#suspect fraudulent activity

Explore tagged Tumblr posts

Text

How can you get assistance from the missing person investigation experts?

Till yesterday the person was with you. Indeed it is hard to accept when you lose someone. It becomes traumatic. But yes, being the well-wisher till your last breath, you will try your best to find out the real reason behind the persons getting missing. So here let’s check out the few facts which say how missing persons Brisbane can help you.

Legal Support

The legal process is quite complicated, so specialised knowledge is required. They help families to stay informed of their legal whereabouts and move accordingly.

Advocating

Families with missing persons often face mental dilemmas. They don’t know whether to come up with the problem for the other person. In that case, they go to the advocates for a way out. And missing person lawyers do handle it delicately. They work with complete compassion and try their best to win the case. Now such a friendly gesture automatically relieves the near ones and family.

Detailed investigation

Once you call up the missing person investigators, they conduct a detailed investigation. But before plunging into the case, they try to find the root cause at length. When a person disappears or gets missing, is it by self-choice, or something wrong happened to the person? They start to garner all sorts of manifestations that support the case. Also, they work hand in hand with the experts, like other Private investigators services and lawyers, to reveal the truth.

Assistance

When someone all of a sudden gets missing automatically, that is the case when you start to think about what happened. And honestly, you don’t get the answer so quickly like an investigator surveillance. But yes, it’s the most challenging time when you feel like getting some support. Well, of course, the investigators do help you overcome that. They allow you to cope with the anxiety that you face during such excruciating moments.

Final say

So you can call any Missing Persons Investigation experts and ensure that you get complete guidance in any case when a near one gets missing.

#missing person investigation#missing person investigation Australia#missing persons Brisbane#childeren Missing Persons Brisbane#Cheating Partners Investigations#address of the missing person#investigator surveillance missing person#fraud investigation#corporate fraud investigation#suspect fraudulent activity#lost friend#Missing family member

0 notes

Text

something the Mullenweg lawsuits allege that is caught my eye is that the company he used as a...I'm not sure what the business term is but Audrey LLC is his company that the lawsuit plaintiffs report were employing them as home healthcare workers. however, Audrey LLC is Matt mullenweg's angel investment firm.

there's no non-suspicious reason i can think of for Matt to be using his investment firm corporation to be employing his mother's home healthcare workers. i assume this has something to do with how a certain amount of shell corporations, borderline fraud, and umbrella corping is actually legal and normal to do in corporate ownership and C-suite activity, and everyone does it and no one considers it criminal unless they are really caught and pinned down about it (such as in a lawsuit but often not even then). the lawsuits allege not just basic abusive workplace conditions (which, to be clear, is normal for many segments of the elder care field: dementia removes the impulse control from old white people who have struggled to contain their horrific personalities and virulent racism and sexual assault urges for 80 years. Kathleen Mullenweg sounds exactly like my awful grandmother) and human trafficking but also that Audrey LLC is a fraudulent organization. i suspect that if anything comes from the lawsuits and their discovery process that actually sticks (besides the wage theft and misrepresentation, those seem pretty solid), it's going to be that Audrey LLC is shady. one of the Reddit mods on the WordPress sub is employed by Audrey, for example

70 notes

·

View notes

Text

HeroFX is a controversial online trading platform established in 2021, with its operations purportedly registered in St. Lucia. Despite offering a range of trading instruments, including forex, indices, shares, futures, crypto, metals, and energies, HeroFX has garnered significant attention for its lack of regulation and legal compliance. The absence of a valid license from reputable financial authorities raises serious concerns about the platform’s credibility and the safety of traders’ funds. Numerous customer complaints and negative reviews have highlighted issues such as difficulties in withdrawing funds, security breaches, and suspected fraudulent activities. Given these red flags, traders are advised to exercise caution and thoroughly evaluate the risks before engaging with HeroFX.

HeroFX Review 2024

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

64 notes

·

View notes

Text

wang yibo - yuehua weibo update on rights protection cases

For a long time, our company has found that there are a large number of users on the Internet who publish and spread information against our company on multiple platforms. The release and dissemination of the allegedly infringing content of our artist Mr. Wang Yibo not only caused serious damage to his reputation but also had a huge negative impact on the entire network environment.

The behavior of the customer has been suspected of seriously infringing on the legitimate rights and interests of Mr. Wang Yibo. In this regard, our company resolutely has zero tolerance and actively

Protect rights through legal channels. Our company is now defending Mr. Wang Yibo’s partial reputation and personal information rights.

The progress of the case is explained as follows:

①During July 2024, WeChat user "Saku La" (WeChat ID: mi************25)

Several seriously insulting and defamatory remarks against Mr. Wang Yibo were posted in the WeChat group chat, which are suspected of infringement.

②During 2023-2024, Weibo user “Like Nine Cats” (UID: 75*****17)

A large number of blog posts against Mr. Wang Yibo were publicly posted on the Weibo platform. The content of the blog posts contained a lot of insults, Defamatory remarks, suspected infringement,

The above suspected infringements have caused Mr. Wang Yibo’s social evaluation to lower and damaged Mr. Wang Yibo’ personal reputation and has been suspected of serious infringement of his reputation. Our company and Mr. Wang Yibo have entrusted Lawyers continue to collect evidence and will file lawsuits in court in accordance with the law, requiring relevant online platforms to disclose the network owners involved in the case.

