#what is an fsa grace period

Explore tagged Tumblr posts

Text

Can I Use My HSA for My Family Members?

The best health savings account (HSA) can do a lot to help you cover medical expenses. These accounts allow you to put aside pre-tax income up to the annual limit. You can also invest the funds in the account to get tax-deferred growth. Furthermore, you can use the money in your HSA for qualified medical expenses tax-free.

HSAs are a fantastic tool that allows you to save for medical care. Whether you use it now or wait until you have major expenses, it can make healthcare far more manageable.

One common question about HSAs is whether or not you can use HSA funds to pay for expenses incurred by family members. In this blog, we'll answer that question and clarify how you can use your HSA.

Using HSA Funds for Family

Your HSA will cover any qualified medical expense, including over-the-counter care products. As long as the expenses fall under IRS-set guidelines, you won't receive a penalty or pay taxes on that spending.

That also covers certain family members. You can use your HSA for family members, but they must be tax dependents. That means you can't use it to help out a friend or assist a sibling.

Your HSA extends to tax dependents only.

Individual vs. Family Health Plans

Confusion about HSA spending for family members often arises due to the different types of coverage you must get to open an HSA. To open an HSA, you must have a high-deductible health plan (HDHP). When you enroll in an HDHP, you can get either individual or family coverage.

Contrary to popular belief, there's no such thing as a "family" or "joint" HSA. Only one person can own an HSA. However, annual contribution limits depend on your HDHP coverage type. In 2023, the annual limit for individual health plans is $3,850 and $7,300 for family plans.

It does not matter whether you have an individual or family health plan. You can use the best health savings account to pay for eligible expenses from tax-dependent family members. What changes between individual and family HDHP health coverage is how much you can contribute to your HSA every year.

Read a similar article about the best employee benefits here at this page.

#what is a hsa#what is an fsa grace period#benefits brokers#is an fsa worth it#fsa deductions#hsa companies

0 notes

Note

If I'm making just over 14k a year and my student loans are around 25k, what repayment option would be best for me? I know you went to college so a girl needs some help. I know that the income based repayment has LOTS of interest tacked on and I won't be paying rent after september, so maybe I should just go with a repayment plan that doesn't have a lot of interest but costs a bit more?? However, I know that like 10% is a good place to start.

Also, how do repayment plans work? Do I have to apply for a certain plan on the FSA website? I figured I could just set up a monthly flat rate fee to pay and that was it.... I'm still in my grace period til this week so nothing is really showing up for me.

you'd be a lifesaver if you could offer some help/advice. thank you so much christina!! i'm the only one in my family to attend college so no one else really knows how to help me.

So it depends a bit on what kind of loans you took our and a couple of other factors. I also want to caveat this by saying I'm not an expert in this at all, so I don't want to promise that this is the absolute best approach or anything. That said, here's what I would do:

Compare your options with the student loan repayment simulator. This should help you identify which loan repayment options fit your situation best.

Look into the SAVE plan. It is an income based repayment plan, but it should lower your payments. With the SAVE plan, if you make your full monthly payment, but it is not enough to cover the accrued monthly interest, the government covers the rest of the interest that accrued that month. That means that your balance won't continue to grow due to unpaid interest. Plus, if you originally borrowed $12,000 or less, your debt is forgiven after 10 years. And if I understand it correctly, if you make less than $32,800 a year, your monthly payment is $0, so my guess is that this is the best option for you at the moment. There are more benefits that are set to roll out in July this year. In this scenario, my understanding is that you could start paying down your principle balance without accruing any interest. So for example, you could take what you would have paid towards rent (say $500 a month), and reduce your debt from $25k to $19k by the end of the year without needing to pay any additional interest (I think). You can apply for SAVE here.

You may also want to look into other debt forgiveness plans. If you work for government or for a nonprofit, you may be eligible for Public Service Loan Forgiveness. And if you're a teacher, you may be eligible for Teacher Loan Forgiveness.

I would also consider talking to your loan servicer, who is a person that you can talk to (for free). They're supposed to help you figure out which repayment plan is best for your situation, although some are better than others. If you go this route, I would make sure to know exactly which plan you think you need or to have pre-set questions you want to ask them so that it's less likely they'll try to sell you on a plan that's not in your best interest.

If you're looking for a new job, I would consider applying to companies that have student loan repayment as part of their benefit package. These are a few companies that offer that as an option, but they're not the only ones. You can also do programs like AmeriCorps, Teach For America, and PeaceCorps that will help you to repay your loans if you serve with them.

You can also apply for scholarships or grants to pay off your student loans. These are typically between $500 and $1000, and can help you shorten the amount of time you're paying the loan for.

At the end of the day, this is a suuuuuuper broken system, and it's unfair that you have to think about this at all. But the SAVE plan is a step in the right direction, and hopefully we'll see more movement on student debt forgiveness in the future.

1 note

·

View note

Text

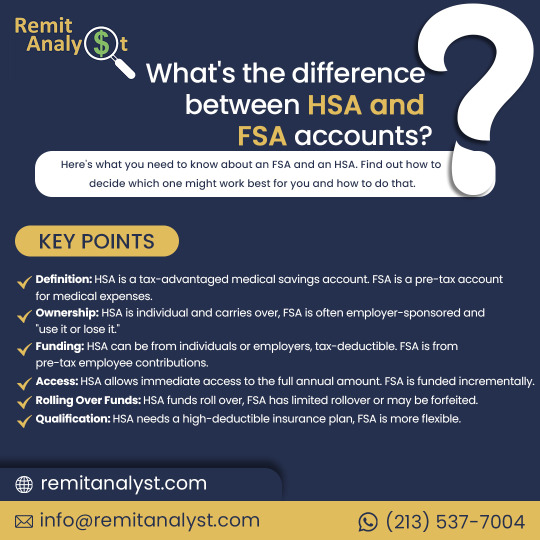

What's the difference between HSA and FSA accounts?

HSA (Health Savings Account) and FSA (Flexible Spending Account). Let's break down the differences between these options and help you make informed choices!

Health Savings Account (HSA)

🔹 Imagine it like a healthcare piggy bank - money goes in tax-free!

🔹 You control it, and it stays with you, even if you change jobs or health plans.

🔹 Contributions are tax-deductible, which is like giving yourself a little financial boost.

🔹 The funds in your HSA can grow over time, providing a nest egg for future medical expenses.

🔹 You need a high-deductible health plan (HDHP) to be eligible for an HSA.

Flexible Spending Account (FSA) 🔸 Think of it as a yearly budget for medical expenses - you plan ahead.

🔸 Funded by pre-tax dollars from your paycheck, reducing your taxable income.

🔸 Use it or lose it - generally, you need to spend the funds within the plan year or a grace period.

