#student loan scams us

Text

My first time watching Glass Onion it was obvious that Miles' speeches were bullshit, but I still searched for any hidden meaning there might be.

The second time is a different experience though because every time my brain starts to search for meaning, I feel like Benoit Blanc discovering that no, there is absolutely no hidden meaning.

It's bullshit it's all nothing nothing nothing! It is just how you end up talking when everyone reacts to your self-aggrandizing word vomit like it is actually wisdom.

Also, legit, when Miles gave his stupid bullshit speech about what the word 'disruptor' means to him, I shit you not I was like holy shit am I back in business school right now?!

Miles must have given speeches like that at 100 business school graduations, goddamn.

Like, the motherfuckers really do sound like this. We didn't have any billionaires come, but we had a lot of millionaire guest speakers in my classes, and they fucking talk like that.

They all think they're rugged capitalists, but they're just glass onions!

#original#glass onion#it's just. business school prepared me really well to succeed in the business world as a straight white neurotypical#able-bodied cis man with a large network of very wealthy friends and family#I really would have killed it if I wasn't a queer autistic cripple!#even the best teachers seemed incredibly unaware of the enormous privilege that they were assuming in their students when they taught#but they basically presupposed you had infinite energy and savings and a disturbingly large number of my classes were just#lectures about pushing as hard as you can no matter what#they used Starbucks as an example of an admirable case of somebody who persisted in going to 150 investor pitches before being approved#and like. how many people do you know who have enough savings to schedule plan and attend 150 investor pitches?#how many people do you know who could set up even 12 through their connections?#where are those savings coming from? where are those investor pitch meetings coming from? those aren't easy to get!!#but none of this was ever mentioned it was just awesome that the guy kept trying I guess.#I have a sneaking suspicion that if I were to have dug deeper into some of the examples we were given that a lot of those#real life businesses probably started with a big big loan from somebody's parents#I was listening to the show you're wrong about which is a really good podcast and Michael Hobbs was like#anytime you see an article glorifying someone's financial success especially at a young age you should control F for 'parents'#because chances are you will probably see the word 'parents' somewhere next to the words 'million dollar loan'#anyway college is a scam. the community aspect was incredibly cool but I don't see why we as a culture need to only be able to access that#kind of community when we are paying a scam Institution a shitload of money for Educations that aren't helpful for the majority of us#if College was free then people could actually study things that are useful or fun for them#I took most of my courses just to fill out my major too. the point wasn't to learn it was to graduate.#and then it turned out that if you're disabled in the way i am it doesn't matter if you have a college degree!#but I'm sure miles would say I just need to pull myself up by my bootstraps. and that's why I'm glad his life got exploded 😌#andi kept him around for his money - why else would he be there when no one even liked him??#he was the bankroll#one time I swear to god we just had the guy from American Psycho just a real ass Patrick Bateman#it was wild watching that movie later and being like ???? I know this guy!#outside of the actual murder scenes everything in that movie is not exaggerated in the slightest those bitches really are like that#like my parents are not 1% level rich so there'd be no giant loans but they are rich. it'd be stupid to act like i didn't benefit from that

99 notes

·

View notes

Text

I FINALLY QUALIFY FOR PUBLIC SERVICE LOAN FORGIVENESS

My initial student loan was $54,935.92.

I paid over $30,887.83*

My loan is currently at $51,756.93.

I thought I had made all 120 qualifying payments last year. I had to submit and resubmit the PSLF application multiple times, because it kept getting sent back because of problems with how my employers signed the form. It turned out some of the payments didn't qualify, so I had to stick with helljob for at least another year.

I definitely had made 120 qualifying payments this year, so I sent the application in December 2023.

Just got notified now that I have made all qualifying payments. I've made three extra payments, even.

"After we receive the approval, it may take up to 90 business days to process this information."

Three more months of helljob, because I still don't trust this is going to go through and I don't want to quit until I know my loans are gone. I do not have anything lined up after helljob, and I'm terrified of losing my helljob health insurance because I got medical complications. But I hate helljob. I hate helljob so much and my first emotion waking every workday is despair.

