgeois.

Modern industry has established the world market, for which the discovery of America paved the way. This market has given an immense development to commerce, to navigation, to communication by land. This development has, in its turn, reacted on the extension of industry; and in proportion as industry, commerce, navigation, railways extended, in the same proportion the bourgeoisie developed, increased its capital, and pushed into the background every class handed down from the Middle Ages.

We see, therefore, how the modern bourgeoisie is itself the product of a long course of development, of a series of revolutions in the modes of production and of exchange.

Each step in the development of the bourgeoisie was accompanied by a corresponding political advance of that class. An oppressed class under the sway of the feudal nobility, an armed and self-governing association in the medieval commune*: here independent urban republic (as in Italy and Germany); there taxable “third estate” of the monarchy (as in France); afterwards, in the period of manufacturing proper, serving either the semi-feudal or the absolute monarchy as a counterpoise against the nobility, and, in fact, cornerstone of the great monarchies in general, the bourgeoisie has at last, since the establishment of Modern Industry and of the world market, conquered for itself, in the modern representative State, exclusive political sway. The executive of the modern state is but a committee for managing the common affairs of the whole bourgeoisie.

* This was the name given their urban communities by the townsmen of Italy and France, after they had purchased or conquered their initial rights of self-government from their feudal lords. [Engels, 1890 German edition] “Commune” was the name taken in France by the nascent towns even before they had conquered from their feudal lords and masters local self-government and political rights as the “Third Estate.” Generally speaking, for the economical development of the bourgeoisie, England is here taken as the typical country, for its political development, France. [Engels, 1888 English Edition]

The bourgeoisie, historically, has played a most revolutionary part.

The bourgeoisie, wherever it has got the upper hand, has put an end to all feudal, patriarchal, idyllic relations. It has pitilessly torn asunder the motley feudal ties that bound man to his “natural superiors”, and has left remaining no other nexus between man and man than naked self-interest, than callous “cash payment”. It has drowned the most heavenly ecstasies of religious fervour, of chivalrous enthusiasm, of philistine sentimentalism, in the icy water of egotistical calculation. It has resolved personal worth into exchange value, and in place of the numberless indefeasible chartered freedoms, has set up that single, unconscionable freedom – Free Trade. In one word, for exploitation, veiled by religious and political illusions, it has substituted naked, shameless, direct, brutal exploitation.

The bourgeoisie has stripped of its halo every occupation hitherto honoured and looked up to with reverent awe. It has converted the physician, the lawyer, the priest, the poet, the man of science, into its paid wage labourers.

The bourgeoisie has torn away from the family its sentimental veil, and has reduced the family relation to a mere money relation.

[ ◁ First | ◃Prev | Table of Contents | Next ▹ ]

23 notes

·

View notes

Text

Unlocking Next-Level Payment Gateway Solutions

Article by Jonathan Bomser | CEO | Accept-credit-cards-now.com

In the swiftly evolving digital landscape of today, businesses increasingly rely on smooth credit card payment gateways to offer customers convenient and secure transaction experiences. The world of payment processing has undergone remarkable shifts, with technologies continuously evolving to meet the demands of modern commerce. From handling high-risk merchant processing to pioneering e-commerce payment solutions, this article delves into the critical components of uncovering advanced payment gateway solutions that cater to the diverse needs of businesses.

DOWNLOAD THE PAYMENT GATEWAY INFOGRAPHIC HERE

Elevated-Risk Payment Processing

Operating within high-risk sectors, such as adult entertainment, online gaming, and subscription services, presents challenges when seeking dependable payment processing. High-risk merchant processing furnishes customized services that cater to the unique requisites of these industries. Employing sophisticated fraud detection and risk mitigation methods, high-risk payment processing providers establish a secure transaction environment. Whether facilitating credit card processing or efficiently managing recurring payments, these solutions ensure seamless and problem-free operations.

Empowering E-Commerce Ventures

The ascent of e-commerce has revolutionized consumer shopping habits, compelling businesses to adapt for enduring competitiveness. E-commerce payment processing solutions are intricately designed to streamline the checkout process and elevate the overall customer experience. Through e-commerce gateways and dedicated merchant accounts, businesses unlock the ability to seamlessly accept credit cards for e-commerce transactions, unlocking fresh avenues for expansion. These solutions offer real-time transaction monitoring, robust data encryption, and diverse payment options catering to the preferences of a diverse customer base.

Revolutionizing Credit Repair Services

Enterprises offering credit repair services also reap substantial benefits from specialized payment processing solutions. Credit repair merchant processing facilitates the streamlined collection of payments for services aimed at improving individuals' credit scores. Equipped with secure credit repair merchant accounts and adept payment gateways, businesses enable clients to conveniently make payments while preserving data confidentiality and complying with industry regulations.

Navigating the Complex CBD Landscape

The CBD sector, marked by intricate regulations and perceived risks, mandates the adoption of tailored payment processing solutions. Regulatory intricacies and potential uncertainties often pose challenges for CBD merchants seeking reliable payment processing services. Tailored CBD merchant accounts and payment processing solutions are meticulously fashioned to cater to the unique demands of the CBD industry, empowering merchants to seamlessly accept credit cards for CBD products. By integrating stringent compliance protocols, these solutions guarantee transparent and secure transactions.

The Heart of Seamless Transactions

Central to these diverse payment solutions are credit card processing systems and adept payment gateways. These systems play an indispensable role in authorizing transactions, securing sensitive data through encryption, and facilitating secure communication between the merchant, the customer, and the financial institution. Online payment gateway solutions ensure that transactions are swiftly and reliably processed, enhancing customer trust and satisfaction.

youtube

Unveiling a Resilient Future

As businesses continue to expand their digital footprint and embrace digital transactions, the significance of robust payment gateway solutions remains unparalleled. Credit card payment gateways serve as a seamless conduit connecting consumers and merchants, enabling efficient and secure real-time transactions. By proactively embracing industry trends and harnessing innovative technologies, businesses can unlock the full potential of advanced payment processing systems, propelling them toward a resilient future.

