#fsa deductions

Explore tagged Tumblr posts

Text

Can I Use My HSA for My Family Members?

The best health savings account (HSA) can do a lot to help you cover medical expenses. These accounts allow you to put aside pre-tax income up to the annual limit. You can also invest the funds in the account to get tax-deferred growth. Furthermore, you can use the money in your HSA for qualified medical expenses tax-free.

HSAs are a fantastic tool that allows you to save for medical care. Whether you use it now or wait until you have major expenses, it can make healthcare far more manageable.

One common question about HSAs is whether or not you can use HSA funds to pay for expenses incurred by family members. In this blog, we'll answer that question and clarify how you can use your HSA.

Using HSA Funds for Family

Your HSA will cover any qualified medical expense, including over-the-counter care products. As long as the expenses fall under IRS-set guidelines, you won't receive a penalty or pay taxes on that spending.

That also covers certain family members. You can use your HSA for family members, but they must be tax dependents. That means you can't use it to help out a friend or assist a sibling.

Your HSA extends to tax dependents only.

Individual vs. Family Health Plans

Confusion about HSA spending for family members often arises due to the different types of coverage you must get to open an HSA. To open an HSA, you must have a high-deductible health plan (HDHP). When you enroll in an HDHP, you can get either individual or family coverage.

Contrary to popular belief, there's no such thing as a "family" or "joint" HSA. Only one person can own an HSA. However, annual contribution limits depend on your HDHP coverage type. In 2023, the annual limit for individual health plans is $3,850 and $7,300 for family plans.

It does not matter whether you have an individual or family health plan. You can use the best health savings account to pay for eligible expenses from tax-dependent family members. What changes between individual and family HDHP health coverage is how much you can contribute to your HSA every year.

Read a similar article about the best employee benefits here at this page.

#what is a hsa#what is an fsa grace period#benefits brokers#is an fsa worth it#fsa deductions#hsa companies

0 notes

Text

🩺 Are you a healthcare practitioner? Discover specialized tax planning strategies designed just for you. From deductions to retirement options, this guide has you covered. Secure your financial future! 💰🌡️ #TaxPlanning #MedicalProfessionals #Finance 📊💉

#Tax Planning#Medical Professionals#Deductions#Retirement Options#Student Loan Debt#Healthcare Practice Ownership#HSAs#FSAs#Compliance#Estate Planning#Tax Updates

0 notes

Text

How are HSAs Taxed?

A health savings account (HSA) is one of the best ways to save for unexpected medical expenses and secure your financial future. These accounts are entirely "portable." They don't tie to your employer; all your contributions stay in your account until you spend them. There are limitations to how much you can contribute to your HSA every year. But that figure can grow for decades, resulting in a comfortable nest egg covering medical expenses when needed.

But that's not all.

HSAs also come with numerous tax advantages. Consider using an HSA calculator for tax savings to understand how these accounts can benefit you. Here's a quick breakdown of the benefits and how they affect your taxes.

Contributions

Whether you make contributions or your employer does, they're tax-free. One of the biggest perks of an HSA is that you can exclude contributions from your gross income. You must report what you or your employer puts into your HSA, but that amount is tax-deductible and will decrease your taxable income.

Interest

Another substantial benefit of having an HSA is that you can invest your contributions. These accounts can grow over time, and any bit of interest you earn is tax-free.

The only exception is if you use your HSA for non-qualifying medical expenses. If that's the case, the interest is tax-deferred. You can only spend the money in your HSA on certain procedures and products. Those restrictions come from the IRS. If you withdraw funds for anything outside those eligible expenses, it counts as taxable income. You may also have to pay a 20 percent penalty.

But if you use your HSA wisely, the interest you gain is tax-free.

Tax-Free Spending

Finally, you can use your HSA for qualifying medical expenses tax-free. As mentioned earlier, you can only use this account to pay for specific items and procedures. These include medically necessary treatments, health care products, etc.