After the platform discloses the real-name identity information, it will file a lawsuit against the real-name authentication subject as soon as possible and request relevant information. The relevant subject publicly apologized to Mr. Wang Yibo in accordance with the law and compensated him with corresponding solatium for mental damage and reasonable compensation.

③Mr. Wang Yibo’s online tort liability dispute case with an online platform and an airline company In February 2024, a certain subject (hereinafter referred to as the "booker") purchased tickets without the consent and authorization of Mr. Wang Yibo. In this case, Mr. Wang Yibo’s name, ID number and other personal information were used without authorization to use a certain website platform to purchase a ticket from an airline. The above behavior of the booker is a violation of Mr. Wang Yibo’s personal identity.

In short, fraudulent use is suspected of being illegal, and it also seriously affects Mr. Wang Yibo’s normal work schedule, and is suspected of infringing Wang Yibo’s normal work schedule.

Regarding the legitimate rights and interests of Mr. Bo, our company and Mr. Wang Yibo have entrusted a law firm to continue to collect evidence and will continue to collect evidence in accordance with the law.

File a lawsuit with the court, requesting the court to order the relevant online platforms and airlines to disclose the use of the ticket bookers involved in the case

Account name, platform registration information, contact information, real identity information, payment platform, payment method, payment information, IP address and other order information. After the court discloses the above information, our company and Mr. Wang Yibo will further commissioned a law firm to file a lawsuit against the real-name authentication subject, requiring the relevant subject to file a lawsuit against Wang Yi in accordance with the law. Mr. Bo publicly apologized and compensated for the corresponding mental damage and reasonable rights protection costs.

In addition to the above cases, there are still other rights protection cases concerning Mr. Wang Yibo’s reputation, portrait, personal information rights, etc.

The item is in progress. Our company once again warns all network entities to immediately stop publishing and disseminating suspected infringements against Mr. Wang Yibo legitimate rights and interests to avoid further expansion of damage consequences and incurring one's own legal liability.

Our company will also pay close attention to network dynamics and continue to entrust law firms to collect evidence and collect evidence on suspected infringing content.

File a lawsuit and resolutely safeguard the legitimate rights and interests of Mr. Wang Yibo!

#wang yibo#I AM ABSOLUTELY HORRIFIED THAT AN AIRPORT EMPLOYEE WILL STEAL HIS INFO LIKE THAT MY GOD#YH should really be more aggressive in protecting yibo in all aspects

46 notes

·

View notes

Text

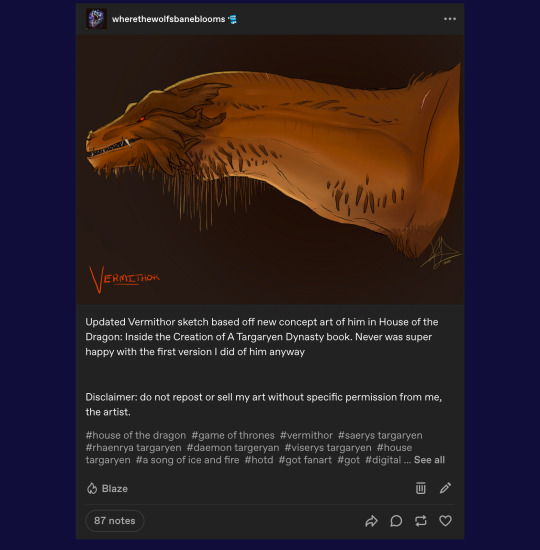

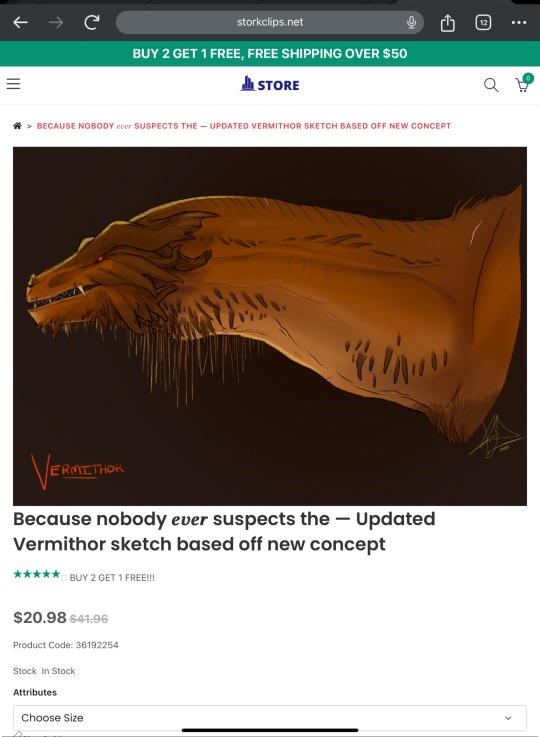

** STOLEN ART: STORKCLIPS.NET **

It pains me to have to write a post like this. But I have recently discovered a website trying to illegally sell my artwork without my permission. I found the site by simply googling “Vermithor” in the search bar with the goal of finding new screenshots of him from the recent House of the Dragon Season 2 trailer to use as reference for a new sketch of him. Imagine my surprise when I found my art came up as one of the most popular images of Vermithor! But my elation did not last long. The site in question: storkclips.net appears to steal artwork and photographs from artists and cosplayers to sell for their own benefit. Not only that, but it appears to be a scam website too and I suspect they are also guilty of data mining. I just wanted to make everyone aware of this so no one else falls victim to their crap. When I attempted to file a DMCA infringement complaint through their software, I was immediately denied access from the site. It is likely they have IP address assessing software that block people who try to accuse them of their crimes from accessing the website again. But I know for a fact the website is still active. This is what happened right after I filed the complaint:

