#underfunding the irs

Explore tagged Tumblr posts

Link

Trump kept saying that he couldn’t release his tax returns because the IRS was auditing them.

As it turns out, the IRS didn’t even start to audit his returns until April of 2019 and even then barely touched them. They never really finished the audit. And the kicker is that the IRS 2019 audit didn’t start until the exact same day a House committee asked to see Trump’s tax returns.

Trump filed returns in 2017 for the two previous tax years, but the IRS began auditing those filings only in 2019 — the first on the same day in April the Ways and Means Committee requested access to his taxes and any associated audits, a report by the panel said. The IRS has yet to complete those audits, it said, and the agency started auditing his filings covering his income while president only after he left office.

The revelation could transform the political context of the committee’s nearly four-year fight to obtain information about Trump’s taxes and any related audits. Its chair, Rep. Richard E. Neal of Massachusetts, had said the panel needed the data to assess the IRS’ mandatory presidential audit program, but Trump’s lawyers and Republicans called that a pretext for a politically motivated fishing expedition.

The suggestion of dysfunction in the auditing program was an early takeaway in what could be a series of disclosures related to the release of Trump’s returns.

It’s clear why the required audit got such a low priority at the IRS.

Starting in 2018, the IRS was run by a Trump appointee, Charles P. Rettig, who left the post last month. In 2016, Rettig, then a tax lawyer in Beverly Hills, California, published a column in Forbes that defended Trump’s decision not to release his taxes as a candidate.

The IRS did not immediately comment on the matter after the disclosure late Tuesday. But Neal said that when the committee had inquired, “Rettig said at different points that they were simply outgunned” and that the IRS said it lacked specialists capable of assessing Trump’s filings.

A Trump appointee claimed that the IRS was “outgunned” and unable to process the Trump audit. So the Biden administration wants to fund the hiring of 87,000 new IRS employees through 2031 so that the IRS won’t be understaffed and overwhelmed for the rest of this decade. Trump Republicans have objected to these new hirings and tried to distort the narrative to claim falsely that these are agents who would go after the middle class.

In fact, for about the past 100 years the GOP has been trying to keep the rich from having to pay their fair share in taxes. Tax breaks for the filthy rich are usually camouflaged as “economic stimulus”. So keeping the IRS overburdened and understaffed keeps it from looking into the returns of billionaires like Donald Trump.

#donald trump#tax returns#irs audit#trump administration#richard e. neal#charles p. rettig#underfunding the irs#tax breaks for the filthy rich#billionaires

10 notes

·

View notes

Text

tax stuff in tags

#hey folks#i don’t write much on this blog but just some overview stuff about taxes#the government wants your money#but it’s okay! they are willing to work with you#you can even grab a fillable PDF from the IRS website and watch a youtube video on how to fill it and what forms you need.#the irs is usually on standby after tax season to get calls and the like#if you call them and say that you missed the deadline#that will not be upset! they are there to get your money not to stress you about it#the IRS is underfunded so it might take a bit to get that help#but i promise there will be help for you if you need it#if there’s any specific questions you have#please DM me#i’ll send some info or try to dig up a link for ya#wish ya all the best folks <3

75K notes

·

View notes

Text

it's getting to that time of year again so. before people start circulating incorrect information on How To File Your American Taxes i would love for everyone to just get in the habit of going directly to the irs website and looking at their FAQs and instructions instead of believing some random user on tumblr has some secret never before known hack about taxes being free

also don't fucking use turbotax it sucks

#laughs awkwardly#tax#just a lil public service announcement from your local tax guy#yes the irs has been doing a crap job due to being perpetually understaffed and underfunded#however they have a duty of consistency so if they said somewhere in an official document (their website) to do something#then they have to let you do the thing. that's just how it goes#also what tax prep software companies are a part of free file changes frequently. CHECK THE IRS WEBSITE

1 note

·

View note

Text

Things the Biden-Harris Administration Did This Week #33

Sep 6-13 2024

President Biden marked the 30th anniversary of the passage of the Violence Against Women Act and highlighted efforts to stop gender based violence. the VAWA was written by then Senator Biden and he often talks about it as his proudest legislative victory. The act transformed how the federal government dealt with domestic violence, sexual assault, and stalking. In part because of the connection to Joe Biden, President Trump and the Republicans allowed the VAWA to expire in 2019. President Biden passed a new reauthorization, with new protections for women against cyber crime, in 2022. On the VAWA's 30th anniversary President Biden announced $690 million in grants to support survivors of gender-based violence.

President Biden and Vice-President Harris announced a new rule to force insurance companies to treat mental health care the same as medical care. The new rule takes on the use by insurance of restrictive practices like prior authorization, and out of network charges, it also closes a loophole in the law that allowed state and local government health insurance not to cover mental health.