If you're considering opening an HSA, use an HSA calculator for tax savings to understand how they can improve your financial situation and prepare for the unknowns of the future. These tax-advantaged accounts can help you reduce taxable income, grow wealth and more.

Read a similar article about HDHP vs PPO here at this page.

#lifestyle spending account#hsa calculator for tax savings#what are employee medical travel benefits#hsa providers#hsa tax deduction#fsa contributions#hsa eligibility

0 notes

Text

Saw that some folks don't know how American Private Insurance Works, so I wanted to show some real life examples of how mine works. For transparency I do not use United Healthcare (I have had them in the past), my numbers are from the insurance I have which is called Aetna; and the plan I use is available through my employer (so if I quit or get fired, I lose my insurance).

So, in my experience. Copays (the amount of money you owe upfront for an appointment) varries depending on what doctor you're seeing. I have to pay this every time I see a doctor, and if I do not have an FSA/HSA card then I have to pay with one of my personal cards.

For a Primary / Family Doctor $30 USD -

For a Specialist (Physical Therapy, Therapist, Orthopedics, literally any specialty doctor) $60 USD -

Urgent Care $75 USD -

Emergency Room $300 USD -

And where does that leave me, 6 months into my year plan (because this resets to Zero every time the plan renews)?

What Does that mean? That means if I went to a hospital today and had to stay overnight, I'd be responsible for $2,422.16 USD before my insurance would cover anything. And I would have to spend another $2,135.40 USD before they would 100% cover the cost. If I needed any surgery, any care, anything that gives a bill, I am responsible for it until I meet those "goals"

But the fun part? I don't know what that would mean for my primary care doctor visits after I meet my out of pocket maximum, because I have NEVER met either my deductible or my out of pocket maximum. Not because I didn't have expensive bills! But because they never fucking applied. Because all of this still hinges on you being IN-network. So if you go to a doctor that's out of network, those numbers are different! They're higher.

I did 13 sessions of physical therapy about 1.5 months ago. That was $780 dollars for the copays. Plus an extra $77.84 because of one of the things I was billed for was not covered with my insurance. Oh yeah, even if you go to an in-network doctor there are procedures that aren't covered by your insurance even if they're necessary. If they were out of network I would have been responsible for a total of $3,885 additional dollars on top of my $780 I paid in co-pays. And that would not have counted towards my deductible. It would have been towards my out-of-pocket max.

I have to look up local doctors in my town to make sure they are in network, people have to look up HOSPITALS to make sure they are in network. Our system is fucked up. I have had reoccurring chest pains since childhood that they can't figure out why, and anytime I get a flair up I have to figure out if I want to take the risk of it being a heart attack or not because it costs $300 to be seen by the emergency room (because urgent care cannot help with chest pain). When my father had a grand mal seizure and possibly hit his head, I as a teenager had to figure out in a moment of crisis if I needed to call 911 or not. Because my father is epileptic with a different type of seizure (partial complex) and while he had frequent episodes, he had not had a grand mal seizure for over 12 years at that point, and I didn't know if we could afford the ambulance. That was one of the most terrifying moments in my life, point blank, made worse because of how fucked up our insurance system is.

57 notes

·

View notes

Text

If you, or someone you love, has ever received a big stack of medical bills just because you, for example, tripped in a parking lot, this post is for you.

Even if you have excellent insurance, you might want to learn about negotiating fees and charges. MANY fees and charges can be negotiated, but you have to ask and/or talk to more than one person. You can also get better rates by shopping around or asking for "self-pay rates" when you make the appointment.

If you read nothing else here, take note of these websites:

Dollarfor.org for negotiating hospital and other medical bills

Goodrx.org for finding best prices on drugs, shots, etc.

Radiologyassist.com for finding best pricing on X-rays, MRIs, etc

https://www.upmc.com/patients.../paying-bill/services/apply for negotiating UPMC bills (hospitals, providers, etc)

https://ahnneighborhood.org/financialassistance/ for negotiating AHN bills

https://www.healthcare.gov/community-health-centers/ database of low-cost or free clinics, searchable by zip code

https://www.kff.org/statedata/ my favorite website for researching healthcare stats

The following is copied from a health researcher named Timothy Frie, whose business name is "nutritionfortrauma"

https://www.timfrie.com/

------------

"There’s an entire market of health care services that most people don’t seem to know about.

