#ADANI-GROUP

Explore tagged Tumblr posts

Text

#INDIA#NSE#ADANI ENTERPRISES#EQUITY#STOCK MARKET#SUZLON ENERGY#SUZLON ENERGY PRICE#YES BANK SHARE#YES BANK SHARE PRICE#SUZLON ENERGY LTD#DERIVATIVE#ADANI-GROUP#ADANI#INVESTING#FINANCIAL-MARKET#BHUJ

1 note

·

View note

Text

The long bezzle

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

When it comes to the modern world of enshittified, terrible businesses, no addition to your vocabulary is more essential than "bezzle," JK Galbraith's term for "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it"

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

The bezzle is contained by two forces.

First, Stein's Law: "Anything that can't go on forever will eventually stop."

Second, Keynes's: "Markets can remain irrational longer than you can remain solvent."

On the one hand, extremely badly run businesses that strip all the value out of the firm, making things progressively worse for its suppliers, workers and customers will eventually fail (Stein's Law).

On the other hand, as the private equity sector has repeatedly demonstrated, there are all kinds of accounting tricks, subsidies and frauds that can animate a decaying, zombie firm long after its best-before date (Keynes's irrational markets):

https://pluralistic.net/2023/06/02/plunderers/#farben

One company that has done an admirable job of balancing on a knife edge between Stein and Keynes is Verizon, a monopoly telecoms firm that has proven that a business can remain large, its products relied upon by millions, its stock actively traded and its market cap buoyant, despite manifest, repeated incompetence and waste on an unimaginable scale.

This week, Verizon shut down Bluejeans, an also-ran videoconferencing service the company bought for $400 million in 2020 as a panic-buy to keep up with Zoom. As they lit that $400 mil on fire, Verizon praised its own vision, calling Bluejeans "an award-winning product that connects our customers around the world, but we have made this decision due to the changing market landscape":

https://9to5google.com/2023/08/08/verizon-bluejeans-shutting-down/

Writing for Techdirt, Karl Bode runs down a partial list of all the unbelievably terrible business decisions Verizon has made without losing investor confidence or going under, in a kind of tribute to Keynes's maxim:

https://www.techdirt.com/2023/08/10/verizon-fails-again-shutters-attempted-zoom-alternative-bluejeans-after-paying-400-million-for-it/

Remember Go90, the "dud" streaming service launched in 2015 and shuttered in 2018? You probably don't, and neither (apparently) do Verizon's shareholders, who lost $1.2 billion on this folly:

https://www.techdirt.com/2018/07/02/verizons-sad-attempt-to-woo-millennials-falls-flat-face/

Then there was Verizon's bid to rescue Redbox with a new joint-venture streaming service, Redbox Instant, launched 2012, killed in 2014, $450,000,000 later:

https://variety.com/2014/digital/news/verizon-redbox-to-pull-plug-on-video-streaming-service-1201321484/

Then there was Sugarstring, a tech "news" website where journalists were prohibited from saying nice things about Net Neutrality or surveillance – born 2014, died 2014:

https://www.theverge.com/2014/12/2/7324063/verizon-kills-off-sugarstring

An app store, started in 2010, killed in 2012:

https://www.theverge.com/2012/11/5/3605618/verizon-apps-store-closing-january-2013

Vcast, 2005-2012, yet another failed streaming service (pray that someday you find someone who loves you as much as Verizon's C-suite loves doomed streaming services):

https://venturebeat.com/media/verizon-vcast-shutting-down/

And the granddaddy of them all, Oath, Verizon's 2017, $4.8 billion acquisition of Yahoo/AOL, whose name refers to the fact that the company's mismanagement provoked involuntary, protracted swearing from all who witnessed the $4.6 billion write-down the company took a year later:

https://www.techdirt.com/2018/12/12/if-youre-surprised-verizons-aol-yahoo-face-plant-you-dont-know-verizon/

