#hindenberg research

Explore tagged Tumblr posts

Text

The long bezzle

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

When it comes to the modern world of enshittified, terrible businesses, no addition to your vocabulary is more essential than "bezzle," JK Galbraith's term for "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it"

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

The bezzle is contained by two forces.

First, Stein's Law: "Anything that can't go on forever will eventually stop."

Second, Keynes's: "Markets can remain irrational longer than you can remain solvent."

On the one hand, extremely badly run businesses that strip all the value out of the firm, making things progressively worse for its suppliers, workers and customers will eventually fail (Stein's Law).

On the other hand, as the private equity sector has repeatedly demonstrated, there are all kinds of accounting tricks, subsidies and frauds that can animate a decaying, zombie firm long after its best-before date (Keynes's irrational markets):

https://pluralistic.net/2023/06/02/plunderers/#farben

One company that has done an admirable job of balancing on a knife edge between Stein and Keynes is Verizon, a monopoly telecoms firm that has proven that a business can remain large, its products relied upon by millions, its stock actively traded and its market cap buoyant, despite manifest, repeated incompetence and waste on an unimaginable scale.

This week, Verizon shut down Bluejeans, an also-ran videoconferencing service the company bought for $400 million in 2020 as a panic-buy to keep up with Zoom. As they lit that $400 mil on fire, Verizon praised its own vision, calling Bluejeans "an award-winning product that connects our customers around the world, but we have made this decision due to the changing market landscape":

https://9to5google.com/2023/08/08/verizon-bluejeans-shutting-down/

Writing for Techdirt, Karl Bode runs down a partial list of all the unbelievably terrible business decisions Verizon has made without losing investor confidence or going under, in a kind of tribute to Keynes's maxim:

https://www.techdirt.com/2023/08/10/verizon-fails-again-shutters-attempted-zoom-alternative-bluejeans-after-paying-400-million-for-it/

Remember Go90, the "dud" streaming service launched in 2015 and shuttered in 2018? You probably don't, and neither (apparently) do Verizon's shareholders, who lost $1.2 billion on this folly:

https://www.techdirt.com/2018/07/02/verizons-sad-attempt-to-woo-millennials-falls-flat-face/

Then there was Verizon's bid to rescue Redbox with a new joint-venture streaming service, Redbox Instant, launched 2012, killed in 2014, $450,000,000 later:

https://variety.com/2014/digital/news/verizon-redbox-to-pull-plug-on-video-streaming-service-1201321484/

Then there was Sugarstring, a tech "news" website where journalists were prohibited from saying nice things about Net Neutrality or surveillance – born 2014, died 2014:

https://www.theverge.com/2014/12/2/7324063/verizon-kills-off-sugarstring

An app store, started in 2010, killed in 2012:

https://www.theverge.com/2012/11/5/3605618/verizon-apps-store-closing-january-2013

Vcast, 2005-2012, yet another failed streaming service (pray that someday you find someone who loves you as much as Verizon's C-suite loves doomed streaming services):

https://venturebeat.com/media/verizon-vcast-shutting-down/

And the granddaddy of them all, Oath, Verizon's 2017, $4.8 billion acquisition of Yahoo/AOL, whose name refers to the fact that the company's mismanagement provoked involuntary, protracted swearing from all who witnessed the $4.6 billion write-down the company took a year later:

https://www.techdirt.com/2018/12/12/if-youre-surprised-verizons-aol-yahoo-face-plant-you-dont-know-verizon/

Verizon isn't just bad at being a phone company that does non-phone-company things – it's incredibly bad at being a phone company, too. As Bode points out, Verizon's only real competency is in capturing its regulators at the FCC:

https://www.techdirt.com/2017/05/02/new-verizon-video-blatantly-lies-about-whats-happening-to-net-neutrality/

And sucking up massive public subsidies from rubes in the state houses of New York:

https://www.techdirt.com/2017/03/14/new-york-city-sues-verizon-fiber-optic-bait-switch/

New Jersey:

https://www.techdirt.com/2014/04/25/verizon-knows-youre-sucker-takes-taxpayer-subsidies-broadband-doesnt-deliver-lobbies-to-drop-requirements/

and Pennsylvania:

https://www.techdirt.com/2017/06/15/verizon-gets-wrist-slap-years-neglecting-broadband-networks-new-jersey-pennsylvania/

Despite all this, and vast unfunded liabilities – like remediating the population-destroying lead in their cables – they remain solvent:

https://www.reuters.com/legal/government/verizon-sued-by-investors-over-lead-cables-environmental-statements-2023-08-02/

Verizon has remained irrational longer than any short seller could remain solvent.

Short-sellers – who bet against companies and get paid when their stock prices go down – get a bad rap: billionaire shorts were the villains of the Gamestop squeeze, accused of running negative PR campaigns against beloved businesses to drive them under and pay their bets off:

https://pluralistic.net/2021/01/30/meme-stocks/#stockstonks

But shorts can do the lord's work. Writing for Bloomberg, Kathy Burton tells the story of Nate Anderson, whose Hindenburg Research has cost some of the world's wealthiest people over $99 billion by publishing investigative reports on their balance-sheet shell-games just this year:

https://www.bloomberg.com/news/features/2023-08-06/how-much-did-hindenburg-make-from-shorting-adani-dorsey-icahn

Anderson started off trying to earn a living as a SEC whistleblower, identifying financial shenanigans and collecting the bounties on offer, but that didn't pan out. So he turned his forensic research skills to preparing mediagenic, viral reports on the scams underpinning the financial boasts of giant companies…after taking a short position in them.

This year, Anderson's targets have included Carl Icahn, whose company lost $17b in market cap after Anderson accused it of overvaluing its assets. He went after the world's fourth-richest man, Gautam Adani, accusing him of "accounting fraud and stock manipulation," wiping out 34% of his net worth. He took on Jack Dorsey, whose payment processor Square renamed itself Block and went all in on the cryptocurrency bezzle, lopping 16% off its share price.

Burton points out that Anderson's upside for these massive bloodletting was comparatively modest. A perfectly timed exit from the $17b Icahn report would have netted $56m. What's more, Anderson faces legal threats and worse – one short seller was attacked by a man wearing brass-knuckles, an attack attributed to her short activism.

Shorts are lauded as one of capitalism's self-correcting mechanisms, and Hindenberg certainly has taken some big, successful swings at some of the great bezzles of our time. But as Verizon shows, shorts alone can't discipline a market where profits and investor confidence are totally decoupled from competence or providing a decent product or service.