At least the loan payments have been paused until the reimbursement is processed. Theoretically I should get reimbursed for the extra payments, too.

* This was only my qualifying payments. The total amount I paid was higher. The website isn't showing me the non-qualifying payments and I have to submit a formal request to get my full payment history. I submitted the request, but it will take a few days to be sent to me.

#This has been a nightmare btw#why yes higher education in the US is a huge scam and utterly inaccessible to most people rn#This wasn't even all of my loans I also got a private loan that I paid off years ago with help from family#I'm one of the LUCKY ones and this ruined my life#student loans#us higher education#what really makes me want to strangle my past self is that I only took these loans because I wanted to be a doctor#like I actually had my bachelor's degree paid off. I didn't need to do this to myself.#But I wanted to be a doctor so I gambled my entire future without realizing I was even gambling let alone that the game was rigged#and I lost it all. Didn't even make med school.#Every single adult I asked for advice on higher education or loans told me 'you're smart and you'll figure it out don't worry'#I've always been a gullible sucker#personal stuff#pslf#public service loan forgiveness

8 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Saving Money and Being Frugal

We’re all in this together. Don’t give up.

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

How to Get DIRT CHEAP Pet Medication, Without a Prescription

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

We will periodically update this list with newer articles. And by “periodically” I mean “when we remember that it’s something we forgot to do for four months.”

Bitches Get Riches: setting realistic expectations since 2017!

Start saving right heckin’ now!

If you want to start small with your savings, consider signing up for an Acorns account! They round up your every purchase to the nearest dollar and save and invest the change for you. We like them so much we’ve generously allowed them to sponsor us with this affiliate link:

Start investing today with Acorns

#frugal#saving money#personal finance#money tips#financial tips#financial literacy#financial freedom#money#debt#money management#how to save money

572 notes

·

View notes

Text

alright, i... didn't want to do this. i didn't want to have to do this. especially with all the hate ive been getting in my inbox recently. but i don't have a choice.

hi. im lulu. im a 21-year-old autistic immunocompromised queer person. i currently live with my mother (senior) and my little sister (10 years old). i need your help to get out.

(context and avenues to help below the cut)

as some of you may know, my stepfather died on august sixth from a heart attack. we lived in his parents basement, as it was all we could afford, and we depended on his income. he had a stable job, and mom decided to become a housewife and sell some things from the buisness they created together. when he died, the buisness was dissolved, as it was an llc partnership. his parents are extremely controlling, and as such, he was only able to finally start building up credit when mom came along, and we were almost at the point where he could qualify for a home loan so we could get out and get away from his parents.

that's gone now.

mom cannot qualify for a home loan because of her student loan payments and the credit card payments. we do not have the money to pay these off, and mom is trying desperately to get a job. we need the money to get out, as my stepfather's parents have been trying to get my sister away from my mom and shove both her and i out of the family for years. things are only getting worse now as we have reason to believe they are spying on our conversations and even going so far as tracking us (for example, they found a spare key to the car and went and took it and "cleaned it out" without mom's knowledge or permission, as it's her car now). they have been trying to circumvent mom and go behind her back during the entire process with the funeral home, coroner's office, all the legal documentation, and they are extremely infuriated that they cannot decide anything or push mom out because they are not the next of kin and have been trying to circumvent this. we have reason to believe that they're going to attempt to sell the cars that are still in my stepfather's name to collect on the money and never give us a dime, like they had with almost all of the money my little sister received as part of the college fund we set up at my stepfather's funeral as well as any money that my little sister had won in the past. we will never see a dime of it, and it's extremely upsetting that they are doing this. they have been running scams for years, and they have been nothing but hellish towards my mother, claiming she's withholding information from them when she has offered more than they've asked for and they have done nothing but take my little sister out and about without ever telling mom anything (for example- they screamed that mom was withholding information when she said she didn't copy the tox report for them because it was empty and claimed they needed to know his cholesterol levels [which doesn't even show up on a tox report- they didn't run his blood, either, and they didn't check his cholesterol levels anyway because they know that's what killed him, they could see it] and would not provide reasoning why [it does not affect them anyway just by nature of it being cholesterol], while on sunday they took my little sister out the whole day and failed to communicate with my mother that she would be with them and would be home after dinner).