#credit card payment#credit card processing#merchant processing#payment processing#accept credit cards#credit card payment processing#high risk payment processing#high risk payment gateway#high risk merchant account#merchant account#Youtube

22 notes

·

View notes

Text

WhatsApp Cloud API Setup For Botsailor

Integrating the WhatsApp Cloud API with BotSailor is crucial for businesses seeking to enhance their customer engagement and streamline communication. The WhatsApp Cloud API enables seamless automation, allowing businesses to efficiently manage interactions through chatbots, live chat, and automated messaging. By connecting with BotSailor, businesses gain access to advanced features like order message automation, webhook workflows, and integration with e-commerce platforms such as Shopify and WooCommerce. This setup not only improves operational efficiency but also offers a scalable solution for personalized customer support and marketing, driving better engagement and satisfaction.

To integrate the WhatsApp Cloud API with BotSailor, follow the steps below for setup:

1. Create an App:

Go to the Facebook Developer site.

Click "My Apps" > "Create App".

Select "Business" as the app type.

Fill out the form with the necessary information and create the app.

2. Add WhatsApp to Your App:

On the product page, find the WhatsApp section and click "Setup".

Add a payment method if necessary, and navigate to "API Setup".

3. Get a Permanent Access Token:

Go to "Business Settings" on the Facebook Business site.

Create a system user and assign the necessary permissions.

Generate an access token with permissions for Business Management, Catalog management, WhatsApp business messaging, and WhatsApp business management.

4. Configure Webhooks:

In the WhatsApp section of your app, click "Configure webhooks".

Get the Callback URL and Verify Token from BotSailor's dashboard under "Connect WhatsApp".

Paste these into the respective fields in the Facebook Developer console.

5. Add a Phone Number:

Provide and verify your business phone number in the WhatsApp section.

6. Change App Mode to Live:

Go to Basic Settings, add Privacy Policy and Terms of Service URLs, then toggle the app mode to live.

7. Connect to BotSailor:

On BotSailor, go to "Connect WhatsApp" in the dashboard.

Enter your WhatsApp Business Account ID and the access token.

Click "Connect".

For a detailed guide, refer to our documentation. YouTube tutorial.

and also read Best chatbot building platform blog

2 notes

·

View notes

Note

I have two questions

What's your advice for an Artist who wants to do commission?

What do you advise Artists to do, particularly those who would want use their online names and do not wish to reveal their real name throughout the payment process? Such as PayPal and ect.

Hello Anon!

This is quite a broad question, but let me list what I can think of:

Create a style sheet or gallery showing what art style you'd do. This can be different from your usual style eg. doing chibis only. It should also give an idea of art, subjects, and themes you're comfortable with drawing for others (or if you want to be a NSFW artist, obviously have NSFW examples :P)

Don't be afraid to focus on a fandom first, especially if you're not sure of demand. Build up your client base and following, and you can slowly offer up more options from there once others know about your experience with comms.

Set up a detailed post or external page/site (I use Carrd) that displays updated info about how your comms work. Include details like steps, estimated waiting times, what to expect, and terms/conditions.

You can just have potential clients DM you directly, but I prefer to use a form (I use Google forms). This way their requests get auto-consolidated into a sheet, I can see who messaged first, and I can edit the sheet to keep track easier (eg. highlight a row to show if paid, or if comm in progress, or if done, etc.).

Be firm and honest in communications. You are essentially selling a product/service, there is no 'customer is always right' but think of it as having common respect for each other. If a client requests a comm you're not comfortable with, you can say no or ask if it can be amended. If you feel you might not be able to deliver the comm or a wip by a milestone, let the client know in advance.

For prices, I cannot advise on this as it depends on circumstances. If you find your art style or type of comms more unique and in demand, you can ask for a higher price. If you are doing this fulltime, you should definitely ask for a higher price (pegged to what you'd think you should earn per hour in a similar job scope). If you're new and are unsure of demand, you can start 'low-ish' and increase your prices over time.

For payment, you should at least ask for partial payment up front for a sketch. Never do 'test' drawings or sketches for free. You can slowly switch to asking for full payment upfront especially if clients are confident you can deliver based on your past work.

About the Paypal thing, it's been a long while since I've set my account up and PP also likes to change stuff on their website 🤔 But I believe as long as you convert your personal account or set up a Business account, you can choose the display name.

25 notes

·

View notes

Text

Finding the Best E-Commerce Website Builder for Your Business

Choosing the right e-commerce website builder is crucial for creating a successful online store. With numerous options available, selecting the best platform can significantly impact your business’s growth and efficiency. Here’s a guide to help you find the best e-commerce website builder that suits your needs.

1. Ease of Use

The best e-commerce website builders should offer an intuitive interface that simplifies the process of setting up and managing your store. Look for platforms with user-friendly drag-and-drop editors and customizable templates. These features make it easier to create a professional-looking website without requiring advanced technical skills.

2. Essential Features

Evaluate the core features each builder offers. Key functionalities include product management, secure payment processing, inventory tracking, and shipping options. Advanced features such as SEO tools, marketing integrations, and analytics capabilities can further enhance your online store’s performance.

3. Design Flexibility

A visually appealing and unique online store helps attract and retain customers. Choose a builder that provides a range of customizable templates and design options. This allows you to tailor your site’s appearance to align with your brand’s identity and create a memorable shopping experience.

4. Scalability

As your business grows, your e-commerce platform should be able to scale with you. Opt for a builder that offers flexible plans and additional features to accommodate increased traffic, a larger product range, and expanded functionalities. Scalability ensures your website remains effective and efficient as your business evolves.

5. Support and Resources

Reliable customer support and comprehensive resources are essential for troubleshooting and ongoing management. Select a builder that provides responsive support through various channels, such as live chat, email, or phone. Additionally, access to tutorials, guides, and community forums can be valuable for resolving issues and learning best practices.

Top Recommendations

Shopify: Known for its ease of use and robust feature set, Shopify is ideal for businesses of all sizes. It offers a wide range of customizable templates, integrated payment options, and excellent customer support.

WooCommerce: Perfect for those familiar with WordPress, WooCommerce provides extensive customization and flexibility. It’s suitable for businesses with specific needs and technical capabilities.

BigCommerce: Renowned for its scalability, BigCommerce is a great choice for growing businesses. It offers built-in features for SEO, multi-channel selling, and advanced analytics.

Wix: Wix combines simplicity with design flexibility. Its drag-and-drop editor and diverse templates make creating a visually appealing online store easy.

Squarespace: With its elegant design templates and user-friendly interface, Squarespace is perfect for businesses seeking a stylish and functional online store with minimal effort.