🔸 Great for predictable, planned medical expenses like copayments, deductibles, or prescriptions.

🔸 Typically, your employer offers FSA options as part of your benefits package.

difference between HSA and FSA accounts depends on your health needs and financial situation. If you anticipate high medical expenses, an HSA could be a great long-term savings tool. If you have predictable costs and want to save on taxes, an FSA might be your best bet!

Remember, it's your healthcare and your money - understanding these options can put you in the driver's seat. Choose wisely and stay financially healthy! 💪🏥

Discover the Best Rates! Send money to India hassle-free from the USA with RemitAnalyst. Get the top exchange rates and seamless online money transfers. Convert USD to INR effortlessly. Start saving on every transfer now!

#HealthcareSavings#FinancialWellness#HSAExplained#FSAInsights#MoneyMatters#MedicalExpenses#BudgetingTips#HealthcareEducation#SaveSmart#EmpowerYourWallet#HSA#FSA#HealthcareFinance101

0 notes

Link

hello! this isn’t the most timely of postings, but I want to make a series with stuff I wish I knew before applying for/getting into college. the series will be most helpful to lower-income american students, because that’s my experience! eventually I’ll have more stuff regarding STEM courses & tips for when you do start college. everything will be tagged #college help by raz. I’ll get a link for it up and running on my blog.

first off, probably the ugliest part of the process for me: filing the FAFSA, aka the Free Application for Federal Student Aid. I wouldn’t be able to go to college without it but the process literally brought me to tears.

if I save just one student some unnecessary frustration, then my job here is done! kal @promethes was my inspiration to do this, she’s running something with a similar purpose in a couple months so if you’re interested keep an eye out for that.

finally, if you’re trying to get into college/are just getting in and have any questions, don’t hesitate to send me an ask!

if you don’t want to open up the link above to a google doc, the text is available under the cut.

Things to know about the FAFSA:

It opens on October 1st every year. Be prepared to file it right when it opens, the aid is first come, first served.

If you’re going right into college after high school, that means you should apply on October 1st of your senior year.

If you missed the deadline, it’s open till June 30th the next year, but do not procrastinate this. Please trust me. Mark October 1st on your calendar, know it like your birthday. This is free money from the gov, don’t miss out.

You need to file for the FAFSA every year you’re in college, it’s not a one-and-done thing.

To file, you will need an FSA ID for you AND one of your parents (unless you’re not a dependent. If you’re living with a parent/legal guardian and they provide more than 50% of your financial support, you’re probably their dependent. That means they claim you on their taxes & get money back on their return). Make those FSA IDs here. Remember the passwords.

These are separate accounts that you’ll need to actually file the FAFSA. Also, if you have loans taken out they’ll show up here.

When you’re ready to do the FAFSA, use this official website. Other websites can charge you. They might not be secure and definitely won’t be any easier.

Sometimes, income is complicated or parents aren’t always on top of their taxes. Thankfully FAFSA wants documents from two years prior, i.e., for the 2020-21 school year they’re asking for 2018 taxes.

Try to check that those are filed away somewhere you can access before the Oct. 1 deadline. Make sure your parents know the government will pay for your schooling if you do this, and you usually won’t have to give that money back.

If your situation changed and you make a lot less than you did 2 years ago, contact your school’s financial aid office. Sometimes they can help with extra aid.

What documents will you need?

Your social security number

Your driver’s license, if you have one

W-2 forms from 2 years prior, and other records of money earned

Your (and/or your parents’) Federal income tax return from 2 years prior (form 1040, will be different if you’re in an American territory and not one of the states)

Any untaxed income records form 2 years prior, like payments to deferred pension & savings plans, tax exempt interest & child support

Records of taxable earnings from federal work-study from 2 years ago

Record of grants, scholarships, or fellowship aid that was included in you or your parent’s 2018 adjusted gross income

Any current bank statements

Any current business and investment mortgage info, business/farm records, stocks/bonds info

Documentation that you’re a permanent US resident or other eligible noncitizen

If you’re lucky, all these records will be filed in one spot or easily accessible. Try to access them early just in case.

If you have an idea what colleges you’re applying to, add them to the FAFSA when prompted. This will help you know exactly how much money they’re giving you sooner.

Because of the whole “parents not being on top of taxes” thing, I’ve always had to manually put things in instead of clicking the button that lets you manually import the info.

It’s frustrating and takes a while, but you will be able to do it. Thankfully the FAFSA has been getting better with the help available on the page (you can click an info button and it explains most things).

Still unsure what something means? Open a new tab on your browser and google it. You need to answer everything honestly, don’t take chances and take your time.

If you do get to auto-import, I suggest you go through the information manually to double check things if it lets you! I’ve used a similar tool with a tax-filing service and they can get some things wrong.

There are a couple “optional” sections. I fill them all out except for the section about assets, which I’ve consistently skipped. I always get max aid doing this, your mileage may vary.

When you finish, you’ll get a number for your EFC, or expected family contribution--how much they predict your family will have to pay for college.�� For example, if that number is 000, you’ll hopefully get maximum aid and your tuition will be paid for.

Sometimes, they can’t give it all in grants (money you don’t have to pay back), so some of the money will be made out to you as subsidized or unsubsidized loans. If you need them, take out the subsidized loans first, these will not gain interest until your grace period ends, typically 6 months after graduation.

I’ve literally never had success applying for random online scholarships and I applied to a lot of them. The FAFSA is so important if your family is low-income, those grants cover my entire tuition. The rest of my college, including room/board and a shitton of fees, is covered by merit scholarships directly from my school. I go to a large, in-state school, and suggest you stay in state if you can’t get into an out of state college that will 100% pay everything for you. Those colleges, not coincidentally, are also extremely hard to get into especially if you don’t have connections--think the Ivies, MIT, etc.

I recommend in-state because it’s almost always much cheaper than out of state tuition. Sometimes colleges have programs that will let you go to another state and pay in-state tuition at their partner school, if you’re desperate to move far look for those programs OR find a farther college in your state keeping in mind how good their program is for the major you’re looking at.

Also, fancy private schools might get you some connections or more famous speakers at events but the quality of your education won’t be much better, if at all.

Look for scholarships that come directly from the school you like.

Merit scholarships are money your school will give you for having good grades/test scores. How much money 100% depends on the school. Mine had a program where they had different levels of aid, and they calculated which level you fell into based on your high school GPA, ACT, and SAT scores. It’s worth trying to improve your scores on one of those tests if you know it’ll get you more money. These scholarships tend to renew every year/semester if you keep your GPA up in college.

For school-specific questions, contact the school’s financial aid office. For general questions, contact me! Send an ask to @razberrybi on tumblr.