they have been screaming at mom for collecting social security as though she was stealing their money and demanded that she doesn't get a job, and we have more than enough reason to believe that they are trying to get her to default on the bills so they finally have legal grounds to take my little sister and kick us out, leaving us with nowhere to go and no options. they have even gone as far as to threaten to take my sister away using force in the past, and, as they have firearms, that is a terrifying threat. they are unhinged and extremely upset that they cannot control us and make us do what they want, how they want, when they want, and they are up in arms over it.

when we move out, all hell is going to break loose, but the longer we wait, the worse it's going to get.

my stepfather, being 37 when he died, did not like thinking about his own mortality, so he didn't have a life insurance policy, a 401K, a will, nothing. we have been left high and dry by his death, and that is pushing aside the grief. we do not have the money to pay off the bills, pay for a lawyer, pay to have the car re-keyed to keep them from stealing it again, or to even flat-out buy a house to circumvent needing a loan, and on top of it all we have to deal with stepfather's parents not allowing us to grieve and implying that mom is a tramp and a heartless bitch that will blow any money given to her when she is more financially responsible than them. we also have to worry about them stealing our things, especially with how much they complain about how messy the basement is when most of the things here are theirs (stepfather's parents are hoarders- more specifically, his father hoards cars, and his mother hoards everything else, going out and shopping frivolously almost every day).

we need help with money, and i hate to ask, especially with the requirement of revealing my legal name and in light of the harassment i have been receiving for over a month now, but we need to get out of here, and we need to get out of here soon. it's only going to get worse the longer we stay. we need money to help with the bills, my mom's student loans, getting a lawyer, and getting a place to move into.

im posting this because im the only one my stepfather's parents won't find on any platform that i choose to use. my current goal is $9,000 USD, if only just to get enough money to get a cheap plot of land to move into, or one of the really cheap houses out here. this won't cover the loans or bills in addition, or the cost of getting a lawyer or anything else we need, but it is enough to get us a cheap place to live. i know it's a lot of money, but we are in a dangerous situation and need the money to escape. if we were to pay for everything, the goal would be in the hundreds of thousands, and i feel horrible just asking for this much. if you can't donate, please reblog, even the visibility might help and please do not spread my legal name. please remember to put "payment" or something generic in the reasoning box if it's required so that i will actually receive the funds instead of having my account purged from the site. i didn't want to ask for this, but i have no other options. please help.

c*sh*pp: $lulunightbon

v*nm*: @Lulilial

Goal: $0/$9,000

#im sorry#i don't know what else to do#please forgive me for this if you ever can#financial aid#autistic#trans

566 notes

·

View notes

Text

Intuit: “Our fraud fights racism”

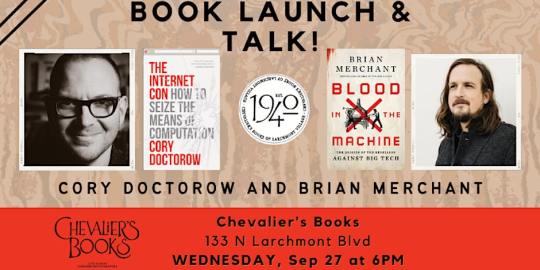

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

You have to understand.

At least at first, I didn’t mean to do it. I had just gotten out of College, a kid with a degree in History and an eye watering amount of debt. I made the mistake of telling the professor I did early 21st century historical reenactments for my summer job and he let me take on a titanic amount of debt for historical realism. I’m not sure who I owe the money to, since we live in a post scarcity society, but I sure worry about repaying it, so I have that going for me. Extra points for realism.

