#they JUST changed the entire system for the store credit card

Explore tagged Tumblr posts

Text

Sorry for disappearing; work absolutely KILLED me both yesterday and today. Will try to get back on tomorrow once I've recuperated some energy

#🅾🆄🆃 🅾🅵 🅼🅰🆂🅺 | ooc#they JUST changed the entire system for the store credit card#the update went live yesterday and it was WAY too busy#today was fine UNTIL after the eclipse#me @ corporate hey maybe you didn't want to have updated the entire card system and store app right before the eclipse

5 notes

·

View notes

Note

this is a slight detour from your usual subject matter but i'm very curious about your experience renting a high-quality camera lens? how did you go about doing that and have you been pleased with how it worked out? (the changing of hands i mean, it's clear you're happy with the lens!)

i didn't know this was a Thing before and now i'm wondering if i might be able to try that myself!

Oh yeah, it's absolutely the best thing if you can't afford fancy lenses / want to try out new gear / just need something for a special occasion.

There are places you can rent online that will ship you gear, and depending on where you live you can often also rent from local camera stores. I've done both!

Right now my main practice is renting lenses from LensRentals, which is an online company that ships out of Tennessee. They've got pretty reasonable rental prices, and they don't charge a deposit - but you do sign a thing saying if you damage or lose it, they can charge you. You can also pay for insurance on the rentals against damage or loss which would mitigate a lot of that cost if something went wrong. I've heard a range of opinions about them, but I've pretty much always had a good experience with them and gotten stuff on time that worked correctly, and their customer service has been really responsive for me when we had some snafus with shipping stuff back lately. One thing they do that I really like is their system is set up with an option to ship directly to FedEx stores for you to pick up, which means I don't have to worry about a package containing pricey gear getting stolen or rained on.

LensRentals also is willing to let you buy their rental gear, which is what I'm hoping to do before I send the really nice huge telephoto lens I've been using back tomorrow. They'll take some of the price of your rental off the purchase cost - it isn't a ton, but it generally covers sales tax and maybe a little more. I like it as a way to purchase used gear because I can see the condition before I commit, and I've had it in my hands and gotten to use it a bunch. That's how I bought my first real digital camera like a decade ago, and where I got my current camera and starter lenses.

If you've got a local rental store, I absolutely encourage going through them! I've done that when traveling - there have been some times I wanted a specific piece of gear to test on a habitat - and it's worked out really well. Plus, supporting local businesses is always the right choice. They'll often all operate a little differently, but it's nice to know people IRL who can help you decide what gear to use or just nerd out with you. Sometimes local places will ask for some type of deposit to make sure you bring the gear back, and TBH if that's within your budget it's perfectly reasonable.

Unfortunately, the local rental place in my area charges a deposit to your credit card for the entire worth your rental until you bring it home, and my credit limit isn't high enough that I can float a hold for that (e.g. upwards of four thousand dollars for the two lenses I'm using lately) and still be able to, y'know, use my card, so I go with online rentals. It drives me up a wall! I'd really like to support local businesses and minimize shipping costs / carbon emissions.

If you think you'd like to rent some gear to try out, I recommend it! Just make sure you know what's compatible with your camera, you've got a safe way to transport and store the rental when you're not using it, and that you know the terms up front. It's been such a fun way to play around and see what I like and what works well for me.

82 notes

·

View notes

Text

Bitching about financials and job things under the cut

My company announced like 2 months ago that our jobs are being eliminated, but it's like this nebulous thing because they're outsourcing and we need to transfer all our products, so my end date isn't until 3/31/2026. Like that's so far in the future and I'm gonna get severence (at end date, i will have worked there for 20 years literally over half my life) + a retention bonus, so I'll be ok for a little while after the fact i think i hope

But anyway i decided to immediately start cost-cutting 2 months ago:

•canceled subscriptions (canceled hulu, paramount+ (i have a plex server hookup anyway), canceled ubereats (and also stopped ordering from them altogether), canceled or went down a level on my minimal patreon subs)

•signed up for Shell's rewards system (it's literally free and you save at least 20cents/gallon every single time and sometimes more without having to spend any money you just click a button and boom extra 10cents if you fill up on a specific day.)

•haven't done *any* fun online shopping or regular store shopping for that matter

•severely cut down my fast food spending (i'm sorry taco bell ily), and as my friends are in similar financial woes, we've stopped ordering food every weekend and opted to make cheap dinners where we each bring some small component like 1 brings pasta 1 brings sauce 1 brings garlic bread

•this isn't a recent change, but i never go out anywhere for like drinks or to see local comedy shows like i used to frequently do. I'm a homebody who goes into the office twice a week and goes to my best friend's house on saturdays and just sits at home the rest of the time

Even with all that!! My debit card is at $26, my 1 credit card is $3 away from its limit, the other is $21 from its limit. I *thankfully* get my paycheck at midnight, but like... woof!

Last paycheck i was down to less than $100 the day before as well. It's so mind-boggling to me that it's this bad. Partially because I've had some unfortunately-timed plumbing issues and had to pay a pricey deductible (but glad i have the insurance obv cuz of how much the total cost would've been otherwise.) But also partially cuz i feel like shit is so much more fucking expensive than it's ever been!! And the last gallon of milk i bought and properly refrigerated went sour like a full week before its expiration date.

I have a decent job and make pretty good money (for now at least.) I have made several cost-cutting measures recently. I feel like I don't *do* anything. And it literally doesn't matter!!

My best friend who has an equally comfortable job told me he had about the same amount of $ as me to last him til his next paycheck too.

And on top of the financial stress, i am so fucking stressed at work because no one knows what they're doing and i keep getting roped into things at the last minute with an IM that says "hey got time for a quick call?" And then i end up having to put together a complicated spreadsheet that is needed by end of week. Why didn't you fucking ask sooner than 2pm on a thursday?! Oh cuz someone who will still have a job at the end of this didn't do what they were supposed to? Ok sure I'll get right on that. And I do. I do get right on that and have it back to you within a couple hours. Because i stupidly care about my job.

Ugghhh i hate everything atm... Except i was able to livestream my favorite singer Terri Clark's debut concert at The Ryman tonight. And i have a ton of Fran/CC fanfics queued up to read. And the Ghosts discord is constantly coming up with the cutest scenarios for H$, my current otp. And i am off the entire next week because next Friday is my birthday. And my dog is snoring.

So i guess it hasn't been such a bad day after all, Charlie Brown... or some such sentimental nonsense 🙃🙃🙃

8 notes

·

View notes

Note

hi i just read your blog description and

how does one even begin to go about downloading an entire bootleg onto a Nintendo 3DS, of all things? what exactly prompted you to do this?

I am so glad you asked!

I enjoy the 3DS (and have an alt blog dedicated to my Nintendo shenanigans!) and I absolutely love having access to media entirely offline and without a buffering time! And to complete the trifecta, I had very bad writers block at the time. So uh there’s the why, the but how is chaos so do buckle in

First, I needed a bootleg as an MP4 as the 3DS no longer runs YouTube and I wanted to have it 100% offline. YouTube downloader and 5 minutes and that part was done. Next, actually getting it on the 3DS. A 3DS doesn’t tolerate MP4 files, and despite mine being homebrewed, I couldn’t find a program to play MP4 files. I, being me, tried to finagle it into working anyway. Unsurprisingly it didn’t, so back to the drawing board.

It took a few minutes of furious googling to remember that the 3DS had a pre-installed camera. That could take videos. However, there were some unfortunate limits..

- The filetype needed to be changed from MP4 to AVI.

- The videos could not exceed 10 minutes.

- The resolution is.. bad. 480x240. But if I wanted to watch Tanz with good resolution, why would I download it to a 3DS, eh? A grade-A viewing experience is clearly not the goal here.

Got to work chopping Tanz into 7-10 minute segments in the most sensible places I could. This is what took the longest, as I wanted the cuts to make some sort of sense. I tried to cut between songs or scenes, on top of an already present break in the music. Next, I ran all of these files through a converter to get them in the AVI that the 3DS can understand. Lastly, there was the small task of getting them onto the SD card and storing backup files in an organized manner on my computer so I can get Tanz onto my OTHER 3DS consoles at a later date. I also have a Switch Lite that I’d like to put it on, but my silly camera exploit won’t work because the Switch doesn’t have a camera. Shame.