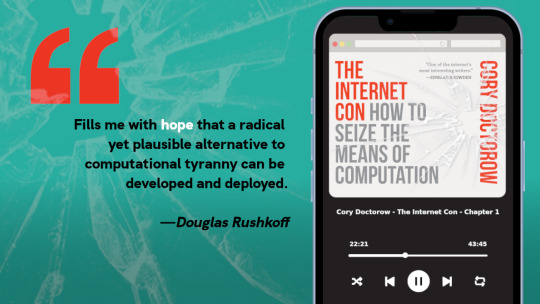

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/10/smartest-guys-in-the-room/#can-you-hear-me-now

#pluralistic#verizon#yahoo#tumblr#bluejeans#aol#vcast#redbox#go90#short sellers#hindenberg research#block#icahn#carl icahn#jack dorsey#square#nate anderson#gautam adani#adani group#icahn enterprises

138 notes

·

View notes

Text

[ID. The Hindenberg over Manhattan on May 6th, 1937. It is a smooth, long blimp. It has four tailfins; the top and bottom fins have bold Nazi flags on them. The image is black and white and taken from a plane slightly above the ship. End ID.]

it was pretty convenient for american history textbooks that the hindenburg burned swastika side first so they could use pictures of that without doing some very awkward explaining about why there was a nazi airship docking in new jersey

#HELLO???#my school never went over the hindenberg and it never interested me enough to do my own research til now-- WHAT?#it wasn't just a nazi sky boat it had fucking SWASTIKAS on the tailfins#oh my god!!!#the scraps were given back to Germany and used to make airships for the fucking luftwaffe#thank you this post for making me google Hindenberg and at least look at the wikipedia abt it#the images of the hindenberg having a lovely little nazi fucking voyage over manhattan got to me the worst#it makes sense. totally checks out for how the US was before joining the war. makes sense for the timeline. 37 would be a nazi year#was never told to me and i never put those pieces together bc i never cared all that much. god damn!

15K notes

·

View notes

Text

how the writing is going

Ok so. LOL. About the only thing I am effectively achieving this week *is* writing, and even that is not really..... I don't have a draft. But I have a whole bunch of sample snippets I've written to try and feel my way through the worldbuilding and discover the sorts of things the characters are likely to be preoccupied with, which is often how I figure out what a plot should be.

The next thing I thought about after dolphins was modes of transport besides sailing ships.

So this is a fairly high-tech society, but they do not have fossil fuels, and they don't have a large-scale power grid. I decided that for aesthetics, but as I'm unpicking my plot, I'm realizing that it makes sense. See, the main driver for all my plot devices is that there's a lot of sun activity-- sunspots, coronal mass ejections, magnetic field anomalies, that sort of shit. A power grid could not survive on a large scale. So all power generation is done in small, local installations-- some very local indeed, panels on rooftops, little waterwheels, tiny wind turbines. Industrial-scale power is generated in hydro plants and used right at the site for hydro-powered manufacturing-- much of it direct hydro-power, not converted to electricity. Just direct drive waterwheel shit. Because the sun can throw whatever shit it wants at the planet and your waterwheel won't notice or care.

That said. Communication over long ranges does pose a significant challenge. You're going to need line-of-sight semaphores and shit, which I had not worldbuilt in the earlier versions but absolutely could add in.

There should be trains, and I haven't really pondered those yet because I need to know more about my geography. Please, god, don't make me draw a map, but I'm gonna have to. Oh well.

But the other thing I thought of and got really excited about was

DIRIGIBLES

It's feasible with technology we currently have, and this is a thing that some large companies are pursuing, to make very large, hydrogen-filled, entirely solar-powered dirigibles for long-distance cargo transportation, faster than ships, the same speed as trucks/trains but more direct, slower than airplanes but INFINITELY lower carbon footprint. And hydrogen is outlawed by the FAA as a lifting gas, not because of the Hindenberg (which had many contributing factors) but because of a Congressional hearing which was presented by the helium lobby in the 20s. Hmmmmm.

A fascinating detail is that you could make a solar-powered lighter-than-air craft operate day and night seamlessly by having a power generation process where some of the day's collected solar energy directly powers the thing, and some of it goes toward... I forget the details but it powers a chemical reaction that, come nightfall, is simply set to reverse itself, which will then release most of the energy that it took to power the reaction in the first place, which you can now use to power your aircraft. Which is not a thing I knew about and I now have to research how that would work because, fascinating.

Anyway. In Fantasy World, there are totally dirigibles, and they're also probably operated by the Navy, and the water-ship sailors fucking hate them, LOL. This will be a wildly entertaining dynamic and I am rubbing my little paws together.

Also.

While feeling sort of brain-dead and stupid, I got a sheet of paper, went through a bunch of lists of historic names and lists of like, suggested baby names from various ethnicities, and I just made lists on this sheet of paper of men's names, women's names, arguably gender-neutral names, and then a huge pile of surnames, and then I sat down with a bullet-pointed list cribbed from the website of the museum of the USS Constitution of all the personnel that would be on a 44-gun frigate ca. 1812, and I first pondered each of the jobs, added some, took some away, came up with my own numbers of how many guys I needed, and then I just sat there and combined the first and last names in aesthetically pleasing ways to generate characters, lightly crossing out ones I'd used. (and sometimes googling them to make sure they're not somebody famous or something, which i always recommend with fictional character creation, especially if you're as oblivious as I am.)

I was unable to resist also coming up with some backstories-- siblings, little work histories, criminal pasts, notable traits, that sort of thing-- for many of the characters.

I did not make up names for every individual person on this ship, which I decided should have a crew of about 150-180, but I made up some names for every position, and considered age and gender as well for all of them.

I will not use many of the characters I've created this way, I'm sure, but the ones with interrelationships will totally somehow get used, and this way as I'm writing if I need a character I can find them already made, and if that person has a defined role, I already know which one and won't lose track of them.

This also got me to consider why people wind up in the jobs they do in this society, what drives them to seek out certain things, and that gave me a lot of background as to what's going on onshore.

I should try to find a list of a dirigible's crew and think about them, too, and build out the train people and routes and whatnot.

I also bought a used older edition on Thriftbooks of The Annapolis Book Of Seamanship and have been reading that with... more interest than I expected actually. I have the 1983 edition and it has a really moving little plea to let the women on your ship also learn to sail because it is foolish to relegate them to the kitchen when if only they were taught how it works, they could save you all in an emergency. LOL I wonder if that's worded differently in the updated new version or not.

23 notes

·

View notes

Text

Fusion is No Solution: An antidote to the usual, incredible hype

Alternative technology tends to be sold as small / human scale and so decentralisable and autonomous until such time as the ‘powers-that-be’ actually take it seriously, at which point it becomes a mega-project under centralised expert control. Witness wind power spawning huge 100m high wind farms, with wave power next to get the same treatment — and it’s typically those pushing such energy generation as ‘alternatives’ that get to be the experts ‘benevolently’ imposing them as soon as the government money starts to come in.

No one could pretend fusion is anything but hi-tech, highly centralised, highly expertise-dependant and demanding huge injections of funding and power, but some still believe it is somehow “clean” and can yield massive amounts of energy, like the old ‘Atoms for Peace’ / ‘too cheap to meter’ codswallop they used to sell us fission back in the 1950s. Needless to say, this is the opposite of the truth.

First off, the isotopes of hydrogen smashed together at super-hot (plasma) temperatures are radioactive. Sure enough, deuterium only has a half-life of 12 years — one reason why its use as a ‘doping agent’ in US nuclear weapons has quietly rendered most of them obselete — but the free neutrons generated by this process often impact the torus’s cladding and not the hydrogen fuel, which really is a long-term waste disposal problem.