After I graduated - with an ulcer from stress worrying about the debt, another point for realism! - I was bumming around the orbital looking for a way to earn some quick cash and I realized how I could put my degree to use. Everyone has everything provided for them by the government because - after the Unpleasantness - we figured out that was easier and cheaper than giving everyone on the planet a gun.

But that means that everyone has mostly forgotten how to keep an eye out for scams. Who is going to scam you anyway when you all have the same access to cheap and easy housing, food, and Space Cocaine?

People who have mountains of debt due to historical accuracy, that’s who.

I set up shop right outside the exit from Customs on the station. Rubes-er People from all over the Galaxy would come, hellbent on seeing the sights of my planet and before they could hit up the Cøffee Haüs they would find me.

I started small; ran a couple of three card monte tables, but without a partner, convincing people they could win without them actually winning was tough. I hacked a janitorbot into being my assistant and soon enough I would have a crowd watching.

This, while effective was incredibly boring, so I changed to my plan B and just started making fake supplements. For maximum compatibility across all of the galactic species, mine were pure carbon (to absorb toxins you see). This increased who I could sell too without worrying (too much) about inadvertently poisoning anyone.

A few people were sad I moved away from scamming people with cards, but they became my first ‘partners’ in selling my supplement. I had to actually explain how a Ponzi scheme worked though, nobody remembered. I told them about how so long as they found more suckers underneath them, they wouldn’t be left holding the bag and it took off like an oxygen accelerated fire.

There was also an oxygen accelerated fire, but that can’t be traced back to me.

Three weeks later, I was the richest human in the Galaxy. Honesty, I didn’t even know where everyone even got the money, I thought we had eliminated it, but here I am, rich as hell. I feel a little bad about it, but if I admit the whole thing was a ploy to pay off my student loans, I worry that they’ll turn on me.

I still haven’t paid off my loans either. I don’t think I can swing the payments and the payments on my Super Dreadnought. Did you know they’ll build anyone one so long as you put the deposit down?

Anyway, do you want to get in on an incredible deal on the low effort world of supplement sales?

#writing#sci fi writing#jpitha#humans are deathworlders#humans are space oddities#humans are space orcs#humans are space capybaras#humans are space australians

235 notes

·

View notes

Note

I feel like some people can't be/refuse to be educated, or they're deliberately being obtuse because they're trolls, psyops, or they just fell for the trolls and psyops. But its still good to point out where they're wrong and to give actual, you know, facts, for the benefit of other people reading who might actually be reachable.

yeah, I mean I usually ignore them because usually its bad faith and when a post is getting hundreds even thousands of notes in a day you just can't keep up with the 10-20-ish people who say something, particularly if its in the tags because thats just hard or fighting in the replies which always feels weird

But I was in a bad mood and in general seeing the same either bad faith or straight up don't know comment over and over and over again is very annoying

the "lol Joe Biden didn't do anything about Student loans!" one is pretty annoying since Biden has forgiven well over 100 BILLION dollars worth of student loan debt, so like he has done a lot on student loan debt. I'm not a big deal but I remember I did one of my "what Biden did this week" posts and it had the student loan debt forgiveness for people who got defrauded by the Art Institutes, and a few people added their stories of being defrauded and being in debt to AI for years and the one that'll stay with me was an older guy who went to try to get a new degree to get a job in a different field kinda late in the game, his 50s or 60s and of course didn't get the jobs he hoped for because scam college and saying how he thought he'd die in debt and it was all gone, all forgiven. So just like people flippantly dismissing a very real life changing thing is very annoying

there are a few other very common annoying ones "why didn't he do this when he controlled congress before!" well he was busy passing the biggest climate change bill any government on earth has ever done, investing in our Infrastructure for the first time since before Reagan was President (Reagan 😒) listen Biden passed 4 of the biggest most transformationally progressive bills the US has seen since LBJ

