#tradesignals

Explore tagged Tumblr posts

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

29 notes

·

View notes

Text

Защита от мошенничества Сбербанка: как избежать фишинга и кибератак в 2025 году

Сбербанк предупреждает о трех главных схемах мошенничества в 2025 году:

Фишинговые атаки через мессенджеры,

Кибератаки на мобильные приложения,

Сайты-клоны.

Будьте внимательны и защитите свои данные!

Финансовые обновления недели

XTB: Переходит к супер приложению, с фокусом на акции и ETFs, несмотря на доминирование CFD в прибыли.

Coinbase: Расширяет присутствие в Европе с приобретением BUX на Кипре.

FTX EU: Неопределенность с новым владельцем.

Saxo Bank: Штраф в 1,6 млн евро за нарушения.

Acuity Trading: Запускает TradeSignals с AI для криптовалют и форекса.

США планируют ввести санкции против китайских банков, обвиняя их в поддержке российского комплекса. Возможны последствия для международных отношений и рынков.

0 notes

Text

🚀 Transform Your Trading with the SMC Trap Strategy! 🌌 Unleash the potential of every trade with insights that guide you to success. ✨

With our groundbreaking strategy, you’ll:

- Navigate market trends with expert precision 🔍

- Trade with confidence and clarity 🛤️

- Secure higher profits while managing risks 📈

No matter your experience level, the SMC Trap Trading Strategy is your gateway to trading mastery. Dive into a world where data-driven decisions lead to unparalleled success. 📊💡

🌐 Ready to level up? Explore the power of AI with our Flux Nebula Signals System. Your journey to trading excellence starts here. Click the link in bio! 🌠 #TradingRevolution #SMCTrap #UnlockPotential #FinancialFreedom #TradeWithConfidence #RiskControl #ProfitMaximization #Stocks #ForexLife #CryptoTrading #DayTraders #SwingTrading #MarketMastery #TechnicalAnalysisPro #InvestingBasics #WealthJourney #TradeSignals #AIInTrading #FluxNebula #SuccessPath #InvestmentTips #MarketTrends #EconomicInsights #TraderLifestyle #FinanceGoals #InvestorGrowth #BusinessStrategy

instagram

0 notes

Text

I Wouldve Made Money Day Trading WAYYYYY Faster If I Had Done This

I Would’ve Made Money Day Trading WAYYYYY Faster If I Had Done This https://www.youtube.com/watch?v=gMWHede66aU 📚 I’ve made some Free Trading Guides and a Trade Tracking Journal I think will really help. More coming soon 🙏 👇Full Video and Free Trading Guides👇 —————-👉LINK IN BIO👈—————— 💬Comment to start a chat with me! It’s my mission to help save as many struggling day traders as possible🙏 ============================== FOLOW So I can help unlock your trading potential 🚀 @TheRealTraderTrainer #tradesignal #tradingsignals #tradeplan #tradingstrategy #stockmarket #forexsignals #cryptotrades #technicalanalysis #tradewithme #daytrading #swingtrading #therealtradertrainer via TheRealTraderTrainer https://www.youtube.com/channel/UCMZjkOXOmG7MuVVJUQWRh3w September 19, 2023 at 07:28AM

#daytrading#tradingrules#strategy#tradingprofits#technicalcharts#consistentprofits#tradingedge#tradingstrategy

0 notes

Video

youtube

Tour of Trading View This video talks through the basics of how to use Trading View.