Verizon isn't just bad at being a phone company that does non-phone-company things – it's incredibly bad at being a phone company, too. As Bode points out, Verizon's only real competency is in capturing its regulators at the FCC:

https://www.techdirt.com/2017/05/02/new-verizon-video-blatantly-lies-about-whats-happening-to-net-neutrality/

And sucking up massive public subsidies from rubes in the state houses of New York:

https://www.techdirt.com/2017/03/14/new-york-city-sues-verizon-fiber-optic-bait-switch/

New Jersey:

https://www.techdirt.com/2014/04/25/verizon-knows-youre-sucker-takes-taxpayer-subsidies-broadband-doesnt-deliver-lobbies-to-drop-requirements/

and Pennsylvania:

https://www.techdirt.com/2017/06/15/verizon-gets-wrist-slap-years-neglecting-broadband-networks-new-jersey-pennsylvania/

Despite all this, and vast unfunded liabilities – like remediating the population-destroying lead in their cables – they remain solvent:

https://www.reuters.com/legal/government/verizon-sued-by-investors-over-lead-cables-environmental-statements-2023-08-02/

Verizon has remained irrational longer than any short seller could remain solvent.

Short-sellers – who bet against companies and get paid when their stock prices go down – get a bad rap: billionaire shorts were the villains of the Gamestop squeeze, accused of running negative PR campaigns against beloved businesses to drive them under and pay their bets off:

https://pluralistic.net/2021/01/30/meme-stocks/#stockstonks

But shorts can do the lord's work. Writing for Bloomberg, Kathy Burton tells the story of Nate Anderson, whose Hindenburg Research has cost some of the world's wealthiest people over $99 billion by publishing investigative reports on their balance-sheet shell-games just this year:

https://www.bloomberg.com/news/features/2023-08-06/how-much-did-hindenburg-make-from-shorting-adani-dorsey-icahn

Anderson started off trying to earn a living as a SEC whistleblower, identifying financial shenanigans and collecting the bounties on offer, but that didn't pan out. So he turned his forensic research skills to preparing mediagenic, viral reports on the scams underpinning the financial boasts of giant companies…after taking a short position in them.

This year, Anderson's targets have included Carl Icahn, whose company lost $17b in market cap after Anderson accused it of overvaluing its assets. He went after the world's fourth-richest man, Gautam Adani, accusing him of "accounting fraud and stock manipulation," wiping out 34% of his net worth. He took on Jack Dorsey, whose payment processor Square renamed itself Block and went all in on the cryptocurrency bezzle, lopping 16% off its share price.

Burton points out that Anderson's upside for these massive bloodletting was comparatively modest. A perfectly timed exit from the $17b Icahn report would have netted $56m. What's more, Anderson faces legal threats and worse – one short seller was attacked by a man wearing brass-knuckles, an attack attributed to her short activism.

Shorts are lauded as one of capitalism's self-correcting mechanisms, and Hindenberg certainly has taken some big, successful swings at some of the great bezzles of our time. But as Verizon shows, shorts alone can't discipline a market where profits and investor confidence are totally decoupled from competence or providing a decent product or service.

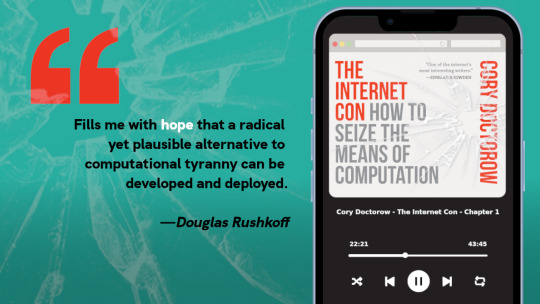

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/10/smartest-guys-in-the-room/#can-you-hear-me-now

#pluralistic#verizon#yahoo#tumblr#bluejeans#aol#vcast#redbox#go90#short sellers#hindenberg research#block#icahn#carl icahn#jack dorsey#square#nate anderson#gautam adani#adani group#icahn enterprises

138 notes

·

View notes

Text

Stop Operation Kagar!

