#Technicalanalysis

Explore tagged Tumblr posts

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

Our First Indicator Script Is Live! EasyChartSignals - Now Available for TradingView!

We are thrilled to announce that our very first indicator script, EasyChartSignals, is finally ready and available for you! 🚀 This powerful tool provides you with automated buy, sell, and stop-loss signals that make trading on TradingView more efficient and simple.

EasyChartSignals has been optimized and tested thoroughly by experienced traders to bring you the most accurate and reliable signals. Whether you're new to trading or an experienced trader, EasyChartSignals helps you make better trading decisions!

Get started with EasyChartSignals today and take your trading to the next level! 🔥

👉 Available for TradingView users now!

📌 Features:

Accurate buy and sell signals

Easy integration with TradingView

Adjustable settings to suit your trading style

🌐 Learn more at: https://easychartsignals.de

Hashtags:

#EasyChartSignals#TradingView#IndicatorScript#TradingSignals#BuySellSignals#AutomatedTrading#TradingTools#ForexTrading#CryptoTrading#DayTrading#StockTrading#TechnicalAnalysis#TradeSmart#ChartSignals

2 notes

·

View notes

Text

#ForexTrading#InvestmentTips#DayTrading#ForexMarket#TechnicalAnalysis#TradingStrategies#Cryptocurrency#FinancialMarkets#ForexSignals#StockMarket#Investing101#ForexEducation#MarketAnalysis#PassiveIncome#AlgoTrading#ForexLifestyle#TradingPsychology#RiskManagement#EconomicNews#TradingMentor#ForexCommunity#ForexBlog#TradingJourney#ForexTips#TradingMindset

2 notes

·

View notes

Text

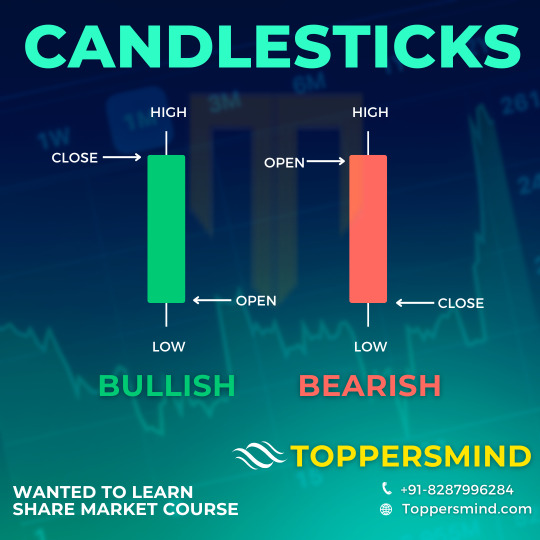

Anatomy of Candlesticks

2 notes

·

View notes

Text

LOWER LOWS AND LOWER HIGHS PATTERN

The "Lower Lows and Lower Highs" pattern is a chart formation where consecutive lower highs and lower lows suggest a short-term reversal. One trading strategy involves entering at the close when a daily bar shows both a lower high and a lower low, with an exit after 1-10 bars. Another strategy enters after two consecutive days of lower highs and lows for stronger confirmation. This pattern is often used to identify potential reversals in trending markets.

2 notes

·

View notes

Text

Earnings Catalysts Could Make These Stocks Rocket

🚀 Earnings Catalysts Could Make These Stocks Rocket 🚀 https://www.youtube.com/watch?v=b1jLKdCDW2A Today I give you my top 3 stock setups going into earnings this week! Some I have bought personally, others looks primed to explode! Biotech's are super hot right now attracting a ton of hedge fund, smart money presence! Remember, when institutions see value and start buying, the street takes notes. Some tickers perform so well that they can be added to major index funds which will naturally cause more people to see value and buy the stock! Any questions please ask! TIMELINE: 0:00 Stock 1 2:01 Stock 2 3:37 Stock 3 ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/a3no9He 👉 Instagram: https://ift.tt/lBLGJWq ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader https://youtu.be/pZAKJLk9o0I 👉 How My Subscribers Doubled Their Money Today!!! https://youtu.be/s5M_OGv8AtM 👉 7 Great Value Stocks to Buy BEFORE They Explode! https://youtu.be/0I451lsCjAc 👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥 https://youtu.be/4B3EK7lb38k ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #stockstobuy #stockstobuynow #stockstowatch #stockstotradetomorrow #stockanalysis #stockmarketnews #stocknews #breakingnews #topstocks #topstockstobuynow #partnership #biotechstocks #millionaire #stockearnings #earningsreport #earningsweek #catalyst Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA May 07, 2024 at 05:55AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