American Rescue Plan

Bipartisan Infrastructure Law

CHIPS and Science Act

Inflation Reduction Act

on top of which he passed the first gun control law out of congress in 30 years, and other things, like the Respect for Marriage Act to protect gay marriage, or making Juneteenth a federal holiday (the first new federal holiday since MLK day in 1983)

SO! thats why he didn't do the things he wants to do in his next term he was busy doing equally (and in the case of climate change more important) things and thats why we should all be hopeful if Joe Biden is President with a Democratic Congress he'll get most if not ALL the things on his agenda done, because he's fucking good at this, we haven't had a President this good at pushing bills through Congress and using every switch and lever of the federal government to make major progressive change since LBJ or FDR, I guess his big mistake was naming it something boring like "Inflation Reduction Act" and not something sexy like "New Deal" or "Great Society"

sorry to go off on a tare there, but its just frustrating to see 40 (out of tens of thousands really) posts saying the same dumb shit and having no real way to respond

92 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

186 notes

·

View notes

Text

Hey y'all please I know it's scary but if you've graduated in the past year make sure you know exactly what's up with your student loans (federal and private).

You should have gotten emails from places like Advantage or Navient or whatever pestering you about your loans and you may want to ignore them thinking they're scams. No they are your loan servicer, corporations that the government hands over management of your federal loans to.

The email should tell you how to register for an account which will let you see your loan payments. They'll probably be in the hundred's of dollars depending on how long it's been since you graduated.

Don't fret! Thanks to Bidens efforts (the like one good thing he's doing), you can easily get put on the SAVE plan, where the department of education pays your interests and you make minimum payments based on your current income (which, if you're following me, probably isn't that high).

Honestly, I'd recommend calling and asking about the SAVE plan. The lady was actually super nice (I have aidvantage so your experience may differ) and my minimum payments went from like $400 a month to $0 (now they're $10 bc I got a raise last summer)

And please, for the love of god, keep an eye on your account. I thought I had set up autopay but for the past couple of months autopay wasn't on, so I got charged $30 in late fees.

These loan servicers will try to wring as much money as they can out of either you or the government. You need to babysit them and make sure everything is up to snuff.

I'd also recommend saving and making large payments every once in a while to push down your total debt. That's what the SAVE plan is great for. Instead of using all your money to pay for interest, you use that money to push down the principle.

#wrenfea.exe#student loans#save plan#new graduates#life advice#also i am not an expert on this stuff this is just my experience and what ive learned from news articles and research#dont feel bad if you struggle with this stuff its purposely made to be scary and confusing#they make more money that way#dont let them#usa centric

14 notes

·

View notes

Video

youtube

In grad school, I made a friend -- “N” -- who was an amazing graphic designer and had a fantastic modern, sleek illustration style that was extremely popular in the mid 2000s.

N and I did everything together, including celebrating holidays, as we were both largely distant from our respective families.

The school we went to... wasn’t a scam, it was a legitimate school and well revered in the industry, but it was way, way overpriced and on the decline (and it no longer exists, which is fine I guess, I paid off my loans and built a business with knowledge not degree recognition.)

I moved away about a month before graduation (for a variety of reasons) so had to fly back to handle the final portfolio review. This went about as well as you are expecting at this point in the story.

Of course, scaling up the plans for my portfolio in the weeks leading up to the flight

I have fantastic memories of Fang screaming the time of my flight and the then-current time at me as I am screaming my printer

Of assembling via x-acto knife in the taxi on the way to the airport (do not do this -- learn from me -- I repeat, do not do this)

Of the cab driver screaming at both of us as we are screaming about how this portfolio review can make or break the next steps of the studio I was about to launch

Fang and I weren’t screaming at each other, more just, brutally intense energy of getting things done that were way outscoped given the time and money resources available

The cab driver was screaming at us

In all fairness to him, we were being unbelievably chaotic

In all fairness to us, he was eating an ice cream cone while driving

So, y’know, everyone was in the wrong here

atty, calling on the phone as we are approaching Departures at the airport: “Hi, uh, N--... so... are you...”