Secondly, as well as being radioactive, tritium can cause cancer, birth defects and other such problems. Dealing with tritium emissions incidental to conventional fission reactors, the Conception Group discovered a Health & Welfare Canada (HWC) report admitting: [5]

a ‘statistically significant’ correlation of central nervous system (CNS) birth defects with large releases of tritium to air: five Pickering infants with CNS defects (anencephaly, microcephaly, spina bifida with hydrocephalus, and two others whose defect code was not on record) were born in January-July 1978, following the airborne tritium releases of April-October 1977. Medical experts link CNS birth defects to radiation exposure, as found after the atomic bombing of Japan.

Fusion researchers concede this is a problem, but claim they only need a small amount of tritium to initiate neutron emission from the deuterium. Engineers admit, however, that “a tritium inventory of 40 kg” as the minimum required to ensure viability.

Thirdly, as hydrogen is such a small molecule, virtually anything is porous to it, making containment much, much more difficult than for fissionable materials. Hydrogen is highly explosive (witness the Hindenberg!) and will be used in combination with super-high temperatures, making plant safety a big issue. One nuclear engineer frankly stated: [6]

“I would be a lot more concerned about a Tritium fire twenty miles away than a meltdown at a fission plant”. There are also likely to be day-to-day hazards caused by the intense electromagnetic forces used to keep the hydrogen plasma off the torus wall, likely affecting workers’ reproductive and central nervous systems and potentially causing leukaemia, if typical of other nonionizing radiation hazards. The same spectacle as occurred at Sellafield — where workers there were warned not to have children — is likely to occur at any future viable fusion plant.

Fourthly, as noted already, both tritium and deuterium are key components of nuclear weapons — indeed, it was Lawrence Livermore’s Edward Teller (a.k.a. ‘Doctor Strangelove’) that first promoted them in the form of the hydrogen bomb, while he was still at Los Alamos — and so represents a proliferation risk, with all the ‘security state’ ramifications of that. So much for ‘fusion for peace’, not that anyone has ever pretended anything so patently stupid — and as Karl Jung argued against fission in his Nuclear State three decades ago, a nuclear state is inevitably ultimately also a totalitarian state.

Fifthly, fusion is mega-science feeding a Promethian mega-science mentality, with huge resources diverted into keeping such experts on the hitech gravy train. The CANDU torus (also known as ITEC) cost the Canadian government £14 billion when established in 1992. It is a pure research facility which will never generate a watt of electricity for nonresearch use and, typical of those that have had a living gifted to them, all objections by citizen groups such as Sierra Club Canada have so far arrogantly been waved aside.

Finally, despite the industry hype we’d all be on fusion power by 1980, not a watt of electricity has been generated by fusion for research purposes as well as for non-research ones. Nuclear engineers admit: [7]

The biggest issue facing DT is the actual breeding of the tritium in the Lithium blanket. It is not a simple problem and may be the death of DT fusion if no practical way of efficiently breeding the tritium and harvesting it quickly without having even minimal losses. This is the part that is the most pessimistic, in my opinion.

In other words, that fusion has always been complete hype and that they may never get it working at all. In this, it certainly is fission+, where at least it was only the safe disposal of the waste they hadn’t figured out before spinning stories to suck the public purse dry.

#green#tech#anarchism#green anarchism#Green Anarchist#70#Mr. Blobby#technology#anarchy#anarchist society#practical anarchy#practical anarchism#resistance#autonomy#revolution#communism#anti capitalist#anti capitalism#late stage capitalism#daily posts#libraries#leftism#social issues#anarchy works#anarchist library#survival#freedom

3 notes

·

View notes

Text

Expert committee was constituted by Supreme Court in the wake of hindenberg report

Background of the case : Vishal Tiwari v. Union of India & Ors.

A bunch of 04 Writ Petitions have been filed before the #SupremeCourt of India in the wake of #Hindenberg Report.

The report alleges, that the #Adani Group of companies has manipulated its share prices; failed to disclose transactions with related parties and other relevant information concerning related parties in contravention of the regulations framed by SEBI; and violated other provisions of securities laws. The report also states that Hindenburg Research has taken a short position in the Adani Group companies through US traded bonds and non-Indian traded derivative instruments.

Directions sought in Writ Petitions

The 04 #WritPetitions separately seek directions from the Apex Court;

Directions to the Union of India and the #UnionMinistryofHomeAffairs to constitute a committee headed by a retired judge of the Supreme Court to investigate the contents of the report published by Hindenburg Research;

Directions to the Union Ministry of Home Affairs to register an #FIR against Mr. Nathan Anderson (#founder of Hindenburg Research) and his associates for short selling, and for directions to recover the profits yielded by the short selling to compensate investors;

Sought a #courtmonitoredinvestigation by a #SpecialInvestigationTeam or by the Central Bureau of Investigation into the allegations of fraud and the role played by top officials of leading public sector #banks and other #lender institutions

Sought directions to any investigative authority to: (i) investigate the Adani Group companies under the supervision of a sitting judge of this Court; and (ii) investigate the role of LIC and SBI in these transactions.

Expert Committee Constituted by Apex Court

The Bench of the Apex Court comprising Hon’ble CJI Dr. D Y Chandrachud, Hon’ble Justice P S Narasimha & Hon’ble Justice J B Pardiwala vide their order dt. 02.03.23 constituted an Expert committee to protect the investors from the volatility of the kind headed by Justice Abhay Manohar Sapre, a former judge of the Supreme Court. The committee comprises Mr. O P Bhatt, Justice J P Devadhar (retired), Mr. KV Kamath,Mr. Nandan Nilekani & Mr. Somashekhar Sundaresan.

Report in two months

The Committee is requested to furnish its report in sealed cover to this Court within two months.

The Committee shall remit on the following:

Provide overall assessment of the situation including the relevant causal factors which have led to the volatility in the securities market in the recent past;

To suggest measures to strengthen investor awareness;

To investigate whether there has been regulatory failure in dealing with the alleged contravention of laws pertaining to the securities market in relation to the Adani Group or other companies; and

To suggest measures to (i) strengthen the statutory and/or regulatory framework; and (ii) secure compliance with the existing framework for the protection of investors.

The Apex Court in its order dt. 10.02.2023 noted the need of reviewing existing regulatory mechanisms in the financial sector to protect Indian investors from volatilities in the market. And suggested Solicitor General of India that to seek instructions from the Union of India on the constitution and remit of an expert committee.

SEBI’s suggestion for securing the interest of the investors:

Mandatory disclosures by listed companies to facilitate free and fair price discovery and to ensure that all investors have equal access to material information for them to be able to take informed investment decisions;

Market systems to ensure seamless trading and settlement including volatility management;

Enforcement action in the event of misconduct in the market including fraud or violations of SEBI regulations.”

With respect to the aforesaid Writ Petitions SEBI submitted, it is already enquiring into, the allegations made in the Hindenburg report as well as the market activity immediately preceding and post the publication of the report and it will not be appropriate to report the details at this stage.

Seema Bhatnagar

1 note

·

View note

Text

Prosecutors seek Icahn Enterprises data after Hindenberg Research Report

Federal prosecutors have requested information from Carl. Icon Icahn Enterprises, prompted by a report from short seller Hindenburg Research questioning the company’s asset valuation policy, the holding company announced Wednesday.

