#stoploss

Explore tagged Tumblr posts

Text

Activate the best TradingView indicator! In this video, I show you how to find the indicator and display it on your chart. You'll learn how to optimally set the stop loss so that the stock shows the highest profit in detail view. Perfect for traders looking to maximize their profits!

0 notes

Text

An In-Depth Exploration of Forex Trading: Market Dynamics, Strategies, and Risk Management

Forex trading, or foreign exchange trading, is a global financial activity that involves the exchange of one currency for another, primarily to make a profit. The forex market, operating as the largest and most liquid financial market globally, sees a daily trading volume exceeding $6 trillion, underscoring its role in the global economy. Due to its vast scope and the involvement of diverse players such as banks, corporations, hedge funds, and individual traders, the forex market functions on a decentralized structure, operating 24 hours a day across various global time zones.

The Structure of Forex Trading and Key Currency Pairs

Forex trading pairs two currencies, with the base currency quoted against the quote currency (e.g., EUR/USD). In each pair, the first currency listed is the base currency, while the second is the quote currency. The trader’s goal is to speculate on the exchange rate between the two. For example, in the EUR/USD pair, a trader anticipates either appreciation or depreciation of the euro relative to the U.S. dollar, trading accordingly to realize gains or limit losses.

The most commonly traded currency pairs fall into three categories:

Major pairs: Pairs like EUR/USD, USD/JPY, GBP/USD, and USD/CHF, which involve the U.S. dollar and are typically the most liquid.

Cross pairs: These include major currencies traded against each other without the USD, such as EUR/GBP or AUD/JPY.

Exotic pairs: Combinations that include a major currency paired with an emerging market currency, such as USD/TRY or USD/MXN.

Reasons for Forex Trading: Speculation, Hedging, and Arbitrage

Speculation: This is the primary reason for many individual and institutional traders in forex. They predict the future direction of currency values based on analysis or market sentiment, aiming to profit from fluctuations. For example, following the 2016 Brexit referendum, the GBP/USD pair became highly volatile, with speculative traders anticipating major shifts in the British pound’s value against the dollar.

Hedging: Many corporations use forex to protect themselves against foreign exchange risk, ensuring predictable profits when dealing with multiple currencies. For example, multinational corporations operating in several countries may hedge their currency exposure to minimize potential losses. A notable example occurred with European exporters hedging against fluctuations in the EUR/USD to maintain predictable costs and revenues.

Arbitrage: Arbitrage is taking advantage of small price discrepancies between markets. In forex, this can occur across various currency exchanges or between related pairs. While opportunities for arbitrage are generally short-lived due to market efficiency, high-frequency trading firms often employ complex algorithms to capitalize on these fleeting price differences.

Benefits and Challenges of Forex Trading

Advantages:

Liquidity: The high liquidity in forex means traders can buy and sell currencies easily without major price changes due to large trades. This liquidity is especially evident in major currency pairs, where market depth allows substantial trades to occur with minimal slippage.

Accessibility: Forex trading is accessible to anyone with an internet connection and a trading platform, making it a popular choice among retail traders worldwide.

Market Volatility: Currency prices are influenced by various economic indicators, geopolitical events, and market sentiment. This volatility creates profit opportunities, such as those seen in the rapid changes in the GBP/USD exchange rate following Brexit.

Leverage: Forex brokers offer leverage, which allows traders to control larger positions with a smaller initial investment. This leverage can magnify both potential gains and losses, making it a powerful tool in the hands of skilled traders.

Challenges and Risks:

Market Risk: Currency values can be highly volatile, with sudden changes stemming from economic events or political decisions. For example, the Swiss National Bank’s decision in 2015 to unpeg the Swiss franc from the euro led to a 30% surge in the franc’s value within minutes, causing significant losses for traders unprepared for such volatility.

Leverage Risk: While leverage amplifies profit potential, it equally magnifies losses. Traders using high leverage without adequate risk management are vulnerable to substantial losses that could exceed their initial investment.

Liquidity Risk: While major currency pairs are generally liquid, exotic pairs can sometimes become illiquid, making it difficult to exit positions during extreme market conditions. This risk is often observed in emerging market currencies, where low liquidity can lead to higher spreads and limited trading options.

Key Forex Trading Strategies

Forex trading strategies are as varied as the traders who use them, but the most common approaches include technical analysis, fundamental analysis, and risk management techniques to safeguard against adverse market movements.

Technical Analysis: This approach involves analyzing historical price charts and patterns to predict future movements. Indicators like moving averages, support and resistance levels, and trendlines are commonly used tools. For example, traders might use the Relative Strength Index (RSI) to determine whether a currency is overbought or oversold. Technical analysis proved valuable during the 2020 COVID-19 pandemic, when rapid price fluctuations required traders to adapt quickly to new trends.