READ MORE >>>>

2 notes

·

View notes

Text

Tamil Film Industry to Pause Productions and Implement New Regulations from November

In a recent high-stakes meeting among key players in Tamil cinema, significant changes are on the horizon. The Tamil Film Producers Association (TFPC), in collaboration with the Tamil Nadu Theatre Owners Association, Tamil Nadu Multiplex Owners Association, and Tamil Nadu Film Distributors, has laid out a series of resolutions aimed at addressing the pressing issues within the industry.

Key Decisions from the Meeting:

OTT Release Window: Films starring major stars will now have an eight-week window between their theatrical release and their debut on OTT platforms. This new regulation aims to maximize the revenue potential from theatrical runs before films become available for streaming.

Actor and Technician Dues: A major concern is the practice of actors and technicians accepting advance payments from multiple production companies while failing to complete existing commitments. To mitigate financial losses for producers, actors and technicians are now required to finish ongoing projects before taking on new ones. Notably, producers are advised to consult the TFPC before beginning new projects involving actor Dhanush, who has been involved in such disputes.

Ceiling on Salaries and Production Costs: The industry has seen a surge in salaries and production costs, impacting overall budgets. The TFPC is working on new regulations to cap these expenses and bring more structure to film financing.

Temporary Suspension of New Shoots: To ensure a smooth transition to these new regulations, a temporary halt on the start of new films has been mandated from August 16, 2024. Current projects must be completed by October 30, 2024, with no new shoots commencing until the new rules are fully implemented.

Communication and Compliance: Producers are required to formally report ongoing film projects to the TFPC. This measure is intended to keep track of productions and enforce the new regulations effectively

Formation of Joint Action Committee: A new committee comprising producers, distributors, and theatre owners will oversee the implementation of these resolutions and address future industry issues.

These sweeping changes come in response to ongoing challenges in Tamil cinema, including financial mismanagement and escalating production costs. The industry has faced similar shutdowns in the past, such as the 2018 strike over revenue sharing issues. This time, however, the focus is on regulating actor and technician conduct, and the industry awaits the reactions from those directly affected by these new rules.

As the TFPC gears up for these significant shifts, it will be crucial to see how these regulations impact the Tamil film industry and whether they effectively address the concerns that have prompted this decisive action.

#Tamil Cinema#Tamil Film Producers Association#Film Industry Regulations#OTT Release Policy#Actor Dues

2 notes

·

View notes

Text

The Next Big Thing: Exploring the World of Cash App Clone

In today's fast-paced world, managing finances has become more convenient than ever before, thanks to the emergence of innovative mobile applications. Among these, the Cash App has garnered significant attention for its user-friendly interface and seamless money transfer capabilities. But what if you could replicate its success with your own custom solution? Enter the Cash App Clone – a revolutionary concept that is reshaping the financial landscape.

Understanding the Cash App Phenomenon

Cash App, developed by Square Inc., has become synonymous with peer-to-peer payments, allowing users to send and receive money effortlessly. With its straightforward design and intuitive features, it has amassed millions of users worldwide, transforming the way people handle their finances.

The Birth of Cash App Clone

Inspired by the success of the Cash App, developers and entrepreneurs have sought to create their own versions of this popular platform. These clones aim to replicate the core functionalities of the Cash App while offering additional features tailored to specific user needs.

How Does a Cash App Clone Work?

A Cash App Clone operates on a similar principle to its predecessor – facilitating secure transactions between users. Users can link their bank accounts or debit cards to the app, enabling them to send money to friends, family, or merchants with just a few taps on their smartphone.

Features That Make a Cash App Clone Stand Out

While the basic premise remains consistent across Cash App Clone, developers often integrate unique features to differentiate their product. These may include:

In-app chat functionality for seamless communication.

Integration with popular payment gateways for added convenience.

Personalized reward programs to incentivize usage.

Budgeting tools and financial insights to help users manage their money effectively.

Benefits of Using a Cash App Clone

The adoption of a Cash App Clone offers numerous benefits to both individuals and businesses alike:

Convenience: Instantly send or receive money anytime, anywhere.

Accessibility: Reach a broader audience with cross-platform compatibility.

Cost-effectiveness: Avoid the hefty transaction fees associated with traditional banking methods.

Security: Benefit from robust encryption protocols to safeguard sensitive information.

Flexibility: Customize the app to suit your specific requirements, whether it's for personal use or business transactions.

Security Measures to Safeguard Your Transactions

With the proliferation of digital payment solutions, security concerns have understandably become a top priority for users. Cash App Clone addresses these concerns by implementing stringent security measures, such as:

Two-factor authentication (2FA) is used to prevent unauthorized access.

End-to-end encryption to protect sensitive data during transmission.

Regular security audits and updates to mitigate potential vulnerabilities.

Future Prospects of Cash App Clones

As society continues to embrace digitalization, the demand for innovative financial solutions is expected to soar. Cash App Clone is well-positioned to capitalize on this

trend, offering a convenient and secure alternative to traditional banking methods. With ongoing advancements in technology, the possibilities for future iterations of Cash App Clone are virtually limitless.

In conclusion, the rise of Cash App Clone represent a paradigm shift in how we interact with money. By harnessing the power of mobile technology, these clones empower users to take control of their finances with ease and confidence. Whether you're a tech-savvy individual or a forward-thinking entrepreneur, embracing this revolution could be the key to unlocking financial freedom in the digital age.

Ready to explore the future of financial technology? Dive into the world of Cash App clone and discover the next big thing in digital transactions. Join us at Omninoz to stay ahead of the curve and revolutionize the way you handle your finances. Let's embark on this exciting journey together!

3 notes

·

View notes

Text

The impact of sustainability in fintech: reflections from the summit

In recent years, the Fintech industry has witnessed a paradigm shift towards sustainability, with an increasing emphasis on integrating environmental, social, and governance (ESG) factors into financial decision-making processes. This transformative trend took center stage at the latest Fintech Summit, where industry leaders converged to explore the intersection of sustainability and financial technology. Among the prominent voices shaping this discourse was Xettle Technologies, a trailblazer in Fintech software solutions, whose commitment to sustainability is driving innovation and reshaping the future of finance.

Against the backdrop of global challenges such as climate change, resource depletion, and social inequality, the imperative for sustainable finance has never been greater. The Fintech Summit provided a platform for thought leaders to reflect on the role of technology in advancing sustainability goals and fostering a more resilient and equitable financial ecosystem.