youtube

#India#indian#Republic of India#Operation Kagar#Operation greenhunt#CPI (Maoist)#Maoism#imperalism#semi colonialism#anti imperialism#anti war#war#genocide#dalits#marxism#marxism leninism#marxism leninism maoism#students#students movment#Adivasi#Adivasis#dalit#modi#narendra modi#fuck modi#bjp#western imperialism#adani group#mining#chattisgarh

4 notes

·

View notes

Text

#savehasdeo#stopadani#hasdeoforest#adani group#adani#class war#coal#mining#coal mining#environmental#environment#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#pollution#pollutants#polluted air#polluters#polluted water#eat the rich#eat the fucking rich#environmental activism#enviroment art

5 notes

·

View notes

Text

Best Shares To Buy — Mutual Funds bought Rs 4,200 crore of Adani stocks in August amidst heightened interest

Secure Your Future with Intensify Research Services Invest in the best shares. our SEBI Registered experts are here to guide you

#best bank nifty tips provider#best bank nifty option tips#accurate stock tips#trading tips#ideal strategies#share market advisory#ipo alert#stock tips advisor#ipo news#stock cash market tips#mutual funds#adani#adani group#gautam adani

1 note

·

View note

Text

Businesses close to Modi and his political circle have done especially well. The most prominent examples are Mukesh Ambani’s Reliance Industries and the Adani Group, conglomerates that reach into numerous areas of Indian life. Their combined market power has grown gigantic in recent years: The flagship stocks of each company are worth about six times more than they were when Modi became prime minister. Some smaller companies have been the target of high-profile raids by tax-enforcement agencies. "If you’re not the two A’s” — Adani or Ambani — it can be treacherous to navigate India’s regulatory byways, said Arvind Subramanian, an economist at Brown University who served under Modi’s government as chief economic adviser from 2014 to 2018. "Domestic investors feel a little bit vulnerable,” he added.

Alex Travelli, ‘India is chasing China’s economy. Something is holding it back’, Japan Times

#Japan Times#Alex Travelli#India#Narendra Modi#Mukesh Ambani#Reliance Industries#Adani Group#Arvind Subramanian#Gautam Adani

2 notes

·

View notes

Text

Gautam Adani Joins Puri Rath Yatra 2025, Shares “Priceless Memories”

Adani Family Participates in Sacred Chariot Festival On June 28, 2025, billionaire industrialist Gautam Adani, along with his wife Priti Adani and son Karan Adani, participated in the annual Puri Rath Yatra. The family joined millions of devotees pulling the majestic chariots of Lord Jagannath, his brother Balabhadra, and sister Subhadra during one of India’s most revered religious…

#Adani Group#Gautam Adani#Indian religious events#Jagannath Yatra 2025#Karan Adani#Lord Jagannath#Odisha Festivals#Prasad Seva#Priti Adani#Puri Dham#Puri Rath Yatra 2025#Rath Poojan#Rath Yatra photos#Rath Yatra rituals

0 notes

Text

Adani Group AGM 2025: जहां भारत को जरूरत हो, वहां हम सबसे पहले होंगे, गौतम अदाणी का बड़ा दावा

Adani Group AGM 2025: Adani Group के चेयरमैन गौतम अदाणी ने ऑपरेशन सिंदूर में अदाणी डिफेंस के योगदान को देशभक्ति की मिसाल बताया. मंगलवार को ग्रुप की 33वीं AGM में उन्होंने कहा कि अदाणी डिफेंस ने ऑपरेशन सिंदूर ��े दौरान भारतीय सेना को अत्याधुनिक ड्रोन और एंटी-ड्रोन सिस्टम उपलब्ध कराए. उन्होंने दोहराया कि अदाणी ग्रुप सुरक्षित जोन में नहीं, बल्कि वहीं काम करता है जहां देश को सबसे ज्यादा जरूरत होती…

0 notes

Text

Adani Realty at Panvel in Navi Mumbai | Luxurious Township Project

Explore Modern Living at Adani Realty Panvel – Where Luxury Meets Connectivity

The real estate industry in Navi Mumbai is coming up as one of the hottest real estate investment destinations for the reason that it offers a complete package of comfort and is in high demand. Amid the new properties, Adani Realty Panvel is a good pick for both occupants and investors looking forward to a stylish yet good-in-the-way-of-infrastructure location.

