#TradingPlan

Explore tagged Tumblr posts

Photo

Want to improve your trading discipline and achieve long-term success in the markets? Follow these tips to develop a strong trading plan, manage risk effectively, control your emotions, and cultivate a disciplined mindset. Remember, discipline is a skill that can be developed with practice and perseverance. Let's start building your path to financial freedom! 💪📈 #tradingdiscipline #tradingmindset #riskmanagement #tradingplan #riskmanagement #emotioncontrol #financialgoals #personalfinance #investing #tradingtips #tradingeducation (at San Francisco, California) https://www.instagram.com/p/CqG2UxiOiaH/?igshid=NGJjMDIxMWI=

#tradingdiscipline#tradingmindset#riskmanagement#tradingplan#emotioncontrol#financialgoals#personalfinance#investing#tradingtips#tradingeducation

5 notes

·

View notes

Link

#tradingview#technicalanalysis#trading strategies#tradingstrategies#kama#kaufman adaptive moving average#tradingsignals#tradingtools#marketvolatility#priceaction#tradingplan

1 note

·

View note

Text

Who needs a Rumpelstiltskin trade plan for tomorrow? 🤔✨ Let's spin some gold out of your trading strategy! Share your thoughts and let’s collaborate on the best tactics to turn your investments into success! 💰💡

0 notes

Text

An In-Depth Exploration of Forex Trading: Market Dynamics, Strategies, and Risk Management

Forex trading, or foreign exchange trading, is a global financial activity that involves the exchange of one currency for another, primarily to make a profit. The forex market, operating as the largest and most liquid financial market globally, sees a daily trading volume exceeding $6 trillion, underscoring its role in the global economy. Due to its vast scope and the involvement of diverse players such as banks, corporations, hedge funds, and individual traders, the forex market functions on a decentralized structure, operating 24 hours a day across various global time zones.

The Structure of Forex Trading and Key Currency Pairs

Forex trading pairs two currencies, with the base currency quoted against the quote currency (e.g., EUR/USD). In each pair, the first currency listed is the base currency, while the second is the quote currency. The trader’s goal is to speculate on the exchange rate between the two. For example, in the EUR/USD pair, a trader anticipates either appreciation or depreciation of the euro relative to the U.S. dollar, trading accordingly to realize gains or limit losses.

The most commonly traded currency pairs fall into three categories:

Major pairs: Pairs like EUR/USD, USD/JPY, GBP/USD, and USD/CHF, which involve the U.S. dollar and are typically the most liquid.

Cross pairs: These include major currencies traded against each other without the USD, such as EUR/GBP or AUD/JPY.

Exotic pairs: Combinations that include a major currency paired with an emerging market currency, such as USD/TRY or USD/MXN.

Reasons for Forex Trading: Speculation, Hedging, and Arbitrage

Speculation: This is the primary reason for many individual and institutional traders in forex. They predict the future direction of currency values based on analysis or market sentiment, aiming to profit from fluctuations. For example, following the 2016 Brexit referendum, the GBP/USD pair became highly volatile, with speculative traders anticipating major shifts in the British pound’s value against the dollar.

Hedging: Many corporations use forex to protect themselves against foreign exchange risk, ensuring predictable profits when dealing with multiple currencies. For example, multinational corporations operating in several countries may hedge their currency exposure to minimize potential losses. A notable example occurred with European exporters hedging against fluctuations in the EUR/USD to maintain predictable costs and revenues.

Arbitrage: Arbitrage is taking advantage of small price discrepancies between markets. In forex, this can occur across various currency exchanges or between related pairs. While opportunities for arbitrage are generally short-lived due to market efficiency, high-frequency trading firms often employ complex algorithms to capitalize on these fleeting price differences.

Benefits and Challenges of Forex Trading

Advantages:

Liquidity: The high liquidity in forex means traders can buy and sell currencies easily without major price changes due to large trades. This liquidity is especially evident in major currency pairs, where market depth allows substantial trades to occur with minimal slippage.

Accessibility: Forex trading is accessible to anyone with an internet connection and a trading platform, making it a popular choice among retail traders worldwide.