Finally--if you manage to complete the FAFSA wholly or partially on your own, congratulations!! It’s not an easy feat. In my experience the FAFSA is literally harder and more frustrating than filing your taxes. Treat yourself for getting it done!

#college help by raz#studyblr#college tips#college advice#university#college#student#studyspo#fafsa#financial aid#promethes#sorry for the tag spam but I want to help this get around!

60 notes

·

View notes

Text

Finland Approves First 5 Crypto Service Providers

Finland’s crypto regulation is now in full effect. The first five crypto service providers have been approved to legally operate in the country, the Finnish financial regulator confirmed to news.Bitcoin.com. The grace period for operating without registration has expired.

Also read: Finland Begins Regulating Crypto Service Providers

Only Five Registrants

Finland’s Financial Supervisory Authority (FIN-FSA) announced on Nov. 1 that it has granted registration to five crypto service providers. The registrants are Localbitcoins, Northcrypto, Prasos, Prasos Cash Management, and Tesseract Group. A spokesperson for the FIN-FSA confirmed to news.Bitcoin.com Monday:

Starting from 1st of November these five virtual currency providers are the only ones allowed to operate in Finland.

Localbitcoins operates a global peer-to-peer bitcoin marketplace. Northcrypto provides an exchange service for BTC and LTC for EUR. Tesseract Group, formerly Whalelend, provides asset management, OTC trading, and lending services.

Prasos offers crypto exchange and asset management services under four different brands. Coinmotion is an investment platform for BTC, LTC, ETH, XRP, and XLM, which also offers private crypto banking, white label solutions, and merchant services. The others are Bittiraha, a Bitcoin community and broker; Denarium, a physical bitcoin manufacturer; and Bittimaatti, a bitcoin ATM network.

“The registration process requires significant effort from the applicants, for example concerning customer due diligence and written documentation of activities,” the FIN-FSA explained.

During the registration process, the regulator assessed whether the applicants have adequate measures in areas such as preventing money laundering (AML) and terrorist financing (CFT), holding and safeguarding client assets, as well as having adequate management structure. The registrants have submitted written statements to the FIN-FSA describing how they are complying with the requirements. Going forward, the regulator will monitor them for compliance such as by requesting clarifications and performing inspections.

The FIN-FSA emphasized:

From 1 November 2019, only virtual currency providers who fulfill the requirements provided by legislation may practice activities in Finland.

Finland’s Crypto Regulation

The Act on virtual currency providers (572/2019) entered into force in Finland on May 1, installing the FIN-FSA as “the registration authority and supervisory authority for virtual currency providers,” the regulator’s website details. The law is based on the EU’s anti-money laundering legislation.

Crypto issuers, exchanges, marketplace operators, and wallet providers are required to register. The FIN-FSA defines a “wallet provider” as “a natural or legal person who holds virtual currency for the account of some other party or provides for the transfer or storage of virtual currency.” Traders who provides crypto services within a limited network or occasionally are exempt from registration, as are professional activities that require some other authorization by other authorities.

The regulator reiterated that “New providers of virtual currencies may not start the provision of services in Finland before their registration application has been approved,” adding:

If the virtual currency provider does not comply with the requirements, its activities will be prohibited and the FIN-FSA will impose a fine on the provider.

What do you think of the FIN-FSA approving these five crypto service providers? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock and the FIN-FSA.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Finland Approves First 5 Crypto Service Providers appeared first on Bitcoin News.

READ MORE http://bit.ly/34w7SyR

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

1 note

·

View note

Text

Sweet Sweet Loopholes

By Sarah Palatnik

Last month, legislation was passed in the house by Democratic Representative Grace Meng of (yay!) New York to allow money from Flexible Spending Accounts to be used for menstrual product purchase. Source: https://www.usatoday.com/story/news/politics/2018/07/27/house-oks-menstrual-equality-measure-help-women-buy-tampons-pads/849074002/

Congresswoman Meng D-NY

What’s a flexible spending account?

From what I can gather, FSA’s are basically health- care savings accounts available to those who receive health insurance from their job. These individuals can put money in these accounts to be used for out- of- pocket medical costs without taxation. Employers can make contributions to their employees’ FSAs but are not required to. Source and more info here: https://www.healthcare.gov/have-job-based-coverage/flexible-spending-accounts/

So anyway, this legislation requires that these “savings accounts” can be used for pads, tamps, liners, cups, and sponges. (Ummm handmade period underwear didn’t make the list???). Now she’s on to the Senate! Will keep you updated.

Pros:

- This legislation capitalizes on a bit of a loophole and thus offers tax-free menstrual products to folks who bleed in any state, as long as they work at a place with health insurance and FSAs.

Cons:

- Not really a con, but something worth noting. Although this seems like a great idea, it’s still a form of “gaming the system.” This solution is only a band-aid and could potentially even distract from bigger issues like instituting universal health care, removing tampon tax for all, and ultimately making menstrual products coverable by said universal healthcare! But whoops there I go dreamin again….

- And, of course, this proposed legislation doesn’t apply to menstruators who are unemployed or who don’t receive healthcare and FSA’s from their job, who tend to be more vulnerable and who would benefit most from this legislation (see previous point).

So, yes, of course, it’s a start, and Congresswoman Meng should be commended for the work that she’s doing. But overall we need to demand more.

Do you have some good tea about period policy in your community? Tell us about it! Email [email protected] <3

#periods#periodpanties#tampon tax#Healthcare#reproductive health#reproductive rights#womens health#reproductive justice#politics

2 notes

·

View notes

Text

What Is the Difference Between an FSA, HRA and HSA?

Learn the differences between FSAs, HRAs and HSAs to determine which is best for your business.

FSAs, HRAs and HSAs all offer tax-free savings employees can use to pay for eligible medical, dental and vision expenses.

The type of account employers offer (FSA, HRA, HSA) depends on what type of healthcare insurance plan(s) they provide.

FSAs and HSAs have limits on how much money can be contributed annually.

Family health plan in York for employees and good healthcare options should be a top priority. In addition to health, dental and vision insurance, many employers choose to offer employees supplemental tax-free accounts that can be used to pay for medical costs, such as flexible spending accounts (FSA), health reimbursement accounts (HRA) and health savings accounts (HSA). Although the purposes of these accounts are similar, there are a few key distinctions that will determine which one is right for your company.

The difference between FSAs, HRAs and HSAs

The primary differences between FSAs, HRAs, and HSAs are based on their ownership, funding, and requirements. Although each account type generally includes tax-free money, they are subject to different rules under the Internal Revenue Code. Kathy Berger, principal benefits consultant at Think HR and Mammoth, said employers and their advisors need to pay careful attention to all design, communication and administration requirements to avoid adverse tax consequences.