2 notes

·

View notes

Photo

😮⬇️ #binancenftmarketplace #binanceview #binanceitalia #traderforex #binancespanish #arttrade #traderbrasil #binancepay #binancesignals #binanceisglobal #tradescantia #tradesofhope #binancesmartchain #forextrader #traderlife #tradesignals #daytrader #worldtradecenter #somostraders #tradeshowbooth #traderindonesia #binancenft #binancepump #traderjoesrecipes #binancenews #tradeshows #traderjoesfinds #criptomoedasbrasil #binancechain https://www.instagram.com/p/CoE9z8MAoNn/?igshid=NGJjMDIxMWI=

#binancenftmarketplace#binanceview#binanceitalia#traderforex#binancespanish#arttrade#traderbrasil#binancepay#binancesignals#binanceisglobal#tradescantia#tradesofhope#binancesmartchain#forextrader#traderlife#tradesignals#daytrader#worldtradecenter#somostraders#tradeshowbooth#traderindonesia#binancenft#binancepump#traderjoesrecipes#binancenews#tradeshows#traderjoesfinds#criptomoedasbrasil#binancechain

1 note

·

View note

Text

Last week in El Cajon, it’s been very rewarding, and I’ve been making MOVES in the business realm! I just set up 3 more revenue streams! Alhumdulilah!

1 note

·

View note

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Photo

TRADE SIGNAL AS ON 15-02-2021📊📈📉 #GBPJPY #COFFEE #CITIgroup #LITECOIN #FTSESignals #ftsetrade #currency #currencytrading #CurrencyTrader #currencyexchange #currencynews #tradesignals #stoploss #Commodities #commoditiestrading #TechnicalAnalysis #technicalanalysist #CapitalStreetFX #dax #tradingeducation #tradingstocks #tradingsetup #tradingforex #forexeducation #forexchart #forex https://www.instagram.com/p/CLUFXMflqWO/?igshid=1ukoyvgxdgqe7

#gbpjpy#coffee#citigroup#litecoin#ftsesignals#ftsetrade#currency#currencytrading#currencytrader#currencyexchange#currencynews#tradesignals#stoploss#commodities#commoditiestrading#technicalanalysis#technicalanalysist#capitalstreetfx#dax#tradingeducation#tradingstocks#tradingsetup#tradingforex#forexeducation#forexchart#forex

0 notes

Text

Unlocking consistent returns: the power of forex signals

Understanding Forex Signals:

Forex signals are indicators or recommendations that provide insights into potential trading opportunities. These signals can be generated through manual analysis by experienced traders or through automated systems. The primary aim of these signals is to alert traders to potentially profitable trades based on specific criteria.

Types of Forex Signals:

Manual Signals:

Expert Analysis: Skilled and experienced traders analyze the market and provide signals based on their insights and strategies.

News-Based Signals: Events and economic indicators can significantly impact currency values. Manual signals may be based on breaking news and economic reports.

Automated Signals:

Algorithmic Trading: Using pre-programmed algorithms to analyze market conditions and execute trades automatically.

Copy Trading: Traders can automatically copy the trades of successful signal providers.

Advantages of Forex Signals:

Time Efficiency:

Forex signals save time by providing traders with pre-analyzed opportunities, eliminating the need for extensive market research.

Expert Guidance:

Access to the expertise of seasoned traders allows less experienced individuals to benefit from the knowledge of professionals.

Emotion Management:

Emotions can cloud judgment in trading. Following signals allows traders to stick to a predefined strategy without being swayed by emotions like fear or greed.

Diversification:

Signals often cover a range of currency pairs, providing diversification benefits and reducing risk.

Key Factors for Consistent Returns:

Risk Management:

Regardless of the accuracy of signals, risk management is crucial. Setting stop-loss orders and controlling the size of trades helps protect against significant losses.

Education:

Traders should understand the basics of forex trading to make informed decisions, even when using signals. Knowledge enhances the ability to assess and filter signals effectively.

Continuous Monitoring:

Markets can change rapidly. Regularly monitoring trades and adjusting strategies based on changing conditions is essential for consistent returns.

Choosing Reliable Signal Providers:

Not all signal providers are equal. Researching and choosing reputable providers with a track record of success is vital.

Challenges and Risks:

Market Conditions:

Signals may not perform well in all market conditions. Understanding the strengths and limitations of the chosen signals is crucial.

Over-Reliance:

Overreliance on signals without understanding the underlying market dynamics can lead to losses.

