#valueinvesting

Explore tagged Tumblr posts

Text

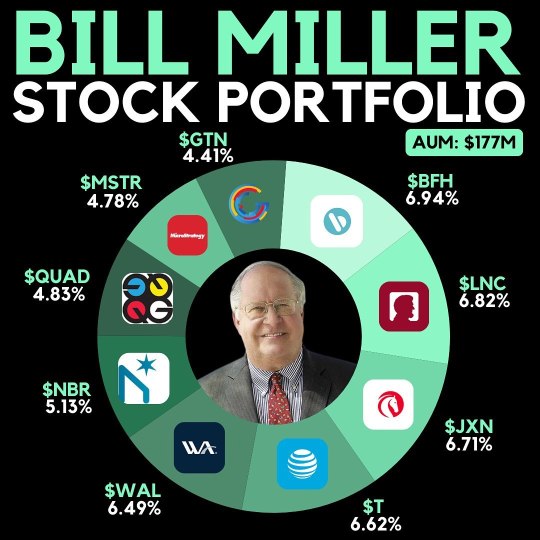

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

Warren Buffett’s Defensive Strategy Raises Questions Amid Record Cash Holdings

https://enterprisewired.com/wp-content/uploads/2025/02/EW-Warren-Buffetts-Defensive-Strategy-Raises-Questions-Amid-Record-Cash-HoldingsSource-kiplinger.com_.jpg

Source: kiplinger.com

Buffett’s Unexplained Caution Leaves Investors Puzzled

Legendary investor Warren Buffett has intensified his defensive approach, selling off more stocks and amassing a record $334 billion in cash. However, his latest annual letter provided little explanation for this move, leaving investors speculating about his rationale. Despite his preference for equities, Berkshire Hathaway has now sold stocks for nine consecutive quarters, including a significant reduction in its holdings of Apple and Bank of America.

Buffett addressed the mounting cash reserves but reassured shareholders that Berkshire remains committed to equities. “Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,” he wrote in his 2024 letter. While investors had hoped for a clear strategy, his statements did little to clarify why the conglomerate continues to hold such substantial cash reserves in an environment where interest rates are expected to decline.

Market Concerns and Investment Hesitation

Warren Buffett’s reluctance to invest heavily comes at a time when the stock market has been performing strongly. The S&P 500 has gained over 20% for two consecutive years, yet Buffett has continued to avoid major investments. Despite rising operating earnings, Berkshire also halted its stock buybacks in the fourth quarter of 2023 and early 2024, signaling further caution from the company.

In his letter, Buffett subtly suggested that market valuations might not be attractive at present. “Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities,” he wrote. His restraint has led to speculation that Berkshire is strategically waiting for better investment opportunities rather than reacting to immediate market conditions.

Economic uncertainty, potential policy shifts under the new administration, and concerns about a slowing economy have created a complex backdrop for investors. While Berkshire Hathaway shares have performed well—rising 25% and 16% in the past two years and gaining 5% in early 2024—some analysts believe Buffett is preparing for potential volatility rather than chasing market momentum.

Transition to Greg Abel and Future Strategy

Warren Buffett also used his annual letter to reaffirm his confidence in Greg Abel, his designated successor, likening his investment acumen to that of the late Charlie Munger. Abel, who oversees Berkshire’s non-insurance businesses, will have the final say on investment decisions, including public stock holdings. Some analysts speculate that Buffett’s recent moves could be aimed at positioning the company for Abel’s leadership by reducing oversized positions and building liquidity for future investments.

Despite his overall cautious stance, Buffett hinted at one area of continued investment: Japanese trading houses. “Over time, you will likely see Berkshire’s ownership of all five increase somewhat,” he noted, signaling a strategic expansion in that sector.

As Warren Buffett remains tight-lipped about his cash-heavy strategy, investors must wait to see whether this defensive approach is a temporary measure or a long-term shift in Berkshire Hathaway’s investment philosophy.

0 notes

Text

Investing is an art, and Warren Buffett has mastered it. His timeless wisdom teaches the importance of patience, protecting capital, and trusting your instincts.