If you don’t have health insurance, you have a high-deductible insurance plan, or you just want to save money on health care costs, here’s several resources you need to know about that could save you tens of thousands of dollars and the stress of unexpected medical bills:

If you need an MRI, x-ray, CT, mammogram, ultrasound, or PET scan, check the cost and availability of RadiologyAssist.com.

You pay one single flat-fee upfront for your scan and you won’t get a bill.

If you need an imaging referral, you can request a virtual consultation for $40.

You can also ask any imaging center for the self-pay rate for the scan you need and compare that to your anticipated out-of-pocket expenses.

If you need blood work, you may be able to pay a lower cost by purchasing the tests from a direct-to-consumer provider like PrivateMD Labs, Ulta Labs, or similar.

Just google “direct to consumer lab testing.”

Personally, I’ve found these services to sometimes be 60-90% cheaper than utilizing the direct-to-consumer options from Quest or Labcorp — even though they’re often the two labs drawing and processing your sample.

You pay one single flat-fee upfront and you won’t get a bill.

If you need more frequent support and care from a primary care provider due to a chronic illness or something else, explore “direct primary care.”

This is not the same as concierge care, which tends to be more expensive in most regions.

These are practices that offer care for a single flat-fee per month that ranges between $30-$100/mo on average.

All of your office visits and most procedures are included.

If you need to visit an urgent care, ask for the self-pay rate up-front.

Many urgent care centers offer an all-inclusive flat-fee option that includes everything that you need while you’re there, excluding medication and third-party lab fees.

This cost can range between $150-$400.

If you need a prescription and it’s more affordable on GoodRx or a similar service, you can ask to pay for it without utilizing your insurance.

I’ve found that some medications are more affordable at privately-owned and operated pharmacies vs. corporate pharmacies.

If your medical debt goes to a collection agency, you can negotiate a settlement to avoid paying the entire fee and/or litigation.

There are tons of resources about this online, including organizations who will support you with this (for a fee).

ALWAYS get and review an itemized bill before paying outstanding medical debt.

You can use HSA and FSA funds to purchase some health-related and wellness products, not just services.

Just Google “HSA shop” and see what you come across.

Review your HSA/FSA restrictions yourself before purchasing anything to ensure you don’t get stuck with an unexpected bill.

In some cases, you may need a letter of medical necessity."

End of Tim Fries

===============

I decided to post this information because although I have been working in healthcare and insurance copywriting and marketing since I was 22 years old, and I knew things were bad, I was reminded just how bad / expensive / confusing the state of US healthcare is after reading story after patient story following the shooting death of the United Healthcare CEO last week.

In May, I fell and broke my arm. It was a serious fracture, both bones, one exposed, and I was in surgery within hours. The good news is my surgeon was awesome and I had zero pain during the rough first 10 weeks of recovery. I took two Tylenol and I didn't even need them.

Because it was unplanned surgery and I spent two days in the hospital, coming through the ER, I got bills from many many different providers. I work in this field so I knew what to expect but it was still a headache and confusing. Especially during a time that I was unable to tie my shoes, pull up my socks, cut my own food, drive, or risk any activity that could lead to me falling. I also had to reduce my work hours since I was typing with one hand.

I'm fine now. I had a LOT of help during the worst of it.

I hope this post reaches someone who needs to see it.