The Biden-Harris administration announced that 50 million Americans, 1 in every 7, have gotten health insurance through Obamacare's marketplaces. Under Biden a record breaking 20.8 million enrolled this year. Since the ACA was passed by President Obama and then Vice-President Biden it has transformed American health care bring affordable coverage to millions and getting rid of "preexisting conditions". During the Presidential debate Vice-President Harris defended the ACA and the need to keep building on it. Trump after 9 years of calling for its repeal said he only had "concepts of a plan" on what to do about health care in America.

The IRS announced that it has recovered $1.3 billion in back taxes from wealthy tax dodgers. For years Republicans have tried to underfund the IRS hindering its ability to police high income tax payers. President Biden in his Inflation Reduction Act ensured that the IRS would have the money it needs to chase high income tax cheats. In February 2024 the IRS launched a program to go after over 100,000 people, making $400,000 or even over $1 million a year who have not filed taxes since 2017. The IRS also launched a program to collect from tax payers who make over $1 million a year who have uncontested debt of over $250,000. Between these two efforts the IRS has collected over a Billion Dollars in back taxes from the richest Americans, so far this year.

The Department of The Interior and White House Climate Advisor Ali Zaidi highlighted green energy efforts on public land. Highlighting two projects planned in Nevada officials talked about the 41 renewable energy projects approved on public land under the Biden-Harris Administration. These projects over 25 gigawatts of clean energy, a goal the Administration's climate plan set for the end of 2025 but met early this year. With the new projects in Nevada this is enough energy to power 12.5 million homes, and the Bureau of Land Management is another 55 utility-scale project proposals across the West.

The Department of The Interior announced $236 million to help fight forest fires and restore landscapes damaged by recent wildfires. Under President Biden's Bipartisan Infrastructure Law, the Administration has spent nearly $1.1 billion dollars to combat deadly wildfires which have over the last 10 years grown in size and intensity thanks to climate change.

The Department of The Interior announced $157 million in wetland conservation. The money is focused on protecting bird habitats. It will protect and preserve thousands of acres of wetlands across 7 states.

The US Senate approved President Biden's nominations of Adam Abelson, Jeannette Vargas, Mary Kay Lanthier, and Laura Provinzino to federal judgeships in Maryland, New York, Vermont, and Minnesota respectively. This brings the total number of federal judges appointed by President Biden to 209. When Biden entered office 318 district judges were Republican appointees and 317 Democratic, today 368 are Democratic appointments and just 267 are Republican. President Biden is the first President in history to have the majority of his appointments not be white men and he has appointed more black women to the bench than any President ever.

#Joe Biden#Thanks Biden#kamala harris#politics#political#US politics#American politics#climate change#domestic violent relationships#mental health#health care#health insurance#tax the rich#judges