I have included below screenshots of the original artwork I posted on tumblr of my updated Vermithor sketch compared to the thief site’s “product”. It is very clearly my art, as they didn’t even bother to remove my signature in the corner at the bottom of his neck. They also used the first portion of my art’s description Updated Vermithor sketch based off new concept from tumblr as their “product’s” title. It is also clear they completely ignored my VERY obvious disclaimer in the worst way possible.

Also, when I googled the website to try a find out information on them what I found gave me reason to believe this website, along with their products, are likely a fake. I’ve posted a screenshot of one of the only reviews I found on storkclips.net that warns people of them being scammers. What this person says is true too, the contact email the site has listed is a fraudulent address and doesn’t work.

To all the creative content makers out there, I suggest taking a look around this website to make sure they haven’t stolen any of your creative property too. I will post a link to my stolen art from the site below. If anyone has any more information, please feel free to reach out to me and I will update this post. Maybe if we can call them out enough on their scams they will shut the site down. Everyone please stay safe.

- Wolf

#house of the dragon#game of thrones#stolen art#scammers#fake website#vermithor#a song of ice and fire#art thieves

28 notes

·

View notes

Text

In 1935, fishermen caught a tiger shark and put it on display in an aquarium in Sydney. Shortly after, the shark fell ill, vomiting in front of a small crowd. Among the contents was a left hand and forearm bearing a distinctive tattoo. Fingerprints confirmed the limb belonged to James "Jim" Smith, a former boxer and petty criminal who had been missing since April 7, 1935. Upon examination, it was discovered that the limb had been deliberately severed with a knife, leading to a murder investigation. Initial investigations pointed towards a Sydney businessman named Reginald William Lloyd Holmes.

Holmes, known for his fraudulent activities and smuggling, also managed a prosperous family boat-building business. Holmes had hired Smith multiple times for insurance scams. They later joined forces in criminal endeavors with Patrick Francis Brady, an ex-serviceman and convicted forger. Smith was last spotted at the Cecil Hotel in the southern Sydney suburb of Cronulla on April 7, 1935, enjoying drinks and cards with Patrick Francis Brady. Prior to this, he had informed his wife that he was going fishing.

During that period, Brady had rented a small cottage on Taloombi Street, Cronulla. Police suspected that Smith met his unfortunate fate at this very cottage, alleging it to be the location of his murder. Port Hacking and Gunnamatta Bay were searched by the Navy and the Air Force, but the rest of Smith's body was never found. Brady was arrested on 16 May and charged with the murder of Smith. Initially, Holmes denied any association with Brady but four days later, on 20 May 1935, the businessman went into his boatshed and attempted suicide by shooting himself in the head with a .32 calibre pistol. However, the bullet instead flattened against the bone of his forehead and he was merely stunned. Holmes eventually cooperated with the police stating that Brady had killed Smith, dismembered his body and stowed it into a trunk that he had then thrown into Gunnamatta Bay.

25 notes

·

View notes

Text

Last month, former president and convicted felon Donald Trump announced that his campaign would accept donations in cryptocurrency. In the weeks that followed, the cybercrime detection firm Netcraft found dozens of scam websites seeking to target Trump supporters and swindle them out of their crypto, according to a report shared exclusively with WIRED.

Netcraft found that in the days leading up to the announcement, scammers registered domains with common misspellings, hoping to capture supporters intending to access donaldjtrump.com. One domain registered to donalbjtrump.com was a near perfect replica of the actual Trump campaign website. And while the Trump campaign accepts donations via Coinbase, a cryptocurrency exchange, some of the scam websites instead appear to be using portals meant to look like Coingate, a blockchain and crypto payment processor.

“As a victim, the fact that the real campaign is using Coinbase payments rather than direct cryptocurrencies” wouldn’t be very obvious, says Rob Duncan, head of research at Netcraft. “The way it's been advertised is ‘Donald Trump's taking cryptocurrency donations,’ when actually that's quite it's a bit more subtle.”

A second surge of fake websites appeared immediately after Trump’s May 30 felony conviction on 34 counts of falsifying business records to pay off the porn star Stormy Daniels. In the hours after his conviction, the campaign raised more than $34 million in donations. Cybercriminals seemed to anticipate this interest, and were ready to capitalize on the donations pouring into the Trump campaign in the wake of the verdict.

“Criminals like to use events like this, to base their scams on topical events, things that people are interested in, where people are more likely to click on links,” says Duncan. In the wake of the October 7 attacks and subsequent conflict in Palestine, Duncan says Netcraft identified several donation scams, targeting people on both sides of the conflict.

“They're interested in getting cryptocurrency from anybody. And they're not bothered about which political persuasion they might have,” says Duncan.

Duncan adds that through checking the blockchain, none of the scams seem to be successful yet, but he suspects that may be because they are relatively new and may not yet be active.

