#title insurance

Explore tagged Tumblr posts

Text

What is Title Insurance and When Do Homebuyers Need It?

2 notes

·

View notes

Text

Elevate Your Transactions with a Leading Commercial Title Insurance Agency

Navigating commercial deals? NexGen Title Agency has your back. As a Commercial Title Insurance Agency, we shield your investments from potential pitfalls, ensuring your rea; estate transactions are rock-solid. Protect your hard-earned assets from any hidden issues that could arise. Visit our website to learn more about our protective solutions. Don't risk your business - let's secure it together. Fill out our quick form on the website to safeguard your commercial journey.

4 notes

·

View notes

Text

Insurance: Protecting Your Real Estate Investment

When you purchase a home or any piece of real estate, it's a significant investment, both financially and emotionally. You spend countless hours searching for the perfect property, secure a mortgage, and go through the intricate process of closing the deal. While you're likely aware of the importance of homeowner's insurance, there's another type of insurance that often goes overlooked but plays a vital role in safeguarding your investment: title insurance.

What is Title Insurance?

Title insurance is a specialized form of insurance that protects homeowners and lenders from financial losses related to defects in a property's title. A property's title is a legal document that establishes ownership and the right to use and possess the property. It also includes any claims or liens against the property, such as unpaid taxes, mortgages, or easements.

When you buy a property, you want to be certain that the seller has a clear and marketable title, which means there are no legal issues that could affect your ownership rights. Title insurance ensures that you are protected if any hidden title defects or legal problems arise after the purchase.

Why Do You Need Title Insurance?

Protection Against Unknown Title Issues: Title insurance provides you with protection against any undiscovered title problems that may arise in the future. Even a meticulous title search can't guarantee that every potential issue will be uncovered. Title insurance offers peace of mind, knowing that you won't be financially responsible for addressing these issues.

2. Safeguarding Your Investment: Your home is likely one of the most significant investments you'll ever make. Title insurance helps protect your investment by minimizing the risk of unexpected title disputes that could result in financial loss or even the loss of your property.

For more information visit → learnwithvm.com

#Title Insurance#Real Estate Investment#Homeownership#Property Ownership#Title Issues#Legal Protection#Lender's Policy#Owner's Policy#Real Estate Closing#Title Search#Title Defects#Mortgage Protection#Hidden Title Problems#Clear Title#Real Estate Transaction#Title Company#Title Examination#Title Policy#Title Search Process#Closing Costs

2 notes

·

View notes

Text

#flat fee mls#flat fee mls listing#flatfeemlslisting#escrow#title insurance#mls listing#listedsimply#california

1 note

·

View note

Text

Protect Your Investment with Comprehensive Title Insurance Today!

Protect your property investment with comprehensive title insurance from a trusted provider. Our title insurance policy in Lake Charles, Louisiana, safeguards homeowners and lenders against title defects, legal disputes, and unforeseen claims. With years of industry experience, we ensure a smooth closing process and offer peace of mind for residential and commercial properties. Contact Lake Area Title at 337-433-9436 for more details!

#estate planning#real estate transactions#title insurance agency#title insurance#best title insurance company#real estate closing services#settlement services

1 note

·

View note

Text

How Much Are Closing Costs in Orange County California: Real Estate Transactions Guide

Credit: Image by Alena Darmel | Pexels

Unlocking the Mystery: How Much Are Closing Costs in Orange County, California?

What are, and how much are closing costs in Orange County, California?

Other costs that come under closing costs are those charged when closing a real estate deal and can be paid either by the buyer or the seller, licensed agents, etc.

In Orange County, the specific sum may differ depending on parameters such as the property's value, the particular terms of the mortgage loan, and the details of the individual transaction.

Understanding these expenses is equally important, especially for anyone in the market who wants to purchase or sell a house in this prime area.

This article defines the various charges included under the broad umbrella of closing costs in Orange County to assist anyone in estimating the charges correctly.

Key Elements of Closing Costs

Loan Origination Fees

These are fees that the borrower perceives as a cost that the lender has imposed on the borrower for providing the loan. They usually range from five percent to one percent of the loaned amount.

Appraisal Fees

A realtor must be hired to make an appraisal to help determine the property's value. This fee may range typically from $300 to $600.

Title Insurance

Title insurance covers future events related to a property's title. The price difference ranges, on average, from $500 to about $1500.

Escrow Fees

An escrow company assists the whole deal with the cash distribution process, completing the entire process as expected. The costs generally used to obtain an escrow may range from $500 to $2000.

Recording Fees

Your local government could collect these fees from you to help you process the requirements needed to transfer the property into your name. They usually cost at least $100 to $250.

Real Estate Agent Commissions

Real estate agent commissions often vary from 5% to 6% of the sale amount and are shared equally between the seller's and the buyer's agent.