Anyway I had to name the files so they would appear in order on the laptop and on the 3DS, and I had an AVI and MP4 for each portion. I think there were like 15 parts? I’ll check in the morning, I’m very tired and the system is dead at the moment. But there’s a folder in the applications section than I transferred the video files into, checking every so often to make sure they were working and uploading properly, and luckily they were so it was just a drag and drop operation from there. And that’s how I got Tanz on a 3DS.

I’ll proofread and add images (I think my blog banner is the Tanz credit screen on the 3DS) in the morning, and better explain some stuff. If you have any questions about this or other 3DS stuff please feel free to ask! I love to talk about it!

7 notes

·

View notes

Text

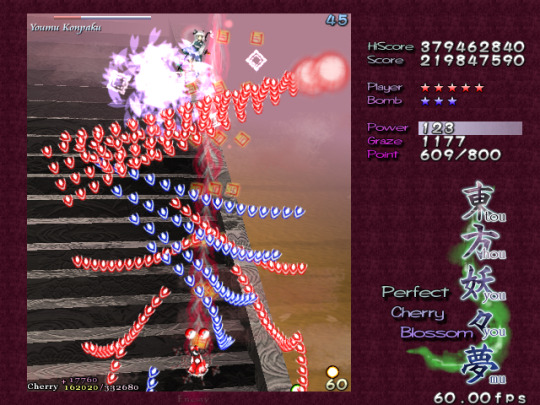

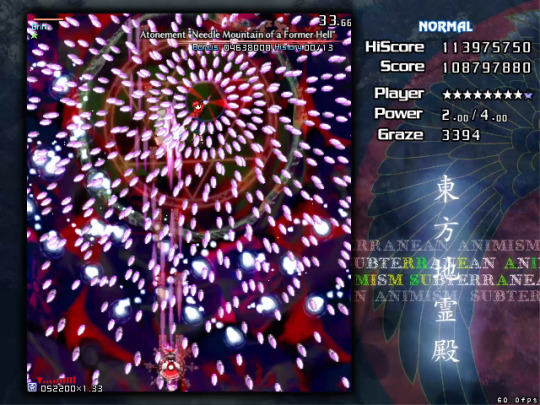

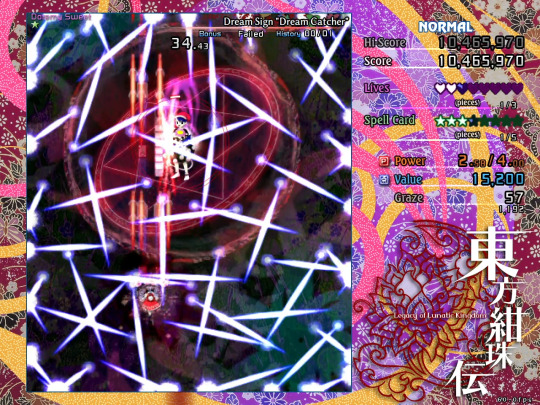

Trying to Talk about Touhou

12 Days of Aniblogging 2023, Day 9

This is the year that something finally clicked. I went from getting a game over halfway through any given Touhou game to racking up Normal one-credit clears in Touhou 6, 7, 8, 10, 11, and 17. It’s a journey that’s required self-restraint so I don’t destroy my hands (see my Caves of Qud post), but I’ve gotten to a point where I can try out a new Touhou and largely intuit what that particular game is putting down without bashing my head against the first few stages for days. It’s a really nice sweet-spot to be in, even if it took years of on-and-off play since 2016 to achieve.

I’m not in a position to give hot bullet dodging tips or anything (you’ll have to turn to John Madden for that), but maybe I can share some scattered views on these games I’ve come to love.

A lot of advice given to new players boils down to either “don’t bomb too much, you’ll lose valuable practice” or “you can bomb, it’s fine”. But my biggest roadblock was actually sticking to one game for years instead of trying out a bunch in that time. Practicing the same spell cards over and over helps you progress much further through one game than your skills would otherwise allow, but I don’t think you’ll learn as much overall! Because even though all the games look very similar from the outside, Touhou is an exercise in constant experimentation between releases.

ZUN is never content to rest on his laurels for too long, always going back to the drawing board and making minor adjustments to the Touhou formula that carry far-reaching implications. For example, Mountain of Faith may be one of the mechanically simpler games, but changing the bombing system from fixed quantities to bombs that lower the player’s shot power has a ton of knock-on effects! It makes bombing during the stages far more viable, and lets the player bomb through spell cards with confidence if they know they’re going to be regaining that power afterwards. This makes Mountain of Faith one of the breezier entries in the series, but only if the player is comfortable with bombing that much. The people who want to prove themselves by capturing as many spellcards as possible will continue to do that and face a moderate challenge. The next Touhou game, Subterranean Animism, uses an identical system, except bombing removes 25% more power from the player, and bosses drop fewer power items after each phase. These little tweaks flip the equation on its head entirely, as bombing even once will leave you noticeably weaker for the rest of the fight. You can’t bomb proactively anymore, but it’s still absolutely worth it when the alternative is dying. It makes these games feel extremely different from one another, and not being able to play them in the same way means you'll have to gain some flexibility.

The method through which you earn extra lives is also in constant flux. ZUN’s thrown every idea at the wall, from score thresholds to collectible UFOs to grazing lots of bullets to just being able to buy them at the metaprogression store. The problem is that no matter the method, it’s going to be gamed by better players and underutilized by novices. That’s why I’ve gradually come around to Subterranean Animism’s system, even though it’s one of the most frustrating at first. It’s absolutely brutal for new players but rewards the right behavior – surviving by any means necessary. For every segment of a boss fight that you make it through without getting hit, regardless of whether or not you bombed, you’re rewarded with a fifth of an extra life. This snowballs both ways. If you’re getting hit a lot in early stages, you’re not going to be receiving any extra support at all, but if you can survive everything thrown at you, you’ll be rewarded with more extra life opportunities than in nearly any other Touhou. My winning run of Subterranean Animism had me get through the first four stages without dying and then break even on Stage 5, letting me face the final boss with eight lives. As mentioned earlier, SA is extremely stringent on bombs, forcing you to learn patterns to a painful degree, but my god did finally capturing all of Satori and Rin’s spells and fumbling through Utsuho’s feel good. After two years of practice, it’s definitely my favorite of the games, and the clear that I’m the most proud of.

top 10 spell card name btw

So switching between games is a great way to pick up general skills and it’s cool to watch ZUN’s gamedev iteration cycle, especially if you’re playing somewhat chronologically. The only challenge is having to learn to allow seven or so girls into your heart at a time. Touhou characters are like Pokemon in that whenever there’s another installment, all of the new ones feel kind of fake for a bit and the part of your brain that keeps track of all these creatures needs time to really integrate them. Maybe this is just a me problem. Eventually though, they are friends all the same. Also, you will learn to love the character portraits. Every era. Give it time.

The early Windows games have most of the classic characters and generally play on the easier side, so maybe start with one of those if you’re interested? Touhou 8 (Imperishable Night) is often recommended as a starting point, and is regarded as one of the easier installments, but the one-off gameplay systems are as numerous as they are ridiculous. Time of night, human/youkai meter, minions, alternate stages, Last Spells - it’s chaos. Also, any plot involving the moon is bound to be truly convoluted, even by Touhou standards. Play 7 or 10 instead (or be like me and start with 6 (definitely use the hitbox patch tho)).

JUST DON'T PLAY LEGACY OF LUNATIC KINGDOM BECAUSE YOU'LL FALL IN LOVE WITH THE MUSIC AND WANT TO KEEP GOING BACK BUT THE GAME WILL BE EXCEEDINGLY FRUSTRATING EVEN IF A LOT OF THE IDEAS ZUN IS TRYING OUT ARE REALLY COOL (i will not be clearing this one ever probably)

I’m glad ZUN is thoughtfully experimenting with trends from other genres such as metaprogression and checkpointing with infinite lives in his more recent games. The non-numbered side games in particular provide a space for him to further mess around. My personal favorites are 100th Black Market, which recontextualizes the roguelike shop from the previous game while acting as a great practice tool, and Fairy Wars, which is stupid fun.

In conclusion, Touhou demonstrates through its excellency that the ideal skill hierarchy for solo gamedev polymaths is music > gameplay > writing > art. See also: Toby Fox.