The Trump campaign did not respond to a request for comment.

Cryptocurrencies can be particularly useful for criminals because they are largely unregulated and don’t have the same constraints that traditional financial institutions do. According to the Federal Bureau of Investigation’s 2023 Internet Crime Report, crypto investment scams cost people some $3.94 billion. “Crypto is obviously a very good mechanism for criminals to use,” says Duncan. “There's no way to reverse payments; once the money's in the criminal's wallet, it's gone.”

Trump’s recent support of crypto is an about-face from his presidency. In 2019, Trump said he was “not a fan” of cryptocurrencies in a series of posts on X, then Twitter. “We have only one real currency in the USA … It is called the United States Dollar!” he posted at the time.

But now, the former president is courting the crypto space. Before his campaign’s announcement in May, Politico reported that Trump held a meeting at Mar-a-Lago with crypto traders where he apparently told them a Trump administration would not oversee the same regulatory scrutiny on crypto that the Democratic Party has sought. As the crypto industry has begun amassing money to attack candidates who favor more regulation of the space, however, some Democrats have backed away from a more hard-line stance.

In December, several leaders in the crypto space launched three political action committees (PACs) aimed at backing candidates with policies friendly to the digital asset industry. David Bailey, CEO of BTC Inc., told CNBC that the crypto industry was committed to raising “$100 million and turning out more than 5 million voters for the Trump reelection effort.”

It is unclear whether the Biden campaign will also begin accepting donations in cryptocurrency, and Netcraft said it has not seen similar scam activity targeting Biden supporters.

Gina Chow, emerging threat specialist at Netcraft, tells WIRED that although the company has found impersonations of Biden in the past, "similar crypto-themed campaigns, like those targeting the Trump campaign, have not yet been identified in our research. As the Biden campaign extends its capacity to accept crypto, it is likely that it will experience similar threats.”

11 notes

·

View notes

Text

Hugo Lowell at The Guardian:

Donald Trump’s campaign may be failing to reach thousands of voters they hope to turn out in Arizona and Nevada, with roughly a quarter of door-knocks done by America Pac flagged by its canvassing app as potentially fraudulent, according to leaked data and people familiar with the matter. The potentially fake door-knocks – when canvassers falsely claim to have visited a home – could present a serious setback for Trump as he and Kamala Harris remain even in the polls with fewer than 20 days until an election.

The Trump campaign earlier this year outsourced the bulk of its ground game to America Pac, the political action committee founded by Elon Musk, betting that spending millions to turn out Trump supporters, especially those who don’t typically vote, would boost returns. But leaked America Pac data obtained by the Guardian shows that roughly 24% of the door-knocks in Arizona and 25% of the door-knocks in Nevada this week were flagged under “unusual survey logs” by the Campaign Sidekick canvassing app. The Arizona data, for example, shows that out of 35,692 doors hit by 442 canvassers working for Blitz Canvassing in the America Pac operation on Wednesday, 8,511 doors were flagged under the unusual survey logs.

The extent of the flagged doors in America Pac’s operation underscores the risk of outsourcing a ground-game program, where paid canvassers are typically not as invested in their candidate’s victory compared with volunteers or campaign staff. America Pac denied it was experiencing that level of actual fraud in Arizona and Nevada and declined to comment on reporting for this story. “Sidekick was never expected to handle the auditing of America Pac’s door operation. The reason the Pac is confident in its numbers is because of the auditing procedures each canvassing firm puts in place and the auditing procedures of the Pac writ large,” a person familiar with the America Pac operation said. The Trump campaign did not respond to multiple requests for comment.

[...]

Suspicious doors

The Trump campaign took a gamble this cycle when it outsourced the bulk of its ground game to political action committees, after the Federal Election Commission earlier this year for the first time allowed campaigns to coordinate its voter turnout efforts with outside groups. The campaign initially envisaged multiple pacs helping to drive the Trump vote, but America Pac ultimately became the largest and most ambitious of the outside groups as it poured more than $29.8m into its field operation for Trump and became the only Pac with a material presence in every battleground state.

The largest of the other Pacs involved with doing field work, such as Turning Point Action and America First Works, have a smaller footprint. Turning Point’s team in Wisconsin has also since been subsumed into America Pac’s operation, two people familiar with the matter said. As a result of its heavy investment, America Pac has been able to post impressive numbers of door-knocks in only a matter of months through its network of several vendors and dozens of subcontractors under those vendors in each of the battleground states. But in the final stretch toward the election, as the total door-knocks have increased, so too have suspected fakes, according to the leaked data. On 15 October, 20.1% of doors in Arizona were flagged under the unusual activity logs. On 16 October, it rose to 23.8% and on 17 October, it hit 26.9%.

The Guardian reports that Elon Musk’s pro-Trump America PAC that serves as one part of Donald Trump’s ground game could be flagged as potentially fraudulent.

#America PAC#Scams#Super PAC#Voter Registration#Donald Trump#2024 Presidential Election#2024 Elections#Elon Musk#Campaign Sidekick#America First Works#Turning Point Action#PACs

5 notes

·

View notes

Text

BBC Article: Microsoft killed my online life after I called Gaza

11 July 2024 | Mohamed Shalaby and Joe Tidy

Palestinians calling home to Gaza on Skype have had their digital lives destroyed, after Microsoft closed their email accounts without warning.