Market Volatility: Currency prices are influenced by various economic indicators, geopolitical events, and market sentiment. This volatility creates profit opportunities, such as those seen in the rapid changes in the GBP/USD exchange rate following Brexit.

Leverage: Forex brokers offer leverage, which allows traders to control larger positions with a smaller initial investment. This leverage can magnify both potential gains and losses, making it a powerful tool in the hands of skilled traders.

Challenges and Risks:

Market Risk: Currency values can be highly volatile, with sudden changes stemming from economic events or political decisions. For example, the Swiss National Bank’s decision in 2015 to unpeg the Swiss franc from the euro led to a 30% surge in the franc’s value within minutes, causing significant losses for traders unprepared for such volatility.

Leverage Risk: While leverage amplifies profit potential, it equally magnifies losses. Traders using high leverage without adequate risk management are vulnerable to substantial losses that could exceed their initial investment.

Liquidity Risk: While major currency pairs are generally liquid, exotic pairs can sometimes become illiquid, making it difficult to exit positions during extreme market conditions. This risk is often observed in emerging market currencies, where low liquidity can lead to higher spreads and limited trading options.

Key Forex Trading Strategies

Forex trading strategies are as varied as the traders who use them, but the most common approaches include technical analysis, fundamental analysis, and risk management techniques to safeguard against adverse market movements.

Technical Analysis: This approach involves analyzing historical price charts and patterns to predict future movements. Indicators like moving averages, support and resistance levels, and trendlines are commonly used tools. For example, traders might use the Relative Strength Index (RSI) to determine whether a currency is overbought or oversold. Technical analysis proved valuable during the 2020 COVID-19 pandemic, when rapid price fluctuations required traders to adapt quickly to new trends.

Fundamental Analysis: Fundamental analysts focus on economic indicators, geopolitical news, and financial policies. Key indicators include interest rates, GDP growth, inflation rates, and employment figures. For instance, a positive NFP (Non-Farm Payroll) report in the U.S. might signal economic strength, often leading to a stronger dollar. The 2008 financial crisis is a historical example of how fundamental analysis can inform traders; as global markets deteriorated, central banks cut interest rates, leading to significant changes in currency values.

Risk Management: Risk management is crucial in forex to protect against unpredictable losses. Common practices include using stop-loss orders, setting risk-reward ratios, and diversifying trades across different currency pairs. For instance, during periods of high uncertainty, such as major central bank announcements, experienced traders often use tighter stop-loss orders to limit potential losses from unexpected price swings.

Real-World Examples and Historical Context

The forex market has seen transformative events that highlight the impact of geopolitical and economic shifts. In recent history:

The Japanese Yen during 2012-2013: The Bank of Japan’s aggressive monetary easing under “Abenomics” led to a dramatic weakening of the yen, which strengthened Japanese exports. Forex traders who recognized this shift profited by shorting the yen against other major currencies.

Swiss Franc in 2015: When the Swiss National Bank unexpectedly removed the Swiss franc’s peg to the euro, it led to unprecedented volatility, causing massive losses for some traders and even bankrupting several small forex brokers. This event underscored the importance of understanding central bank policies and maintaining proper risk management.

COVID-19 Pandemic Impact on Forex Markets: The pandemic led to significant shifts in major currency values as governments implemented stimulus measures, and investors sought safe-haven currencies like the U.S. dollar and Japanese yen. This period of heightened volatility provided opportunities and challenges for traders, demonstrating how external shocks can affect the forex market.

Conclusion: Mastering Forex Trading with Knowledge and Caution

Forex trading offers ample opportunities for profit but also presents substantial risks, underscoring the need for disciplined strategies, solid market knowledge, and effective risk management. The lessons of historical events—like the unpegging of the Swiss franc, shifts under Abenomics, and recent volatility caused by COVID-19—illustrate the market’s complexity and the potential for sudden, drastic changes. By staying informed, analyzing market data, and using proven trading strategies, forex traders can navigate this dynamic environment, balancing the pursuit of profit with the essential practice of risk management.