Scams:

The forex market is not immune to scams. Traders should be cautious and choose signal providers carefully to avoid fraudulent schemes.

Conclusion:

While forex signals offer a valuable tool for traders seeking consistent returns, they are not a guaranteed pathway to success. Successful trading requires a holistic approach that includes a blend of education, strategic thinking, and effective risk management. Traders should view signals as part of their toolkit and not as a standalone solution. When used wisely, forex signals can indeed contribute to achieving more consistent returns in the ever-evolving world of forex trading.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

18 notes

·

View notes

Text

A Sharp Reflex Rally

While it is indeed a sharp “reflex rally,” With follow through today, please remember this: “Bear Markets” are not resolved in a single Day, Week, or a Month. Most importantly, "bear markets” do not end with “consumer confidence” still very elevated. Notice that during each of the previous two bear market cycles, confidence dropped by an average of 58 points. This past week, we saw early indications of the unemployment that is coming to America as jobless claims surged to 10 million, and unemployment in April will surge to 15-20%. Confidence, and ultimately consumption, Which comprises 70% of GDP, will plummet as job losses mount. It is incredibly difficult to remain optimistic when you are unemployed. No Light At The End Of The Tunnel Yet The markets have been clinging on to “hope” that as soon as the virus passes, there will be a sharp “V”-shaped recovery in the economy and markets. While we strongly believe this will not be the case, we do acknowledge there will likely be a short-term market surge as the economy does initially come back “online.” That surge could be very strong and will once again have the media crowing the “bear market” is over. However, for now, we are not there yet. Most importantly, as shown below, the majority of businesses will run out of money long before SBA loans, or financial assistance can be provided. This will lead to higher, and a longer-duration of unemployment. What the cycle tells us is that jobless claims, unemployment, and economic growth are going to worsen materially over the next couple of quarters. The problem with the current economic backdrop, and mounting job losses, is the vast majority of American’s were woefully unprepared for any disruption to their income going into recession. Two important points: The economy will eventually recover, and life will return to normal. The damage will take much longer to heal, and future growth will run at a lower long-term rate due to the escalation of debts and deficits. For investors, this means a greater range of stock market volatility and near-zero rates of return over the next decade. The Bear Still Rules History tells the story covering the last 8 full fledged bear markets: The should be sold into! In other words, if you have taken the decline thus far, When you see the rally explode up, sell it and preserve as much as you can before the next dip. On Friday, our colleague, Jeffery Marcus of TP Analytics, penned the following: When the 11-year bull market trend ended, other shorter trends were also violated. In late February, the S&P 500 fell below its 14-month uptrend line, and in early March the 13-month uptrend line was violated. Those breaks set in place the steep declines seen in the 2nd and 3rd weeks of March. While it may seem like an epic battle is going on around S&P 500 2500, the real problem is the downtrend forming from the 2/19 high. TPA still continues to see real long term support in the 3% range between 2110 and 2180. A less likely move below that support, would leave long term support levels of the lows of 2014 and 2015. S&P 500 – Long Term

