#time-savingtips

Explore tagged Tumblr posts

Text

Simple Fixes for Common Recipe Errors

Cooking can be a delicious adventure, but it's not always smooth sailing. No worries. Our friendly, foolproof solutions are here to rescue you from everyday recipe mishaps. Get ready to be the cooking pro you've always wanted to be.

0 notes

Text

Simple Fixes for Common Recipe Errors

Cooking can be a delicious adventure, but it's not always smooth sailing. No worries. Our friendly, foolproof solutions are here to rescue you from everyday recipe mishaps. Get ready to be the cooking pro you've always wanted to be.

0 notes

Text

5 Beauty Hacks Every Woman Should Know

Every woman wants to look her best, but let’s face it, life can be busy and overwhelming. Sometimes, we need quick and easy beauty hacks to elevate our routine and help us feel our best. Here are 10 beauty hacks that every woman should know. Каждая женщина хочет выглядеть как можно лучше, но давайте посмотрим правде в глаза, жизнь может быть занятой и подавляющей. Иногда нам нужны быстрые и…

View On WordPress

#beautyhacks#makeup#quickbeautytips#selfcare#skincare#time-savingtips#babyface#beauty queen#beauty routine#forever young#how you glow#life changing hacks for women#lifehacks#wakeup and makeup#wellness

0 notes

Photo

Its time to move your money from 𝐁𝐀𝐑𝐍𝐈 𝐭𝐨 𝐒𝐈𝐏. 𝐒𝐭𝐚𝐫𝐭 𝐲𝐨𝐮𝐫 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐣𝐨𝐮𝐫𝐧𝐞𝐲 𝐭𝐨𝐰𝐚𝐫𝐝𝐬 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐈𝐧𝐝𝐞𝐩𝐞𝐧𝐝𝐞𝐧𝐜𝐞. 𝐒𝐭𝐚𝐫𝐭 𝐲𝐨𝐮𝐫 𝐒𝐈𝐏 𝐓𝐨𝐝𝐚𝐲. #BarniSeAzadi For any further assistance Feel Free to Contact us at :- +91 97925 01234 Our Website:- www.kstarsip.com 𝐋𝐞𝐚𝐫𝐧 𝐛𝐚𝐬𝐢𝐜 𝐌𝐀𝐍𝐓𝐑𝐀 𝐟𝐨𝐫 𝐬𝐚𝐯𝐢𝐧𝐠 𝐚𝐧𝐝 𝐚𝐜𝐡𝐢𝐞𝐯𝐢𝐧𝐠 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐠𝐨𝐚𝐥𝐬:- https://forms.gle/iJEuP2F96UaUCFsb9 #mutualfunds #sip #moneysavingtips #investment #financialplanning #fundmanagement #savingtips #kstargroup #kstarfinancialservicespvtltd #Lucknow #financialadvisor

0 notes

Text

4 Drawing Time-Saving Tips

From a guy who spent 13 YEARS drawing a comic Video and Text by larsmartinson

In this video, we get great Time-Saving Tips from the artist Lars Martinson that he has learned as I worked on his graphic novel. My name is Lars Martinson and I'm a cartoonist. I devoted 13 YEARS to drawing a graphic novel. In this video, I discuss what went wrong, and layout four things I intend to keep in mind to finish future projects more quickly. Buy my comics! http://larsmartinson.com/buy/ "Fail Faster" video: https://youtu.be/rDjrOaoHz9s MN Original video about me: https://youtu.be/cZSH4axuDI8 For more from larsmartinson @ Website @ Facebook @ Twitter Read the full article

#artist#drawing#drawingfaster#drawinglesson#DrawingTime-SavingTips#drawingtips#drawingtutorial#graphicnovel#LarsMartinson#larsmartinson#Time-SavingTips#tutorial#workfaster