Maximize Profits, Minimize Losses: A 3-Step Risk Management Strategy for Forex Trading

youtube

Forex trading is an exciting yet challenging field, with the allure of high profits balanced by the risk of substantial losses. For new traders, the complexity of the market can be daunting, making effective risk management critical for long-term success. While there’s no magic formula to eliminate risk entirely, seasoned traders know that disciplined risk management is the secret to consistent profitability. This article will present a practical, three-step strategy to help traders maximize their gains while protecting against unnecessary losses.

Step 1: Set a Risk Tolerance Level

The first step to managing risk effectively is understanding your personal risk tolerance and setting boundaries. This involves deciding how much of your capital you’re willing to risk on each trade. A common guideline is the “1% rule,” which suggests risking no more than 1% of your total trading capital on any single trade. For example, if your account balance is $10,000, you’d aim to risk no more than $100 on each trade.

This rule limits potential losses, preventing emotional decision-making, which can often lead to poor trading choices. By establishing a clear risk tolerance, you build a protective foundation that lets you stay focused on strategy, not fear of losses. While the 1% rule is a common benchmark, some traders might find a 2% or even 0.5% limit more suitable, depending on their risk appetite and trading experience.

Step 2: Use Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for implementing your risk tolerance in real time. A stop-loss order automatically closes a trade when it reaches a specified price level, helping limit potential losses. Take-profit orders, on the other hand, lock in profits when the trade reaches a target price. Using these orders effectively enables traders to cap both their losses and their gains in advance, which brings greater consistency and reduces emotional trading.

For instance, suppose a trader buys the EUR/USD pair at 1.1000, targeting a 100-pip gain with a take-profit order at 1.1100 and placing a stop-loss order 50 pips below at 1.0950. In this scenario, the trader sets a risk-to-reward ratio of 1:2, meaning they stand to gain twice as much as they could potentially lose. Such a ratio helps traders manage risk efficiently, aiming to make profits larger than their losses over time.

Real-world data supports this approach. According to a study by FXCM, traders who maintained a 1:2 risk-to-reward ratio tended to be more successful than those with less favorable ratios. This illustrates that managing both the upside and downside of a trade is essential for consistent profitability.

Step 3: Diversify and Limit Leverage

Leverage can amplify returns, but it can also increase losses dramatically if not managed carefully. In forex, leverage allows traders to control larger positions than their account balance would normally permit. For instance, with a 50:1 leverage ratio, a $200 investment can control a $10,000 position. However, this also means that a minor 1% price change could wipe out the account balance if things go wrong.

Many traders fall into the trap of overleveraging, lured by the prospect of massive returns. But the key to sustainable growth is to use leverage prudently. Experts recommend limiting leverage to a manageable level—ideally no more than 10:1 or even lower for beginner traders. Limiting leverage helps prevent catastrophic losses, especially during volatile market conditions, which can create unexpected price movements.

Diversification is also critical. Relying on a single currency pair or market can expose you to undue risk if that specific market experiences extreme volatility. Instead, trading across multiple pairs reduces exposure to adverse price movements in a single pair. For example, if a trader is focusing primarily on EUR/USD, they might add USD/JPY or GBP/USD positions to balance their exposure to any euro or dollar-specific risks.

Conclusion

In conclusion, effective risk management is the backbone of successful forex trading. By setting clear risk limits, utilizing stop-loss and take-profit orders, and controlling leverage and diversification, traders can protect their capital while still pursuing profitable trades. These three steps—setting a risk tolerance, using stop-loss and take-profit orders, and managing leverage and diversification—create a balanced approach that keeps emotions in check and helps traders make rational decisions. While forex trading is inherently risky, applying these strategies enables traders to maximize profits while keeping losses within manageable limits, setting the stage for long-term success in the forex market.

Learn more...

#ForexTrading#MarketDynamics#Strategies#RiskManagement#CurrencyMarkets#TradingStrategies#TechnicalAnalysis#FundamentalAnalysis#MarketVolatility#Leverage#Liquidity#RiskRewardRatio#PositionSizing#StopLoss#TradingPlan#EmotionalControl#ContinuousLearning#ProfessionalDevelopment#Youtube

0 notes

Text

10 essential trading skills every trader should have

Trading isn’t just a game of numbers; it’s a sophisticated dance of strategy, emotion, and intellect. For those ready to plunge into the thrilling world of financial markets, mastering a blend of essential skills can make the difference between striking gold and striking out. Buckle up, because here’s your guide to the ten trading skills that will help you turn the market’s chaos into your playground.