792 notes

·

View notes

Text

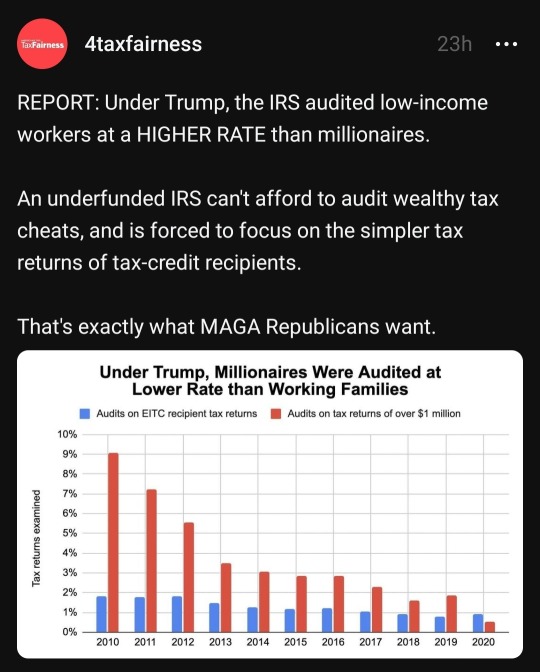

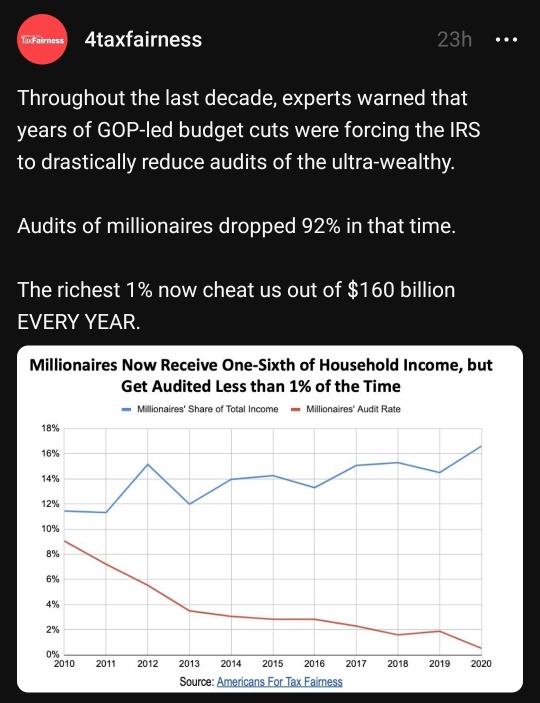

Death by a thousand cuts. By underfunding the IRS, Republicans never had to legislate their obvious agenda to protect the wealthy.

Imagine if GOP had to campaign on 'we are going to cut audits on millionaires by 92%'?

Also, when the topic of weaponizing the government comes up, think about the reverse action: a toothless IRS allowing billionaires to evade audit.

1K notes

·

View notes

Text

The IRS plans to end a major tax loophole for wealthy taxpayers that could raise more than $50 billion in revenue over the next decade, the U.S. Treasury Department says. The proposed rule and guidance announced Monday includes plans to essentially stop “partnership basis shifting” — a process by which a business or person can move assets among a series of related parties to avoid paying taxes. Biden administration officials said after evaluating the practice that there are no economic grounds for these transactions, with Deputy Treasury Secretary Wally Adeyemo calling it “really just a shell game.” The officials said the additional IRS funding provided through the 2022 Inflation Reduction Act had enabled increased oversight and greater awareness of the practice. “These tax shelters allow wealthy taxpayers to avoid paying what they owe,” IRS commissioner Danny Werfel said. Due to previous years of underfunding, the IRS had cut back on the auditing of wealthy individuals and the shifting of assets among partnerships and companies became common. The IRS says filings for large pass-through businesses used for the type of tax avoidance in the guidance increased 70% from 174,100 in 2010 to 297,400 in 2019. However, audit rates for these businesses fell from 3.8% to 0.1% in the same time frame. Treasury said in a statement announcing the new guidance that there is an estimated $160 billion gap between what the top 1% of earners likely owe in taxes and what they pay.

300 notes

·

View notes

Text

"I think the US should have an automatic income tax system instead of forcing us to do it ourselves."

Great!

Increase funding for the IRS.

They've been chronically underfunded since the 1980s.

You want a simpler tax system that impacts rich people as much as the impoverished and the middle class?

Fund the IRS so they have the manpower to do it.

364 notes

·

View notes

Text

thinking about how hundreds of Ukranian mercenaries showed up to help the IOF begin its ground invasion in Gaza around the same time US special forces showed up yet people are still supporting the militaries and governments of the regimes giving real material support to genocide The US cancelled COVID subsidies and gave that $50bil to Ukraine. The US took 14bil in funding from the IRS (which is so understaffed and underfunded it can only afford to go after poor people in audits) to give to the Israeli occupation and genocide of Palestine. Like, Ukraine's still fending off the obviously immoral Russian invasion but still somehow has fighters to spare to support massacring indigenous people? And it just so happens that funding the US's proxy war with Russia is also killing disabled, marginalized, and oppressed people of color in the US and Palestine? how fucking white to manage such effective investments in genocide

#anarchotahdigism#free palestine#death to all states#death to israel#death to america#genocide joe#anarchism#anticapitalism#eugenics#covid#wear a mask#genocide#ableism#mordantivore

73 notes

·

View notes

Text

Death at the Holy House of Pym

Chapter 1

I wanted to write some Halloween-y stories to unwind. I also love the holiday.

I'm using my OCs/Tavs for these stories. I'm also open to feedback and even courage it!

Characters:

Paloma and Lamia are the leads. Newcomers will be introduced in time.

Summary:

Paloma and Lamia are summoned back to the orphanage they grew up in. When they arrive, they discover something dark has taken over the orphanage.

Inspired by Betrayal at Baldur's Gate, Death House, and The Devil's Backbone.

18+ (No smut, but it is meant to be horror. There is blood and gore.)

The orphanage never sent letters. Ever since Paloma and Lamia aged out of the Holy House of Pym, they had never heard a word from them. Not even to ask for money. Now there was a letter sitting on the dining room table from the Mother of the House. When it arrived, it looked like any other letter, except that its wax seal bore the mark of Ilmater.

Lamia did her best to sound detached. “So….”

“So?”

“We’re going, right?”

“We?” Paloma looked over at her. Lamia was avoiding her gaze, still attempting to seem disinterested.