BBC News has spoken to 20 Palestinians living abroad who say Microsoft, which owns the voice and video chat app, kicked them out of their accounts. The total number affected is thought to be much higher.

In some cases, these email accounts are more than 15 years old and the users have no way to retrieve emails, contacts or memories.

Microsoft says they violated its terms of service - but will not say how - and the decision is final.

The Gazans say they have no links to Hamas - designated as a terrorist organisation by some Western countries, including the US, where Microsoft is headquartered - and accuse the technology giant, the most valuable company in the world, of persecuting them unfairly.

Switched off

Salah Elsadi is living in the US and, like many Palestinians abroad, was using Skype to call his wife, children and parents on their mobile phones in Gaza.

The internet is frequently disrupted or switched off because of the Israeli military campaign - and standard international calls are very expensive.

With a paid Skype subscription, it is possible to call mobiles in Gaza cheaply - and while the internet is down - so it has become a lifeline to many Palestinians.

But in April, Mr Elsadi, like many others, was kicked out of his account - and all services linked to his Microsoft Hotmail account.

He has missed out on job offers and can no longer access his bank accounts, which are tied to his Hotmail account, he says.

"I've had this Hotmail for 15 years," Mr Elsadi says.

"They banned me for no reason, saying I have violated their terms - what terms? Tell me.

"I've filled out about 50 forms and called them many many times."

Others have complained on social media of similar treatment.

Some fear they are being wrongly accused of being a part of Hamas.

'Fraudulent activity'

“We are civilians with no political background who just wanted to check on our families," Eiad Hametto says. He was calling his family from Saudi Arabia.

"They’ve suspended my email account that I’ve had for nearly 20 years.

"It was connected to all my work."

"They killed my life online.”

Microsoft did not respond directly to the accusation these people have been labelled as Hamas - but a spokesperson said it did not block calls or ban users based on calling region or destination.

"Blocking in Skype can occur in response to suspected fraudulent activity," they said without elaborating. And users could appeal.

But many of those BBC News has spoken to say they have tried many times and are receiving the same blanket response.

One, Khalid Obaied, has lost faith with Microsoft.

"I don't trust them any more," he says.

"I paid for a package to make phone calls - then, after 10 days, they ban me for no reason.

"They have never provided a reason.

"That means it's only because I’m a Palestinian calling Gaza.”

#falasteen#palestine#gaza#ghazzah#microsoft#skype#major companies doing their utmost to once again punish palestinians for being palestinian

6 notes

·

View notes

Text

ATTENTION: Possible Fraud🚨⚠️

A person is suspected of selling trucks online under false pretenses and engaging in fraudulent activity. They may accept payments and then block communication without providing the truck or refunding the money. Be vigilant and cautious when making online purchases, especially if the seller requests untraceable forms of payment.

Protect yourself from scams by doing your due diligence and only working with reputable sellers.

#online scams#scam alert#scam warning#scammers#scam#stolen photos#bez tytulu#economics#delicious#studying

2 notes

·

View notes

Text

How to Get Money off a Closed Cash App Account

Having your Cash App account closed can be a stressful experience, especially if there were funds in the account. Whether it was closed due to a violation of terms of service, suspicious activity, or another reason, many users are left wondering how to recover their money. In this guide, we’ll cover the steps you need to take to get money off a closed Cash App account and address common concerns.

Why Did My Cash App Account Get Closed?

Understanding why your Cash App account was closed is the first step in resolving the issue. There are several reasons why this might happen:

1. Violation of Terms of Service

Cash App has strict guidelines regarding how its platform can be used. If you are suspected of engaging in activities that violate their terms of service, such as fraudulent transactions, your Cash App account may be closed.

2. Unverified Identity

If you fail to complete the required identity verification process, Cash App may flag your account as suspicious and eventually close it. This is done to protect both you and the platform from potential security risks.

3. Suspicious or Unusual Activity

If Cash App detects unusual or suspicious behavior, such as multiple failed login attempts, large unverified transactions, or accessing your account from different locations or devices, they might close the account to prevent fraud.

4. Multiple Accounts

Operating multiple Cash App accounts without proper verification or authorization could result in your Cash App account being closed.

What happens if Your Cash App Account is closed?

When your Cash App account is closed, it doesn’t mean that your money is gone forever. Cash App typically holds any remaining funds until the issue is resolved or the money is returned to the original funding source (such as a linked bank account or card). However, getting access to these funds requires following certain procedures.

1. Funds Are Temporarily Held

Cash App will hold the funds in your closed account until the account is reopened or until a refund is issued to the linked payment method. In some cases, you may be able to reopen your closed Cash App account to gain access to your funds.

2. Pending Transactions

If you had any pending transactions when your account was closed, those payments will either be canceled, refunded, or put on hold until the issue is resolved.

How to Get Money off a Closed Cash App Account

If your Cash App account got closed and you need to retrieve your money, here are the steps you can take:

1. Contact Cash App Support

The most direct way to recover funds from a closed Cash App account is to contact Cash App Support. Follow these steps to reach out:

Open the Cash App (if possible) or visit their website.

Tap your profile icon in the upper right corner.

Scroll down and select "Support."

Choose "Something Else" and then "Account Settings".