At the heart of the discussions was the recognition that sustainability is not just a moral imperative but also a strategic imperative for Fintech firms. By integrating ESG considerations into their operations, products, and services, Fintech companies can mitigate risks, enhance resilience, and unlock new opportunities for growth and value creation. Xettle Technologies’ representatives underscored the company’s commitment to sustainability, highlighting how it is embedded in the company’s culture, innovation agenda, and business strategy.

One of the key themes that emerged from the summit was the role of Fintech in driving sustainable investment. Through innovative solutions such as green bonds, impact investing platforms, and ESG scoring algorithms, Fintech firms are empowering investors to allocate capital towards environmentally and socially responsible projects and companies. Xettle Technologies showcased its suite of Fintech software solutions designed to facilitate sustainable investing, enabling financial institutions and investors to align their portfolios with their values and sustainability objectives.

Moreover, the summit explored the transformative potential of blockchain technology in advancing sustainability goals. By enhancing transparency, traceability, and accountability in supply chains, blockchain can help address issues such as deforestation, forced labor, and conflict minerals. Xettle Technologies’ experts elaborated on the company’s blockchain-based solutions for supply chain finance and sustainability reporting, emphasizing their role in promoting ethical sourcing, responsible production, and fair labor practices.

In addition to sustainable investing and supply chain transparency, the summit delved into the role of Fintech in promoting financial inclusion and resilience. By leveraging technology and data analytics, Fintech firms can expand access to financial services for underserved populations, empower small and medium-sized enterprises (SMEs), and build more inclusive and resilient communities. Xettle Technologies’ representatives shared insights into the company’s initiatives to support financial inclusion through digital payments, microfinance, and alternative credit scoring models.

Furthermore, the summit highlighted the importance of collaboration and partnership in advancing sustainability goals. Recognizing the interconnected nature of sustainability challenges, participants underscored the need for cross-sectoral collaboration between Fintech firms, financial institutions, governments, civil society, and academia. Xettle Technologies reiterated its commitment to collaboration, emphasizing its partnerships with industry stakeholders to drive collective action and scale impact.

Looking ahead, the future of sustainability in Fintech appears promising yet complex. As Fintech firms continue to innovate and disrupt traditional financial systems, they must prioritize sustainability as a core principle and driver of value creation. Xettle Technologies’ visionaries reiterated their commitment to sustainability, pledging to harness the power of technology to build a more sustainable, inclusive, and resilient financial ecosystem for future generations.

In conclusion, the Fintech Summit served as a catalyst for reflection and action on the role of sustainability in shaping the future of finance. From sustainable investing and supply chain transparency to financial inclusion and resilience, Fintech has the potential to drive positive change and advance sustainability goals on a global scale. Xettle Technologies’ leadership in integrating sustainability into its Fintech solutions exemplifies its dedication to driving innovation and creating shared value for society and the planet. As the industry continues to evolve, collaboration, innovation, and sustainability will be key drivers of success in building a more sustainable and resilient financial future.

2 notes

·

View notes

Text

ARCHITECTURAL HARDWARE B2B PLATFORM

ARCHITECTURAL HARDWARE B2B PLATFORM

Our digital platform is built with user experience in mind, featuring intuitive navigation, detailed product descriptions, and advanced search capabilities. Whether you're searching for specific items or browsing for inspiration, IBAIS MEDIA makes it easy to find the perfect hardware solutions for your projects.

Connect directly with trusted suppliers and manufacturers, negotiate pricing, and manage orders seamlessly through our platform. With secure payment gateways and transparent communication channels, you can trust IBAIS MEDIA to facilitate smooth transactions every step of the way.

Stay informed and inspired with our curated content, including industry insights, trends, and product updates. We are committed to providing you with the knowledge and resources you need to stay ahead in the ever-evolving architectural hardware landscape.

Join us on IBAIS MEDIA's Architectural Hardware Products B2B Digital Platform and experience the convenience and efficiency of modern procurement. Together, let's elevate your projects to new heights of excellence. Welcome aboard!

#architecture#design#marketing#b2bplatform#hardware#hardwareb2bplatform#business#wooden#architectural#architecturalhardware#hardwareproducts#windows#doors#furniture#hoedecor#advertising#advertisingagency#digital art#digital marketing#social media#socialmediamarketing#mediaagen#interior design#interiordecor#interiors#home design#home decor#kitchen

2 notes

·

View notes

Text

Hello! I’m doing art commissions now!

If you are interested, please look at the provided info and DM me here or on my Instagram: Velimation

Copyright

I (the artist) have rights to the finished project.

The artist reserves the right to post (or not to) the finished project on social media.

Any private, non commercial use is allowed, such as free personal projects, print the artwork for your own personal projects or as a gift, use it in your private games as your character token, and so on.

The artist has the right to use the artwork in any professional portfolio.

Commercialization requires at least a 150% fee of the total price.

The client still holds copyright claims to the character.

Any editing (asides from cropping for use as an avatar etc.) is prohibited.

All personal information will be kept private and confidential.

Full credits will be given if you choose to upload to social media.

Clients are not permitted in any circumstances to use any part of the finished product for non-fungible tokens or genAI. Use of my artwork for any advertising or profits associated with non-fungible tokens, blockchains, genAI, or cryptocurrency is strictly prohibited.

I will never sell/resell any of my artwork as non-fungible tokens. If artwork I have created, regardless if commissioned or personal, is listed as a non-fungible token or cryptocurrency, it is stolen.

General

Art commissions are a digital hood only, no shipping is required.

By ordering a commission and sending payment, you are agreeing to the Terms of Service.

The client is responsible for providing any necessary information and communicating clearly what their requirements are.

Commissions must be requested through either email ([email protected]) or Instagram DM until I set up the inquiry form.

Commissions are for personal use only.

If I accept your commission, I will contact you with a list of questions that you must answer. If I do not get back to you within 3 days, I have refused your commission.

I hold the right to refuse any commission without explanation if I deem it uncomfortable, or if I believe the client is being rude.

Character descriptions and references are required no matter the commission type or subject.

Payment & pricing

Commissions will be priced individually. The final price will be decided by the artist, depending on the complexity of the task, length of the project, and quality of the references/description.

Payment will be done through CashApp before I start the project.

Full 100% payment in advance. Payment in USD.

Additional fees

Additional limbs (wings, tails, extra arms etc.) will cost extra depending on complexity.