“It was addressed to both of us,” Lamia pointed out.

Paloma had met Lamia in the orphanage, and Paloma had immediately adopted her as a younger sister. They understood each other in a way many didn’t.

Paloma was a drow, born in the Underdark but brought to the surface as an infant. She had no memories of her time below, but she was regarded with the same ire as any other drow. Lamia was a changeling, rejected by almost everyone.

Everyone at the orphanage knew that Paloma and Lamia had become sisters. It made sense to address the letter to both of them.

“Why would you want to go?”

“Why wouldn’t I?”

Paloma stared at her, silently. After a moment or two, she finally said, “You hated that place.”

Lamia spent most of her childhood bad mouthing The Holy House of Pym, an orphanage run by Ilmater painbearers.

The orphanage had always been underfunded, leading to burnt out and tired clergy. They didn’t always make the best choices. They could be short with the children, Lamia in particular. Her constant troublemaking had everyone on edge. No one knew how to handle her save for Paloma.

Lamia shrugged, trying so hard to seem noncommittal. “I’m allowed to visit places I hate. Besides, now I’m old enough to tell them where they can shove their bullshit.” She waited a beat before she added, “Up their ass.”

“Lamia.”

“That’s where they can shove it.”

Paloma sighed. “I won’t be going.”

“Why not?”

“I have no reason to.”

“I thought you liked it there.”

“It was enough at the time,” Paloma answered, truthfully. It had been enough when she didn’t know any better. “I never hated it, but I don't have a lot of love for it either.”

“And the masochists?”

“Painbearers,” Paloma corrected, though she knew it was intentional. “I haven't spoken to them in years. They always kept us at arm's length. I imagine it was so they could avoid getting their hearts broken if we were adopted or…”

It wasn't unusual for children to go missing from orphanages in Baldur's Gate. Some found themselves working for criminals or, in the worst case scenarios, killed. Orphans were a common target among the murderous. Orphans were vulnerable and often unattended. When they did go missing, very few resources went into finding them. It was up to the orphans themselves to watch over each other. You learned to trust no one but those in your cluster.

“That was their excuse. They could have tried harder.” Lamia didn’t mince her words. As far as she was concerned, they could have been more protective, and more aggressive in pursuing anyone who harmed them. The painbearers’ “hard on for suffering,” as Lamia would say, got underfoot when it came to taking care of the kids.

“True.” As a child, Paloma would have argued with her, wanting to defend the clergy. Now, as an adult with children of her own, she’d come around to Lamia’s side.

Lamia wouldn't gloat at getting Paloma to agree. She'd already been aware she'd won on this particular topic. “I wanna see how they're doing. Now that they have no power over us. Don’t you?”

“No.”

“Why not?”

“I don't consider them to be worth my time.”

“You don't?”

“I built a life outside of them for myself. I have no reason to even think about them anymore.”

“Despite everything?”

“Because of everything. I owe them nothing, including my thoughts.”

Lamia considered this, and then shook her head. “I don’t do high road shit. I want them to see how great I turned out in spite of them.” “You're an escaped convict.”

“Exactly! And they thought I wouldn't amount to anything!” Lamia considered her status as a source of pride. Paloma didn't try to sway her from it.

Lamia had been in prison for the last ten years, missing a lot of her niblings’ lives. Paloma’s eldest, Orianna, was only two when Lamia was sent to prison. After years of being missing in action, the wayward aunt had ended up on Paloma’s doorstep during a thunderstorm, soaking wet. Paloma was convinced she’d let herself get that soaked on purpose, hoping to look like a pathetic wet cat to be taken in. Lamia was manipulative when she wanted to be.

Paloma knew she’d broken out of prison the moment she laid eyes on her. And Paloma knew the hulking dragonborn who stood over Lamia’s shoulder was her accomplice. (The duo eventually introduced the dragonborn as Allie.) Despite her better judgment, Paloma invited them both inside and made a place for them. As the dutiful older sister, she was far too accustomed to cleaning up after other people’s mistakes. Besides, it was her baby sister, she had to help.

Paloma didn’t reveal that she knew the truth of their situation. Lamia painted some tall tale about getting released for good behavior. That story would only work on someone who didn’t know Lamia. Paloma wanted to see how long it would take for Lamia to come clean on her own.

It only took a few weeks before Lamia admitted she was a fugitive. When Paloma said that she knew the whole time, Lamia couldn’t be upset or surprised. Paloma just knew things. Lamia promised they’d only stay a short while. Paloma knew that was a lie, too. She’d already prepared for an indefinite stay.

The fugitives became a permanent fixture. Paloma put them to work helping around the house. Raising kids in a house with two convicts wasn’t ideal, but they didn’t live in an ideal world and she trusted Lamia. When it came to family, Lamia was loyal to a fault.