An FSA is an employer-owned and employee-funded account that employees can use to pay eligible healthcare costs that are not covered by other plans. Employees can contribute up to $2,750 per year to the account. Employers can choose to allow up to $550 of unused funds to roll over to the next year or permit a grace period of up to 2.5 months for unused balance.

An HRA is an employer-owed and employer-funded account that employees can use to pay eligible healthcare costs that are not covered by other plans. There is no limit on how much money an employer can contribute each year, and employers choose whether to allow unused HRA funds to roll over into the new year.

An HSA is an employee-owned and employee-funded account that employees can use to pay eligible healthcare costs that are not covered by other plans. Funds can be invested, and employees must be enrolled in a high-deductible health plan (HDHP) to be eligible. Individual employees can contribute up to $3,550 annually, and all unused funds can roll over into the new year.

0 notes

Text

Tips on How to Spend Your FSA So You Don't Lose It

If you have a flexible spending account, you only have a finite amount of time to use the funds you contribute. While employers can provide grace periods and rollover options, these accounts are often "use it or lose it."

Fortunately, there are many ways to spend your FSA before that expiration date hits! But how do FSAs work, and what can you use your funds on?

How Do FSAs Work?

An FSA is an employer-sponsored benefit allowing employees to contribute pre-tax dollars with every paycheck for qualified medical expenses. There's an annual limit to how much money you can put into your account, and you can only use the funds to pay for costs outlined by the IRS.

Furthermore, those funds typically expire at the end of the year. If you don't spend them, they go back to your employer.

Spending Your FSA Funds

Spending your FSA is usually easy if you have doctor appointments, prescription medications, dental care and other services throughout the year. But if you rarely use it, you might scramble at the end of the year to avoid losing your contributions.

Here are a few ideas on what you can use leftover FSA funds for at the end of the year.

Stock Up on Essentials

Did you know you can use your FSA to buy over-the-counter products? Headache medicine, pain relievers, decongestants, antacids, menstrual products and more all count as qualified medical expenses.

Why not stock up? You can spend that last bit on products you'll likely use next year, ensuring you never run out.

Buy New Sunglasses

You can also use your FSA to pay for optometry services and products. If you have prescription lenses, consider buying a new pair of sunglasses. Pick up a new stylish pair you can use when summer rolls around!

Try a New Service

FSAs cover all your typical healthcare services like doctor's visits and specialist care. However, you can also use those funds on less traditional services like acupuncture or chiropractic services.

Try those services if you have aches and pains. It's a great way to use up your FSA funds while seeing if you like the experience.

Read a similar article about is an FSA worth it here at this page.

#what is an fsa#hdhp#2024 contribution limits for fsa#health savings account companies#hsa qualification#top rated hsa#how do fsas work

0 notes

Text

I used to work in FSA/HSA admin, and I strongly suggest reaching out to your hr or your tpa to figure out what the regulations are for this year because there has been a LOT of COVID related changes around FSA, and which changes each company adopted is different.

Some companies allow for dollars to carry over into the FSA for the next year. This is typically capped out at around $500, but the government is allowing for companies to choose to offer unlimited carryover for plans ending in 2020 and 2021, so a lot more people are not going to be losing their money, just as a this year thing. Other companies allow for grace period, where you have a couple of extra months to spend down the funds from the previous year. Typically this ends on 3/15, but again due to COVID employers can choose to extend this to 12/31/2022 for plan years that end on 12/31/2021.

For HSA I don’t suggest a panic spend down, those funds just stay with you in a bank account that you own. They’re essentially IRAs but health related. That being said, the FSA store is an awesome resource that is available to use your pretax dollars on.

so anyone with FSA that's about to expire should really check out FSAstore before it expires. you can literally buy almost any OTC medical supplies you need on there and it's perfect to use up your FSA before you lose it

#usa healthcare is violence#seriously idk how these things are legal because they sure as shit are immoral

2K notes

·

View notes

Text

What Is a Flexible Spending Account?

If you’ve ever looked into health care savings options, you’ve probably come across flexible spending accounts. But what are FSAs, and are they the right option for you? Read on to learn more and find out if you should open an FSA.

What Is an FSA?

An FSA, or flexible spending account, is a tax-advantaged savings account that can be used for medical and dental services.

How Does a Flexible Spending Account Work?

An FSA can only be set up for employees by their employers. If your employer offers an FSA, you can then opt in and make contributions. Your contributions will be deducted from your earnings, and you won’t have to pay any income or payroll taxes on them. If you have medical or dental expenses, you can then use this money tax-free. It’s important to keep in mind that FSA funds don’t roll over into the next period, so you must use them before your period is over. However, many employers allow for a 2.5 month grace period. Some employers may also allow for up to $550 in unused funds to roll over.

The annual contribution limit of an FSA is $2,750 for individuals. If you’re married, your spouse can also contribute through their employer. If you have a dependent-care FSA, your limit is $5,000 for joint and individual filings or $2,500 if you file separately.

Should I Open an FSA?

The choice to open an FSA is up to you, but there can be many advantages. When you have money in your flexible spending account, you can use it for any qualified medical expenses that you come across throughout the year. In general, cosmetic procedures won’t be covered, but most other medical expenses are. Having untaxed funds to cover expenses can definitely save you money. The other considerations to keep in mind are the fact that rollover is limited and that flexible spending accounts typically can’t be used to cover insurance premiums.

Choosing an FSA

If you’re an employer, the choice of the FSA you offer is an important one. Make sure to provide something that offers the best advantages for you and your employees.

To find HSA investment options, visit this website.

#hsa#health savings account#hsa vs fsa#how to compare health insurance plans#hsa investment options#hsa rollover rules

0 notes

Text

7 FAQs employees have about HRAs

Health reimbursement arrangements (HRAs) are becoming increasingly common as more employers are seeking an alternative to traditional health benefits. Employees that are newly offered an HRA through their employer can be confused about how an HRA works. They might be used to another type of health benefit, like traditional group health insurance. This could even be the first time they’ve been offered a benefit by an employer.

For employees in this situation and employers wanting to help them, we’ve compiled 7 of the questions employees most frequently ask about HRAs.

1. Who handles the HRA money?

The money or allowance offered through an HRA is either handled by the employer directly or a third-party administrator. Some companies opt for an annual allowance, or they might split the total into monthly increments.

HRAs are often confused with a health savings account (HSA) or flex spending account (FSA). With HSAs and FSAs, the employee owns an account into which contributions are made. The employee then uses a debit card as they would with a checking account to make payments for their out-of-pocket health care costs. The employee owns the funds, and they can make their own contributions to the account.

In a health reimbursement , or HRA, the company offers its employees a specific allowance and then reimburses them for medical costs through that allowance. With an HRA, the employer owns the funds. In most cases, companies provide reimbursements through the employee’s paycheck, but they could also pay through separate check, cash, or an ACH transfer. Rarely, an employer may provide an HRA debit card, but the funds are still employer-owned. Employees can’t make contributions to their HRA allowance.

