#trading economics crude oil prices

Explore tagged Tumblr posts

Text

Oil Prices Inch Up Despite Mixed Signals

Oil prices edged slightly higher on Friday. Contracts for Brent crude oil expiring in August climbed 0.4%, reaching $86.73 per barrel. Similarly, West Texas Intermediate (WTI) crude futures, a key benchmark for North American oil, rose 0.4% to $82.09 per barrel.

This modest increase comes amidst conflicting forces in the oil market. While concerns about potential supply disruptions from the Middle East and ongoing geopolitical tensions provided some upward pressure, a strong U.S. dollar acted as a counterweight. A stronger dollar can make oil, priced in dollars, less attractive to buyers using other currencies.

The focus for investors has now shifted to upcoming U.S. inflation data, which could influence future decisions by the Federal Reserve on interest rates. Higher interest rates can strengthen the dollar and potentially dampen demand for oil.

#Oil prices#Brent crude oil#West Texas Intermediate (WTI)#Crude oil futures#Oil market trends#Middle East supply disruptions#Geopolitical tensions#U.S. dollar strength#Federal Reserve interest rates#U.S. inflation data#Oil demand#Energy market analysis#Global oil supply#Commodities trading#Economic indicators

0 notes

Text

He’s a f—king madman who has no idea what he’s doing or what kind of harm he’s going to cause. Coffee prices will soar and it won’t’t just be Columbian coffee because it will create a greater demand for coffee from other nations. Then you can expect all the importers and retailers to price gouge on top of that. Pressed flowers will become unaffordable as well. Then gas prices will rise because their cheap crude oil will suddenly cost 25% more and again everyone else in the business will see increased demand and raise their prices and price gouge on top of that. Worse, he’s threatening to Jack the tariffs up to 50% for countries that won’t now to his demands.

Tariffs are meant to be used sparingly to stimulate domestic industry instead of relying on foreign producers. They were never intended to be used across the board on every item from a country. The foreign producers aren’t going to absorb a 25% loss in revenue, that’s never happened and likely never will. Prices for American consumers will rise by 25% plus inconvenience fees and price gouging.

Tariffs aren’t a weapon if you think they are you’re just shooting your own citizens in the foot. This is pretty basic stuff. Most people learned this when studying early American history in elementary school. American leaders in the post-revolutionary years imposed tariffs on European manufactured goods such as tools, guns, furniture, machines, etc to end reliance on imported goods while stimulating American manufacturing and turning us into an exporting nation.

Trump’s sole college degree is a bachelor’s in economics. This dumb ass should know how this works. He the densest mother f—ker alive and is completely incapable of being taught anything. Further he’s suffering cognitive decline due to mental illness and is a raging drug addict on top of that. Coke as an upper and Adderall to come down. His shadow president, Elon Musk, ironically only has a bachelor’s degree as well and surprise it’s also in economics. He should know better but also is suffering from mental illness and the consumption of mass quantities of Ketamine. Two moronic drug addicts.

The Republicants who should be advising Trump aren’t the best and brightest either. Nearly all of them haven’t gone beyond a bachelor’s degree and they certainly didn’t major in anything that would be useful in managing a large country with the largest economy on the planet. They are trying to run a government based on sound bites and talking points they picked up from the uneducated hosts of Fox News and Fox Business.

Once countries get burned by Trump’s tariffs they will seek out trading partners in Russia, Asia, the Middle East, and Africa. Once a trading partner leaves they almost never return. We’ll be forced to seek out more expensive trading partners who will be very cautious dealing with an unreliable USA. Further Columbia will stop cooperating and sharing intelligence in the war against the narco terrorists. Politically all these nations Trump alienates will realign their political goals with BRICS which is growing as an alternative trade and policy for nations not aligned with the Western and first world states. This is an economic and foreign policy disaster that will ripple through the world for decades to come. Trump isn’t just going to crash our economy but likely cause a worldwide depression, or at least recession. When the US catches a cold the rest of the world sneezes.

THIS IS NOT NORMAL AND ITS NOT EVEN RATIONAL.

#trump doesn’t understand tariffs#Trump’s advisers are not intelligent or well educated and certainly are not competent#tariffs are not tools#nobody wins a trade war#an unsuccessful NYC realtor is not qualified to be president#this is self destructive#the US and world economies will suffer#republican assholes#maga morons#traitor trump#crooked donald#traitor#resist#republican values#republican hypocrisy#republican family values

96 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

November 26, 2024

Heather Cox Richardson

Nov 27, 2024

Today presented a good example of the difference between governance by social media and governance by policy.

Although incoming presidents traditionally stay out of the way of the administration currently in office, last night, Trump announced on his social media site that he intends to impose a 25% tariff on all products coming into the U.S. from Mexico and Canada “until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!” Trump claimed that they could solve the problem “easily” and that until they do, “it is time for them to pay a very big price!”

In a separate post, he held China to account for fentanyl and said he would impose a 10% tariff on all Chinese products on top of the tariffs already levied on those goods. “Thank you for your attention to this matter,” he added.

In fact, since 2023 there has been a drop of 14.5% in deaths from drug overdose, the first such decrease since the epidemic began, and border patrol apprehensions of people crossing the southern border illegally have fallen to the lowest number since August 2020, in the midst of the pandemic. In any case, a study by the libertarian Cato Institute shows that from 2019 to 2024, more than 80% of the people caught with fentanyl at ports of entry—where the vast majority of fentanyl is seized—were U.S. citizens.

Very few undocumented immigrants and very little illegal fentanyl come into the U.S. from Canada.

Washington Post economics reporter Catherine Rampell noted that Mexico and Canada are the biggest trading partners of the United States. Mexico sends cars, machinery, electrical equipment, and beer to the U.S., along with about $19 billion worth of fruits and vegetables. About half of U.S. fresh fruit imports come from Mexico, including about two thirds of our fresh tomatoes and about 90% of our avocados.

Transferring that production to the U.S. would be difficult, especially since about half of the 2 million agricultural workers in the U.S. are undocumented and Trump has vowed to deport them all. Rampell points out as well that Project 2025 calls for getting rid of the visa system that gives legal status to agricultural workers. U.S. farm industry groups have asked Trump to spare the agricultural sector, which contributed about $1.5 trillion to the U.S. gross domestic product in 2023, from his mass deportations.

Canada exports a wide range of products to the U.S., including significant amounts of oil. Rampell quotes GasBuddy’s head of petroleum analysis, Patrick De Haan, as saying that a 25% tax on Canadian crude oil would increase gas prices in the Midwest and the Rockies by 25 cents to 75 cents a gallon, costing U.S. consumers about $6 billion to $10 billion more per year.

Canada is also the source of about a quarter of the lumber builders use in the U.S., as well as other home building materials. Tariffs would raise prices there, too, while construction is another industry that will be crushed by Trump’s threatened deportations. According to NPR’s Julian Aguilar, in 2022, nearly 60% of the more than half a million construction workers in Texas were undocumented.

Construction company officials are begging Trump to leave their workers alone. Deporting them “would devastate our industry, we wouldn’t finish our highways, we wouldn’t finish our schools,” the chief executive officer of a major Houston-based construction company told Aguilar. “Housing would disappear. I think they’d lose half their labor.”

Former trade negotiator under George W. Bush John Veroneau said Trump’s plans would violate U.S. trade agreements, including the United States–Mexico–Canada Agreement (USMCA) that replaced the 1994 North American Free Trade Agreement that Trump killed. The USMCA was negotiated during Trump’s own first term, and although it was based on NAFTA, he praised it as “the fairest, most balanced, and beneficial trade agreement we have ever signed into law. It’s the best agreement we’ve ever made.”

Trump apologists immediately began to assure investors that he really didn’t mean it. Hedge fund manager Bill Ackman posted that Trump wouldn’t impose the tariffs if “Mexico and Canada stop the flow of illegal immigrants and fentanyl into the U.S.” Trump’s threat simply meant that Trump “is going to use tariffs as a weapon to achieve economic and political outcomes which are in the best interest of America,” Ackman wrote.

Iowa Republican lawmaker Senator Chuck Grassley, who represents a farm state that was badly burned by Trump’s tariffs in his first term, told reporters that he sees the tariff threats as a “negotiating tool.”