Friend on phone, bright voiced: “Frantically preparing for the portfolio review in 36 hours? Yeah! Hey where are you? Do you want to grab a bite to eat and rehearse?”

atty: “Rehearse? Are you done, show off?!”

(Uncomfortable laughter on phone): “OH no, not even close. How far along are you?”

atty: “I’m in a cab with glue spray.”

Friend on phone, getting worried as he can hear the city sounds: “Oh man I can just come get you, where are you?”

This time it is atty who laughs uncomfortably.

I fly across the country, take a cab to N--’s apartment from the destination airport (it would take way too long for him to drive, he needs to work). I crash on his couch and for the next 24+ hours we finish our projects, rehearse...

...and listen to Tom Waits for the first time.

Which is the point of the story. It was N--’s apartment, so he picked the music, and I didn’t care because I was intoxicated and caffeinated with the very specific combination used by art students.

This experience is how I discovered Tom Waits’ music.

121 notes

·

View notes

Photo

On food and groceries:

How to Shop for Groceries like a Boss

Why Name Brand Products Are Beneath You: The Honor and Glory of Buying Generic

If You Don’t Eat Leftovers I Don’t Even Want to Know You

You Are above Bottled Water, You Elegant Land Mermaid

You Should Learn To Cook. Here’s Why.

On entertainment and socializing:

The Frugal Introvert’s Guide to the Weekend

7 Totally Reasonable Ways To Save Money on Cheap Entertainment

Take Pride in Being a Cheap Date

The Library Is a Magical Place and You Should Fucking Go There

Your Library Lets You Stream Audiobooks and eBooks FOR FREEEEEEE!

What’s the Effect of Social Media on Your Finances?

You Won’t Regret Your Frugal 20s

On health:

How to Pay Hospital Bills When You’re Flat Broke

Run With Me if You Want to Save: How Exercising Will Save You Money

Our Master List of 100% Free Mental Health Self-Care Tactics

Why You Probably Don’t Need That Gym Membership

On other big expenses:

Businesses Will Happily Give You HUGE Discounts if You Ask This Magic Question

Understand the Hidden Costs of Travel and Avoid Them Like the Plague

Other People’s Weddings Don’t Have to Make You Broke

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

When (and How) to Try Refinancing or Consolidating Student Loans

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

On buying secondhand and trading:

Almost Everything Can Be Purchased Secondhand

I Am a Craigslist Samurai and so Can You: How to Sell Used Stuff Online

The Delicate Art of the Friend Trade

On giving gifts and charitable donations:

How Can I Tame My Family’s Crazy Gift-Giving Expectations?

In Defense of Shameless Regifting

Make Sure Your Donations Have the Biggest Impact by Ruthlessly Judging Charities

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

How to Spot a Charitable Scam

Ask the Bitches: How Do I Say “No” When a Loved One Asks for Money… Again?

On resisting temptation:

How to Insulate Yourself From Advertisements

Making Decisions Under Stress: The Siren Song of Chocolate Cake

The Magically Frugal Power of Patience

6 Proven Tactics for Avoiding Emotional Impulse Spending

On minimalism and buying less:

Don’t Spend Money on Shit You Don’t Like, Fool

Everything I Know About Minimalism I Learned from the Zombie Apocalypse

Slay Your Financial Vampires

The Subscription Box Craze and the Mindlessness of Wasteful Spending

On saving money:

How To Start Small by Saving Small

Not Every Savings Account Is Created Equal

The Unexpected Benefits (and Downsides) of Money Challenges

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

The Magic of Unclaimed Property: How I Made $1,900 in 10 Minutes by Being a Disorganized Mess

#saving money#being frugal#money advice#personal finance#how to save money#impulse spending#spend less

3K notes

·

View notes

Text

Honest question, but also because I feel like laughing at this fucking government and these fucking loan emails:

Ngl, I'm willing to pay the barest of minimums to keep my credit consistent (which, fuck that scam ass system too). But I have no real intention of ever getting that full amount back to them. Specially right now lmao. They clearly fucking got it 🤣😭

#nelnet keeps sending me these fucking emails#adding all that fucking interest and you think i just got it#give me the job that pays this off like was PROMISED#a fucking joke lmaoo

30 notes

·

View notes

Text

Hiii! I am coming here to plug my print store!