2. How do I get reimbursed with my HRA?

To have their expenses verified, employees must provide documentation showing the type of expense, the cost of the expense, and the date of service. The expense must be incurred by the participating employee or their dependents.

Oftentimes, employees will submit an itemized statement to substantiate their expenses. The information may be shown together in one document, or provided through multiple documents. Employees will either provide documents directly to their employer, or by submitting them to a third-party administrator or benefits advisor.

3. What expenses are eligible?

The IRS allows tax-free reimbursement of certain health care expenses through an HRA, generally items or services whose main purpose is to alleviate or prevent a disability or illness.

Here’s a list of some common eligible expenses:

Doctor visits

Dental services

Vision services

Prescriptions

Health insurance premiums

First aid kits

Bandages

Hospital care

Emergency services

Eligible expenses can vary by HRA type. An employer might also limit which expenses are eligible for reimbursement.

4. How long does it take to get reimbursed?

Once an employee has submitted an expense, employers will generally reimburse qualified expenses within 30 days, often by the next paycheck.

Employees enrolled in an HRA can always check with their employers to find out more about when to expect their reimbursements.

5. What about my tax credit?

Employees participating in an HRA who have individual insurance coverage may be eligible to receive a federal subsidy to help pay their insurance premium. This subsidy is called a premium tax credit. Depending on the type of HRA, there are different rules about how a premium tax credit should be handled.

Let’s take a look at how premium tax credits work with some of the most commonly offered HRAs:

ICHRA: Employees can’t receive a tax credit and participate in the ICHRA. If they’re eligible for a tax credit because the allowance they’re offered is unaffordable, they must choose between accepting the tax credit and participating in the ICHRA.

QSEHRA: Employees offered a QSEHRA who are eligible for a premium tax credit should reduce their credit by the amount of allowance they’re offered regardless of how much they’re reimbursed.

Group HRA (integrated HRA): This HRA is meant to be offered in conjunction with group health insurance, therefore, premium tax credits aren’t a consideration.

Excepted benefit HRA: This HRA doesn’t allow reimbursement of major medical insurance premiums, therefore, premium tax credits aren’t a consideration.

6. Do I get to take the allowance with me if I leave?

The allowances offered under an HRA are employer-owned. That means the allowance is available for employees to use for out-of-pocket health care costs, but ultimately belongs to the company.

Unlike FSAs and HSAs, the allowance is not portable and doesn’t go with an employee if they leave the company.

7. Is my HRA allowance “use it or lose it” by year?

Allowances may roll over year to year at the discretion of the business. If allowances don’t roll over at the end of the year, employees will lose out on the funds if they’re not used within the allotted timeframe.

Employers must provide a runout period allowing employees to submit expenses for reimbursement that occurred during the plan year. This allows employees a grace period after the plan year has ended to use their allowance before the funds are no longer available.

Conclusion

The HRA is a powerful tool for employers looking to hire and keep talented employees. For employees, it can make a real difference to their physical and financial well-being. Receiving a new health benefit is exciting, but can leave employees with many questions. Employees who are informed about how their benefits work are empowered to utilize them to their fullest extent.

Informational Source

0 notes

Text

Consumer-Directed Health Plans Are Becoming More Popular: How Do You Choose?

Consumer-directed health plans like Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs) and Health Reimbursement Accounts (HRAs) are becoming more popular as Americans seek to gain greater control over managing their high healthcare costs. In a study done by AARP, researchers found that consumers can benefit from consumer-directed health plans, but deciding which plan is best and having the skills to manage the plan may be more than some consumers are able to handle. A BlueCross BlueShield Association press release in early 2007, reports that 57% of HSA-eligible enrollees opened HSA accounts in 2006. According to the same press release, the U.S. Department of Treasury estimates that by 2010, 40 to 45 million Americans will be enrolled in an HSA-eligible insurance plan. BlueCross BlueShield Association has launched the Blue Healthcare Bank in order to help provide its healthcare insurance customers a one-stop, integrated customer service model with expertise in healthcare-related financial services. The Blue Healthcare Bank will work with BlueCross BlueShield companies to provide debit cards and other financial services tied to HSAs, FSAs, and HRAs. According to the U.S. Government Accountability Office (GAO), the reason consumer-directed health plans are becoming so popular is because of the rising costs of health care in America. Consumer-directed health plans can provide consumers a convenient, consistent way to pay for eligible medical, dental, and vision services and for expenses associated with high-deductible medical plans. Debit cards tied to certain consumer-directed health plans can be used in the medical provider’s office to pay for medical services and insurance deductibles. This eliminates the need to wait for health care expense reimbursement by your health insurance provider. For some consumer-directed health plans, you can use the money or the debit card for expenses that are not covered under your health insurance plan BEFORE you make the contributions. Some plans also allow coverage under another health plan and allow you to be reimbursed for healthcare insurance premiums. Examples of some of the eligible expenses under consumer-directed health plans include: deductibles and co-pays dental services eye exams, eye glasses, contacts, LASIK surgery hearing exams drug addiction programs weight loss programs medical equipment prescription drugs OB/GYN dermatologist and Allergist Over-the-counter (OTC) expenses like cold/flu medicines, sleep aids, pain relievers, bandages, condoms, cough drops, reading glasses, nasal sprays, and pregnancy test kits Over-the-counter expenses like sunscreen, vitamins to treat a medical condition, hormone therapy, arthritis, and orthopedic inserts might be allowed with a doctor’s note Examples of expenses that are NOT eligible under most consumer-directed health plans include: deodorant mouthwash moisturizers sleeping pills multivitamins toothpaste and toothbrush weight scales medicated soap

Brief Description of Various Consumer-Directed Health Plans

(Benefit plans can vary widely. For more details about consumer-directed health plans available to you, check with your employer’s benefit department) Flexible Spending Account (FSA) FSA contributions can carry a pre-tax benefit. An FSA does not have to be pre-funded. Your designated contribution amount for the year is available on the first day of the plan year. For example, if you say you will contribute $2,000 total during the year, divided into equal payroll deductions, you will be able to spend the whole $2,000 on the first day of the year if you need to. You have to spend all the contributed FSA money in that plan year. Some FSA plans allow a 75-day grace period for rollover and spending. For many people who plan properly at the beginning, this is not a problem. Most programs have electronic worksheets available to help you calculate your estimated medical expenses barring any catastrophic event. Long-term care expenses are not eligible under an FSA plan. Health Savings Account (HSA) The HSA is an interest-bearing account where employee contributions may be pre-tax or tax deductible. An HSA must be pre-funded with your contributions. Under the HSA, long-term care expenses and long-term care coverage can be reimbursed. The contributions to the HSA are deducted from the employee’s paycheck. There are limits on HSA contributions. There are minimums on the amount of deductible you must pay in your health insurance plan. Contributions can be carried over and are portable; there are penalties for withdrawing the money for use other than health-related eligible expenses. Health Reimbursement Account (HRA) An HRA is an employer-sponsored plan where your contributions do not have a pre-tax benefit. Long-term care expenses can be reimbursed from HRA contributions. Usually, an HRA account does not have to be pre-funded to use available funds. Some HRA plans allow you to use the funds following termination or while covered by another employer’s plan. Otherwise, the HRA funds are not portable. In some cases, the employer may allow you to carry over unused HRA funds.