The best opportunities come when others hesitate. Learn how to navigate equity investing with confidence—watch the full video now!

#WarrenBuffett#InvestingWisdom#StockMarket#EquityInvesting#PersonalFinance#InvestmentStrategy#FinanceEducation#WealthBuilding#LongTermInvesting#ValueInvesting#FinancialFreedom#MoneyManagement#SmartInvesting#StockMarketTips#InvestorMindset#MarketTrends#1lakhbankersby2030#InvestmentTips#BusinessSuccess#FinancialGrowth#InvestingForBeginners

0 notes

Text

Value Stock Opportunities Identifying Market Gems.

Explore value stock opportunities and uncover market gems with high potential. Understand the key factors that make these stocks attractive and how they maintain strong positions in their respective sectors. Gain insights into the stability and growth potential these value stocks offer.

Read more :

https://kalkinemedia.com/us/stocks/value

0 notes

Text

When you’re stuck in the loop, it’s time for a smarter move. Let us guide you to financial clarity. 💵

#MarketMovers#Bullish#Bearish#StockGains#TradingLife#WallStreet#StockMarketSuccess#LearnToInvest#SmartInvesting#WealthMindset#InvestSmart#WealthBuilding#FinancialPlanning#ValueInvesting#BuyAndHold#StockMarket#Investing#StockMarketTips#StockTrader#StockMarketNews#StockMarketInvesting#StockTrading#StockMarketAnalysis#StockInvesting#StockMarketUpdates

0 notes

Text

Video: Important Stock Metrics

The video is about analyzing #valueinvesting for #dividends and what #metrics I find most #important during #stockanalysis. I review the various #ratios, such as #P/E, #P/B, #Debt-to-Equity, #fairvalue and talk about the overall approach. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada. Visit: http://www.canadianmoneytalk.caThe Investing &…

View On WordPress

#approach#Debt-to-Equity#dividends#economicmoat#fairvalue#important#investing#metrics#P/B#P/E#ratios#stock#stockanalysis#valueinvesting

0 notes

Text

https://anthonydoty.com/wp-content/uploads/2024/09/large-cap-value-investing-strategies.jpg 💼 Unlocking Wealth: Large Cap Value Investing Strategies 💡 📊 Did you know that large cap value stock... 👉 Dive deeper into financial insights on our website https://tinyurl.com/29dodbxe. Start your journey to financial freedom today! 🌟 🚀 Don’t miss out on our free 30-minute consultation to kickstart your financial empowerment journey. Click the link in our bio to book now! 🔔 Follow us for more expert tips and join our community of empowered individuals. 💪 #FinancialFreedom #WealthBuilding #BudgetingTips #FinancialPlanning #Empowerment #Success #AnthonyDoty"

#Uncategorized#Bluechipstocks#financialplanning#investmenttips#Largecapinvesting#MarketAnalysis#PortfolioManagement#Stockmarketstrategies#valueinvesting#WealthCreation

0 notes

Text

youtube

Value Investing's Comeback: 4 Reasons It's Set to Outperform Growth

Strategies for value investing are resurfacing, positioning themselves to surpass the growth-oriented techniques that dominated the market a few years ago. The valuation difference between value and growth companies may close as a result of a number of important variables, such as altering investor mood and evolving market conditions. Consequently, cautious investors using a "rope-a-dope" approach could benefit from the changing market environment.

0 notes

Text

Warren Buffett and Berkshire Hathaway have reached a record cash pile of over $325 billion! Recently, Buffett resumed purchasing stocks, adding significant investments in Occidental ($409M), Sirius XM ($107M), and Verisign ($45M). With such a massive cash reserve, he has the power to acquire any of these companies outright. What would you do with $325 billion? I believe this is an opportune moment for strategic investments, rather than frivolous spending. It's essential to stay informed about market movements and heed the strategies of seasoned investors like Buffett. Let's learn from their decisions to shape our own investment strategies! 💼📈

#WarrenBuffett#BerkshireHathaway#InvestmentStrategy#StockMarket#CashReserve#FinancialWisdom#SmartInvesting#MarketTrends#ValueInvesting#WealthManagement#InvestmentOpportunities#StrategicInvestments#Buffettology#FinanceTips#InvestingGoals

0 notes

Text

Introducing our Benjamin Graham Calculator

Excited to share something new that I’ve been working on—our very own Benjamin Graham Calculator. If you’re interested in value investing, this tool might just become your new best friend.