0 notes

Photo

What is motion waste in business?🙋🏻♂️🙋♀️🙋 Never heard of it? Fine. Let me tell you about it...✌ Every distance that you walk or travel (aka motion waste) is money and time. This will impact business profit, productivity, and efficiency💰 Swift left and press play ▶️ to know 👇 ✅What is motion waste? ✅Why motion is not good for your business? ✅How motion waste is being generated? ...and so much more! 👉Have questions? Comment below! Follow @businesscoachchiong for more business improvement tips 🗄 Save this post ✉️ Share this post ❤️ Like this post PS: Struggling to increase business profits and customer satisfaction? Sign up for the Value Stream Mapping (VSM) training to learn how to reduce business wastes and costs. 👉Tap the link in my bio NOW! #manufacturingindustry #manufacturingservices #americanmanufacturing #manufacturingexcellence #manufacturingsector #manufacturingplant #8wastes #organizationalchange #eliminatewaste #leanthinking #problemsolving #problemsolvingskills #leadershipdevelopment #businessgrowthstrategy #increaseprofits #operationalexcellence #processoptimization #businesswaste #savingtips #reducecosts #leanmanagement #leandevelopment #savetimeandmoney #leansystem #companyculture #culturechange #culturetransformation #processexcellence #leanoffice #changemanagement (at Alabama USA) https://www.instagram.com/p/CLg9Br_J8pl/?igshid=17fkb270ufmlb

#manufacturingindustry#manufacturingservices#americanmanufacturing#manufacturingexcellence#manufacturingsector#manufacturingplant#8wastes#organizationalchange#eliminatewaste#leanthinking#problemsolving#problemsolvingskills#leadershipdevelopment#businessgrowthstrategy#increaseprofits#operationalexcellence#processoptimization#businesswaste#savingtips#reducecosts#leanmanagement#leandevelopment#savetimeandmoney#leansystem#companyculture#culturechange#culturetransformation#processexcellence#leanoffice#changemanagement

0 notes

Photo

WHAT HAS LOCKDOWN TAUGHT US ABOUT OUR MONEY HABITS? ⠀⠀ Over the last few months we have had to find a new normal in our lives including things like the way we work, socialize, shop.... but what has this done to our finances? ⠀⠀ I wanted to have a look to see....⠀⠀ ——————————-⠀⠀ 💅🏻 Luxury items - Don’t know about you but I’ve been doing these myself at home which is definitely a money saver!...I do need a beard cut though! ✂️ ⠀⠀ .⠀⠀ 🏋🏼♀️ Exercise is free - I workout a lot at home but this has become so easy over lockdown...saving on gym fees.⠀⠀ .⠀⠀ 🧮 Budgeting has become necessary - with a lot of our wages cut by 80%, or maybe more, cutting costs has become a way of life when before we might not have even thought about it...maybe some of these principles can continue?⠀⠀ .⠀⠀ 🛍 Browsing and impulse buying has stopped - with all the shops shut has buying stuff you don’t need become a realisation?⠀⠀ .⠀⠀ 🍔 We’ve all had to stop eating out - I’m not suggesting we never do this again but not doing it certainly shows how much is spent on it.⠀⠀ .⠀⠀ 💰 Is you emergency fund enough? - It’s been a true eye opener when your income stops as you know it!⠀⠀ .⠀⠀ I think it’s true that lockdown has made us appreciate what we do have.... friends, family, neighbours...these are true wealth. ⠀⠀ ———————————⠀⠀ Just thought I would look as some things lockdown might have made apparent but what have you found? ⠀⠀ Drop them in comments 👇🏻👇🏻👇🏻⠀⠀ Hope you’re keeping well at such a tough time.⠀⠀ .⠀⠀ Comment Like Share⠀⠀ .⠀⠀ #lockdown #lockdownlife #lockdownchallenge #lockdownlearning #lockdownworkout #emergencyfund ##emergencyfunds #ihaveenough #moneysaving #moneysavingtips #savingmoneyiscool #savemoney #savingpennies #savemoneytips #savemoneylivebetter #savingmoney #savingtips #savingsgoals #moneymaker #makethemostofyourmoney #savecash #savingsgoals #bestsaving #budget #budgeting #frugal #frugalliving #whycryovermoney #financialeducation https://www.instagram.com/p/CCtTWPkBKPy/?igshid=60lw0guva3g6