6 notes

·

View notes

Text

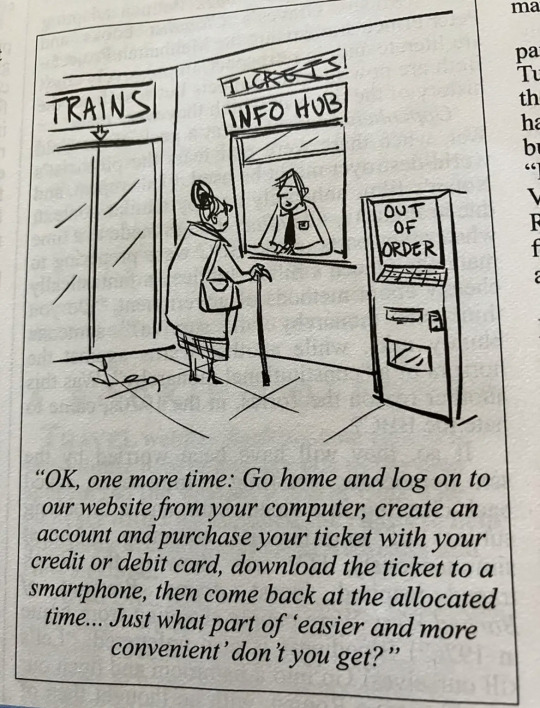

This reminds me of an issue I had when I first moved to Ontario. Local transit is really great, but it all runs through a tap card that you have to buy. They discontinued physical tokens years ago, and are only just starting to implement pay by tapping credit cards in the last year (and it’s unpredictable which buses will have it). You can also pay cash, but you have to have coins and won’t get change back.

Well, my uni campus was a solid 2km away from the nearest store where a tap card is sold, which was right next to the nearest bank (for getting change). As a disabled student, this made it INCREDIBLY difficult to get started with the transit system. To make matters worse, you can’t use or load funds on a new tap card for 24hrs after purchase, and bank ATMs only distribute $ in $20 bills. This meant I had to walk the entire way there AND back to get a card to be able to use transit.

I don’t know if there’s really a point to this post, but the meme really did hit home for me because despite having a major public transit system available in my area, there are still significant barriers to access that are compounded by shutting down the ability to purchase physical tickets/tokens.

169K notes

·

View notes

Link

#androiddigitalwallet#builddigitalwallet#builddigitalwalletapp#createdigitalwallet#creditcardvsdigitalwallet#cryptowallet#developdigitalwallet#digitalwallet#digitalwalletapp#digitalwalletdefinition#digitalwalletvsdebitcard#digitalwallets#howdoiuseadigitalwallet#howtobuildadigitalwallet#howtomakeadigitalwallet#whatisadigitalwallet#whatisdigitalwallet?

1 note

·

View note

Text

Decoding Cryptocurrency: The Digital Treasure of the Future

Welcome to the vibrant and often mysterious world of cryptocurrency, a digital gold rush that's reshaping the financial landscape right before our eyes. Let's embark on a journey to decode this phenomenon, making it as easy to understand as shopping with your favorite cashback credit card.

The Birth of Cryptocurrency

Imagine you're playing an online game, and you earn gold coins that you can use to buy gear for your character within that virtual realm. Now, picture if those virtual coins could be used to buy actual things in the real world, like a coffee or a car. That's the essence of cryptocurrency — a form of money that exists entirely online.

It all began with Bitcoin in 2009. Created by an enigmatic figure known as Satoshi Nakamoto, Bitcoin introduced us to a revolutionary idea: money that can be sent directly between people, without passing through a bank.

Blockchain - The Wizard Behind the Curtain

Cryptocurrencies are powered by a magical ledger called 'blockchain.' Imagine a book recording every single transaction you make, viewable by anyone but impossible to erase or change once written. This book is stored not just in one place, but across thousands of computers around the world. This is the blockchain, the foundation upon which the realm of cryptocurrency rests.

Benefits - More Than Just Internet Money

Cryptocurrencies offer several benefits:

Security: Transactions are secured through cryptographic techniques — think of these as unbreakable secret codes.

Speed and Cost: Sending cryptocurrencies often works out faster and cheaper than traditional bank transfers, especially across borders.

Exclusive Ownership: When you own cryptocurrency, it's like having a safe deposit box only you can access. There's no need for banks or third parties to validate your ownership.

Privacy: They offer more privacy than conventional bank transactions (though they're not completely anonymous).

Inflation Resistance: There's often a cap on the number of coins that will exist, potentially protecting them from devaluation through inflation.

Practical Use Cases - Not Just for Tech Wizards

Now, let’s talk about using cryptocurrency. Joe buys a coffee token on a cryptocurrency platform and sends it to his local coffee shop's digital wallet—an online space to hold digital money. This transaction is recorded on the blockchain, validating Joe's purchase without revealing his personal info.

Cryptocurrency is also making a splash in the remittance market. Maria in Canada wants to send money to her family in the Philippines. Traditionally, this involves fees and waiting periods due to currency exchange and bank processing times. With cryptocurrency, Maria can send her hard-earned money almost instantaneously and for a fraction of the cost, directly into her family’s digital wallet. The blockchain records the transaction securely, and Maria's family can exchange the digital currency for local currency through a local crypto exchange or spend it directly at businesses that accept it.

The Future – Sky's the Limit

Picture a world where buying a house, getting paid for your job, or even casting a vote in national elections could be done securely and instantly through cryptocurrency. The possibilities are vast. Financial inclusion for the unbanked, transparent and secure voting systems, smart contracts that execute automatically when conditions are met—the future is as bright and unknown as the early days of the Internet.

Developments in this sphere are leading to concepts like "Decentralized Finance" or DeFi, a system where financial products are available on a public decentralized blockchain network. This makes them open to anyone to use, not just customers of banks or particular institutions. It's like having a stock market, loans, and insurance policies running globally, accessible to anyone with an Internet connection, and no middleman taking a cut.

User Impact - What Does It All Mean?

What does cryptocurrency mean for you, the reader? It could change the way you think about money. Imagine carrying your bank in your wallet — not just access to your funds, but the bank itself. You have the power to transact, invest, and manage your finances without ever stepping into a physical bank.

However, remember to exercise caution. Cryptocurrency markets can be volatile; prices may wildly fluctuate. It's like the stock market on steroids, so it's prudent to invest wisely. Also, be aware of regulations as they vary by country and are still being developed in many places.

Concluding Thoughts - Embracing Digital Currencies

Cryptocurrency isn't a trend; it's a technological leap akin to the birth of the internet. Like any frontier, it holds boundless opportunities alongside new challenges. As we witness this digital currency’s evolution, staying informed will be crucial. Whether cryptocurrencies become the standard in our digital lives, or a niche product for certain types of transactions, they've already altered the way we think about and use money.

In sum mary, it's not just an alternative form of money; it's a financial revolution offering empowerment by decentralizing the control of transactions and reducing dependency on traditional banking systems.

So, as we sail towards a digital future, consider this: cryptocurrencies might be the roots of a new kind of global financial ecosystem. One that is borderless, inclusive, and open to all.

And rest assured, whether you're a tech enthusiast diving into mining (the process of creating new coins) or a casual observer keeping an eye on the rise of digital wallets, there's a place for you in this unfolding chapter of the digital age.

So, will you stand by the sidelines, or are you ready to dive into the world of cryptocurrencies? Remember, knowledge is power, and in the fast-evolving realm of digital currencies, staying informed is the key to unlocking the treasure trove of possibilities.

Keep track of this exciting journey through digital landscapes, and harness the potential that lies in the pixelated heart of cryptocurrency. It may just be the most thrilling ride of our lifetime.

Curious about making your first crypto transaction or understanding what blockchain is all about? Visit [Your Blog or Website] for more insights and take the first step on your personal crypto voyage. Happy exploring, and welcome to the future of finance!

0 notes

Text

INTENT PROJECT

In a world full of blockchain technology innovation, intent is the key to understanding the dynamics of change and development that occur. In this article, we will discuss how intent influences the evolution of the crypto world. The intentions of participants in a crypto project often reflect their hopes, goals, and beliefs in blockchain technology. By understanding this, we can see how society’s vision is shaping the future of crypto.

In the world of crypto and blockchain, Bounty Campaigns have become a popular method to promote projects and gain contributions from the community. In this article, we will discuss how intent influences Bounty Campaign dynamics and the results achieved . Are the Bounty Campaign participants’ intentions always in line with the campaign objectives? How can a clear intent help increase participation and the quality of contributions to the campaign? Find the answer in this article . The intentions of participants in a Bounty Campaign can vary, from the aim of obtaining material rewards to the intention to actively support the project. In this article, we will discuss the various intents that may underlie participation in the campaign.