View On WordPress

0 notes

Text

Hydrogen-breathing aliens? Study suggests new approach to finding extraterrestrial life

by David Rothery

An exoplanet and its atmosphere pass in front of its star (artist’s impression, from an imaginary point near to the planet). NASA Goddard Space Flight Center

The first time we find evidence of life on a planet orbiting another star (an exoplanet), it is probably going to be by analysing the gases in its atmosphere. With the number of known Earth-like planets growing, we could soon discover gases in an exoplanet’s atmosphere that are associated with life on Earth.

But what if alien life uses somewhat different chemistry to ours? A new study, published in Nature Astronomy, argues that our best chances of using atmospheres to find evidence of life is to broaden our search from focusing on planets like our own to include those with a hydrogen atmosphere.

We can probe the atmosphere of an exoplanet when it passes in front of its star. When such a transit happens, the star’s light has to pass through the planet’s atmosphere to reach us and some of it is absorbed as it goes. Looking at the star’s spectrum – its light broken down according to its wavelength – and working out what light is missing because of the transit reveals which gases the atmosphere consists of. Documenting exoplanet atmospheres is one of the goals of the much-delayed James Webb Space Telescope.

If we were to find an atmosphere that has a different chemical mix to what we would expect, one of the simplest explanations would be that it is maintained that way by living processes. That is the case on Earth. Our planet’s atmosphere contains methane (CH₄), which naturally reacts with oxygen to make carbon dioxide. But the methane is kept topped up by biological processes.

Another way to look at this is that the oxygen wouldn’t be there at all had it not been liberated from carbon dioxide by photosynthetic microbes during the so-called great oxygenation event that began about 2.4 billion years ago.

Look beyond oxygen atmospheres

The authors of the new study argue that we should start investigating worlds larger than the Earth whose atmospheres are dominated by hydrogen. These may not have any free oxygen, because hydrogen and oxygen make a highly flammable mixture.

The hydrogen-filled Hindenberg airship destroyed by fire in 1937. Such a fire could not happen on a world with an oxygen-free hydrogen atmosphere. Murray Becker/Associated Press

Hydrogen is the lightest of all molecules and escapes to space easily. For a rocky planet to have gravity strong enough to hang on to a hydrogen atmosphere, it needs to be a “super-Earth” with a mass between about two and ten times the Earth’s. The hydrogen could either have been captured directly from the gas cloud where the planet grew, or have been released later by a chemical reaction between iron and water.

The density of a hydrogen-dominated atmosphere decreases about 14 times less rapidly the higher up you go than in an atmosphere dominated by nitrogen like the Earth’s. This makes for a 14-times greater envelope of atmosphere surrounding the planet, making it easy to spot in the spectra data. The greater dimensions would also improve our chances of observing such an atmosphere by direct imaging with an optical telescope.

Hydrogen-breathing in the lab

The authors carried out laboratory experiments in which they demonstrated that the bacterium E. coli (billions of which live in your intestines) can survive and multiply under a hydrogen atmosphere in the total absence of any oxygen. They demonstrated the same for a variety of yeast.

Although this is interesting, it does not add much weight to the argument that life could flourish under a hydrogen atmosphere. We already know of many microbes within the Earth’s crust that survive by metabolising hydrogen, and there is even a multicellular organism that spends all its life in an oxygen-free zone on the floor of the Mediterranean.

Spinoloricus, a tiny but multicellular organism that apparently requires no oxygen to live. Scale bar is 50 micrometres. Roberto Danovaro, Antonio Dell'Anno, Antonio Pusceddu, Cristina Gambi, Iben Heiner & Reinhardt Mobjerg Kristensen

Earth’s atmosphere, which started out without oxygen, is unlikely ever to have had more than 1% hydrogen. But early life may have had to metabolise by reacting hydrogen with carbon to form methane, rather than by reacting oxygen with carbon to form carbon dioxide, as humans do.

Biosignature gases

The study did make an important discovery though. The researchers demonstrated that there is an “astonishing diversity” of dozens of gases produced by products in E. coli living under hydrogen. Many of these, such as dimethylsilfide, carbonyl sulfide and isoprene, could be detectable “biosignatures” in a hydrogen atmosphere. This boosts our chances of recognising life signs at an exoplanet – you have to know what to look for.

That said, metabolic processes that use hydrogen are less efficient than those using oxygen. However, hydrogen breathing life is already an established concept so far as astrobiologists are concerned. Sentient hydrogen breathers have even made appearances in some rationally-based science fiction, such as the Uplift novels of David Brin.

The authors of the new study also point out that molecular hydrogen in sufficient concentration can act as a greenhouse gas. This could keep a planet’s surface warm enough for liquid water, and hence surface life, further from its star than would otherwise be the case.

The authors shy away from considering the chances of finding life in giant gas planets like Jupiter. Even so, by expanding the pool of habitable worlds to include super-Earths with hydrogen-rich atmospheres, they have potentially doubled the number of bodies we could probe to find those first elusive signs of extraterrestrial life.

About The Author:

David Rothery is Professor of Planetary Geosciences at The Open University

This article is republished from our content partners over at The Conversation under a Creative Commons license.

17 notes

·

View notes

Text

You ever just feel the need to research random historical events?? Like you'll be getting into bed and suddenly?? The Hindenberg ?? I wonder how many people died?? Was it really big? The Treaty of Versailles ?? Attack on Pearl Harbour?? WhO WAS THE 1ST TSAR OF RUSSIA

1 note

·

View note

Text

Imagined communities and societal myths....

An Imagined community- a socially constructed nation, imagined by the people who perceive themselves as part of that group.

Ralph Lauren began to build his brand with the concept of nostalgia as his main focal point. He marketed his clothes by designing garments that provoke a sense of ivy league privilege. this, in turn, was able to convince buyers that by purchasing the garment you were buying into that lifestyle. The desired market for this product, over time, became not the elite but the community who wanted to be considered an elite. Due to the fact that this marketing technique was so successful, many brands have emulated this behavior which has enabled them to create brand loyalty in their consumers.

Similarly, the ad campaign for ‘JUUL’ (a vape company) has been able to create this feeling in a similar way. Their target audience may be different from that of Ralph Lauren but by exploiting the idea of an imagined community of Juul users in their campaign they have managed to successfully sell this idea.

After doing some more research into this, I discovered that although their product was not initially aimed at teenage consumers, the Juul became very popular around consumers of this age range in the USA.

Roman Vishniak

(Vishniaks daughter Mara posing in front of an election poster for Hindenberg and Hitler that reads ‘ The Marshal and Corporal: Fight with Us for Peace and Equal Rights,’ Wilmersdorf, Berlin), 1933

silver gelatin print

In my opinion, the significance of this image lies within the fact that Vishniak has chosen to place his daughter at the far left end of his photograph, which allows the viewer to recognise the most important element (being the propaganda posters). The eye is drawn to the two male figures in the central poster, possibly suggesting that they are dominant figures. Even if the onlooker of this image has no knowledge of who the Hitler was, they will still be able to infer that he was a man of importance of that time due to the gravitas brought on by his positioning in this photograph.