Select "Closed Account" and follow the prompts to explain your situation.

Make sure to provide accurate information, including your registered email address, full name, and any details about the funds you are trying to recover.

2. Request a Refund

If your account cannot be reopened, Cash App may issue a refund to the bank account or card linked to your account. This refund can take a few days to process, depending on your bank or card issuer.

3. Submit Identity Verification

If your account was closed due to identity verification issues, you will need to provide the following:

Your full name.

Your date of birth.

Your Social Security number (SSN).

A government-issued photo ID (e.g., driver’s license or passport).

Once your identity is verified, Cash App may either reopen your account or refund the funds to your original payment method.

4. Monitor the Status

After you have submitted your request, keep an eye on your email or in-app messages for updates from Cash App Support. They may require additional information or documentation to process your refund.

5. What to Do if Money Was Sent to a Closed Account

If someone sent money to your closed Cash App account, the payment will likely be rejected and returned to the sender. You should ask the sender to check their transaction history, and if the money is not automatically refunded, they can contact Cash App Support for assistance.

How to Reopen a Closed Cash App Account

In some cases, it’s possible to reopen a closed Cash App account. Here’s how:

1. Submit a Reopen Request

To reopen your Cash App account, contact Cash App Support and explain why you believe the account was wrongfully closed or provide any missing information.

2. Provide Necessary Documents

If the closure was related to identity verification, you’ll need to submit documents proving your identity, such as your government-issued ID and SSN.

3. Wait for a Response

Once you’ve submitted your reopen request and any required documentation, Cash App Support will review your case. The review process can take a few days to a week, depending on the complexity of the issue.

4. Check for Account Restrictions

After your account is reopened, ensure that there are no lingering restrictions, such as limits on transactions. If there are, contact Cash App Support to resolve these issues.

Conclusion

If your Cash App account is closed, you can still recover your funds by following the correct procedures. Contact Cash App Support, provide the necessary verification documents, and request a refund if the account cannot be reopened. With the right approach, you can successfully get money off a closed Cash App account and prevent future account closures by following Cash App’s terms of service and verifying your identity.

Frequently Asked Questions

1. What happens if my Cash App account is closed?

If your Cash App account is closed, your funds will be held temporarily. You can recover them by contacting Cash App Support and requesting a refund or reopening the account.

2. Why did my Cash App account get closed?

Your Cash App account may be closed due to violations of the terms of service, unverified identity, or suspicious activity. You can contact Cash App Support to find out the exact reason.

3. Can I get money off a closed Cash App account?

Yes, you can retrieve funds from a closed Cash App account by contacting Cash App Support and requesting a refund to your linked bank account or card.

4. What should I do if someone sent money to my closed Cash App account?

If money was sent to a closed Cash App account, the payment will likely be rejected and returned to the sender. If not, the sender should contact Cash App Support for assistance.

5. Can I reopen a closed Cash App account?

Yes, you can attempt to reopen a closed Cash App account by contacting Cash App Support and providing any necessary identity verification documents.

2 notes

·

View notes

Text

Cash App Account Closed: Violation of Terms of Service

Cash App, one of the most popular mobile payment services, provides users with the ability to send, receive, and manage money easily. However, there are instances where Cash App closes account due to violations of their Terms of Service. If your Cash App account was closed, it can be a frustrating and confusing experience, especially if you believe you've done nothing wrong. In this article, we'll explore why Cash App closed your account, potential reasons for violations of terms, and steps to take if this happens to you.

Common Reasons Why Cash App Closed Your Account

If you found yourself in a situation where Cash App closed your account for no reason, it’s important to note that there are several reasons Cash App might take such action. Even though it may seem random or unjustified, Cash App has policies in place that users may unknowingly violate. Below are some of the key reasons:

1. Violation of Terms of Service

One of the most common reasons Cash App shuts down accounts is due to a violation of their Terms of Service. Cash App requires that all users follow their strict guidelines. Engaging in any activity that violates these terms—whether knowingly or not—can result in your account being closed.

Common violations include:

Fraudulent activity: Engaging in fraud or attempting to scam other users will lead to a swift closure.

Suspicious transactions: Large amounts of money being transferred without verification or unusual transaction behavior might trigger a closure.

Use of Cash App for prohibited activities: This includes illegal activities, gambling, or selling unauthorized products and services.

Violating the age restriction: Users must be at least 18 years old to hold a Cash App account.

2. Multiple Accounts

Cash App closed your account for no reason might actually be linked to the use of multiple accounts. Cash App does not allow users to maintain more than one personal account, and creating multiple accounts with the same identification or payment information can cause the system to flag your accounts and ultimately lead to their closure.

3. Incomplete Identity Verification

Failure to verify your identity on Cash App is another potential reason for account closure. Cash App account closed due to insufficient information is common when users do not complete the verification process. Unverified accounts have strict limits on transactions, and attempting to exceed these limits without proper identification could lead to a temporary or permanent account suspension.

4. Violation of Cash App Bitcoin Policies

Cash App allows users to buy, sell, and withdraw Bitcoin. However, Cash App closed my account might be the result of breaching their cryptocurrency rules. For example, attempting to withdraw more Bitcoin than allowed or using Bitcoin transactions for unlawful purposes will likely lead to the shutdown of your account.

5. Unauthorized Access or Hacking

If Cash App suspects that your account has been hacked or accessed by unauthorized parties, they may shut it down to protect your funds and personal information. Cash App closed my account for no reason may simply be a security measure implemented to safeguard your data, especially if suspicious activity has been detected.

6. Chargebacks or Disputes

If you file too many chargebacks or disputes with your bank or card issuer after making transactions on Cash App, the platform may consider you a high-risk user. Cash App shut down accounts with frequent chargebacks to minimize potential losses from refund abuse or fraudulent disputes.

7. Using a VPN or Proxy Server

Cash App monitors users’ geographic locations to ensure compliance with its services. If you use a VPN or proxy server to mask your location, Cash App closed my account might be the result of this action. The platform could suspect that you are engaging in suspicious activities, prompting them to take immediate action to shut down your account.

Steps to Take if Cash App Closed Your Account

If Cash App closed your account for no reason, don’t panic. There are steps you can take to try to resolve the issue and regain access to your funds.

1. Contact Cash App Support

The first thing to do is reach out to Cash App Support. Explain the situation and ask for the specific reason your account was closed. You can contact support through the app itself by navigating to your profile and selecting the “Support” option. Be patient, as it may take time for them to investigate the matter thoroughly.

2. Verify Your Identity

If your account was closed due to verification issues, you may be required to provide additional identification. Submitting the necessary documents, such as a government-issued ID and proof of residence, can help to restore your account. In many cases, Cash App shut down accounts until the verification process is complete.

3. Review Your Transaction History

It’s crucial to review your recent transactions to ensure that none of them might have triggered the violation of Cash App’s Terms of Service. If you notice any suspicious transactions or charges that you did not authorize, be sure to report these to Cash App immediately.

4. Stop Using Multiple Accounts

If you’ve been using multiple Cash App accounts, be aware that this is likely the cause of the shutdown. To avoid this issue in the future, ensure that you are only using one account per person, as Cash App prohibits users from holding multiple personal accounts.

5. Wait for a Response

After reaching out to support and submitting the necessary documents, it may take some time for Cash App to respond and take action. During this waiting period, avoid creating new accounts, as this could complicate matters further.

How to Prevent Your Cash App Account from Being Closed

To prevent your Cash App account from being closed in the future, follow these best practices:

Stay compliant with Cash App’s Terms of Service: Ensure that all of your transactions are lawful and within the permitted uses of the platform.

Verify your identity: Complete the verification process as early as possible to avoid potential limitations or closures.

Monitor your account activity: Regularly review your transaction history to catch any unusual or suspicious behavior that may result in account closure.

Avoid multiple accounts: Stick to a single account to avoid breaching Cash App’s terms regarding account usage.

Stay within the limits: Be mindful of Cash App’s transaction limits and ensure that you don’t attempt to bypass them.

FAQs

Why did Cash App close my account for no reason?

Cash App may close your account for various reasons, including suspicious activity, violation of their Terms of Service, or incomplete identity verification.

Can I recover my Cash App account after it was closed?

Yes, in many cases, contacting Cash App Support and providing additional identification can help you recover your account.

What should I do if Cash App shut down my account?

Contact Cash App Support, verify your identity, and review your transaction history for any suspicious or prohibited activity.

Can I use Cash App again after my account was closed?

It depends on the reason your account was closed. In some cases, you may be able to restore your account, while in others, Cash App may permanently disable it.

Why would Cash App shut down an account for suspicious activity?

Cash App monitors accounts for unusual transactions, high-risk activities, and possible breaches of their Terms of Service. Suspicious activity could include large unverified transfers, unauthorized access, or illegal transactions.

4 notes

·

View notes

Video

youtube

vehicle fraud case with me toyota corolla sindh plate BGB-898 TOYOTA COR... Sir IG panjab DR Usman Anwar, you had previously received 1787 sp many a lot of time on your portal regarding the suspects Waqar Ilyas, Aftab Gohar, who have been involved in fraud since 2012/22, 1845/22, 2362/22. These suspects were previously associated with a platform of an organization and had been involved in fraud. They are still engaging in fraudulent activities and have stolen 5 cars, which they have sold. The poor people whose cars were stolen are still facing problems. Despite knowing about the suspects, the police have not taken action against them. They are still operating with the protection police.I request you to take strict action against these criminals. They are working with a network that is covering up for them. Please help us recover our stolen vehicle, BGB-16-898 Toyota Corolla GLi, and also recover 20 lakhs from them. The suspect is scheduled to appear in court on 6/9/24 before Judge Qaseem Rasool, where they are still managing to operate their business with the help of their connections, even though their criminal activities are known. Best Regards 3630202807343 Mohammad Asif khan 03018431238 H-70/1 KB socity cant lahore.

2 notes

·

View notes

Text

Helen Brach

Helen Brach was an American heiress and philanthropist who disappeared under mysterious circumstances. Born on February 10, 1911, she was the widow of Frank Brach, the owner of the Brach's Candy company. Helen Brach was known for her love of horses and involvement in the equestrian world.

On February 17, 1977, Helen Brach was reported missing. She was last seen at the Mayo Clinic in Rochester, Minnesota, where she had been receiving medical treatment. Despite extensive investigations and searches, her whereabouts remain unknown, and she was declared legally dead in 1984.

The investigation into Helen Brach's disappearance revealed a complex web of fraudulent activities and criminal connections. Authorities discovered that Richard Bailey, a horse trainer with whom Helen had a business relationship, had defrauded her out of millions of dollars. Bailey was convicted of conspiracy to commit murder but not charged directly in connection with her disappearance.

Over the years, there have been various theories and speculation about what happened to Helen Brach. Some believe that she was murdered due to her knowledge of fraudulent horse deals, while others suspect that she may have been a victim of a crime syndicate involved in illegal activities related to the horse industry.

The case remains open, and law enforcement agencies continue to investigate leads and follow up on any new information that may arise. Helen Brach's disappearance has garnered significant media attention and has been the subject of books, documentaries, and true-crime investigations.

It's worth noting that the details and theories surrounding Helen Brach's disappearance are complex and at times speculative. The investigation remains ongoing, and the ultimate fate of Helen Brach continues to be a mystery.

Read more

#true crime#disappearance#missing#helen brach#mystery#unsolved mystery#wikipedia#weird facts#weird history#strange facts#strange history#random fact#weird wikipedia#wikiweird#history

24 notes

·

View notes

Text

MICHIGAN CITY, Ind. (WNDU/Gray News) - - Police in Indiana are investigating a scheme where multiple restaurant employees allegedly used stolen money to bail out inmates from jail.

The LaPorte County Sheriff’s Office said employees from a Hardee’s restaurant used stolen money from customers to bail out the inmates.

According to the sheriff’s office, jail staff noticed last month that suspiciously large amounts of funds were being placed into the accounts of inmates at the county jail from a source outside the jail.

The same inmates were reportedly bonding out of the jail almost immediately and leaving with the remaining balance on a jail-issued debit card.

This led to an investigation, where officials discovered a fraud scheme involving multiple employees from a Hardee’s restaurant in Michigan City, as well as several other people.

Police did not provide the address of the restaurant, but the WNDU reported the only Hardee’s restaurant located in Michigan City is at 5223 Franklin Street.

Officials say the Hardee’s employees involved took photos of customers’ debit and credit cards that paid in the drive-thru and were fraudulently using those cards to place money into inmate’s accounts that had low bails set.

The inmates would then bond out of jail, take the jail-issued debit card with the extra money left on it, and withdraw the remaining money from an ATM.

Deputies said a total of $14,700 was charged fraudulently, and the victims are working with their financial institutions to get their money back.

Authorities said ten suspects are facing several felony charges, including fraud, conspiracy to commit fraud, and criminal organization activity as a result of the investigation:

Darrien Ward – Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Prince Arnold - Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Kristin Vanschoyck - Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Madison Zuk – Conspiracy to Commit Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Anisa Higginbotham - Conspiracy to Commit Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Hollie LaChapelle - Conspiracy to Commit Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Carissa Bealor - Conspiracy to Commit Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Lawrence Armstrong - Conspiracy to Commit Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Moesha Monique Savanna Payne - Conspiracy to Commit Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Dylnn Scott - Conspiracy to Commit Fraud (Level 5 Felony) and Criminal Organizational Activity (Level 6 Felony)

Police say Scott is the only suspect who has not been arrested yet.

Anyone with information on Scott’s whereabouts should call the Fugitive Apprehension Street Team (FAST) at 219-608-9572 or Michiana Crime Stoppers at 800-342-7867.

7 notes

·

View notes

Text

Moldovan prosecutors and investigative officers detained eight Ukrainian citizens on Wednesday for alleged involvement in corrupt schemes that defrauded 40 Ukrainian military personnel who gave advance payments for the purchase of off-road vehicles needed for frontline operations.

The off-road vehicles were offered for sale on the internet by members of the group allegedly involved in the fraud.

The Moldovan authorities said that the Ukrainian soldiers were inspired by fundraising campaigns to transfer the money in order to use the vehicles in the defence of Ukraine on the eastern front.

However, after the money was transferred, the cars were not delivered to the Ukrainian military, and the money was not returned.

The day after the money transfer, members of the corrupt scheme would withdraw the transferred money from cash machines in Moldova or use it directly to pay for services or purchases, according to the Moldovan prosecution.

“The detained suspects are refugees from Ukraine [who came] to Moldova after the outbreak of the war in the neighbouring country. They are between 28 and 43 years old, and among them is a woman,” the prosecution said.

The prosecution added that the suspects are part of a criminal group active since 2022. After defrauding the victims and obtaining the money, they then proceeded to commit the crime of money-laundering, according to the prosecution.

Law enforcement authorities from Chisinau and Kyiv worked together on the operation to dismantle the organised criminal group.

They carried out more than 20 searches in Moldova and more than ten in Ukraine.

In Moldova, the authorities seized 22 luxury cars allegedly bought with money obtained through fraud, including a Porsche, a Mercedes-AMG G63 and BMW models X5, X6, and X7.

The authorities also confiscated 4.5 kg of gold jewellery, money made from the scam, and over 80 bank cards from Moldova, Ukraine and Russia.

The Ukrainian authorities meanwhile claimed that the victims of the fraudulent scheme amount to more than 100.

The Chisinau Court’s Ciocana headquarters ordered that the suspects be remanded in custody for 30 days. However, their lawyers appealed to the Chisinau Court of Appeals, which has yet to rule on their pleas.

2 notes

·

View notes