#Gautam Adani

Explore tagged Tumblr posts

Text

Parvathy is struggling to establish her own identity and existence since the death of her husband. She has been strong-armed out of her family home so a new block of high-rise apartments can be constructed on the land where she currently lives. With all paperwork in her deceased husband’s name, Parvathy has no legal way to prove that the house she’s currently living in actually belongs to her, and is on the verge of becoming homeless. “Class is a privilege reserved for the privileged,” boasts the tagline of the builders ready to demolish Parvathy’s home. Kapadia articulates an uncomfortable truth: that the economic success story of Modi’s India—with industrialists Adani and Ambani as its self-proclaimed poster boys—is built upon the displacement and disenfranchisement of thousands of underprivileged, routinely exploited undocumented migrant workers like Parvathy.

Virat Nehru, ‘Review: ‘All We Imagine as Light’ is a Stunning Tale of Intimacy as Dissent’, Rough Cut

21 notes

·

View notes

Text

The long bezzle

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

When it comes to the modern world of enshittified, terrible businesses, no addition to your vocabulary is more essential than "bezzle," JK Galbraith's term for "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it"

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

The bezzle is contained by two forces.

First, Stein's Law: "Anything that can't go on forever will eventually stop."

Second, Keynes's: "Markets can remain irrational longer than you can remain solvent."

On the one hand, extremely badly run businesses that strip all the value out of the firm, making things progressively worse for its suppliers, workers and customers will eventually fail (Stein's Law).

On the other hand, as the private equity sector has repeatedly demonstrated, there are all kinds of accounting tricks, subsidies and frauds that can animate a decaying, zombie firm long after its best-before date (Keynes's irrational markets):

https://pluralistic.net/2023/06/02/plunderers/#farben

One company that has done an admirable job of balancing on a knife edge between Stein and Keynes is Verizon, a monopoly telecoms firm that has proven that a business can remain large, its products relied upon by millions, its stock actively traded and its market cap buoyant, despite manifest, repeated incompetence and waste on an unimaginable scale.

This week, Verizon shut down Bluejeans, an also-ran videoconferencing service the company bought for $400 million in 2020 as a panic-buy to keep up with Zoom. As they lit that $400 mil on fire, Verizon praised its own vision, calling Bluejeans "an award-winning product that connects our customers around the world, but we have made this decision due to the changing market landscape":

https://9to5google.com/2023/08/08/verizon-bluejeans-shutting-down/

Writing for Techdirt, Karl Bode runs down a partial list of all the unbelievably terrible business decisions Verizon has made without losing investor confidence or going under, in a kind of tribute to Keynes's maxim:

https://www.techdirt.com/2023/08/10/verizon-fails-again-shutters-attempted-zoom-alternative-bluejeans-after-paying-400-million-for-it/

Remember Go90, the "dud" streaming service launched in 2015 and shuttered in 2018? You probably don't, and neither (apparently) do Verizon's shareholders, who lost $1.2 billion on this folly:

https://www.techdirt.com/2018/07/02/verizons-sad-attempt-to-woo-millennials-falls-flat-face/

Then there was Verizon's bid to rescue Redbox with a new joint-venture streaming service, Redbox Instant, launched 2012, killed in 2014, $450,000,000 later:

https://variety.com/2014/digital/news/verizon-redbox-to-pull-plug-on-video-streaming-service-1201321484/

Then there was Sugarstring, a tech "news" website where journalists were prohibited from saying nice things about Net Neutrality or surveillance – born 2014, died 2014:

https://www.theverge.com/2014/12/2/7324063/verizon-kills-off-sugarstring

An app store, started in 2010, killed in 2012:

https://www.theverge.com/2012/11/5/3605618/verizon-apps-store-closing-january-2013

Vcast, 2005-2012, yet another failed streaming service (pray that someday you find someone who loves you as much as Verizon's C-suite loves doomed streaming services):

https://venturebeat.com/media/verizon-vcast-shutting-down/

And the granddaddy of them all, Oath, Verizon's 2017, $4.8 billion acquisition of Yahoo/AOL, whose name refers to the fact that the company's mismanagement provoked involuntary, protracted swearing from all who witnessed the $4.6 billion write-down the company took a year later:

https://www.techdirt.com/2018/12/12/if-youre-surprised-verizons-aol-yahoo-face-plant-you-dont-know-verizon/

Verizon isn't just bad at being a phone company that does non-phone-company things – it's incredibly bad at being a phone company, too. As Bode points out, Verizon's only real competency is in capturing its regulators at the FCC:

https://www.techdirt.com/2017/05/02/new-verizon-video-blatantly-lies-about-whats-happening-to-net-neutrality/

