#cadjpy

Explore tagged Tumblr posts

Text

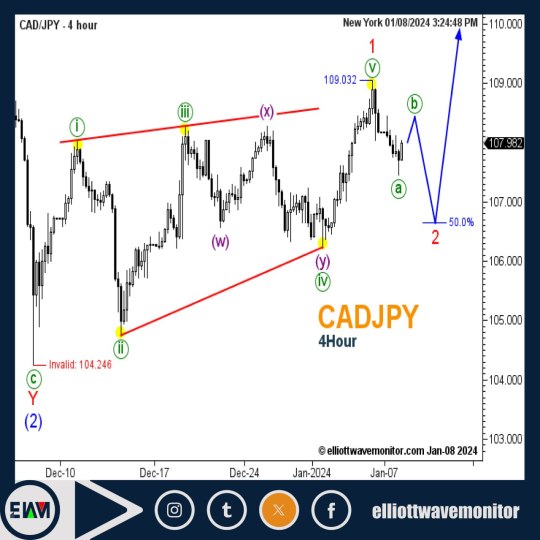

CADJPY - 4Hour

#forex#forextrader#elliottwave#bitcoin#investing#priceaction#forextraining#marketing#eurusd#forexprofit

3 notes

·

View notes

Text

@CADJPY(H4)-Pattern: Gartley : SellStop@: 110.20, StopLoss: 110.53, TakeProfit_1: 109.71, TakeProfit_2: 109.26, TakeProfit_3: 108.94-2025.01.07 06:29

FxMath Harmonic Patterns Scanner @CADJPY(H4)-Pattern: Gartley : SellStop@: 110.20, StopLoss: 110.53, TakeProfit_1: 109.71, TakeProfit_2: 109.26, TakeProfit_3: 108.94 Pay 89$ by Crypto instead of 199$ by regular payments MT4 Payment Link: https://commerce.coinbase.com/checkout/d38bd415-87a7-4bf0-9c76-1889fa393ef8 MT5 Payment Link:…

View On WordPress

0 notes

Video

youtube

CADJPY: Getting into my low risk BUY territory (LRBT)

0 notes

Text

Forex MT4 chart protected profits in CADJPY M15 non repaint signal. ( More info inside Official Website: wWw.ForexCashpowerIndicator.com ). . ⭐ Cashpower Indicator *Lifetime License with right to Future updates versions FREE. No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees; Lifetime License ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification ✅ Powerful AUTO-Trade Option Subscription . ✅ *Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.* . PS:( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our Genuine old Indicator . Beware, this FAKE FILE reproduction can break and Blown your Mt4 account and also currupt your computer. . Recommended FX Brokerage to run Cashpower-XM Broker: https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

#forexindicator#cashpowerindicator#indicatorforex#forex#forexindicators#forexprofits#forexsignals#forextradesystem#forexvolumeindicators#forexchartindicators

0 notes

Video

youtube

#CADJPY Technical Analysis and Trade Idea

0 notes

Text

CADJPY: Pullback From Key Structure 🇨🇦🇯🇵

📉CADJPY may drop from a key daily horizontal resistance.

The price formed a double top on that and violated its neckline.