Very complex decorations (jewelry, tattoos, clothing designs etc.) will cost extra.

Portraits will be done on a solid color background.

Additional fees will depend on the complexity of the commission.

Once the project is finished, minor changes (such as minor color adjustments, mistake fixes, or minor details) will be free for three (3) business days. Any large changes (clothing changes, poses, setting) will be charged as extra.

Any deadlines must be communicated and agreed upon prior to the project beginning. Strict deadlines will incur a fee.

A 100% fee will be charged for every extra character that is commissioned as I prefer doing single character drawings.

Workflow

Commission time might take 3 days to 2 months depending on the complexity of the project. I will contact you for any delays.

The amount of time spent on the project depends on how quickly you provide feedback on the progress.

I will send updates as they occur. Please check your email for any updates every 1 to 2 days.

Any unpaid commissions will be removed after 5 days of no response of alternate arrangements have not been scheduled.

If you change your mind about the commission, let me know as soon as possible! It is not rude to let me know and will make me feel better than no response at all.

A 75% refund will be given if you let me know you are cancelling the commission. No refund will be given if you do not let me know, and a 25% refund will be given if the project is already complete.

I draw

Original characters

Fictional characters

I don’t draw

Real people

Furry art (not skilled enough)

Example Fandoms

Hazbin Hotel

Miraculous Ladybug

Dungeons and Dragons

Elder Scrolls

Sims

DC Comics

Marvel

Prices

Portraits: $20-$50

Stylized Portrait: $40 - $70

Full body: $60 - $100

Enviornment: $120 - $200

#art#commission#art commisions#art commissions open#art comms open#artist#digital art#fanart#Hazbin hotel fanart#helluva boss fanart#miraculous ladybug fanart#commisions open#elder scrolls#skyrim#tes#the elder scrolls#elder scrolls skyrim#elder scrolls oblivion#oblivion#morrowind#elder scrolls morrowind#fanart commissions#my art#my commissions#commissions

2 notes

·

View notes

Text

High-Risk Payment Processing Techniques: Best Practices

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving realm of e-commerce, payment processing takes center stage, enabling businesses to smoothly accept credit card payments and ensure seamless customer transactions. However, for industries deemed high-risk, such as credit repair and CBD sales, navigating the payment processing landscape presents distinct challenges. In this article, we dive into the intricacies of high-risk payment processing methods and present best practices to guarantee secure and efficient transactions. Whether you're a newcomer to high-risk payment processing or looking to refine your current strategies, these insights will steer you toward favorable outcomes.

DOWNLOAD THE HIGH-RISK PAYMENT PROCESSING INFOGRAPHIC HERE

Understanding High-Risk Payment Processing

Effective navigation of the high-risk payment processing sphere necessitates a clear comprehension of high-risk industries. Sectors like credit repair and CBD sales often fall into this category due to intricate regulations and an elevated risk of chargebacks. Consequently, high-risk merchants require specialized payment processing solutions tailored to mitigate associated risks.

The Importance of Merchant Accounts

Merchant accounts form the backbone of efficient payment processing. These accounts, specifically designed for high-risk businesses, facilitate the secure transfer of funds from customers' credit cards to the merchant's bank account. Establishing a high-risk merchant account ensures seamless payment processing, enabling businesses to broaden their customer base and enhance revenue streams.

Exploring High-Risk Payment Gateways

High-risk payment gateways serve as virtual checkpoints between customers and merchants. These gateways safeguard sensitive financial information by encrypting data during transactions. When selecting a high-risk payment gateway, emphasize security features and compatibility with your business model to guarantee safe and smooth payment processing.

Tailored Solutions for Credit Repair Businesses

Credit repair merchants face unique challenges due to the industry's regulatory landscape. Obtaining a credit repair merchant account equipped with specialized payment processing solutions can aid in navigating these complexities. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures ensures compliance and fosters customer trust.

CBD Sales and Payment Processing

CBD merchants operate in a market brimming with potential but also shrouded in uncertainty. Shifting regulations demand a flexible approach to CBD payment processing. Collaboration with experienced payment processors well-versed in the intricacies of CBD sales and the utilization of age verification systems can streamline transactions and bolster customer confidence.

Mitigating Chargeback Risks

Chargebacks pose a significant threat to high-risk merchants, frequently arising from disputes, fraud, or unsatisfactory service. Proactively address this issue by providing exceptional customer support, transparent refund policies, and clear product descriptions. Consistent communication can forestall chargebacks and maintain a healthy merchant-consumer relationship.

youtube

Future-Proofing High-Risk Payment Processing

Advancing technology necessitates the evolution of high-risk payment processing techniques to stay ahead of potential threats. Embrace emerging solutions like AI-driven fraud detection and biometric authentication to enhance security and streamline payment processing. Staying informed and adapting to industry trends ensures the future-proofing of payment processing strategies for high-risk merchants.

High-risk payment processing amalgamates industry knowledge, tailored solutions, and cutting-edge security measures. Whether operating in credit repair or CBD sales, a comprehensive understanding of high-risk payment processing intricacies is imperative. Leveraging specialized merchant accounts, payment gateways, and proactive chargeback prevention methods enables high-risk merchants to confidently accept credit card payments and cultivate long-term customer relationships. In an ever-evolving landscape, embracing innovative payment processing solutions guarantees a secure and prosperous future for high-risk businesses.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#Youtube

17 notes

·

View notes

Text

Best Billing Machines in India

Effectiveness in transactions is essential in the busy realms of commerce and retail. Billing machines, a crucial tool in this process, have advanced significantly over time, with UDYAMA POS setting the standard in India. This article highlights UDYAMA POS's ground-breaking position in the industry while examining the innovations, customer satisfaction, and variety of (Best Billing Machines in India) that are supplied. (Best Billing Machines in Delhi) are essential for streamlining billing processes because they provide cutting-edge functionality catered to various corporate requirements. The choice of billing machines can have a big impact on revenue creation and productivity for businesses of all sizes, from small merchants to multinational corporations.

Considering the Value of Billing Equipment

Competent billing is the foundation of any flourishing company. For any type of business—retail, dining, or service—accurate and timely invoicing is essential to preserving both the company's finances and its reputation with clients. This procedure is automated using billing machines, which streamlines transactions and lowers the possibility of errors. Contemporary billing machines enable organizations to improve operational efficiency and concentrate on their core competencies by providing functions such as inventory management, sales analysis, and tax calculation.