2 notes

·

View notes

Text

Fundamental Analysis of Maruti Suzuki

Established in February 1981 as Maruti Udyog Limited, Maruti Suzuki India Limited (MSIL) is now the largest passenger car manufacturer in India. A joint venture between the Government of India and Suzuki Motor Corporation of Japan, the latter currently holds a 58.19% stake in the company. With a diverse portfolio of 16 car models and over 150 variants, Maruti Suzuki caters to various consumer segments, from entry-level small cars like the Alto to the luxury sedan Ciaz.

Sales and Industry Trends

Indian passenger vehicle industry saw record sales of 4.1 million units in 2023, becoming the third largest market globally

Share of utility vehicles in the industry increased to 53% in Q3, with SUVs contributing to about 63%

CNG vehicles saw a share increase to about 16.5% in the industry, with CNG sales reaching an all-time high of ~30%

Company crossed annual sales milestone of 2 million units in 2023 and had highest ever exports of about 270,000 units

Q3 FY23–24 saw total sales of 501,207 vehicles, with net profit rising over 33% year-on-year

Retail sales in Q3 were higher than wholesales, with discounts of INR 23,300 per vehicle

Maruti Suzuki Financials

Revenue and Net Profit: In FY23, Maruti Suzuki witnessed a YoY increase of 33.10% in revenue, reaching Rs. 1,17,571.30 crore, with a net profit of Rs. 8,211 crore, marking a 111.65% YoY increase.

Profit Margins: Operating Profit Margin (OPM) and Net Profit Margin (NPM) improved in FY23, standing at 9% and 6.83%, respectively.

Return Ratios: Return on Equity (RoE) and Return on Capital Employed (RoCE) showed improvements in FY23, reaching 13.28% and 16.02%, respectively.

Debt Analysis: The Debt to Equity ratio slightly increased to 0.02 in FY23, with a healthy Interest Coverage ratio of 70.37.

#StockMarket#Investing#TradingTips#FinancialFreedom#InvestmentStrategy#MarketAnalysis#StockPicks#PortfolioManagement#EconomicIndicators#StockResearch#RiskManagement#MarketTrends#DividendInvesting#TechnicalAnalysis#FundamentalAnalysis

3 notes

·

View notes

Text

Web3Crunch - Web3 | Crypto | Blockchain | Technical Analysis

Web3Crunch is your go-to source for expert crypto technical analysis and insights on the fast-evolving world of Web3. From blockchain to decentralized finance and NFTs, we've got you covered.

Visit Website - https://web3crunch.tech/

2 notes

·

View notes

Text

Technical analysis is essential for success in forex trading. Among all the technical analysis used in forex, which one is the best?

6 notes

·

View notes

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Text

How Coyyn.com Economy is Shaping the Future of Digital Finance and Economic Growth

As the world transitions to a more digitally driven economy, platforms like Coyyn.com are emerging as key players in the financial landscape. The Coyyn.com economy refers to the growing digital ecosystem that integrates blockchain technology and cryptocurrency into everyday financial operations. This article will explore how Coyyn.com contributes to the global economy, its influence on financial trends, and its long-term impact on economic growth.

What is Coyyn.com and Its Role in the Economy?

Coyyn.com is a cutting-edge digital platform that offers a wide range of services centered around cryptocurrencies, digital assets, and financial technology. It operates by creating a secure, decentralized environment where users can exchange digital currencies and participate in the global economy. The Coyyn.com economy encompasses not only cryptocurrency trading but also services like digital wallets, investment tools, and blockchain technology, all of which facilitate financial inclusion and access.

Impact of Coyyn.com on Global Financial Systems

The Coyyn.com economy has far-reaching effects on global financial systems. Here's how:

Boosting Digital Currency Adoption: As more individuals and businesses join the Coyyn.com economy, the demand for cryptocurrencies and digital assets grows, directly impacting the global adoption of digital currencies.