1. To prevent the possibility of irreversible inflation, all inventories have been set at the maximum. Initially, the entire token supply of 2,000 million INTENT will be printed first to the origin address. These tokens will then be distributed according to the given rules. To ensure that all active users are entitled to INTENT automatically, the distribution period is taken from business predictions covering a five year period.

2. Ownership of INTENT (regardless of whether acquired for activities or purchased on the secondary market, regardless of whether held in a custodial or non-custodial wallet) mathematically continues to generate loyalty credits, referred to as Loyaltents [LT]. This LT is used by users to reduce costs associated with the use of TENT trading services.

3. On the other hand, Loyalty tokens cannot be separated from the user and cannot be transferred, in contrast to INTENT tokens which can be transferred just like other blockchain tokens. Therefore, users are encouraged to buy INTENT tokens, which makes their services more affordable (or completely free), sell them whenever they want on secondary markets, or even keep them more than necessary for their use (for example, for governance or speculative) . reason ).

4. A portion of other TENT earnings is added to this pool, called the Discount Pool, along with card interchange fees collected from each card transaction. It is designed as a balanced power system: on the one hand, it is designed to provide positive incentives for users to transact and be active in the TENT ecosystem, which results in the acquisition of more INTENT tokens, which in turn results in more discounts. (Loyal). DISCOUNT POOL is dedicated to distributing tokens to INTENT token holders and lowering their fees. Conversely, as the volume increases, the speed of Loyaltents 11 formation (i.e. the speed of filling up the DISCOUNT POOL) slows down. At the same time, the relative effect of demurrage continues to increase, meaning users are encouraged to use Loyaltent rather than hoard it.

5. INTENT’s effective functionality, which allows users to save money or ultimately eliminate all costs associated with using TENT’s services to purchase, store, exchange and spend cryptocurrencies, is the source of value that INTENT has. Large amounts of euros serve as a support for value, which is not a virtual asset.

MOBILE TENTS APPLICATION

This is a unique platform that allows users to connect wallets to Mastercard payment cards and use cryptocurrencies in everyday life.

B) Seamless Mastercard payments, native custodial wallets, fast payment and exchange capabilities, extensive security features, comprehensive compliance solutions, and the TENT team’s proprietary utility currency, INTENT, are just some of the features the TENT team has implemented.

Where can I buy INTENT?

INTENT cannot be purchased directly in the wallet, before the secondary market is created. You can only earn INTENT by actively using the TENT wallet or later by purchasing it from another holder.

But we assume that the secondary market will open soon after the initial launch, which will make INTENT available on exchanges. We will announce concrete exchanges soon.

How can I get INTENT tokens?

INTENT Tokens can only be earned through user activity within the TENT application. This is a reward and incentive for active TENT users. You can also buy INTENT from other TENT users or on exchanges after it has been listed and sold by other holders.

What is the use of INTENT?

ROAD MAP

2022

Initial stage

INTENT token White Paper

Initial generation of INTENT tokens

2023

Initialization phase

Platform TENDA 1Q

1Q TENT Mobile App: Android and iOS Version Implements multi-factor authentication to log in to the app

Custody crypto account

Integrated Crypto SWAP Functionality

Integrated online system functions for KYC/KYT functionality

Blockchain implementation and underlying cryptocurrency

TENDA 2Q Mobile Application: Integration of gas station solutions for tokens in custody crypto accounts

Added payment gateway functionality for crypta purchases with payment cards

Expanding the number of supported blockchains and cryptocurrencies

Completed payment card integration development

2Q INTENT — Web3 application for vesting INTENTINTENT provides smart contracts

Web application with METAMASK wallet integration

KYC/KYT integration

TENDA 3Q Mobile App: Chart integration for individual portfolios

Implementation of IBAN solution for EUR, USD accounts completed

Implemented functionality to buy/sell crypto from an IBAN account

Work on the discount pool has begun

INTENTION 3Q: Implement INTENT airdrop functionality in a mobile application

Launch of INTENT vesting in mobile applications

Work on the discount pool has begun

TENDA 4Q Mobile App: self-custody wallet implementation

Reference code functionality

Completed development of a custom payment card (for secure one-time purchases)

TENDA 4Q web application ::Deploying MVP version for testing

Reference code functionality

Completed development of a custom payment card (for secure one-time purchases)

2024

INTENT 2QPre-sale of IEO INTENT on P2B Exchange

Listed on the P2B Exchange

TENDA 3Q Mobile App: Regular savings function

Self-custody HW wallet security via NFC card

FUTURE PLAN:

Revolutionizing Financial Freedom Through Improved TENT App Functionality and INTENT Token Roadmap!

ENHANCED USER EXPERIENCE:

Simplifies the registration process for new users to simplify account setup.

Create a user-friendly interface with intuitive navigation and clear labeling.

Introducing a personalized dashboard with customizable widgets for effective asset and transaction tracking.

INTENT TOKEN EXPANSION AND INTEROPERABILITY: EXPANDING INTENT TOKEN ACCESSIBILITY:

Listing INTENT Tokens on various centralized exchanges (CEX) globally, increases liquidity and availability. DEX Integration:

Launching INTENT Tokens on select decentralized exchanges (DEX), encouraging decentralized trading and community engagement.

In-App Integration with Partner Platforms: Collaborate with partner applications to integrate INTENT Token, enriching its usability in the financial ecosystem.

TENT WEB APPLICATION:

Introducing the desktop version of TENT, ensuring seamless accessibility across platforms.

Improves desktop UI/UX for optimal user experience and accommodates additional features.

Provides users with advanced focus mode features and in-depth reports for better financial management.

Developed a browser add-on to facilitate access to TENT features during web browsing.

ADVANCED TRANSACTION CAPABILITIES:

Enable scheduled and recurring payments, alongside batch payment processing.

Implement transaction categorization for efficient expense management.

INTEGRATION WITH FINANCIAL SERVICES:

Integration with Financial Services:

Integrates tax reporting tools to assist users in cryptocurrency tax compliance.

Partner with lending platforms to provide crypto-backed lending options.

CROSS-CHAIN COMPATIBILITY:

Exploring interoperability solutions for seamless token transfer across blockchain networks.

Expanding support to popular blockchain networks to increase availability and liquidity.

DEFI INTEGRATION AND INVESTMENT OPPORTUNITIES:

Established DeFi protocols for yield farming, liquidity mining and staking.

Compiling a list of vetted DeFi projects and in-app investment opportunities.

COMPLIANCE WITH REGULATIONS AND LEGAL FRAMEWORK:

Ensure compliance with evolving regulations, including MiCA in the EU.

Provides resources and guidance on regulatory compliance for the safe use of cryptocurrency.

GLOBAL EXPANSION STRATEGY:

Plan expansion to markets outside the EU/EEA region, taking into account regulatory requirements and market demand.

Conduct market research to identify growth opportunities in target regions.

CONTINUOUS IMPROVEMENTS AND FEEDBACK:

Implement a feedback system for user input and iterative improvements.

Update the plan based on user feedback, market trends, and technology advances.

AI-ASSIST INTEGRATION:

Introducing AI assistance for user onboarding, customer support, and application navigation.

Update the plan based on user feedback, market trends, and technology advances.

MONEY BACK & LOYALTY PROGRAM:

Launch cashback and loyalty programs to drive user engagement and loyalty.

MONEY SENDING SOLUTIONS:

Integrate remittance solutions for efficient cross-border transactions.

ASSET DIVERSIFICATION:

Added new asset classes to expand investment opportunities.

APPLE PAY AND GOOGLE PAY INTEGRATION:

Provides card virtualization compatible with Apple Pay and Google Pay for convenient payments.

EXPANDED TOKEN SUPPORT:

Introducing a new set of supported tokens for diversified investment options.

TAX FORM INTEGRATION:

Simplify tax reporting with automatic tax service integration.

INTERNATIONAL EXPANSION:

Expanding TENT’s reach globally, including regions such as the Americas, Latin America, Asia and Australia.

CBDC INTEGRATION

Collaborate with CBDC projects to promote digital currency interoperability.

ADVANCED TRADING FEATURES

Enhance the trading experience with stop-loss orders, automated trading, and more.

