#usdcad

Explore tagged Tumblr posts

Text

Bailey Hints at Rate Cuts, OPEC and Job Data Focus

Bailey Hints at Rate Cuts, OPEC and Job Data Focus Bank of England Governor Andrew Bailey grabbed attention yesterday. He suggested up to four UK rate cuts might happen next year as inflation eases. The pound briefly dipped before recovering, showing cautious about the BoE’s approach. Mixed data is also in focus today. Eurozone factory orders improved, while US jobless claims and Challenger job…

#AUDUSD#BaileySpeech#CrudeOil#EURUSD#ForexNews#GBPUSD#GoldPrices#JoblessClaims#MarketUpdate#NZDUSD#OPECMeeting#RateCuts#SilverPrices#USDCAD#USDCHF#USDINR#USDJPY#USDMXN

0 notes

Text

معاينة مؤشر أسعار المستهلك الكندي: بيانات التضخم لشهر يناير في دائرة الضوء حيث يدرس بنك كندا محور السياسة

من المتوقع أن يرتفع مؤشر أسعار المستهلك الكندي بنسبة 3.3% على أساس سنوي في يناير. من المقرر أن تؤثر بيانات التضخم في مؤشر أسعار المستهلك الكندي على توقيت خفض سعر الفائدة من بنك كندا. ستقوم هيئة الإحصاء الكندية بنشر بيانات التضخم لمؤشر أسعار المستهلك يوم الثلاثاء. ستنشر هيئة الإحصاء الكندية بيانات مؤشر أسعار المستهلك عالية التأثير من كندا يوم الثلاثاء في الساعة 13:30 بتوقيت جرينتش. من المرجح أن…

View On WordPress

0 notes

Text

The USDCAD rebounds due to various factors. Explore in our latest Forex Breaking News https://markets.tradermade.com/breaking/loonie-limps-as-oil-tanks-and-greenback-gains-swagger. Crude oil dips. Tomorrow’s data releases are crucial. Stay tuned!

0 notes

Text

#Forex pairs#EURUSD#USDJPY#GBPUSD#AUDUSD#NZDUSD#USDCAD#CHFJPY#EURJPY#GBPJPY#AUDJPY#NZDJPY#USDMXN#Forex commodities#XAUUSD#XAGUSD#USDCOPPER#USDCRUDE#USDBRL#USDSGD#USDTRY#USDZAR#Forex indices#US30#US500#NAS100#GER30#FRA40#UK100#JPN225

0 notes

Text

Market Update: Tech Stocks Propel S&P 500 and Nasdaq, Bond Yields Soar, and Global Currencies React

On Monday, the S&P 500 and the Nasdaq surged by 0.7% and 1.6%, respectively, thanks to robust gains in the tech sector. Nvidia and Tesla #dowjones #sp500 #nasdaq #interestrates #inflation #TSLA #nvidia #forex

On Monday, the S&P 500 and the Nasdaq surged by 0.7% and 1.6%, respectively, thanks to robust gains in the tech sector. Nvidia and Tesla took the spotlight, propelling the market upward. Nvidia saw an impressive 8.5% jump, boosted by HSBC raising its price target to $780 just ahead of the chip giant’s earnings announcement this Wednesday. Meanwhile, Tesla bounced back with a 7.3% gain after a…

View On WordPress

0 notes

Text

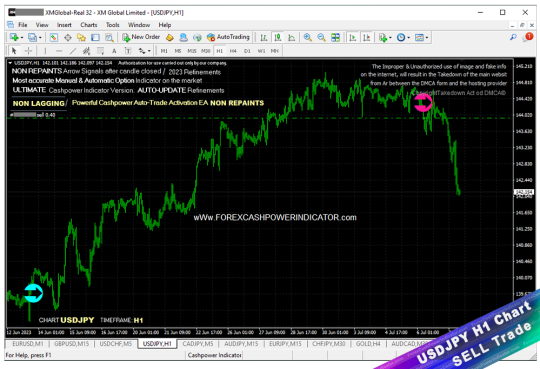

Precise Reversal SELL Trade Entry in #Usdjpy in H1 Timeframe. Sell Trade entry to Early entry on 1 hour chart (H1) for big selling profits on 1-day chart (D1). . Forex Cashpower Indicator Version is Lifetime license ultimate NON REPAINT Signals with Smart algorithms that emit precise signals in Reversal zones of Trends with big trades volumes. Official Website: wWw.ForexCashpowerIndicator.com . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING ✅ Less Signs Greater Profits 🔔 Sound And Popup Notification ✅ Minimizes unprofitable/false signals 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at FBS brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#forexindicators#forexsignals#indicatorforex#forexindicator#cashpowerindicator#forex#forexprofits#forextradesystem#forexvolumeindicators#forexchartindicators#usdjpy#eurjpy#eurusd#usdcad#gbpusd#forex trading#forexeducation#forexindonesia#forexmoney#forexhelp#forexmarket#forexanalysis#xtreamforex#forex signals indicators#forex signals#forex indices#forex indicators#forex indicators mt4#forex indicators list#forex indicator

0 notes

Text

Forex Trading Strategies: Navigating Market Trends Amid Economic Shifts

Forex traders need adaptable strategies to thrive in unpredictable market conditions. This post focuses on forex trading methods such as scalping, market trend analysis, and risk management.

Gold is currently experiencing bearish momentum, with RSI divergence suggesting further declines. While short-term pullbacks may occur, traders can capitalize on these movements with scalping strategies aimed at price dips.

Silver’s price action shows a pullback, but the overall market remains bearish. RSI and MACD signals hint at potential for a temporary rally. Scalping traders should focus on short-term selling opportunities.

The U.S. dollar continues to strengthen as inflation fears delay potential rate cuts. The DXY index reflects this, offering opportunities for traders to go long on USD pairs, including USDJPY and USDCHF.

GBPUSD is maintaining a bearish trend, with minimal resistance to further declines. Short-term pullbacks could offer opportunities for scalping, but the long-term outlook remains negative.

The Australian dollar is showing consolidation, lacking clear direction. Traders should wait for a breakout before entering positions, using proper forex risk control measures to manage volatility.

NZDUSD is in a downtrend, with RSI suggesting a possible short-term reversal. However, the broader trend remains bearish, offering short-term selling opportunities for scalpers.

EURUSD remains weak, with both RSI and MACD signaling further declines. Scalping traders can take advantage of short pullbacks while keeping a bearish outlook.

USDJPY continues its bullish momentum, supported by strong buying pressure. Traders should use caution and manage risk, looking for potential overbought signals.

USDCHF is moving upward, but a pullback seems likely. Traders can capitalize on small price movements through scalping strategies while managing risk.

USDCAD shows signs of a potential pullback after an uptrend. Traders should wait for confirmation and use forex signals to time entries and exits effectively.

With effective forex trading methods like scalping, market analysis, and risk control, traders can adapt to market fluctuations and maximize profits.

#Forex trading methods#Forex scalping strategies#Forex market trends#Forex risk control#Forex signal trading

3 notes

·

View notes

Text

FxMath Trade Fusion AI-167.20 Pips Profit

FxMath Trade Fusion AI-167.20 Pips Profit Open Time: 2025-03-03 06:00 Basket Profit: 167.20 Pips Basket Information Open Basket Time: 2025-03-03 06:00 Basket Profit: 167.20 Pips Max Drawdown: -24.30 Pips Number of Trades: 13 Currency Pair Performance Currency Pair Profit EURJPY 44.8 Pips GBPJPY 29.7 Pips USDJPY 23.6 Pips EURAUD 21.6 Pips USDCAD 6.6 Pips NZDCAD 3.5…

View On WordPress

0 notes

Text

Labor Market Insights & Monetary Policy: Today's Events

Labor Market Insights & Monetary Policy: Today’s Events Today the markets are centered around employment data and central bank speeches. The US ADP Employment Change report is expected to provide insights into labor market conditions. This comes ahead of the NFP later this week. Meanwhile, speeches from BoE Governor Bailey, ECB President Lagarde, and Fed Chair Powell will keep investors alert…

#AUDUSD#CrudeOil#EURUSD#ForexNews#GBPUSD#GoldPrices#LagardeSpeech#MarketUpdate#NZDUSD#PowellSpeech#USDCAD#USDCHF#USDINR#USDJPY#USDMXN#USDStrength

0 notes

Text

The USDCAD Trade Balance Secret: How to Predict Market Moves Like an Insider The USDCAD pair isn’t just another Forex duo—it’s a market barometer that holds the secrets to North American trade flows, economic shifts, and golden trading opportunities. But most traders focus on surface-level technicals, missing the hidden patterns that institutions use to stay ahead. Today, we’re diving deep into the USDCAD trade balance and uncovering the strategies that can transform how you trade this pair. Why Trade Balance Matters More Than You Think The trade balance—the difference between a country’s exports and imports—has a direct impact on a currency’s strength. A trade surplus (more exports than imports) means higher demand for the currency, while a trade deficit weakens it. For USDCAD, understanding Canada’s trade relationship with the U.S. is crucial since the U.S. accounts for over 75% of Canada’s exports. The Hidden USDCAD Trade Balance Formula: - Surplus Boom – When Canada exports more oil and raw materials, demand for CAD increases, pushing USDCAD lower. - Deficit Drag – A weakening trade balance (more imports than exports) means less demand for CAD, sending USDCAD higher. - Inflation and Rate Reaction – A strong trade balance often leads to a hawkish Bank of Canada (BoC), which can support CAD further. Little-Known Fact: Canada’s trade balance with the U.S. has historically moved in cycles that align with crude oil prices. Spotting this pattern gives traders an edge in timing their USDCAD trades. The USDCAD Trade Balance Trading Playbook 1. The Oil Connection: CAD’s Not-So-Secret Best Friend Canada’s economy is heavily dependent on crude oil exports. This makes the CAD behave like an oil-backed currency. When oil prices rise, Canada earns more from exports, leading to CAD strength and pushing USDCAD down. When oil tanks, USDCAD goes up. 📌 How to Trade It: - Monitor WTI crude oil prices alongside Canada’s trade balance releases. - If oil rallies before a trade balance surplus report, consider shorting USDCAD. - If oil collapses and a trade balance deficit is expected, USDCAD longs become attractive. 2. Front-Running Institutional Moves with COT Data The Commitments of Traders (COT) report reveals how hedge funds and institutional traders position themselves in the market. If large speculators are bullish CAD, they anticipate a stronger trade balance or rising oil prices. 📌 How to Trade It: - Check COT data every Friday to see institutional shifts. - If large traders are net long CAD and trade balance is improving, consider shorting USDCAD. - If they’re shorting CAD and trade balance is worsening, go long USDCAD. Why Most Traders Get It Wrong (And How You Can Avoid It) Most retail traders ignore economic indicators like the trade balance because they focus only on technical charts. However, institutional traders combine fundamentals with technicals, creating hidden trends that can be exploited. 📌 Common Mistakes to Avoid: - Ignoring the trade balance and blindly trading technical setups. - Overlooking crude oil’s impact on CAD. - Not factoring in rate differentials between the Federal Reserve and the Bank of Canada. Pro Tip: The BoC’s interest rate decisions are often influenced by trade balance shifts. A strong trade balance can lead to rate hikes, while a weak one can mean rate cuts. Stay ahead of these moves. Game-Changing Strategy: Trade Balance + Interest Rate Divergence One of the most overlooked strategies in USDCAD trading is the interest rate differential play. When the BoC is tightening policy while the Fed is dovish, CAD strengthens, and USDCAD falls. If the trade balance is also in surplus, the move is even stronger. 📌 How to Trade It: - Track the BoC’s stance and compare it to the Fed. - Look for positive trade balance surprises aligning with a hawkish BoC. - Enter a USDCAD short when these factors converge. Final Thoughts: Mastering the USDCAD Trade Balance Advantage Mastering the USDCAD trade balance isn’t just about tracking one economic release—it’s about combining fundamental insights, institutional positioning, and technical triggers. By using these hidden techniques, you’ll trade like an insider, spotting opportunities most traders miss. 🚀 Ready to take your USDCAD trading to the next level? - Get real-time economic updates at StarseedFX Forex News - Master next-level strategies with free Forex courses at StarseedFX Education - Join the StarseedFX Community for expert trade alerts at StarseedFX Community —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

USDCAD stuck below 1.3400 as bets for Fed rate cuts grow & Canadian inflation cools. Key data this week (CPI, retail sales) could trigger a Loonie rally - traders, buckle up! Find more in our latest Breaking News: https://markets.tradermade.com/breaking/usdcad-confined

0 notes

Text

#Forex pairs#EURUSD#USDJPY#GBPUSD#AUDUSD#NZDUSD#USDCAD#CHFJPY#EURJPY#GBPJPY#AUDJPY#NZDJPY#USDMXN#Forex commodities#XAUUSD#XAGUSD#USDCOPPER#USDCRUDE#USDBRL#USDSGD#USDTRY#USDZAR#Forex indices#US30#US500#NAS100#GER30#FRA40#UK100#JPN225

0 notes

Text

USDCAD M1 Timeframe SCALPER Mode, o.90 Lots Buy trade based in last NON REPAINT Signal. Official Website: wWw.ForexCashpowerIndicator.com

. Start Improve your Strategy with Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful AUTO-Trade Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

. ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

2 notes

·

View notes

Text

Analytical review: S1_Take (12 pairs)

Profit and risks with leverage 1:100 Detailed report on the account with S1_Take settings. We tested 12 currency pairs (1% risk per trade) to complete the picture. 🔸Deposit: 10000$ 🔸Balance: 12811$ 🔸Profit: $4161.82 (3 days: +473.90$) 🔸Withdraw: -1350$ 🔸Best Pair: USDCAD (+$1272.84) 🔸Worst Pair: NZDUSD (-1272.84$) 🔸Avg Time: ~57 min With 10 trades at the same time, the deposit is overloaded due to 1:100 leverage. To reduce the risk, you can increase the balance or reduce the number of pairs. The results are similar to #S1_PayOFF (https://forexroboteasy.com/results/s1_payoff/) //Conclusion: //analyse → refine S1_Take → stay flexible 🚀 With EASY Bots the settings change automatically. Write @fxroboteasyteambot - we'll show you everything! #S1_Take #ForexTrading #ForexRobot #TradingRobot #MetaTrader5 #ExpertAdvisor #ForexEA #MT5EA #AutomatedTrading #AlgorithmicTrading #ForexAnalysis #RiskControl #FXResults #TrustedEA #ForexSignals #ForexBots #EASYBots #LeverageTest Translated with www.DeepL.com/Translator (free version)

0 notes