I got scammed out of all of my savings that I need to pay off student loans. It was thousands of dollars I got refunded in 2020-2021 from housing and department fees that I did not use because I was doing school online. I am working with my bank to get it all back but this is a very stressful time so I am trying to be proactive about earning back the money I had lost.

Any print store purchases or kofi donations would be really helpful in this time.

(reblogs and boosts appreciated)

#art#illustration#comics#critical role fanart#critical role#hades game#bells hells#hades game art#critical role c3#oc

9 notes

·

View notes

Text

Friends with Military Benefits | Prologue | Jake Seresin x Reader

[graphic]

next chapter | masterlist

synopsis: purple hearts!au in which you marry jake “hangman” seresin for insurance… and what seems like a simple scam might turn out not to be so simple after all

warnings: no use of y/n, mention of divorce

...

“Hey! Movie star in the corner! Butt over here, stop lollygagging around!”

“You’re trying too hard,” you call back in response, standing nevertheless and stretching before heading over to where your best friend, Lina, is working on setting up the bar before opening. Bending down to open a few cabinets, you yell into the other room, “Hey, Pen, we still on to perform tonight?”

“Depends on how dissatisfied the crowd is with you stopping their music,” your boss shoots back. Savage.

Penny Benjamin, your boss and friend-slash-mentor, was your saving grace. She had hired you around the time she bought the bar, The Hard Deck, a few years ago from some of the money in the settlement of the divorce with her ex-husband, Darren—or as you and your coworkers call him, Darren the Douche. Creative, you’re well aware. Penny was the only reason you weren’t on the streets, giving you a place to put your feet down and start working to pay back the colossal mountain of student loan debt you had acquired over four years of undergrad.

You’ve given up on grad school entirely.

Time flies as you, Lina, and your coworkers Sam, Evan, Hannah, and Cody finish prepping for opening rush. Penny has six of you on staff—everyone one rotates days off, and today, a Monday, is Sawyer’s. Yours is Thursday, so only three days to go.

Soon enough, the bar opens. It’s the hotspot Navy bar in the area, uniforms filling the place as it gets later on into the evening.

“Lina!” Sam hollers suddenly as she hurries to the bar, calling your name as well and snapping you out of the zone. “Penny gave the all-clear.”

You grin, high-fiving the blonde. “Perfect.” Hopping the counter, you wink at your boss as she comes to take your place, prompting her to shake her head in fond exasperation. The jukebox cuts out suddenly, causing groans as everyone looks to where Evan unplugged it while the rest of you head to the piano that doubles as a makeshift stage for your purposes. One night after the bar had closed, on Penny’s night off (Tuesdays), the half-drunken six of you had discovered that you were all musically inclined. That led to the creation of a band; practices were bi-weekly after closing Tuesday and at Hannah’s apartment on Friday before work.

Picking up the mic, you tap it to gain the attention of the bar’s patrons, who quickly grow excited as they realize what’s about to go down. Despite missing a bassist—Sawyer—who doubles with backing vocals, you’re still going to make some music and it’s going to sound good. It’s a sporadic event, so when given the chance, your group grabs it whole-heartedly.

“Hey, everyone, how we doing tonight?” You greet to cheers and whoops as the band begins playing in the background. You grin, waiting the necessary measures before coming in.

Where it began, I can’t begin to knowing

But then I know it’s growing strong

Was in the spring

And spring became the summer

Who’d have believed you’d come along

Hands, touching hands

Reaching out, touching me, touching youuuu

Sweet Caroline!

You pause, holding the mic out to the crowd as they yell, “BUM BUM BUM!” before resuming.

Good times never seemed so good

“SO GOOD! SO GOOD! SO GOOD!”