Summary;

EXTRAORDINARY INFORMATION VISIT:

WEBSITE: https://intent-token.com/

WHITE DOCUMENT: https://www.intent-token.com/about

TWITTER: https://twitter.com/TentAppOfficial

TELEGRAM: https://t.me/TentAppOfficial

LINKEDIN: https://www.linkedin.com/company/tentapp

Discord: https://discord.com/invite/k87gHJvtbV

AUTHOR

Forum Username: Java22 Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443255 Telegram username: @Javania22 BEP-20 Wallet Address: 0x39aEF5f1cf37c0f1d015435F592Ce632720cB713

0 notes

Text

Wave As You Go By

I remember to my fleeting days of youth how we paid for things in stores and restaurants. You either had cash, or you handed over a credit card to some guy who then laid it atop a cumbersome manual device. He then slid the arm over your card to capture an imprint—ka-chunk!—and handed you the carbon copy. A few weeks later it might show up on your bill, after much more manual processing.

Later we enjoyed the ease of simply swiping our plastic, be it credit or debit, greatly simplifying and speeding up our transactions. Over-use of your credit card could result in it becoming “swiped out,” meaning the magnetic stripe on the back becomes very scuffed from repeated use.

But in the last few years, the rate of change has magnified. Apple Pay, Google Pay, and others all decided they wanted to be part of the payment eco-system, thereby grabbing a very small sliver of each transaction, but also providing convenience.

Then came tap-to-pay, which makes buying things ridiculously easy, whether in a store or at the gas pump. No need to worry about nefarious people installing credit card skimmers to steal your data.

Then there’s QR-pay, which I use in restaurants whenever possible, since I don’t want to relinquish my card to a total stranger for 10 minutes while they disappear to a hidden place. That’s risky business, and has also resulted in much fraud. Heck, I used QR-pay last night at Walmart, a handy feature of my Walmart+ membership. Talk about being in control, I not only scanned and bagged my own items, but then used my phone camera to pay for it from within the app. Easy peasy.

But wait, there’s more.

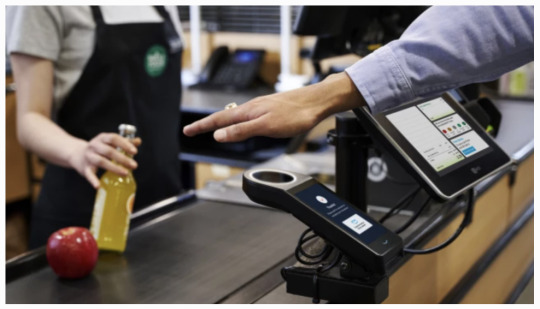

Biometrics are rapidly becoming the new cool way to pay. Last fall Amazon-owned Whole Foods announced it was rolling out its pilot program of hand scanners across the entire chain. Now when I go to a Whole Foods—mind you, we will never have one in Amarillo, but I shop there whenever I am in a larger city—I just wave my hand, and off I go.

Sure, it is its detractors, mostly those who contend that Big Data—meaning every big company that collects customer data—already has too much of our information. I reply, “But unless someone has me handcuffed against my will, or has chopped off my hand, this is exceedingly secure.” Your palm print is unique. I know. There is no perfect system, just like someone could have stolen my wallet 50 years ago with its cash and plastic, but I feel good about this.

And now Tencent, the Chinese firm behind their social media site WeChat, is doubling down on palm readers. This is not to be confused with American rapper 50 Cent, and I seriously doubt the Chinese entity has ever rapped. As much as we Americans love to be suspicious of anything the Chinese are doing, I must say they are leapfrogging much of the world with this effort. I recall China having QR-pay when we visited in 2019, and we were left scratching our heads and digging for RMBs to pay our lunch tab. Now they are reaching for the stars.

Tencent sees a hand-waving future in this, and not just for payments. Imagine being able to enter the subway or bus with a simple wave. Opening the front door of your house. Or entering your secure corporate campus and office. Even Google employees today have to “badge-in” and “badge-out.” Badges are so 1990s.

The long and the short of it is that we would not need to tote as many things as we have been doing, such as wallets and keys. I would stop short of saying we won’t need to carry our phone, because that would kind of negate the benefit of having such a handy mobile device. I mean, unless you simply do not want to be reachable.

Once again, there will be a transition period, and the hardware and software expense will be huge up front for businesses and anyone else using it. We just saw gas stations in the US transition to chip card readers (as mandated by law), and only some of those have tap-to-pay. All of that would be scrapped with a palm scanner.

And what of the Luddites who do not want to go along with any of this? My brother still prefers cash, and is loathe to use anything else. Going to pro sports and concerts these days is practically out of the question, because those venues no longer take cash, and ticketing is done electronically via your phone. When he saw me pay for my Whole Foods purchase a week ago in Orlando, he shrugged in a negative kind of way.

So does this mean businesses will have to retain legacy systems for those who do not want to adopt palm scanning? Tough question, because it would be even more expensive for companies. Perhaps what needs to be done is a concerted education effort to convince everyone of the merits of the new way, and demonstrate how that, while nothing is perfect, it is a step closer in the right direction.

Just be careful where and when you wave your hand. You may be paying for someone else’s dinner or groceries.

Dr “Ya Gotta Hand It To Them” Gerlich

Audio Blog

1 note

·

View note

Text

Revolutionizing the Payment Landscape: How Auxpay is Changing the Game

In today’s fast-paced digital world, businesses need efficient and secure payment solutions to thrive. Enter Auxpay, the trailblazing platform that is transforming the way businesses accept payments. With its cutting-edge technology and user-centric approach, Auxpay is poised to revolutionize the payment landscape and empower businesses of all sizes.

The Rise of Auxpay

Auxpay has emerged as a leading player in the payment industry, leveraging state-of-the-art technology to deliver seamless payment experiences. Whether you run a small e-commerce store or a bustling brick-and-mortar shop, Auxpay offers a comprehensive suite of payment solutions tailored to your unique needs.

The Power of Simplicity

One of the key features that sets Auxpay apart is its commitment to simplicity. Unlike many other payment platforms that bombard businesses with complicated processes and hidden fees, Auxpay streamlines the entire payment journey. From the initial setup to processing transactions, everything is designed to be intuitive and user-friendly.

Security at Its Core

Security is paramount when it comes to payment processing. Auxpay recognizes this and has implemented top-of-the-line security measures to safeguard businesses and their customers. With advanced encryption and fraud detection, you can rest assured that every transaction is protected.

A World of Possibilities

Auxpay opens up a world of possibilities for businesses, enabling them to accept various payment methods effortlessly. From credit and debit cards to mobile payments and even cryptocurrencies, Auxpay ensures that you never miss out on a sale due to limited payment options.

Seamless Integration

For businesses already using other software or platforms, the idea of integrating a new payment system might sound daunting. However, Auxpay makes integration a breeze with its seamless compatibility with numerous business tools and applications.

The Benefits of Auxpay for Businesses

Increased Revenue: By providing customers with multiple payment options and a frictionless checkout process, Auxpay can significantly increase your revenue and reduce cart abandonment rates.

Enhanced Customer Experience: With fast and secure payments, Auxpay ensures that your customers have a positive and hassle-free shopping experience, encouraging repeat business.

Real-Time Analytics: Auxpay’s robust analytics and reporting tools give you valuable insights into your business’s performance, allowing you to make data-driven decisions.

Scale with Confidence: Whether your business is just starting or experiencing rapid growth, Auxpay can scale alongside you, supporting your expansion without missing a beat.

What Users are Saying

Businesses across various industries have already embraced Auxpay and are reaping the rewards. One satisfied user, Sarah from an e-commerce store, says, “Since switching to Auxpay, our sales have soared, and our customers love the seamless checkout experience.”

Embrace the Future with Auxpay

In the ever-evolving world of payments, staying ahead of the curve is crucial. Auxpay’s innovative approach and dedication to empowering businesses make it a natural choice for those seeking a payment partner that can grow with them.

Conclusion

In conclusion, Auxpay is more than just a payment platform; it’s a game-changer for businesses worldwide. With its simplicity, security, and adaptability, Auxpay is paving the way for a new era of payment processing. Whether you’re a small business owner or a seasoned entrepreneur, Auxpay’s suite of solutions has something to offer everyone. Embrace the future of payments and elevate your business by joining the revolution with Auxpay. To learn more and take the first step towards transforming your payment experience, visit http://Auxpay.net today.

1 note

·

View note

Text

Libraries and Librarians on Film: You're a Big Boy Now (1966)

This film is notable, not just just because it prominently features a library, but because it features the central research library of OUR library system! It features such NYPL treasures and landmarks as our famous reading room, the Patience and Fortitude lion statues, the Gutenberg Bible, the stacks beneath the library where staff members wear roller skates to get back and forth through the stacks quickly (wait ... what?), and the giant walk-in safe where the library keeps its classic pornography collection (wait ... WHAT???)

Needless to say, there is SOME fictionalizing of our library in this film!