For those who might not know, Benjamin Graham is often referred to as the “father of value investing.” He believed that by calculating the intrinsic value of a stock, investors could make smarter decisions, buying stocks that are undervalued by the market. This method helps reduce risk and maximize potential returns.

Our Benjamin Graham Calculator is designed to do just that—help you estimate the intrinsic value of a stock based on the principles laid out by Graham himself. All you need to do is enter the current share price, EPS (Earnings Per Share) for the last four quarters, the expected growth rate, and the current yield on AAA corporate bonds. The calculator will then provide you with an estimated intrinsic value per share and tell you whether the stock might be overvalued.

This tool is perfect for those who want to dive deeper into their investment research and make more informed decisions. It’s straightforward, easy to use, and built with value investors in mind.

If you’re curious about how it works or want to give it a try, head over to our Tools section and check it out. I’d love to hear your thoughts and see how it’s helping you on your investing journey! Check out: https://www.bearsavings.com/tools/benjamin-graham-calculator/

0 notes

Text

Warren Buffett Finally Reveals The Mysterious Company He’s Invested Billions Of Dollars In

Warren Buffett Finally Reveals The Mysterious Company He’s Invested Billions Of Dollars In

📖To read more visit here🌐🔗: https://onewebinc.com/news/warren-buffet-reveals-berkshire-hathaway-chubb-stake/

#warrenbuffett#investing#billionaire#stockmarket#mysteryrevealed#valueinvesting#berkshirehathaway#longterminvesting#financialguru#wallstreet

0 notes

Text

A Mica Band Heater Manufacturer is a specialized entity dedicated to the production of mica band heaters, crucial components widely used in industrial settings for precise and efficient heating applications. These manufacturers play a pivotal role in supplying the industrial sector with high-quality heating solutions tailored to meet diverse operational needs across various industries.

#IndustrialHeating#MicaBandHeaters#Manufacturing#Customization#QualityMatters#TechnicalSupport#Reliability#ValueInvesting#BusinessSolutions#IndustrialAutomation#HeatManagement#ProductQuality#CustomerSatisfaction#Efficiency

0 notes

Text

Value Investing Strategies for Long-Term Growth

Implement effective value investing strategies to find undervalued stocks with strong growth potential. Focus on identifying companies with solid fundamentals and low price-to-earnings ratios for long-term success in the stock market.

For more information visit at: https://cse.google.com.au/url?q=https://kalkinemedia.com/us/stocks/value

#ValueInvesting#UndervaluedStocks#StockMarket#InvestingStrategies#LongTermGrowth#StockTips#ValueStocks

0 notes

Text

Introducing Dhanvikas ,where your financial dreams find their path to reality. As your dedicated investment partner, we're committed to delivering personalized solutions and expert guidance to help you achieve your goals. Let's embark on this journey together. Let's grow together

#Dhanvikas#Finance#InvestmentStrategy#WealthManagement#CapitalGrowth#StockMarket#FinancialPlanning#AssetManagement#ROI#PortfolioManagement#EconomicOutlook#DividendInvesting#FinancialFreedom#RetirementPlanning#PassiveIncome#ValueInvesting#Diversification#MarketAnalysis#InvestmentOpportunity#InvestmentEducation

1 note

·

View note

Text

Maximize Your Stock Market Returns with Buffett’s Proven Strategy

Investing in the stock market can be a powerful way to build wealth, but it requires a sound strategy to navigate its complexities. Warren Buffett, one of the most successful investors of all time, has a proven approach that has consistently delivered high returns. In the book "Buffett’s 2-Step Stock Market Strategy: Know When to Buy A Stock, Become a Millionaire, Get The Highest Returns," the secrets of his investment success are revealed. This article will explore how you can maximize your stock market returns by adopting Buffett’s strategy.