Before You Decide on a Consumer-Directed Health Plan

Many factors go into the decision about which consumer-directed health plan is best for you and your family. Your employer’s human resources or benefits department can provide detailed information about what consumer-directed health plans are available to you. You may consider taking the consumer-directed health plan information to a tax advisor or CPA to help determine the tax implications and options for your personal income situation. Read the full article

0 notes

Text

Tips on How to Get the Most Out of Your FSA

Do you have the option to open a flexible spending account (FSA) at your job? If so, take full advantage of it! These accounts are a valuable employer-offered benefit that can help you save on qualified medical expenses. But how does a FSA work? There are many ways to take advantage of an FSA, but few know how to get the most out of these accounts. Here's what you need to know about FSAs.

How Does a FSA Work?

FSAs are accounts that you can put pre-tax dollars into. Your employer can also fund the FSA, but those details vary from one company to the next. You don't pay taxes on your contributions; If you use that money on qualified medical expenses, you won't pay taxes on withdrawals.

You can only use an FSA on certain medical expenses. That includes doctor's visits, medical procedures, prescriptions, insurance deductibles, etc.

Know Your Deadlines

One of the most important things you should know to use your FSA to its full potential is the expiration deadlines. Unlike health savings accounts (HSAs), FSAs don't roll over into the next year. That means you only have a certain period to use the funds in your FSA. After that point, you're out of luck!

Some plans have grace periods and carryover policies. Familiarize yourself with those details to know when to use your FSA.

Understand the Eligible Expenses

The IRS dictates what counts as an eligible expense. That list of qualifying expenses is bigger than you think! In addition to obvious healthcare costs, you can use your FSA to pay for things like family planning products, menstrual care, acne medications and more.

Read up on what you can use your FSA for. Many drugstores have specific FSA sections or shelf labels to help you understand what products are eligible for FSA coverage and what isn't. Use that information to your advantage. There's a good chance that you can pay for the care and comfort products you use every day with your FSA.

Read a similar article about FSA here at this page.

#use hsa toward family planning#hra vs. hsa#limited purpose fsa#midyear financial check-in#hsa qualified expenses#premium only plans#how does a fsa work

0 notes

Text

Journal Task Week 5

Week 5: History: Methodical Contextualisation Task: what does historical research mean and how can it change our understanding of an image?

Today we looked at history as a field and as a methodology. History is often seen as a linear narrative, based in truth, but the reality is far more complex. In the quote from David Bates (below) he talks about how a photograph is produced within a context; the decisions the photographer makes about how he takes that image whether he is making conscious decisions or not will effect how the final image looks.

“All photographs are produced within a context. A photographer works with materials (camera, computer, prints etc.) within a definite social place and time. These materials and the choices the photographer exercises over them, whether conscious or not (i.e., not ‘thinking about it’) organizes the look of the picture”.

(Bate, D. 2009, p.16.)

As a field the history of photography and art can be investigated by looking at: Individual practitioners (their lives and works, who worked with whom, when and where, how and why they did what they did). Periods (what kind of work was created during a specified time period). Styles (how styles interacted with each other – what influence what/whom). Movements (how movements came and went, how they interacted with each other) Using history as field we can ask certain question:

What happened? - a descriptive account

Why did it happen?

How was it possible that it did happen?

Why an individual/set of individuals acted in a certain way. (Seeking to explain individuals’ intentions, motivations, influences etc)

What exactly happened in this historical period

By answering these questions this would lead me into using history as method. I would do this by going to the library, looking at archives, etc. Historical research cannot be achieved by googling, proper research needs to be done.

Examples of how a historical understanding of a picture can change the way we think about it:

Apollo 11, view of Earth rising above Moon’s horizon

When we first look at this picture we can see the view of the earth from the moon. When looking at the historical context in which the picture was taken, we see it against a backdrop of the Cold War; The Cuban missile crisis; The Vietnam War and the arms war, Earth rise becomes a stark remind of Earth’s vulnerability. 'Our planet is a lonely speck in the great enveloping cosmic dark,' the US astronomer, Carl Sagan, noted. 'There is no hint that help will come from elsewhere to save us from ourselves.' UK space historian Robert Poole says ‘ the first popular expressions of ecological concern can be traced to the publication of that picture: dazzling blue ocean, the jacket of cloud and the relative invisibility of the land and human settlement’. 'It is a rebuke to the vanity of humankind,' says Poole. 'Earthrise was an epiphany in space’. It has become one of history’s most influential images.

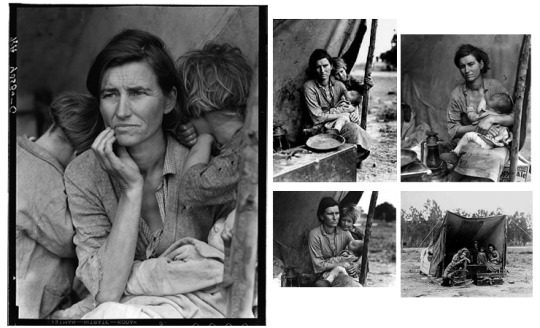

Migrant Mother, taken by Dorothea Lange in 1936

Another example is Dorothea Lange Migrant Mother (2),1936. This image was taken by Lange who was part of the FSA (The Farm Security Administration), The FSA included other photographers and their task was to capture images to help combat rural poverty in the Great Depression.The photo was circulated in newspapers across the nation and became a symbol for strength in difficult times. The government responded by sending 20,000 pounds of food to the camp. By understanding the historical context in which the picture was taken we have a deeper understanding of the image.

Below are two images by Julia Margaret Cameron. I have recently rediscovered her work in this semesters lectures. I am fascinated by the history/stories behind both Julia Cameron and her equally interesting models. There is so much research you could do into her photography using history as your methodology. I have included some information I have found on Mrs Herbert Duckworth, and also on Alice Liddell who has the Lewis Carol connection, and is thought to be the ‘Alice’ in Alice in Wonder Land book. I would like to see the images at The Victoria & Albert Museum, and have the opportunity to do some proper historical research into Julia Margaret Cameron.

