#xChief

Explore tagged Tumblr posts

Text

EURUSD sets up a bearish trading week. Target 1.0900 📊

0 notes

Text

Abstract:xChief (formerly known as Forex Chief) is a forex broker located in Mwali, regulated by Reg.number HY00923433 the Mwali International Services Authority (MISA). xChief, It was founded in 2014.

0 notes

Text

xChief - $100 No-Deposit Bonus

No-Deposit Bonus – Here at xChief, we credit you with a $100 free bonus on sign-up, with no deposit required. This allows you to try out the company’s services and test your chosen trading strategy. You will get the No-Deposit Bonus automatically within the xChief mobile application, once account verification is successfully completed.

https://www.fxnewsnow.com/news/details/xchief-100-no-deposit-bonus

#FXnewsNow, #ForexNews, #FinancialMarkets, #ForexTrading, #MarketUpdates, #EconomicNews, #FXAnalysis, #CurrencyTrading, #GlobalEconomy, #ForexTraders, #Finance, #Investing, #DayTrading, #StockMarket, #Crypto, #Cryptocurrency, #Blockchain, #Trading, #InvestmentTips, #FinanceNews, #MoneyManagement, #WealthBuilding, #FinancialFreedom, #InvestmentStrategy, #MarketTrends, #Dubai, #UAE, #UnitedArabEmirates,

1 note

·

View note

Text

Test the Forex Waters Risk-Free: Claim Your $100 No Deposit Bonus at XChief (April 2024)

Are you ready to explore the dynamic world of forex trading without risking your own funds? Look no further! Xchief.com, a reputable online broker, offers an enticing $100 no deposit bonus to kickstart your trading journey. In this post, we’ll guide you through the steps to claim this bonus, highlight the associated conditions, and explain the withdrawal process. How to Get the Bonus? Sign Up: …

View On WordPress

0 notes

Text

+3

❝I said,

stay the f u c k back.❞

#brokensoldier#fckwallstreet#xchief#ellie's defensive against older men she doesn't know#especially after david#u gh#[ ; v: main ]

3 notes

·

View notes

Text

“ Hey, Charlie! I didn't think you'd be home. Looks like I beat Bella. Do you mind if I wait here for her? ”

1 note

·

View note

Text

❝One.❞ ❝Two.❞ ❝Three.❞ ❝Four——-❞

❝——......❞

❝....Oh!❞ ❝Hey, Mister Swan.❞

❝————————…!❞ ❝Dang it!❞

❝One—❞

2 notes

·

View notes

Text

EURUSD открывает торговую неделю с медвежьего настроения. Цель 1,0900 📊

0 notes

Text

// There's a Charlie? dudeeeeeeeeeeeeee let me love you. Charlie is amazing! There's been Charlie roleplayers before, but none have actually stuck around.

2 notes

·

View notes

Text

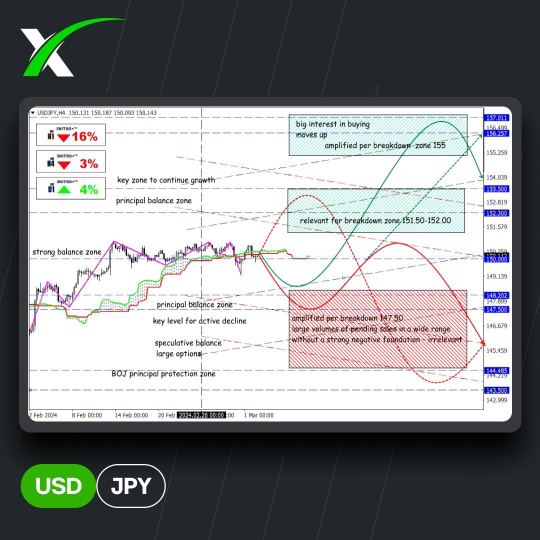

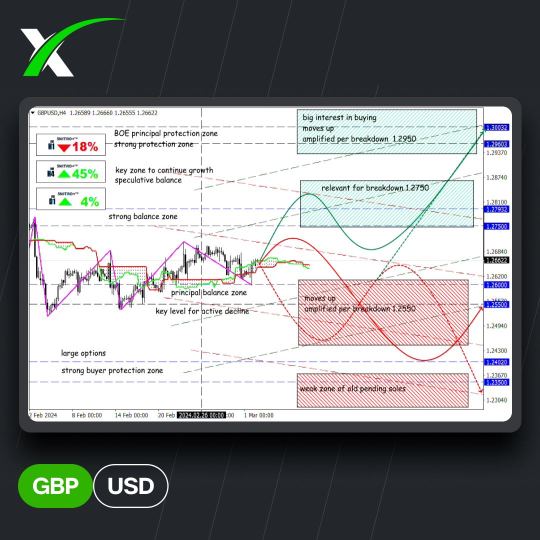

GBPUSD заслуживает особого внимания!