The Simplicity of Buffett’s Strategy

Warren Buffett's investment philosophy is grounded in simplicity and practicality. His 2-step strategy is easy to understand and implement, making it accessible for investors at all levels. Here’s a breakdown of the steps:

Step 1: Knowing When to Buy a Stock

The first step is identifying the right time to purchase a stock. This involves several key elements:

Fundamental Analysis: Look for companies with strong financials, including robust earnings, low debt, and good cash flow. Evaluate their financial statements to assess their health and stability.

Intrinsic Value: Determine if a stock is undervalued by comparing its market price to its intrinsic value. Intrinsic value is calculated based on the company’s future earnings potential and overall financial condition.

Competitive Advantage: Invest in companies with a sustainable competitive advantage, also known as an economic moat. These companies are better positioned to maintain profitability and fend off competitors.

Market Conditions: Purchase stocks during market downturns or periods of pessimism when quality companies are undervalued. Buffett famously advises being “fearful when others are greedy and greedy when others are fearful.”

By focusing on these factors, you can identify high-quality stocks that are trading at attractive prices.

Step 2: Holding the Stock for Maximum Returns

Once you’ve identified and purchased an undervalued stock, the next step is to hold it for the long term. Here’s why this approach works:

Compounding: Holding stocks for an extended period allows your investments to benefit from the power of compounding. Compounding generates exponential growth as your investment returns begin to generate their own returns.

Minimized Costs: Long-term holding reduces transaction costs and tax liabilities associated with frequent trading, thereby enhancing your net returns.

Market Resilience: Quality companies tend to recover and grow over time, even if their stock prices fluctuate in the short term. Holding onto these stocks helps you ride out market volatility and capitalize on long-term growth.

Buffett’s strategy emphasizes patience and a long-term perspective, which are essential for achieving substantial returns.

Real-Life Application: Buffett’s Investment in Coca-Cola

Buffett’s investment in Coca-Cola is a prime example of his 2-step strategy. He began purchasing Coca-Cola shares in 1988 when the stock was undervalued. By holding onto these shares for decades, Buffett has seen significant appreciation in their value, underscoring the effectiveness of his approach.

Practical Tips for Maximizing Returns

Conduct Thorough Research: Before investing, perform comprehensive research to understand the financial health and market position of the companies you’re interested in.

Stay Disciplined: Stick to your investment criteria and avoid making impulsive decisions based on market fluctuations or short-term trends.

Be Patient: Understand that building wealth through investing takes time. Commit to holding your investments for the long term to fully realize their growth potential.

Diversify: Spread your investments across different sectors and industries to mitigate risk and enhance your portfolio’s resilience.

Conclusion

Warren Buffett’s 2-step stock market strategy is a proven method for achieving high returns. By knowing when to buy stocks and holding them for the long term, you can maximize your investment gains and build substantial wealth. Whether you’re a novice investor or a seasoned pro, these principles can significantly enhance your investment strategy.

For a detailed guide on adopting Warren Buffett’s approach and becoming a successful investor, read our comprehensive review of "Buffett’s 2-Step Stock Market Strategy: Know When to Buy A Stock, Become a Millionaire, Get The Highest Returns" here.

Unlock the secrets to maximizing your stock market returns with insights from Warren Buffett’s proven strategy. Read the full review now.

#WarrenBuffett#StockMarketReturns#InvestmentStrategy#ValueInvesting#BuffettBooks#FinancialSuccess#Investing#StockMarket#WealthBuilding#LongTermInvesting

0 notes

Text

Video: The Pros and Cons of Dividend Investing

As a #dividend #investor, I look at #pros and #cons of #dividend #investing to see whether it is appropriate for you. I look at #taxes, #growth, #Value and the #psychology of dividends and staying invested. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada. Visit: http://www.canadianmoneytalk.caThe Investing & Personal Finance Basics course is at…

#capitalgains#cashflow#comparison#cons#dividend#growth#investing#investor#pros#psychology#suggestions#taxes#value#valueinvesting

0 notes