#HOA Fees

Explore tagged Tumblr posts

Note

just out of curiosity, what motivated you to move into a gated community? was it the only home available at a decent price, or was ‘gated community’ part of the factor? i am asking because i personally would rather set myself on fire than live in a gated community, and i genuinely (and non judgementally! i promise!) am fascinated to hear the motivation/reasoning behind seeking one out, *if* that was part of your decision to move there? bc thats a very different perspective than my own

(feel free to ignore this message obviously)

As a high income single female I felt it was better for security and peace of mind. Also, it was a good investment at the time as we were able to get in at pre-construction prices. That meant getting an immediate increase in property value upon collecting the keys. It has since appreciated in value faster than I hoped too, so my mortgage balance is now only 40% of the new market value. The HOA fees of this development were low enough too. And the rules and restrictions are not as asinine as others I saw lol. It's been 4 years, so far so good.

0 notes

Text

Lol I’ve just clocked HOA’s fees are basically council tax

Thats so wild cause there is pretty much little accountability but they’re doing the work that council over here in the uk handle

0 notes

Text

How Much Are Closing Costs in Orange County California: Real Estate Transactions Guide

Credit: Image by Alena Darmel | Pexels

Unlocking the Mystery: How Much Are Closing Costs in Orange County, California?

What are, and how much are closing costs in Orange County, California?

Other costs that come under closing costs are those charged when closing a real estate deal and can be paid either by the buyer or the seller, licensed agents, etc.

In Orange County, the specific sum may differ depending on parameters such as the property's value, the particular terms of the mortgage loan, and the details of the individual transaction.

Understanding these expenses is equally important, especially for anyone in the market who wants to purchase or sell a house in this prime area.

This article defines the various charges included under the broad umbrella of closing costs in Orange County to assist anyone in estimating the charges correctly.

Key Elements of Closing Costs

Loan Origination Fees

These are fees that the borrower perceives as a cost that the lender has imposed on the borrower for providing the loan. They usually range from five percent to one percent of the loaned amount.

Appraisal Fees

A realtor must be hired to make an appraisal to help determine the property's value. This fee may range typically from $300 to $600.

Title Insurance

Title insurance covers future events related to a property's title. The price difference ranges, on average, from $500 to about $1500.

Escrow Fees

An escrow company assists the whole deal with the cash distribution process, completing the entire process as expected. The costs generally used to obtain an escrow may range from $500 to $2000.

Recording Fees

Your local government could collect these fees from you to help you process the requirements needed to transfer the property into your name. They usually cost at least $100 to $250.

Real Estate Agent Commissions

Real estate agent commissions often vary from 5% to 6% of the sale amount and are shared equally between the seller's and the buyer's agent.

Home Inspection Fees

A home inspection costs between $300 and $500 and helps ensure that all the property's parts are functional.

Notary Fees

These are sometimes needed to notarize other documents that might be required, and the cost could be $100-$150.

Pest Inspection Fees

Some instances require a pest inspection, usually costing between $100 and $200.

Prepaid Expenses include property tax, home insurance, and mortgage interest. The figure may differ depending on the kind of property and loan.

Factors Affecting Closing Costs

Several factors can affect closing costs in Orange County, including:

Property Price

Closing costs for homes sold at higher prices are typically higher because they are calculated based on a percentage of the sales price.

For instance, expenses such as title insurance, escrow fees, and transfer taxes are often proportional to the property's value. Additionally, more significant mortgage amounts can increase loan origination, appraisal, and points fees.

Therefore, buyers and sellers should expect higher closing costs for properties sold at significant amounts.

Type of Loan

Besides, additional requirements are specific to some types of loans and the relevant fees. For example, the F.H.A. loan may be simplified by its relatively high costs, such as requiring a more significant down payment or other initial costs. Still, it has lower interest rates than conventional loans.

Negotiation

Commission may also be bargained between the purchaser and the property vendor. For example, a seller can offer to 'buy down' a part of the closing cost attached to the real estate to assure the buyer to close the transaction.

Service Providers

Consumers must opt for fewer service providers, including title companies, Escrow Companies, home inspectors, and other title closing costs. It is also important to note that fees differ from broker to broker, so it is prudent to note the fees charged.

Location

Certain local taxes and fees, like special assessments or transfer taxation, may vary depending on the particular neighborhood or district within Orange County.

