#Adani Enterprises

Explore tagged Tumblr posts

Text

0 notes

Text

The Adani Group of Companies

0 notes

Text

Unveiling the Kotak Mahindra Bank and Hindenburg Saga: What Really Happened?

Source: Internet In a gripping turn of events, Kotak Mahindra Bank has found itself at the center of a sensational controversy involving the short-selling of Adani Enterprises’ shares. This unfolding drama, triggered by a damning report from Hindenburg Research, has led to a wave of investigations and clarifications. Here’s the story behind the headlines.The Hindenburg Report: A Market…

View On WordPress

#2024#Adani Enterprises#financial market#Hindenburg report#Kingdon Capital#Kotak Mahindra Bank#regulatory oversight#SEBI#Short-selling

0 notes

Text

Adani Enterprises Gets Board Approval to Raise Rs 16,600 Crore via QIP

Adani Enterprises has made a significant move to strengthen its financial position. On Tuesday, the company received board approval to raise Rs 16,600 crore through the qualified institutional placement (QIP) route. This method allows listed companies to raise funds by issuing equities to qualified institutional buyers.

In a formal filing to the exchanges, Adani Enterprises, the flagship company of the Adani Group, announced that the board has approved the fund-raising initiative. The plan involves issuing equity shares with a face value of Re 1 each and/or other eligible securities in one or more tranches, not exceeding an aggregate amount of Rs 16,600 crore.

This announcement comes on the heels of a similar move by Adani Energy Solutions, another group company, which received board approval to raise Rs 12,500 crore through the QIP route just a day earlier.

Adani Enterprises’ stock price closed at Rs 3,244.35 per share, down 1.33% on the BSE on the day of the announcement. This fund-raising effort follows a challenging period for the company. In February 2023, Adani Enterprises had to call off its fully subscribed Rs 20,000 crore follow-on public offer (FPO) and return the money to investors after the US-based Hindenburg Research accused the group of stock manipulation and accounting fraud. The conglomerate denied these allegations, but the report led to heavy selling pressure on the stock exchanges, causing a 30-80% crash in the shares of Adani Group companies.

Despite these setbacks, Adani Enterprises and Adani Ports have bounced back, erasing the losses caused by the Hindenburg report. Adani Ports has even risen over 80% from its pre-Hindenburg report levels.

In terms of financial performance, Adani Enterprises reported a 39% drop in profit after tax (attributable to owners) to Rs 449 crore for the quarter ended March 31, 2024, down from Rs 735 crore in the same period the previous year. However, for the full fiscal year 2024, the company's profit after tax increased by 31% to Rs 3,240 crore compared to Rs 2,464 crore in FY23. Additionally, its total income saw a marginal rise of 1% to Rs 29,630 crore from Rs 29,311 crore in the quarter ended March 2023.

This fund-raising initiative via QIP is a strategic step for Adani Enterprises as it aims to bolster its financial health and support its growth ambitions.

0 notes

Text

AdaniConneX Secures $1.44 Billion Investment for Green Data Centers

AdaniConneX, a collaboration between Adani Enterprises and EdgeConneX of the US, has secured a substantial investment of up to $1.44 billion (Rs 11,520 crore) for its upcoming green data centers. This funding includes an initial commitment of $875 million, with the possibility of increasing it to $1.44 billion.

The CEO of AdaniConneX, Jeyakumar Janakaraj, emphasized the importance of this funding in supporting the development of sustainable and environmentally friendly digital infrastructure. The new data centers will utilize state-of-the-art technologies and renewable energy solutions to minimize their impact on the environment while maximizing operational efficiency.

To finance these initiatives, AdaniConneX has partnered with several international banks, including ING Bank N.V, Intesa Sanpaolo, KfW IPEX, MUFG Bank Ltd., Natixis, Standard Chartered Bank, Société Générale, and Sumitomo Mitsui Banking Corporation.

This funding represents a significant step towards AdaniConneX's goal of creating a one gigawatt (GW) data center platform that is environmentally and socially responsible. By leveraging the expertise of Adani Group, India's largest infrastructure player, and EdgeConneX, one of the largest private data center operators, AdaniConneX aims to accelerate India's digital growth and economic progress.

1 note

·

View note

Text

#INDIA#NSE#ADANI ENTERPRISES#EQUITY#STOCK MARKET#SUZLON ENERGY#SUZLON ENERGY PRICE#YES BANK SHARE#YES BANK SHARE PRICE#SUZLON ENERGY LTD#DERIVATIVE#ADANI-GROUP#ADANI#INVESTING#FINANCIAL-MARKET#BHUJ

1 note

·

View note

Text

Adani Enterprises Share Price Nov 2023

Adani Enterprises Share Price Nov 2023 Adani Enterprises Share Price Nov 2023 https://groww.in/stocks/user/explore Hello everyone, kya haal hai aap sabhi ka. hope ke aap sabhi ashe honge. Aaj market ka mahoul bohat asha raja. jaisa ki aap sabhi jante hi hai ke hum aap sabhi ke liye apni website par har roz market ke kisi ek stock ke bare mein baat karte hain, aur aaj hum baat karne ja rahe hai…

View On WordPress

0 notes

Video

youtube

3900 करोड़ का घोटाला? मोदी-अड़ानी पर कांग्रेस नेताओं का चौंकाने वाला खुलासा

he Coal scam 2018 to 2023 with evidence in Amrut Kal!