Although we see photographs in our everyday lives, it is rare that one considers the significance that they hold... they provide us with a snapshot of reality ( if they have not been manipulated by the photographer).

In my opinion, the one thing that has always fascinated me about photography is that producers are able to instill their own ideologies into their images from the moment that they set up the framing of the shot.

According to theorist Roland Barthe on the topic of semiotics, the creator will utilise particular signs in their work that will conjure up themes or images of a time or subject. e.g. a fox is often used to symbolise deception. This is useful for when the media producer is interested in receiving a preferred reading of the media product.

In terms of the myths that are formed from appropriating popular culture, I believe that society has become very much dependant on these in order to have an element of fantasy in their lives. I think that there is a great need for painting a picture of an ideal world in today's society. Particularly for my own generation, I feel that we like to present a particular image our ourselves to the world and this is repeated by others which essentially helps to build the imagined community that I have mentioned previously.

anyways..... i wrote way too much for this one. so I'm gonna stop now :)

0 notes

Text

Ey yo fuckers

You remember how i said i’d make a list of good games n shit right? Well here the fuck it is scoob. PLEASE REBLOG THIS IT TOOK HOURS TO PUT TOGETHER OH MY GOD

Cute Demon Crashers! - Cute Demon Crashers! is a silly little short game that gives a lazy virgin college student a fun and safe space to explore her first sexual experience with a partner of her choice, if she so desires. Warnings: 18+

Desolate village - Desolate Village is a Adventure-horror game developed for the 2016 Pixel Horror Jam. The game deals with a the protagonist name Alex, as he wakes up in a village filled with talk animals villagers that all know who he is. But Alex does not remember who they are or how they got in the village. Warnings: Gore

Lads in Distress - The whole of Lunar Kingdom is abuzz with excitement and curiosity - Princess Charming is throwing a royal ball to celebrate her 18th birthday, much to everyone's surprise. Invitations have been sent to nobles and royals from all neighboring nations, although Charming and her parents only really care about the princes. After all, everyone knows that the true purpose of the ball is for Charming to find a man suitable as her husband so she can form an advantageous political alliance, or even merge their nations together, to save her kingdom from poverty. Unfortunately (or perhaps fortunately?) for Charming, the princes may need to be rescued just as much as her kingdom does. Warnings: None

Love Is Strange - In Love is Strange, you play as Max Caulfield, an 18-year-old in her second year at the prestigious Blackwell Academy in the sleepy seaside town of Arcadia Bay, Oregon. Max, who aspires to become a famous photographer, finds herself challenged by the prospect of entering a photography contest hosted by her school. To be able to enter the contest, she has to pick a partner to work with. From there on out, what happens is up to you. Warnings: None (that i’m aware of, it didn’t interest me enough to finish it (not saying it’s bad!!! just not my cup of tea))

Out of sight - When Lina decided to go to the park to finish reading a book she couldn't have anticipated that misplacing her glasses could lead to paranormal encounters. Warnings: Death

Pretty please - A short game about a lady who goes into a beauty clinic to "fix a few things". Warnings: blood, mildly unsettling imagery

Seduce me the otome - "It seemed like the start of something new. Something that would change." You are a senior in high school along with your two best friends, Naomi Patterson and Suzu Cappini. You are also the granddaughter of Harold Anderson, the CEO and founder of Anderson Toys, a toy company sworn to give children amazing products and give a large part of their profit to charity. One day, you get called home to attend your grandfather's funeral. After the funeral, you learn that you have inherited his large estate. Your father suggests you move in immediately, so the next day, you move out of your parents home and into your estate. When you enter your new home, however, you see five injured, yet very handsome men on the lobby floor. They eventually awaken and make it known that they were attacked by a group of dangerous 'misfits' and ran to find shelter, passing out as soon as they entered your home. You find out that they are incubi, 'demons who consume and use sexual energy of humans to survive'. With nowhere to go and a target on their backs, they ponder what what to do. Out of sympathy, you offer your home as refuge for a while in exchange for minor servitude (it is a big house, after all). They happily agree. What will happen as the incubi get comfy? Why exactly did they come the human world? Who are the 'misfits', and will they stop pursuing them so the incubi can leave? ...Will you WANT them to leave? (it has a sequel, among other things!! very good!!!!!) Warnings: mentions of blood, guns & other weapons, optional sex scenes

The shadows that run along side our car - The road is long. Two strangers sit side by side as night falls over. The car speeds down the open highway. Without a soul around them, everything seems to slip away. On a journey to no one knows where, all they have is words and time. And that time is dwindling fast. The shadows are chasing. Warnings: mentions of suicide, violence, death, and mentions of zombies (im not sure if they actually show up, ill update this if i see any)

Solanaceae Another Time - After bumping into a strange witch, Sal is told he was once the witch's lover in a past life. Though doubtful, Sal takes a leap of faith and gets his fortune read by the witch. What he learns sends him on a month long journey of self discovery and magical encounters... Warnings: sex (but you can avoid this in the start of the game)

This, my soul - When your ship and fellow crew members are destroyed during a routine mission by space debris, you are rescued by the one laborer-class android who happened to be nearby... Now the two of you must spend an entire three-month journey alone with each other aboard the small, maintenance ship that is taking you back to civilization. Along the way, there is little on board to keep you occupied... save the android. He calls himself Silas. As the situation forces you to get to know one another, you quickly figure out that while he may not have emotions the way WE understand them, he IS a construct designed to learn, adapt, and serve... Warnings: suggestive content

Cinderella Phenomenon - Four years after the end of the Great War and the loss of her mother, Crown Princess Lucette of Angielle is still struggling to come to terms with her new life and step-family. Cold-hearted and bitter, Lucette fails to recognize the suffering of those around her as she is consumed by grief and resentment. But Lucette's life is once again turned upside down when she becomes a victim of the Fairytale Curse.Join Lucette as she goes from riches to rags and journeys to regain her life and break her curse. Warnings: none as of yet, but i’m still playing through

Unfinished games:

What's your sign quiz - In this teaser story, the 12 signs of the Zodiac need your help. But not before getting to know you a little first! This game is a personality quiz where they try to guess... What's Your Sign? With the option of a short or long quiz (12 or 24 questions), there's lots of replay ability with the various responses you'll get. Get to know all of your astrological faves before you begin your magical adventure together! Warnings: none

Date or Die - In this demo, you'll see the opening moments of the game, where you'll be introduced to the cast of characters, find your match, and get an overview of the stakes involved. In addition to containing a completely different script from the original demo, this prologue also features new sprites and artwork for all characters, introduces one or two faces you might not have seen before, and gives you a clearer idea of what to expect when you first open the full game! Warnings: mentions of killing, and treats toward a younger unseen party

Dr.Frank - After being kicked out of both his PhD program (plant science) as well as medical school (Pathology), Dr. Frank had pretty much resolved himself to a life of solitude and science. That is, until a handsome stranger knocked on his door and swept him off his feet. Dominik seemed to be the perfect boyfriend- attentive, caring, and interested in Dr. Frank's work. Maybe too interested. Three months into the rainbow-colored relationship, Dominik runs off with Dr. Frank's lifelong research on resurrection to present at the annual prestigious Hindenberg University Conference, under his own name. Livid, Dr. Frank decides the only course of action: Revenge. Not only is Dr. Frank going to one-up Dominik's presentation by presenting the world's first artificial life form, but Dr. Frank is going to make said life form the world's hottest, most beautiful boyfriend. EVER. Warnings: grave robbing, bad jokes