0 notes

Text

GBPUSD deserves special attention

0 notes

Text

Solana could grow by 20%

0 notes

Text

💱 Target levels and forecast for the week 04.03. – 08.03.

We are in for a challenging week. ⠀ NFP: signs of continued strength in the labor market are inevitable, and a strong economy could lead to a resurgence in inflation. The unemployment rate is expected to remain at 3.7% and wage growth is expected to slow. ⠀ Powell testimony: before NFP, it is worth listening to the semi-annual monetary policy report before the House committee on Wednesday and the Senate committee on Thursday. ⠀ ECB meeting: no change in policy is expected, investors will wait for the magic mantra to be repeated that it is too early to discuss rate cuts. ⠀ Oil prices: OPEC+ extended oil production cuts for Q2 in an attempt to prevent a global surplus and support prices. Commentary on this topic has garnered speculation on major benchmarks, but within reasonable limits. ⠀ Fans of Asian assets are advised not to miss the publication of China's CPI and PPI tomorrow morning, we are waiting for the market reaction on Monday. ⠀ Recall the fundamental events that you need to pay attention to (GMT 0 time): ⠀ Tue, 05 USD: Services, composite PMI (14:45); ISM Non-Manufacturing PMI, Employment, Prices (15:00); API Weekly Crude Oil Stock (21:30) GBP: Services, composite, PMI (09:30) ⠀ Wed, 06 AUD: GDP, Retail Sales (00:30) USD: ADP Nonfarm Employment Change (13:15); Fed Chair Powell Testifies; JOLTs Job Openings (15:00); Crude Oil Inventories (+Cushing) (15:30); Beige Book (19:00) ⠀ Thu, 07 AUD: Trade Balance (00:30) CNY: Exports, Imports, Trade Balance (03:00) EUR: ECB Monetary Policy Statement, Interest Rate Decision (13:15); Press Conference (13:45); President Lagarde Speaks (15:00) USD: Initial Jobless Claims, Exports, Imports, Nonfarm Productivity, Trade Balance (13:30); Fed Chair Powell Testifies (15:00); ⠀ Fri, 08 USD: Nonfarm Payrolls (13:30); WASDE Report (17:00)

#EURUSD#GBPUSD#USDJPY#XTIUSD#Profits#xChief#forexsignals#MarketFocus#forexnews#Stock#StopLoss#EconomicCalendar#worldnews#forexmarket

0 notes

Text

💱 Целевые уровни и прогноз на неделю 04.03. – 08.03.

⠀ Нам предстоит сложная неделя. ⠀ NFP: признаки сохранения прочности на рынке труда неизбежны, а сильная экономика может привести к возобновлению инфляции. Ожидается, что уровень безработицы сохранится на уровне 3,7%, а рост заработной платы замедлится. ⠀ Показания Пауэлла: перед NFP стоит послушать полугодовой отчет по монетарной политике перед комитетом Палаты представителей в среду и комитетом Сената в четверг. ⠀ Заседание ЕЦБ: изменений в политике не ожидается, инвесторы будут ждать повторения волшебной мантры о том, что пока рано обсуждать снижение ставок. ⠀ Цены на нефть: ОПЕК+ продлил сокращение добычи нефти на 2 квартал, пытаясь предотвратить глобальный профицит и поддержать цены. Комментарии на эту тему гарантируют спекуляции на основных бенчмарках, но в разумных пределах. ⠀ Фанатам азиатских активов рекомендуем не пропустить публикацию CPI и PPI Китая завтра утром, реакцию рынка ждем в понедельник. ⠀ Фундаментальные события, на которые необходимо обратить внимание (время GMT 0): ⠀ Вт, 05 USD: PMI – композитный, сферы услуг (14:45); ISM для непроизводственной сферы – PMI, занятость, цены (15:00); запасы нефти по данным API (21:30) GBP: PMI – композитный, сферы услуг, (09:30) ⠀ Ср, 06 AUD: ВВП, розничные продажи (00:30) USD: Статистика рынка труда от ADP (13:15); выступление Пауэлла; число открытых вакансий от JOLTS (15:00); запасы сырой нефти (+ в Кушинге) (15:30); Бежевая Книга (19:00) ⠀ Чт, 07 AUD: Торговый баланс (00:30) CNY: Экспорт, импорт, торговый баланс (03:00) EUR: Заседание ЕЦБ, процентная ставка (13:15); пресс-конференция ЕЦБ (13:45); выступление Лагард (15:00) USD: Число заявок на пособие по безработице, производительность труда в несельскохозяйственном секторе (13:30); выступление Пауэлла (15:00); ⠀ Пт, 08 USD: Nonfarm Payrolls (13:30); отчет WASDE (17:00)

#EURUSD#GBPUSD#USDJPY#XTIUSD#Profits#xChief#forexsignals#MarketFocus#forexnews#Stock#StopLoss#EconomicCalendar#worldnews#forexmarket

0 notes