#lockdown#lockdownlife#lockdownchallenge#lockdownlearning#lockdownworkout#emergencyfund#emergencyfunds#ihaveenough#moneysaving#moneysavingtips#savingmoneyiscool#savemoney#savingpennies#savemoneytips#savemoneylivebetter#savingmoney#savingtips#savingsgoals#moneymaker#makethemostofyourmoney#savecash#bestsaving#budget#budgeting#frugal#frugalliving#whycryovermoney#financialeducation

0 notes

Photo

A year later - check back with your status now. How have you changed or grown? . A year ago, my net worth was $686,417.39. . A year later, my net worth is now $846,980.22. . I have gone up in my net worth $160,562.83 or 23.39%. . Now that I am on a break from working (see? No crazy financial independence ramen lifestyle for me), my net worth will dip back down. . Ebb and flow, but the net result is in 10 years I went from $78,097 in my net worth to $846,980.22 ... I have amassed $768,883.22 in 10 years, while living my best life and not being a Scroogette. . The main thing for me is my NET GROWTH trajectory over time. I do not sweat the small dips in the months, even years. . In another 10 year, I can expect to add another $750K to my net worth to be a $1.5M millionaire by the time I am 45. . Is it the most impressive money journey ever? NO. I could have saved much much more money, but I like having work life balance and taking time off here and there in between work, like.. now. . . . #savespendsplurgemoney #debtfreejourney #debtfree #successful #savemoney #success #moneymaker #savingmoney #howtosavemoney #moneysavingtips #savemoneytips #debtfreejourneycanada #savemoneylivebetter #savingtips #savingmoney #richlife #wealth #succeed #savemoneytime #yourbestlife #savemoneytoday #savemoneysavelife #savemoneychallenge #debtfreecommunity #debtfreegoals #debtisdumb #debtfreeliving #debtfreedom #debtfreelife #debtfreecommunitycanada https://www.instagram.com/p/ByobbU4A9ep/?igshid=1ut4s0ywn6qef

#savespendsplurgemoney#debtfreejourney#debtfree#successful#savemoney#success#moneymaker#savingmoney#howtosavemoney#moneysavingtips#savemoneytips#debtfreejourneycanada#savemoneylivebetter#savingtips#richlife#wealth#succeed#savemoneytime#yourbestlife#savemoneytoday#savemoneysavelife#savemoneychallenge#debtfreecommunity#debtfreegoals#debtisdumb#debtfreeliving#debtfreedom#debtfreelife#debtfreecommunitycanada

0 notes

Photo

Welcome to thrifty Thursday tips, every week I’ll let you in some of my thrifty secrets that let me set back from my professional job to spend time with my kids. This week it’s a simple but effective one, you’ll never have to by bottled water again. It take a couple of minutes once a week to prep and you will always have fresh great tasting water as any busy person needs. Follow the pictures to see how it’s done ✅🙏🤩👌😃 #financialhero #smartmoney #mrssmartmoney #savingtips #thriftythursdays #ratrace #timewithkids #spendwell #savewater #savepennies #financialsuperheroes #beyourownhero #beyourownfinancialsuperhero (at Ireland (country)) https://www.instagram.com/p/BqeVVIGnzYY/?utm_source=ig_tumblr_share&igshid=1tmpmaqz98bnq

#financialhero#smartmoney#mrssmartmoney#savingtips#thriftythursdays#ratrace#timewithkids#spendwell#savewater#savepennies#financialsuperheroes#beyourownhero#beyourownfinancialsuperhero

0 notes

Text

Ten Tips to get Christmas sorted!

Money saving tips for Christmas from LoanPig.

We hate to say it but Christmas is coming! Even though it hardly seems five minutes since last Christmas, it’s already that time of year when the clocks are going back, the evenings are darker earlier, and the battle of the Christmas ads is about to begin.

Many of us dread Christmas. We don’t want to: we want to be swept along in the tide of Christmas cheer that seems to engulf all those around us. Which can make us feel very like Scrooge! The problem is money. How can we let go and enjoy ourselves when we are constantly worried about either not being able to pay for things or sliding deeper into debt?

So let’s take a deep breath and look at some ways that we can plan ahead for a Christmas that is heavenly but doesn’t cost the earth.