Foreign leaders had no choice but to respond. Mexican president Claudia Sheinbaum issued an open letter to Trump pointing out that Mexico has developed a comprehensive immigration system that has reduced border encounters by 75% since December 2023, and that the U.S. CBP One program has ended the “caravans” he talks about. She noted that it is imperative for the U.S. and Mexico jointly to “arrive at another model of labor mobility that is necessary for your country and to address the causes that lead families to leave their places of origin out of necessity.”

She noted that the fentanyl problem in the U.S. is a public health problem and that Mexican authorities have this year “seized tons of different types of drugs, 10,340 weapons, and arrested 15,640 people for violence related to drug trafficking,” and added that “70% of the illegal weapons seized from criminals in Mexico come from your country.” She also suggested that Mexico would retaliate with tariffs of its own if the U.S. imposed tariffs on Mexico.

Canadian prime minister Justin Trudeau did not go that far but talked to Trump shortly after the social media post. The U.S. is Canada’s biggest trading partner, and a 25% tariff would devastate its economy. The premier of Alberta, Danielle Smith, seemed to try to keep her province’s oil out of the line of fire by agreeing with Trump that the Canadian government should work with him and adding, “The vast majority of Alberta’s energy exports to the US are delivered through secure and safe pipelines which do not in any way contribute to these illegal activities at the border.”

Trudeau has called an emergency meeting with Canada’s provincial premiers tomorrow to discuss the threat.

Spokesperson for the Chinese embassy in Washington Liu Pengyu simply said: “No one will win a trade war or a tariff war” and “the idea of China knowingly allowing fentanyl precursors to flow into the United States runs completely counter to facts and reality.”

In contrast to Trump’s sudden social media posts that threaten global trade and caused a frenzy today, President Joe Biden this evening announced that, after months of negotiations, Israel and Lebanon have agreed to a ceasefire brokered by the U.S. and France, to take effect at 4:00 a.m. local time on Wednesday. “This is designed to be a permanent cessation of hostilities,” Biden said.

Lebanon’s Iran-backed Hezbollah attacked Israel shortly after Hamas’s attack of October 7, 2023. Fighting on the border between Israel and Lebanon has turned 300,000 Lebanese people and 70,000 Israelis into refugees, with Israel bombing southern Lebanon to destroy Hezbollah’s tunnel system and killing its leaders. According to the Lebanese Ministry of Public Health, Israeli attacks have killed more than 3,000 people and injured more than 13,000, while CBS News reports that about 90 Israeli soldiers and nearly 50 Israeli civilians have been killed in the fighting. Under the agreement, Israel’s forces currently occupying southern Lebanon will withdraw over the next 60 days as Lebanon’s army moves in. Hezbollah will be kept from rebuilding.

According to Laura Rozen in her newsletter Diplomatic, before the agreement went into effect, Israel increased its airstrikes in Beirut and Tyre.

When he announced the deal, Biden pushed again for a ceasefire in Gaza, whose people, he said, “have been through hell. Their…world is absolutely shattered.” Biden called again for Hamas to release the more than 100 hostages it still holds and to negotiate a ceasefire. Biden said the U.S. will “make another push with Turkey, Egypt, Qatar, Israel, and others to achieve a ceasefire in Gaza with the hostages released and the end to the war without Hamas in power.”

Today’s announcement, Biden said, brings closer the realization of his vision for a peaceful Middle East where both Israel and a Palestinian state are established and recognized, a plan he tried to push before October 7 by linking Saudi Arabia’s normalization of relations with Israel to a Palestinian state. Biden has argued that such a deal is key to Israel’s long-term security, and today he pressed Israel to “be bold in turning tactical gains against Iran and its proxies into a coherent strategy that secures Israel’s long-term…safety and advances a broader peace and prosperity in the region.”

“I believe this agenda remains possible,” Biden said. “And in my remaining time in office, I will work tirelessly to advance this vision of—for an integrated, secure, and prosperous region, all of which…strengthens America’s national security.”

“Today’s announcement is a critical step in advancing that vision,” Biden said. “It reminds us that peace is possible.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters From An American#American History#justice#bribes#billionaires#rule of law#plunder#economic madness#tariffs#deportation

17 notes

·

View notes

Text

Excerpt from this story from Grist:

Shortly after he was reelected last month, Donald Trump announced an economic gambit that was aggressive even by his standards. He vowed that, on the first day of his second term, he would slap 25 percent tariffs on imports from Canada and Mexico, and boost those already placed on Chinese products by another 10 percent.

The move set off a frenzy of pushback. Canadian Prime Minister Justin Trudeau even flew to the president-elect’s Florida resort to make his case. Economists say the potential levies threaten to upend global trade — including green technologies, many of which are manufactured in China. The moves would cause price spikes for everything from electric vehicles and heat pumps to solar panels.

“Typically with tariffs, we’ve seen [companies] pass them along to the consumer,” said Corey Cantor, electric vehicles analyst at Bloomberg NEF. Ansgar Baums, a senior fellow at the nonpartisan foreign policy think tank Stimson Center, said retaliatory moves from the three targeted countries would only make things worse. “It will drive up consumer costs and hurt those who cannot afford it.”

Trump has acknowledged that possibility. But he has argued that tariffs are necessary to force Canada and Mexico to crack down on drugs, particularly fentanyl, and on migrants crossing the border into the U.S.

The recently threatened tariffs would ratchet prices even higher on things like solar panels, but are also much more far-reaching because of their broad application to North American trading partners. One sweeping impact would be on gasoline prices, because although the U.S. is world’s largest oil producer, older domestic refineries can only process the type of heavier crude that comes from Canada. GasBuddy projects that tariffs could add 35 cents to 75 cents on a gallon of gas.

Automakers will also be hard hit, as $97 billion in parts and some 4 million vehicles come from Canada and, especially, Mexico. That’s where some of the more affordable EVs, such as Ford’s Mustang Mach-E and the Chevrolet Equinox, are manufactured. Wolfe Research said that “given the magnitude, we’d expect most investors to assume Trump ultimately does not follow through with these threats,” but that if they were put in place, tariffs would add $3,000 to the price of the average car, regardless of whether it’s powered by gasoline or a battery.

14 notes

·

View notes

Text

The Port & the City

Buenos Aires, photo by lasgalletas (Creative Commons CC BY-NC 2.0)

Introduction

City of witches and of asphalt, port with no exit to the sea! — La Portuaria, from the port of Buenos Aires

Some cities have a port, and some port cities have a port culture. That's how I call it, anyway. It's a very special thing. It's created by the furious economic activity that concentrates around the coming and going of ships, cargo, and people. A port needs to cater to all of that, the ships and the cargo, the shipowner and the dockworker, the captain and the deckhand, the tourist and the sailor and the fisherman. And that transforms the entire city.

Where a port city meets the sea, there's shipping companies, travel agencies, imports/exports, truck companies, posh hotels, shitty hotels, fancy bars, seedy bars, brothels, strip clubs, theatres, restaurants, casinos, bookshops, tool shops, souvenir shops, fishing supplies, and fresh fish. There's peddlers and businessmen, porters and accountants, all sorts of people, and they all mingle. They have to! The port's there!

Port cities have their own landmarks and geography, with docks, wharfs, piers, depots, gates, shipyards, and people can orient themselves by relation to the water.

New York City, photo by Kari Nousiainen (Creative Commons CC BY-NC 2.0)

Crime

My gold watch and my pocketbook and lady friend were gone And there was I, Jack all alone, stark naked in the room — the port of New York City

Port cities attract furious criminal activity. Firstly and obviously, everything that's smuggled will be smuggled through here, from cocaine to counterfeit handbags to guns to oil. (I mean crude/refined oil, though with the prices we've seen lately, olive oil is equally plausible.) Port authorities, customs, shipowners and workers, all can have a hand in the pie, a little finger or both hands shoulder-deep, depending on how high up the ladder they are.

Second, ports are always full of newcomers, sailors and passengers, and all newcomers are potential marks. Con artists, scammers, and grifters of all sorts can ply their trade here. There's also a lot of shilling for more or less legitimate businesses (come buy this, sir! rent a room here, ma'am! oh but you must have a drink there, buddy!), and peddling less then legitimate goods (may I interest you in a fine watch? Rayban glasses, I have Rayban glasses! 100% genuine!). And then there's good old pickpocketing. Although in most cases, pickpockets are not allowed to operate within the port itself: it's bad for everyone else's business, and unlike cops, "everyone else" can actually enforce that.