1. Market Analysis: The Art of Decoding the Market’s Secrets

Imagine being a market detective, unraveling the clues that dictate price movements. That’s what market analysis is all about. Whether you’re delving into fundamental analysis—crunching numbers from earnings reports and economic indicators—or the art of technical analysis, which involves interpreting charts and patterns, being able to read the market’s secret language is key. Think of it as having a map to navigate the market’s maze.

2. Risk Management: Your Financial Safety Net

Risk management is like having a safety net beneath your tightrope. It’s all about knowing your limits and setting boundaries to protect your capital. Think of stop-loss orders as your market parachute, designed to slow your fall when things go wrong. By balancing risk and reward, you’re not just protecting your assets—you’re building a sturdy foundation for future trading.

3. Discipline: The Power of Sticking to Your Guns

In the fast-paced world of trading, discipline is your anchor. It’s the ability to stick to your trading plan no matter how turbulent the waters get. Imagine it as your personal trading GPS, guiding you through the fog of market emotions and keeping you on course. Discipline helps you avoid impulsive decisions and stay true to your well-thought-out strategies.

4. Patience: The Virtue of Waiting for the Perfect Wave

Patience isn’t just a virtue in trading; it’s a superpower. In a world where immediate gratification can be tempting, waiting for the right trade setup or signal can feel like an eternity. But much like a surfer waiting for the perfect wave, the rewards for those who wait can be immense. Mastering patience means knowing when to sit tight and when to strike, ensuring you’re always in the right place at the right time.

5. Adaptability: The Ability to Pivot with Precision

The market is an ever-shifting landscape, and adaptability is your ability to pivot when conditions change. Imagine it like a skilled dancer adjusting to a new rhythm. Whether it’s reacting to economic shifts, new technologies, or unexpected events, being adaptable allows you to stay ahead of the curve and seize new opportunities as they arise.

6. Technical Proficiency: Navigating Your Trading Tools Like a Pro

In today’s digital age, being technically savvy is a must. Think of trading platforms and tools as your trading cockpit—knowing how to operate them efficiently ensures you’re not fumbling when the market is moving fast. From charting software to trading algorithms, mastering these tools helps you execute trades with precision and clarity.

7. Emotional Control: Keeping Your Cool When the Market’s Hot

Emotions in trading can be like a double-edged sword. They can fuel your enthusiasm or lead to rash decisions. Emotional control is your ability to keep your cool, much like a zen master in a high-stakes poker game. Techniques such as mindfulness and journaling can help you manage stress and make decisions based on logic, not emotion.

8. Research Skills: The Quest for Knowledge

In the realm of trading, knowledge is power. Think of research as your treasure hunt for valuable insights. Staying updated with news, market trends, and economic developments equips you with the information needed to make informed decisions. The more you know, the better you can anticipate market movements and position yourself advantageously.

9. Networking: Building Your Trading Tribe

In trading, it’s not just what you know but who you know. Networking is about building relationships with fellow traders and financial experts. Imagine it as creating your own trading support network where ideas are exchanged, strategies are discussed, and opportunities are uncovered. Being part of a trading community provides valuable insights and fosters collaboration.

10. Strategic Thinking: Crafting Your Master Plan

Strategic thinking is your blueprint for success. It’s about setting clear goals, defining your trading style, and crafting a plan to achieve those goals. Picture it as designing a roadmap for your trading journey. With a solid strategy in place, you’ll navigate market challenges with confidence and purpose.

Conclusion

Trading is as much an art as it is a science, requiring a unique blend of skills and attributes. By mastering these ten essential skills—market analysis, risk management, discipline, patience, adaptability, technical proficiency, emotional control, research skills, networking, and strategic thinking—you’ll be well-equipped to transform market chaos into opportunity. So gear up, sharpen your skills, and get ready to make your mark in the exhilarating world of trading.