And sucking up massive public subsidies from rubes in the state houses of New York:

https://www.techdirt.com/2017/03/14/new-york-city-sues-verizon-fiber-optic-bait-switch/

New Jersey:

https://www.techdirt.com/2014/04/25/verizon-knows-youre-sucker-takes-taxpayer-subsidies-broadband-doesnt-deliver-lobbies-to-drop-requirements/

and Pennsylvania:

https://www.techdirt.com/2017/06/15/verizon-gets-wrist-slap-years-neglecting-broadband-networks-new-jersey-pennsylvania/

Despite all this, and vast unfunded liabilities – like remediating the population-destroying lead in their cables – they remain solvent:

https://www.reuters.com/legal/government/verizon-sued-by-investors-over-lead-cables-environmental-statements-2023-08-02/

Verizon has remained irrational longer than any short seller could remain solvent.

Short-sellers – who bet against companies and get paid when their stock prices go down – get a bad rap: billionaire shorts were the villains of the Gamestop squeeze, accused of running negative PR campaigns against beloved businesses to drive them under and pay their bets off:

https://pluralistic.net/2021/01/30/meme-stocks/#stockstonks

But shorts can do the lord's work. Writing for Bloomberg, Kathy Burton tells the story of Nate Anderson, whose Hindenburg Research has cost some of the world's wealthiest people over $99 billion by publishing investigative reports on their balance-sheet shell-games just this year:

https://www.bloomberg.com/news/features/2023-08-06/how-much-did-hindenburg-make-from-shorting-adani-dorsey-icahn

Anderson started off trying to earn a living as a SEC whistleblower, identifying financial shenanigans and collecting the bounties on offer, but that didn't pan out. So he turned his forensic research skills to preparing mediagenic, viral reports on the scams underpinning the financial boasts of giant companies…after taking a short position in them.

This year, Anderson's targets have included Carl Icahn, whose company lost $17b in market cap after Anderson accused it of overvaluing its assets. He went after the world's fourth-richest man, Gautam Adani, accusing him of "accounting fraud and stock manipulation," wiping out 34% of his net worth. He took on Jack Dorsey, whose payment processor Square renamed itself Block and went all in on the cryptocurrency bezzle, lopping 16% off its share price.

Burton points out that Anderson's upside for these massive bloodletting was comparatively modest. A perfectly timed exit from the $17b Icahn report would have netted $56m. What's more, Anderson faces legal threats and worse – one short seller was attacked by a man wearing brass-knuckles, an attack attributed to her short activism.

Shorts are lauded as one of capitalism's self-correcting mechanisms, and Hindenberg certainly has taken some big, successful swings at some of the great bezzles of our time. But as Verizon shows, shorts alone can't discipline a market where profits and investor confidence are totally decoupled from competence or providing a decent product or service.

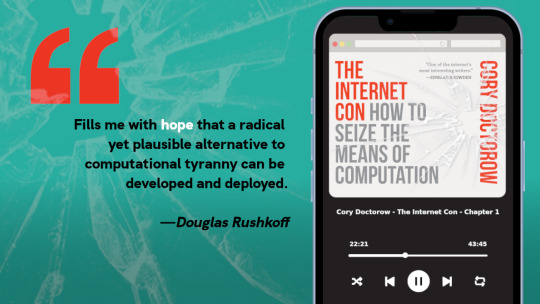

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/10/smartest-guys-in-the-room/#can-you-hear-me-now

#pluralistic#verizon#yahoo#tumblr#bluejeans#aol#vcast#redbox#go90#short sellers#hindenberg research#block#icahn#carl icahn#jack dorsey#square#nate anderson#gautam adani#adani group#icahn enterprises

138 notes

·

View notes

Text

Inside Jeet Adani and Diva Shah’s Dreamy Wedding!

Billionaire Gautam Adani’s youngest son, Jeet Adani married Diva Jaimin Shah in an intimate wedding ceremony. Read below to know more!

Renowned Indian businessman Gautam Adani’s youngest son, Jeet Adani married Diva Shah on February 7, 2025, in an intimate ceremony at Adani Shantigram township in Ahmedabad. Even after being a high-profile event, their wedding was a close-knit affair attended only by family and some close friends. The ceremony followed traditional Gujarati and Jain customs.