Paws and Effect My Dogs Are Human! - Charlie's got everything a quirky millennial could want: A new job, an upcoming party, and super-cute Pomeranians. Naturally, it all goes wrong. Charlie's birthday is in a few days and she's looking forward to a quiet, at-home party with a few friends. But a small (read: not small) problem arises when, due to inexplicable circumstances, her two Pomeranians transform into humans! Why did this happen? What can be done? Can dogs be trusted with fingers? With more questions than answers, Charlie finds herself embroiled in a nonsensical adventure with her once-canine companions. As her dogs' many personality quirks hound them in their human lives, how will Charlie cope with her new circumstances? Warnings: none as of yet

The Letter - In the outskirts of Luxbourne City stands a 17th-century English mansion, rumored to be haunted by vengeful spirits. After reading a letter discovered inside on the day of its open house, seven people find themselves trapped in a vicious cycle of madness plaguing the Ermengarde Mansion for centuries. Will they be able to free themselves from it, or will they become another casualty? Warnings: death, disturbing imagery, blood, gore, jumpscares, general horror warnings

7 notes

·

View notes

Text

Celebrate Armistice Day with These 4 World War I Games

At the eleventh hour of the eleventh day of the eleventh month in 1918, Germany entered into an armistice with the Allied powers, officially ending the Great War. The substantial losses suffered fighting for the end of the conflict have never been forgotten, their sacrifice honored every year on November 11. As the United States salutes its veterans, the world gathers in thought to commemorate the victory achieved with the signing of the armistice.

This Armistice Day, take a few moments to revisit the early 20th-century war in a digital historical setting. The following games recreate elements of the Great War, immersing players in an experience that may help them appreciate the reality of the fight that cost more than 9 million lives.

Battlefield 1

(PC, PS4, Xbox One)

Compare a list of World War I games to one of World War II titles, and you’ll notice a glaring discrepancy. The First World War receives much less attention in pop culture, which is what makes games like Battlefield 1 so important. It may not have been the best Battlefield game to come from the DICE development team, but it’s difficult to contest that it has been one of the most historically significant.

A video game will never truly capture the horrors of World War I. Battlefield 1 tries hard, though, starting players off with a prologue that attempts to show the weight of the war. Players bounce between different members of the Harlem Hellfighters during a German onslaught in France. It’s a futile effort to hold the defensive position as each player-controlled character succumbs to the conflict. The rest of the game is a bit less morose, but the Harlem Hellfighter opening reminds players that the war had real casualties - and it’s those fallen soldiers that we commemorate on Armistice Day.

Battlefield 1’s campaign takes players all over the Eastern Front, from the Gallipoli Campaign to an aerial conflict over a German encampment. It’s a relatively broad scope of the conflict, ensuring players see multiple sides of the Great War.

Valiant Hearts: The Great War

(Android, iOS, PC, PS3, PS4, Switch, Xbox 360, Xbox One)

What DICE attempted to do in the opening minutes of Battlefield 1, Ubisoft Montpellier made the entire basis of Valiant Hearts: The Great War. When we talk about war, it’s so easy to overlook the stories that unfold amidst the smoke and gunfire. In Valiant Hearts, players are introduced to four unique characters with interconnected destinies in the heart of the Great War. Though they’re told through a vibrant 2D, animated comic book, the stories in The Great War have no issues pulling heartstrings and focusing on the drama of war.

To unravel this quartet of tales, players explore battlefields, complete puzzles, and fully immerse themselves in futile combat. In Valiant Hearts, it’s not about padding your kill/death ratio but surviving in one of the world’s darkest times.

Though the stories are a work of fiction, you know they’re not far from the real tales of the men that stormed the battlefields. This adds weight to every decision you make as you start to feel like the director of a World War I soldier’s harrowing journey.

Tannenberg

(PC, PS4, Xbox One)

World War I historians will recognize Tannenberg as the battle that almost annihilated the Russian Second Army. Named by German Field Marshal Paul von Hindenberg to honor the failure of the Teutonic Knights at the Battle of Grunwald (1410), the Battle of Tannenberg pushed the Russian army out of East Prussia.

The Russian/German conflict is the subject of Tannenberg, a 64-player historical multiplayer experience from M2H Blackmill Games. Though the game isn’t a recreation of the Battle of Tannenberg, it borrows locations from the East Prussian Campaign to send players to authentic battlegrounds on the Eastern Front.

M2H Blackmill Games emphasized authenticity, ensuring everything from the maps down to the uniforms bore a resemblance to their real-world counterparts. The gameplay is similar to most large-scale multiplayer shooters, but Tannenberg does feature the Maneuver game mode inspired by how the war unfolded across the Eastern Front. Oversized maps feature shifting battle lines that must be taken to claim victory in the unique multiplayer match.

Unfortunately, in its quest for authenticity and realism, M2H also added unnecessary gore mechanics that may come across as inappropriate.

Darkest Hour: A Hearts of Iron Game

(PC)

For players that enjoy an overview of history, a team of modders at a Paradox Interactive forum took the core experience of Hearts of Iron and created Darkest Hour. The grand strategy game launches with the start of World War I, but also recognizes that history didn’t stop when Germany surrendered.

Though you’ll be celebrating the end of the war in the real world, the in-game clock will simply fast forward to the next conflict. And it’s a cycle that repeats across multiple campaigns well into the 20th century. Whether you’re strategizing through the Invasion of Poland or watching the start of the Great War in 1914, you’ll find yourself immersed in a deep and engaging game that utilizes the best of Hearts of Iron.

Darkest Hour will test your ability to lead and command with a vast selection of mechanics to keep an eye on. Changes to Hearts of Iron for Darkest Hour include a new map that provides greater detail and a revamped artificial intelligence.

--

At SJR Research, we specialize in creating compelling narratives and provide research to give your game the kind of details that engage your players and create a resonant world they want to spend time in. If you are interested in learning more about our gaming research services, you can browse SJR Research’s service on our site at SJR Research.

0 notes

Text

Shares of Tesla rival Nikola crater after ‘fraud’ accusation

One of Tesla’s main rivals is planning to take legal action against an activist short-seller that accused it of being “an intricate fraud.”

Shares of electric automaker Nikola — which like Tesla is named after the 19th-century inventor — were down more than 15 percent Friday afternoon after a report from Hindenburg Research accused founder Trevor Milton of lying about his company’s tech in order to score a major partnership with General Motors.

Hindenberg shorted the stock on Thursday and said that it had gathered “extensive evidence — including recorded phone calls, text messages, private emails and behind-the-scenes photographs — detailing dozens of false statements” by Milton.

Among the accusations leveled against Nikola is that a January 2018 video of its Nikola One semi truck driving on the highway was staged. Hindenburg wrote that it had found the Utah road where the video was shot and determined that a truck put in neutral could reach speeds of more than 50 miles per hour on it. Hindenburg said that Nikola had the truck towed to its starting point and “simply filmed it rolling down the hill.”