And third, there's the entertainment sector: the trifecta of night life, sex work, and gambling, all going hand in hand with the sale and consumption of drugs and booze. Expect the port city to be much more entangled in all that than other cities, and the port itself to attract the bulk of it, or the worst of it. Things that are theoretically illegal might be tolerated here, things that are heavily regulated elsehwhere might follow their own rules here, and things that are otherwise unheard of can be found here. What are you into? Step right up but beware: the large print giveth and the small print taketh away.

The upshot of all this is that people in the port's vicinity (not the whole city, though) are more likely to be involved, or at least personally know someone who's involved, in profoundly shady and/or illegal business. And that certainly affects the culture. Breaking the law is more "eh" than "oh my!".

Clydebuilt Museum, photo by Paisley Scotland (Creative Commons CC BY 2.0)

Politics

All my life I've lived beside the waters that they call the Clyde I build the ships and watch them glide down the Broomielaw, sir Trudge to work in sleet and rain, labour for another's gain know yer place and don't complain, that's the rich man's law, sir — Alistair Hulett, from the shipyards of Glasgow

A port displays furious political activity. Unions are strong here, because labour is not only working, it's working hard, manually, in the same spaces (so they can talk about it!), and facing the same dangers to life and limb. Working on the docks, handling cargo containers, and ship-building and maintenance are very hazardous jobs (scrapping even more so, I'd say dramatically so), and under these conditions, it's easier to spot the enemy. Not automatic though. Port cities are traditionally, but not unconditionally, strongholds of the left.

Today, it's extremely important for the left to take the ports, because if it doesn't the fascists will. The workforce here has significant ethnic diversity, coming both from inland (immigrants and local minorities) and from the sea (sailors who go around the world sometimes end up working in random ports). So basically, this either goes "proletarians of the world unite" or "foreigners are stealing our jobs", no middle ground.

By the way, if all your knowledge about port unions comes from The Wire, or worse (for our older readers) from On the Waterfront, please be aware that these are slanted depictions, and you don't actually know anything. [They're not equally slanted, The Wire is nowhere near the other one's level of shameless propaganda, nor so completely divorced from reality. I mean yes, unions can be involved in shady business; so can literally everyone else in the port. But On the Waterfront, without the slightest exaggeration, is to American organised labour what Birth of a Nation is to Black Americans.]

Valparaíso, photo by [o] Rolando Vejar (Creative Commons CC BY-SA 2.0)

Culture

Amo el amor de los marineros que besan y se van. Dejan una promesa. No vuelven nunca más. — Pablo Neruda, from the port of Valparaíso

The port's culture seeps through the rest of the city. This is where sailor lore gets created and spread, and a port by definition loves travel and the ocean. Many non-sailors fall for it hook, line and sinker, and write poems and sing songs and their heart swells at the mere thought of sailing. But their fascination is often rose-tinted, whereas people who make a living from the sea typically have a love/hate relationship with it.

Maiden voyages are important occasions in shipbulding ports. A ship's last voyage, before it goes to scrap, is also memorable. If the ship regularly docks there, it will be the talk of the town, and if it's a passenger ship [this assumes a geography with regular passenger runs], a whole mess of people will be sharing stories and memories, waving it farewell, shouting, applauding, crying a little. It can get very emotional.

There's also a silly sort of localism/professional pride going on, where even the port's accountants, who've never set foot below decks IF they've actually boarded a ship, feel like they're a different species of accountant, inexplicably tougher and saltier than their more, er, inland colleagues. No matter who you are and what you do, it's badge of honour to say you're from and/or work at the port, like you're automatically endowed with tenacity and street smarts. It doesn't make sense, but there you have it.

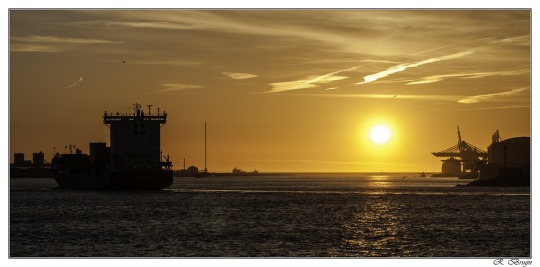

Rotterdam, photo by MaxAmy Photography (Creative Commons CC BY-ND 2.0)

Desire

In the port of Amsterdam there's a sailor who dies Full of beer, full of cries, in a drunken town fight In the port of Amsterdam there's a sailor who's born On a hot muggy morn by the dawn's early light — Jacques Brel (in David Bowie's adaptation), from the port of Amsterdam

A port is filthy, grubby, and hopelessly romantic. If it faces somewhat west, it's on fire every sunset. Silhouettes of gigantic cranes are framed by red clouds like alien tripods. The sun sinks into the ocean, and tell me, in the whole wide earth, is there a sweeter sight? Ships approach like sea beasts, and dock in their usual place like old friends.

A port carries the whiff of grease and petrol, the cool sea breeze, and the incessant sounds of waves and engines and – most of all – people. A port IS people, passing. And tell me, in the whole wide world, is there anything more exciting and heartwrenching than people passing? A port city can fill you with wanderlust and feel like a prison, or a warm welcome, or a devastating farewell.

And if you point a gun to my head and force me to describe a port in a single word, I'll have to say: desire.

Love me, leave me, hold me tight, walk away, forget. Look at how I broke inside, and how the sea has swelled! It's pouring out a riot of colours, scents, and lights, and in the city's gutter it's building paradise. — Ξύλινα Σπαθιά, from the port of Thessaloniki

Thessaloniki, photo by Arend Kuester (Creative Commons CC BY-NC 2.0)

La Portuaria - Un dia cualquiera (El bar de la calle Rodney) | the port of Buenos Aires

Ξύλινα Σπαθιά - Ρόδες | the port of Thessaloniki

Tom Waits - Step right up

Finbar Furey - New York City girls | the port of New York

The Dubliners - Go to sea no more | the port of Liverpool

Alistair Hulett - The Old Divide and Rule | the shipyards of Glasgow

The Dreadnoughts - Roll Northumbria | the shipyards of Tyne

The Longest Johns - Fire & flame | the port of Halifax

Maria del Mar Bonet - Merhaba | the ports of the Mediterranean

Cesária Évora - Mar de canal | the port of Mindelo

Susana Baca - Los marineros | the port of Valparaíso

Παντελής Θαλασσινός - Άσπρο καΐκι στη Νέα Πέραμο | the little port of Nea Peramos

Jacques Brel - Amsterdam | the port of Amsterdam

Social Waste - Kasbah | the port of Algiers

Πάνος Κατσιμίχας - Ο πιλότος Νάγκελ | the port of Colombo, so far from Lofoten

Ξύλινα Σπαθιά - Φωτιά στο λιμάνι | the port of Thessaloniki

#the city speaks#theory#trs#the ramblin' rover#pirate#booze#booze et al#no tears for the creatures of the night#smuggler#pickpocket#mixtape#prison ballads#ONE of these days I'll learn to be concise I swear#also I ain't translating Naruda to english#the Rogue's school of translation gives exactly zero fucks#but there's a limit#look it up it's called ''Farewell''#also I didn't include a planned section on immigration#because I got too fucking upset to write words

62 notes

·

View notes

Text

The outgoing Biden administration threw the proverbial kitchen sink at Russia’s energy sector on Friday with a sweeping slate of sanctions meant to curtail Moscow’s still-resilient energy earnings and potentially weaken its war-making power in a critical year for Ukraine’s survival.

The measures announced Friday do all and more that the Biden administration had shied away from since the start of the full-scale Russian invasion of Ukraine in 2022: going after the production, distribution, sales, and financing of Russian oil and gas, long the mainstay of Moscow’s war chest and still the most vulnerable part of its creaky economy.

The moves include sanctions on two Russian oil majors, Gazprom Neft and Surgutneftegas, as well as more than 180 shadow fleet tankers, natural gas producers, energy traders, and oil field service providers.

“Russia is now in the penalty box,” said a senior administration official who spoke on background under conditions set by the White House.