“Come with me,” Lamia begged.

“Why can't you go alone?”

“It looks better if we're both doing great, which we are.”

“Are we doing great?”

Paloma knew the truth: Lamia could face down creatures ten times her size or a fleet of Githyanki, but she couldn't go back to the House of Pym alone. She needed her big sister.

“Allie can watch the kids,” Lamia added.

“No.” That was one mistake Paloma would never repeat again, much to the children's dismay. They hadn't seen anything wrong with the wanton destruction Allie encouraged. The kids considered mom to be a buzzkill.

Orianna had dramatically told her that she was “stifling Auntie Allie.” The eldest Silkflower child had discovered that it’s important to “be yourself” and hadn’t grasped a lot of the nuance of that yet.

“Fine, the old woman next door can watch them,” Lamia said, exasperated.

“Alright.” Paloma could see this was important to her. “I’ll ask Mrs. Rosemaul tonight when she gets home. I want to take her some bread anyway.” She had emphasized the woman’s name, trying to shift Lamia from calling her the old woman next door. Paloma wanted to instill some kind of manners into her.

Lamia smiled. “On that note,” Lamia pushed herself out of her chair. “I’m gonna go mess with the kids.”

Paloma smiled as Lamia exited in a hurry. Paloma really did consider herself lucky to have her sister back in her life. As she turned to the stove to finish preparing dinner, she heard the familiar screams of her kids being “terrorized” by their aunt. The screams were followed by giggles. Paloma couldn’t help but laugh.

Later that evening, armed with freshly baked bread and cheese, Paloma asked “that old woman next door” if she could sit for the children the night Paloma and Lamia would be at the Holy House of Pym.

Mrs. Rosemaul agreed to do it, rejecting the small stipend Paloma tried to pay her. The older woman had become a widow at a young age and raised her children alone. She understood a single parent’s plight. It didn’t hurt that Mrs. Rosemaul was lonely and loved having the children around. They breathed life into her aging bones and that was payment enough.

It would only be two days later when Paloma left the children in Mrs. Rosemaul’s care. She and Lamia then set out on the road toward their old stomping grounds. It had been at least a decade, but the way felt familiar.

Lamia confidently led the way to the orphanage, possibly empowered by Paloma’s presence. Paloma clutched a weave basket in her hand, the soft raffia giving a slight crunch under the pressure. She had refused to come empty handed, so she brought a few bottles of wine as a gift for their hosts.

The winding hill the orphanage sat on no longer felt so mountainous. It was still a trek though. As they climbed the hill, they were followed by the sickly sweet smell of heliotropes, a familiar childhood scent. Trees lined the dirt path that would lead them to the Holy House’s front door.

Paloma stopped a moment, noticing a familiar tree. It stood out among the others, as it was covered in carvings. When they were children, they had picked an enormous oak to carve little messages and names in. It looked like the tradition had died after they left. Had the children carried on, the tree most likely would have been a toothpick by now.

“Do you think it’s still there?”

Paloma jumped at the sound of Lamia’s voice. She whipped around to see Lamia was only a few feet behind her.

“Our names,” Lamia clarified.

Paloma returned her gaze to the tree. It didn’t take long to find them. She was amazed they had lasted so long. She ran her thumb over her own name, feeling the roughness of the bark and sharp edges caused by the carving. Her penmanship had improved since those days. She lingered a moment before pulling her hand away.

“Come on, we should keep going before it gets dark,” Paloma said, returning to the road. The sun had already started to set. There wouldn’t be much more daylight left.

Lamia quickly caught up to her. “Remember that druid kid who cried when he saw all the carvings?”

“Bobbin.”

“His name was Bobbin?”

“You don’t remember?”

Lamia responded with an insouciant shrug. “In my defense, he wasn’t around for very long.”

“He aged out of the orphanage with us.”

“Huh, I guess we just didn’t talk very much.”

“We talked to him every day,” Paloma’s voice rose as she grew more incredulous. “He asked you to help him ask out that girl from town. He tried to invite you to the wedding! How could you forget him?”

“Maybe he shouldn’t have been such a background character if he wanted me to notice him.”

Paloma let out a deep breath. She wouldn’t keep pressing for the sake of her own sanity. It’s not like Bobbin would ever know about this conversation. Thank the gods for that.

It wasn’t too much longer before the towering orphanage came into view. Even now, the place made Paloma feel so small. Its walls were made of dark limestone and the steepled roof was covered in black tiles. The long, thin windows were darkened, making it impossible to peak inside.

It was possible that the painbearers were reading stories by the fireplace, letting it be their only light. One of the fond memories Paloma had of her childhood were of those nights. She hoped the tradition had continued on.