Now, if I was going to discuss this entire film, it would take a LOT of posts, because there are so many topics worth discussing. I could share all of the New York City locations that are frozen in time, like the Automat, the last of the old Penn Station as it was being demolished, the "OLD" Times Square (if you know what I mean), and the Alice in Wonderland statue in Central Park. I could also discuss the intricacies of the plot, like how a young man named Bernard Chanticleer who works for the New York Public Library feels overwhelmed by many things in his life, including his relationship with his parents, his desire for two different women, and the challenge of living in the same building as an aggressive rooster. Or I could talk about how this film is populated by a very strange cast of characters, including, I kid you not, an albino hypnotherapist with a wooden leg!

Okay, but since I'm NOT going to talk about all of that, let's focus on the vintage NYPL stuff, shall we?

No one will be seated during the gripping CARD CATALOG scene!

BTW, if you're wondering (like I was) what books she's looking up and requesting, WE NEVER FIND OUT!!!

Here's Francis Ford Coppola's credit, over a shot of the book elevator. Fun fact: you're only supposed to use this elevator for books, NOT staff members!

Here's our hero Bernard holding his roller skates, listening to his colleague Raef tell him why he shouldn't ride in the book elevator.

This is a cool shot of the interior of the library's main hall. If you come in through the main entrance on 5th Avenue, look up and you'll see these archways.

Ah, yes. THE VAULT. If the head of the library (I.H. Chanticleer, played by Rip Torn) wants you to go in THE VAULT with him, you should run in the other direction.

FYI, this plot point was one of the reasons that NYPL objected to having this movie filmed in this building. From IMDB trivia:

Francis Ford Coppola was desperate to film on location at the New York Public Library but the library refused because of the scene involving classic pornography locked up in a steel vault. However, Mayor John V. Lindsay was eager to promote the city and prevailed on the Library to change it's mind. This is why Lindsay gets a special thanks credit. The vault scene was eventually filmed on a sound stage.

Now, one of the movie's plot points that is technically true is that NYPL does own one of the famous Gutenberg Bibles. They don't leave it out in the open, though, which is probably a good thing ...

Because this makes it easy for Bernard to steal it ...

And run through the reading room ...

... and run outside with it down Fifth Avenue ...

... and this chase scene continues downtown, right through a department store where people apparently didn't realize that they were being filmed! From IMDB trivia:

The chase through the store occurred at the Mays department store on East 14th Street and Union Square. It happened during normal business hours and used hidden cameras.

I hope that you enjoyed this unusual tour through the yesteryear of the New York Public Library, where some ideas worked, but other ideas were sometimes a problem:

FYI, I can't find any evidence that NYPL staff ever used roller skates to get around the stacks. Mr. Coppola said in an interview on TCM that his older brother told him that "... below in the stacks, the young people who get the books are on roller skates. I don't think it was true." HOWEVER, it appears that this urban legend has some layer of truth, because it was reported in The New York Times that this technique was once employed at the NYU library!!!

If you would like to experience You're a Big Boy Now for yourself, you can check it out on DVD from the New York Public Library. It's available to watch through the Internet Archive, and you can also keep your eyes peeled in case TCM shows it again!

ETA: in case you’d like to get the vibe of this movie without watching the whole thing, TCM has a clip of the first several minutes of the movie on its website! Red-hot card catalog action! Walking through the reading room! PNEUMATIC TUBES!!!!! Plus, some amazing music!

1 note

·

View note

Text

Tech for Good: Highlighting the Positive Impact of Technology on Business and Society

The development and use of advanced technologies like intelligent automation and AI come with the possibility of raising productivity and economic growth as well as enhancing the quality of life of a wider variety. Modern technology has had a huge impact on our society, providing a variety of benefits including improved production processes requiring fewer resources and less time. These technologies also contribute to and promote healthier living, life longevity, and leisure. At the same time, these advances have the potential to reduce the disruption and social destabilization brought on by their implementation. Let us discuss more on this and find out the positive impacts technology is creating on society as well as the environment.

Improved Connections and Communication

Technological revolutions have made a huge impact on the way humans interact. A range of new avenues have opened up for advertisers and media professionals to reach their audiences, from websites to video platforms to social media. Technologies like video chatting and cloud-based systems let people work together quickly and easily. This enhances communication as well as overall workplace performance. What's more, we can now share photos, videos, and stories in a matter of seconds through digital communication.

Improved Education

Technology in the classroom facilitates self-paced learning, permitting students to go at their own speed. If kids need additional instruction, they can remain on particular lessons until they fully comprehend, or those who need less help can continue ahead. Meanwhile, educators can focus more on personally assisting those in need. Teachers can also focus on enhancing the learning experiences of the students by providing them with quality education.

Improved Healthcare

The health industry has changed significantly due to the emergence of technology. An abundance of cures has been created and treatment and care have become more effective. With the advent of AI and chatbots, doctors no longer have to worry about common patient queries. The AI chatbots and virtual assistants can be advanced to answer queries while enhancing the relationship with the patients. Doctors can also utilize the data to predict and gain insights about patients' health. We can say that these advancements in technology have drastically enhanced the diagnostics process, becoming more accurate, quicker, and easier to access.

Technology Promotes Inclusivity

We can say that technology can have a profound impact and help in creating support for culture and inclusivity. Think about the implementation of technology in healthcare, hiring, education, and other processes. Every individual or consumer will get a response. There will be no biases or concerns involved in the process. Individuals who are suffering from any kind of disability will also not face any concerns while dealing with advanced technologies. It can be an excellent addition, making communication and the entire process more seamless for each individual.

Effective Money Management

Technology has given us a much simpler way to handle financial matters. Keeping track of your receipts and bills has been made much easier, and paying taxes can all be done with just a few clicks. With cutting-edge mobile wallets, debit, and credit cards, it's not necessary to carry physical cash with us. Furthermore, with online investment platforms and expense trackers, monitoring your finances is a breeze. Technology provides a much simpler and safer way to manage money.

Effective Data Management

Before technology, retrieving and saving data used to be a big hassle. Look back at how hospitals and schools used to maintain huge files of data. What’s worst is that the data can be stolen or modified without being noticed by professionals. One can eliminate this and strengthen the security of data by implementing technology. Storing the data on cloud-based solutions can be an excellent idea. It will not only keep the data safe and secure but will also help with data retrieval. Furthermore, there are multiple other ways available to safeguard the data. One can even limit access to the data or adopt safety measures to ensure nobody can make any kind of alterations to the data.

Saves Money

Gathering data and compiling reports are some of the mundane and time-consuming tasks involved in each industry. Furthermore, if the data is entered manually, there are risks of errors and chances that the data may not be updated. If the staff member is absent, you may further have to face the consequences. This can be eliminated by incorporating technologies. Having current and relevant data in front of the eyes can help identify opportunities and problems. Businesses can take the right action by reading the reports with one click. While training required to understand these technologies might be expensive, the benefits certainly outweigh the time you may invest. It could be an excellent investment for the future of any organization.

Reduced Energy Consumption

In response to the increasing use of tech in the workplace, ICT companies have designed “greener technology” to reduce the negative effect of computers and technology on the environment. Examples of green technologies include multi-function devices and PC power management systems, which can help businesses with high-tech needs reduce energy expenditure.

Transforming Daily Lives

Technology is not just limited to energy consumption but also creates a profound impact on the food production industry. Our ways of farming are becoming less harmful as we are getting more aware of the surrounding ecosystems. It is also helping create alternatives and electric vehicles, reducing the impact on natural resources and transportation facilities. Furthermore, technology is helping reduce pollutants from our daily activities. Technology can also be used to spread more information and insights on how one can dramatically reduce the environmental impact.

Technology has the power to transform the society and the planet. However, the misuse of technologies can also lead to a deteriorating impact on the environment. One should be mindful of their decisions and implement technology only when it is required.

0 notes

Text

EDIT: Removed the link because the GoFundMe is defunct. Thanks for helping us meet our goal!

(New post because I put the wrong year on the previous one. It is Sep 11, 2021, and this fundraiser was started near the end of August 2021.)

Short version: We are trying to keep our family together. I'm disabled and autistic. My gf (also American) and I were in the mountains in the Philippines when lockdown hit. Shortly after that, we found out we were having a baby.

Shortly after our daughter was born (still in lockdown), the project I was writing for was canceled with no notice, leaving us with just my disability and a bunch of debt.