Here are our Ten Tips:

Decide now what you are doing

This is the first thing to get sorted. Within families Christmas can often lead to squabbles. For that reason we can tend to put off the awkward conversations and the decision-making until nearer the time. But this can lead to a lot of last-minute juggling and you are likely to spend more money if you are rushing around trying to sort out presents and hospitality for unexpected guests.

As well as family, perhaps rethink some of what you do when you meet up with friends. Many of us end up with a lot of different gatherings, and if these are all in pubs or restaurants it can get horribly expensive. So this year why not organise at least some of the get-togethers in people’s’ homes, with everyone contributing food and drink to the party. This will be cheaper than splashing out money you can’t really afford in pubs and restaurants – but just as much fun.

So get these kind of decisions made now so that you have time to plan accordingly and follow our remainingmoney savingtips. Then when Christmas does come round, you will be sorted and ready to have fun!

Plan your budget

The next big thing to do is make a budget. Many of us are scared to do this because it can be horrifying to see how much money you are really spending. But it is much better to face reality than end up in a complete financial mess in January, as it can then take you months to recover from this.

So make a list of absolutely everything that you think you will need to buy this Christmas: presents, cards, postage, decorations, food, drink, extra home supplies (bedding, towels etc) for guests, socialising, travel and anything else that you think you might need to spend. If in doubt, include it: better to over budget than not have enough.

You will then be able to see whether you have enough money to cover everything that you are currently planning to spend, or whether you need to follow some more of ourmoney savingtips below!

Stick to your budget

But before leaving the topic of budgets, make sure that once you have done your budget, you do stick to it! Budgets can look completely workable on paper, but it is all too easy to overspend and still end up in a mess without understanding why.

So you need to keep track of your budget carefully. Record details of everything you spend on Christmas, either in a notebook or on your computer or phone. You can then see if you are overspending on a particular area and then need to cut down on something else in your budget to keep within your spending limits.

Presents – reduce the number you give

We all love to give presents but there comes a time when you have to reconsider. Let’s be honest, there are people that get harder and harder to buy for each year, and their gifts to you are probably pretty predictable too. It is often a good idea to agree either to stop the presents or to do them in a different way. So for example if you have brothers and sisters with their own families then you could agree just to buy presents for the children from now on. For the adults perhaps you could either do a Secret Santa between you all, or each take turns to host a special event – an “unofficial Christmas” – during the year.

Presents – set an upper limit on price

Another consideration when buying presents, especially for children of family members, is to agree an upper price limit and then all be rigorous about sticking to it. This really helps with the budgeting and can even make it a fun challenge when you know you simply cannot spend more than what you have agreed. This is a great way tosave moneyand also avoid the embarrassment caused by exchanging gifts that have obviously cost very different amounts.

Presents – get the best deals

When buying presents it is so easy to get carried away and panic that your gift is not going to be good enough. So it can be really helpful to get back to basics. It’s the thought that counts, not the amount spent on it. If you are really trying to get your finances in order then be open-minded about where you get those presents. Once you have decided the kind of thing you want, then look for a really good deal – for example on an online sites such as eBay, in a charity shop or even inthe Black Friday sales in November. If you allow yourself plenty of time then you just might be able to pick up a real bargain.

Presents – be creative

One final thought on presents is that you can save a lot of money by being creative. Is there anything that you could make for gifts rather than buying what someone else has made? Whether you can sew or knit, make jewellery, paint pictures or bake cupcakes; there is a lot of potential for homemade gifts which are often appreciated way more than something off the shelf.

If you are really up against it financially then another idea is to offer your time instead of a gift. Simply think about what you are good at and could offer, and prepare a pretty home made voucher that commits you to provide this during the year. Whether it’s babysitting, dog walking, decorating, DIY, car maintenance or computer wizardry; giving someone a definite offer to do this can really be the best Christmas gift ever: the gift that goes on giving.

Cut down the cost of food

Let’s face it: we all eat far too much over Christmas. This means that we also spend too much money buying too much food, and create a lot of waste. Make this year different! It’s perfectly possible to have a wonderful Christmas with plenty to eat, but without spending a fortune.