Fundamental Analysis: Fundamental analysts focus on economic indicators, geopolitical news, and financial policies. Key indicators include interest rates, GDP growth, inflation rates, and employment figures. For instance, a positive NFP (Non-Farm Payroll) report in the U.S. might signal economic strength, often leading to a stronger dollar. The 2008 financial crisis is a historical example of how fundamental analysis can inform traders; as global markets deteriorated, central banks cut interest rates, leading to significant changes in currency values.

Risk Management: Risk management is crucial in forex to protect against unpredictable losses. Common practices include using stop-loss orders, setting risk-reward ratios, and diversifying trades across different currency pairs. For instance, during periods of high uncertainty, such as major central bank announcements, experienced traders often use tighter stop-loss orders to limit potential losses from unexpected price swings.

Real-World Examples and Historical Context

The forex market has seen transformative events that highlight the impact of geopolitical and economic shifts. In recent history:

The Japanese Yen during 2012-2013: The Bank of Japan’s aggressive monetary easing under “Abenomics” led to a dramatic weakening of the yen, which strengthened Japanese exports. Forex traders who recognized this shift profited by shorting the yen against other major currencies.

Swiss Franc in 2015: When the Swiss National Bank unexpectedly removed the Swiss franc’s peg to the euro, it led to unprecedented volatility, causing massive losses for some traders and even bankrupting several small forex brokers. This event underscored the importance of understanding central bank policies and maintaining proper risk management.

COVID-19 Pandemic Impact on Forex Markets: The pandemic led to significant shifts in major currency values as governments implemented stimulus measures, and investors sought safe-haven currencies like the U.S. dollar and Japanese yen. This period of heightened volatility provided opportunities and challenges for traders, demonstrating how external shocks can affect the forex market.

Conclusion: Mastering Forex Trading with Knowledge and Caution

Forex trading offers ample opportunities for profit but also presents substantial risks, underscoring the need for disciplined strategies, solid market knowledge, and effective risk management. The lessons of historical events—like the unpegging of the Swiss franc, shifts under Abenomics, and recent volatility caused by COVID-19—illustrate the market’s complexity and the potential for sudden, drastic changes. By staying informed, analyzing market data, and using proven trading strategies, forex traders can navigate this dynamic environment, balancing the pursuit of profit with the essential practice of risk management.

Maximize Profits, Minimize Losses: A 3-Step Risk Management Strategy for Forex Trading

youtube

Forex trading is an exciting yet challenging field, with the allure of high profits balanced by the risk of substantial losses. For new traders, the complexity of the market can be daunting, making effective risk management critical for long-term success. While there’s no magic formula to eliminate risk entirely, seasoned traders know that disciplined risk management is the secret to consistent profitability. This article will present a practical, three-step strategy to help traders maximize their gains while protecting against unnecessary losses.

Step 1: Set a Risk Tolerance Level

The first step to managing risk effectively is understanding your personal risk tolerance and setting boundaries. This involves deciding how much of your capital you’re willing to risk on each trade. A common guideline is the “1% rule,” which suggests risking no more than 1% of your total trading capital on any single trade. For example, if your account balance is $10,000, you’d aim to risk no more than $100 on each trade.

This rule limits potential losses, preventing emotional decision-making, which can often lead to poor trading choices. By establishing a clear risk tolerance, you build a protective foundation that lets you stay focused on strategy, not fear of losses. While the 1% rule is a common benchmark, some traders might find a 2% or even 0.5% limit more suitable, depending on their risk appetite and trading experience.

Step 2: Use Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for implementing your risk tolerance in real time. A stop-loss order automatically closes a trade when it reaches a specified price level, helping limit potential losses. Take-profit orders, on the other hand, lock in profits when the trade reaches a target price. Using these orders effectively enables traders to cap both their losses and their gains in advance, which brings greater consistency and reduces emotional trading.

For instance, suppose a trader buys the EUR/USD pair at 1.1000, targeting a 100-pip gain with a take-profit order at 1.1100 and placing a stop-loss order 50 pips below at 1.0950. In this scenario, the trader sets a risk-to-reward ratio of 1:2, meaning they stand to gain twice as much as they could potentially lose. Such a ratio helps traders manage risk efficiently, aiming to make profits larger than their losses over time.

Real-world data supports this approach. According to a study by FXCM, traders who maintained a 1:2 risk-to-reward ratio tended to be more successful than those with less favorable ratios. This illustrates that managing both the upside and downside of a trade is essential for consistent profitability.

Step 3: Diversify and Limit Leverage

Leverage can amplify returns, but it can also increase losses dramatically if not managed carefully. In forex, leverage allows traders to control larger positions than their account balance would normally permit. For instance, with a 50:1 leverage ratio, a $200 investment can control a $10,000 position. However, this also means that a minor 1% price change could wipe out the account balance if things go wrong.