Because of a paperwork snafu, it's going to take six months to a year minimum to get our daughter (born in March of 2021) declared a US citizen and get her on my disability, plus we're going to have a lot of extra fees from overstaying our visas (even though it isn't by choice), PLUS a bunch of other unplanned expenses. Even if we could travel right now, our daughter can't, and there's no guarantee we'd be allowed back into the country to reunite with her.

Longer version:

I'm autistic, have two spine injuries, and traumatic brain injury, ADHD, bipolar disorder, and CPTSD. Although I may not LOOK it, I am totally and permanently disabled. Writing fiction is one of the few things I can semi-reliably do with my multiple disabilities, but it's tough finding a paying gig at that, so for most of the past ten years, disability has been my only income. In fact, a big part of why I went into debt to move to the Philippines was that it's possible to live independently here on the pittance that the US pays in disability.

Last year I was offered a deal to adapt one of my old stories (along with a setting I've spent ten years on) for a mobile game. Shortly after that, my girlfriend (also American) and I found out we were having a baby. All good, right? It looked like I might finally be able to get OFF of disability.

Then we had three hospitalizations (pneumonia for me, and two kidney infections for my gf), and when El was born, she required a C Section, which more than tripled our hospital bill (PI has a national health care system, but we are not on it yet.) THEN my computer started dying--and without a computer, I couldn't adapt my stuff. But hey, no problem, because I'd have money coming in from adapting my story, right?

So I went into debt to get a new machine that was suitable for adapting stuff to a video game, literally DAYS before the entire project was canceled with zero notice. And I couldn't take the gear back, because here in the Philippines, if you pay with a card, you can only return items for store credit, not a refund.

Now, the rules for tourist visas in the Philippines (this is relevant): Permanent resident visas are expensive (and they're not processing any right now anyway), so most expats just renew their tourist visa every two months at the local immigration office. You can do this for 36 months, and then you have to leave the country for 24 hours to "reset" everything.

Covid lockdown happened shortly before we were due to reset our visas, and was still in effect when El was born. And speaking of El...

Fathers are not allowed in the delivery room here, and because that's where they ask for the child's name, and because Zoey was all drugged up from the C Section, El ended up with a name too long to fit on official US forms (and yes, we tried). This means we have to amend the birth certificate before we can even APPLY to have El recognized as a US citizen, get her an SSN, a passport, and put her on my disability. We are told that just amending the birth certificate may take up to six months, even after we finish jumping through all the hoops.

That's before we can even START the process of getting El citizenship papers, a passport, and on my social security, which involves a trip to and stay in Manila (where the Lamda variant has been spotted) so that someone at the US embassy can interview us as a family.

Add to all this the ever-changing travel restrictions here--special passes are required off and on to enter and leave the city where we live, with little to no notice of when those restrictions change--and it's a mess.

Back to the visa stuff. Zoey and I could technically leave the country to reset our visas, but would not be able to take El with us, and there is no guarantee we'd be allowed back in to reunite with her. We're NOT going to leave without her.

This means we're on the hook for much higher fees to extend the usual 36-month limit, PLUS once El is declared a US citizen and gets a passport, we'll be on the hook to pay all her visa and extension fees from the date of her birth onward, all at once.

To be honest, this fundraiser covers MAYBE a third of what we're going to need to take care of all this, but we were uncomfortable asking for more.

There's more detail I could go into, and more expenses that have cropped up, but this is already too long. Suffice to say that if something COULD go wrong, it HAS gone wrong. And we appreciate your support.

911 notes

·

View notes

Photo

AU where deltarune and undertale are merged and all the darkners are monsters. i have a TON of lore thoughts about this au that didn’t make it into drawings so, more details under the cut

-i guess biggest thing first: card castle. which didn’t get a drawing because i don’t really have any design changes i wanna make to it? but it mostly stays the same - it’s a smaller sub-kingdom inside the underground, that’s ordinarily led by four rulers. spade king staged a coup and now he has designs on the throne of the entire underground, because he’s of the opinion that asgore’s too wishy-washy and not fit to rule.

-spade king wants the human SOULs to make himself strong enough to defeat asgore, because he knows right now he’s definitely not gonna beat him in a fair fight

-gaster built queen alongside the CORE. he intended for her to be sort of a backup emergency system, storing all the data on how to keep things running in case anything ever happened to him. he didn’t ever intend for her to be placed in charge of it full-time, but then, he never envisioned a whole city springing up around his creation either. or getting erased from spacetime. funny how life happens sometimes, isn’t it?

-queen actually couldn’t care less about breaking the barirer. as the personification of the CORE, she physically can’t leave the immediate area of cyber city anyway, so she has no real incentive to help asgore collect souls. however, she DOES care a lot about alphys, who has taken over helping her keep the CORE running, and has noticed that she’s been... quiet, lately. like something’s weighing on her she doesn’t want to talk about. queen wants to give her some new test subjects to help cheer her up! (this absolutely will not cheer her up)

-berdly is alphys’ intern, which really means he gets shoved off onto queen most of the time, because alphys is too nervous to handle instructing a whole person even when she’s not also covering up a massive science disaster in her basement. to her credit, queen handles the annoying little nerd pretty well.

-alphys building mettaton’s body and all still happens in this ‘verse. queen’s well aware mettaton’s a poser and not a real AI, but she’s not going to say anything about it yet

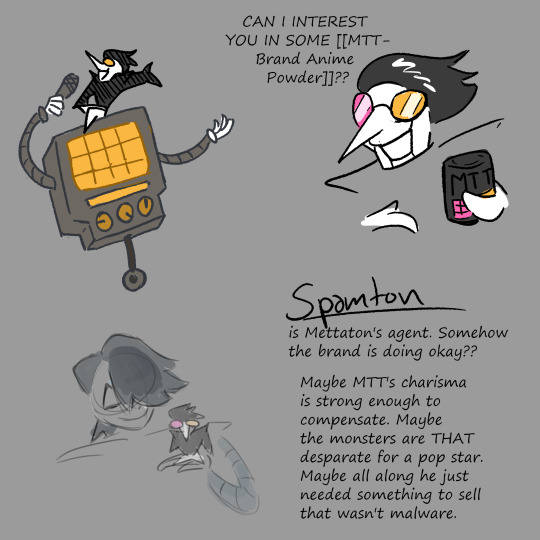

-mettaton has no real interest in the management side of stardom, and alphys is too anxious to handle the people stuff even if she did have the time, so he rolled over to the storefront side of cyber city and picked up an addison that wasn’t doing anything because they live for this kinda stuff, right?

-and somehow managed to pick up The Worst One.

-the brand really shouldn’t be doing as well as it is considering who’s in charge of it, but somehow things seem to be working out okay? things are selling, the ads are working, people are showing up to performances, so probably best to just... let spamton keep doing whatever it is he’s doing?

-also mettaton would never admit it but he’s kind of got a soft spot for the little dude. he knows exactly how it feels growing distant from your family once you finally get the fame you’ve been chasing, after all

-the holidays live in snowdin, of course! mrs. holiday isn’t the mayor, but she IS very involved in local organizing and hosts a lot of get-togethers. noelle helps out at the library.

-rudy... was handed over to the royal scientist for experimental treatment once it became clear the local hospital wasn’t enough, and they haven’t seen him since. noelle would really, really like to see her dad, but she knows that it’s probably important not to disturb doctor alphys or the other patients. she can wait! it’s fine!

-in the meantime, she’s been sneaking over to waterfall a lot. it’s quiet and peaceful there, and she used to come here with her dad a lot, whispering into echo flowers and making them “talk” to each other. it’s a nice place for her to get away when everything feels like too much

-also, waterfall has susie in it!

-susie is a swamp monster who lives in the swamp. this just felt right.

-after some initial confusion/fright (on noelle’s part) and hostility (on susie’s part), they slowly warmed up to each other. susie’s brash, reckless nature is kind of a balm for noelle’s soul, when she really wishes she could just get up on the roof and scream at the universe that nothing is FAIR. and susie REALLY likes it when she can get noelle to come out of her shell a little and do crazy things with her. who knew this adorable deer girl had such a loud side!

#deltarune#the nemesis speaks#swift plays deltarune#i don't really have much of a plot here in terms of what happens when the humans arrive#mostly just setting#deltatale

524 notes

·

View notes

Text

✨ HOW TO BECOME A WEALTHY MIDDLE AGED MAN✨

PT.2: Overview to understanding different saving/retirement methods, investments, and forms of income

Pt. 2.2 Overview of Investments

Welcome lovelies to (what I hope will be) a helpful series on gaining wealth and becoming financially literate and independent!