For example, some areas might have higher special assessment fees for community improvements, while transfer taxes might differ based on local ordinances.

Both buyers and sellers must be mindful of these potential variations when exploring properties in different parts of the county, as they can impact the overall cost of the transaction.

Awareness of these factors allows individuals to make informed decisions and accurately assess the financial implications of their real estate transactions.

Reducing Closing Costs

Both consumers and sellers can take steps to minimize their closing costs, including:

Shop Around

It's beneficial to contact multiple lenders and different title and escrow companies to inquire about their fees. By comparing rates, you can strive to find the most reasonable and competitive pricing for your needs.

Negotiate

In most cases, there is usually a bargaining process with the other side about splitting or reimbursing some or all the closing costs. For instance, a seller may propose to the buyer that he or she bear the invoice of the owner’s title insurance.

Review the Loan Estimate

Borrowers are entitled to receive the loan estimate from the lender within three days of application completion. To establish the probable closing costs, read the document and establish whether any areas of understanding are ambiguous or if any fees seem to be inordinately high.

Ask for Seller Concessions

Potential buyers can also ask sellers for certain contingencies to pay some closing costs while bargaining for the purchase price. This can be particularly helpful in a buyer’s market because sellers might be more open to such an approach.

Use a No-Closing-Cost Loan

Different lenders provide no-closing-cost mortgage loans in which the closing costs are included in the Mortgage Balance or paid off through a higher Mortgage Rate. Although this helps save money initially, it leads to an increased term of paying off the borrowed sum.

The following points explain why closing costs should be considered an integral part of real estate transactions in Orange County, California. Both buyers and sellers must also be aware of these costs to conduct a transaction efficiently.

In every real estate transaction, expenses related to the conveyance of title to real estate must be ascertained, and these expenses may indeed affect the financial relationships between the two entities.

Get more fascinating information on our website at https://occoastrealestate.com/orange-country-closing-costs/.

#Community Information#Real Estate Blogs#Homes for Sale#Orange County CA Real Estate#Orange County CA Closing Costs#Property Taxes#Escrow#Title Insurance#Appraisal Fees#Loan Origination Fees#Home Inspection#Transfer Taxes#Recording Fees#Attorney Fees#Notary Fees#HOA Fees#Home Warranty Fees#Pest Inspection Fees#Survey Fees

1 note

·

View note

Photo

What To Consider When Buying An Out-Of-State Property: 6 Essential Tips

Investing in real estate can be a lucrative strategy to build your wealth. With the right guidance and research, purchasing a property offsite can be made less daunting. Consider some essential tips when evaluating potential new properties far from home.

#property#newproperties#realestate#affordable homes#public transportation#hoa fees#outofstateproperty#out of state investment

1 note

·

View note

Text

-might get kicked out for unrelated reasons (HOA) But small look at the landlord situation. Landlord emailed us some legal documents earlier- which included an admission that he's been getting the rent checks (which he was previously claiming we weren't paying and citing as his grounds for eviction) - as well as documentation of two other instances of attempted extortion.... I've lost the plot completely at this point

#like ❓ what are you doing.... that was your entire argument........#-and again not sure what i can share but.#trying to demand payment on late fees....#threatening to email dad's employer if he didn't pay said late fees ....#then admitting that we've been paying the rent- not only on time but a few days early every month-#thereby... making the late fees invalid AND attempted extortion... wyd#edit- i mean actually the hoa issues ARE landlord related ig

137 notes

·

View notes

Text

please consider HOA. w/ @adhdo5's ClockworkLocusts :]

(for cringetober day 1: screenshot redraw)

original screenshots :]. yes i forget to f1 frequently

#I have no better caption. consider them#it's technically october since I'm in est and I CANNOT prep early I NEED to show people things. Okay#this gets many tags cause I am proud of it .#cringetober#cringetober2024#mineblr#and the universe said you were not alone!#I've considered the following tag for hoa but im not sold#and the universe said you forgot to pay your homeowners association fees#OC art

59 notes

·

View notes

Text

I CALLED my fucking mortgage company to make SURE they were going to pay my fucking property taxes and they ONLY PAID PART OF THEM!

30 notes

·

View notes

Text

damn you can buy a house in a country club community for 350k?? I thought it would be more somehow. The amenities are wild.