A lot of overspending on food happens when we leave too much to the last minute then panic buy because we suddenly worry that there will not be enough food. So the key thing to do is to plan your menus carefully then just buy what you actually need.

So sit down with either some Christmas recipe books or the Internet, and plan what you are going to cook and when. Two ways to save money are firstly to try and plan dishes that use some of the same ingredients so that you can buy in bulk and save money that way. Secondly be realistic about your portion sizes. You want people to have enough but not to be left with mountains of waste. Check out websites such as Love Food, Hate Waste for guidance on portion sizes.

Once you have done your planning then start shopping. Start now! If you buy as much as you can in advance this will spread the cost and avoid last minute rushing around. It’s also a good idea to plan a time when you will do that last minute shopping so that you feel in control of it; why not put a date in the diary that you can work towards. Nearer that time check out the best supermarket deals for the things you want. Even if that means splitting your shopping between two or three different stores it will be worth it to get the best combination of money-saving deals around.

Cut down the cost of drink

Just as with food, most of us also spend far too much money on drink over Christmas. We feel obliged to have supplies of every kind of drink possible “just in case”. It is impossible for the average household to be as well-stocked as the local pub, so this year why not just make sure that you have a plentiful supply of the most popular drinks – eg beer, wine, cider and soft drinks – and if guests have other preferences then ask them to bring their own.

Most of us also drink far too much over the festive season so perhaps it’s time to embrace the concept of drink free days and have some days when you lay off the alcohol. Not only will this be cheaper but you will feel a lot better, and will enjoy a few drinks even more on those days when you are drinking.

Save more money for Christmas

Even if you follow all the above steps, Christmas can still be an expensive time. If you know that there will still be a shortfall in your Christmas budget then you still have time to rescue the situation.

One way is to try and find some extra work over the next few weeks. There are many seasonal opportunities in shops, bars and hotels that you may be able to fit in around existing commitments. Yes it will be tough, but it’s only for a few weeks. Or you could see if there are things you can do on an ad hoc basis such as babysitting, pet sitting, odd jobs etc.

It’s also a good time of year to have a good clear out of your home; to declutter before Christmas. This may reveal items that you no longer need, and can sell on eBay or perhaps have a car boot stall. There may be someone out there looking for the very thing that you are trying to get rid of.

Finally, you may want consider taking out a small loan to help you through Christmas. It is better to borrow money on a planned basis, with a clear timescale for paying it back, than end up drowning in uncontrolled credit card debt. At LoanPig we offer a range of short term loans that could be just what you are looking for. Loans that you can repay in affordable instalments over a time period that works with your budget. Click here to find out more about this possibility.

Whatever your plans for Christmas 2018, we hope that our Ten Tips help you to manage your money more effectively – andsave moneywherever possible – so that you can really enjoy Christmas this year.

Check back here soon for more money saving tips from LoanPig.

The post Ten Tips to get Christmas sorted! appeared first on LoanPig.

from LoanPig https://www.loanpig.co.uk/ten-tips-to-get-christmas-sorted/ from Loan Pig https://loanpig.tumblr.com/post/179211263382

0 notes

Photo

#Feature @simplefinancialconcepts:⠀ ...⠀ We all want to be successful with handling money but it can be overwhelming at times. In my new blog post, I give 10 tips that you can use to win with money to have a healthy financial future.⠀ simplefinancialconcepts.com⠀ .⠀ .⠀ .⠀ .⠀ #debtfree #debtfreecommunity #debtfreejourney #savemoney #winning #instagood #regram #repost #reposting #spotlight #moneytips #Minimalist #Frugal #FrugalLiving #MinimalistStyle #Minimalism #MoneyMatters #PersonalFinance #Money #FinancialFreedom #Finance #Budget #Budgeting #Millennials #StudentLoans #BudgetTips #SpendSmart #SavingTips (at United States)

#money#spotlight#savingtips#budget#minimaliststyle#savemoney#studentloans#winning#personalfinance#debtfreejourney#reposting#moneytips#financialfreedom#finance#millennials#moneymatters#spendsmart#frugalliving#debtfree#minimalist#feature#minimalism#debtfreecommunity#budgettips#repost#regram#frugal#budgeting#instagood