Many traders fall into the trap of overleveraging, lured by the prospect of massive returns. But the key to sustainable growth is to use leverage prudently. Experts recommend limiting leverage to a manageable level—ideally no more than 10:1 or even lower for beginner traders. Limiting leverage helps prevent catastrophic losses, especially during volatile market conditions, which can create unexpected price movements.

Diversification is also critical. Relying on a single currency pair or market can expose you to undue risk if that specific market experiences extreme volatility. Instead, trading across multiple pairs reduces exposure to adverse price movements in a single pair. For example, if a trader is focusing primarily on EUR/USD, they might add USD/JPY or GBP/USD positions to balance their exposure to any euro or dollar-specific risks.

Conclusion

In conclusion, effective risk management is the backbone of successful forex trading. By setting clear risk limits, utilizing stop-loss and take-profit orders, and controlling leverage and diversification, traders can protect their capital while still pursuing profitable trades. These three steps—setting a risk tolerance, using stop-loss and take-profit orders, and managing leverage and diversification—create a balanced approach that keeps emotions in check and helps traders make rational decisions. While forex trading is inherently risky, applying these strategies enables traders to maximize profits while keeping losses within manageable limits, setting the stage for long-term success in the forex market.

Learn more...

#ForexTrading#MarketDynamics#Strategies#RiskManagement#CurrencyMarkets#TradingStrategies#TechnicalAnalysis#FundamentalAnalysis#MarketVolatility#Leverage#Liquidity#RiskRewardRatio#PositionSizing#StopLoss#TradingPlan#EmotionalControl#ContinuousLearning#ProfessionalDevelopment#Youtube

0 notes

Text

What is scalping??

Scalping is a short-term trading strategy in the stock market where traders aim to make small, quick profits by buying and selling stocks within minutes or even seconds. The key idea behind scalping is to exploit small price movements in highly liquid stocks, making numerous trades throughout the day. How Scalping Works Scalping involves buying a large number of shares and selling them as soon…

View On WordPress

#DayTrading#HighLiquidity#IndianStockMarket#IntradayTrading#MarketVolatility#NSE#QuickProfits#RelianceIndustries#RiskManagement#Scalping#ShortTermTrading#StockMarketStrategy#StopLoss#TradingTips

0 notes

Text

DAX Analyse für Dienstag, 02. Juli 2024 – Erweiterung mit Elliott-Wellen-Theorie

15-Minuten-Chart

Der 15-Minuten-Chart zeigt eine Seitwärtsbewegung, wobei der RSI bei 45,88 liegt, was auf eine neutrale Marktstimmung hindeutet. Der MACD deutet auf eine leichte bärische Divergenz hin, was auf eine mögliche kurzfristige Korrektur hindeuten könnte. Die Bollinger-Bänder sind relativ eng, was auf eine bevorstehende Volatilitätsausweitung hinweisen könnte.

4-Stunden-Chart

Im 4-Stunden-Chart zeigt der RSI einen Wert von 55,95, was auf eine leicht bullische Stimmung hindeutet. Der MACD hat eine positive Divergenz, was auf eine Fortsetzung des Aufwärtstrends hinweisen könnte. Die Bollinger-Bänder sind weit auseinander, was auf eine hohe Volatilität hinweist.

1-Stunden-Chart

Der 1-Stunden-Chart zeigt eine neutrale bis leicht bullische Tendenz. Der RSI liegt bei 50,45 und der MACD zeigt eine leicht negative Divergenz, was auf eine mögliche Korrektur hinweist. Die Bollinger-Bänder deuten auf eine erhöhte Volatilität hin.

Tages-Chart

Der Tages-Chart zeigt eine Erholung vom jüngsten Tief. Der RSI liegt bei 49,31, was auf eine neutrale Stimmung hinweist. Der MACD zeigt eine positive Divergenz, was auf eine Fortsetzung des Aufwärtstrends hinweisen könnte. Die Bollinger-Bänder sind weit auseinander, was auf eine hohe Volatilität hinweist.

Wahrscheinliche nächste Bewegung

Basierend auf den Charts könnte der Markt in den nächsten Handelstagen eine leichte Aufwärtsbewegung erleben, gefolgt von möglichen Korrekturen aufgrund der Volatilität.

Ausführliche Analysen, inkl Handelszonen (Long- und Shortbereiche) TakeProfit, StopLoss Bereichen, sowie Leverageempfehlung erhalten Sie im kostenpflichtigen Analyse-Abo Dax30 (GER) unter http://lanzerath-wahnfried.it im Shop

Elliott-Wellen-Analyse für Dienstag, den 2. Juli 2024

15-Minuten-Chart

Der 15-Minuten-Chart zeigt eine mögliche Wellenstruktur, die auf eine abgeschlossene Korrekturwelle (Welle 4) hindeutet und eine bevorstehende impulsive Welle 5 vermuten lässt. Der RSI bei 45,88 unterstützt diese Annahme, da er auf eine Erholung aus einer überverkauften Zone hinweisen könnte.