I’ve been inclined

“BUM BUM BUM!”

To believe they never would

But now I…

The song ends to soon for your liking, and Penny is motioning for you all to wrap it up instead of going into something different. “Thank you! We are Jukebox Replacement!” You say into the mic, to the groans of the crowd at its ending. You chuckle as one holds up a thumbs down. “Dude, that was your request. Anyways, give it up for Penny, the owner, who really meant it when she said only one song! Oh, and please don’t forget to tip your servers, ‘cause—P.S.—we’re also your servers.”

Laughing with your friends, you move back to your paying jobs, the vibrant air from playing remaining for a split second before dissipating as you return to the real world, feeling far less alive than before.

#jake hangman seresin x reader#jake seresin fanfiction#jake seresin x reader#Jake Seresin imagine#jake hangman seresin#jake seresin#hangman seresin x reader#hangman x reader#top gun maverick fanfiction#top gun maverick#top gun fanfic#top gun maverick fanfic#jake seresin fanfic#series#fwmb

73 notes

·

View notes

Note

Quick question, is it seen as bad to shit talk about a college in the United States?

I don't know, it might be because I'm from another country, but I'm really used to me and my classmates complaining about our college. So it's weird to see that as a bad thing.

It depends on the college and who you're talking to -- some get weird about it, especially the more expensive/prestigious schools -- but I've never met anyone who had a problem with shit talking their college. Especially if they're struggling with student loans and feeling vaguely scammed.

13 notes

·

View notes

Text

My??? Student loans were just FORGIVEN??? And I’m getting my cash back?????? They just sent me the email and I read the news this morning. The school I went to was a big gigantic scam so I kinda hoped this would happen but always assumed it wouldn’t. Damn. Gonna vent a little cause boy do I have thoughts.

That school beat me into the ground and wrecked my relationship with art for actual years, genuinely fuck them. The amount of people on power trips there was wild. I think we students would get told at least three times a quarter that we were worthless as artists, not as good as xyz school, replaceable, expendable, and only worth what we could rake in financially from our artwork. If you weren’t a financial success, you were worthless as an artist. We were all replaceable at any time because there were “too many” artists and tons better than us. The head of the department I was in (prior to essentially getting fired for misconduct, I think) used to tell us that unless a pencil was in our hands eight hours a day at least, we’d never amount to anything and may as well go home. I personally had an instructor who wasn’t even involved with my program tell a few of us that my group’s project had no “deeper world-changing meaning” and so it was a waste of time and we weren’t going to get anywhere in life. Then he spent the rest of the class jerking himself off by showing off some video game he was vaguely involved with. Great instruction, 10/10.

At that point I was just trying to graduate and get the fuck out. I didn’t care, and I couldn’t just drop out because they boxed me in financially. That was emotionally my lowest point in life and my health definitely reflected that. My portfolio instructor at least understood and did what she could to help me get outta there smoothly. She saw it was a shit show. Unfortunately she was also one of the instructors who liked to tell us we sucked before she saw the writing on the wall about the school tanking soooo… I don’t feel very warmly about her.

There are so many fucked up things I remember about that place and that’s not even getting into the administration. The school didn’t even have certified instructors teaching us, it was pretty much 70% “adjunct staff.” Some of them were good at teaching (maybe because they were the only ones actually certified lol) and I learned from a few (my painting instructor and a few of my 3d instructors were cool) but most of them… very clearly had no idea what they were doing.

It was hell and I don’t like thinking about it. I saw it break so many of my friends and classmates, and I stopped drawing and painting altogether for years after I graduated. I’m someone with a history of being extremely self-critical due to trauma and the DID makes it hard for me to feel “alive” or present when I’m under extreme stress. I wasn’t diagnosed yet so I didn’t know how to handle my condition and the school only exacerbated it with how they treated us. How fitting that a few days after I was finally able to draw in my sketchbook again, this happens. I’m gonna go celebrate with my family soon.

3 notes

·

View notes