The two sisters approached the wooden doors. Paloma reached for one of the silver knockers.

“Wait.” Lamia grabbed her wrist. She pointed to the door handle. Paloma looked down to see a bloody hand print just above the doorknob. Paloma’s blood ran cold. She grabbed the handle, shocked when the door simply opened with a slight push. It should have been locked. Paloma pushed the door open wide. The little bit of daylight left poured in through the doorway.

“Gods….” Paloma’s heart dropped into her stomach. She felt Lamia grab onto her arm for support.

Blood. It was all over the floor, the walls, and the antique furniture. Pieces of skin and gore littered the entryway. Paloma spotted a chunk of scalp on the corner of a table. Someone had lost it in what must have been a horrifically violent fight. The stench of death was overpowering.

One thought immediately came to Paloma.

“Where are the children?”

#bg3 oc#bg3 tav#tav oc#ttrpg oc#ttrpg ocs#pathfinder ocs#pathfinder character#dnd character#dnd ocs#Lamia#Paloma#dnd fanfic#ttrpg fanfic#I genuinely can't tell if I'm a good writer or not#tw gore#tw blood#tw death#tw child death#tw violence#tw murder#Death at the Holy House of Pym

4 notes

·

View notes

Text

it would be 5x easier to convince americans that taxes were good/neutral if the irs weren't so underfunded and bad at its job in all its dealings w average folk

10 notes

·

View notes

Text

everything i watch and read is like "yes the IRS could technically prosecute or seize money from you for this but that's exceptionally rare because they're such a shitty little underfunded understaffed incompetent overburdened inadequate government agency"

#it's like they're talking about an animal that can bite and attack humans but only in very rare cases and most frequently only relies on#puffing itself up and trying to scare attackers off

3 notes

·

View notes

Text

In their first act of legislative business, the new House Republican majority voted to cut funding for the Internal Revenue Service (IRS). The vote was a symbolic effort to repeal the $80 billion increase in funding the revenue agency received last year as part of the Inflation Reduction Act. Cutting IRS funding is a terrible idea. A well-funded IRS can distribute emergency aid quickly, serve taxpayers efficiently, and help ensure that millionaires have to follow the tax laws just like everyone else. It’s an essential investment in good government.

The IRS has been persistently underfunded for decades, but the years since 2010 have been particularly tough. Tax law expert Chye-Ching Huang notes that the enforcement budget of the IRS dropped by nearly a quarter in less than ten years. In 2017, the IRS employed less than 10,000 revenue agents—the last time that was true was 1953: the Brooklyn Dodgers were in the World Series, the median housing price was about $8,000, and the IRS was handling over 100 million fewer individual income tax returns a year. The IRS is also “overwhelmingly reliant” on antiquated technology, the U.S. Taxpayer Advocate notes, “systems that are at least 25 years old, use obsolete programming languages (e.g., COBOL), or lack vendor support, training, or resources to maintain.”

It is worth noting how much the IRS has managed to achieve despite its perpetually inadequate resources. When COVID struck, for example, only the IRS had the capacity to send millions of emergency checks to keep American households afloat. As my Tax Policy Center colleague Howard Gleckman has said, the IRS “did an extraordinary job in getting these checks out in very difficult circumstances.”

But the budgetary toll of persistent underfunding is unmistakable. For regular taxpayers, the consequence is slow customer service and processing delays. Some politicians have irresponsibly suggested that every new IRS employee will be a gun-toting enforcement agent. Actually, the IRS desperately needs employees to process refunds and answer tax filers’ phone calls. Out of the 282 million phone calls the IRS received in 2021, only 11% or 32 million were actually answered. Nearly half the new IRS money is going to taxpayer services and modernization, which will make the agency more responsive and efficient for taxpayers.

About $45 billion of the $80 billion in new funding is going to enforcement, and that is great news. For the wealthiest and most sophisticated tax filers, a cash-strapped IRS has meant a tax evasion free-for-all. Currently, the tax gap, which is the amount in taxes that are owed but not paid, comes to nearly $7 trillion over a decade. Three fifths of the tax gap is due to underreporting of income by the top 10% of taxpayers, and more than a quarter comes from the top 1%.

But the IRS has been left without the resources to hire and support the kind of tax experts who can catch wealthy tax cheats. The lack of staff was highlighted recently when it was revealed that the audit of former president Donald Trump was staffed by exactly one revenue agent. But Trump wasn’t the only one whose taxes were going without thorough examination. Audits of millionaires have dropped 61% in less than a decade. For those making more than $5 million, the audit rate has dropped 87%.