4-Stunden-Chart

Im 4-Stunden-Chart könnte sich der Markt in einer impulsiven Welle 3 eines größeren Zyklus befinden. Der RSI von 55,95 und die positive Divergenz im MACD unterstützen die Annahme einer Fortsetzung des Aufwärtstrends, was typisch für Welle 3 ist. Die Bollinger-Bänder deuten auf eine erhöhte Volatilität hin, was ebenfalls typisch für diese Phase ist.

1-Stunden-Chart

Der 1-Stunden-Chart zeigt möglicherweise eine Korrekturphase, die als Welle 4 interpretiert werden könnte. Der RSI von 50,45 und die leicht negative Divergenz im MACD deuten auf eine bevorstehende Abschlusskorrektur hin, bevor die impulsive Welle 5 beginnt.

Tages-Chart

Der Tages-Chart zeigt eine größere Wellenstruktur, wobei sich der Markt möglicherweise in einer Welle C einer ABC-Korrektur befindet. Der RSI von 49,31 und die positive Divergenz im MACD deuten auf das Ende der Korrektur und den Beginn eines neuen Aufwärtsimpulses hin.

Wahrscheinliche nächste Bewegung

Basierend auf der Elliott-Wellen-Analyse könnte der Markt in den nächsten Tagen eine impulsive Aufwärtsbewegung (Welle 5) erleben, die durch eine abgeschlossene Korrekturwelle vorbereitet wurde. Kurzfristige Rücksetzer könnten als Einstiegspunkte für Long-Positionen genutzt werden.

Disclaimer: Diese Analyse dient nur zu Informationszwecken und stellt keine Finanzberatung dar. Der Handel mit Finanzinstrumenten ist mit Risiken verbunden und kann zum Verlust des gesamten investierten Kapitals führen. Bitte konsultieren Sie einen professionellen Finanzberater, bevor Sie Handelsentscheidungen treffen.

#DAX#Index#Chartanalyse#technische Analyse#Aktienmarkt#RSI#MACD#Bollinger Bänder#Trend#Unterstützung#Widerstand#Handelsstrategien#Finanzmärkte#Investitionen#Marktdynamik#Leverage#StopLoss#TakeProfit#Elliott-Wellen-Theorie

0 notes

Text

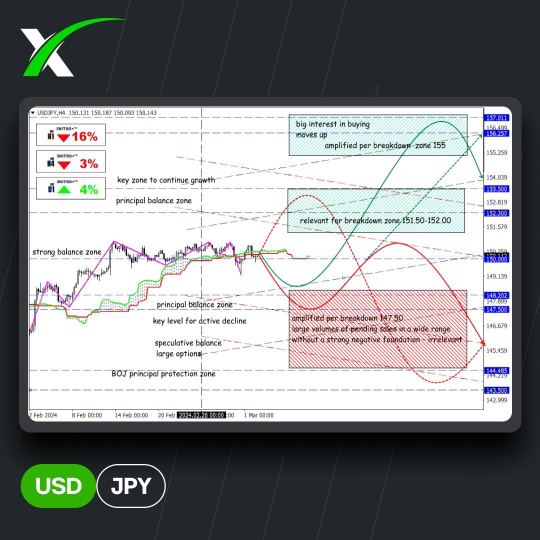

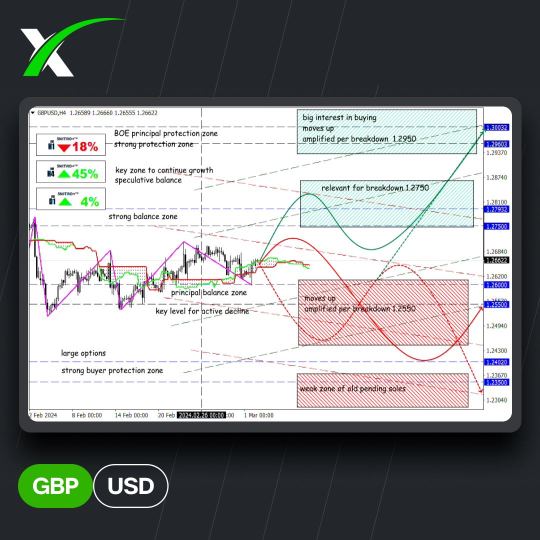

💱 Target levels and forecast for the week 04.03. – 08.03.