Senior administration officials expect that the new measures will cost Russia billions of dollars a month in foregone energy revenues—no small achievement when the Kremlin banks on the order of about $20 billion a month by fueling the world at war. The idea is that Russia is going to now have to seriously choose not between guns and butter but between oil tankers and military tanks.

“Today’s actions build on recent steps that reinforce an economic trajectory along which Russia will face hard choices,” U.S. Deputy National Security Advisor Daleep Singh said in a statement. Singh described the measures as the “most significant sanctions yet” on Russia’s energy sector.

The question of why the White House decided to make these moves now is both easy to answer and surprising. For years, President Joe Biden has avoided taking the necessary and hard steps to fully go after Russia’s cash cow because that would have meant higher oil prices (and gas prices) and higher inflation for Americans. That was a particular concern during the 2022 midterm elections and especially in the recently concluded presidential contest. That is not a concern for the Biden White House now.

Officially, the White House says it is unleashing the kraken now because oil markets are relaxed and the costs will be bearable. Indeed, benchmark global crude prices have been languishing in the $70 per barrel range, which gives the administration and the United States plenty of room to run before worrying about triple digits.

Unofficially, the Biden White House is packing boxes, and this slate of sanctions is a way to kneecap Russia before handing off control to the incoming Trump administration. Given the ambivalence shown by President-elect Donald Trump and many of his officials to continue U.S. support for Ukraine, aggressive action now to further constrain Russia’s war chest gives Ukraine one last lifeline that might have not materialized otherwise. Given the stakes for Ukraine, Europe, and ultimately for the United States, buying time in 2025 makes sense.

But Friday’s measures aren’t a restraint on the incoming administration or a Parthian shot but quite the opposite.

“I view it as a gift to the Trump administration—Biden is doing the dirty work, giving the next administration more leverage to get [Russian President Vladimir] Putin to the table,” said Edward Fishman, a former senior U.S. sanctions official now at the Center on Global Energy Policy at Columbia University. “The Russian economy is already bad, so this gives the incoming administration a lot more leverage over Russia without starting on the wrong foot.”

Even those countries that might be expected to bristle at restrictions on Russian oil trade—China, India, and Turkey have outdone themselves by snapping up cheap Russian crude oil and oil products during the war—have little to fear from the latest U.S. moves. Reuters reported this week that a major Chinese port had already moved to ban U.S.-sanctioned oil tankers. India has even less to fear because the more untouchable Russia’s oil exports become, the cheaper they potentially are.

“Traders love this: ‘You guys are toxic. I need a bigger discount.’ Anybody who understands oil trading understands that India has been one of our best assets in constraining Russian oil revenue, because they can demand big discounts,” said Craig Kennedy, an expert on Russia’s energy sector at Harvard University’s Davis Center for Russian and Eurasian Studies. “India’s constantly been looking for pretexts for deeper discounts, and here we have it.”

The nitty gritty of the latest U.S. measures is where things get interesting. They go soup-to-nuts on all aspects of the Russian energy trade, which even three years into war brings in about $665 million a day to Putin’s coffers. The good news is that before the war, that was closer to $1 billion a day. The bad news is that for the last two years, sanctions have hardly budged those Russian revenues. What the latest sanctions target is everything. Much of the attention is on the designation of 183 Russian tankers, since the whole point of Russia’s sanctions-skirting exercise for the last two years has hinged on a shadow fleet of oil tankers that are entirely outside the remit of Western whipsticks.

Russia can’t trade energy much these days except by sea, so tankers are ground zero in this fight.

“Sanctioning 183 vessels will be a huge hit to Russia’s seaborne crude oil exports—it will be really huge,” said Petras Katinas of the Finland-based Centre for Research on Energy and Clean Air (CREA), where he tabulates Russian fossil fuel earnings.

Utilizing the dominance of the dollar, Biden administration officials now expect that ports and insurance companies will balk at doing business with the tankers, fearful that they may too find themselves in the crosshairs of secondary sanctions, which could cut off access to U.S. financial institutions. The preemptive ban by China’s Shandong Port Group this week spoke volumes.

Russia’s shadow fleet includes both officially Russian-flagged vessels that have fled Western insurers and a greater host of aged ships bought on the sly to ferry illicit goods. Together, that fleet carries more than 80 percent of Russia’s seaborne oil exports, according to CREA. U.S. sanctions, as have been levied piecemeal in the past, have kept those ships idling, cutting their oil transport by more than 90 percent. With the new steps, that could be a billion dollars monthly gone right there, if not more.

But the ultimate goal of curtailing what effectively amounts to between one-third and one-half of the active Russian shadow fleet is not to chase those ships from the sea entirely or to remove those barrels of Russian oil from the market. Rather, it is to herd those illicit vessels back into the confines of the Western-led, -insured, and -regulated maritime market, which includes a price cap on Russian oil that, at $60 a barrel, remains lower than what some rogue traders can still get.

“This is a long overdue step in terms of making the oil price cap binding,” Fishman said. Russia can either forgo shipping oil (and lose money) or ship oil through regulated tankers (and lose money). “This is an attempt to put real teeth into the price cap,” he said.

Depending on whom you talk to, each and every bit of the latest sanctions package is especially powerful. For Fishman, it is the United States going after two of Russia’s five major oil producers with straight-up sanctions that could potentially remove up to 2 million barrels a day of oil from global markets.

“We have not ever seen blocking sanctions on a Russian oil company directly. This is more than we ever did since 2014,” when Russia first invaded Ukraine, he added.

For Kennedy, it’s the future of Russia’s tired oil fields: The restrictions on oil field services companies mean that the Kremlin will be hard-pressed to squeeze more oil out of old fields that require world-class expertise to manage geriatric reservoirs, aided even during the war and sanctions years by Western firms such as SLB.

“Maybe not tomorrow, but they’ll lose access to the capabilities, and that will make it riskier and costlier to maintain current production levels,” Kennedy said.

And there are additional restrictions on Russian liquefied natural gas exports, which have been a life vest for the Russian gas industry and one rare growth area, especially in exports to Europe. The U.S. State Department went after a couple of minor Russian LNG projects and continued pressure on a marquee Arctic LNG project, all of which will make Russian tanked gas less appealing and U.S. natural gas exports even more so. That is likely music to Trump’s ears.

Senior administration officials fully expect that Russia will try to evade the new sanctions. Following the 2022 invasion, Russia became the most sanctioned country in the world, with more than 16,000 people and companies subject to a patchwork of international sanctions and export control orders intended to deprive it of the resources and technology to fuel its defense industrial base.

These measures have forced Moscow to seek out new and cumbersome routes to sell its energy and acquire advanced technology. This has come at a steep cost but does not appear to have persuaded Putin to climb down from his maximalist aims of subjugating Ukraine.

The senior administration official compared U.S. sanctions to sand being poured into the gears of the Russian war machine.

The ultimate point of the belated sanctions, like the belated arms deliveries or the belated lifting of targeting restrictions, is to make it harder for Putin to continue waging a war on Ukraine that has cost him hundreds of billions of dollars and hundreds of thousands of men.

“For every tanker they have to buy, that’s fewer tanks they can buy for their war of choice in Ukraine,” a second senior administration official said ahead of the announcement.

Russia remains nonplussed by the latest moves, as one does with a currency measured in wheelbarrows and interest rates in double digits.

“Some manage to leave a mark on history, while others only manage to leave a mark,” Russian Foreign Ministry spokesperson Maria Zakharova said in response to Biden’s new sanctions.

7 notes

·

View notes

Text

Tariffs

i asked elon musks ai to explain this to me, so i would be getting my information from what everyone is calling an unbiased source. so this is per GROK collection of data on the subject have fun......

Canada is a significant supplier of energy to the United States. According to various sources:

Crude Oil: Canada supplies about 60% of the U.S.'s crude oil imports.

Natural Gas: Canada is the source of nearly all (98% or 99%) of the U.S.'s natural gas imports.

Electricity: Canada exports a considerable amount of electricity to the U.S., with figures indicating around 33 terawatt-hours in 2023, which constitutes about 90% of the U.S.'s annual electricity imports.

Uranium: Canada also supplies 25% of the U.S.'s uranium imports.

This overview shows that the U.S. heavily relies on Canada for various forms of energy, making Canada one of the largest energy suppliers to the U.S.