Hindenburg’s accusations arrive just days after General Motors took an 11-percent stake in the company — a multibillion-dollar partnership which would see GM engineer and manufacture the all-electric Badger pickup that the Phoenix-based startup first unveiled in February. Nikola will also get access to GM’s Ultium batteries and Hydrotec fuel cells, which it will use in the electric semi trucks it is developing.

Nikola’s stock surged as much as 53 percent following the Tuesday announcement, but has now given up all of its gains, plus an additional 10 percent loss.

“To be clear, this was not a research report and it is not accurate. This was a hit job for short sale profit driven by greed,” Nikola said in a statement. “We have nothing to hide and we will refute these allegations.”

The Phoenix-based company said it intended to bring the actions of the activist short-seller, along with evidence and documentation, to the attention of the Securities and Exchange Commission.

Hindenburg founder Nathan Anderson said in a statement on Friday that his firm would welcome a lawsuit by Nikola.

“The company answered none of the 53 questions we raised in our report after promising a full rebuttal,” he said.

“We are pleased that Nikola is engaging with the SEC and we are not surprised that Trevor Milton is not commenting further on advice of counsel.”

Milton tweeted on Friday that Hindenburg’s questions are “easy to comment on”, and he will release a detailed response soon.

Nikola shares were down 15.8 percent Friday afternoon, trading at $31.63.

With Post wires

The post Shares of Tesla rival Nikola crater after ‘fraud’ accusation appeared first on The Lastes US & World News - Opinion, Entertainments, Sports,....

from Bussiness – The Lastes US & World News – Opinion, Entertainments, Sports,… https://ift.tt/3iqPizM via https://usagag.com

0 notes

Text

Adani group shares recovered after Hindenberg impact report, but domestic mutual funds reduce holdings in group shares

Adani Group Shares: Following the massive drop in Adani Group shares following the Hindenburg Research report, all of the group’s shares are trying to recover from the lower levels. But mutual funds have not stopped selling their stake in the group’s publicly traded companies. Mutual funds have invested only 0.9 percent in Adani Group stocks of their total assets of $182 billion through March…

View On WordPress

0 notes

Text

Two Companies Hit with COVID-19-Related D&O Lawsuits

A California-based vaccine development company has been hit with a coronavirus outbreak-related securities class action lawsuit, based on the company’s statements about its COVID-19 vaccine development efforts and about the company’s participation in a federal government vaccine development program. In addition, in a separate development, a different company has been hit with a coronavirus outbreak-related shareholder derivative lawsuit, based on the company’s statements concerning its ability to provide COVID-19 testing kits.

Vaxart Securities Class Action Lawsuit

According to the complaint in the securities class action lawsuit filed against the company on August 24, 2020, at the beginning of 2020, Vaxart, a vaccine development company, had only 14 full-time employees and a market capitalization of $17 million. Its largest shareholder, Armistice Capital LLC, owned shares and warrants representing about a 30% ownership stake in the company.

In early 2020, the company’s share price began to climb, from just 0.35 per share to $2.92 per share on June 2, 2020, following several statements by the company about its efforts to develop an oral COVID-19 vaccine.

On June, 8, 2020, the securities complaint alleges, the company amended Armistice’s warrant agreements, allowing Armistice to exercise its warrants immediately. The company also issued millions of dollars of stock options to Vaxart’s most senior executives.

On June 25, 2020, the company issued a press release announcing that it had entered an agreement to enable production of one billion or more COVID-19 vaccine doses annually. The company’s share price doubled on the announcement, from $3.61 per share to $6.26 per share.

On June 26, 2020, the company issued another press release stating that Vaxart’s vaccine had been selected for the U.S. government’s “Operation Warp Speed” (a government initiative to encourage development of a COVID-19 vaccine). This announcement caused the company’s share price to rise to a high of $14.30.

Between June 26 and June 29, 2020, the complaint alleges, Armistice exercised all of its warrants and then sold over 27.6 million Vaxart shares, reaping profits of approximately $200 million.

On July 25, 2020, the complaint alleges, “details emerged revealing Defendants’ deception” concerning “their pump and dump scheme.” On July 25, the New York Times published an article entitled “Corporate Insiders Pocket $1 Billion in Rush for Coronavirus Vaccine” (here), reporting, among other things, on Vaxart’s executives and major shareholders significant profits in trading in the company’s shares following the company’s announcement of its participation in Operation Warp Speed. The Times article reported that Vaxart “is not among the companies selected to receive significant financial support from Warp Speed.” The complaint alleges that the company’s share price declined on this news.

On August 24, 2020, a plaintiff shareholder filed a securities class action lawsuit against the company, its current CEO, its former CEO (and director), Armistice, and two Armistice executives who served on the Vaxart board. The complaint states that the action arises from “Defendants’ fraudulent scheme to profit from artificially inflating the Company’s stock price by announcing false and misleading information concerning Vaxart’s oral COVID-19 vaccine candidate, including its purported involvement in ‘Operation Warp Speed’ (OWS), a program which commits federal government to massive funding for the development of COVID-19 vaccines.”

The plaintiff shareholder purports to represent a class of investors who purchased Vaxart securities during the period June 25, 2020 to July 25, 2020. The complaint alleges that the defendants violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder, and seeks damages on behalf of the class.

SCWorx Derivative Suit

In a separate development, on August 21, 2020, a plaintiff shareholder filed a derivative lawsuit in the Southern District of New York against the board of directors of SCWorx Corp., as well as against the company itself as a nominal defendant. A copy of the derivative lawsuit complaint can be found here.

SCWorx is a healthcare information software services company. The derivative lawsuit is based on alleged misrepresentations the company allegedly made with respect to a contract the company had entered for the sale of COVID-19 test kits. The company’s share price rose on news of the agreement, but later fell following an online report raising questions about the agreement. As discussed here, the company and certain of its directors and officers previously had been hit with a securities class action lawsuit based on essentially the same allegations.

The complaint alleges that in an April 13, 2020 press release (here) referring to a “first installment purchase order,” the company announced that it had “received a committed purchase order” for two million COVID-19 Rapid Testing Units, with provision for additional weekly orders of 2 million units for 23 weeks, valued at $35 million per week. According to the press release, the purchase order came from Rethink My Healthcare.

On April 17, 2020, the company issued a second press release (here), in which the company said that it “confirms previously disclosed plans to distribute COVID-19 Rapid Testing Units.” The press release again referenced the committed purchase order from Rethink My Healthcare. The press release also said that SCWorx “continues to anticipate receiving the first 2 million rapid detection kits within approximately two weeks and looks forward to providing incremental updates as they become available.”

According to the complaint, in a separate development on April 17, 2020, online research firm Hindenburg Research published a report (here) captioned with a title reading in part “Evidence Points to its Massive COVID-19 Test Deal Being Completely Bogus.”

According to the Hindenberg report, the CEO of the supplier from which SCWorx reportedly was buying the test kits, Promedical, “formerly ran another business accused of defrauding investors” and was “alleged to have falsified his medical credentials.” Promedical supposedly was sourcing the test kits with a Chinese company called Wandfo, but, the analyst report claims, “Wandfo put out a press release days ago stating that Promedical ‘fraudulently misrepresented themselves’ as sellers of its Covid-19 tests and disavowed any relationship.” The analyst report further said that the buyer that SCWorx claimed to have lined up does not appear to be “capable of handling hundreds of millions of dollars of orders.”