Goals: 109.86 / 109.6 ————————— Daily/1H time frames

More news on my blog

0 notes

Text

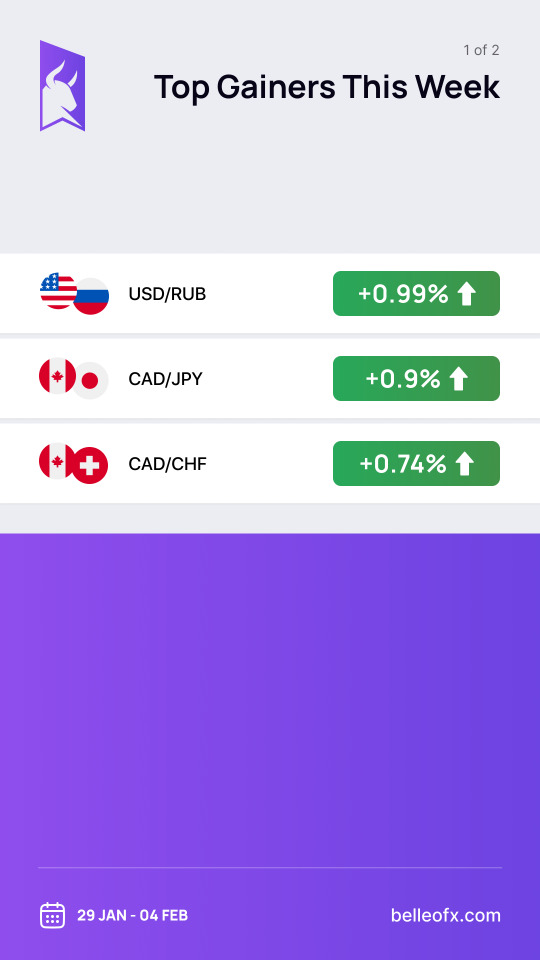

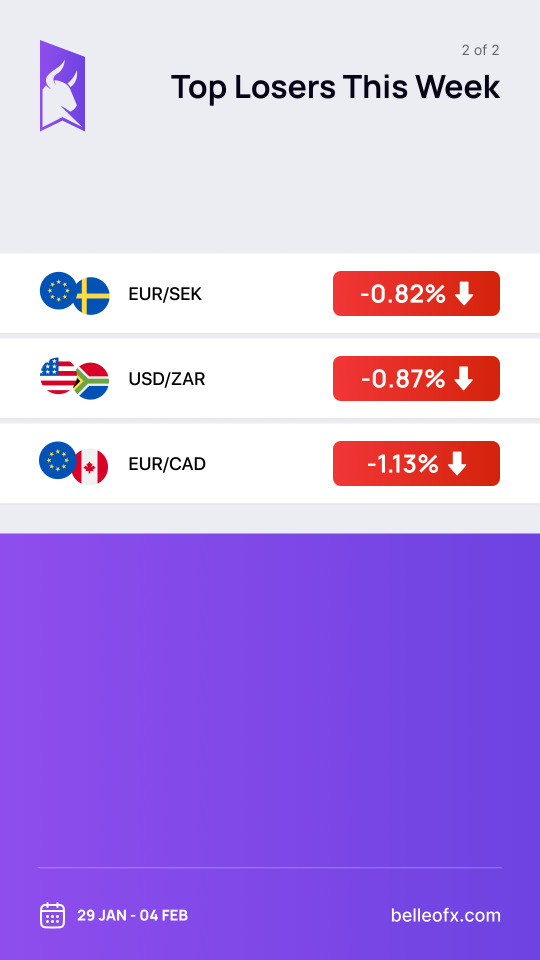

Presenting our weekly top performers and underperformers [29 Jan - 04 Feb, 2024]:

📈Top Gainers This Week ✓ USDRUB +0.99% ✓ CADJPY +0.90% ✓ CADCHF +0.74%

📉Top Losers This Week ☒ EURSEK -0.82% ☒ USDZAR -0.87% ☒ EURCAD -1.13%

Ready to take control of your trading journey? Open your live trading account today - Seize the Bull within you! 📈🐃

Join now: https://pa.belleofx.com/en/signup

BelleoFX Market Updates

0 notes

Text

افضل استراتيجية تداول و تعلم اساسيات التداول بالعملات الأجنبية ( الفوركس ) https://forextrading.auncan.com XAUUSD - BTCUSD - EURUSD - GBPUSD - AUDUSD - AUDCAD - AUDCHF - AUDJPY - AUDMXN - AUDNZD - CADCHF - CADJPY - CHFJPY - EURAUD - EURCAD - EURCHF - EURGBP - EURJPY - EURNZD - GBPAUD - GBPCAD - GBPCHF - GBPJPY - GBPNZD - NZDCAD - NZDCHF - NZDJPY - NZDUSD - USDCAD - USDCHF - USDJPY - USDMXM - USDZAR

0 notes

Text

CADJPY, vicini alla MML W1

Ormai molte posizioni sono state chiuse sul CADJPY... #traderlife #business #money #forextrader #trading #invest #millionaire #forextraining #forex #scalping #intraday #business #entrepreneur #motivation #marketing #success #money #smallbusiness #entrepreneurship #businessowner #mindset #inspiration #lifestyle #startup #digitalmarketing #goals #bhfyp #life #branding #investment #finance #fashion #work #socialmedia Read the full article

0 notes

Text

Cặp tiền CADJPY là gì? Cách giao dịch CADJPY ra sao?

Cặp tiền CADJPY là một trong những cặp tiền chéo trong thị trường ngoại hối để chỉ tỷ giá giữa đồng tiền Canada và đồng Yên Nhật Bản.

Trong cặp tiền này, đồng tiền Canada (CAD) được coi là đồng tiền cơ bản và đồng Yên Nhật Bản (JPY) là đồng tiền đối với đồng tiền cơ bản.

Tức là, nếu giá trị của tiền CADJPY tăng, điều đó có nghĩa là đồng tiền Canada đã tăng giá trị đối với đồng Yên Nhật Bản hoặc đồng Yên Nhật Bản đã giảm giá trị đối với đồng tiền Canada.

0 notes

Text

@CADJPY(H1)-Pattern: Butterfly : SellStop@: 110.21, StopLoss: 110.52, TakeProfit_1: 109.72, TakeProfit_2: 109.27, TakeProfit_3: 108.96-2025.01.07 06:29

FxMath Harmonic Patterns Scanner @CADJPY(H1)-Pattern: Butterfly : SellStop@: 110.21, StopLoss: 110.52, TakeProfit_1: 109.72, TakeProfit_2: 109.27, TakeProfit_3: 108.96 Pay 89$ by Crypto instead of 199$ by regular payments MT4 Payment Link: https://commerce.coinbase.com/checkout/d38bd415-87a7-4bf0-9c76-1889fa393ef8 MT5 Payment Link:…