Promoting Financial Inclusion: By providing services to regions with limited access to traditional banking systems, Coyyn.com is creating more equitable opportunities for financial participation worldwide.

Driving Economic Development: The Coyyn.com economy stimulates growth in emerging markets by enabling small businesses and individuals to access global financial resources.

Technological Innovation and the Future of the Coyyn.com Economy

At the core of Coyyn.com’s operations is its innovative use of technology, particularly blockchain, which ensures transparency, security, and decentralization. As the Coyyn.com economy grows, we expect technological advancements to continue shaping its future, with more AI integrations, automation of financial transactions, and the expansion of decentralized finance (DeFi).

Blockchain Security: Blockchain technology used by Coyyn.com enhances the security of financial transactions, ensuring that users are protected from fraud and unauthorized access.

AI-Powered Financial Services: The integration of AI into the Coyyn.com economy is expected to revolutionize personalized financial services, making them more accessible and efficient.

The Role of Decentralization in the Coyyn.com Economy

One of the key elements that define the Coyyn.com economy is decentralization. Unlike traditional banking systems, Coyyn.com operates without a central authority, giving users more control over their financial assets. This decentralization can result in lower transaction costs, increased transparency, and a more equitable financial system for all participants in the Coyyn.com economy.

The Key Drivers of Economic Growth in the Coyyn.com Economy

1. Innovation in Digital Finance

The Coyyn.com economy thrives on innovation in digital finance, which is transforming traditional financial models. By embracing cutting-edge technologies such as blockchain and smart contracts, Coyyn.com provides users with faster, more cost-effective financial solutions.

2. Creating New Job Opportunities

As the Coyyn.com economy expands, it is expected to create a variety of job opportunities in sectors like technology development, digital marketing, blockchain consulting, and cybersecurity. These roles contribute to the broader economy by driving employment and improving skills in emerging tech fields.

3. Strengthening Global Connectivity

The Coyyn.com economy fosters a more connected world by allowing seamless cross-border transactions. This helps bridge gaps between economically diverse regions and supports the movement of capital, goods, and services globally.

FAQs

Q1. What is Coyyn.com and how does it contribute to the economy?

Ans. Coyyn.com is a digital platform that facilitates cryptocurrency trading and provides a range of financial services. It contributes to the global economy by promoting digital currency adoption, enhancing financial inclusion, and fostering economic growth in underserved regions.

Q2. How does Coyyn.com affect the traditional banking system?

Ans. The Coyyn.com economy challenges traditional banking by providing decentralized financial solutions. This decentralization reduces reliance on banks and gives individuals more control over their finances.

Q3. What makes Coyyn.com secure for financial transactions?

Ans. Coyyn.com uses blockchain technology to ensure secure transactions. This technology guarantees transparency, security, and reduces the risk of fraud, making it a safe platform for users to manage their digital assets.

Q4. Can Coyyn.com help reduce financial inequality?

Ans. Yes, the Coyyn.com economy provides financial tools to people in regions with limited access to traditional banking services, offering a chance for more inclusive financial participation and reducing inequality.

Q5. What role does Coyyn.com play in job creation?

Ans. As the Coyyn.com economy grows, it creates job opportunities in emerging sectors such as blockchain technology, cybersecurity, digital marketing, and more, contributing to both local and global economies.

Q6. Is Coyyn.com a good investment option?

Ans. The Coyyn.com economy offers opportunities for investment in cryptocurrencies and digital assets. However, like all investments, it comes with risks, and potential investors should conduct thorough research before engaging with the platform.

Q7. How does Coyyn.com promote economic growth in developing countries?

Ans. Coyyn.com fosters economic growth in developing countries by providing access to global financial markets, improving financial literacy, and enabling small businesses to thrive in the digital economy.

Conclusion

The Coyyn.com economy represents the future of digital finance, offering innovative solutions that challenge traditional economic systems. By leveraging blockchain technology and promoting financial inclusion, Coyyn.com has become a driving force in shaping the global economy. Its continued growth will likely foster job creation, technological innovation, and greater connectivity across regions. As we move toward a more digitalized financial landscape, the Coyyn.com economy will undoubtedly play a key role in redefining how we interact with money, investments, and global markets.