9 notes

·

View notes

Text

happy the end of january. may i present to you this months financial diary entry, the first of twelve.

disclaimers: it looks like i make good money, but the way the paychecks fell, all of the money for the first half of february came to me on the 31st. i make $3/hour below a living wage, and work between 32 & 36 hours per week instead of a full 40.

i am privileged to be able to live with my parents and it is the only way i can be alive. my only route out of this house is extreme frugality. (to either buy a very small and shitty house or to go to college for a better job) extreme frugality has never come naturally to me. you will see this.

anyway sprouty loves talking super candidly about money so here's the dirt

I did not meet my savings goal ($600), I exceeded my debt repayment goal($600) I do not consider these 'spent' money

pretending i didnt accidentally put these in dollars, i almost met my spend vs no spend day balance goal (50/50 or better) i did undershoot my weekly grocery spend goal (100/wk)way ahead of schedule (this goal was set for the end of March) but id like to see if it's possible to bring this down to 50/wk because I was still horrified with the total

health & medical does include $33 for deodorant and facial moisturizer to last me til at LEAST may. health & medical does not include prescriptions or other assorted medical bills paid through my FSA. i pay for my prescriptions, my psychiatrist, and my less expensive dental work through this account, this month approximately $350. this money is not counted in the spreadsheet as it is automatically deducted from my pre tax paycheck and never meets my bank account. nevertheless it is my money that i spent

valid unnecessary spending is anything that was not straight up necessary to my survival that was explicitly within the rules. ex. cat toys & furniture wax

bent rules category is just about only things i spent money on and was mad about. most of these instances led to a modification of the rules.

broken rules is mostly my fucking gym membership that i cancelled but not before they charged me a $50 fuck you fee on 1/1 AND the $11 monthly fee. after that it's purchases made on literally the first outing of the year, and two forgotten lunches.

#pointedly not thinking about the incoming recession#these tariffs are. bonkers.#we will pretend that this is going to be a choice im allowed to make for a while longer#once the economy explodes we'll come around to it

2 notes

·

View notes

Text

They can help me!!! It'll be fucking expensive but at least I'll meet my deductible? But yeah looking at like 2000$ that I'm not gonna put on my FSA bc I don't wanna empty that quite yet

Im gonna apply for care credit wish me luck on that end but yeah if you wanna purchase from my online shops every lil bit helps a bunch

1 note

·

View note

Text

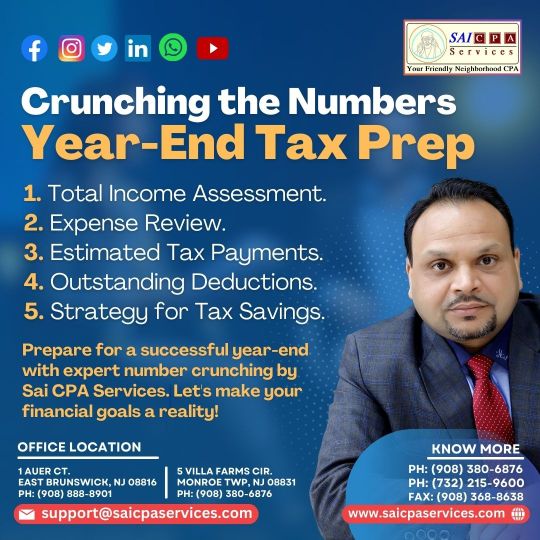

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ (908) 380-6876

1 Auer Ct, East Brunswick, New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

Esketamine Cost with Insurance: Strategies for Affordability

Introduction:

Esketamine, a breakthrough treatment for depression, has shown promising results for individuals who have not responded well to traditional antidepressant medications. However, one of the concerns that may arise when considering esketamine treatment is the associated cost. In this blog post, we will explore various strategies to make esketamine more affordable by leveraging insurance coverage and exploring cost-saving options.

Understanding Insurance Coverage:

Begin by understanding the specifics of your insurance policy. Review the coverage details and determine if esketamine is included as a covered medication. Check if there are any restrictions, limitations, or prior authorization requirements. This will give you a clearer picture of what costs to expect and how to navigate the process.

Consult with Your Insurance Provider:

Contact your insurance provider directly to gain insights into your coverage for esketamine. Ask specific questions about copayments, deductibles, and any potential out-of-pocket expenses. Seek clarity on the documentation required for reimbursement and the steps involved in filing claims.