We are in for a challenging week. ⠀ NFP: signs of continued strength in the labor market are inevitable, and a strong economy could lead to a resurgence in inflation. The unemployment rate is expected to remain at 3.7% and wage growth is expected to slow. ⠀ Powell testimony: before NFP, it is worth listening to the semi-annual monetary policy report before the House committee on Wednesday and the Senate committee on Thursday. ⠀ ECB meeting: no change in policy is expected, investors will wait for the magic mantra to be repeated that it is too early to discuss rate cuts. ⠀ Oil prices: OPEC+ extended oil production cuts for Q2 in an attempt to prevent a global surplus and support prices. Commentary on this topic has garnered speculation on major benchmarks, but within reasonable limits. ⠀ Fans of Asian assets are advised not to miss the publication of China's CPI and PPI tomorrow morning, we are waiting for the market reaction on Monday. ⠀ Recall the fundamental events that you need to pay attention to (GMT 0 time): ⠀ Tue, 05 USD: Services, composite PMI (14:45); ISM Non-Manufacturing PMI, Employment, Prices (15:00); API Weekly Crude Oil Stock (21:30) GBP: Services, composite, PMI (09:30) ⠀ Wed, 06 AUD: GDP, Retail Sales (00:30) USD: ADP Nonfarm Employment Change (13:15); Fed Chair Powell Testifies; JOLTs Job Openings (15:00); Crude Oil Inventories (+Cushing) (15:30); Beige Book (19:00) ⠀ Thu, 07 AUD: Trade Balance (00:30) CNY: Exports, Imports, Trade Balance (03:00) EUR: ECB Monetary Policy Statement, Interest Rate Decision (13:15); Press Conference (13:45); President Lagarde Speaks (15:00) USD: Initial Jobless Claims, Exports, Imports, Nonfarm Productivity, Trade Balance (13:30); Fed Chair Powell Testifies (15:00); ⠀ Fri, 08 USD: Nonfarm Payrolls (13:30); WASDE Report (17:00)

#EURUSD#GBPUSD#USDJPY#XTIUSD#Profits#xChief#forexsignals#MarketFocus#forexnews#Stock#StopLoss#EconomicCalendar#worldnews#forexmarket

0 notes

Text

💱 Целевые уровни и прогноз на неделю 04.03. – 08.03.

⠀ Нам предстоит сложная неделя. ⠀ NFP: признаки сохранения прочности на рынке труда неизбежны, а сильная экономика может привести к возобновлению инфляции. Ожидается, что уровень безработицы сохранится на уровне 3,7%, а рост заработной платы замедлится. ⠀ Показания Пауэлла: перед NFP стоит послушать полугодовой отчет по монетарной политике перед комитетом Палаты представителей в среду и комитетом Сената в четверг. ⠀ Заседание ЕЦБ: изменений в политике не ожидается, инвесторы будут ждать повторения волшебной мантры о том, что пока рано обсуждать снижение ставок. ⠀ Цены на нефть: ОПЕК+ продлил сокращение добычи нефти на 2 квартал, пытаясь предотвратить глобальный профицит и поддержать цены. Комментарии на эту тему гарантируют спекуляции на основных бенчмарках, но в разумных пределах. ⠀ Фанатам азиатских активов рекомендуем не пропустить публикацию CPI и PPI Китая завтра утром, реакцию рынка ждем в понедельник. ⠀ Фундаментальные события, на которые необходимо обратить внимание (время GMT 0): ⠀ Вт, 05 USD: PMI – композитный, сферы услуг (14:45); ISM для непроизводственной сферы – PMI, занятость, цены (15:00); запасы нефти по данным API (21:30) GBP: PMI – композитный, сферы услуг, (09:30) ⠀ Ср, 06 AUD: В��П, розничные продажи (00:30) USD: Статистика рынка труда от ADP (13:15); выступление Пауэлла; число открытых вакансий от JOLTS (15:00); запасы сырой нефти (+ в Кушинге) (15:30); Бежевая Книга (19:00) ⠀ Чт, 07 AUD: Торговый баланс (00:30) CNY: Экспорт, импорт, торговый баланс (03:00) EUR: Заседание ЕЦБ, процентная ставка (13:15); пресс-конференция ЕЦБ (13:45); выступление Лагард (15:00) USD: Число заявок на пособие по безработице, производительность труда в несельскохозяйственном секторе (13:30); выступление Пауэлла (15:00); ⠀ Пт, 08 USD: Nonfarm Payrolls (13:30); отчет WASDE (17:00)

#EURUSD#GBPUSD#USDJPY#XTIUSD#Profits#xChief#forexsignals#MarketFocus#forexnews#Stock#StopLoss#EconomicCalendar#worldnews#forexmarket

0 notes

Text

AUD/JPY - Trade 3rd - Money Growth

Full Breakdown

1 note

·

View note

Text

Understanding the Average True Range (ATR) Indicator: A Key Tool for Volatility Analysis

When it comes to trading and investing in financial markets, one of the most crucial factors to consider is volatility. Volatility measures the degree of price fluctuations, and it plays a significant role in determining a trader’s risk and reward potential. The Average True Range (ATR) indicator is a powerful tool that provides valuable insights into market volatility. In this blog post, we…