Essential Factors to Take-into-Account:

Creative Software for Billing:

Linked billing software is the cornerstone of modern billing systems. Look for systems with powerful reporting features, user-friendly interfaces, and customizable invoice templates. These features simplify the process of creating invoices and provide useful information on sales patterns and inventory management.

Choices for Internet Access:

In today's networked environment, billing machines with several connectivity options are more versatile and easy. Bluetooth and Wi-Fi enabled devices facilitate seamless communication with other corporate systems, allowing for real-time data synchronization and remote management.

Reliable Payment Processing:

Security is essential while processing financial transactions. Choose billing machines with robust encryption features and PCI-compliant payment processing services installed. This ensures the confidentiality and integrity of client data while lowering the risk of fraud and data breaches.

Design compactness and portability:

Small, portable billing devices are ideal for businesses with limited space or that are mobile. Look for portable devices with long-lasting batteries and sturdy construction. This simplifies invoicing in a number of contexts, including shop counters and outdoor events.

Possibility of Development and Enhancement:

Invest in scalable and easily upgraded invoicing solutions to accommodate future business growth and changing needs. Modular systems with interchangeable parts facilitate the easy integration of additional features as your business expands.

UDYAMA Point of Sale Advantages

The Indian billing machine market has seen a radical transformation thanks to UDYAMA POS's state-of-the-art technology and customer-focused mentality. A selection of models designed to satisfy particular business needs are available from UDYAMA POS. These approaches have improved the checkout experience for customers while also increasing operational efficiency.

There are many different types of billing machines available on the market, ranging from sturdy desktop models for high-volume organizations to portable devices for transactions while on the go. Every kind has distinctive qualities designed for particular commercial settings, which emphasizes how crucial it is to choose a machine that fits your operational requirements.

Features of a Billing System to Take-into-Account

Durability, connectivity choices, and convenience of use are important factors to take-into-account when selecting a billing machine. A machine that performs well in these categories can significantly improve business operations by facilitating faster and more dependable transactions.

(Best UDYAMA POS Billing Machine) Models

A range of models that are notable for their cost, dependability, and functionality are available from UDYAMA POS. With the help of this section's thorough analysis of these best models, you can make an informed choice depending on your unique business needs.

How to Choose the Right Invoicing Equipment

When choosing a billing machine, it's important to evaluate your company's needs, budget, and the features that are most important to your daily operations. This guide provides helpful guidance to assist you in navigating these factors.

Benefits of Changing to a Modern Billing System

Modern billing systems, such as those provided by UDYAMA POS, can greatly improve customer satisfaction and efficiency. The several advantages of performing such an upgrade are examined in this section, ranging from enhanced client satisfaction to streamlined operations.

Advice on Installation and Upkeep

Making sure your billing machine is installed correctly and receiving routine maintenance is essential to its longevity and dependability. Important setup and maintenance advice for your new gadget is included in this section.

Field Research: UDYAMA POS Success Stories

The revolutionary effect of UDYAMA POS billing devices on businesses is demonstrated by actual success stories from the retail and hospitality industries. These case studies demonstrate how businesses have benefited from increased customer satisfaction and operational efficiency thanks to UDYAMA POS technology.

All products in the Billing Machine are:

(Handy POS Billing Machine)

(Android POS Billing Machine)

(Windows POS billing Machine)

(Thermal Printer Machine)

(Label Printer Machine)

Enhancing Efficiency with Best Billing Machines in India:

The adoption of the (best billing machines in Noida) has revolutionized the way businesses manage their finances. These advanced solutions offer a myriad of benefits, including:

Simplified Billing Procedures: By automating invoice generation and payment retrieval, billing procedures are made more efficient and less prone to human error and delay.

Enhanced Accuracy: Up-to-date billing software guarantees precise computations, removing inconsistencies and billing conflicts.

Improved Customer Experience: Easy and quick transactions increase client happiness and loyalty and encourage recurring business.

Real-Time Insights: Rich reporting tools offer insightful information on inventory control and sales performance, facilitating well-informed decision-making.

Observance of Regulatory Mandates: Pre-installed compliance tools guarantee that financial reporting requirements and tax laws are followed, lowering the possibility of fines and audits.

Frequently Asked Questions:

Are billing systems appropriate for all kinds of companies?

Absolutely! Billing machines come in various configurations and are tailored to suit the needs of diverse businesses, from small retailers to large enterprises.

Can billing devices accept several forms of payment?

Yes, most modern billing machines support multiple payment options, including cash, credit/debit cards, mobile wallets, and online payments.

How frequently should the software on billing machines be updated?

It's recommended to update billing machine software regularly to ensure optimal performance, security, and compatibility with the latest regulations and technologies.

Do billing machines need to be connected to the internet?

While internet connectivity is not mandatory for basic billing operations, it may be necessary for accessing cloud-based features, software updates, and remote management capabilities.

Is it possible to link accounting software with billing machines?

Yes, many billing machines offer integration with popular accounting software packages, facilitating seamless data transfer and reconciliation.

Are POS terminals easy to use?

Most billing machines are designed with ease of use in mind, featuring intuitive interfaces and straightforward setup processes. Training and support are typically provided to ensure smooth adoption and operation.

UDYA MA POS, a business renowned for its wide range of products, innovative solutions, and happy clients, is the result of searching for the (best billing machines in India). Considering how organizations are always changing, choosing the right billing system is essential. Thanks to its commitment to quality and innovation, UDYAMA POS is a leader in the billing machine industry, ensuring that transactions will become more streamlined, dependable, and fast in the future. The strategic decision to invest in the (top billing machines in Gurgaon) could have a significant effect on businesses of all kinds. These innovative solutions help organizations thrive in the present competitive market by streamlining billing processes, increasing precision, and providing insightful data.

Regardless of the size of your business, selecting the correct billing equipment is critical to increasing productivity and spurring expansion.

Visit the website for more information: www.udyamapos.com

2 notes

·

View notes

Text

How Can Gen AI Revolutionize Your Accounts Receivable Process?

The advent of Generative AI (Gen AI) heralds a paradigm shift in the landscape of Finance and Accounting (F&A). Much like the introduction of spreadsheets as a product innovation decades ago, finance professionals were quick to embrace and derive immense benefits from the use of spreadsheets.