So the government just taxes it's constituents by way of tariffs

Yes, in essence, tariffs can be seen as a way for the government to tax its constituents, but the mechanism and impact are more nuanced:

Direct Payment: Importers pay the tariff directly to the government when goods enter the country. These importers might be domestic companies or individuals.

Indirect Impact: The burden often gets passed on indirectly. Here's how:

Consumers: If importers increase the price of goods to cover the cost of tariffs, consumers end up paying more for these products. This is effectively a tax on consumption.

Businesses: Companies might absorb part of the tariff cost to remain competitive, impacting their profit margins or leading them to find cost-saving measures elsewhere, which could indirectly affect employees or other business decisions.

Revenue Collection: The government collects this revenue, which can be used for public expenditure, reducing other taxes, or paying down national debt. However, the primary goal of tariffs might also include protecting domestic industries, which can lead to higher prices for goods in general, not just imports.

Market Dynamics: Tariffs can alter market dynamics, sometimes leading to higher prices for both imported and domestic goods if domestic producers raise their prices due to less competition.

Economic Theory: Economists often discuss tariffs in terms of "tax incidence," which looks at who ultimately bears the economic burden. The incidence can split between consumers and producers based on how sensitive demand and supply are to price changes (elasticity).

So, while tariffs are a form of taxation that directly affects importers, the economic burden or "tax" can be shared among consumers, domestic producers, and importers in various proportions, depending on many factors including the specifics of the tariff, the type of goods, and market conditions.

Why does Donald trump think tariffs will pay America via foreign countries if it's the importer is the one that pays it

Donald Trump's rhetoric on tariffs, particularly during his campaigns and presidency, often emphasized the notion that tariffs are paid by foreign countries, which would, in turn, benefit the U.S. economy. Several reasons might explain this perspective:

Misunderstanding or Simplification for Political Messaging:

Trump might have simplified or misrepresented how tariffs work to fit into a political narrative. By saying that foreign countries pay tariffs, he could appeal to those who view trade as a zero-sum game where the U.S. should "win" against other countries. This simplification might be intended to resonate with voters by portraying him as tough on trade with nations perceived as economic adversaries, particularly China.

Negotiation Strategy:

Trump often used tariffs as leverage in trade negotiations. His claim that foreign countries pay might have been part of a strategy to pressure those countries into making concessions, assuming that they would see the tariffs as a direct cost they must bear to maintain access to the U.S. market.

Revenue Focus:

He emphasized the revenue aspect of tariffs, stating that they would fill the U.S. Treasury with money from foreign countries. This view overlooks the fact that while tariffs do generate revenue for the government, the economic cost is borne domestically by importers and consumers. Trump might have focused on the revenue collection aspect to highlight his plan to reduce the national deficit or fund his tax cuts without directly increasing domestic taxes.

Economic Nationalism:

Trump's economic policy was often framed under the banner of "America First," where tariffs were seen as a tool to protect and revive American industries. By suggesting that other countries pay, he could frame tariffs as a means to correct trade imbalances, even if economically, it's the domestic importers and consumers who bear the cost.

Public Perception and Media:

Trump's communication style frequently involved bold claims and straightforward messages over nuanced explanations. This approach might cater to public perception or media narratives where complex economic concepts are reduced to soundbites.

However, from an economic standpoint, as numerous analyses and expert opinions have pointed out, tariffs are typically paid by domestic importers, who then might pass on these costs to consumers or absorb them, affecting the price of goods or profit margins:

Economists' View: Studies and statements from economists, including those from institutions like the Peterson Institute for International Economics, have consistently shown that while tariffs generate revenue for the U.S. government, the economic burden largely falls on American businesses and consumers through higher prices or reduced profits.

Public Discourse on X: Posts on X have highlighted the misunderstanding, with users clarifying that tariffs are not paid by the exporting country but by U.S. importers, indirectly affecting U.S. consumers.

These sources emphasize that while the government collects the tariff revenue, it's the domestic market that feels the economic impact.

#president trump#donald trump#trump#trump 2024#trump vance 2024#trump vs harris#2024 presidential election#presidential debate#civil rights#human rights#thoughts and tariffs#trump tariffs#us tariffs#trade tariffs#25% tariffs#canada#grok

6 notes

·

View notes

Text

Gas Station Stream of Consciousness Post

Gas Stations as Liminal Spaces

I've had quite a few hyperfixations in my day - ATMs, laundry detergents, credit cards - so my current one pertaining to gas stations is fitting considering my affinity for liminal spaces and the dedication of this blog to them. Liminal spaces are transitory in nature, hence their portrayal in online circles through photos of carpeted hallways, illuminated stairwells, dark roads, and backrooms, among other transitional points.

Gas stations are posted online as well; images of their fuel pumps or neon signage photographed through a rainy car window communicate their liminality and the universal experiences they provide to all of society. Perhaps they are the ultimate specimen of a liminal space. The machines they are created for, automobiles and tractor trailers alike, themselves are tools for motion, vestibules that enable travel and shipment across long distances at high speeds. Cars and roads are liminal spaces, albeit in different formats, and gas stations serve as their lighthouses. Vehicles at filling stations, therefore, are in a sense liminal spaces within liminal spaces within liminal spaces.

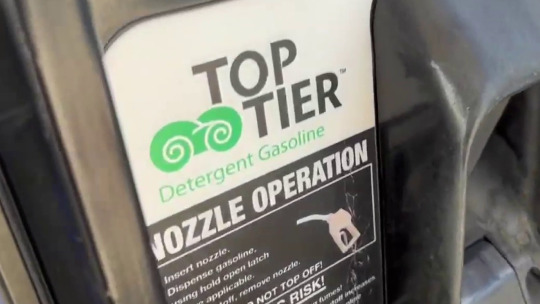

The uniqueness of a gas station as a liminal space, however, is its intersection with the economics and aesthetics of capitalism. Gasoline (and diesel fuel) is a commodity, downstream from crude oil, merely differentiated by octane ratings. Some argue that minute distinctions between agents, detergents, and additives make some brands better than others. Indeed, fuels that are approved by the Top Tier program, sponsored by automakers, have been shown to improve engine cleanliness and performance, but this classification does not prefer specific refiners over others; it is simply a standard. To a consumer, Top Tier fuels are themselves still interchangeable commodities within the wider gasoline commodity market.

The Economics of Gas Stations

The market that gas stations serve is characterized by inelastic demand, with customers who reckon with prices that fluctuate day in and day out. This is not to say that consumer behavior does not change with fuel prices. It has been observed that as prices rise, consumers are more eager to find the cheapest gas, but when prices fall, drivers are less selective with where they pump and are just happy to fill up at a lower price than last week. In response, gas stations lower their prices at a slower rate than when increasing prices, allowing for higher profit margins when wholesale prices fall. This has been dubbed the "rockets and feathers" phenomenon.

When portrayed as liminal spaces, gas stations are most often depicted at night, places of solitude where one may also enter the adjacent convenience store and encounter a fellow individual who isn't asleep, the modern day lightkeeper. The mart that resides at the backcourt of a gas station is known to sell goods at higher prices than a supermarket, simultaneously taking advantage of a captive customer, convenient location, and making up for the inefficiencies of a smaller operation. It may come as no surprise, then, that gas stations barely make any money from fuel sales and earn their bulk through C-store sales. This is a gripe I have with our economic system. Business is gamified, and in many cases the trade of certain goods and services, called loss leaders, is not an independent operation and is subsidized by the success of another division of a business, a strategy inherently more feasible for larger companies that have greater scale to execute it.

Nevertheless, most gas station owners, whether they have just one or hundreds of sites, find this method fruitful. Even though most gas stations in the US sell one of a handful of national brands, they operate on a branded reseller, or dealer, model, with oil companies themselves generally not taking part in the operations of stations that sell their fuels. The giants do still often have the most leverage and margin in the business, with the ability to set the wholesale price for the distributor, which sells at a markup to the station owner, which in turn will normally make the least profit in the chain when selling to the end customer at the pump. This kind of horizontal integration that involves many parties lacks the synergies and efficiencies of vertical integration that are so applauded by capitalists, but ends up being the most profitable for firms like ExxonMobil, who only extract and refine oil, and on the other end of the chain merely license their recognizable brands to the resellers through purchasing agreements. Furthermore, in recent years, independent dealers have sold their businesses to larger branded resellers, in many cases the ones from whom they had been buying their fuel.