Home Inspection Fees

A home inspection costs between $300 and $500 and helps ensure that all the property's parts are functional.

Notary Fees

These are sometimes needed to notarize other documents that might be required, and the cost could be $100-$150.

Pest Inspection Fees

Some instances require a pest inspection, usually costing between $100 and $200.

Prepaid Expenses include property tax, home insurance, and mortgage interest. The figure may differ depending on the kind of property and loan.

Factors Affecting Closing Costs

Several factors can affect closing costs in Orange County, including:

Property Price

Closing costs for homes sold at higher prices are typically higher because they are calculated based on a percentage of the sales price.

For instance, expenses such as title insurance, escrow fees, and transfer taxes are often proportional to the property's value. Additionally, more significant mortgage amounts can increase loan origination, appraisal, and points fees.

Therefore, buyers and sellers should expect higher closing costs for properties sold at significant amounts.

Type of Loan

Besides, additional requirements are specific to some types of loans and the relevant fees. For example, the F.H.A. loan may be simplified by its relatively high costs, such as requiring a more significant down payment or other initial costs. Still, it has lower interest rates than conventional loans.

Negotiation

Commission may also be bargained between the purchaser and the property vendor. For example, a seller can offer to 'buy down' a part of the closing cost attached to the real estate to assure the buyer to close the transaction.

Service Providers

Consumers must opt for fewer service providers, including title companies, Escrow Companies, home inspectors, and other title closing costs. It is also important to note that fees differ from broker to broker, so it is prudent to note the fees charged.

Location

Certain local taxes and fees, like special assessments or transfer taxation, may vary depending on the particular neighborhood or district within Orange County.

For example, some areas might have higher special assessment fees for community improvements, while transfer taxes might differ based on local ordinances.

Both buyers and sellers must be mindful of these potential variations when exploring properties in different parts of the county, as they can impact the overall cost of the transaction.

Awareness of these factors allows individuals to make informed decisions and accurately assess the financial implications of their real estate transactions.

Reducing Closing Costs

Both consumers and sellers can take steps to minimize their closing costs, including:

Shop Around

It's beneficial to contact multiple lenders and different title and escrow companies to inquire about their fees. By comparing rates, you can strive to find the most reasonable and competitive pricing for your needs.

Negotiate

In most cases, there is usually a bargaining process with the other side about splitting or reimbursing some or all the closing costs. For instance, a seller may propose to the buyer that he or she bear the invoice of the owner’s title insurance.

Review the Loan Estimate

Borrowers are entitled to receive the loan estimate from the lender within three days of application completion. To establish the probable closing costs, read the document and establish whether any areas of understanding are ambiguous or if any fees seem to be inordinately high.

Ask for Seller Concessions

Potential buyers can also ask sellers for certain contingencies to pay some closing costs while bargaining for the purchase price. This can be particularly helpful in a buyer’s market because sellers might be more open to such an approach.

Use a No-Closing-Cost Loan

Different lenders provide no-closing-cost mortgage loans in which the closing costs are included in the Mortgage Balance or paid off through a higher Mortgage Rate. Although this helps save money initially, it leads to an increased term of paying off the borrowed sum.

The following points explain why closing costs should be considered an integral part of real estate transactions in Orange County, California. Both buyers and sellers must also be aware of these costs to conduct a transaction efficiently.

In every real estate transaction, expenses related to the conveyance of title to real estate must be ascertained, and these expenses may indeed affect the financial relationships between the two entities.

Get more fascinating information on our website at https://occoastrealestate.com/orange-country-closing-costs/.

#Community Information#Real Estate Blogs#Homes for Sale#Orange County CA Real Estate#Orange County CA Closing Costs#Property Taxes#Escrow#Title Insurance#Appraisal Fees#Loan Origination Fees#Home Inspection#Transfer Taxes#Recording Fees#Attorney Fees#Notary Fees#HOA Fees#Home Warranty Fees#Pest Inspection Fees#Survey Fees

1 note

·

View note

Text

#Property legal status#Court cases on property#Real estate disputes#Registrar's Office inquiry#Right to Information (RTI) Act#Digital property records#Les Pendens order#Due diligence in real estate#Title insurance#Property transaction risks

1 note

·

View note

Text

How Title Insurance can Help Change Realty Landscape

Begin a new journey of confidence with Title Insurance, reshaping the realty horizon. Experience the security of clear ownership, reduced risks, and potential interest rate benefits. It's not just about property, but the assurance of a home where dreams flourish. Trust in a transformed real estate landscape, where Title Insurance becomes your steadfast companion, paving the way for a brighter tomorrow.