Research In-Network Providers:

Find out if there are any in-network providers or clinics that offer esketamine treatment. In-network providers often have negotiated rates with insurance companies, which can lead to more affordable treatment options. Consider reaching out to these providers and confirming their acceptance of your insurance plan.

Seek Prior Authorization:

Some insurance plans may require prior authorization for esketamine therapy. Work closely with your healthcare provider to gather the necessary medical documentation and submit it to your insurance company. This step helps ensure that the treatment is medically necessary, potentially increasing the chances of coverage approval.

Explore Financial Assistance Programs:

Research financial assistance programs offered by pharmaceutical companies or non-profit organisations. These programs can provide financial support or discounts for eligible individuals who are prescribed esketamine. Check the eligibility criteria and application process for each program to see if you qualify.

Compare Insurance Plans:

During the open enrollment period or when considering a change in insurance coverage, compare different insurance plans to find the one that offers the best coverage for esketamine. Look for plans that have a higher level of coverage or lower out-of-pocket costs for this specific medication.

Utilise. Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs):

If you have an FSA or HSA, consider using these accounts to pay for esketamine treatment. These accounts allow you to set aside pre-tax dollars specifically for medical expenses, potentially reducing the overall cost of treatment.

Talk to Your Healthcare Provider:

Engage in an open conversation with your healthcare provider about the financial aspect of esketamine treatment. They may have valuable insights or recommendations to help you navigate the insurance process, explore cost-saving options, or even consider alternative treatment approaches.

Conclusion:

While the cost of esketamine treatment with insurance can be a concern, there are strategies available to make it more affordable. By understanding your insurance coverage, seeking prior authorization, exploring financial assistance programs, and considering cost-saving options, you can optimise the affordability of esketamine treatment. Remember to engage with your healthcare provider and insurance company to ensure a smooth and cost-effective journey towards better mental health.

2 notes

·

View notes

Text

2 Reasons an HDHP May Not Be the Best Option for You

High-deductible health plans (HDHPs) are a type of health insurance plan that helps you save on monthly premium costs. When you compare an HDHP vs PPO or other health plan, your monthly premium bill will be much more affordable. But there are several disadvantages to consider.

There are many benefits to getting an HDHP, including the ability to open a health savings account (HSA). But is an HDHP right for you? Here are a few reasons why you might want to reconsider.

You Can't Afford Higher Out-of-Pocket Expenses

Despite all the perks of having an HDHP, one significant tradeoff exists. That's the higher deductible and out-of-pocket maximum.

Your deductible is how much you'll have to pay before your health insurance coverage takes over. You must pay 100 percent of healthcare costs before coverage kicks in. Depending on your plan, you may have to cover copays or coinsurance until you reach the out-of-pocket maximum.

The out-of-pocket maximum is the total amount you'll have to pay for covered healthcare services annually. Once you meet that, your health insurance will take care of the rest. In the fight between HDHP vs PPO, the former typically has a higher deductible, but that out-of-pocket max protects you from significantly higher expenses. For 2024, the out-of-pocket maximums for an HDHP can't exceed $8,050 for individuals or $16,100 for families.

If you're unable to cover your deductible, you may want to reconsider getting an HDHP.

You'll Need Substantial Medical Care

If you think you'll need considerable healthcare services throughout the year, exploring other plan options may be a better choice. HDHPs are often the go-to for people who are young and relatively healthy. They're a fantastic way to save on monthly premiums when you don't think you'll need much medical care.

The coverage is still there if needed, but you're not paying high premiums to get it. If you don't fall into that category, getting a plan that focuses on lower deductibles with better coverage over more affordable premiums may be better.

Read a similar article about 2024 contribution limits for FSA here at this page.

#flexible employee benefits#hsa vs fsa#high deductible health plan#hdhp vs ppo#hsa investment#flexible benefit administrators#hsa tax forms

0 notes

Text

One thing I want to add to this is that to "get around" paying for coverage, HDHP plans are becoming more prevalent. They won't cover a lot of Medical costs until you hit your deductible regardless if you have a copay. And even a small (under 5K) deductible can be difficult for a family or individual to afford/meet. What they want you to do is get a HSA (those are fine but have rules) or an FSA (these have some *extra* shenanigans) to pay for your healthcare until you hit that deductible. So, y'know, yes you have coverage and can't be denied/kicked off your plan for existing but it's can be a bitch and a half to get health insurance to actually pay for shit.

That said: the ACA was the right move. We need it. We need it expanded. We need the same kind of health coverage as places like Norway and Sweden.

One thing the analysts back in 2012 were right about is that they’d stop calling it “Obamacare” the second it started working and lo and behold anytime it was actually threatened under Trump it became The ACA and now Leftists who were in Kindergarten when the ACA was passed think Democrats have added nothing to this country.

#The ACA also now has mandatory coverage for HIV/AIDS antiretroviral therapy (ART - the maintenance drugs you may have heard about!)#Remember when these were price gouged bc they were 'high demand'? ACA swiftly made coverage mandatory after that snafu#But in all honesty a lot of this mandatory coverage is the result of years of behind the scenes tireless work!#ACA also covers cancer care! SO much cancer care that I am a necessary expert for my analyst team to teach cancer etiology + coding#ACA is also a generally 'zero sum game'#Meaning insurers can't use this as a profit center. There are multiple audits a year to confirm patient population 'sickness'#we need single payer healthcare

18K notes

·

View notes

Text

Can I Withdraw Money From My HSA?

Working with HSA account providers is a great way to plan for your future. Health savings accounts (HSA) allow you to save for qualified medical expenses. These accounts grow over time, creating a nice safety net when you need it.

But can you withdraw money for things other than healthcare costs?

How an HSA Works

There are many benefits to having an HSA. It's a tax-advantaged savings account where 100 percent of your contributions are tax-deductible. Plus, withdrawals for qualified medical expenses are tax-free, and the interest you gain over time is tax-deferred. That's a lot of power for an account few people know about.

But of course, there are limits. For example, you can only contribute up to the annual limit. For 2023, that's $3,850 for individuals and $7,750 for families.

You also have to consider what you can use the HSA for. The IRS sets strict guidelines on what constitutes a qualified medical expense. It can cover medically necessary procedures, doctor's care, preventative treatments, dental procedures, vision and more. HSAs are also great for over-the-counter products like pain relievers.

What About Non-Medical Expenses?

The important thing to remember about an HSA is that it only covers qualified medical expenses. Anything outside the IRS guidelines does not count.

It is possible to withdraw money from your HSA. You can close your account, get the funds as a check and spend it on what you want. Nothing is stopping you from doing that, and HSA account providers will oblige. But if you go that route, you lose all the tax benefits and may have to pay steep penalties.

Withdrawing money from your HSA for non-medical expenses results in that money getting taxed as ordinary income. Furthermore, the IRS imposes a 20 percent penalty. That's a lot of money you'll lose.

If you're over 65 or become disabled, you won't incur the IRS penalty. But the money you withdraw will still count as taxable income. It's important to consider the tax implications and fees if you ever think about taking money out of your HSA for anything other than qualified medical expenses.

Read a similar article about HSA contribution limit here at this page.

#is an hsa tax deductible#how is my fsa funded#hdhp vs ppo#hsa debit card#hsa account providers#hsa investment#what is an hra

1 note

·

View note

Text

Personal Tax Planning California: Smart Strategies to Save More

Managing your taxes effectively is crucial for keeping more of your hard-earned money while staying compliant with tax laws. Personal tax planning California can help individuals reduce their tax liabilities and maximize savings through smart financial strategies. Whether you’re a salaried employee, a freelancer, or a small business owner, proper planning ensures you take advantage of every available deduction and credit.

In this blog, we’ll explore key tax-saving strategies to help you optimize your financial future.

1. Understand Your Tax Bracket

One of the first steps in personal tax planning California is knowing your tax bracket. The U.S. tax system is progressive, meaning the more you earn, the higher your tax rate. Understanding where you fall within the tax brackets can help you make informed decisions about deductions, investments, and contributions to tax-advantaged accounts.

2. Maximize Tax-Deductible Contributions

A great way to reduce taxable income is by contributing to tax-advantaged accounts such as:

401(k) or IRA: Contributions to these retirement accounts lower your taxable income while helping you save for the future.

Health Savings Account (HSA): If you have a high-deductible health plan, contributing to an HSA allows you to save money tax-free for medical expenses.

Flexible Spending Account (FSA): This account helps cover healthcare and dependent care expenses with pre-tax dollars.

These contributions play a vital role in tax planning for individuals California, as they can significantly lower tax burdens.

3. Take Advantage of Tax Credits

Tax credits directly reduce your tax liability, making them more valuable than deductions. Some common tax credits include:

Earned Income Tax Credit (EITC): Designed for low- to moderate-income individuals.

Child Tax Credit: Provides relief for families with dependent children.

Education Credits: The American Opportunity and Lifetime Learning credits can help offset higher education costs.

By leveraging these credits, you can reduce your overall tax bill effectively.

4. Organize Your Deductions

Itemizing deductions can sometimes result in greater tax savings than taking the standard deduction. Common itemized deductions include:

Mortgage interest

Property taxes

Medical expenses exceeding a certain threshold

Charitable donations

If your deductible expenses exceed the standard deduction amount, itemizing can be a beneficial strategy for personal tax planning California.

5. Plan for Capital Gains and Losses

If you invest in stocks, real estate, or other assets, capital gains taxes can impact your earnings. To minimize taxes:

Hold investments for more than a year to benefit from lower long-term capital gains tax rates.

Offset gains by strategically selling underperforming investments.

Consider tax-loss harvesting to balance out taxable gains.

Effective capital gains management is a crucial part of tax planning for individuals in California who have investment portfolios.

6. Seek Professional Tax Planning Assistance

Tax laws are constantly changing, making it essential to have expert guidance. A professional tax planner can:

Identify the best strategies based on your income and financial goals.

Ensure compliance with California tax laws.

Help with filing tax returns accurately and efficiently.

Conclusion

Effective personal tax planning California requires smart strategies, proactive decision-making, and expert guidance. At Optimize Accounting Solutions, we specialize in tax planning for individuals California, helping clients reduce their tax burdens while maximizing savings. Our expert team ensures you take full advantage of tax deductions, credits, and legal tax-saving opportunities. Contact Optimize Accounting Solutions today to streamline your tax planning and secure your financial future!

Optimize Accounting Solutions 39812 Mission Blvd, Suite 224, Fremont, CA 94539 (510) 574 8849 [email protected] https://maps.app.goo.gl/wNh21TTwJDLTzWjSA

0 notes

Text

10 Things Everyone Should Know About Dental Insurance and Coverage

Navigating dental insurance can feel overwhelming, but understanding the basics is key to making the most of your coverage and maintaining a healthy smile. At Dental Specialists Group, we’re here to help you decode the complexities of dental insurance. Here are 10 essential things everyone should know about dental insurance and coverage:

1. Dental Insurance is Different from Medical Insurance

Unlike medical insurance, which covers catastrophic events and illnesses, dental insurance focuses on prevention. Most plans emphasize routine care, such as cleanings and exams, while providing partial coverage for more extensive procedures like fillings, crowns, and orthodontics.

2. Understand Your Plan’s Structure

Most dental insurance plans operate on a 100-80-50 coverage model:

100% coverage for preventive care (cleanings, exams, and X-rays).

80% coverage for basic procedures (fillings, root canals, and extractions).

50% coverage for major procedures (crowns, bridges, and dentures). Be sure to review your plan’s specifics to understand what’s covered.

3. Know Your Annual Maximum

Dental insurance plans typically have an annual maximum, the total amount the insurer will pay in a year. Common maximums range from $1,000 to $2,000. Once this limit is reached, you’ll be responsible for any additional costs.