#TradingPlan#Laabhum#TradeSmart#RiskManagement#TradingStrategy#MarketResearch#InvestmentGoals#FinancialPlanning#TraderTips#MarketSuccess#TradingGuide#SmartInvesting#PlanYourTrades#StockMarket#TradingSuccess

0 notes

Text

How to Start Forex Trading

Starting my journey in Forex trading was both exciting and a bit overwhelming. I remember feeling a mix of curiosity and fear as I stepped into the world of currency trading. If you're like me and want to dive into Forex, this guide will help you navigate the basics so you can trade confidently and successfully. What is Forex Trading? Forex, or foreign exchange, is the global marketplace for buying and selling currencies. It’s the largest financial market in the world, with trillions of dollars traded daily. Unlike the stock market, the Forex market operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time.

Why Trade Forex? There are several reasons why I chose to trade Forex: Accessibility: I can start trading with a relatively small amount of money. Flexibility: I can trade from anywhere, as long as I have an internet connection. Diverse Opportunities: There are many currency pairs to choose from, including major, minor, and exotic pairs. You can click on my recommended broker now to start your trading journey. Getting Started: My Step-by-Step Guide Here’s how I got started with Forex trading: 1. Learn the Basics Before jumping in, I took the time to understand some key concepts: Currency Pairs: Forex trading involves pairs, like EUR/USD. The first currency is the base, and the second is the quote. Pips: This is the smallest price move in a currency pair. Leverage: This allows me to control larger positions with a smaller amount of capital, but it also increases risk. READ MORE… Read the full article

#beginner'sguide#currencymarket#currencypairs#forexbroker#forexeducation#Forextrading#Riskmanagement#tradingplan#TradingStrategies#TradingTips

0 notes

Text

How to Develop a Trading Plan.

#WhatisForex#HowtoTradeForex#ForexChartPatterns#WhatisForexTrading#WhyTradeForex#CommonForexMistakes#ForexTradingSignals#TradingPlan#WhoTradesForex#HowtoBuyandSellCurrency

0 notes

Text

Forex Trading Secrets: Strategies Used by Successful Traders

Unveiling the Secrets of Successful Forex Traders: Proven Strategies for Profitable Trading. By Amir Shayan Foreign exchange (forex) trading has gained immense popularity in recent years as traders seek opportunities to profit from the global currency markets. However, the forex market is highly dynamic and can be challenging to navigate, especially for beginners. Successful traders possess a unique set of skills and employ effective strategies to gain an edge in this competitive arena. In this comprehensive guide, we will delve into the forex trading secrets used by successful traders that can help you improve your trading performance and increase your chances of success.

Introduction to Forex Trading

Forex trading involves the buying and selling of currencies with the aim of making a profit from the fluctuations in their exchange rates. It is the largest financial market globally, with an average daily trading volume exceeding $6 trillion. Unlike other financial markets, forex operates 24 hours a day, five days a week, making it accessible to traders worldwide. The Basics of Forex Trading Before we delve into the strategies used by successful traders, let's review the fundamental concepts of forex trading: - Currency Pairs: Forex trades are conducted in currency pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is the base currency, while the second is the quote currency. The exchange rate indicates how much of the quote currency is required to purchase one unit of the base currency. - Leverage: Forex brokers often offer leverage, allowing traders to control larger positions with a smaller amount of capital. While leverage amplifies potential profits, it also increases the risk of losses. - Market Participants: The forex market includes various participants, such as banks, financial institutions, corporations, governments, and individual retail traders. - Market Sentiment: Market sentiment refers to the overall feeling of traders and investors towards a particular currency or the market as a whole. It can significantly influence price movements.

Forex Trading Secrets Used by Successful Traders

Now that we have a foundational understanding of forex trading, let's explore the strategies and secrets that successful traders use to thrive in this challenging environment: 1. Developing a Trading Plan Successful forex traders operate with a well-defined trading plan. This plan outlines their financial goals, risk tolerance, trading strategies, and money management rules. A trading plan helps traders stay disciplined and avoid emotional decision-making, which is crucial for long-term success. 2. Risk Management Managing risk is a cornerstone of successful forex trading. Experienced traders never risk more than a small percentage of their trading capital on any single trade. Setting stop-loss and take-profit levels before entering a trade is a common risk management technique used to protect against significant losses. 3. Technical Analysis Technical analysis involves analyzing historical price charts and using various technical indicators to identify potential entry and exit points. Successful traders often combine multiple technical tools to gain a comprehensive view of market trends and make informed trading decisions. 4. Fundamental Analysis Fundamental analysis focuses on economic and geopolitical factors that can influence currency prices. Successful traders keep an eye on economic indicators, central bank decisions, and global events to anticipate market movements. 5. Trading Psychology The mindset of a trader is critical to success. Emotions such as fear and greed can cloud judgment and lead to impulsive decisions. Successful traders practice discipline, patience, and emotional control to avoid making irrational choices. 6. Keeping Up with Market News Forex markets can be influenced by unexpected news events. Staying informed about economic releases and market news helps traders react quickly to potential opportunities or risks. 7. Adapting to Market Conditions Market conditions can change rapidly. Successful traders are flexible and willing to adapt their strategies to suit different market environments. 8. Backtesting and Demo Trading Before risking real money, successful traders often test their strategies through backtesting and demo trading. Backtesting involves applying a strategy to historical data to evaluate its performance. Demo accounts allow traders to practice and refine their skills in a risk-free environment. 9. Continuous Learning Forex trading is a never-ending learning process. Successful traders dedicate time to educate themselves about the latest market trends, techniques, and strategies. 10. Diversification Diversifying a trading portfolio across various currency pairs can help spread risk and reduce exposure to individual market fluctuations.

Conclusion

Forex trading can be a rewarding endeavor for those who approach it with the right knowledge and mindset. Successful traders employ a combination of technical and fundamental analysis, risk management, and emotional discipline to navigate the forex market's complexities. Remember that consistent profitability in forex trading takes time, practice, and a commitment to continuous improvement. By applying the secrets and strategies discussed in this guide, you can increase your chances of becoming a successful forex trader. Always remember to trade responsibly and never risk more than you can afford to lose. Read the full article

#diversification#Forextrading#fundamentalanalysis#marketnews#Riskmanagement#successfultraders#Technicalanalysis#tradingplan#Tradingpsychology#tradingstrategies

0 notes

Text

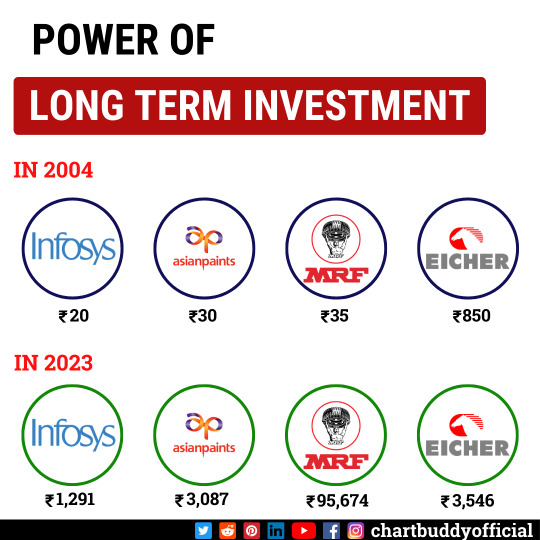

🌐 Join a Thriving Community: Connect with fellow traders, share insights, and learn from each other's experiences. ChartBuddy's vibrant trading community provides a platform to elevate your skills and expand your trading network. 🤝

Follow + Like + Share + Comment

Follow us for daily tips and setups Turn on post notifications

Follow more update @chartbuddyofficial

#tradingforex#tradingstrategy#tradingcards#tradingsignals#tradingtips#tradingstocks#tradinglifestyle#tradingsetup#tradingview#forextrading#cryptotrading#daytrading#optionstrading#tradingsystem#tradingcardgame tradinglife#tradingonline#tradingplan#tradingeducation

1 note

·

View note

Text

Launch Your Own Crypto Exchange Software in USA - Dynamic Technologies

🚀🔒 Launch Your Own Crypto Exchange Software! 💻💰

Ready to dive into the world of cryptocurrencies? Create your very own crypto exchange platform and empower users to trade digital assets securely.

With our cutting-edge software, you can enter the lucrative crypto market and unlock unlimited potential.

Partner with us for a comprehensive white label solution that drives growth and success.

✉️ : [email protected] 📞 : +91-8383814618 🌐 : www.dyntech.io

𝗕𝗼𝗼𝗸 𝗮𝗻 𝗔𝗽𝗽𝗼𝗶𝗻𝘁𝗺𝗲𝗻𝘁 𝗪𝗶𝘁𝗵 𝗮𝗻 𝗘𝘅𝗽𝗲𝗿𝘁: https://calendly.com/dynamictechnologies/30min

#DynamicTechnologies#CryptoExchange#BlockchainTechnology#daytrader#stocktrader#swingtrading#TradingPlatform#OnlineBrokers#TradingSolutions#Fintech#FinancialSuccess#InvestmentJourney#StartYourBusiness#tradinglifestyle#tradingplan#cryptotrading#cryptotradar#cryptoworld#cryptoinvestor#cryptomarket

1 note

·

View note

Text

Common Forex Mistakes.

#WhatisForex#HowtoTradeForex#ForexChartPatterns#WhatisForexTrading#WhyTradeForex#CommonForexMistakes#ForexTradingSignals#TradingPlan#WhoTradesForex#HowtoBuyandSellCurrency

0 notes

Text

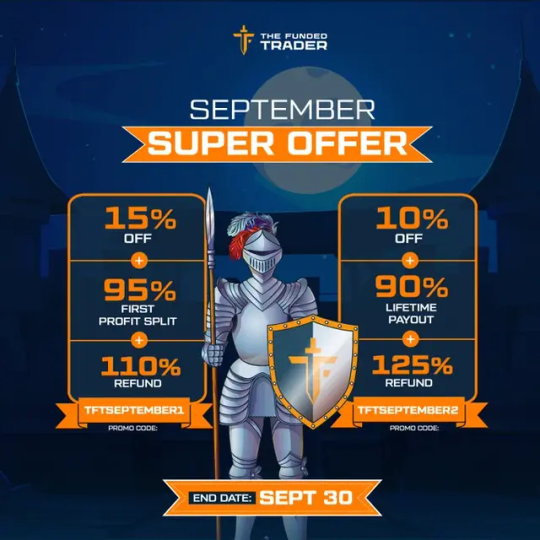

the 🔥Super offer promotions🔥 for september

⚔️THE FUNDED TRADER⚔️ -------------------------------- 💎PROMO 1💎 15% off + 95% first profit split + 110% refund Promo Code: TFTSEPTEMBER1

💎PROMO 2💎 10% off + 90% lifetime payout + 125% refund Promo Code: TFTSEPTEMBER2

💎PROMO 3💎 Terms: 40% Off + 95% Lifetime 👉Code: TFTLIFE

🚨 end September 30th🚨

get your self signed up with the best propfirm 🔥

🔽 🔽 🔽

🔽🌏Official site 🌏 TheFundedTrader

USE CODE FOR 🔥5% OFF🔥 YOUR NEXT CHALLENGE -- 👉TFTTrader9858519

#tradingforliving#learnforex#forexmentorship#forextraderlifestyle#foreignexchangemarket#tradeonline#stocktrade#tradelike#stockstrading#tradingeducation#swingtrader#currencytrading#tradingonline#learntotrade#learntoearn#tradingplan#wealthcreation#wealthbuilding#tradingforex#forexmentor#forexlife#swingtrading#traderlifestyle#stocktrading

1 note

·

View note

Text

Forex Trading Secrets: Strategies Used by Successful Traders

Uncover the Secrets of Successful Forex Traders and Boost Your Trading Profits By Amir Shayan Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global market. It is a decentralized market where traders speculate on the value of different currency pairs, aiming to make a profit from fluctuations in exchange rates. While forex trading offers immense opportunities for financial gain, it is also a highly competitive and risky market. To succeed as a forex trader, it is crucial to have a deep understanding of the market and employ effective strategies. In this article, we will uncover some of the forex trading secrets used by successful traders to maximize their profits and minimize risks. - Develop a Solid Trading Plan One of the key secrets to successful forex trading is having a well-defined trading plan. A trading plan outlines your goals, risk tolerance, trading strategy, and money management rules. It acts as a roadmap that guides your trading decisions and helps you stay disciplined in the face of market fluctuations. A solid trading plan includes: - Clearly defined goals: Set realistic and achievable goals for your trading journey. - Risk management strategy: Determine your risk tolerance and establish proper risk management techniques such as setting stop-loss orders and using appropriate position sizing. - Trading strategy: Choose a trading strategy that aligns with your trading style and preferences, whether it's scalping, day trading, swing trading, or long-term investing. - Money management rules: Define how much capital you are willing to risk on each trade and how much you aim to make. - Understand Technical and Fundamental Analysis Successful forex traders combine technical analysis and fundamental analysis to make informed trading decisions. Technical analysis involves studying price charts, identifying patterns, and using indicators to predict future price movements. Fundamental analysis, on the other hand, involves analyzing economic data, geopolitical events, and central bank policies to assess the intrinsic value of a currency. By understanding both forms of analysis, traders can gain a comprehensive view of the market and make more accurate predictions. - Implement Risk Management Techniques Risk management is a critical aspect of forex trading. Successful traders understand the importance of preserving capital and managing risk effectively. Some essential risk management techniques include: - Setting stop-loss orders: Placing stop-loss orders helps limit potential losses by automatically closing a trade when the price reaches a predetermined level. - Using proper position sizing: Calculating the appropriate position size based on your risk tolerance and the distance to the stop-loss level helps control risk and prevent overexposure. - Diversifying your portfolio: Spreading your investments across different currency pairs and asset classes reduces the impact of any single trade on your overall portfolio. - Practice Patience and Discipline Patience and discipline are vital qualities for successful forex traders. It is crucial to wait for high-probability trading setups and avoid impulsive trades based on emotions or market noise. Disciplined traders stick to their trading plan and avoid making impulsive decisions based on short-term market fluctuations. - Continuously Learn and Adapt The forex market is constantly evolving, and successful traders understand the importance of continuous learning. Stay updated with market news, economic indicators, and new trading strategies. Adapt to changing market conditions and be willing to modify your trading approach when necessary. - Utilize Technology and Automation Technology has revolutionized the forex market, offering traders advanced tools and platforms to enhance their trading capabilities. Take advantage of trading software, charting platforms, and algorithmic trading systems to analyze the market, identify trading opportunities, and execute trades more efficiently.

Conclusion

Forex trading can be highly rewarding, but it requires knowledge, skills, and the right strategies. Successful traders develop a solid trading plan, understand technical and fundamental analysis, implement risk management techniques, practice patience and discipline, continuously learn and adapt, and leverage technology to enhance their trading activities. By incorporating these secrets into your trading approach, you can increase your chances of success in the forex market. Remember, trading is not a guaranteed path to riches, and it is essential to approach it with a realistic mindset and proper risk management. Read the full article

#Forextrading#fundamentalanalysis#marketanalysis#marketvolatility#MoneyManagement#Riskmanagement#successfultraders#Technicalanalysis#tradingplan#tradingstrategies

0 notes

Text

Don't settle for average when you can soar to extraordinary heights with ChartBuddy. 🚀✨ Start your journey towards trading success today!

Follow + Like + Share + Comment

Follow us for daily tips and setups Turn on post notifications

Follow more update @chartbuddyofficial

#tradingforex#tradingstrategy#tradingcards#tradingsignals#tradingtips#tradingstocks#tradinglifestyle#tradingsetup#tradingview#forextrading#cryptotrading#daytrading#optionstrading#tradingsystem#tradingcardgame tradinglife#tradingonline#tradingplan#tradingeducation

1 note

·

View note

Video

youtube

Live Compounding Trades #compoundingstrategy #tradingplan #tradingstrate...

0 notes