Mrs. Herbert Duckworth, (1867), by Julia Margaret Cameron

INFORMATION TAKEN FROM THE JOHN PAUL GETTY MUSEUM:

Mrs Herbert Duckworth (née Julia Jackson, 1846-1895) was widely regarded as the most attractive of all the daughters born to the Pattle sisters. She was the child of Mia, Julia Margaret Cameron’s youngest sister, and her husband John Jackson, a physician who practiced for twenty-five years in Calcutta. Her beauty prompted several proposals of marriage, most notably from William Holman Hunt and the sculptor Thomas Woolner. She was continually sought after as a model by leading artists of the day: George Frederick Watts drew her often during childhood and painted her portrait in oil in 1874; Edward Burne-Jones used her as the model for the Virgin in his Annunciation (1879), one of the great works of Pre-Raphaelite painting. Cameron photographed her treasured namesake, niece, and godchild repeatedly over the years, creating a corpus of works that are among the finest examples of her work.

In 1867, at the age of twenty-one, Jackson accepted the marriage proposal of Herbert Duckworth (1833-1870), a barrister. This striking portrait and another, probably made just prior to her wedding, project an image of heroic womanhood and celebrate her cool, Puritan beauty. The perfect framing of the bust in both is given great emphasis by Cameron’s handling of light, which is carefully cast to accentuate the strength and beauty of the head. This is the most revolutionary aspect of these pictures and is akin to the attention and quality of effort Cameron expended on her images of famous men.

Duckworth was widowed in 1870 after only three years of marriage. Mourning the loss of her husband she took up studies on agnosticism and also began to nurse the ill and dying. In this period she came to know Leslie Stephen (1832-1904), an author on the subject of agnosticism and the brother-in-law of her friend Anne Thackeray. After his wife Minnie died in 1875, Stephen and Duckworth grew even closer eventually marrying in 1878. They went on to have four children, including the artist Vanessa Bell and the author Virginia Woolf. Woolf described her mother in the character of Mrs. Ramsay in To the Lighthouse (1927): “The Graces assembling seemed to have joined hands in meadows of asphodel to compose that face.” Cameron’s 1872 portrait of Duckworth seems to echo this description with its subtitle, “A Beautiful Vision” (

Pomona1872

Julia Margaret Cameron British

Alice Liddell (1852–1934)—who, as a child, was Lewis Carroll’s muse and frequent photographic model—posed for Cameron a dozen times in August and September 1872. Against a dense background of foliage and bedecked with flowers, the twenty-year-old Liddell was photographed by Cameron as the embodiment of fruitful abundance, Pomona, Roman goddess of gardens and fruit trees.

INFORMATION TAKEN FROM THE V&A

0 notes

Text

Federal Student Aid (FAFSA) 2020-2021

FAFSA ( Free Application. For Federal Student Aid) form can be used to apply for financial aid for college or graduate school. The FAFSA doesn’t pay for anything. The FAFSA is the application for financial aid. Aid comes from college. I strongly recommend that you talk to the financial aid office at the college you’d like to attend, and tell them what you told me.

Where Can Start?

Goto https://studentaid.gov/h/apply-for-aid/fafsa. click start here to start application

Am I eligible for FAFSA

https://studentaid.gov/understand-aid/eligibility

2020-2021 school year: Use the 2020-2021 FAFSA, which opens October 1, 2019. This one requires 2018 tax information.

If you are First Time applying for FASFA follow this step by step guide

Create an FSA ID. This is your legal electronic signature to sign your FAFSA. It’s linked to your Social Security number. If you are a dependent student, one of your parents will need to make one as well. If your parent already has an FSA ID (for themselves or for other children), they must use their existing FSA ID.

Gather all necessary documents, including bank statements, tax information (W-2s, tax returns), any records of untaxed income, etc.

Start the FAFSA! If you or your parent are given the option to use the IRS Data Retrieval Tool, use it! It will drag tax information from the IRS straight to the FAFSA and save you a lot of time.

Estimate your aid

https://studentaid.gov/understand-aid/estimate

FAQ

If you want aid for summer 2021, you need to add MSU to your 2020-2021 FAFSA and resubmit it, because summer 2021 is part of the 2020-2021 aid year (at most schools). You’ll also need to do the 2021-2022 FAFSA when it opens this October. MSU won’t even look at your FAFSA until you’re admitted, so there’s no issue here.

Yes, you can do the FAFSA without having been admitted. Make sure you meet all deadlines for transferring to MSU. You would likely apply to MSU this fall.

Private loans are awful scams that ruin many lives. Please don’t do what you outline here. It’s really a bad idea.

If I didn’t qualify for any Financial aid last semester (not even loans) would it make any sense to even apply for it now?

Federal Pell Grants usually are awarded only to undergraduate students who display exceptional financial need and have not earned a bachelor’s, graduate

The Excelsior Scholarship, in combination with other student financial aid programs, allows students to attend a SUNY or CUNY college tuition-free.

So I recently just accepted financial aid for nursing school for the 20-21 academic year. How do I pay it off, rather quickly? I noticed words such as interest rates and 6-months grace period on one of the documents but I am still confused. I am not too familiar with any financial stuff so I’m just concerned with paying any extra fees because I’m doing something wrong.

—Sounds like you’ve accepted loans. You need to do something called a Master Promissory Note and entrance counseling (an online module to teach you about the loans and how to use them). Ask your financial aid office for a financial aid counselor to walk you through your aid offer.

Direct PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for college or career school. PLUS loans can help pay for education expenses not covered by other financial aid.

FAFSA Pay Back:

I also just looked further into your question and the total amount is in regards to a year total not monthly. So back in 2018 how much did your parents pay for your rent and other bills. I personally wouldn’t include food estimates since they would be buying groceries regardless of you living there-I could be wrong but food isn’t specified. (I would add it if you lived under a separate roof and they paid for your individual groceries)

—

Yes, you should be independent despite living at home. You just need to be 24+ by Dec. 31 of the year you are applying for.

Yes, it automatically locks those since you are counted as independent

You typically want to go with your best guess (so maybe 550 if you aren’t sure?) and it’s based on the day you are filling out the FAFSA itself so it could vary

General rule I like to go by is trying to provide the most accurate information but not providing additional information if it’s not required (especially financial).

Hope this helps! I’m a college adviser but I normally work with hs students so I tried my best to answer as I don’t have too many independent students

Cal Grant : The Student Aid Commission strives to make education beyond high school financially accessible to all Californians.

Do you have to fill out the Direct Loan Master Promissory Note and Direct Loan Entrance Counseling every year?

—Yes, because loans are offered per year. Each year’s loan is unique

My college requested verification after doing the fafsa. Do I have to print out the tax return transcript request form to sign it and email it? It doesn’t let me type on the lines on the pdf.