View On WordPress

#ATRFormula#ATRIndicator#AverageTrueRange#BreakoutTrading#ChartingSoftware#FinancialMarkets#Investing#MarketVolatility#PortfolioDiversification#RiskManagement#stoploss#TakeProfit#TechnicalAnalysis#TradingSignals#TradingStrategies#TradingTips#TradingTools#TrendFollowing#VolatilityAnalysis#VolatilityIndicator

0 notes

Text

Giới thiệu về Stop Loss và cách đặt lệnh Stop-loss trong giao dịch forex

Thế nào là Stop Loss? Lý do gì mà Stop-Loss bị bỏ quên? Những tư tưởng sai lầm khi đặt lệnh stop loss tìm hiểu tại: https://forexno1.net/stop-loss-la-gi/

0 notes

Text

"Take Control of Your Trading Journey with ChartBuddy: Unlocking Reliable Buy/Sell Signals and Advanced Chart Analysis." . . .

Follow + Like + Share + Comment

Follow us for daily tips and setups Turn on post notifications

Follow for more update @chartbuddyofficial

#forex#stockmarket#nifty#bitcoins#crypto#technicalanalysis#tradingcards#tradingtips#tradingmemes#forextrading#success#business#bullishtrend#chartanalysis#stoploss#traders#trademarketing#sharemarket#riskmanagement#riskanalysis#financialgrowth#startupindia#sensex#explorepage#chartbuddyofficial#investing#trader#forextrader#money#stocks

0 notes

Text

In the ultrafast scalping world, every second matters. Expert Trading Panel executes trade 5X faster.

Make it yours and trade like a pro. https://wetalktrade.com/best-mt4-expert-advisor-mt5-expert-trading-robot/

#expertadvisor#tradingpanel#mt4#mt5#forextrading#tradingtool#tradingrobot#lot#takeprofit#stoploss#experttradingpanel#wetalktrade

0 notes

Text

The Psychology of Risk Management in Trading: An In-Depth Exploration with Real-World Examples

Risk management is a critical component of any successful trading strategy. It involves understanding, assessing, and mitigating the risks associated with trades to ensure long-term profitability and protect capital. While technical analysis, market knowledge, and sound strategies are essential, the psychological aspect of risk management often determines a trader's success or failure. This essay delves into the psychological factors behind risk management, exploring how traders can develop a mindset that enables them to handle risk effectively. We will also examine real-world examples that highlight the role of psychology in trading success.

1. The Importance of Risk Management in Trading

Trading is inherently risky. Markets are influenced by numerous variables, including economic data, geopolitical events, and investor sentiment, all of which can change rapidly. Proper risk management ensures that traders can weather losses and capitalize on opportunities while protecting their capital from catastrophic declines.

A. Capital Preservation

At the heart of risk management is the concept of capital preservation. Experienced traders understand that the primary goal is not to make money quickly but to survive in the market long enough to grow their capital steadily. Without proper risk controls, even a string of profitable trades can be undone by a single large loss.

Example: The collapse of LTCM (Long-Term Capital Management) in 1998 serves as a classic example. Despite employing some of the brightest minds in finance and having access to sophisticated mathematical models, LTCM failed due to poor risk management. Their highly leveraged positions magnified their exposure to market volatility, and when markets moved against them, the losses were catastrophic. This illustrates the danger of not adhering to disciplined risk management, even for institutional traders.

B. Risk-Reward Ratio

One of the most fundamental principles in risk management is the risk-reward ratio. This refers to the potential profit of a trade compared to its potential loss. A trader must assess whether the potential reward justifies the risk. A common guideline is to aim for a risk-reward ratio of at least 1:2, meaning that for every dollar risked, the potential reward should be two dollars.

Example: Consider a forex trader who places a trade on EUR/USD with a stop-loss of 50 pips and a target of 100 pips. If the trader wins, they gain 100 pips, but if they lose, they only lose 50 pips. This is a risk-reward ratio of 1:2, which, over time, increases the chances of profitability even if the win rate is not exceptionally high.

2. The Role of Psychology in Risk Management

Successful risk management goes beyond calculations and strategy—it is deeply rooted in psychology. The ability to handle uncertainty, control emotions, and stay disciplined is what separates professional traders from amateurs.

A. The Fear of Losing

One of the most pervasive psychological challenges traders face is the fear of losing. This fear often leads traders to hold onto losing positions for too long, hoping the market will reverse, or to exit winning positions too early to lock in small gains. This behavior undermines sound risk management principles and leads to inconsistent performance.

Example: In the world of retail trading, this fear of losing is common among beginners. A trader may enter a position on a stock, watch it dip slightly, and then panic and close the trade at a small loss, only to see the stock rebound shortly after. By not adhering to their original stop-loss, they miss the potential gains, driven by fear rather than logic.

