#2008 bank crisis

Explore tagged Tumblr posts

Text

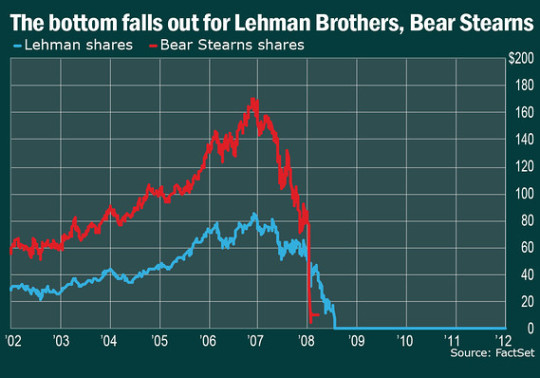

Warning signs of the instability of the global financial system abounded in the months leading up to the 2008 Lehman Brothers crash. Among these early signs were the astounding revelations about UBS, the world’s largest private bank, by Stephanie Gibaud, who was employee at the bank’s French division. Gibaud refused instructions given to her and other employees to delete all their company files. In doing so, she helped reveal a vast web of corruption and fraud linking UBS to a shadowy tax evasion scheme. More than 15 years later, Gibaud has endured harassment, professional ostracization, lawsuits, and threats. She joins The Chris Hedges Report to speak on her ordeal and the extent of corruption in the international banking system.

Chris Hedges: Stephanie Gibaud in June, 2008, was ordered by one of her managers at the UBS Bank in Paris, to destroy all her computer files that related to customers with offshore accounts in Switzerland. The order came in the wake of the 2007 American banker, Bradley Birkenfeld’s disclosure of client information to the US Department of Justice, which suggested that UBS was facilitating massive tax evasion schemes for its American clients, which ultimately led to a penalty of $780 million. Swiss banks have long been havens for those seeking to avoid taxes. In 2014, for example, Credit Suisse, which would also plead guilty to sheltering money for its clients so they could avoid paying taxes, had to pay $2.6 billion in penalties.

Gibaud, however, was the only bank employee at UBS who refused to delete her files. She protested to UBS management and French regulators. Her documents would eventually help to identify 38,000 offshore bank accounts amounting to $12 billion. UBS responded by trying to fire her as part of a mass redundancy of 100 employees during the 2008 financial crisis. The French Ministry of Work intervened, but her life at UBS became excruciating. She suffered harassment and discrimination along with social and professional isolation. She endured constant anxiety and depression. UBS fired her finally in 2012. She was sued for defamation by the bank after writing her book, The Woman Who Knew Too Much, part of a series of lawsuits that plague her to this day.

She requested compensation totaling 3.5 million euros and the judge gave her 4,500 euros, which barely covered her legal fees. UBS was eventually forced to pay a record fine in 2019 of $4.9 billion, but Gibaud found herself financially ruined and blacklisted from the financial sector where she had spent her career. The French legal system does not compensate whistleblowers, unlike the US. The Commodities Future Trading Commission, for example, recently awarded an anonymous whistleblower around $200 million for providing information about Deutsche Bank’s manipulation of the LIBOR benchmark. Birkenfeld, who exposed UBS’s offshore accounts for American clients, was handed a check from the US Treasury for $104 million, minus taxes. Gibaud is currently battling in the French courts to become the first legally recognized whistleblower, which could pave the way for greater protection and compensation.

35 notes

·

View notes

Text

Oh! The 2008 recession was really fucked up! The banks knew the whole time! And did nothing! Told no one!

3 notes

·

View notes

Text

#2008#bankruptcy#credit default swaps#crisis#derivatives#financial collapse#fraud#government bailout#investigation#lending practices#mortgage-backed securities#regulation#regulatory failure#risky loans#Silicon Valley Bank#subprime mortgages#systemic risk#United States

11 notes

·

View notes

Photo

Andy Kessler writing in today’s Wall Street Journal: Silicon Valley Bank failed because there weren’t enough white men on the bank’s Board of Directors.

#wsj#wall street journal#racism#sexism#silicon valley bank#svb#news corp#dow jones#andy kessler#sure bc white bankers had nothing to do with the 2008 financial crisis

6 notes

·

View notes

Text

Bank of Dave (2023)

🎬Based on the true-life experiences of Dave Fishwick. Telling the story of how a working class Burnley man and self-made millionaire fought to set up a community bank.

📝A truly uplifting, feel good and inspirational story which will leave you with a smile. Recommend watch especially during cold winter nights.