0 notes

Photo

(via How to Blog Productively: 16 Experts Reveal Their Secrets)

0 notes

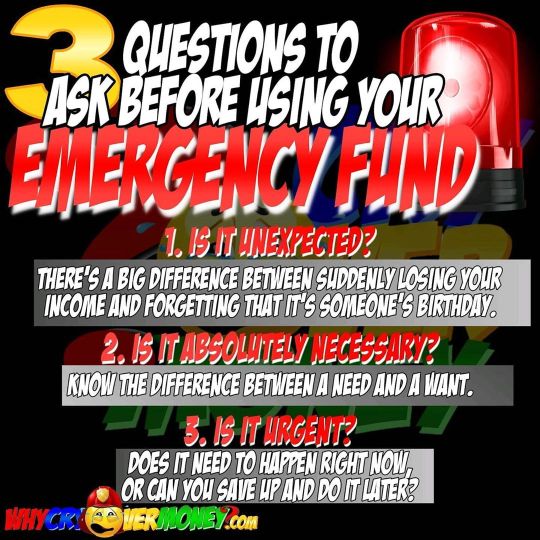

Photo

Stay calm. Don't freak out. Remember to take your time and make smart decisions during a time of crisis.⠀ ⠀ #emergencyfund #emergencyfunds #savingpot #savings #savingsgoals #savingschallenge #savingsaccount #savingtips #savingstracker #savingsplan #savingsgoal #savingsjourney #savingstip #savingsjar #savingsbox #whycryovermoney https://www.instagram.com/p/CBoZHsqhfby/?igshid=7bbznjb71ub6

#emergencyfund#emergencyfunds#savingpot#savings#savingsgoals#savingschallenge#savingsaccount#savingtips#savingstracker#savingsplan#savingsgoal#savingsjourney#savingstip#savingsjar#savingsbox#whycryovermoney

0 notes

Photo

I think my last post confused some people, so I thought I would clarify. . Yes, I make $20K - $30K a month, WHEN I WORK. This means when I don’t work (like right now), I get $0. . I have only been working half my career. I am not a die-hard rabid early retirement person, and I would rather enjoy my years now when I am young (36), than to work like mad only to have free time when I am older, maybe less mobile, etc. I call this semi-retirement.. part-time? It is very odd and I do not know others who do this yet, but I do. 👋🏻 . Anything can happen. People have plans but spouses die, people get sick and are unable to work... lots of things happen. I would rather live in the now, and balance my work/life. Carpe Diem, responsibly. . I bought my house (cost $600K, but I only paid half), and paid cash (no mortgage), and my car ($180K) last year. Basically, my fixed assets are set. House, car, I'm good. Now I am just paying for living expenses... . My partner is already retired and covers his half of the bills which are NOT FACTORED IN HERE. . This is why my base budget for basic expenses is about $2000/month which is just MY HALF. I would ideally like a budget of $3500, because I am spendy, but at the core of it all, my blogs/books bring in $1000 a month, my $200K freelancer emergency fund for living pulls in $383-ish a month, and if I took my dividends at $614, I could technically stop working today. . But, I won’t. I need more money to feel secure, and until I get my next contract, hit my first million, plow that chunky $200K EF into the market, Wash, Rinse, Repeat.... . What is surprising is I COULD retire. I didn't know that before. . Hope that clears things up.. #savespendsplurgemoney #moneyteam #debtfreejourney #debtfree #financialgrowth #savemoney #financialgoals #moneymaker #savingmoney #howtosavemoney #moneysavingtips #financialdomination #debtfreejourneycanada #savemoneylivebetter #savingtips #savingmoney #moneygoals #budget #debtfreejourney #financialfreedom #budgetlife #savemoneytoday #financialliteracy #budgetplanner #debtfreecommunity #debtfreegoals #debtfreeliving #debtfreedom #debtfreecommunity #debtfreecommunitycanada https://www.instagram.com/p/B2HfT5AndFG/?igshid=o0uv4ff3hox7