B. Overconfidence and Greed

Conversely, overconfidence and greed are psychological traps that can also lead to poor risk management. After a series of successful trades, traders may increase their position sizes without adjusting for risk, believing that they have a foolproof strategy. This can lead to significant losses when the market inevitably turns against them.

Example: The dot-com bubble of the late 1990s provides a stark example of how greed can influence risk-taking. Many investors and traders ignored traditional valuation metrics and poured money into technology stocks, believing they could only go higher. When the bubble burst in 2000, billions were lost, and many traders saw their portfolios wiped out due to excessive risk-taking and a lack of discipline.

C. The Impact of Loss Aversion

Loss aversion is a well-documented psychological phenomenon in which the pain of losing is felt more intensely than the pleasure of gaining. This can lead traders to avoid closing losing positions, hoping they will turn around, rather than accepting the loss and moving on. Loss aversion often leads to greater losses, as small losses accumulate into large ones when positions are held too long.

Example: A trader may enter a position expecting a stock to rise but sees it decline steadily. Instead of adhering to their stop-loss, they refuse to close the position, hoping for a reversal. The stock continues to fall, resulting in a much larger loss than initially planned. This inability to accept small losses is a hallmark of loss aversion and a significant barrier to effective risk management.

3. Techniques for Overcoming Psychological Barriers

To manage risk effectively, traders must develop psychological resilience and discipline. Several techniques can help traders overcome the emotional challenges of risk management.

A. Sticking to a Trading Plan

One of the most effective ways to mitigate emotional decision-making is to follow a predefined trading plan. A solid trading plan includes entry and exit criteria, position sizing rules, and risk management guidelines. By having a plan in place, traders are less likely to make impulsive decisions based on emotions.

Example: A day trader may decide in advance that they will risk no more than 1% of their account on a single trade and will only enter trades that meet specific technical criteria. By sticking to these rules, they can remove emotional biases from their decision-making and ensure consistency in their approach.

B. Use of Stop-Loss Orders

Stop-loss orders are an essential tool for risk management. A stop-loss order automatically closes a trade when a predetermined price is reached, limiting the potential loss. By using stop-losses, traders can ensure they do not hold onto losing positions for too long, even when emotions are running high.

Example: A forex trader enters a long position on the USD/JPY pair, setting a stop-loss 50 pips below their entry price. If the market moves against them, the trade is closed automatically at the stop-loss level, preventing further losses. This removes the emotional temptation to hold onto the trade in hopes of a reversal.

C. Position Sizing and Diversification

Position sizing is another critical aspect of risk management. By carefully determining how much of their capital to allocate to each trade, traders can protect themselves from significant losses. Diversification—spreading risk across different assets—can also help reduce the impact of any single trade or asset's performance on the overall portfolio.

Example: An options trader might decide to risk only 2% of their capital on any single trade. Additionally, they may diversify by trading multiple assets, such as equities, forex, and commodities, rather than focusing on one market. This reduces the risk of a single market event wiping out their entire portfolio.

D. Managing Expectations and Accepting Losses

Traders must accept that losses are a natural part of trading. By managing their expectations and understanding that even the best traders experience losses, they can maintain a balanced mindset. Accepting losses as part of the process helps traders avoid emotional reactions that can lead to poor decision-making.

Example: Paul Tudor Jones, one of the most successful hedge fund managers, is famous for his strict adherence to risk management. He often reminds traders that protecting capital is more important than chasing profits. His success is largely due to his ability to take losses quickly and move on to the next opportunity, rather than allowing losing trades to spiral out of control.

4. Real-World Examples of Effective Risk Management

Several high-profile traders and investors have demonstrated the importance of psychological resilience and disciplined risk management.

A. Ray Dalio and Bridgewater Associates

Ray Dalio, the founder of Bridgewater Associates, one of the world’s largest hedge funds, is known for his focus on risk management. Dalio emphasizes diversification and risk parity, spreading risk across asset classes to protect the fund from extreme market events. This approach allowed Bridgewater to weather the 2008 financial crisis with minimal losses while many other hedge funds collapsed.

B. Stanley Druckenmiller

Legendary trader Stanley Druckenmiller credits his success to being disciplined in risk management. Druckenmiller once said that he believes in taking large positions when the odds are overwhelmingly in his favor but exiting quickly when the trade goes wrong. His ability to recognize when a trade isn't working and cut losses has been a hallmark of his success over decades.

Conclusion

The psychology of risk management in trading is as important, if not more so, than the technical aspects of any strategy. Traders who master their emotions, stick to disciplined risk management principles, and accept losses as part of the process are more likely to achieve long-term success. By using tools like stop-loss orders, following a trading plan, and managing position sizes effectively, traders can mitigate risk and stay in the game. However, without the right mindset, even the most sophisticated strategy can fail. Successful traders understand that the market is unpredictable, and the key to thriving in it is psychological resilience and disciplined risk management.