0 notes

Link

0 notes

Text

0 notes

Text

Adani group’s flagship company Adani Enterprises Ltd (AEL) says it has pledged to grow 100 million trees by 2030, which it claims is the "largest 1t.org pledge" in India so far and among the most ambitious corporate pledges globally.

0 notes

Text

0 notes

Text

#newsarival#adani power share price#adani stocks#adani shares#adani ports#adani green#adani enterprises#viral stories#viraltopic#berita viral#viralpage#viral on internet#viral hit#trend

0 notes

Text

Domestic mutual funds reduced their holdings in Adani group firms such as Adani Ports & SEZ, Ambuja Cements, and Adani Enterprises in the March quarter. Following a research study by the US-based forensic short-seller Hindenburg Research accusing the company of brazen stock manipulation and accounting fraud for decades, Adani group shares saw significant volatility throughout the quarter.

1 note

·

View note

Text

Gautam Adani- His Early Life and Background

businessman. He was born on June 24, Originally, in Ahmedabad, Gujarat, India, 1962. Adani came from a middle-class family and was the second of five brothers. He attended Sheth Chimanlal Nagindas Vidyalaya and graduated with a B.Com degree from Gujarat University.

Gautam Adani began his career as a diamond sorter in Zaveri Bazaar, Mumbai. After a few years, he returned to Ahmedabad and started his own trading business with a small capital. He initially traded in polyvinyl chloride (PVC) and later diversified into other industries such as agribusiness, power generation, oil and gas exploration, and ports and logistics. He also ventured into infrastructure and resources sectors, including ports, logistics, agribusiness, power generation, and transmission, and oil and gas exploration and production.

Through his entrepreneurial spirit, Adani has grown into a significant player in Indian business and economy, with the group’s revenue crossing $13 billion in 2019. Despite his success, Adani has also faced criticism and controversy over his business practices and environmental impact.

0 notes

Text

The long bezzle

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

When it comes to the modern world of enshittified, terrible businesses, no addition to your vocabulary is more essential than "bezzle," JK Galbraith's term for "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it"

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

The bezzle is contained by two forces.

First, Stein's Law: "Anything that can't go on forever will eventually stop."

Second, Keynes's: "Markets can remain irrational longer than you can remain solvent."

On the one hand, extremely badly run businesses that strip all the value out of the firm, making things progressively worse for its suppliers, workers and customers will eventually fail (Stein's Law).

On the other hand, as the private equity sector has repeatedly demonstrated, there are all kinds of accounting tricks, subsidies and frauds that can animate a decaying, zombie firm long after its best-before date (Keynes's irrational markets):

https://pluralistic.net/2023/06/02/plunderers/#farben

One company that has done an admirable job of balancing on a knife edge between Stein and Keynes is Verizon, a monopoly telecoms firm that has proven that a business can remain large, its products relied upon by millions, its stock actively traded and its market cap buoyant, despite manifest, repeated incompetence and waste on an unimaginable scale.

This week, Verizon shut down Bluejeans, an also-ran videoconferencing service the company bought for $400 million in 2020 as a panic-buy to keep up with Zoom. As they lit that $400 mil on fire, Verizon praised its own vision, calling Bluejeans "an award-winning product that connects our customers around the world, but we have made this decision due to the changing market landscape":

https://9to5google.com/2023/08/08/verizon-bluejeans-shutting-down/

Writing for Techdirt, Karl Bode runs down a partial list of all the unbelievably terrible business decisions Verizon has made without losing investor confidence or going under, in a kind of tribute to Keynes's maxim:

https://www.techdirt.com/2023/08/10/verizon-fails-again-shutters-attempted-zoom-alternative-bluejeans-after-paying-400-million-for-it/

Remember Go90, the "dud" streaming service launched in 2015 and shuttered in 2018? You probably don't, and neither (apparently) do Verizon's shareholders, who lost $1.2 billion on this folly:

https://www.techdirt.com/2018/07/02/verizons-sad-attempt-to-woo-millennials-falls-flat-face/

Then there was Verizon's bid to rescue Redbox with a new joint-venture streaming service, Redbox Instant, launched 2012, killed in 2014, $450,000,000 later:

https://variety.com/2014/digital/news/verizon-redbox-to-pull-plug-on-video-streaming-service-1201321484/