3 notes

·

View notes

Text

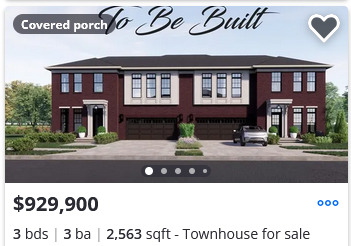

A MILLION DOLLARS TO LIVE IN A FUCKING TOWNHOME (THAT'S NOT EVEN BUILT YET BTW (AKA WE WON'T BUILD THIS HIDEOUS ATROCITY UNTIL TWO MOTHERFUCKERS ARE DUMB ENOUGH TO CLAIM A WANT FOR THIS SHIT))

3 notes

·

View notes

Text

still far too broke to seriously contemplate home buying, but i do check listings for houses that meet certain criteria im interested in sometimes

this shit is baffling though

sometimes water/sewage/trash is included as part of the HOA fee and occasionally there's listings that roll electricity and/or internet into that, too. but this particular listing has none of that.

in what goddamn world is it tempting to pay $5,196 a year to a governing body that nitpicks what you do to the exterior of your home and when you set the trash out and only provides... roof repair and front yard maintenance??? we live in a desert. we don't have lawns.

#i would LOVE to only look at options with no HOAs#but there's a grand total of 41 listings under 250k here and that drops to 5 when looking for ones with no HOA#and i know not every HOA is nuts; my dad took over the one in his neighborhood after the previous head went mad with power#and tried to fine everyone for minor or non-existent infractions#the board that took over was much more reasonable and everyone remains content with it a decade later#but i still wouldnt pay $433 a MONTH for that. jesus.#genuinely what is this money FOR#there's another listing w/ $278 monthly HOA fees and THAT includes water/sewer/trash#what the fuck could this one possibly need $433 a month for#and let's be clear about this: it is not a particularly nice house or a particularly nice neighborhood. it's... fine.

2 notes

·

View notes

Text

Something needs to give so I can buy a house.

#because I’m currently going out of my mind but there’s nothing on the market for me#unless I want to try to afford a $2800 month mortgage and never leave my house#or rent and just waste money again#idk how I’m gonna do this because it’s just me there’s no dual income that will be going into a house#and the lowest prices right now are $325K for 800sq ft#and condos are about the same price wise with $350-$500 a MONTH hoa fees

28 notes

·

View notes

Text

being a homeowner is like “i never have to pay rent again! wahoo!!”

but then you get billed $6,000 from the city for pooping

#babble#I JUST PAID MY CAR INSURANCE NOW I HAVE TO PAY A SEWEGE OFFSET FEE?????#i dont fucking understand i already pay for sewage its divided up in my HOA why am i paying more????

3 notes

·

View notes

Text

$500+ a month HOA fees should be criminal it should get you beheaded reign of terror style it should have an angry mob on your doorstep threatening to hang your children and set your house on fire and yet-

#i hate it here i hate it here i hate jt here i hate it here#every place i could theoretically afford to buy is either in a 55+ community or has an enragingly high HOA fee thus making it unaffordable#its downright predatory we need to start killing people [for legal purposes this is a joke]

6 notes

·

View notes

Text

HOA is charging every unit $3200 for roof repairs what the actual fuck

4 notes

·

View notes

Text

longingly staring at pictures of condos online

#mine#there's one in my area rn that's only 155k! they usually go for 180k-190k#hoa fees are 200 but they cover a lot#I'd jump on it if it weren't for my steadily tanking credit score#I won't be able to afford to pay it off til summer probably and if buying's as rough as last year 🙃🙃🙃

6 notes

·

View notes

Text

Every time I see a condo listing that seems decent only for it to pull the 'tenant in place, invest today!' bullshit makes me want to start biting like I have zero interest in becoming a landlord i just want to move out of my moms house before I turn 30 and don't want to throw money away spending double what I'd pay for a mortgage in rent every month

#kam talks#BITING BITING BITING#and it always sends up red flags because like ok whats wrong with the place that the og landlord doesnt want their ~passive income~ anymore#'just get a house instead' hoa fees on average are less than what id pay on my own for utilities/maintenance and i dont want a lawn#also houses are way more expensive like starter homes are completely extinct in florida

3 notes

·

View notes