#RiskManagement#TradingPsychology#BehavioralFinance#MarketPsychology#InvestorBehavior#RiskPerception#EmotionalTrading#CognitiveBiases#Heuristics#DecisionMaking#TradeManagement#PositionSizing#StopLoss#RiskRewardRatio#MarketVolatility#Uncertainty#FearAndGreed#AnchoringBias#ConfirmationBias#HindsightBias

0 notes

Text

youtube

Identify trend direction quickly and get precise entry and exit points. Non-repainting and identifies best trade opportunities. Make the most out of it now. https://www.youtube.com/watch?v=DqIsCEmx-yM

#trendpower#nonrepainting#accurateindicator#mt4indicatormt5#mt5indicator#takeprofit#stoploss#trendreversal#tradingsystem#tradersir#Youtube

0 notes

Text

The Importance of Risk Management in Forex Trading

risk management: How managing risks can make or break your Forex trading success By Amir Shayan Forex trading is a highly volatile market where the potential for profits and losses is great. As such, it is critical for traders to implement effective risk management strategies to protect their investments. In this article, we'll explore the importance of risk management in forex trading and provide tips on how to manage risk effectively.

The Importance of Risk Management in Forex Trading

Risk management is the process of identifying potential risks and implementing strategies to minimize or mitigate those risks. In forex trading, risk management is critical because of the potential for significant losses. Without proper risk management strategies in place, traders may be exposed to losses that could wipe out their accounts. One of the key benefits of effective risk management is that it can help traders stay in the game for the long term. By managing risk, traders can limit their losses and ensure that they have enough capital to continue trading. Additionally, effective risk management can help traders make better decisions by reducing emotional reactions to market fluctuations. Risk management is also important for traders who use leverage. Leverage allows traders to control large positions with a small amount of capital. However, it also increases the potential for losses. Without proper risk management, traders may be exposing themselves to losses that are much larger than their initial investment.

Tips for Effective Risk Management in Forex Trading

- Use Stop Loss Orders Stop loss orders are one of the most effective tools for managing risk in forex trading. These orders allow traders to set a specific price at which their position will be automatically closed if the market moves against them. Stop loss orders can help limit losses and prevent traders from losing more money than they can afford. - Set Realistic Targets Setting realistic targets is an important part of risk management in forex trading. Traders should set profit targets based on their trading strategy and risk tolerance. It's important to remember that forex trading is a long-term game, and traders should not expect to make large profits overnight. - Use Proper Position Sizing Proper position sizing is critical for managing risk in forex trading. Traders should never risk more than they can afford to lose. One common rule of thumb is to risk no more than 1-2% of your account balance on any given trade. - Avoid Overtrading Overtrading is a common mistake that many forex traders make. This occurs when traders open too many positions at once, which can lead to increased risk and potential losses. Traders should stick to their trading plan and avoid the temptation to open too many positions at once. - Diversify Your Portfolio Diversification is an important part of risk management in forex trading. Traders should diversify their portfolios by trading different currency pairs and using different trading strategies. This can help reduce the risk of losses in one particular area. - Keep Emotions in Check Emotions can be a major factor in forex trading, and they can lead to poor decision making. Traders should keep their emotions in check and avoid making impulsive decisions based on fear or greed. It's important to stick to your trading plan and avoid making emotional decisions that could lead to losses.

Conclusion

Effective risk management is critical for success in forex trading. Traders should implement strategies such as stop loss orders, proper position sizing, and diversification to minimize their risk exposure. Additionally, traders should keep their emotions in check and avoid overtrading to ensure that they have enough capital to continue trading in the long term. By following these tips, traders can manage their risk effectively and increase their chances of success in the forex market. Read the full article

#Currencyexchange#financialmarkets#Forextrading#investment#MoneyManagement#Riskmanagement#stoploss#tradingplan#Tradingpsychology#tradingstrategies

0 notes

Text

What is Stop Loss in the Military? – The Answer and More

In this article, we will explore the concept of stop loss in the military and the various perspectives surrounding this issue.

Read more: https://www.safecallnow.org/stop-loss-in-the-military/

0 notes

Text

SL là gì? Hướng dẫn đặt SL cho người mới

SL là viết tắt của Stop Loss, là lệnh dừng lỗ. Đây là lệnh cắt lỗ tự động được trader cài sẵn cho giao dịch. Nhà đầu tư sau khi nghiên cứu và phân tích thị trường sẽ chọn một mức giá cụ thể có thể gồng lỗ được nhiều nhất để đặt lệnh Stop Loss. Xem tiếp: https://vnforex.com/sl-la-gi-huong-dan-dat-sl-cho-nguoi-moi-giao-dich/

0 notes