Jeet Adani, 27, the youngest son of billionaire businessman Gautam Adani is currently appointed as the Director of Adani Airports. He graduated from the University of Pennsylvania’s School of Engineering and Applied Sciences and has been part of the Adani Group since 2019. Diva Jaimin Shah, originally from Mumbai, is the daughter of prominent diamond merchant Jaimin Shah. She pursued higher education at the esteemed Parsons School of Design in New York. The couple got engaged in 2023 and decided to tie the knot in 2025.

Read Also: 7 Spring Wedding Decor Ideas!

The Adanis opted for a simple yet sophisticated celebration to celebrate the union of Jeet and Diva. On the occasion, Gautam has pledged to donate INR 10,000 crore towards healthcare, education, and skill development. According to many esteemed media houses, it is predicted that the major part of this donation will focus on major infrastructure projects to provide affordable, world-class healthcare through hospitals and medical colleges, high-quality K-12 schools, and cutting-edge global skill academies to ensure employability for all.

Various NGOs like Family of Disabled (FOD) from Delhi and Kai Rassi from Chennai, played a vital role in enhancing the celebrations. Reports indicate that Jeet collaborated with renowned designer Manish Malhotra and the NGO Family of Disabled to create custom shawls for the bride and groom.

Their pre-wedding celebrations were also a spectacle in itself. Their mehendi ceremony was a vibrant celebration featuring the extensive use of handmade crochet flowers for decoration, rather than real ones. The venue was transformed into a vibrant, colourful jungle oasis for the event. It took 500 Indian artisans’ exemplary skills to transform Diva and Jeet’s dream mehendi fantasy into reality.

Read Also: 4 Trending Bridal Makeup Ideas for 2025

0 notes

Video

youtube

अडाणी के बेटे जीत का विवाह संपन्न

#youtube#wedding#marrige#jeet wedding#diva#jeet weds diva#gauttam adani#business#adani groups#gautam adani#gauttam adani news#breaking news#wedding news#wedding update

1 note

·

View note

Text

Jeet Adani’s Wedding on Feb 7–Here’s What We Know So Far

0 notes

Text

Resilience in the Face of Adversity: Gautam Adani’s Take on US Indictments

Introduction Gautam Adani, one of the world’s leading business magnates, has often found himself at the center of controversies. Recently, his enterprise faced scrutiny with allegations stemming from the United States. Demonstrating steadfast resilience, Adani assured his stakeholders that such challenges only serve to strengthen the group’s foundations and determination to excel. A Strong…

#adani#Adani Group#business#business leadership#corporate resilience.#corporate strategy#ethical leadership#finance#Gautam Adani#Gautam Adani 1 hour income#Gautam Adani company list#Gautam Adani daughter.#Gautam Adani family#Gautam Adani group contact number#Gautam Adani house#Gautam Adani net worth#Gautam Adani net worth in rupees#Gautam Adani wife#global business impact#india#Indian Economy#infrastructure development#leadership insights#Mukesh Ambani net worth#net worth of Gautam Adani in billion#news#overcoming challenges#resilience in business#richest man in India#stakeholder trust

0 notes

Text

TotalEnergies Halts Investment in Adani Green Amid Bribery Allegations

TotalEnergies has decided to pause its investment in Adani Green Energy until there is more clarity regarding a U.S. bribery case involving Indian billionaire Gautam Adani, as confirmed by CEO Patrick Pouyanne on Tuesday.

The French company, which currently holds a 19.8% stake in Adani Green, has other projects in its portfolio that will help meet its renewable energy expansion targets, Pouyanne explained during an interview at the Energy Intelligence Forum with Reuters.

Pouyanne further emphasized that the firm’s ongoing renewable energy initiatives remain unaffected by this pause, ensuring that TotalEnergies can still progress toward its sustainability goals. Read more

0 notes

Text

Indian billionaire Adani charged in US over $265m bribery allegations

Indian billionaire Gautam Adani was charged by US prosecutors for his alleged involvement in a $265-million bribery scheme, according to Reuters.

Multiple fraud allegations against Adani, one of the world’s richest men, and seven other defendants caused his companies’ stocks and bonds to plunge on Thursday. Adani Green Energy, the company targeted by the allegations, also cancelled a $600-million bond sale.

The charges followed a major upheaval at the Adani Group last year after Hindenburg Research released a report accusing it of misusing offshore tax havens. US federal prosecutors said the defendants agreed to bribe Indian government officials to win contracts that were expected to generate $2 billion in profits over 20 years.