Well-settled in Panvel, Adani Realty Navi Mumbai marries intelligent design with urban advantage to provide an effortless fusion of comfort and convenience. It integrates innovation, an eco-friendly environment, and lifestyle amenities that signify the modern-day hopes and desires of homebuyers and investors today. Adani Project Panvel fosters a community-centric lifestyle with open spaces, wellness zones, and smart planning tailored to meet the evolving needs of modern urban families.

Key Highlights of Adani Realty Panvel

Adani Group Navi Mumbaioffers a lifestyle of luxury in perfect convenience. Some of the best features are:

Stylish 1BHK and 2BHK residences planned to optimize space and sunlight

Vaastu-friendly apartments to attract good energy and harmony

Premium construction with high-end materials and the finest architecture

Secured enclave with 24x7 security and CCTV monitoring for protection

Facilities like high-speed elevators, fire fighting, and sufficient parking

Amenities and Location Benefits

Features: The Adani Realty Navi Mumbai is conveniently located in Panvel, while the basic amenities and infrastructure are within easy access of the inhabitants:

Close to malls, hospitals, schools, and banks for your daily needs.

Well connected enough to the main highway stations and new metro for convenience

Surrounded by parks, restaurants, and commercial hubs adding to lifestyle comfort

A Strong Investment Prospect

Adani Panvel presents attractive opportunities for buyers who want growth and value in their investment:

Positioned in a fast-developing urban corridor with rising property appreciation potential

Supported by a trusted developer known for timely delivery and transparent dealings

Provides various layouts catering to end-users and investors, boosting resale value

Why Choose Adani Realty Panvel?

With an amalgamation of modern design, thoughtful amenities, and a location that would mesmerize, Adani Realty Panvel would be a coveted address in Navi Mumbai. The township provides a peaceful and connected living experience for both working professionals and families. With world-class connectivity and high-end construction, Adani Project Panvel brings long-term value to your lifestyle and corresponds to future infrastructure development around the area. The residential complex provides an optimal mix of nature, connectivity, and urban comforts that make it a suitable choice for a future-proofed lifestyle.

In the future, the infrastructure development of the area and the rising urbanization guarantee this home will appreciate further. For those seeking a smart home investment with lasting benefits, Adani Panvel offers both comfort and a bright future. Driven by growing demand and location advantage, this property has the potential to deliver strong returns and high rental yield over time. Owning a home in Adani Group Navi Mumbai not only secures your present living standards but also promises a prosperous tomorrow in Navi Mumbai’s fast-growing corridor.

#adani panvel#adani realty panvel#adani navi mumbai#adani realty navi mumbai#adani group panvel#adani group navi mumbai#adani project panvel

0 notes

Text

Adani Realty Panvel is a premier Navi Mumbai township project offering majestic 1 & 2 BHK flats with elite amenities Contact +91 7718088030 for details. Visit Us: https://adani-realty-panvel.com/

#adani panvel#adani realty panvel#adani navi mumbai#adani realty navi mumbai#adani group panvel#adani group navi mumbai#adani project panvel

0 notes

Text

gautam-adani-group-tax-2024-25-adani-group-income-stats

बंपर कमाई के बाद अडानी ग्रुप ने कितना दिया टैक्स? सामने आया आंकड़ा

अरबपति गौतम अडानी का अडानी ग्रुप कितना टैक्स देता है? इसकी जानकारी सामने आ गई है. 2023-24 की तुलना में अडानी ग्रुप ने 2024-25 में 29% ज्यादा टैक्स दिया है. अडानी ग्रुप की तरफ से दी गई जानकारी में बताया है कि ग्रुप ने 2024-25 में करीब 75 हजार करोड़ रुपये का टैक्स जमा किया है. इससे पहले 2023-24 में अडानी ग्रुप ने 58,104 करोड़ रुपये का टैक्स भरा था.