Then there was Sugarstring, a tech "news" website where journalists were prohibited from saying nice things about Net Neutrality or surveillance – born 2014, died 2014:

https://www.theverge.com/2014/12/2/7324063/verizon-kills-off-sugarstring

An app store, started in 2010, killed in 2012:

https://www.theverge.com/2012/11/5/3605618/verizon-apps-store-closing-january-2013

Vcast, 2005-2012, yet another failed streaming service (pray that someday you find someone who loves you as much as Verizon's C-suite loves doomed streaming services):

https://venturebeat.com/media/verizon-vcast-shutting-down/

And the granddaddy of them all, Oath, Verizon's 2017, $4.8 billion acquisition of Yahoo/AOL, whose name refers to the fact that the company's mismanagement provoked involuntary, protracted swearing from all who witnessed the $4.6 billion write-down the company took a year later:

https://www.techdirt.com/2018/12/12/if-youre-surprised-verizons-aol-yahoo-face-plant-you-dont-know-verizon/

Verizon isn't just bad at being a phone company that does non-phone-company things – it's incredibly bad at being a phone company, too. As Bode points out, Verizon's only real competency is in capturing its regulators at the FCC:

https://www.techdirt.com/2017/05/02/new-verizon-video-blatantly-lies-about-whats-happening-to-net-neutrality/

And sucking up massive public subsidies from rubes in the state houses of New York:

https://www.techdirt.com/2017/03/14/new-york-city-sues-verizon-fiber-optic-bait-switch/

New Jersey:

https://www.techdirt.com/2014/04/25/verizon-knows-youre-sucker-takes-taxpayer-subsidies-broadband-doesnt-deliver-lobbies-to-drop-requirements/

and Pennsylvania:

https://www.techdirt.com/2017/06/15/verizon-gets-wrist-slap-years-neglecting-broadband-networks-new-jersey-pennsylvania/

Despite all this, and vast unfunded liabilities – like remediating the population-destroying lead in their cables – they remain solvent:

https://www.reuters.com/legal/government/verizon-sued-by-investors-over-lead-cables-environmental-statements-2023-08-02/

Verizon has remained irrational longer than any short seller could remain solvent.

Short-sellers – who bet against companies and get paid when their stock prices go down – get a bad rap: billionaire shorts were the villains of the Gamestop squeeze, accused of running negative PR campaigns against beloved businesses to drive them under and pay their bets off:

https://pluralistic.net/2021/01/30/meme-stocks/#stockstonks

But shorts can do the lord's work. Writing for Bloomberg, Kathy Burton tells the story of Nate Anderson, whose Hindenburg Research has cost some of the world's wealthiest people over $99 billion by publishing investigative reports on their balance-sheet shell-games just this year:

https://www.bloomberg.com/news/features/2023-08-06/how-much-did-hindenburg-make-from-shorting-adani-dorsey-icahn

Anderson started off trying to earn a living as a SEC whistleblower, identifying financial shenanigans and collecting the bounties on offer, but that didn't pan out. So he turned his forensic research skills to preparing mediagenic, viral reports on the scams underpinning the financial boasts of giant companies…after taking a short position in them.

This year, Anderson's targets have included Carl Icahn, whose company lost $17b in market cap after Anderson accused it of overvaluing its assets. He went after the world's fourth-richest man, Gautam Adani, accusing him of "accounting fraud and stock manipulation," wiping out 34% of his net worth. He took on Jack Dorsey, whose payment processor Square renamed itself Block and went all in on the cryptocurrency bezzle, lopping 16% off its share price.

Burton points out that Anderson's upside for these massive bloodletting was comparatively modest. A perfectly timed exit from the $17b Icahn report would have netted $56m. What's more, Anderson faces legal threats and worse – one short seller was attacked by a man wearing brass-knuckles, an attack attributed to her short activism.

Shorts are lauded as one of capitalism's self-correcting mechanisms, and Hindenberg certainly has taken some big, successful swings at some of the great bezzles of our time. But as Verizon shows, shorts alone can't discipline a market where profits and investor confidence are totally decoupled from competence or providing a decent product or service.

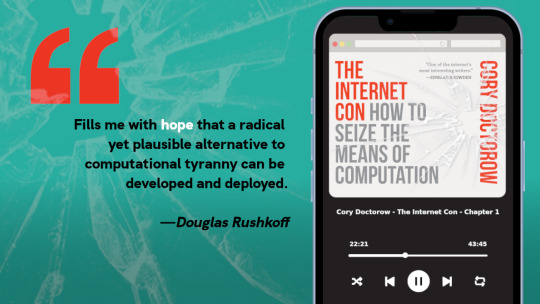

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/10/smartest-guys-in-the-room/#can-you-hear-me-now

#pluralistic#verizon#yahoo#tumblr#bluejeans#aol#vcast#redbox#go90#short sellers#hindenberg research#block#icahn#carl icahn#jack dorsey#square#nate anderson#gautam adani#adani group#icahn enterprises

137 notes

·

View notes