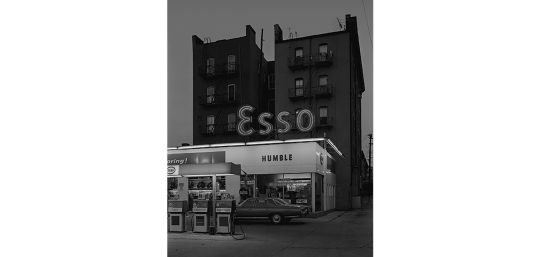

A Word on ExxonMobil's Branding Potential

The largest publicly traded oil company in the world is Exxon Mobil Corporation. It is a direct descendent of the Rockefeller monopoly, Standard Oil, which was broken up in 1911 into 34 companies, the largest of which was Jersey Standard, which became Exxon in 1973. This title was generated by a computer as the most appealing replacement name to be used nationwide to unify the Humble, Enco, and Esso brands, decades before AI was spoken of. The latter brand is still used outside of the United States for marketing, arising from the phonetic pronunciation of the initials of Standard Oil. In 1999, Exxon and Mobil merged, and the combined company to this day markets under separate brands. Exxon is more narrowly used, to brand fuel in the United States, while Mobil has remained a motor oil and industrial lubricant brand, as well as a fuel brand in multiple countries.

Mobil originated in 1866 as the Vacuum Oil Company, which first used the current brand name for Mobiloil, and later Mobilgas and Mobilubricant products, with the prefix simply short for "automobile". Over time, Mobil became the corporation's primary identity, with its official name change to Mobil Oil Corporation taking place in 1966. Its updated wordmark with a signature red O was designed by the agency Chermayeff & Geismar, and the company's image for service stations was conceived by architect Eliot Noyes. New gas stations featured distinctive circular canopies over the pumps, and the company's recognizable pegasus logo was prominently on display for motorists.

I take issue with the deyassification of the brand's image over time. As costs were cut and uniformity took over, rectangular canopies were constructed in place of the special ones designed by Noyes that resembled large mushrooms. The pegasus remained a prominent brand icon, but the Mobil wordmark took precedence, which I personally believe to be an error in judgement. This disregard for the pegasus paved the way for its complete erasure in 2016 with the introduction of ExxonMobil's "Synergy" brand for its fuel. The mythical creature is now much smaller and appears only at the top right corner of pumps at Mobil gas stations, if at all.

Even into the 90s and the 21st century the Pegasus had its place in Mobil's marketing. In 1997, the company introduced its Speedpass keytag, which was revolutionary for its time and used RFID technology, akin to mobile payments today, to allow drivers to get gas without entering the store or swiping a card. When a Speedpass would be successfully processed, the pegasus on the gas pump would light up red.

When Exxon and Mobil merged in 1999, the former adopted the payment method too, with Exxon's less iconic tiger in place of the pegasus.

The program was discontinued in 2019 in favor of ExxonMobil's app, which is more secure since it processes payments through the internet rather than at the pump.

What Shell has done with its brand identity is what Mobil should've done for itself. The European company's logo was designed in 1969 by Raymond Loewy, and is a worth contender for the "And Yet a Trace of the True Self Exists in the False Self" meme. In recent years, Shell went all in on its graphic, while Mobil's pegasus flew away. I choose to believe that the company chose to rebrand its stations in order to prevent the malfunction in the above image from happening.

ExxonMobil should have also discontinued the use of the less storied Exxon brand altogether, and simplifying its consumer-facing identity to just the global Mobil mark. Whatever, neither of the names are actual words. As a bonus, here is a Google map I put together of all 62 gas stations in Springfield, MA. This is my idea of fun. Thanks for reading to the end!

#exxonmobil#exxon#mobil#gas station#gas stations#liminal space#liminal spaces#liminal#liminalcore#liminal aesthetic#justice for pegasus#shell#corporations#capitalism#branding#marketing#standard oil#economics#gas#gasoline#fuel#oil companies

110 notes

·

View notes

Text

Heather Cox Richardson

November 26, 2024

Heather Cox Richardson

Nov 27

Today presented a good example of the difference between governance by social media and governance by policy.

Although incoming presidents traditionally stay out of the way of the administration currently in office, last night, Trump announced on his social media site that he intends to impose a 25% tariff on all products coming into the U.S. from Mexico and Canada “until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!” Trump claimed that they could solve the problem “easily” and that until they do, “it is time for them to pay a very big price!”

In a separate post, he held China to account for fentanyl and said he would impose a 10% tariff on all Chinese products on top of the tariffs already levied on those goods. “Thank you for your attention to this matter,” he added.

In fact, since 2023 there has been a drop of 14.5% in deaths from drug overdose, the first such decrease since the epidemic began, and border patrol apprehensions of people crossing the southern border illegally have fallen to the lowest number since August 2020, in the midst of the pandemic. In any case, a study by the libertarian Cato Institute shows that from 2019 to 2024, more than 80% of the people caught with fentanyl at ports of entry—where the vast majority of fentanyl is seized—were U.S. citizens.

Very few undocumented immigrants and very little illegal fentanyl come into the U.S. from Canada.

Washington Post economics reporter Catherine Rampell noted that Mexico and Canada are the biggest trading partners of the United States. Mexico sends cars, machinery, electrical equipment, and beer to the U.S., along with about $19 billion worth of fruits and vegetables. About half of U.S. fresh fruit imports come from Mexico, including about two thirds of our fresh tomatoes and about 90% of our avocados.

Transferring that production to the U.S. would be difficult, especially since about half of the 2 million agricultural workers in the U.S. are undocumented and Trump has vowed to deport them all.

Rampell points out as well that Project 2025 calls for getting rid of the visa system that gives legal status to agricultural workers. U.S. farm industry groups have asked Trump to spare the agricultural sector, which contributed about $1.5 trillion to the U.S. gross domestic product in 2023, from his mass deportations.

Canada exports a wide range of products to the U.S., including significant amounts of oil. Rampell quotes GasBuddy’s head of petroleum analysis, Patrick De Haan, as saying that a 25% tax on Canadian crude oil would increase gas prices in the Midwest and the Rockies by 25 cents to 75 cents a gallon, costing U.S. consumers about $6 billion to $10 billion more per year.

Canada is also the source of about a quarter of the lumber builders use in the U.S., as well as other home building materials. Tariffs would raise prices there, too, while construction is another industry that will be crushed by Trump’s threatened deportations. According to NPR’s Julian Aguilar, in 2022, nearly 60% of the more than half a million construction workers in Texas were undocumented.

Construction company officials are begging Trump to leave their workers alone. Deporting them “would devastate our industry, we wouldn’t finish our highways, we wouldn’t finish our schools,” the chief executive officer of a major Houston-based construction company told Aguilar. “Housing would disappear. I think they’d lose half their labor.”

Former trade negotiator under George W. Bush John Veroneau said Trump’s plans would violate U.S. trade agreements, including the United States–Mexico–Canada Agreement (USMCA) that replaced the 1994 North American Free Trade Agreement that Trump killed. The USMCA was negotiated during Trump’s own first term, and although it was based on NAFTA, he praised it as “the fairest, most balanced, and beneficial trade agreement we have ever signed into law. It’s the best agreement we’ve ever made.”

Trump apologists immediately began to assure investors that he really didn’t mean it. Hedge fund manager Bill Ackman posted that Trump wouldn’t impose the tariffs if “Mexico and Canada stop the flow of illegal immigrants and fentanyl into the U.S.” Trump’s threat simply meant that Trump “is going to use tariffs as a weapon to achieve economic and political outcomes which are in the best interest of America,” Ackman wrote.

Iowa Republican lawmaker Senator Chuck Grassley, who represents a farm state that was badly burned by Trump’s tariffs in his first term, told reporters that he sees the tariff threats as a “negotiating tool.”

Foreign leaders had no choice but to respond. Mexican president Claudia Sheinbaum issued an open letter to Trump pointing out that Mexico has developed a comprehensive immigration system that has reduced border encounters by 75% since December 2023, and that the U.S. CBP One program has ended the “caravans” he talks about. She noted that it is imperative for the U.S. and Mexico jointly to “arrive at another model of labor mobility that is necessary for your country and to address the causes that lead families to leave their places of origin out of necessity.”