Disclaimer: Check other posts. It's too long to keep typing out.

Now comes (what I believe) is the fun part of money. Making it grow.

Investments are defined as “an asset or item acquired with the goal of generating income or appreciation.” Essentially, anything you purchase with the belief that in time it will be worth more. This includes the entire stock market, cryptocurrencies, art, real estate, jewelry, vintage coins, designer bags, etc. Of course, some of these take more time and each comes with some amount of risk. These variables change according to your strategy as an investor.

✨THINGS TO KEEP IN MIND✨

Begin as a Beginner

Do not overwhelm yourself during your financial literacy journey by trying to learn everything, all at once, while also trying it all out. The thing that creates the most confusion when learning is believing the lie that you can multitask well. Yes, start with a brief overview of the systems and institutions (what we are currently doing in the series) but literally all you need to start is definitions and a gist so that you can comprehend how they connect later on. Learning an entire world that has never been taught to you is going to take time, and I’m talking years. And then, when you think you have something down your going to mess up or read an article about how the stock you saw yesterday for $6 is now $1000 and you’re going to be frustrated (this happens a lot). But, If you want to learn about the stock market, focus on the stock market. Retirement still scares you, focus on that until you master it and have a plan. And for Christ’s (or whatever deity/person/universe you believe in) if you do not have a steady stream of income do not put your last pennies trying to get into crypto (or any investing truly). This is something to start after you have income, a savings, a retirement, and have paid off at least most debts.

Recommended sources to learn more:

Netflix has a great series called “Explained” where (you guessed it) they explain things. While I recommend every episode because you can never learn too much, there are ones specifically dedicated to the stock market, cryptocurrencies, and billionaires each that helps to uncomplicate the history and purpose of each of these things.

✨Let’s get started✨

The Stock Market

“Stock markets are real and electronic exchanges that enable the buying and selling of securities. The most popular include the NYSE, Nasdaq MarketSite, and Tokyo Stock Exchange.” Let me, let you, in on a little secret-the stock market is essentially fantasy football (sorry, my American is showing) but with companies. When you buy a security, you are betting that (in the long run or short run, depending on your strategy) that a certain company will perform well and gain profits, which in turn will gain you money on what you bet. There are two categories of players in the market which include the assets (the football players) and the investors (the betting public). Of the assets you can categorize further by what position they play on the field…

Stocks

Most well-known, but the riskiest. The “star” player that everyone hypes up and takes all the credit. Stocks are fractional pieces of publicly traded companies, and by buying a stock you own a relative size of that company. They are either “paying you” through growth (when their stock price rises) or through dividends (when they send you a piece of their profits directly).

Mutual Funds

Less known but a safer bet than single stocks. Popular among those in middle age. “Mutual funds are baskets of stocks or bonds. They come in all different shapes and sizes, from covering broad stock market indexes to focusing on specific sectors.” When you buy a mutual fund, you are saying that you believe on average that pile of stocks/bonds are going to do well, instead of betting on a single player. Usually they are actively managed by people who are trying to “beat” the market for you. Statistically good for the short term, long term are less effective than ETFs.

Index Funds: a subset of mutual funds that are passively managed and track indexes like an ETF but trade like a mutual fund (once at the end of the day and without reliance of supply and demand)

ETFs

Exchange traded funds. The up-and-coming underdog that’s gaining popularity. These are passively managed baskets of stocks and bonds that track over a specific index like the S&P 500. They work like stocks, being traded throughout the day, relying on supply and demand, while giving a lot of the advantages that mutual funds do. They also come with their own set of disadvantages but are still a great way to diversify a portfolio inexpensively.

Bonds

The reliable bench players you know you can put in to save a game. Great safe bets that can generate a steady income. Bonds work like a loan for a regular person, except for a company. You can loan your money to a company which will pay you a principal plus a fixed interest back every specified period. There are different types which come with different advantages and strategies, so make sure to read the fine print.

Commodities

Tangible goods that go into manufacturing-Gold, oil, metals, corn, soybeans, etc. A good defensive team to have in the game for a hedge against inflation or economic troubles. They trade in a commodity exchange. You can still access them through most brokers.

Source to look into for deeper understanding and questions: https://www.investopedia.com/terms/i/investment.asp

Easy way to get started quickly:

1. Create a brokerage account: There are lots of accounts to choose from, but I would go for accounts that have zero fees and no minimum, this is starting to become the norm but once upon a time you had to give a minimum investment of $5000 to get started. I personally use Charles Schwab and Robinhood. I love all of the tools and accounts Schwab has and Robinhood is just easy to use.

2. Sign up: this may take a day or two to finalize, especially with banks but it shouldn’t be a big deal

3. Connect a card or account to transfer funds

4. Buy your first security: I would start off with simply looking up beginner investments on google. I recommend either an ETF, index fund, or choose a company that you have an interest in because you will be more likely to keep up on their news

5. Tip: think long term as a beginner. Sure, once you start learning and understanding you can change your strategy to gain more in a shorter time, but this comes with much more risk. Do not be an idiot and sell all of your stock when you see your investment plummet nor sell as soon as you see it go up a little. The best advice for a beginner: Buy a stock and leave it alone (for YEARS)

Property/Real Estate

There are many ways to invest in real estate-you can buy a property, you can invest in a property fund, you can become a landlord,or you can flip a property. Again, depending on the strategy, will change the risk and reward you have taken on. All of these options are usually on the more cash heavy side but can reap a lot of rewards if done right.

Source to look into:

https://www.nerdwallet.com/article/investing/5-ways-to-invest-in-real-estate

Easy way to get started quickly:

1. Buy a real estate ETF or fund, you can just look this up on google or through your brokerage

2. OR you could look into buying a property near you and renting it out if you have that much cash (Make sure to do your research, this can get pretty complicated)

Art

Also considered property but until recently it was incredibly hard to invest in art without significant cash and contacts available. Now, there are platforms like Masterworks where you can buy a fraction of a piece like a stock of Monet and you get the rise in appreciation. However, it still is for those with money already available, I believe you have to invest a minimum of $2500 to get started on MW.

Sources to look into: https://www.investopedia.com/articles/pf/08/fine-art.asp

Crypto

Cryptocurrencies are digital currencies that are not backed by real or tangible assets or goods, but on the trust and value of the people that use them, and supply and demand. They can be traded like stocks on an exchange and are tracked with a digital ledger on the blockchain. The first cryptocurrency was Bitcoin and the rest that have followed are categorized as altcoins (alternative coins).

The stage of cryptocurrencies we are in is likened to the early 90s with the internet. Not a lot people truly understand the blockchain (the vast ledger space which contains every transaction made securely in encrypted “blocks” that are then “chained” together so that if one block is compromised the whole chain shuts it down.) It is decentralized and written simultaneously on thousands of super computers. The beauty of it is that if one ledger on one computer is somehow hacked or wrong the rest of the computers storing the ledger interrupt and either fix it or shut it down. A way to understand it is blockchain is to the internet as bitcoin is to a website, but the internet runs off people trusting the system, blockchain runs off trusting no one.

The currencies that run on blockchain can have a multitude of purposes, but bitcoin was really just the starting solution to fix the problem of trust on the internet. People wanted a secure, anonymous, untraceable way to spend money online, like cash is in the real world. And while for the most part it is just that, it isn’t completely anonymous. Like in the real world if you buy something from Mcd*nalds with cash that transaction is still recorded in their system and through a receipt. Your crypto transactions are recorded in the blockchain, but most people don’t even know how to access the ledger so for now any ill*cit purchases you make are pretty safe.

I HIGHLY recommend looking into a cryptocurrency course or training just because there is so much that goes into it and lots of details that can help you. This investment is incredibly risky and volatile! I only would suggest investing an amount you are completely comfortable to lose ALL of.

Sources to learn more:

https://www.investopedia.com/cryptocurrency-4427699

Easy to get started quickly (Please dear lord do your research first):

1. Sign up on a crypto exchange like Coinbase or Binance, some brokers (like Robinhood) also allow you to trade crypto but it’s a very limited selection

2. Do lots of research!! (I’m going to say it until you get it, and I don’t think you get it yet)

3. Think of it like stocks, if you read up on the coin and its purpose, and think that it’s going to be useful soon or in the future, then invest

4. Tip: the crypto market moves MUCH faster than the stock market and is much more sensitive. In just these last few days (literally hours) bitcoin was trading at $40,000+, the following day, for whatever reason (people got scared, people wanted to sell to get profits, etc.) it will barely hold $33,000. So, invest wisely!