Gen AI in Finance and Accounting emerges as a potential game-changer, poised to revolutionize traditional practices within the realm of F&A and invoice payments. However, for this potential to be realized, CFOs must demonstrate openness to experimentation, allowing themselves to explore the tangible impact of Gen AI in Finance and Accounting functions.

Embarking on this journey necessitates a focused exploration of Gen AI’s applicability, particularly within accounts receivable management and invoice payments. By delving into this domain, CFOs can gain firsthand insight into the transformative power of Gen AI in Accounts Receivable. As with any strategic business investment, it is prudent to assess the anticipated returns and the timeframe within which these benefits can be realized.

In essence, embracing Gen AI in accounts receivable and invoice payments represents not only a technological advancement but also a strategic imperative for forward-thinking finance leaders. By embracing innovation and fostering a culture of experimentation, organizations can unlock unprecedented efficiency, agility, and competitive advantage in the ever-evolving landscape of finance and accounting.

How Can Gen AI Revolutionize Your Accounts Receivable Process?

Irrespective of the organization, to ensure optimal efficiency within the accounts receivable function and to explore the potential of integrating Gen AI powered Accounts receivable, it is essential to adopt a strategic approach centered around four key building blocks. These pillars serve as the foundation for effective management and innovation in accounts receivable:

Receivable Antecedents :

This encompasses the meticulous orchestration of all preliminary tasks necessary to establish a receivable. From the initial engagement with clients to the negotiation of terms, to the careful documentation of agreements, each step in this process demands precision and foresight. Building strong receivables antecedents lays the foundation for smooth transactions, timely invoice payments and ensures a robust financial framework

They include:

Customer Onboarding: Accurate customer data collection, credit checks, and setting credit limits.

Sales Order Processing: Efficiently converting orders into invoices.

Contractual Agreements: Clear terms and conditions regarding payment terms, discounts, and penalties.

Order Fulfillment: Ensuring timely delivery of goods or services.

Timely Invoicing: Generate invoices promptly after goods/services are delivered.

Clear and Accurate Invoices: Ensure clarity, itemization, and correct pricing.

Invoice Presentment and Reminders:

In the dynamic landscape of revenue management, the presentation of invoices holds paramount importance. It transcends beyond mere documentation; it embodies the essence of your transactions, encapsulating the value exchanged with your clients. Your approach to invoice presentment and invoice payments is characterized by clarity, accuracy, and timeliness. Moreover, one need to recognize the strategic significance of reminders in facilitating prompt invoice payments. Through proactive communication and gentle nudges, you endeavor to uphold transparency, nurture client relationships, and optimize cash flow dynamics.

This step involves creating and delivering invoices to customers:

Multiple Channels: Offer electronic and paper-based invoice delivery to facilitate invoice payments.

Standard Payment Reminder Schedule:

o Set a consistent schedule for sending payment reminders. This helps maintain clarity and predictability for both you and your clients.

o Send reminders before the due date to gently prompt clients to pay on time.

o Issue reminders close to the actual due date to emphasize the urgency.

• Personalized Reminders:

o Customize your reminders to suit each client. Address them by name and include relevant details.

o Personalization shows that you value the relationship and encourages prompt payment.

• Politeness and Professionalism:

o Maintain a polite and professional tone in your reminders.

o Avoid threatening language or negativity that could harm the client relationship.

o Clearly state the purpose of the reminder and the essential details, such as the invoice number, amount due, and due date.

Collaboration :

Collaboration lies at the heart of your approach, both externally with your valued customers and internally among your team members and departments. Externally, effective collaboration involves understanding your clients’ needs, communicating transparently, and working together to resolve any issues or discrepancies promptly. Internally, collaboration ensures alignment across functions, streamlines processes, and maximizes efficiency, ultimately leading to superior customer service and satisfaction.

Effective communication is crucial:

Customer Communication: Regular follow-ups, addressing queries, and resolving disputes.

Internal Coordination: Collaboration between sales, finance, and customer service teams.

Dispute Resolution: Swiftly address any discrepancies.

Payments and receipt management :

Efficient management of invoice payments and receipts is essential for maintaining cash flow and optimizing financial performance. This includes implementing secure and convenient payment channels, diligently tracking incoming payments, and promptly reconciling accounts. By prioritizing invoice payments and receipt management, you can minimize delays, mitigate risks, and ensure the stability and resilience of our financial ecosystem.

Efficient handling of incoming invoice payments:

Payment Channels: Accept various methods (credit cards, bank transfers, etc.).

Reconciliation: Match payments with outstanding invoices.

Cash Application: Apply payments accurately to the correct accounts.

What are the building blocks of Gen AI in Accounts Receivable?

Overall, Gen AI in accounts receivable encompasses a wide range of capabilities making it a versatile tool for various applications across different domains. A few of the core building blocks are –

Data Generation: Gen AI In accounts receivable, can generate synthetic data to augment existing datasets used for training predictive models. For example, it can create simulated customer invoice payments histories, including variations in payment amounts, frequencies, and timing. This synthetic data allows organizations to train their models more comprehensively, improving the accuracy of predictions regarding future payment behavior.

Data Conversion: Gen AI in accounts receivable can facilitate the conversion of data between different formats in the accounts receivable process. For instance, it can automatically convert paper-based invoices into digital formats by extracting relevant information such as invoice numbers, amounts, and due dates using optical character recognition (OCR) technology. This conversion streamlines the invoicing process, reducing manual effort and minimizing errors.

Data Categorization: Gen AI in accounts receivable, can categorize transactions based on various criteria such as invoice payment methods, customer segments, or invoice statuses. For example, it can automatically classify incoming invoice payments as cash, checks, or electronic transfers, allowing finance teams to track payment trends and reconcile accounts more efficiently. By categorizing transactions accurately, Gen AI powered accounts receivable enhances data organization and facilitates deeper insights into receivables management.

Advisor Functionality: Gen AI in accounts receivable serves as an intelligent advisor by providing actionable insights and recommendations based on analyzed data. For example, it can identify patterns of late invoice payments or discrepancies in invoicing that may indicate potential issues with specific customers or billing processes. By alerting finance teams to these anomalies, Gen AI powered accounts receivable enables proactive intervention to mitigate risks and optimize cash flow management.