#savespendsplurgemoney#moneyteam#debtfreejourney#debtfree#financialgrowth#savemoney#financialgoals#moneymaker#savingmoney#howtosavemoney#moneysavingtips#financialdomination#debtfreejourneycanada#savemoneylivebetter#savingtips#moneygoals#budget#financialfreedom#budgetlife#savemoneytoday#financialliteracy#budgetplanner#debtfreecommunity#debtfreegoals#debtfreeliving#debtfreedom#debtfreecommunitycanada

0 notes

Photo

I really do not want to hear it. If I asked you if you had time for an all-expenses paid spa day with me, you would rearrange your schedule to make it right? . So why won’t you take the dams amount of time to manage and work on your money? . Stop making excuses. You simply do not want to because it seems difficult, time consuming, boring, tricky and you are scared. . I get it. I have been there. $60K in student debt, my last $2K spent on something I did not even know existed - rent / key deposit and first AND last month’s rent - and starting a new job the following week. . I sat myself down, told myself this debt was REAL and I would have to devote my pay towards it. I had no idea how, used TheBudgetingTool.com , and 18 months later I was a changed woman - debt free with $0 to her net worth instead of being in the hole. . Fast forward to today, I have $840K in net worth (house and car paid, half of that is cash/investments) and am taking the next few months to year or so off, and in a very solid financial position. . It only took me one afternoon to decide and a few months of work with lots of reading and revelations. . . Better NOW than one year later wondering: WHY DID I NOT START THEN? . Do not be in the same spot a year later. . . . . . . . #moneyteam #debtfreejourney #debtfree #financialgrowth #savemoney #financialgoals #moneymaker #savingmoney #howtosavemoney #moneysavingtips #financialdomination #debtfreejourneycanada #savemoneylivebetter #savingtips #savingmoney #moneygoals #budget #debtfreejourney #financialfreedom #budgetlife #savemoneytoday #financialliteracy #budgetplanner #debtfreecommunity #savespendsplurgemoney #debtisdumb #debtfreeliving #debtfreedom #debtfreecommunity #debtfreecommunitycanada https://www.instagram.com/p/By6c_NyAert/?igshid=19wlciauv1r65

#moneyteam#debtfreejourney#debtfree#financialgrowth#savemoney#financialgoals#moneymaker#savingmoney#howtosavemoney#moneysavingtips#financialdomination#debtfreejourneycanada#savemoneylivebetter#savingtips#moneygoals#budget#financialfreedom#budgetlife#savemoneytoday#financialliteracy#budgetplanner#debtfreecommunity#savespendsplurgemoney#debtisdumb#debtfreeliving#debtfreedom#debtfreecommunitycanada

0 notes

Photo

Everything has a price. Are you willing to pay it? . Sometimes, until you have “been there, done that”, it seems like it is not that bad. Doable, even. But it really isn’t if you peek under the veil and realize it is fights, sleepless nights and stress to work harder to keep up the façade. . It is exhausting. Even just running a blog, and doing VERY MINOR style shots and these mini posts, it sucks up a huge amount of my time. I have much respect for people who do this as their only bread & butter. . So, look. Appreciate what you do have, not what you don’t. . . . #moneyteam #debtfreejourney #debtfree #successful #savemoney #success #moneymaker #savingmoney #howtosavemoney #moneysavingtips #savemoneytips #debtfreejourneycanada #savemoneylivebetter #savingtips #savingmoney #richlife #wealth #succeed #savemoneytime #yourbestlife #savemoneytoday #savemoneysavelife #savemoneychallenge #debtfreecommunity #debtfreegoals #savespendsplurgemoney #debtfreeliving #debtfreedom #debtfreelife #debtfreecommunitycanada https://www.instagram.com/p/By8zd7mo7_E/?igshid=mrpki7w8mu5a

#moneyteam#debtfreejourney#debtfree#successful#savemoney#success#moneymaker#savingmoney#howtosavemoney#moneysavingtips#savemoneytips#debtfreejourneycanada#savemoneylivebetter#savingtips#richlife#wealth#succeed#savemoneytime#yourbestlife#savemoneytoday#savemoneysavelife#savemoneychallenge#debtfreecommunity#debtfreegoals#savespendsplurgemoney#debtfreeliving#debtfreedom#debtfreelife#debtfreecommunitycanada

0 notes