At the same time, responding to a push from Congress, the IRS has focused instead on a much cheaper form of audit, targeting recipients of the Earned Income Tax Credit—i.e. low-income, working families. As a result, the EITC recipients are audited at the same rate as the top 1% of earners. As law professor Dorothy Brown explains, the consequence of high levels of EITC audits is a serious racial disparity in tax policing.

Treasury Secretary Janet Yellen has insisted that the new funding not be used to increase audit rates on those earning less than $400,000 a year. So, the new funding will help rebuild the capacity of the IRS to audit the wealthy, making the tax system far fairer. And, of course, closing the tax gap raises revenues—it’s a policy that more than pays for itself. The IRS investments are expected to raise $124 billion.

The Republican effort to repeal the IRS’s $80 billion funding increase will not move forward in the Democrat-controlled Senate. But the IRS might yet see its funding decline, if the House Republicans negotiate a cut in the budget fights later this year. If that happens, it is bad news for the millions of American households who pay their taxes honestly, and great news for the country’s richest tax evaders. Funding the IRS will shore up an essential government service, making tax filing easier and tax enforcement fairer.

8 notes

·

View notes

Text

Christopher Weyant, The Boston Globe

* * * *

LETTERS FROM AN AMERICAN

Members of the House of Representatives returned to work today after their summer break. They came back to a fierce fight over funding the government before the September 30 deadline, with only 12 days of legislative work on the calendar. That fight is also tangled up with Republican extremists’ demands to impeach President Joe Biden—although even members of their own caucus admit there are no grounds for such an impeachment—and threats to the continued position of Kevin McCarthy (R-CA) as speaker of the House.

It’s an omnishambles, a word coined in 2009 by the writers of the BBC political satire The Thick of It, meaning “a situation, especially in politics, in which poor judgment results in disorder or chaos with potentially disastrous consequences.”

It fits.

In August, the Senate Appropriations Committee passed 12 spending bills covering discretionary funding—about 27% of the budget—by bipartisan votes, within limits set as part of the deal Speaker McCarthy made with President Biden to prevent the U.S. defaulting for the first time in history.

But the House left for summer break without being able to pass more than one of the 12 necessary bills. The extremists in the House Freedom Caucus oppose the spending levels Biden and McCarthy negotiated, insisting they amount to “socialism,” although with the exception of the Covid-19 blip, discretionary federal spending has stayed level at about 20% of the nation’s gross domestic product since 1954.

The Republican-dominated House Appropriations Committee has reneged on the deal McCarthy struck, producing bills that impose cuts far beyond those McCarthy agreed to. In particular, it cut Inflation Reduction Act (IRA) funding for programs to address climate change and the Internal Revenue Service, which has been badly underfunded since at least 2010, leaving wealthy tax cheats unaudited. The cuts are ideological: the bills have cut funding for food assistance programs for pregnant mothers and children, grants to school districts serving impoverished communities, the Environmental Protection Agency, agencies that protect workers’ rights, federal agencies’ civil rights offices, the Centers for Disease Control and Prevention, the IRS (on top of clawing back funding in the IRA), and so on.

Although appropriations bills are generally kept clean, the extremists have loaded the must-pass bills with demands unrelated to the bill itself. They have put measures restricting abortion and gender-affirming care in at least 8 of the 12 bills. Even if such measures could make it through the Democrat-dominated Senate—and they can’t—President Biden has vowed to veto them.

Even fellow Republicans are balking at the attempt of the extremists to get their ideological wish list by holding the government hostage. Representative Rosa DeLauro of Connecticut, the top Democrat on the House Appropriations Committee, told reporters she doesn’t see how the Republicans are going to get the bills out of the committee, let alone pass them. “Overall, I think it's going to be very, very hard to get these bills forward,” she said.

Far from negotiating with McCarthy over the break, Freedom Caucus members appear to be increasing their demands as a shutdown looms. In August, the caucus announced it would not support even a short-term funding bill unless it also included their own demands for border policy, an end to what they call “woke” policies in the Department of Defense, and what they call the “unprecedented weaponization” of the Justice Department and the Federal Bureau of Investigation. They also oppose funding for Ukraine to enable it to fight off Russia’s invasion.

They have hinted they will use procedural votes to prevent any large spending bill from getting to the floor at all. One of the tools at their disposal is a challenge to McCarthy’s leadership, which thanks to the deal he struck to get the speakership in the first place, a single member can bring. Today, Florida representative Matt Gaetz threatened to “lead the resistance” if McCarthy worked with Democrats to fund the government.

They have offered McCarthy a way to avoid that showdown: impeach President Joe Biden, although there is no evidence the president has committed any “high crimes and misdemeanors” required for an impeachment.

Today, McCarthy availed himself of that escape clause. On the first day back from a 45-day August break, rather than tackling the budget crises, he endorsed an impeachment inquiry into President Biden.