#bank of dave#rory kinnear#community spirit#2008 financial crisis#credit crunch#joel fry#phoebe dynevor#feel good#feel good friday#netflix films#british films#hugh bonneville#netflix

10 notes

·

View notes

Text

Relevant:

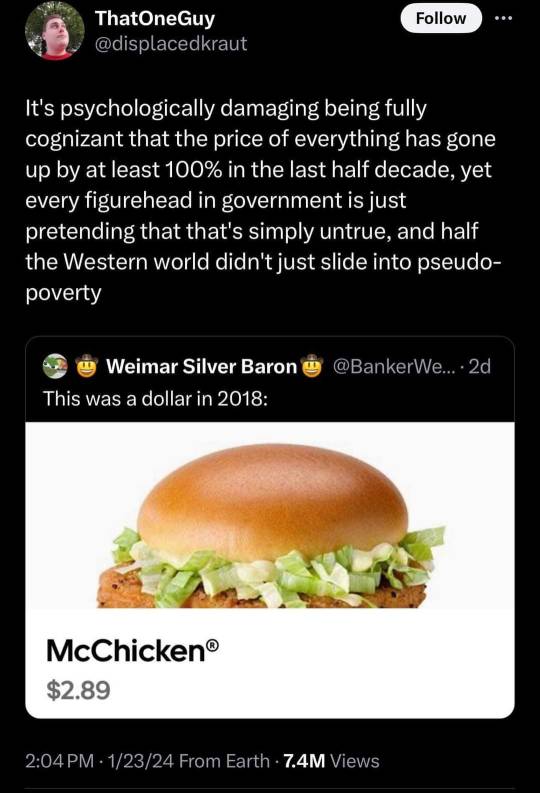

The term "soft landing" in news articles often peaks right before an economic shitstorm hits.

#also the yield curve for bonds has been inverted for over a year#and every other economic indicator has been flashing red#this economy has only been kept up by silicon valley tech stocks (mag7)#everything else has been eating shit#and that's not even talking about the impending real estate crisis and insane unrealized losses for banks (much worse than 2008)

69K notes

·

View notes

Text

Michael Douville & John Rubino: The World is about to change! Get Rich or Ignore at Your Peril!

The World is About to change! Pension Funds may not be able to honor their obligations.

Ecclesiastes 7:12 For the protection of wisdom is like the protection of money, and the advantage of knowledge is that wisdom preserves the life of him who has it. Proverbs 27:12 The prudent sees danger and hides himself, but the simple go on and suffer for it. John Rubino’s newsletter can be accessed at rubino.substack.com. John is an American thought leader, former Wall Street Analyst, and…

#2008#banking crisis#commercial real estate#commodities#copper#credit crunch#gfc#gold#housing bubble#housing market#housing market crash#Inventory myth#silent depression#silver#uranium

0 notes

Text

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges. ll. Background of the 2008 Market Crash A. Economic conditions leading up to the crash Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

Reblogging this with a link to the article which was posted back in 2015.

Until bankers go to prison, the bailouts will get bigger and bigger.

#the article itself tries to explain macroeconomic policy#and can be interesting for you to read but I should mention the basic context#is that Iceland had a horrible bank crisis in 2008 and they just let the banks fail#and then prosecuted the bankers and sentenced I think 30 of them to 98 years in jail#while this is a good outcome the number of years in prison is disproportionate to other crimes#but the original article just doesn’t mention it because the actual impact of the punishment doesn’t matter#all that matters is that the Bad Bankers got Owned by the Libs#i guess I’m also more interested to know if there are long term impacts on corruption#especially in Iceland#and whether such similar actions of letting the banks fail would work in larger economies#Iceland’s economy is 330k people large#i imagine letting an economy the size of China to go the same way would be… worse#anyway ymmv I just have doubts abt this article framing

23K notes

·

View notes

Link

#2011#2008 financial crisis#occupy wall street#the 99%#protest#business#banks#macroeconomics#economics#economy

0 notes

Text

Federal regulators on Tuesday [April 23, 2024] enacted a nationwide ban on new noncompete agreements, which keep millions of Americans — from minimum-wage earners to CEOs — from switching jobs within their industries.

The Federal Trade Commission on Tuesday afternoon voted 3-to-2 to approve the new rule, which will ban noncompetes for all workers when the regulations take effect in 120 days [So, the ban starts in early September, 2024!]. For senior executives, existing noncompetes can remain in force. For all other employees, existing noncompetes are not enforceable.

[That's right: if you're currently under a noncompete agreement, it's completely invalid as of September 2024! You're free!!]

The antitrust and consumer protection agency heard from thousands of people who said they had been harmed by noncompetes, illustrating how the agreements are "robbing people of their economic liberty," FTC Chair Lina Khan said.

The FTC commissioners voted along party lines, with its two Republicans arguing the agency lacked the jurisdiction to enact the rule and that such moves should be made in Congress...

Why it matters

The new rule could impact tens of millions of workers, said Heidi Shierholz, a labor economist and president of the Economic Policy Institute, a left-leaning think tank.

"For nonunion workers, the only leverage they have is their ability to quit their job," Shierholz told CBS MoneyWatch. "Noncompetes don't just stop you from taking a job — they stop you from starting your own business."

Since proposing the new rule, the FTC has received more than 26,000 public comments on the regulations. The final rule adopted "would generally prevent most employers from using noncompete clauses," the FTC said in a statement.

The agency's action comes more than two years after President Biden directed the agency to "curtail the unfair use" of noncompetes, under which employees effectively sign away future work opportunities in their industry as a condition of keeping their current job. The president's executive order urged the FTC to target such labor restrictions and others that improperly constrain employees from seeking work.