They also alleged that Adani and another executive of the former Adani Green Energy CEO, Vneet Jaain, raised more than $3 billion in loans and bonds while hiding their corruption from lenders and investors. The three were charged with securities fraud, conspiracy to commit securities fraud and conspiracy to commit e-fraud. The US Securities and Exchange Commission (SEC) stated:

Gautam and Sagar Adani were engaged in the bribery scheme during a September 2021 note offering by Adani Green that raised $750 million, including approximately $175 million from US investors. The SEC’s complaint against Gautam and Sagar Adani charges them with violating the antifraud provisions of the federal securities laws. The complaint seeks permanent injunctions, civil penalties, and officer and director bars.

Stocks plunging amid allegations

Shares in Adani Green Energy fell 17%, with shares in many of the conglomerate’s other companies losing more than 10%. The group lost $28 billion in value in trading on Thursday, taking the combined market capitalisation of its companies to $141 billion. Before last year’s Hindenburg report, the group enjoyed a market value of $235 billion.

Meanwhile, political opponents accused prime minister Narendra Modi’s administration of favouring Adani in government decisions. On Thursday, India’s Congress party repeated calls for a parliamentary enquiry into alleged wrongdoing by the Adani Group.

Five other defendants were charged with conspiracy to violate the Foreign Corrupt Practices Act, a US anti-bribery law, and four were charged with conspiracy to obstruct justice. However, none of the defendants were in custody, a spokesperson for US Attorney Breon Peace in Brooklyn said.

Shares in GQG Partners, an Australian-listed investment company that was a major backer of Adani, also fell 20%, the biggest one-day drop since it listed three years ago.

Gautam Adani’s fortune is estimated at $69.8bn according to Forbes, which makes him the second richest person in India after Mukesh Ambani.

Read more HERE

#world news#news#world politics#adani green energy#bribery#gautam adani#usa#usa politics#usa news#united states#united states of america#us politics#india#india news#indian economy#indian politics

0 notes

Text

In the recent past, reputed foreign publications reported three explosive news stories but none of them made it to the pages of Indian newspapers. A follow-up investigation, or questions for the government, is unimaginable. On 12 December, Bloomberg reported that Taiwan's Chang family, which was charged by the Indian government in 2014 of being used by billionaire Gautam Adani's empire to siphon money overseas, has now resurfaced under a new name and is again working with the conglomerate. Two days later, the French newspaper MediaPart reported that the Modi government is refusing to cooperate with French judges who have requested India's assistance in their ongoing investigation into alleged corruption in the sale of 36 Dassault-built Rafale fighter jets to India in 2016 for €7.8 billion. This has been highlighted in a diplomatic note written in July by the French ambassador to India, Emmanuel Lenain. Only last month, The Caravan published an in-depth investigation into kickbacks received in 15 major arms deals which, too, saw no coverage by the Indian media. On 10 December, the Washington Post reported on an organisation set up and run by a serving intelligence officer to research and discredit foreign critics of the Modi government. This blurs the line traditionally observed by the country's security establishment between operations that serve India and those that advance the ruling political party's aims.

Sushant Singh, ‘Fire and Smoke’, Caravan

#Caravan#Sushant Singh#India#Emmanuel Lenain#Narendra Modi#Rafale fighter jets#Dassault#France#Taiwan#Chang Yung-fa#Washington Post#MediaPart#Gautam Adani#Bloomberg

5 notes

·

View notes

Text

Will Adani be second time lucky?

It isn’t the first time that Indian billionaire Gautam Adani is facing the US music. Earlier, the accuser was US short-seller Hindenburg Research. Now, it is New York federal prosecutors. The Adani Group chairman, the second richest man in India, has been indicted by them in New York on November 20th. The charges are serious – bribery and brazen lies, securities and wire frauds, misleading US…

#Adani after Hindenburg#Adani and Department of Justice#Adani and Modi#Adani and SEC#Adani and the Indian government#Adani and US investors#Adani Green Energy#Adani indicted#Adani&039;s bribery#Gautam Adani

0 notes

Text

Gautam Adani is a self-made billionaire and chairman of the Adani Group, a multinational conglomerate with diversified interests. Born into a middle-class family in Ahmedabad, Gujarat, Adani dropped out of school at 16. He later moved to Mumbai to work in the diamond trade.

0 notes

Text

Kenya Cancels Adani Group Deals Amid Scrutiny

Kenya has terminated multiple contracts with the Adani Group, citing concerns over irregularities and transparency. This decision marks a significant challenge for the Indian conglomerate's global operations, as it faces increasing scrutiny over its business practices.

This was originally posted on India weekly. Read the detailed report here

0 notes