4. Preventive Care is Key

Most dental insurance plans cover preventive care at no or minimal cost. Regular check-ups and cleanings not only maintain your oral health but also help you avoid costly procedures in the future.

5. Understand Waiting Periods

Many dental plans impose waiting periods before certain treatments are covered. For example, a plan might require a six-month wait for fillings or a year for major procedures. If you’re purchasing new insurance, plan accordingly to avoid surprises.

6. Network Providers Can Save You Money

Choosing a dentist within your insurance network often reduces costs. In-network providers have agreed-upon rates with your insurer, which means lower out-of-pocket expenses for you. Out-of-network care may still be covered but at a higher cost.

7. Not All Procedures Are Covered

Cosmetic procedures, such as teeth whitening and veneers, are usually not covered by dental insurance. Be sure to review your plan for exclusions to avoid unexpected expenses.

8. FSA and HSA Funds Can Help

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) allow you to set aside pre-tax dollars for medical and dental expenses. These funds can cover deductibles, co-pays, and procedures not covered by insurance.

9. You Can Appeal Denied Claims

If your insurer denies a claim, don’t panic. Many insurance companies allow appeals. Work with your dentist’s office to gather documentation and submit a formal request for reconsideration.

10. Read the Fine Print

Every dental insurance plan is different, so take the time to read the details. Pay attention to coverage limitations, exclusions, and out-of-pocket costs. Knowledge is power when it comes to maximizing your benefits.

Final ThoughtsUnderstanding your dental insurance and coverage empowers you to make informed decisions about your oral health. At Dental Specialists Group, we’re here to guide you through the process and ensure you receive the care you need. If you have questions about insurance or need assistance navigating your coverage, don’t hesitate to contact us. Your healthy smile is worth it!

0 notes

Text

Navigating the FEHB Retiree Open Season: A Guide for Federal Retirees | Smarter Feds

The Federal Employees Health Benefits (FEHB) Retiree Open Season is a crucial time for federal retirees to review and adjust their health insurance coverage. This annual period typically occurs in the fall, allowing retirees to choose from a wide range of health plans offered by participating insurance carriers.

Understanding the FEHB Retiree Open Season

What is the FEHB Retiree Open Season?

It's the annual period when federal retirees can enroll in, change, or cancel their FEHB coverage.

Why is it important?

This is your chance to review your current plan, compare options, and select the coverage that best suits your needs and budget.

Changes made during the Open Season are effective on January 1st of the following year.

Key Considerations for Retirees

Review Your Current Coverage:

Analyze your current plan's premiums, deductibles, copayments, and out-of-pocket maximums.

Consider your healthcare needs and utilization patterns.

Explore Plan Options:

The FEHB program offers a wide variety of plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High Deductible Health Plans (HDHPs).

Compare premiums, deductibles, and out-of-pocket costs for each plan.

Consider Your Budget:

Factor in the cost of premiums, deductibles, and potential out-of-pocket expenses.

Explore options like Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs) to help manage healthcare costs.

Seek Guidance:

Consult with a federal retirement planner for personalized advice on choosing the right FEHB plan.

Utilize the resources available on the Office of Personnel Management (OPM) website, including plan comparisons and online enrollment tools.

Tips for Navigating the Open Season

Plan Ahead:

Start reviewing your options early in the Open Season to avoid last-minute stress.

Gather Information:

Request plan brochures and compare plan benefits carefully.

Ask Questions:

Contact your insurance carrier or a federal retirement planner to clarify any questions you may have.

Enroll or Make Changes Promptly:

Ensure your enrollment or plan changes are submitted before the Open Season deadline.

Remember: The FEHB Retiree Open Season is a valuable opportunity to ensure you have the most appropriate and cost-effective health insurance coverage for your retirement years. By Smarter Feds carefully reviewing your options and making informed decisions, you can navigate the Open Season successfully and enjoy peace of mind knowing you have the healthcare coverage you need.

#fers special provision employee training#thrift savings plan - tsp training orlando#fers special retirement supplement workshops#fers annuity training workshops jacksonville

0 notes

Link

0 notes