View On WordPress

0 notes

Text

Master CADJPY with Delta Hedging: The Hidden Formula Traders Ignore The Hidden Formula Only Experts Use: CADJPY + Delta Hedging Strategies Let’s face it: trading is like a rollercoaster ride—thrilling, unpredictable, and occasionally nauseating. But when it comes to Forex trading, mastering niche strategies like CADJPY delta hedging can feel like unlocking a VIP pass to the trading amusement park. While most traders chase EURUSD like it’s the only star in the galaxy, CADJPY quietly offers unique opportunities for those in the know. Add delta hedging into the mix, and you’ve got a recipe for precision trades that’ll make your portfolio purr like a satisfied cat. Why CADJPY Deserves Your Attention Think of CADJPY as the underrated indie movie in a sea of blockbuster hits. It doesn’t grab headlines, but its subtleties can pack a punch. Here’s why: - Oil and Risk Sentiment Correlation: CADJPY is heavily influenced by oil prices (thanks to Canada’s oil-driven economy) and global risk sentiment (courtesy of Japan’s yen haven status). Spotting divergences between these drivers can uncover golden trading opportunities. - Volatility Sweet Spot: While it’s not as wild as GBPJPY, CADJPY provides enough movement to capitalize on, without leaving you clutching your trading journal in despair. - Technical Patterns Abound: CADJPY loves a good trendline or Fibonacci retracement. It’s like a textbook example for technical analysis aficionados. What Is Delta Hedging, and Why Should You Care? Delta hedging sounds intimidating, but it’s essentially a fancy term for neutralizing your position’s sensitivity to price movements. By adjusting your hedge as the market moves, you’re playing 4D chess while others are still learning checkers. Here’s how it works: - The Basics: Delta measures how much an option’s price will change for a one-point move in the underlying asset. A delta of 0.5 means the option moves half as much as the underlying. - The Hedge: If you’re long on CADJPY, you can use delta hedging to offset potential losses through options or other currency pairs. - Dynamic Adjustment: As the delta changes with market conditions, you tweak your hedge to stay balanced. Think of it as maintaining your footing on a shifting tightrope. Why Most Traders Get It Wrong (And How You Can Avoid It) Most traders fail with delta hedging because they either: - Ignore Correlations: CADJPY has unique dynamics compared to major pairs. Misjudging oil’s impact or underestimating yen’s safe-haven flows can derail your strategy faster than hitting the wrong button on a high-leverage trade. - Overcomplicate Things: Delta hedging doesn’t have to involve spreadsheets that look like rocket launch calculations. Start simple and build as you gain confidence. - Forget to Adjust: A set-it-and-forget-it approach doesn’t work here. Regular adjustments are key to keeping your hedge effective. The Forgotten Strategy That Outsmarted the Pros Here’s a little-known tactic: combining delta hedging with options straddles on CADJPY during periods of expected high volatility. This approach works because: - Options Straddles: By buying both a call and a put at the same strike price, you’re positioned to profit regardless of direction. - Delta Neutrality: Pairing this with delta hedging minimizes your directional risk while capitalizing on volatility spikes. - Case Study: In June 2023, CADJPY saw a 2% swing following an OPEC meeting. Traders using this strategy locked in gains by adjusting their hedges as volatility unfolded. Game-Changing Tips for CADJPY Delta Hedging - Leverage Cross-Market Analysis: Watch oil futures and S&P 500 volatility indexes (VIX) for clues about CADJPY movements. - Utilize Smart Tools: Platforms like StarseedFX’s Smart Trading Tool can automate delta calculations and position adjustments. Check it out here. - Manage Risk Like a Pro: Never hedge more than 50% of your position until you’re confident in your strategy. Delta hedging isn’t foolproof; it’s a precision tool, not a safety net. The One Simple Trick That Can Change Your Trading Mindset Treat delta hedging as an ongoing conversation with the market rather than a one-time task. It’s like maintaining a long-distance relationship—constant communication and adjustments are key. Monitor your delta weekly, especially during major economic events or oil price fluctuations. Hidden Patterns That Drive CADJPY - Asian Session Trends: CADJPY often sees movement during the Asian trading session when Japanese data or geopolitical news hits the wires. - Oil Inventory Reports: Pay attention to U.S. crude oil inventory data—it’s an indirect yet powerful CADJPY driver. - Seasonal Fluctuations: Historically, CADJPY trends upward during Q4 as oil demand rises and risk sentiment improves. Your Next Move Trading CADJPY with delta hedging isn’t about making big, splashy bets. It’s about precise execution and leveraging niche strategies to gain an edge. Whether you’re just starting out or looking to level up, tools like StarseedFX’s Free Trading Journal can help you track and refine your approach. Take these insights, test them, and share your experiences. The Forex market rewards those who think outside the box—and CADJPY with delta hedging is your golden ticket. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Video

youtube

CADJPY: Nice CUP&HANDLE pattern. 300Pips+ expected buying.

0 notes

Text

Forex Online Trading Platform

Forex Online Trading Platform by cwgmarkets. Forex Broker USD-GBP, EURUSD, GBPAUD and CADJPY Futures trading on MT4 platform. cwgmarkets is a regulated Forex Broker offering a host of facilities for traders to make profits from the markets we are well known for our intuitive platform and top customer support.

0 notes