Read more: https://propertygully.com/how-title-insurance-can-help-change-realty-landscape/

1 note

·

View note

Text

Everything About Title Insurance in Alberta: A Complete Guide for You!

Bought a new home? Congratulations! Have you ever considered what could go wrong when purchasing a home? Title insurance is something homebuyers often overlook, but it's crucial for protecting your investment against fraud.

Let's explore what title insurance is, why you may need it, and how to make sure you're covered when investing in a new property.

What is Title Insurance?

When you buy a home, you receive a title - a legal document that shows ownership of the property. Title insurance protects against defects in the title that may not surface during initial title searches before the sale. For example, issues like unpaid taxes, unclear heirs, or false deeds may come up later that could question your rights as the legal owner. Title insurance defends you financially in cases of third-party claims related to your home's title. It's a one-time cost that's typically required by mortgage lenders.

youtube

Why Do You Need Title Insurance?

Title insurance serves a few key purposes:

First, it facilitates mortgage approvals by assuring the lender that the title they'll hold as collateral has no defects.

It also safeguards your biggest investment - your home. Even extensive title searches can miss issues like forgery or unpaid debts, which title insurance would cover.

Lastly, it saves you the substantial legal fees that would come with defending your property rights.

Overall, title insurance lets you rest assured that your home is protected.

What Should You Look for?

As you go for title insurance, prioritize providers who offer comprehensive protection, have strong financial backing, and feature online tools for tracking your policy. Look for no deductibles and low premiums. Also, check if the insurer offers post-purchase monitoring in case new encumbrances appear. Choosing the right title insurance from a trusted provider safeguards the roof over your head.

Wrap Up:

Securing title insurance is a critical part of buying a home, assuring defects while streamlining the entire transaction. As you search for your dream home, connect with a reputable Alberta title insurance company early on to make sure you've selected ample coverage against fraud or claims. Protecting your most valuable asset is worth that extra peace of mind.

1 note

·

View note

Text

Knowing what needs to get done before a closing can be a lot, and you will probably have many questions, but ya know what? I have a lot of answers, and I'm here to help.

1 note

·

View note

Text

#brucelee knows what is up!

This week’s shout out goes to @lakewoodtitletx

@MyLifeWerks fedplanwerks.com @amdecinc @AcePDR1 @BentleyMolding

#dallas#sailing#mattress#lewisvilletx#garland#title insurance#insurance agent#bruce lee#injectionmolding#lifeinsurance#screen printing services#auto dent repair

1 note

·

View note

Text

Demystifying Title Insurance: Your Trusted Shield in Real Estate

When it comes to one of life’s most significant financial investments—real estate—ensuring that your ownership is free from any encumbrances or disputes is paramount. This is where title insurance comes into play, serving as a safeguard against potential risks that may threaten your property rights. In this article, we’ll demystify the world of title insurance, explaining what it is, why it’s…

View On WordPress

1 note

·

View note

Text

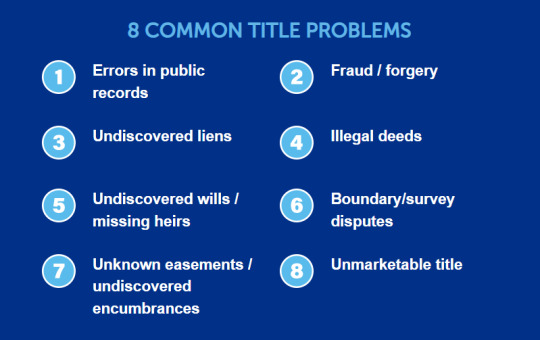

8 Common Title Problems & How Title Insurance Can Help

Buying a home is so exciting! 🏡 But did you know your dream home could have hidden title problems that threaten your ownership rights? 😱 It’s true – and more common than you’d think! Before you buy, make sure to get title insurance. It’s the best way to defend your property from past defects.👍 Here’s why it’s so important: First, title issues like forged documents or clerical errors can pop up…

View On WordPress

1 note

·

View note

Text

Title companies goes extra mile for a hassle-free property-buying process

Title companies play an essential role in the buying process when buying a home. There are title companies near me that verify whether a home buyer has a legitimate title to the property. The main purpose of title companies for real estate is to verify that a seller has the right to sell the property. Visit us for more details.

1 note

·

View note

Video

youtube

Title insurance Company in Florida, providing services throughout the st...

0 notes

Text

Get Efficient Title Insurance Services for Secure Transactions!

Title insurance agents protect property buyers and lenders from financial loss due to defects in titles, such as liens or encumbrances. Our skilled agents provide peace of mind by safeguarding investments along with resolving any title-related issues that may arise during the real estate process. Contact Lake Area Title at 337-433-9436 for more details.

#title insurance agency#insurance agents#Title insurance#title insurance firm#best title insurance company

0 notes