—You can submit a SIGNED copy of the tax return itself to your financial aid office.

—Go to the IRS website and do the online request. That form is for paper copies and you cannot get a paper copy right now.

I recently moved to the us and haven’t received my ssn and it may take a while a after October any idea about what I can do?

—-If you’re not a citizen or eligible non-citizen, you aren’t eligible for federal financial aid. Look at private schools which may have more money to give. Or start at community college which is much cheaper.

If you have more question or want answer please post your question:

FAFSA/financial aid verification questions? Get help here! from college

from USA Admission – Study in USA , F1 Visa, Opt https://usaadmission.com/federal-student-aid-fafsa/

0 notes

Text

Coronavirus Surprise: IRS Allows Midyear Insurance And FSA Changes

The economic upheaval and social disruption caused by the coronavirus pandemic have upended the assumptions many people made last fall about which insurance plan to sign up for, or how much of their pretax wages to sock away in health or dependent care flexible spending accounts.

You may find yourself in a high-priced health plan you can no longer afford because of a temporary pay cut, unable to get the medical care you might have planned and budgeted for, or not sending the kids to day care. Normally you’d be stuck with the choices you made unless you had a major life event such as losing your job, getting married or having a child. But this year, things may be different.

Last month, the Internal Revenue Service announced it would let employees add, drop or alter some of their benefits for the remainder of 2020. But there’s a catch: Your employer has to allow the changes.

The new guidance applies to employers that buy health insurance to cover their workers as well as those that pay claims on their own, called self-insuring. It’s unclear how many employers will take advantage of the new flexibility to offer what amounts to a midyear open enrollment period. If you’re wondering what your company will do, ask.

Email Sign-Up

Subscribe to KHN’s free Morning Briefing.

Sign Up

Please confirm your email address below:

Sign Up

“If a consumer finds themselves economically strapped and their finances have changed, and they’re in a situation where they really would like to rethink their coverage, they may want to approach their employer and see if they’re planning to adopt any of these changes,” said Jay Savan, a partner at human resources consultant Mercer.

Some health care policy experts are unimpressed with the new coverage options, noting that earlier this spring the Trump administration opted not to create a special enrollment period for uninsured workers to buy subsidized health insurance on the Affordable Care Act’s health insurance marketplaces.

“It’s not likely that many people will take up this new coverage opportunity, and it won’t address the problem of lack of coverage that many people are facing,” said Sabrina Corlette, a research professor at Georgetown University’s Center on Health Insurance Reforms.

Assuming you still have employer-sponsored coverage, here are examples of circumstances workers may face and what the IRS changes could mean for them.

You want to switch to a cheaper plan to put more money into savings during these uncertain times. Can you do that?

If your employer decides to allow it, you can.

One consideration: If you switch plans midyear, you may have to start all over again paying down your deductible and working toward reaching your annual out-of-pocket maximum spending limit for the year, said Katie Amin, a principal at Groom Law Group in Washington, D.C., a firm specializing in health care and benefits.

“Some employer plans would credit you under the new option if you switched plans,” Amin said. “It depends.”

You’ve got a high-deductible plan and are worried about high medical bills if you get COVID-19. Can you switch to a plan with more generous coverage?

The IRS guidance allows it, but your employer probably won’t, say experts. It’s impossible for workers or their bosses to know who will develop COVID-19. But the concern among employers is that people willing to pay more for generous coverage may be sicker and have higher health care costs than other workers, and could therefore cost the plan more, a phenomenon called adverse selection.

In addition to evaluating whether employees could benefit from midyear changes, an employer will weigh financial considerations, said Steven Wojcik, vice president of public policy at the Business Group on Health, which represents large employers.

They’ll ask, “What is the adverse selection risk, and what is going to be the uptake [in coverage] if you open up enrollment?” he said.

Under the new rules, if you haven’t had health insurance on the job before but would like to sign up now, you can do that, too, if the employer decides to permit it.

What if one spouse gets laid off but the other is still employed? Can the couple switch their family coverage to the employed spouse’s plan?

Yes. But this was already allowed before the new IRS guidance came out. Under long-standing rules, if workers’ life circumstances change they’re entitled to change their coverage during the year.

Can you drop your employer coverage altogether?

Yes, if your employer permits it. Normally, once you sign up for health insurance through your employer and agree to have your premiums deducted from your paycheck, you can’t drop coverage during the year unless you experience a qualifying life event. Under the new IRS rules, you can drop your coverage, but only if you replace it with another form of comprehensive coverage such as through a health insurance exchange or Tricare, the military health insurance program.

One thing that won’t qualify as comprehensive coverage: a short-term plan, said Amin. The Trump administration has encouraged the adoption of limited-duration plans with terms that can last for nearly a year. They don’t typically cover preventive care or preexisting conditions, and renewal is not guaranteed.

You’ve put thousands of dollars into a flexible spending account to cover day care expenses this year, but now the kids are home full time. Can you change the amount?

Yes, but once again this is allowed only if your employer agrees to it. Likewise, if you want to increase your pretax contribution because you need to hire someone to care for your kids at home while you work, you can do that, too. You can also establish a new flexible spending account for dependent care expenses in 2020 if you don’t already have one.

Employees are legally entitled to put up to $5,000 annually into a dependent care FSA to pay for day care, preschool, after-school programs or summer camp.

“Since it’s the employees’ money, my guess is employers will allow them to make changes,” said David Speier, who is in charge of the benefit accounts group at human resources consultant Willis Towers Watson.

You planned to use money left over in last year’s FSA to cover the cost of a medical procedure in early March. But that was postponed because of the coronavirus and you’ve missed the March 15 deadline for using those funds. Do you have any recourse?

Under the new IRS guidance, employers can opt to extend the grace period for using leftover 2019 FSA funds through the end of 2020. Typically, those funds would have disappeared under “use it or lose it” rules if they hadn’t been used by March 15. In 2019, the maximum pretax contribution to a health care FSA was $2,700; this year it’s $2,750.

Similar to the changes now permitted for dependent care FSAs, employers can also decide to permit workers to prospectively decrease or rescind their elected health care FSA amounts altogether.

If you decide to stop contributing to your FSA, you can spend down the money that’s accumulated there on health care expenses, but you can’t cash out the account, said Amin. For example, if you’ve accumulated $500 in your FSA, you can use that money for eyeglasses or other approved expenses through the end of the year. But your employer can’t give you the $500 outright, essentially cashing out the account.

Employers have expressed a lot of interest in implementing the flexible spending account changes, said Mercer’s Savan.

“We expect them to have a lot of traction,” he said.

Coronavirus Surprise: IRS Allows Midyear Insurance And FSA Changes published first on https://nootropicspowdersupplier.tumblr.com/

0 notes