According to the complaint, the company’s share price fell 17% over three consecutive trading sessions following the publication of the analyst’s report.

On April 21, 2020, the SEC halted trading of the Company’s stock, effective April 22, 2020.

The complaint seeks to recover damages from the defendant directors for breaches of their fiduciary duties as directors and/or officers of SCWorx, unjust enrichment, abuse of control, gross mismanagement, waste of corporate assets, and for contribution under Sections 10(b) and 21D of the Securities Exchange Act of 1934.

Discussion

According to my tally, the securities suit filed against Vaxart represents the 20th corornavirus outbreak-related securities class action lawsuit that has been filed so far. (As I have noted in prior posts about coronavirus-related securities litigation, my tally differs from other published tallies, as I have included in my tally a number of securities suits that others have not.)

The securities suits generally fall into three categories: (1) companies that have been sued because the companies experienced a COVID-19 outbreak in company facilities (for example, cruise lines and a private prison system); (2) companies, like Vaxart, that are alleged to have made misleading statements about the company’s ability to profit from the pandemic; (3) companies who share prices declined due to business interruption or revenue downturn as a result of the pandemic or government stay-at-home orders. We probably will continue to see more lawsuits in the second category, but going forward I think we will see more lawsuits falling in the third category.

Though there have now been (at least according to my count), at least 20 coronavirus-related securities class action lawsuits filed, that is a relatively modest number of cases, at least in the context of securities class action lawsuit filing patters over the last three years, in which the total number of securities suits exceeded 400 per year. To be sure, a total of 20 suits does represent a significant phenomenon, worth following and monitoring, even it is not the same type of wave of litigation that, for example, following in the wake of the global financial crisis.

According to my count, the shareholder derivative lawsuit filed against SCWorx is the third coronavirus related derivative lawsuit filed so far. All three of the derivative lawsuit have involved companies that previously had been sued in securities class action lawsuits based on substantially the same allegations. (The other two derivative suits involved Inovio and Zoom). So far at least, coronavirus-related derivative litigation has not been a significant separate phenomenon.

Two Companies Hit with COVID-19-Related D&O Lawsuits published first on http://simonconsultancypage.tumblr.com/

0 notes

Text

Healthcare Software Services Company Hit with COVID-19 Related Securities Suit

In what is the fifth coronavirus outbreak-related securities class action lawsuit to date, a plaintiff shareholder has filed a securities class action lawsuit against a healthcare information software services company. The lawsuit is based on alleged misrepresentations the company allegedly made with respect to a contract the company had entered for the sale of COVID-19 test kits. The company’s share price rose on news of the agreement, but later fell following an online report raising questions about the agreement. The plaintiff’s April 29, 2020 complaint can be found here.

The Lawsuit

On April 29, 2020, a plaintiff shareholder filed a securities class action lawsuit in the Southern District of New York against SCWorx Corp. and its CEO Marc Schessel. The complaint purports to be filed on behalf of a class of SCWorx investors who purchased the company’s securities during the period April 13, 2020 and April 17, 2020.

The complaint alleges that in an April 13, 2020 press release (here) referring to a “first installment purchase order,” the company announced that it had “received a committed purchase order” for two million COVID-19 Rapid Testing Units, with provision for additional weekly orders of 2 million units for 23 weeks, valued at $35 million per week. According to the press release, the purchase order came from Rethink My Healthcare.

On April 17, 2020, the company issued a second press release (here), in which the company said that it “confirms previously disclosed plans to distribute COVID-19 Rapid Testing Units.” The press release again referenced the committed purchase order from Rethink My Healthcare. The press release also said that SCWorx “continues to anticipate receiving the first 2 million rapid detection kits within approximately two weeks and looks forward to providing incremental updates as they become available.”

According to the complaint, in a separate development on April 17, 2020, online research firm Hindenburg Research published a report (here) captioned with a title reading in part “Evidence Points to its Massive COVID-19 Test Deal Being Completely Bogus.”

According to the Hindenberg report, the CEO of the supplier from which SCWorx reportedly was buying the test kits, Promedical, “formerly ran another business accused of defrauding investors” and was “alleged to have falsified his medical credentials.” Promedical supposedly was sourcing the test kits with a Chinese company called Wandfo, but, the analyst report claims, “Wandfo put out a press release days ago stating that Promedical ‘fraudulently misrepresented themselves’ as sellers of its Covid-19 tests and disavowed any relationship.” The analyst report further said that the buyer that SCWorx claimed to have lined up does not appear to be “capable of handling hundreds of millions of dollars of orders.”

According to the complaint, the company’s share price fell 17% over three consecutive trading sessions following the publication of the analyst’s report.

On April 21, 2020, the SEC halted trading of the Company’s stock, effective April 22, 2020.

The complaint alleges that during the class period the defendants failed to disclose to investors: “(1) that SC Worx’s supplier for COVID-19 test had previously misrepresented its operations; (2) that SCWorx’s buyer was a small company that was unlikely to adequately support the purported volume of orders for COVID-19 tests; (3) that, as a result, the Company’s purchase order for COVID-19 tests had been overstated or entirely fabricated; and (4) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects, were materially misleading and/or lacked a reasonable basis.”

The complaint alleges that the defendants’ omissions violated Sections 10(b) and 20(a) of the Securities and Exchange Act of 1934 and seeks to recover damages on behalf of the plaintiff class.

Discussion

As noted at the outset, this complaint represents the fifth coronavirus outbreak-related securities class action lawsuit to be filed, joining those previously filed against Norwegian Cruise Lines (here), Inovio (here), Zoom (here), and Phoenix Tree Holdings Ltd. (here).

The new lawsuit against SCWorx is one of several from among these five suits based on alleged company statements about operating capabilities and opportunities to profit from the coronavirus outbreak. The Inovio lawsuit, for instance, involved allegations based on alleged statement about the company’s virus vaccine capabilities. The separate SEC enforcement action filed earlier this week against Praxsyn Corporation (which I noted in a prior blog post, here) was also based on allegations about the company’s statements about its plans to provide high-rated health care face masks.

SCWorx is also one of several companies whose stock the SEC has halted trading in recent days relating to coronavirus-related capabilities. For example, the SEC had also previously halted trading in Praxsyn’s shares. As discussed in an April 20, 2020 Law360 article (here), during the period February to April 2020, the agency had halted trading in the stocks of twenty stocks over COVID-19 concerns.

We are now well into the coronavirus outbreak and already well into the period in which the economic fallout has started to accumulate. Securities class action lawsuits related to the pandemic and its economic fallout had been slow to amass, but over the course of the past week, the pace of pandemic-related securities suit filings seems to have picked up. As the economic consequences of the outbreak continue to develop and spread, we are likely to see more lawsuits arrive. Over time, I expect many more will be filed.

Healthcare Software Services Company Hit with COVID-19 Related Securities Suit published first on http://simonconsultancypage.tumblr.com/

0 notes