This is a fascinating moment, as the Republicans have opened an impeachment inquiry into Biden with no evidence of wrongdoing. For all their breathless statements before the TV cameras, they have not managed to produce any evidence. Trump's own Department of Justice opened an investigation into Biden four years ago and found nothing to charge. As Josh Marshall of Talking Points Memo notes, Biden’s taxes are public, and a U.S. attorney has been scrutinizing Biden’s son Hunter for years; red flags should have been apparent long ago, if there were any.

Just yesterday, Representative Jamie Raskin (D-MD) tore apart the talking points far-right Republicans have been using to smear the president. He noted that none of the bank records Representative James Comer (R-KY) has referenced show any payments to President Biden, none of the suspicious activity reports the Oversight Committee has reviewed suggest any potential misconduct by Biden, none of the witness accounts to the Oversight Committee show any wrongdoing by Biden, Hunter Biden’s former business associates explicitly stated they had no reason to think President Biden was involved in his son’s business ventures, and so on.

This inquiry is not actually about wrongdoing; it is a reiteration of the same plan Trump tried to execute in 2019 when he asked Ukraine president Volodymyr Zelensky to smear Biden before the 2020 presidential election. By launching an inquiry, Republicans can count on their false accusations spreading through the media, tainting their opponents even without evidence of wrongdoing. See, for example, Clinton, Hillary: emails.

McCarthy insisted to reporters that an impeachment inquiry would simply give House committees leverage to subpoena officials from the White House, but during the Trump administration, the Department of Justice issued an opinion that the House must take a formal vote to validate an impeachment inquiry. It did so in reaction to then–House speaker Nancy Pelosi’s launch of an impeachment inquiry without such a vote, and the decision invalidated subpoenas issued as part of that inquiry. Pelosi went on to hold a vote and to launch an official inquiry.

It will not be so easy for McCarthy. He has not wanted to hold a vote because outside of the Freedom Caucus, even Republicans don’t want to launch an impeachment inquiry when there is no evidence for one. Senate Republicans today were quick to tell reporters they were skeptical that McCarthy could get enough votes in the House for an article of impeachment, and they were clear that a Senate trial was not an option. Representative Ken Buck (R-CO), himself a member of the Freedom Caucus, said: “The time for impeachment is the time when there’s evidence linking President Biden—if there’s evidence linking President Biden to a high crime or misdemeanor. That doesn’t exist right now.”

The attack on Biden is a transparent attempt to defend former president Trump from his own legal troubles by suggesting that Biden is just as bad. Russia’s president Vladimir Putin today also defended Trump, saying that his prosecutions show that the United States is fundamentally corrupt. His comment made former representative Liz Cheney (R-WY) seem to wash her hands of the modern incarnation of her political party. “Putin has now officially endorsed the Putin-wing of the Republican Party,” she wrote. “Putin Republicans & their enablers will end up on the ash heap of history. Patriotic Americans in both parties who believe in the values of liberal democracy will make sure of it.”

Representative Alexandria Ocasio-Cortez (D-NY) summed up the day: “So let me get this straight: Republicans are threatening to remove their own Speaker, impeach the President, and shut down the government on September 30th—disrupting everyday people’s paychecks and general public operations. For what? I don’t think even they know.”

The center-right think tank American Action Forum’s vice president for economic policy, Gordon Gray, had an answer. Ever since the debt ceiling fight was resolved, he told Joan E. Greve of The Guardian, “there’s a big chunk of House Republicans who just want to break something. That’s just how some of these folks define governing. It’s how their constituents define success.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#letters from an american#Heather Cox Richardson#impeachment#the free-dumb caucus#corrupt GOP#radical Republicans#debt ceiliing#breaking things#destructive Republicans

3 notes

·

View notes

Link

4 notes

·

View notes

Text

tax PSA for US artists

Even if you're not "officially" working as a freelance artist (as a business for profit, which files a Schedule C or similar), you DO still need to declare hobby income, particularly if you use payment processors like Paypal, venmo, etc. which track your transactions. They report to the IRS and the IRS will use the info when reviewing your tax return.

You may be able to get away with not doing it, if you're physical cash-only and there's no paper trail, but I can't recommend it. Firstly, because it'd be unprofessional on my part; secondly, because getting audited by the IRS is not fun and will almost definitely cost you more than you would save in taxes. Don't assume that just because they're overworked and underfunded means that you won't be caught. Better safe than sorry!

2 notes

·

View notes

Text

i love filing taxes. i love how doing a paper form means you'll never get your tax return from an overencumbered and underfunded irs. but the free file form online just throws 503s 55% of the time

2 notes

·

View notes