कैसे चुकाया 75 हजार करोड़ का टैक्स?

अडानी ग्रुप ने एक प्रेस रिलीज जारी कर बताया है कि 2024-25 यानी अप्रैल 2024 से मार्च 2025 में ग्रुप ने 74,945 करोड़ रुपये का टैक्स भरा है.

ग्रुप ने बताया कि 74,945 करोड़ रुपये में से 28,720 करोड़ रुपये का टैक्स अडानी ग्रुप ने सीधे जमा किया है. वहीं 45,407 करोड़ रुपये का इनडायरेक्ट टैक्स दिया है. इसके अलावा 818 करोड़ रुपये का कंट्रीब्यूशन अलग-अलग तरीकों से दिया गया है.

पूरा आर्टिकल पढ़ने के लिए नीचे लिंक पर क्लिक करें👇

बंपर कमाई के बाद अडानी ग्रुप ने कितना दिया टैक्स? सामने आया आंकड़ा

#adani group tax#अडानी समूह#गौतम अडानी#अडानी समूह टैक्स#टैक्स पारदर्शिता रिपोर्ट#अडानी समूह टैक्स पारदर्शिता रिपोर्ट#adani group#gautam adani#tax transparency report#adani group tax transparency report#Adani Group#tax outgo FY25#Rs 75#000 crore tax payment#direct taxes#indirect taxes#employee social security#portfolio companies#fiscal year 2025#Adani Enterprises#Adani Cement

0 notes

Text

Adani Stocks Plunge on US Probe Allegations - Company Rejects Claims - Your Winning Stock Market Strategy

Master RSI (buy low, sell high) & SMA (ride the trend) for smarter trades! Visit www.intensifyresearch.com Now (SEBI-registered RA expertise)

#stock market#finance#share market#investing#banknifty#sensex#nifty prediction#nifty50#nse#economy#bse#bse sensex#indian stock market#investing stocks#stock trading#economics#geopolitics#adani#adani group

1 note

·

View note

Text

Adani Group Posts Stellar 2024-25 Performance; EBITDA Hits All-Time High

Ahmedabad (Gujarat): Adani Group has posted a stellar performance in the recently concluded financial year 2024-25 with its EBITDA hitting an all-time high of Rs 90,000 crore (USD 10.5 billion). It also made a record capital expenditure of Rs 126,000 crore (USD 14.7 billion) in 2024-25. Its Profit After Tax (PAT) rose to an all-time high of Rs 40,565 crore in 2024-25. The conglomerate as a whole…

0 notes

Text

बाजार में हाहाकार, Adani की Sanghi Industries का शेयर ₹51 पर लुढ़का

News Website: ब्लैक मंडे पर शेयर बाजार में कोहराम, Adani Group की Sanghi Industries का शेयर ₹51 पर लुढ़का नई दिल्ली | BETULHUB: शेयर बाजार में सोमवार को जबरदस्त गिरावट देखने को मिली। बीएसई सेंसेक्स 2,226.79 अंक यानी 2.95% की गिरावट के साथ 73,137.90 अंक पर बंद हुआ। दिनभर के कारोबार में यह एक समय 3,939.68 अंक तक गिरकर 71,425.01 अंक पर भी पहुंच गया था। इस भारी गिरावट से निवेशकों को एक ही दिन में…

0 notes

Text

Adani Power upper circuit: Adani Power share price zooms 5% for 2nd consecutive day; what should investors do?

Elevate Your Portfolio with Intensify Research" Call on 9111777433

#stock tips advisor#ideal strategies#stock cash market tips#accurate stock tips#share market advisory#best bank nifty option tips#trading tips#adani group

1 note

·

View note