Overall, Generative AI enhances the efficiency and effectiveness of accounts receivable operations by generating data, facilitating data conversion, categorizing transactions, and providing intelligent advisory support. By leveraging Gen AI capabilities, organizations can streamline receivables management processes, improve decision-making, and ultimately enhance financial performance.

#ar automation solution#AI in Accounts Receivable#ar collection#Payment Reminder#cashflow management#AI In Finance & Accounting

2 notes

·

View notes

Text

COMMISSION OPEN NOW!

Hey hey...

Have you ever wanted to have an ink illustration drawn by me?

...like this, for example? 😏😉😺

Well now YOU CAN!

Because I am opening commission now!

Ink illustrations, to be precise 😏 (gouache illos comms coming later this year, stay tuned for info 👀👀)

General Guidelines below the cut:

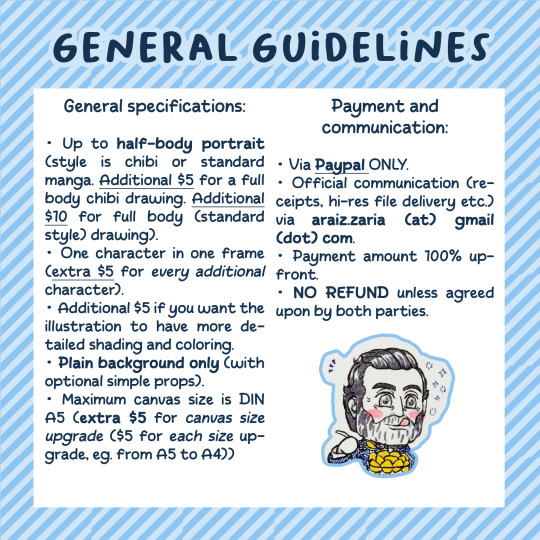

General specifications:

Up to half-body portrait (style is chibi or standard manga. additional $5 for a full body chibi drawing. additional $10 for full body (standard style) drawing).

one character in one frame (extra $5 for every additional character).

additional $5 if you want the illustration to have more detailed shading and coloring.

plain background only (with optional simple props).

Maximum canvas size is DIN A5 (extra $5 for canvas size upgrade ($5 for each size upgrade, eg. from A5 to A4))

Payment and communication:

via Paypal ONLY.

Initial contact via DM (here or over at ko-fi). Official communication (receipts, hi-res file delivery etc.) via araiz.zaria (at) gmail (dot) com.

Payment amount 100% upfront.

NO REFUND unless agreed upon.

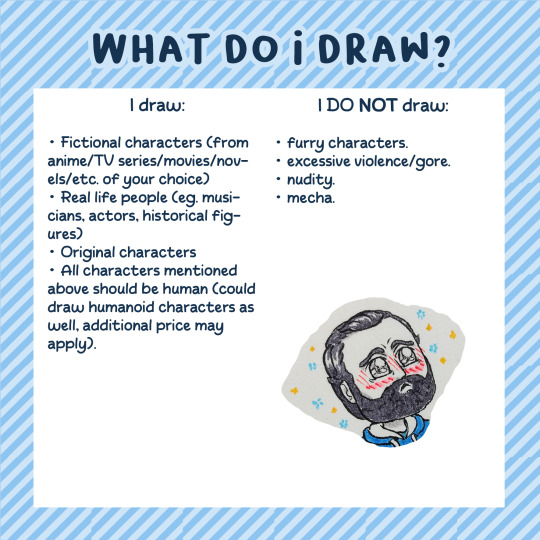

I can draw:

Fictional characters (from anime/TV series/movies/novels/etc. of your choice)

Real life people (eg. musicians, historical figures)

Original characters

All characters mentioned above should be human (could draw humanoid characters as well, additional price may apply).

I can't draw:

furry characters.

excessive violence/gore.

nudity.

mecha.

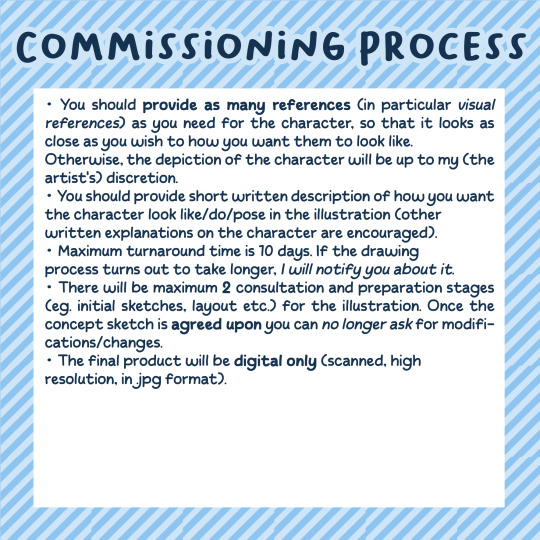

Commissioning process

You should provide as many references (in particular visual references) as you need for the character, so that it looks as close as you wish to how you want them to look like. Otherwise, the depiction of the character will be up to my (the artist's) discretion.

You should provide short written description of how you want the character look like/do/pose in the illustration (other written explanations on the character are encouraged).

Maximum turnaround time is 10 days. If the drawing process turns out to take longer, I will notify you about it.

There will be maximum 2 consultation and preparation stages (eg. initial sketches, layout etc.) for the illustration. Once the concept sketch is agreed upon you can no longer ask for modifications/changes.

The final product will be digital only (scanned, high resolution, in .jpg format).

Image use

Commissioned image is intended for personal use only.

Personal use includes: print out for private use, digital uses such as social media avatars, reposting on your personal account.

Credit me (araiz-zaria) and link back to my online profile when using commissioned image as social media avatar/reposting it on your personal account

Notify me in advance if the commission is intended to be private (so that the progress images won't be uploaded publicly).

The artist retains the right to the commissioned image.

Usage as AI feed/NFT is STRICTLY FORBIDDEN. THE ARTIST RESERVES THE RIGHT TO BLOCK A PREVIOUS CLIENT WHO IS FOUND OUT TO USE THEIR COMMISSIONED IMAGE FOR AI/NFT PURPOSES AND REFUSE THEM FOR UPCOMING COMMISSIONS.

#artists on tumblr#art commisions#commission#traditional art#drawing#original art#illustration#traditional art commissions#pen and ink#ink#manga#history art#sort of#modern au of sorts#fan art#those are the kind of drawings you can order from me 😆#reblogs are highly appreciated ofc 🥺

4 notes

·

View notes