His analysis agrees with our own: “While the technical picture of the market also suggests the recent “bear market” rally will likely fade sooner than later. Such an advance will ‘lure’ investors back into the market, thinking the ‘bear market’ is over. Importantly, despite the sizable rally, participation has remained extraordinarily weak. If the market was seeing strong buying, as suggested by the media, then we should see sizable upticks in the percent measures of advancing issues, issues at new highs, and a rising number of stocks above their 200-dma.” On a daily basis, these measures all have room to improve in the short-term. However, the market has now confirmed longer-term technical signals suggesting the “bear market” has only just started. There are reasons to be optimistic about the markets in the very short-term. We will get through this crisis. People will return to work. The economy will start moving forward again. However, it won’t immediately go right back to where we were previously. We are continuing to extend the amount of time the economy will be “shut down,” which exacerbates the decline in the employment, and personal consumption data. The feedback loop from that data into corporate profits, and earnings, is going to make valuations more problematic even with low interest rates currently. This is NOT the time to try and “speculate” on a bottom of the market. You might get lucky, but there is very high risk you could wind up losing even more capital. For long-term investors like our Wealth Preserver Members, just remain patient and let the market dictate when the bottom has been formed. As you can see in the image below, the InterAnalyst Green Buy signal will come as it has every other time. But it only signals when the market is on solid footing. Bear markets never end with optimism, but in despair. So remain patient, it the bear will end and you will capture the slingshot move back up once the markets are on solid footing. Although we continue to author opinion and analysis, please remember that our writings do not replace the green buy and red sell signals derived from over 140 years of market analytics. Use the Wealth Maximizer Pro to help give you daily charts and signals to help with daily market direction. Apply those to the Wealth Maximizer Weekly charts and signals to give you more confidence in the direction. When the Wealth Preserver Monthly signal confirms both the Wealth Maximizer and Wealth Maximizer Pro memberships, you are prepared for the slingshot. Members Version of A Sharp Reflex Rally Members please login to view your market signals and read the balance of this post for entry and exit points. Read the full article

#DIA#DowJonesMarketUpdate#DowJonesupdate#GoldTradingSignals#Nasdaq#QQQ#QQQTradingSignals#Russell2000#S&P500Index#S&P500TradingSignals#SPYTradingSignals#TradeSignals#WealthMaximizer#WealthMaximizerPRO#WealthPreserver

0 notes

Photo

#CADJPY - Forecast and Analysis - Oct-21 (1 Day) . . . follow us 👉 @elliottwavemonitor follow us 👉 @elliottwavemonitor follow us 👉 @elliottwavemonitor . . . 🛎 Turn on Post Notifications so you never miss out any posts ✋ Kindly note for my followers: All comments with „@„ are blocked as a way to keep away the bots. If you want to comment on a post just remove the „@„. . . . . HASHTAGS : #forexsignaltrading #forextraderlifestyle #tradingforex #trade #trader #tradeforex #traderlifestyle #traderbrasil #traders #forextrader #tradelines #tradesignals #traderlife #traderindonesia #trades #traderforex #stock #stockmarket #stocks #stockstrader #stockstowatch #stockmarkets #stockmarketindia #stockmarketnews #stockmarketinvesting #stockmarketeducation #waveanalysis #elliottwave #elliottwavemonitor (at USA) https://www.instagram.com/p/CVS5IqQMWRh/?utm_medium=tumblr

#cadjpy#forexsignaltrading#forextraderlifestyle#tradingforex#trade#trader#tradeforex#traderlifestyle#traderbrasil#traders#forextrader#tradelines#tradesignals#traderlife#traderindonesia#trades#traderforex#stock#stockmarket#stocks#stockstrader#stockstowatch#stockmarkets#stockmarketindia#stockmarketnews#stockmarketinvesting#stockmarketeducation#waveanalysis#elliottwave#elliottwavemonitor

0 notes

Photo

Ranking today @ #1632 and getting closer to the top 1000.....There may be some interesting developments with the Oil markets this week. Will be monitoring the situation.....RISK ON! IcebergTraderFX - Autocopy our trade signals https://www.zulutrade.com/trader/376868 #trader #forexlifestyle #forex #forextrading #forextrader #forexsignals #tradesignals #imarketslive #forexmarkets #zulutrade #fxjunction #metatrader4 #cryptocurrency #eur #gbp #cad #nzd #chf #aud #jpy #usd #gold #oil #mt4 https://www.instagram.com/p/B1YsDrYAO6m/?igshid=19ttnlxho43n

#1632#trader#forexlifestyle#forex#forextrading#forextrader#forexsignals#tradesignals#imarketslive#forexmarkets#zulutrade#fxjunction#metatrader4#cryptocurrency#eur#gbp#cad#nzd#chf#aud#jpy#usd#gold#oil#mt4

0 notes

Text

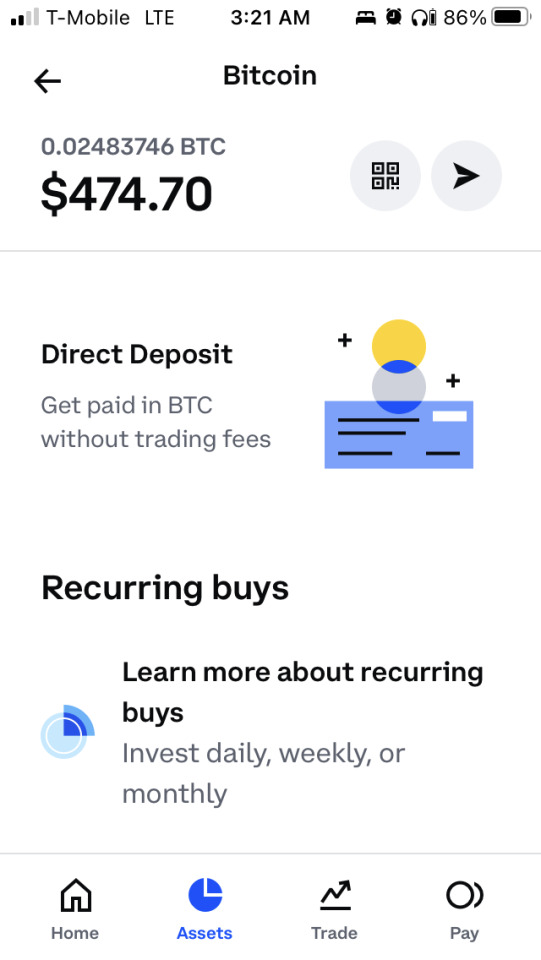

Intelligent Cryptocurrency

If you'd like to get involved with cryptocurrencies but you don't know where to start or you don't have the time to figure out how it works and which coins to buy on your own, then you need to join Intelligent Cryptocurrency right now-https://bit.ly/384IaVH

We'll teach you step-by-step how cryptocurrencies work, where to buy them, where to store them, how to trade them and what to look for to have the best chance of high returns.

#cryptocurrency#crypto#cryptomoney#cryptonews#makemoney#howtomakemoneyfast#makemoneyathome#make money online#how to make money online#earnmoneytoday#earnmoneyathome#earn money online#earnmoneyonline#bitcoin#online money#money#cash#tradesignals#trade#forex

0 notes

Photo

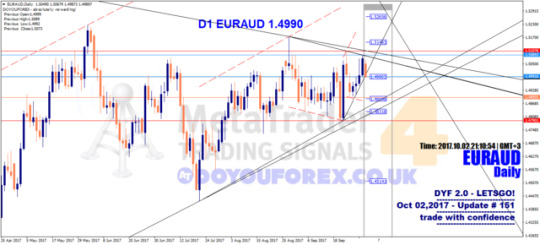

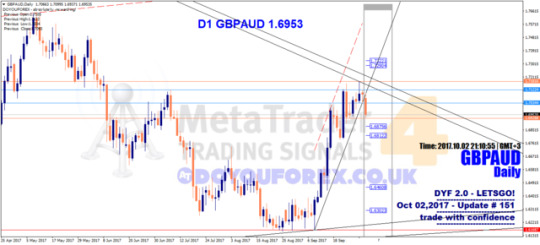

AUD

DYF levels for October 02, 2017

Update #151

doyouforex.co.uk

All social media posts are commentary only and should not be construed as buy/sell recommendations. Analyze & trade at your own risk

#doyouforex#forexsignals#forexcopier#tradecopier#tradesignals#forex#eurusd#usdchf#usdcad#eurgbp#gbpusd#nzdusd#usdjpy#eurjpy#gbpjpy#audusd#euraud#gbpaud#xauusd#gold#usoil#us#ukbrent#uk#india#china#russia#japan#brazil#dubai

1 note

·

View note