She noted that the fentanyl problem in the U.S. is a public health problem and that Mexican authorities have this year “seized tons of different types of drugs, 10,340 weapons, and arrested 15,640 people for violence related to drug trafficking,” and added that “70% of the illegal weapons seized from criminals in Mexico come from your country.”

She also suggested that Mexico would retaliate with tariffs of its own if the U.S. imposed tariffs on Mexico.

Canadian prime minister Justin Trudeau did not go that far but talked to Trump shortly after the social media post. The U.S. is Canada’s biggest trading partner, and a 25% tariff would devastate its economy. The premier of Alberta, Danielle Smith, seemed to try to keep her province’s oil out of the line of fire by agreeing with Trump that the Canadian government should work with him and adding, “The vast majority of Alberta’s energy exports to the US are delivered through secure and safe pipelines which do not in any way contribute to these illegal activities at the border.”

Trudeau has called an emergency meeting with Canada’s provincial premiers tomorrow to discuss the threat.

Spokesperson for the Chinese embassy in Washington Liu Pengyu simply said: “No one will win a trade war or a tariff war” and “the idea of China knowingly allowing fentanyl precursors to flow into the United States runs completely counter to facts and reality.”

In contrast to Trump’s sudden social media posts that threaten global trade and caused a frenzy today, President Joe Biden this evening announced that, after months of negotiations, Israel and Lebanon have agreed to a ceasefire brokered by the U.S. and France, to take effect at 4:00 a.m. local time on Wednesday. “This is designed to be a permanent cessation of hostilities,” Biden said.

Lebanon’s Iran-backed Hezbollah attacked Israel shortly after Hamas’s attack of October 7, 2023. Fighting on the border between Israel and Lebanon has turned 300,000 Lebanese people and 70,000 Israelis into refugees, with Israel bombing southern Lebanon to destroy Hezbollah’s tunnel system and killing its leaders. According to the Lebanese Ministry of Public Health, Israeli attacks have killed more than 3,000 people and injured more than 13,000, while CBS News reports that about 90 Israeli soldiers and nearly 50 Israeli civilians have been killed in the fighting. Under the agreement, Israel’s forces currently occupying southern Lebanon will withdraw over the next 60 days as Lebanon’s army moves in. Hezbollah will be kept from rebuilding.

According to Laura Rozen in her newsletter Diplomatic, before the agreement went into effect, Israel increased its airstrikes in Beirut and Tyre.

When he announced the deal, Biden pushed again for a ceasefire in Gaza, whose people, he said, “have been through hell. Their…world is absolutely shattered.” Biden called again for Hamas to release the more than 100 hostages it still holds and to negotiate a ceasefire. Biden said the U.S. will “make another push with Turkey, Egypt, Qatar, Israel, and others to achieve a ceasefire in Gaza with the hostages released and the end to the war without Hamas in power.”

Today’s announcement, Biden said, brings closer the realization of his vision for a peaceful Middle East where both Israel and a Palestinian state are established and recognized, a plan he tried to push before October 7 by linking Saudi Arabia’s normalization of relations with Israel to a Palestinian state. Biden has argued that such a deal is key to Israel’s long-term security, and today he pressed Israel to “be bold in turning tactical gains against Iran and its proxies into a coherent strategy that secures Israel’s long-term…safety and advances a broader peace and prosperity in the region.”

“I believe this agenda remains possible,” Biden said. “And in my remaining time in office, I will work tirelessly to advance this vision of—for an integrated, secure, and prosperous region, all of which…strengthens America’s national security.”

“Today’s announcement is a critical step in advancing that vision,” Biden said. “It reminds us that peace is possible.”

3 notes

·

View notes

Text

November 26, 2024

HEATHER COX RICHARDSON

NOV 27

Today presented a good example of the difference between governance by social media and governance by policy.

Although incoming presidents traditionally stay out of the way of the administration currently in office, last night, Trump announced on his social media site that he intends to impose a 25% tariff on all products coming into the U.S. from Mexico and Canada “until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!” Trump claimed that they could solve the problem “easily” and that until they do, “it is time for them to pay a very big price!”

In a separate post, he held China to account for fentanyl and said he would impose a 10% tariff on all Chinese products on top of the tariffs already levied on those goods. “Thank you for your attention to this matter,” he added.

In fact, since 2023 there has been a drop of 14.5% in deaths from drug overdose, the first such decrease since the epidemic began, and border patrol apprehensions of people crossing the southern border illegally have fallen to the lowest number since August 2020, in the midst of the pandemic. In any case, a study by the libertarian Cato Institute shows that from 2019 to 2024, more than 80% of the people caught with fentanyl at ports of entry—where the vast majority of fentanyl is seized—were U.S. citizens.

Very few undocumented immigrants and very little illegal fentanyl come into the U.S. from Canada.

Washington Post economics reporter Catherine Rampell noted that Mexico and Canada are the biggest trading partners of the United States. Mexico sends cars, machinery, electrical equipment, and beer to the U.S., along with about $19 billion worth of fruits and vegetables. About half of U.S. fresh fruit imports come from Mexico, including about two thirds of our fresh tomatoes and about 90% of our avocados.

Transferring that production to the U.S. would be difficult, especially since about half of the 2 million agricultural workers in the U.S. are undocumented and Trump has vowed to deport them all. Rampell points out as well that Project 2025 calls for getting rid of the visa system that gives legal status to agricultural workers. U.S. farm industry groups have asked Trump to spare the agricultural sector, which contributed about $1.5 trillion to the U.S. gross domestic product in 2023, from his mass deportations.

Canada exports a wide range of products to the U.S., including significant amounts of oil. Rampell quotes GasBuddy’s head of petroleum analysis, Patrick De Haan, as saying that a 25% tax on Canadian crude oil would increase gas prices in the Midwest and the Rockies by 25 cents to 75 cents a gallon, costing U.S. consumers about $6 billion to $10 billion more per year.

Canada is also the source of about a quarter of the lumber builders use in the U.S., as well as other home building materials. Tariffs would raise prices there, too, while construction is another industry that will be crushed by Trump’s threatened deportations. According to NPR’s Julian Aguilar, in 2022, nearly 60% of the more than half a million construction workers in Texas were undocumented.

Construction company officials are begging Trump to leave their workers alone. Deporting them “would devastate our industry, we wouldn’t finish our highways, we wouldn’t finish our schools,” the chief executive officer of a major Houston-based construction company told Aguilar. “Housing would disappear. I think they’d lose half their labor.”

Former trade negotiator under George W. Bush John Veroneau said Trump’s plans would violate U.S. trade agreements, including the United States–Mexico–Canada Agreement (USMCA) that replaced the 1994 North American Free Trade Agreement that Trump killed. The USMCA was negotiated during Trump’s own first term, and although it was based on NAFTA, he praised it as “the fairest, most balanced, and beneficial trade agreement we have ever signed into law. It’s the best agreement we’ve ever made.”

Trump apologists immediately began to assure investors that he really didn’t mean it. Hedge fund manager Bill Ackman posted that Trump wouldn’t impose the tariffs if “Mexico and Canada stop the flow of illegal immigrants and fentanyl into the U.S.” Trump’s threat simply meant that Trump “is going to use tariffs as a weapon to achieve economic and political outcomes which are in the best interest of America,” Ackman wrote.

Iowa Republican lawmaker Senator Chuck Grassley, who represents a farm state that was badly burned by Trump’s tariffs in his first term, told reporters that he sees the tariff threats as a “negotiating tool.”

Foreign leaders had no choice but to respond. Mexican president Claudia Sheinbaum issued an open letter to Trump pointing out that Mexico has developed a comprehensive immigration system that has reduced border encounters by 75% since December 2023, and that the U.S. CBP One program has ended the “caravans” he talks about. She noted that it is imperative for the U.S. and Mexico jointly to “arrive at another model of labor mobility that is necessary for your country and to address the causes that lead families to leave their places of origin out of necessity.”