"The freedom to change jobs is core to economic liberty and to a competitive, thriving economy," Khan said in a statement making the case for axing noncompetes. "Noncompetes block workers from freely switching jobs, depriving them of higher wages and better working conditions, and depriving businesses of a talent pool that they need to build and expand."

Real-life consequences

In laying out its rationale for banishing noncompetes from the labor landscape, the FTC offered real-life examples of how the agreements can hurt workers.

In one case, a single father earned about $11 an hour as a security guard for a Florida firm, but resigned a few weeks after taking the job when his child care fell through. Months later, he took a job as a security guard at a bank, making nearly $15 an hour. But the bank terminated his employment after receiving a letter from the man's prior employer stating he had signed a two-year noncompete.

In another example, a factory manager at a textile company saw his paycheck dry up after the 2008 financial crisis. A rival textile company offered him a better job and a big raise, but his noncompete blocked him from taking it, according to the FTC. A subsequent legal battle took three years, wiping out his savings.

-via CBS Moneywatch, April 24, 2024

--

Note:

A lot of people think that noncompete agreements are only a white-collar issue, but they absolutely affect blue-collar workers too, as you can see from the security guard anecdote.

In fact, one in six food and service workers are bound by noncompete agreements. That's right - one in six food workers can't leave Burger King to work for Wendy's [hypothetical example], in the name of "trade secrets." (x, x, x)

Noncompete agreements also restrict workers in industries from tech and video games to neighborhood yoga studios. "The White House estimates that tens of millions of workers are subject to noncompete agreements, even in states like California where they're banned." (x, x, x)

The FTC estimates that the ban will lead to "the creation of 8,500 new businesses annually, an average annual pay increase of $524 for workers, lower health care costs, and as many as 29,000 more patents each year for the next decade." (x)

Clearer explanation of noncompete agreements below the cut.

Noncompete agreements can restrict workers from leaving for a better job or starting their own business.

Noncompetes often effectively coerce workers into staying in jobs they want to leave, and even force them to leave a profession or relocate.

Noncompetes can prevent workers from accepting higher-paying jobs, and even curtail the pay of workers not subject to them directly.

Of the more than 26,000 comments received by the FTC, more than 25,000 supported banning noncompetes.

#seriously cannot emphasize enough that this is going to be a huge deal for so so many people#it could seriously drag up wages in food and service industries in particular#especially in the long run#and also massively reshape tech and video game industries#do you have any idea how many game devs are legally not allowed to start their own studios? probably most of them#and that's about to change for the better!!#ftc#noncompete#united states#us politics#business#business news#biden administration#voting matters#democrats#federal trade commission#video game industry#game devs#fast food#fast food workers#labor#labor rights#workers rights#blue collar#service workers#good news#hope

3K notes

·

View notes

Video

youtube

Central Banks and regulators raced to reassure markets and customers Monday, after one of the world's largest banks exited the global stage in a forced takeover. The details of the 3.2 billion dollar deal for USB and Credit Suisse rattled some investors. But regulators have sought to make one thing clear: The focus is on depositors and the health of the overall banking system.

1 note

·

View note

Text

#crisis financiera#banking#economist dubbed ‘dr doom’ who predicted 2008 meltdown warns us bank collapse could trigger global recession

0 notes

Text

#2008 recession#bailout#central banks#consumer confidence#economic downturn#financial institutions#foreclosure#global financial crisis#government debt#government regulation#housing market crash#quantitative easing#risky lending practices#stimulus package#stock market#subprime mortgages#TARP#unemployment

0 notes

Text

"kamala is a cop"

but you don’t understand! When she was a prosecutor, she pissed off California police unions when she didn’t push for the death penalty for a man convicted of killing a police officer. She chose to push non violent, first-time offenders into education programs instead of prison because she wanted “to create a system to decrease the likelihood that the revolving door will continue”. As Attorney General, she prosecuted for profit colleges, and banks following the 2008 crisis. In the face of Black Lives Matter, her office launched implicit bias training and she was proud of her work in reforming the criminal justice system of California. As senator, she shined when she questioned Brett Kavanaugh in his senate hearing. When you say “she was a cop” you simplify her impressive record as a prosecutor, attorney general, and senator into just “cop”. While there is valid criticism to her record as Attorney General in her response to Black Lives Matter, as well as her stance on Palestine, there is more nuance to Election 2024 than just “kamala is a cop” and “another time picking the lesser of two evils.” Kamala Harris is the obvious choice for 2024.

#kamala harris#kamala for president#vote kamala#vote harris#vote blue#please vote#fucking vote#american politics#election 2024#us elections#donald trump#democrats#kamala 2024#kamala harris 2024#kamala harris for president#attention democrats#democratic party#kamala is a cop#your vote matters#get out the vote#project 2025#voting#go vote#vote democrat

794 notes

·

View notes

Text

Me @ banks rn tbh

youtube

#the loan debt cancelation slowness is probably more complicated than 'he won’t sign the paper' but i do feel the rage about bank bailout 2#i guess they had to bail out the banks to stop a crisis but like. why does this keep happening?#(i know i know greed and capitalism but still)#also I'm not entirely clear on the details but I dont *think* this bailout is the same as the 2008 crisis

15K notes

·

View notes