#technologies#technicalanalysis#investment#investors#aa investigations#police investigation#coyyn.com#economy#money sending#moneydream#money#old money

0 notes

Text

The Role of Trading Value in Technical Analysis

Technical analysis is a fundamental aspect of trading that helps investors and traders make informed decisions by studying past market data. Among the various factors that influence technical analysis, trading value (or volume) plays a crucial role. Trading value represents the total amount of a security traded over a given period and is used to confirm trends, identify reversals, and assess market strength. This article explores the importance of trading value in technical analysis and how traders utilize it to enhance their strategies.

Understanding Trading Value

Trading value, often referred to as volume, is the total quantity of a financial asset traded within a specific timeframe. It indicates the level of activity surrounding a particular security and provides insights into market sentiment. When trading value is high, it suggests strong interest in the asset, whereas low trading value indicates reduced participation.

Volume is an essential component of technical analysis because it helps validate price movements. If a price trend is accompanied by high volume, it is more likely to be sustainable. Conversely, a price move on low volume might be weak and short-lived. Understanding trading value allows traders to distinguish between genuine market movements and potential price manipulations.

The Importance of Trading Value in Technical Analysis

1. Confirmation of Trends

One of the primary roles of trading value in technical analysis is to confirm trends. When prices move in a particular direction, traders look at volume to determine whether the trend has strong support. A bullish trend accompanied by increasing volume signals strong buying interest, making it more likely to continue. On the other hand, a declining market with rising volume suggests strong selling pressure, reinforcing the downward movement.

For example, if a stock is rising but volume remains low, it may indicate weak interest, suggesting a possible reversal. Conversely, if the stock rises with a significant increase in volume, the uptrend is likely to continue.

2. Identifying Market Reversals

Trading value can also signal potential market reversals. Sudden spikes in volume often precede major price reversals. This is because large institutional traders and investors enter or exit positions, leading to abrupt changes in market direction.

A common reversal pattern is the "volume climax," where a stock experiences a surge in trading volume at a market top or bottom. If a security has been in an uptrend and suddenly experiences heavy volume with little price gain, it could indicate that buying pressure is exhausted and a reversal may be imminent. Similarly, during a downtrend, a sharp increase in volume with price stabilization may suggest a bottoming-out phase.

3. Breakout and Breakdown Confirmation

Breakouts occur when an asset's price moves above a key resistance level, while breakdowns happen when it falls below a support level. Trading value plays a crucial role in confirming these movements.

For a breakout to be valid, it should be accompanied by a significant increase in volume. This indicates that buyers are strongly supporting the move, increasing the likelihood of sustained upward momentum. If the breakout occurs on low volume, it may be a false breakout, where the price quickly returns to its previous levels.

Similarly, a breakdown below a critical support level should be confirmed by high trading value, indicating strong selling pressure. A low-volume breakdown may lack conviction and could result in a rebound.

4. Divergence Analysis

Volume divergence occurs when price movement is not supported by corresponding changes in trading value. This divergence can signal a weakening trend and potential reversal.

For instance, if a stock continues to rise but volume starts decreasing, it suggests that buying interest is waning. This could indicate an upcoming price decline. Similarly, if a stock is in a downtrend but trading value starts increasing, it could mean selling pressure is reducing, and a reversal to the upside might be near.

5. Assessing Market Strength

Market strength is a key component of technical analysis, and trading value helps traders gauge it effectively. Strong trends are usually accompanied by high volume, while weak trends show declining volume. By analyzing volume patterns, traders can assess whether a trend has the strength to continue or if a potential reversal is on the horizon.

Key Volume-Based Indicators

To effectively use trading value in technical analysis, traders often rely on volume-based indicators. Some of the most popular ones include:

1. On-Balance Volume (OBV)

OBV is a cumulative volume indicator that adds volume on up days and subtracts it on down days. It helps traders identify whether volume is supporting the price trend. A rising OBV suggests that buying pressure is increasing, confirming an uptrend, while a declining OBV indicates selling pressure, supporting a downtrend.

2. Volume Weighted Average Price (VWAP)

VWAP calculates the average price of a security, weighted by volume. It is often used by institutional traders to assess whether the current price is overvalued or undervalued relative to average trading levels. If the price is above VWAP, it suggests a bullish trend, while a price below VWAP indicates a bearish trend.