She noted that the fentanyl problem in the U.S. is a public health problem and that Mexican authorities have this year “seized tons of different types of drugs, 10,340 weapons, and arrested 15,640 people for violence related to drug trafficking,” and added that “70% of the illegal weapons seized from criminals in Mexico come from your country.” She also suggested that Mexico would retaliate with tariffs of its own if the U.S. imposed tariffs on Mexico.

Canadian prime minister Justin Trudeau did not go that far but talked to Trump shortly after the social media post. The U.S. is Canada’s biggest trading partner, and a 25% tariff would devastate its economy. The premier of Alberta, Danielle Smith, seemed to try to keep her province’s oil out of the line of fire by agreeing with Trump that the Canadian government should work with him and adding, “The vast majority of Alberta’s energy exports to the US are delivered through secure and safe pipelines which do not in any way contribute to these illegal activities at the border.”

Trudeau has called an emergency meeting with Canada’s provincial premiers tomorrow to discuss the threat.

Spokesperson for the Chinese embassy in Washington Liu Pengyu simply said: “No one will win a trade war or a tariff war” and “the idea of China knowingly allowing fentanyl precursors to flow into the United States runs completely counter to facts and reality.”

In contrast to Trump’s sudden social media posts that threaten global trade and caused a frenzy today, President Joe Biden this evening announced that, after months of negotiations, Israel and Lebanon have agreed to a ceasefire brokered by the U.S. and France, to take effect at 4:00 a.m. local time on Wednesday. “This is designed to be a permanent cessation of hostilities,” Biden said.

Lebanon’s Iran-backed Hezbollah attacked Israel shortly after Hamas’s attack of October 7, 2023. Fighting on the border between Israel and Lebanon has turned 300,000 Lebanese people and 70,000 Israelis into refugees, with Israel bombing southern Lebanon to destroy Hezbollah’s tunnel system and killing its leaders. According to the Lebanese Ministry of Public Health, Israeli attacks have killed more than 3,000 people and injured more than 13,000, while CBS News reports that about 90 Israeli soldiers and nearly 50 Israeli civilians have been killed in the fighting. Under the agreement, Israel’s forces currently occupying southern Lebanon will withdraw over the next 60 days as Lebanon’s army moves in. Hezbollah will be kept from rebuilding.

According to Laura Rozen in her newsletter Diplomatic, before the agreement went into effect, Israel increased its airstrikes in Beirut and Tyre.

When he announced the deal, Biden pushed again for a ceasefire in Gaza, whose people, he said, “have been through hell. Their…world is absolutely shattered.” Biden called again for Hamas to release the more than 100 hostages it still holds and to negotiate a ceasefire. Biden said the U.S. will “make another push with Turkey, Egypt, Qatar, Israel, and others to achieve a ceasefire in Gaza with the hostages released and the end to the war without Hamas in power.”

Today’s announcement, Biden said, brings closer the realization of his vision for a peaceful Middle East where both Israel and a Palestinian state are established and recognized, a plan he tried to push before October 7 by linking Saudi Arabia’s normalization of relations with Israel to a Palestinian state. Biden has argued that such a deal is key to Israel’s long-term security, and today he pressed Israel to “be bold in turning tactical gains against Iran and its proxies into a coherent strategy that secures Israel’s long-term…safety and advances a broader peace and prosperity in the region.”

“I believe this agenda remains possible,” Biden said. “And in my remaining time in office, I will work tirelessly to advance this vision of—for an integrated, secure, and prosperous region, all of which…strengthens America’s national security.”

“Today’s announcement is a critical step in advancing that vision,” Biden said. “It reminds us that peace is possible.”

—

3 notes

·

View notes

Text

U.S. n-Propyl Acetate Prices, News, Trend, Graph, Chart, Monitor and Forecast

The n-Propyl Acetate market has witnessed dynamic fluctuations in pricing, driven by a combination of supply chain factors, raw material costs, and demand trends across various industries. This solvent, widely used in coatings, adhesives, inks, and personal care products, has experienced varying price movements based on regional market conditions and economic trends. The pricing of n-Propyl Acetate is heavily influenced by feedstock prices, particularly acetic acid and propanol, which are subject to fluctuations due to crude oil price volatility and production rates. Over recent months, global prices have remained relatively stable in some regions while facing downward pressure in others due to weak demand and ample supply. The United States market, for instance, has observed steady pricing, largely due to stable raw material costs and consistent demand from end-use industries such as paints and coatings. The industrial and manufacturing sectors continue to play a significant role in shaping the market landscape, with production levels and trade policies also contributing to price trends. Additionally, supply chain disruptions caused by logistics challenges and geopolitical issues have impacted pricing trends in certain markets.

Get Real time Prices for n-Propyl Acetate : https://www.chemanalyst.com/Pricing-data/n-propyl-acetate-1133

In the Asia-Pacific region, particularly in China and India, n-Propyl Acetate prices have experienced fluctuations due to changes in crude oil prices, demand from downstream industries, and regional economic conditions. The Chinese market has faced moderate price volatility, influenced by fluctuating feedstock costs and varying demand from the industrial and construction sectors. In India, market prices have slightly declined in certain months due to weakened demand from the coatings and printing industries, despite government initiatives aimed at boosting the construction sector. However, the long-term outlook remains positive, with growing industrialization and infrastructure projects driving demand. In Europe, n-Propyl Acetate prices have faced some downward pressure due to weak economic conditions and subdued industrial activity. Energy prices, which have been volatile in the region, have also played a role in determining production costs, impacting overall market pricing.

One of the major factors influencing the global n-Propyl Acetate market is the cost of acetic acid and propanol, the two key raw materials. These feedstocks are directly linked to crude oil prices, making them susceptible to global oil market trends. Any fluctuations in crude oil prices can have a cascading effect on the cost structure of n-Propyl Acetate production. Additionally, the supply and demand balance of these feedstocks can create price volatility, especially during periods of increased production or supply shortages. Market players closely monitor these trends to anticipate future price movements and make strategic purchasing decisions.

The demand for n-Propyl Acetate is strongly linked to its applications in the coatings, adhesives, and personal care industries. The coatings industry, in particular, is a significant consumer of this solvent due to its superior solubility properties. As urbanization and infrastructure development continue to expand, particularly in emerging economies, the demand for coatings and, consequently, n-Propyl Acetate is expected to rise. The adhesive and sealant industry also contributes to the market's growth, with increased applications in packaging and construction. Additionally, the pharmaceutical and cosmetics sectors use n-Propyl Acetate in various formulations, further driving demand. However, economic downturns and slowdowns in construction activities can have an adverse impact on demand, leading to price reductions in some markets.

The global market outlook for n-Propyl Acetate remains positive, with a projected compound annual growth rate (CAGR) driven by industrial expansion and technological advancements. Market analysts anticipate steady growth over the next decade, supported by rising consumption across multiple end-use sectors. The solvent's eco-friendly properties, compared to other volatile organic compounds (VOCs), also contribute to its increasing adoption. Stricter environmental regulations regarding solvent emissions have prompted industries to seek alternatives with lower environmental impact, positioning n-Propyl Acetate as a viable option. Innovations in production processes and supply chain optimization are also expected to play a role in stabilizing prices and ensuring steady market growth.

In North America, market stability has been a key feature, with demand remaining consistent despite economic fluctuations. Manufacturers have maintained steady production levels, ensuring balanced supply and demand dynamics. The U.S. market has benefited from a well-established industrial base and consistent raw material availability, leading to moderate price movements. Additionally, ongoing trade discussions and logistics improvements have helped maintain stable pricing trends. In Latin America, demand for n-Propyl Acetate has been growing, particularly in Brazil and Mexico, where the construction and manufacturing sectors have seen expansion. However, economic uncertainties and currency fluctuations have posed challenges, leading to periodic price variations.

The European market has experienced some softness in pricing due to sluggish industrial growth and concerns over energy costs. The region's focus on sustainability and environmental compliance has influenced the demand for n-Propyl Acetate, with manufacturers exploring greener production methods. While demand remains steady, economic headwinds and regulatory challenges may impact pricing trends in the future. The Middle East and Africa region has shown moderate growth, driven by increasing industrialization and infrastructure projects. With continued investments in the construction and automotive industries, the demand for solvents like n-Propyl Acetate is expected to increase. However, geopolitical instability and supply chain disruptions remain potential risks that could influence market pricing.