3. Accumulation/Distribution (A/D) Line

The A/D line measures the flow of money into or out of a security. If the A/D line is rising while the stock price is declining, it signals that accumulation (buying) is occurring, which could lead to a price reversal. Conversely, a falling A/D line with a rising price suggests distribution (selling), warning of a potential downturn.

4. Chaikin Money Flow (CMF)

CMF is another volume-based indicator that assesses buying and selling pressure over a specific period. A positive CMF value indicates strong buying pressure, while a negative CMF suggests selling dominance. Traders use CMF to confirm price trends and potential reversals.

Practical Application of Trading Value

To illustrate the significance of trading value in technical analysis, consider a scenario where a stock is experiencing a bullish breakout above a resistance level. If the breakout is accompanied by a substantial increase in volume, it validates the movement, encouraging traders to enter long positions. However, if the breakout occurs on low volume, traders may be skeptical and wait for further confirmation before acting.

Using a Demo Account, traders can practice identifying such patterns without financial risk, refining their strategies before committing real capital.

Similarly, if a stock is declining and reaches a significant support level with high volume, traders might anticipate a breakdown and prepare for further downside. But if volume is low, the support level may hold, leading to a potential price rebound.

Conclusion

Trading value is an essential component of technical analysis that helps traders confirm trends, identify reversals, and assess market strength. By analyzing volume patterns and utilizing volume-based indicators, traders can make more informed decisions and improve their trading strategies. Trillium Financial Broker emphasizes the importance of understanding trading value, allowing investors to differentiate between strong and weak price movements, ultimately leading to better market predictions and profitable trades.

#TradingValue#TechnicalAnalysis#StockMarket#TradingStrategy#MarketTrends#VolumeAnalysis#FinancialMarkets#InvestmentTips

0 notes

Text

Crack the candlestick code, and master the market

#CandlestickPatterns#TechnicalAnalysis#ChartPatterns#TradingSignals#StockCharts#StockMarket#TradingTips#InvestingWisely#MarketTrends#FinancialFreedom

0 notes

Text

📈 Learn Stock Market Trading—Online/Offline Batch! 🚀

📢 Are you ready to master the stock market? Whether you're a beginner or an experienced trader, our expert-led course will equip you with advanced trading skills! 💹💰

✨ What You’ll Learn:

✅ Basics of Stock Market

✅ Advanced Technical Analysis

✅ Futures & Options (F&O) Trading

✅ Reality Trading Concept

✅ Trading Psychology

✅ MTA Special Strategy 🏆

🔗 More Information:

📞 70101 33354

🌐 www.mytradersarena.com

🎯 Join Now & Start Your Trading Journey Today!

#tradingInstitute#stockmarketIndia#traderscommunity#chennaitraders#mytradersarena#mytradersarenaofficial#mytradersarenastockmarket#tradingfloor#chennai#cowrkingspace#tradinghub .#🔻#stockmarket#tradingeducation#investsmart#financialfreedom#tradinglife#stockmarketindia#futuresandoptions#learntotrade#wealthcreation#technicalanalysis#stocktrading#onlinetrading#passiveincome#tradermindset#MTAStrategy 🚀#student#srmuniversity#annauniversity

0 notes

Text

This Stock Can Gap Up And EXPLODE (RIP to Short Sellers)

🩳🔥This Stock Can Gap Up And EXPLODE (RIP to Short Sellers)🩳🔥 https://www.youtube.com/watch?v=Byn2TCGU1-o All eyes are on this HOT stock going into the weekend. This low float, highly shorted stock can be the next AMC or GME like squeeze and can destroy anyone shorting it. keep your notifications on as this is time sensitive and can gap up tomorrow. ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/ET9xcjI 👉 Instagram: https://ift.tt/F5AcBfE ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 Why 2024 Was My BEST YEAR EVER And How 2025 Will Be Even Better! https://youtu.be/JBpA0YX9tQM 👉 Will This Penny Stock SURGE After Huge Partnership News With AT&T? https://youtu.be/8N9lMRLC8f0 👉 This Stock Can Explode in 2025: Here's Why!! https://youtu.be/XZsI7a6vn1Y 👉 Haters LAUGHED When We Alerted This 10X Stock! https://youtu.be/hMpNn6eGPeY ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #stockanalysis #shortsqueeze #trading #stockstobuy #avidtrader Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA February 14, 2025 at 07:07AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes