#startup investor platform

Explore tagged Tumblr posts

Text

Securing Equity-Free Funding for Startups: Strategies and Insights for Indian Entrepreneurs

In the dynamic landscape of startup funding in India, securing the right financial support is crucial for success. With various options available, understanding how to navigate the funding ecosystem can significantly impact a startup's growth trajectory. This blog delves into the concept of equity free funding and explores how startup investor platform is making it easier for startups to thrive without relinquishing ownership.

Understanding Startup funding in India

Startup funding in India has seen a dramatic evolution over the past decade. From traditional venture capital and angel investments to new-age funding models, the opportunities for startups have expanded. However, equity free funding has emerged as a game-changer for many entrepreneurs who wish to retain full control of their businesses while securing necessary capital.

What is equity free funding?

Equity free funding refers to financial support provided to startups without requiring them to give away a portion of their equity. This type of funding is particularly attractive for founders who prefer to maintain complete ownership of their company. It typically includes grants, revenue-based financing, and other non-dilutive funding sources.

The rise of startup investor platforms

Startup investor platforms have become instrumental in facilitating equity free funding for startups. These platforms connect startups with investors and financial institutions that offer non-dilutive funding options. By leveraging these platforms, startups can access various funding opportunities that do not involve giving up equity.

Klub is one such platform that has been at the forefront of providing equity free funding solutions. By partnering with innovative startups, Klub helps them secure capital while preserving their equity, enabling them to focus on scaling their businesses without the pressure of equity dilution.

Types of equity free funding available

Grants: Various government and private organisations offer grants to startups. These funds are typically provided for specific projects or research and do not require repayment or equity stake.

Revenue-based financing: This model allows startups to secure funding in exchange for a percentage of future revenue. Unlike traditional loans, repayment is tied to the startup's performance, making it a flexible option.

Crowdfunding: Platforms like Kickstarter and Indiegogo offer a way for startups to raise money from the public. Backers contribute funds in exchange for rewards or pre-orders, rather than equity.

Competitions and Challenges: Many organisations and incubators host competitions where startups can win equity free funding as part of the prize. These opportunities often come with additional perks like mentorship and visibility.

How to leverage startup investor platforms

Startup investor platforms are designed to streamline the funding process. By creating a compelling profile and pitching effectively, startups can attract interest from investors who are keen on providing equity free funding. These platforms often offer tools and resources to help startups improve their chances of securing financial support.

Klub stands out in this space by offering tailored funding solutions that cater specifically to the needs of startups looking for equity free fundingoptions. Their platform not only connects startups with suitable funding sources but also provides valuable insights and support throughout the funding process.

Key takeaways

Navigating the world of startup funding in India can be complex, but equity free funding offers a viable path for many entrepreneurs. By utilising startup investor platforms, startups can access a range of funding options without diluting their equity. Understanding these options and leveraging available resources can help startups achieve their growth objectives while maintaining full control of their business.

In conclusion, the landscape of startup funding in India is evolving, and equity free funding is becoming an increasingly popular choice. Platforms like Klub are leading the way in providing innovative solutions that empower startups to secure the capital they need without giving up ownership.

#startup investor platform#startup funding in india#equity free funding#equity free funding for startups

0 notes

Text

How Angel Investors for Startups Can Be Your Key to Expanding Your Vision

Securing Angel Investors for Startups is an effective way for entrepreneurs to transform their ideas into reality. These investors offer more than just funding; they bring in-depth knowledge of the industry, which can help startups refine their business strategies. With angel investors, startups have the resources they need to turn ambitious goals into tangible results.

0 notes

Text

0 notes

Text

7 Tips To Effectively Pitch Your Business To Potential Investors

After you have established your business and started earning revenue, it’s time to get on the next step of your entrepreneurial journey - raising funding for your startup. Nowadays, you can register on a startup funding app to present your business idea to potential investors. Read more

#invest in startups#investing platforms#startup funding app#startup investment#investors#crazy money#crazy money app#business

0 notes

Note

Forgive me if I'm mistaking you for another person, but I remember you speaking at multiple points on the unsustainability of free social media services (I think especially in response to the cohost collapse?), and I'm curious on what your thoughts on bluesky are so far. I'm not an expert on the subject, but from what I've read previously it seemed like they were on track to be financially sustainable, but I don't know if the recent floods of users has thrown those projections off. Sorry if I'm mixing you up with someone else on my timeline, in that case just ignore me.

bluesky will almost certainly follow the same trajectory of monetisation => bloat => enshittification => decline as every other major platform built on venture capital and user hoarding. it's a terrible model that only works in the short term as a mirage for attracting funding and making founders look good for a year or two before they sell.

you can see the same effect in the decline of all the subscription box services that came into vogue just before covid: they feel great to use for as long as the initial injection of venture funding lasts, because the purpose of that funding at that stage is to attract users and impress the next round of funders with how pleasant/intuitive/efficient/ethical/good value the service is. that's the stage where they're handing out freebies and bowling over influencers, and every ingredient in the box is fresh and high quality and locally sourced. wow what a good deal, what a great system!!! why hasn't anyone done this before? the answer is because it's unsustainable by design. they rack up good reviews, sign on a billion new users, attract new funding from a bunch of much more credulous investors, and then gut all of the expensive parts. portions get smaller, ingredients get worse, packaging gets flimsier, prices go up, freebies turn into "5% off your first 9 boxes when you invite 3 friends", and customer service vanishes.

with social media (and platforms like discord) the logic is the same, it's just a little less glaringly obvious to the end user because they're not coming home to leaking packages of rancid chicken on the doorstep. bluesky has an advantage over tiny operations like cohost because it was founded by a billionaire making a point for the sake of his own image. it got a really significant chunk of startup funding, and the owner had existing connections and rep in the space to attract more. That's why it has survived the goldrush period, why it still feels good to use, and why users who have been burned so many times before are finally accepting it as a stable, reliable option. It's still in its venture capital honeymoon phase where the only thing worth spending money on is making the service attractive to users.

What I expect we will see next, with another mass influx of users from twitter and new funding from a rogue's gallery of tech venture sickos led by Blockchain Capital is a strong ramp up into monetising that userbase. They've already been pretty forthright about how they plan to do this, and I think it's a solid roadmap of how Bluesky will bloat and decay over the next few years:

this is a huge lol. don't worry, we're not going to hyperfinancialize the social experience through NFTs. the thing even crypto freaks started feigning amnesia about a year ago. real "our health conscious sodas are 100% arsenic free" messaging here. They know perfectly well that rubes users are suspicious of their typical 5 dimensional tech finance chess games and are patting our hands about last week's bogeymen so nobody worries too hard about whatever 'decentralised developer ecosystem' just happens to be helmed by a bunch of crypto guys. this definitely means something good and based and not a google-like single sign on user data harvesting operation.

This is the same shit that's currently rotting the floorboards of discord. Bluntly, there is no way to run a platform on this scale without gating functionality behind paid services. Discord has been squeezing free-tier file uploads and call quality etc. down steadily and cranking up subscription costs over the last year or two, throwing in chaff like animated avatar frames to try and justify the user cost. They're also doing the same misdirection thing again here, pointing to Thing We All Hate to deflect from thing we might not like very much when they do it. Booo elon booo we all hate elon!!! wait how do we feel about subscription models again,

watch out for this to kill porn on bsky like it has killed porn on every other social platform 👍 boooo we hate elon boooo stupid idiot and his 'everything app' booooo wait why do you need my tax information, what's that about mastercard,

Look, we are all aware social media is a money pit. Let's not forget dorsey was looking to sell twitter in the first place, long before elon's very public plunge into total online derangement. Subscription services are not going to plug the hole, so we are gradually going to see more and more spaghetti thrown at the wall while early funders shuffle cards and do their pyramid scheme bit bringing in stupider and stupider investments. this is the window in which bluesky will be temporarily worth using for us, for the idiot public, the poorly rendered crowd jpegs in the background of their venture capital MOBA. it's in their interests to slow and pad the decline as much as possible, because that is how they get maximally paid.

Given the scale of the money involved, and dorsey's weird ego investment, I think bluesky will probably manage a controlled drift for a good few years before it gets really bloated and painful. and by then we will all be so used to the *checks notes* decentralised developer ecosystem that we'll just be posting through it, watching another generation of columnists call another collapsing platform 'their beloved hellsite' and passing around that meme about not getting out of our chairs no sir until idk we all get on a fediverse neurolink alternative to stick it to the elongated muskrat and our brains pop peacefully in our sleep. which I guess is the closest thing to viability any social media platform can achieve.

anyway diogenes the cynic is also on bluesky

483 notes

·

View notes

Video

youtube

Should Billionaires Exist?

Do billionaires have a right to exist?

America has driven more than 650 species to extinction. And it should do the same to billionaires.

Why? Because there are only five ways to become one, and they’re all bad for free-market capitalism:

1. Exploit a Monopoly.

Jamie Dimon is worth $2 billion today… but not because he succeeded in the “free market.” In 2008, the government bailed out his bank JPMorgan and other giant Wall Street banks, keeping them off the endangered species list.

This government “insurance policy” scored these struggling Mom-and-Pop megabanks an estimated $34 billion a year.

But doesn’t entrepreneur Jeff Bezos deserve his billions for building Amazon?

No, because he also built a monopoly that’s been charged by the federal government and 17 states for inflating prices, overcharging sellers, and stifling competition like a predator in the wild.

With better anti-monopoly enforcement, Bezos would be worth closer to his fair-market value.

2. Exploit Inside Information

Steven A. Cohen, worth roughly $20 billion headed a hedge fund charged by the Justice Department with insider trading “on a scale without known precedent.” Another innovator!

Taming insider trading would level the investing field between the C Suite and Main Street.

3. Buy Off Politicians

That’s a great way to become a billionaire! The Koch family and Koch Industries saved roughly $1 billion a year from the Trump tax cut they and allies spent $20 million lobbying for. What a return on investment!

If we had tougher lobbying laws, political corruption would go extinct.

4. Defraud Investors

Adam Neumann conned investors out of hundreds of millions for WeWork, an office-sharing startup. WeWork didn’t make a nickel of profit, but Neumann still funded his extravagant lifestyle, including a $60 million private jet. Not exactly “sharing.”

Elizabeth Holmes was convicted of fraud for her blood-testing company, Theranos. So was Sam Bankman-Fried of crypto-exchange FTX. Remember a supposed billionaire named Donald Trump? He was also found to have committed fraud.

Presumably, if we had tougher anti-fraud laws, more would be caught and there’d be fewer billionaires to preserve.

5. Get Money From Rich Relatives

About 60 percent of all wealth in America today is inherited.

That’s because loopholes in U.S. tax law —lobbied for by the wealthy — allow rich families to avoid taxes on assets they inherit. And the estate tax has been so defanged that fewer than 0.2 percent of estates have paid it in recent years.

Tax reform would disrupt the circle of life for the rich, stopping them from automatically becoming billionaires at their birth, or someone else’s death.

Now, don’t get me wrong. I’m not arguing against big rewards for entrepreneurs and inventors. But do today’s entrepreneurs really need billions of dollars? Couldn’t they survive on a measly hundred million?

Because they’re now using those billions to erode American institutions. They spent fortunes bringing Supreme Court justices with them into the wild.They treated news organizations and social media platforms like prey, and they turned their relationships with politicians into patronage troughs.

This has created an America where fewer than ever can become millionaires (or even thousandaires) through hard work and actual innovation.

If capitalism were working properly, billionaires would have gone the way of the dodo.

427 notes

·

View notes

Text

No, “convenience” isn’t the problem

I'm touring my new, nationally bestselling novel The Bezzle! Catch me in CHICAGO (Apr 17), Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Using Amazon, or Twitter, or Facebook, or Google, or Doordash, or Uber doesn't make you lazy. Platform capitalism isn't enshittifying because you made the wrong shopping choices.

Remember, the reason these corporations were able to capture such substantial market-share is that the capital markets saw them as a bet that they could lose money for years, drive out competition, capture their markets, and then raise prices and abuse their workers and suppliers without fear of reprisal. Investors were chasing monopoly power, that is, companies that are too big to fail, too big to jail, and too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

The tactics that let a few startups into Big Tech are illegal under existing antitrust laws. It's illegal for large corporations to buy up smaller ones before they can grow to challenge their dominance. It's illegal for dominant companies to merge with each other. "Predatory pricing" (selling goods or services below cost to prevent competitors from entering the market, or to drive out existing competitors) is also illegal. It's illegal for a big business to use its power to bargain for preferential discounts from its suppliers. Large companies aren't allowed to collude to fix prices or payments.

But under successive administrations, from Jimmy Carter through to Donald Trump, corporations routinely broke these laws. They explicitly and implicitly colluded to keep those laws from being enforced, driving smaller businesses into the ground. Now, sociopaths are just as capable of starting small companies as they are of running monopolies, but that one store that's run by a colossal asshole isn't the threat to your wellbeing that, say, Walmart or Amazon is.

All of this took place against a backdrop of stagnating wages and skyrocketing housing, health, and education costs. In other words, even as the cost of operating a small business was going up (when Amazon gets a preferential discount from a key supplier, that supplier needs to make up the difference by gouging smaller, weaker retailers), Americans' disposable income was falling.

So long as the capital markets were willing to continue funding loss-making future monopolists, your neighbors were going to make the choice to shop "the wrong way." As small, local businesses lost those customers, the costs they had to charge to make up the difference would go up, making it harder and harder for you to afford to shop "the right way."

In other words: by allowing corporations to flout antimonopoly laws, we set the stage for monopolies. The fault lay with regulators and the corporate leaders and finance barons who captured them – not with "consumers" who made the wrong choices. What's more, as the biggest businesses' monopoly power grew, your ability to choose grew ever narrower: once every mom-and-pop restaurant in your area fires their delivery drivers and switches to Doordash, your choice to order delivery from a place that payrolls its drivers goes away.

Monopolists don't just have the advantage of nearly unlimited access to the capital markets – they also enjoy the easy coordination that comes from participating in a cartel. It's easy for five giant corporations to form conspiracies because five CEOs can fit around a single table, which means that some day, they will:

https://pluralistic.net/2023/04/18/cursed-are-the-sausagemakers/#how-the-parties-get-to-yes

By contrast, "consumers" are atomized – there are millions of us, we don't know each other, and we struggle to agree on a course of action and stick to it. For "consumers" to make a difference, we have to form institutions, like co-ops or buying clubs, or embark on coordinated campaigns, like boycotts. Both of these tactics have their place, but they are weak when compared to monopoly power.

Luckily, we're not just "consumers." We're also citizens who can exercise political power. That's hard work – but so is organizing a co-op or a boycott. The difference is, when we dog enforcers who wield the power of the state, and line up behind them when they start to do their jobs, we can make deep structural differences that go far beyond anything we can make happen as consumers:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

We're not just "consumers" or "citizens" – we're also workers, and when workers come together in unions, they, too, can concentrate the diffuse, atomized power of the individual into a single, powerful entity that can hold the forces of capital in check:

https://pluralistic.net/2024/04/10/an-injury-to-one/#is-an-injury-to-all

And all of these things work together; when regulators do their jobs, they protect workers who are unionizing:

https://pluralistic.net/2023/09/06/goons-ginks-and-company-finks/#if-blood-be-the-price-of-your-cursed-wealth

And strong labor power can force cartels to abandon their plans to rig the market so that every consumer choice makes them more powerful:

https://pluralistic.net/2023/10/01/how-the-writers-guild-sunk-ais-ship/

And when consumers can choose better, local, more ethical businesses at competitive rates, those choices can make a difference:

https://pluralistic.net/2022/07/10/view-a-sku/

Antimonopoly policy is the foundation for all forms of people-power. The very instant corporations become too big to fail, jail or care is the instant that "voting with your wallet" becomes a waste of time.

Sure, choose that small local grocery, but everything on their shelves is going to come from the consumer packaged-goods duopoly of Procter and Gamble and Unilever. Sure, hunt down that local brand of potato chips that you love instead of P&G or Unilever's brand, but if they become successful, either P&G or Unilever will buy them out, and issue a press release trumpeting the purchase, saying "We bought out this beloved independent brand and added it to our portfolio because we know that consumers value choice."

If you're going to devote yourself to solving the collective action problem to make people-power work against corporations, spend your precious time wisely. As Zephyr Teachout writes in Break 'Em Up, don't miss the protest march outside the Amazon warehouse because you spent two hours driving around looking for an independent stationery so you could buy the markers and cardboard to make your anti-Amazon sign without shopping on Amazon:

https://pluralistic.net/2020/07/29/break-em-up/#break-em-up

When blame corporate power on "laziness," we buy into the corporations' own story about how they came to dominate our lives: we just prefer them. This is how Google explains away its 90% market-share in search: we just chose Google. But we didn't, not really – Google spends tens of billions of dollars every single year buying up the search-box on every website, phone, and operating system:

https://pluralistic.net/2024/02/21/im-feeling-unlucky/#not-up-to-the-task

Blaming "laziness" for corporate dominance also buys into the monopolists' claim that the only way to have convenient, easy-to-use services is to cede power to them. Facebook claims it's literally impossible for you to carry on social relations with the people that matter to you without also letting them spy on you. When we criticize people for wanting to hang out online with the people they love, we send the message that they need to choose loneliness and isolation, or they will be complicit in monopoly.

The problem with Google isn't that it lets you find things. The problem with Facebook isn't that it lets you talk to your friends. The problem with Uber isn't that it gets you from one place to another without having to stand on a corner waving your arm in the air. The problem with Amazon isn't that it makes it easy to locate a wide variety of products. We should stop telling people that they're wrong to want these things, because a) these things are good; and b) these things can be separated from the monopoly power of these corporate bullies:

https://pluralistic.net/2022/11/08/divisibility/#technognosticism

Remember the Napster Wars? The music labels had screwed over musicians and fans. 80 percent of all recorded music wasn't offered for sale, and the labels cooked the books to make it effectively impossible for musicians to earn out their advances. Napster didn't solve all of that (though they did offer $15/user/month to the labels for a license to their catalogs), but there were many ways in which it was vastly superior to the system it replaced.

The record labels responded by suing tens of thousands of people, mostly kids, but also dead people and babies and lots of other people. They demanded an end to online anonymity and a system of universal surveillance. They wanted every online space to algorithmically monitor everything a user posted and delete anything that might be a copyright infringement.

These were the problems with the music cartel: they suppressed the availability of music, screwed over musicians, carried on a campaign of indiscriminate legal terror, and lobbied effectively for a system of ubiquitous, far-reaching digital surveillance and control:

https://pluralistic.net/2023/02/02/nonbinary-families/#red-envelopes

You know what wasn't a problem with the record labels? The music. The music was fine. Great, even.

But some of the people who were outraged with the labels' outrageous actions decided the problem was the music. Their answer wasn't to merely demand better copyright laws or fairer treatment for musicians, but to demand that music fans stop listening to music from the labels. Somehow, they thought they could build a popular movement that you could only join by swearing off popular music.

That didn't work. It can't work. A popular movement that you can only join by boycotting popular music will always be unpopular. It's bad tactics.

When we blame "laziness" for tech monopolies, we send the message that our friends have to choose between life's joys and comforts, and a fair economic system that doesn't corrupt our politics, screw over workers, and destroy small, local businesses. This isn't true. It's a lie that monopolists tell to justify their abuse. When we repeat it, we do monopolists' work for them – and we chase away the people we need to recruit for the meaningful struggles to build worker power and political power.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/12/give-me-convenience/#or-give-me-death

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

350 notes

·

View notes

Note

So Webtoons is getting sued by a bunch of law firms in class action lawsuit. Saw it on reddit. Apparently they lied to shareholders about revenue which is like one of the worst things I could imagine doing to your shareholders. Then their stock dropped again. Wow....wonder how this is gonna effect readers going forward or how they're gonna be more exploitative in the future. Not saying the down of Webtoons has begun but I wonder if it's gonna be the start of it.

Yep, I've been following this since the initial investigations began.

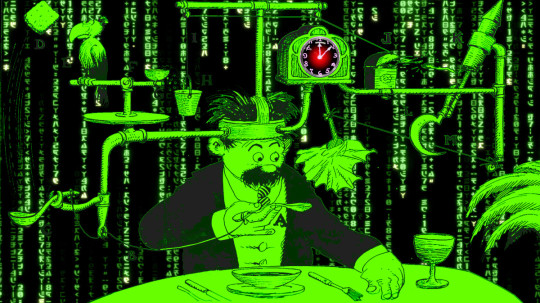

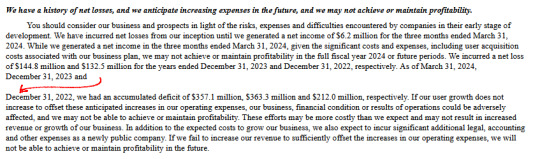

All that said, we likely won't see anything of this for a while, if anything even comes of it. The reality is that Webtoons... really didn't actually lie about being bad at making money. It's literally outlined in their IPO documentation:

So these lawsuits, at least in my opinion (*I AM NOT A LAWYER NOR AM I ANYONE WHO HAS ANY EXPERIENCE PLACING WALL STREET BETS, TAKE WHAT I HAVE TO SAY WITH MOUNTAINS OF SALT) is less about Webtoons 'lying' to shareholders and more so about them kicking the debt down the road which these lawyers want to try and hold them accountable for. It's not uncommon for startups to seek out private and/or public funding to help them stay out of bankruptcy, but such practice is incredibly shitty because if a company was already near the point of bankruptcy to begin with, what exactly is going to change to ensure that they actually make that money back with an additional net gain for those investors?

So in that sense, either something will come of this, or it won't, nothing's really a guarantee as of now. It's just as common for startups seeking public investments to get sued within their first 1-2 years because a company not returning on their initial investments within 3-6 months is a prime cut for lawyers to drool over. Despite their attempts to be honest about their earnings, the vast majority of Wall Street investors are paranoid little fuckers who invest in whatever's new and exciting with the hopes that it'll turn them a profit quickly and without headache. Unfortunately, Webtoons isn't a company that's known for having huge profit margins, which these investors would have realized if they knew anything about this industry or at the very least, bothered to read the fine print that Webtoons was obligated to lay out for them in their documentation. At best the majority of them saw Webtoons' offering that covered buzzwords like "content generation" and "AI" and went "yes please, I love money!" without realizing that webtoons, as a medium, have some of the highest production expenses to lowest-paying demographics out there and therefore companies like Webtoons aren't going to be a short-term gratification. It's more like waiting it out for the "next big thing" that will make that stock valuable again, a massive gamble that isn't guaranteed to payoff. And that's just the game of Wall Street in general.

That said, it's because of how difficult it is to directly monetize digital comics that Webtoons often has to rely on selling merchandise and IP rights in the hopes they'll land a whale - but even their pre-existing whales like Lore Olympus and Let's Play have either nothing to show for themselves, or have left the platform entirely. Of course, they'll vaguely claim that two of Netflix's highest-performing projects came from their platform, but any peek at an aggregated Top 10 list will prove that that is simply not true, and at best, they're referring to True Beauty's live action adaption, which is simply not even close to breaching that list of all-time top-performers (except probably in Korea but this is Goldman Sachs and their American investors they're trying to convince), All of Us are Dead (see above, same situation as True Beauty), and Heartstopper which is... not even an Originals series. Of course, that didn't stop Webtoons and Tapas from boasting about Heartstopper's Netflix adaption and its success on the platform, but literally none of its success is exclusively owed to either of those platforms, Alice Oseman flies solo and if anything, Heartstopper never would have gotten to the point it's at if it were tied down to a Webtoon Originals contract.

So in a sense, until anything comes of these lawsuits, they're more so just lawyers jumping on their own investment opportunity - the opportunity to get settlements from Webtoons for both their clients and themselves by extension. At best what they feasibly have against Webtoons is the company getting way too high on their own supply without anything to feasibly show in terms of profit for their IP's. Considering how many IP's they sold to television and film production studios back in 2019-2022 when they were at their peak over the lockdowns - a peak that is long in the rearview mirror - they are incredibly behind in actually paying off those promises. Even in a recent meeting they held just the other day with Goldman Sachs, they're quoted as saying: "When Rachel Smythe was a graphic designer in New Zealand, 4 or 5 years ago, and she had a story to tell, we enabled her to not just tell it in one part of the world, but globally. She became a NYT Bestselling author, she is rumored to be releasing soon as a major animated release."

When even the company that hosts Lore Olympus as its prize pig can only say that its long-anticipated TV production that both Rachel and Webtoons have been assuring people on repeat that the show is "still happening" and that what they've seen so far "looks amazing" is simply 'rumored to be releasing soon'... I don't even have the words to describe how embarrassing that is for them. Never mind the fact that Lore Olympus has been over for months and both it and its creator, Rachel, have been falling into the pits of irrelevancy. They don't have any other home-runners to bet on, they're just continuing to bank on Rachel as their own example of someone who "got big" even though it was years ago and that fame is now shrinking with the passage of time, you can even see the performance of the series dipping in its own front-end metrics over time. They are trying so hard to convince people that they're worth investing in when the one thing that actually DID have that kind of allure has now come and gone.

Never mind the fact that again, most Wall Street investors probably don't even participate in webtoon culture so the name "Rachel Smythe" isn't some golden ticket to fortune. Lore Olympus might get a bit more of a reaction, but it's going to be a lot more mixed due to how divisive the series became in the end, and general audiences who are new to Webtoons as a public company (and the medium as a whole) are still not so likely to know what the fuck that means or why it's significant. The best time to pull the "we have Rachel Smythe!" card in the public investing pool was, like many other things Webtoons has fallen behind in, years ago. Now it's clear Webtoons thinks that Rachel is their own personal J.K. Rowling, but they forgot the part where Rachel is creating for an incredibly niche and historically unprofitable medium that is nowhere near as big as what Harry Potter was back in its prime, and - personally speaking - that Rowling and Rachel are both, well... terrible at what they do.

Webtoons also has the added burden of not being a startup company. They're not some grassroots Silicon Valley tech startup run by a bunch of friends "with a dream", they're an extension of an industry that thrives overseas but barely has any infrastructure to support it here. They've been bankrolled for years by an overseeing tech company - Naver - but have consistently failed to get out of the red and so of course, now they're turning to public investments to help them out and subsequently, are passing that debt off to the next highest bidder, which is Wall Street. They had nearly a decade to figure their shit out here in the West and while they had their opportunities to thrive, those opportunities have come and gone, a lot of doors have closed and now this all feels like their own attempts to rip those doors back open again.

There is a LOT to insinuate already that Webtoons - a Korean-hosted platform - wasn't ready to enter the Western market and this fumbling of their public stock image is yet another great example of that. Even outside of Webtoons, other Korean-run platforms like Tapas have relied on private investments to keep them afloat (and still do, Tapas is still operating privately) and have routinely struggled to get a real foothold in the greater Western industry despite how much they hyped themselves up as the "next big thing". They're all playing the same game over and over again expecting better scores even though the playing fields are entirely different than what they've come to expect in Korea, where much of the entertainment industry is built around webtoons, much like how our entertainment industry in the West is built around comic giants like Marvel and DC (and even those giants are faltering as we've been seeing over the past several years).

Anyways. I don't know if this lawsuit is gonna go anywhere, there's a lot to the legal process that could lead to a variety of different outcomes, but at the very least, their plummeting stock value and the lawyers circling them from above is yet another notch on their belt of fuck-ups over the past few years. I know it's easy to say this in hindsight and I'm not the kind of guy to say "I told you so", but considering I've been following along with the bullshit of these major platforms for years and knew as soon as Webtoons was rumored to be going forward with an IPO that it would lead to disaster, I'm pretty confident in saying, "No really, I told you so." And I don't entirely blame the investors for that (except for the ones that clearly didn't read the fine print) - I also blame Webtoons for that, because they are a chronically unprofitable company run by a bunch of clowns who manufactured their own demise by getting in WAY over their heads and clearly don't even have a concept of a plan let alone an actionable one.

And that sucks, because the people who stand to get hurt the most are the ones who were made those empty promises years ago, long before the platform entered Wall Street - and that's the creators who were promised that their livelihoods would be secured and their work would be protected.

I will forever bully and make fun of Webtoons for everything they've done in and to this industry. I hope at the very least those investors learned an expensive lesson, and that the damage these lawsuits have already caused to Webtoons' public image - regardless of whether or not these lawsuits win - empowers others who have been screwed over by them to speak up and make their moves. They are not a monolith. They are a brittle business operating from the trunk of a clown car on their way to becoming a penny-stocks sham.

Fuck Webtoons <3

54 notes

·

View notes

Text

"Just weeks before the implosion of AllHere, an education technology company that had been showered with cash from venture capitalists and featured in glowing profiles by the business press, America’s second-largest school district was warned about problems with AllHere’s product.

As the eight-year-old startup rolled out Los Angeles Unified School District’s flashy new AI-driven chatbot — an animated sun named “Ed” that AllHere was hired to build for $6 million — a former company executive was sending emails to the district and others that Ed’s workings violated bedrock student data privacy principles.

Those emails were sent shortly before The 74 first reported last week that AllHere, with $12 million in investor capital, was in serious straits. A June 14 statement on the company’s website revealed a majority of its employees had been furloughed due to its “current financial position.” Company founder and CEO Joanna Smith-Griffin, a spokesperson for the Los Angeles district said, was no longer on the job.

Smith-Griffin and L.A. Superintendent Alberto Carvalho went on the road together this spring to unveil Ed at a series of high-profile ed tech conferences, with the schools chief dubbing it the nation’s first “personal assistant” for students and leaning hard into LAUSD’s place in the K-12 AI vanguard. He called Ed’s ability to know students “unprecedented in American public education” at the ASU+GSV conference in April.

Through an algorithm that analyzes troves of student information from multiple sources, the chatbot was designed to offer tailored responses to questions like “what grade does my child have in math?” The tool relies on vast amounts of students’ data, including their academic performance and special education accommodations, to function.

Meanwhile, Chris Whiteley, a former senior director of software engineering at AllHere who was laid off in April, had become a whistleblower. He told district officials, its independent inspector general’s office and state education officials that the tool processed student records in ways that likely ran afoul of L.A. Unified’s own data privacy rules and put sensitive information at risk of getting hacked. None of the agencies ever responded, Whiteley told The 74.

...

In order to provide individualized prompts on details like student attendance and demographics, the tool connects to several data sources, according to the contract, including Welligent, an online tool used to track students’ special education services. The document notes that Ed also interfaces with the Whole Child Integrated Data stored on Snowflake, a cloud storage company. Launched in 2019, the Whole Child platform serves as a central repository for LAUSD student data designed to streamline data analysis to help educators monitor students’ progress and personalize instruction.

Whiteley told officials the app included students’ personally identifiable information in all chatbot prompts, even in those where the data weren’t relevant. Prompts containing students’ personal information were also shared with other third-party companies unnecessarily, Whiteley alleges, and were processed on offshore servers. Seven out of eight Ed chatbot requests, he said, are sent to places like Japan, Sweden, the United Kingdom, France, Switzerland, Australia and Canada.

Taken together, he argued the company’s practices ran afoul of data minimization principles, a standard cybersecurity practice that maintains that apps should collect and process the least amount of personal information necessary to accomplish a specific task. Playing fast and loose with the data, he said, unnecessarily exposed students’ information to potential cyberattacks and data breaches and, in cases where the data were processed overseas, could subject it to foreign governments’ data access and surveillance rules.

Chatbot source code that Whiteley shared with The 74 outlines how prompts are processed on foreign servers by a Microsoft AI service that integrates with ChatGPT. The LAUSD chatbot is directed to serve as a “friendly, concise customer support agent” that replies “using simple language a third grader could understand.” When querying the simple prompt “Hello,” the chatbot provided the student’s grades, progress toward graduation and other personal information.

AllHere’s critical flaw, Whiteley said, is that senior executives “didn’t understand how to protect data.”

...

Earlier in the month, a second threat actor known as Satanic Cloud claimed it had access to tens of thousands of L.A. students’ sensitive information and had posted it for sale on Breach Forums for $1,000. In 2022, the district was victim to a massive ransomware attack that exposed reams of sensitive data, including thousands of students’ psychological evaluations, to the dark web.

With AllHere’s fate uncertain, Whiteley blasted the company’s leadership and protocols.

“Personally identifiable information should be considered acid in a company and you should only touch it if you have to because acid is dangerous,” he told The 74. “The errors that were made were so egregious around PII, you should not be in education if you don’t think PII is acid.”

Read the full article here:

https://www.the74million.org/article/whistleblower-l-a-schools-chatbot-misused-student-data-as-tech-co-crumbled/

17 notes

·

View notes

Text

I don’t see how else to make sense of it. 2022 was the year the 20-year tech bubble finally burst. 2023 was still bad for startups, and was full of bad headlines for the big platforms. And yet, in the markets, tech investors just took a deep collective breath and started inflating the next bubble, as though the previous year had never happened.

Silicon Valley runs on Futurity

42 notes

·

View notes

Text

Maximising Your Startup Funding in India with Equity Free Options

Navigating the funding landscape is one of the most challenging aspects of launching a startup. For entrepreneurs, maximising startup funding in India without giving up equity can be a game-changer. This blog explores how startups can leverage equity free funding options to fuel their growth while retaining full control over their business.

Understanding equity free funding

Equity free funding refers to financial support that does not require entrepreneurs to give up ownership stakes in their company. Unlike traditional funding methods, such as venture capital or angel investments, which typically involve exchanging equity for capital, equity free funding allows startups to access capital without diluting their ownership. This funding model is becoming increasingly popular in India, providing an attractive alternative for founders seeking to retain control over their ventures.

The rise of equity free funding in India

India's startup ecosystem is thriving, with numerous opportunities for entrepreneurs to secure funding. The rise of equity free funding options is a notable trend, offering innovative solutions for startups at various stages of growth. Programs and platforms dedicated to equity free funding are becoming more prevalent, providing crucial financial support while preserving founders' equity.

Exploring startup investor platforms

Startup investor platforms have become pivotal in connecting startups with potential investors. These platforms often feature various funding options, including equity free solutions. By listing their business on these platforms, entrepreneurs can attract investors interested in providing non-equity-based funding. Platforms like Klub are instrumental in offering equity free funding, allowing startups to access the capital they need while maintaining full ownership of their business.

Key equity free funding options

Several equity free funding options are available for startups in India. Each offers unique benefits and caters to different business needs:

Grants and competitions: Government and private sector grants are available for startups meeting specific criteria. Competitions and awards can also provide substantial funding without requiring equity. These funds are often aimed at fostering innovation and supporting high-potential startups.

Revenue-based financing: This funding model provides capital in exchange for a percentage of future revenues. Startups repay the funding based on their revenue performance, with no equity stake given away. This model aligns the interests of the startup and the investor, as both parties benefit from the company's success.

Crowdfunding: Equity free crowdfunding platforms allow startups to raise funds from a large number of individual backers. By offering rewards or pre-selling products, startups can secure capital without giving up equity. Platforms like Kickstarter and Indiegogo have gained popularity for this type of funding.

Debt financing: Traditional loans and credit lines are another option for equity free funding for startups. While these require repayment with interest, they do not involve giving up ownership. Debt financing can be a suitable choice for startups with a clear plan for revenue generation.

Benefits of equity free funding

Opting for equity free funding provides several advantages for startups:

Full ownership: Entrepreneurs retain complete control over their business, enabling them to make strategic decisions without external influence.

Preserved equity: Founders can keep their equity intact, which can be valuable for future funding rounds or potential exits.

Aligned interests: Many equity free funding models, such as revenue-based financing, align the interests of both the startup and the investor, fostering a collaborative relationship.

How to maximise equity free funding

To maximise equity free funding, startups should:

Research opportunities: Explore various funding options and platforms to identify the best fit for their business needs. Understanding the requirements and benefits of each option can help in making informed decisions.

Craft a compelling pitch: Whether applying for grants, participating in competitions, or using crowdfunding platforms, a well-prepared pitch is crucial. Clearly articulate the business’s value proposition, market potential, and financial projections.

Leverage startup investor platforms: Utilise platforms like Klub, which offer equity free funding solutions. By engaging with these platforms, startups can gain access to valuable resources and connect with investors interested in supporting their growth.

Build a strong network: Networking with industry experts, mentors, and other entrepreneurs can provide valuable insights and connections. A strong network can enhance credibility and increase opportunities for securing equity free funding for startups.

Conclusion

Maximising startup funding in India with equity free options offers a strategic advantage for entrepreneurs looking to retain control and ownership of their ventures. By exploring various funding models, leveraging startup investor platforms, and crafting compelling pitches, startups can secure the necessary capital while preserving their equity. With the rise of equity free funding options, the path to achieving business goals has never been more accessible.

#startup investor platform#startup funding in india#equity free funding#equity free funding for startups

0 notes

Text

Blum Memepad: Revolutionizing Token Launches and Community-Driven Growth

If you’ve spent any time in the crypto or DeFi space, you’ll know how transformative blockchain technology has been. It’s like going from horse-drawn carriages to electric cars—an entirely new way of operating that’s faster, more efficient, and packed with potential. Yet, even in this advanced ecosystem, one challenge remains: how do we give new tokens and projects the attention and resources they need to thrive?

This question has been central to the growth of decentralized finance. Enter Blum Memepad, a platform that simplifies token launches and empowers communities to back the projects they believe in. Today, I want to share why Blum Memepad is a game-changer—not in abstract terms, but in a way that resonates with you as someone interested in the evolution of finance and crypto.

The Problem Blum Memepad Solves

Let’s start with a familiar analogy: launching a token in the crypto world is a lot like starting a small business in a bustling city. You might have an incredible product, but without visibility, support, and resources, you’ll struggle to make an impact. Traditionally, new tokens have faced the same hurdles. Developers needed significant funding, partnerships, or sheer luck to get noticed.

Blum Memepad flips the script. It acts like a decentralized “Shark Tank” where the community, rather than a few gatekeepers, decides which tokens deserve to succeed. This isn’t just empowering for developers; it’s transformative for investors, who now have a say in shaping the crypto landscape.

How Blum Memepad Works

Imagine you’re a developer with a groundbreaking idea for a token. On Blum Memepad, you can present your project directly to the community. Here’s how it works:

1. Developers create and launch their tokens on the platform.

2. The community evaluates the project and decides whether to back it by contributing TON tokens (the native currency of the TON blockchain).

3. If the project secures 1,500 TON, it automatically gets listed on STON.fi, a leading decentralized exchange (DEX).

It’s that simple. No need for endless meetings with potential investors or navigating complicated listing processes. With Blum Memepad, your token’s success depends on the merit of your idea and the trust of the community.

For traders and investors, this system is equally rewarding. It’s like being an early investor in a startup—you get in on the ground floor, where the potential for growth is highest. But, as with all investments, it’s crucial to do your due diligence and diversify your portfolio to manage risks.

Why Meme Coins

Now, let’s address a common question: why focus on meme coins? After all, aren’t they just jokes that trend for a while before disappearing?

Not quite. Meme coins are a fascinating case study in community power. Unlike traditional assets, whose value often hinges on complex fundamentals, meme coins derive their worth from the people who rally behind them. It’s not so different from art—sometimes, the value of a painting lies not in its materials but in the emotions it evokes and the community it inspires.

Blum Memepad recognizes this potential. By providing a structured launchpad for meme coins, it gives these tokens the visibility and legitimacy they need to succeed while ensuring that the process is transparent and community-driven.

Blum Memepad and the TON Ecosystem

One of the most exciting aspects of Blum Memepad is its integration with the TON blockchain, an ecosystem designed for speed, scalability, and security. Every token launched on Blum Memepad contributes to the growth and vibrancy of TON, creating a cycle of innovation and opportunity.

Think of TON as a thriving marketplace where Blum Memepad acts as a dynamic new stall. Each token launched not only adds to the variety of offerings but also attracts more traders, developers, and investors, making the entire ecosystem more robust.

Why This Matters to You

If you’re a developer, Blum Memepad offers an unprecedented opportunity to launch your token without the traditional barriers of cost, connections, or gatekeeping. It’s like being given a stage at the world’s largest expo, where all you need is a compelling idea and the courage to present it.

For traders and investors, Blum Memepad is a treasure chest of opportunities. By participating in token launches, you’re not just buying assets—you’re investing in ideas, supporting innovation, and helping shape the future of decentralized finance.

Blum Memepad in Action

Over the past month, Blum Memepad has already attracted more than 34 million users, with participants completing tasks and accumulating Blum Points. These points will soon play a significant role in the platform, adding another layer of engagement and reward.

This success isn’t just numbers—it’s proof of concept. It shows that the crypto community is ready for a platform that prioritizes transparency, accessibility, and community-driven growth.

The Bigger Picture

Blum Memepad is more than just a launchpad; it’s a symbol of what decentralized finance can achieve when innovation meets community trust. It embodies the principles that have made blockchain technology so revolutionary: transparency, inclusivity, and the power of the collective.

As someone passionate about the crypto space, I see Blum Memepad as a beacon for what’s possible. It simplifies the complex, democratizes the exclusive, and makes the future of finance accessible to everyone. Whether you’re a developer with a vision or an investor with a keen eye for potential, Blum Memepad offers a platform where your efforts can truly make a difference.

Final Thoughts

The world of crypto and blockchain is evolving rapidly, and staying ahead means embracing platforms like Blum Memepad that challenge the status quo. It’s not just about launching tokens; it’s about building an ecosystem where ideas can thrive, communities can grow, and innovation can flourish.

If you’re ready to be part of this revolution, now is the time to explore Blum Memepad. Not just as a platform, but as a movement toward a more decentralized and community-driven financial future.

4 notes

·

View notes

Text

#platform for angel investors#online startup investment platform#platform for startups and investors

0 notes

Text

#invest in startups#investing platforms#startup funding app#startup investment#investors#crazy money#crazy money app#business#fundraising

0 notes

Text

From La Stampa (translated from Italian):

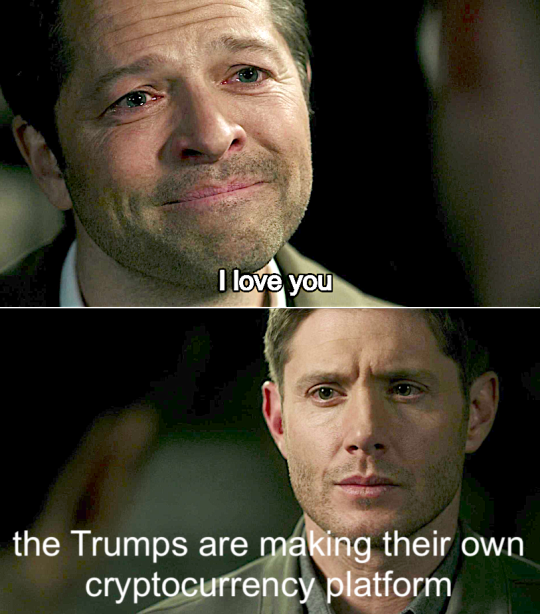

“Make Finance Great Again,” Trump family makes its own cryptocurrency and allies with Silicon Valley It will be called “World Liberty Financial,” will have tech investors and real estate developers from Chase Herro and Zak Folkman to Steve Witkoff inside. Sons Eric and Donald Jr. will coordinate. And his backer Tyler Winklevoss jokes, “Donald has been orange-pilled, indoctrinated.” Jacopo Iacoboni Sept. 17, 2024 Updated 11:00 a.m. 3 minutes of reading

They want to do a kind of “make finance great again,” along the lines of MAGA, the election slogan and the Make America Great Again campaign. Donald Trump's sons, Don Jr. and Eric, of course with their father's imprimatur, are about to launch a new cryptocurrency platform that will be called “World Liberty Financial,” and will allow users to make even massive transactions without a bank getting in the way and extracting fees (and with a very low level of tax tracking, it should be added). A couple of concepts familiar to bitcoin fans, for example, but which the Trump family now has ambitions to decline on a large scale. It is not certain that this marriage between Trumpism and decentralized finance, DeFi, is a harbinger of only positive developments. The board of “World Liberty Financial” will also consist of former crypto investors such as Chase Herro and Zak Folkman, and Steve Witkoff, a real estate developer and old friend of Trump. But thanks to documents filed with the U.S. Federal Election Commission that we have been able to read we know that in general the entire Trump campaign - Make America Great Again Inc. - received money not only from Musk, but cryptocurrency from billionaire twins Cameron and Tyler Winklevoss, who lead the cryptocurrency company Gemini: about $3.5 million in Bitcoin on July 19, the day after Trump's speech at the Milwaukee convention. The Winkelvosses also poured in money to America PAC, the tech investor-backed group that Musk helped launch in 2024 (Trump had bragged that Musk was giving him $45 million a month; Musk said his contribution is “at a much lower level”). Another co-founder of a cryptocurrency exchange, Jesse Powell, boss of Kraken, and venture capitalists Marc Andreessen and Ben Horowitz (who created a16z) who have invested billions of dollars in cryptocurrency startups, have also made endorsements and poured money into Trump. In short, for the Trump family to embark on this big cryptocurrency project is a natural consequence of the fact that these are almost becoming a Republican asset in the campaign, and the “libertarian” wing of the old Gop is now a kind of very, very rampant ideologized “cyberlibertarianism.” The real boss of the “tech bros” according to many is not Elon Musk, but Peter Thiel. Zuckerberg's longtime partner in Facebook, co-founder of PayPal, Thiel's fortune has at least doubled during the Trump presidency. Palantir-a much-discussed software company variously accused of extracting data from Americans and profiling them-has managed to get a contract from the Pentagon. Other donors to MAGA Inc include Jacob Halberg, Palantir's princely analyst, and Trish Duggan, a wealthy Scientology funder and friend of the tech bros. Trump's vice presidential candidate, J. D. Vance, traveled to Silicon Valley and the Bay Area, celebrating a dinner at the home of BitGo CEO Mike Belshe, 100 people each pouring in between $3,300 a plate and a $25,000 roundtable. Trump in 2021 called bitcoin a “fraud against the dollar.” A few weeks ago, speaking in Nashvill at the bitcoin fan conference, he promised, “The United States will become the crypto capital of the planet.” Better than his friend Putin's Russia, although this Trump did not say so explicitly. The fact is that after his speech, Tyler Winklevoss ran on X (now the realm of cyberlibertarians) and joked that Donald had been “orange-pilled,” making a Matrix analogy, had been “indoctrinated,” or had finally seen the real reality behind the appearances.

3 notes

·

View notes

Text

Eric and Donald Trump Jr., the sons of former president Donald Trump, have pledged to “make finance great again” with a new family-run crypto endeavor called World Liberty Financial.

Introduced in a meandering livestream on X Monday, the Trump family and their associates described World Liberty Financial as a crypto platform that would let users conduct transactions without a bank sitting in the middle and extracting fees—a concept known as decentralized finance, or DeFi.

While short on details, Donald Trump, Jr. and Eric Trump both stressed repeatedly that World Liberty Financial’s primary goal was to make DeFi more broadly accessible. “It’s truly our job to make it understandable,” said Eric Trump during the livestream. “We have to make it intuitive, we have to make it user-friendly, and we will.”

Former President Donald Trump joined the call as well, stressing his pro-crypto stance. “I do believe in it,” said Trump of cryptocurrency generally. “It has a chance to really be something special.”

The Trumps aren’t alone in leading World Liberty Financial. They’re joined by crypto veterans Chase Herro and Zak Folkman, as well as Steve Witkoff, a real estate investor and friend of Donald Trump’s. In addition to the platform itself, World Liberty Financial will come with a governance token, WLFI, which will provide owners the right to vote “on matters of the platform.” Approximately 63 percent of the tokens will be sold to the public; 17 percent are set aside for user rewards, and 20 percent will be reserved for World Liberty Financial team compensation.

The Trump brothers had teased the new endeavor repeatedly in the weeks leading up to the announcement. In an X post on August 6, Eric wrote that he had “truly fallen in love with crypto/DeFi.” The following day, in another post, Donald Jr. said he was “about to shake up the crypto world” and warned his followers not to “get left behind.” On August 22, in a somewhat cryptic post on Truth Social, the former president himself promoted the project: “For too long, the average American has been squeezed by the big banks and financial elites. It’s time we take a stand—together,” wrote Trump.

World Liberty Financial marks the latest development in Trump’s bid to court the crypto industry, members of which are broadly supportive of his reelection campaign.

Some high-profile crypto figureheads have thrown millions of dollars at the Trump campaign, in the hope of ousting the Democrat administration under which financial regulators have cracked down on crypto. Cameron and Tyler Winklevoss, founders of crypto exchange Gemini, each donated $1 million to Trump, as did Jesse Powell, cofounder of another exchange, Kraken. Venture capitalists Marc Andreessen and Ben Horowitz, founders of a16z, which has invested billions of dollars in crypto startups, have also publicly endorsed Trump.

“The degree to which crypto executives are getting involved in politics is a marked shift from previous elections. It’s inarguable, the degree of politicization that has happened in the industry,” says Molly White, author of crypto-skeptic newsletter Citation Needed and creator of Follow The Crypto, a project that traces the impact of crypto industry donations on the upcoming US election. “There has been a concerted effort to present [crypto] as an election issue and convince politicians they need to take a stance on it, or lose out on voters.”

As it turned out, Trump was readily convinced: Despite having previously dismissed bitcoin as a “scam,” Trump has recently taken to pitching himself as the crypto president. In July, speaking to thousands of bitcoiners at a conference in Nashville, Tennessee, Trump promised to turn the US into the “crypto capital of the planet” and establish a national “bitcoin stockpile” if reelected. In a post on X after the speech, Tyler Winklevoss celebrated the former president having been “orange-pilled”—crypto lingo meaning “indoctrinated.”

Initially, when Eric and Donald Jr. first began to hint at the World Liberty Financial project, there was speculation they were gearing up to launch an official Trump crypto token.

In the last year, tens of Trump-inspired memecoins have come to market, becoming something of a bellwether for the upcoming election, fluctuating in price along with changes in Trump’s political fortunes. One such token, DJT, issued in early June, surged in price amid rumors that it originated with the Trump family. In a broadcast on X, Martin Shkreli, of “pharma bro” fame, claimed to have created the token in partnership with Barron Trump, the former president’s 18-year-old son. On August 6, the price of DJT sank by 90 percent after large quantities were sold off by an anonymous token holder. “Wasn’t me!” said Shkreli, in an email to WIRED, when asked whether he knew who was responsible for the sell-off. The price of DJT was $0.0002441 per coin on Monday.

The press office for the Trump campaign did not respond to questions about Barron’s alleged involvement with the DJT token. In a post on X in the leadup to announcing World Liberty Financial, Donald Jr. warned followers to “beware of fake tokens claiming to be part of the Trump project.”

World Liberty Financial will face steep competition in a DeFi market already crowded with similar services, among them Aave, Compound, Venus Protocol, and others. “DeFi is pretty mature, especially on the over-collateralized side,” says Zach Hamilton, founder of crypto startup Sarcophagus and venture partner at VC firm Venture51.

But the Trumps need not necessarily do anything novel, if they can capitalize on their mammoth public platform to peddle the new venture. “[World Liberty Financial] is launching with the most free marketing that any crypto company could ever get,” says Hamilton. “Trump is the king of living rent free in people’s minds.”

Incumbents in the DeFi industry are cautiously optimistic about the prospect of the Trump family’s arrival; at once glad of the publicity and wary of the reputational damage World Liberty Financial could cause if it were to fall on its face, or if a technical snafu were to result in financial losses.

“I welcome any effort to bring DeFi into the mainstream,” says Brad Harrison, CEO of Venus Protocol. “But like the autopilot in a Tesla, DeFi may give the appearance of something that’s simple, but the inner workings are complex. Without a solid grasp of its nuances in the hands of seasoned technologists and financial engineers, a new platform risks being more of a branding exercise than a substantive and safe contribution to the space.”

Irrespective of the risk in placing trust in a crypto platform yet to be battle tested, industry enthusiasts are likely to patronize World Liberty Financial if only to signal support for Trump’s political endeavors. “We are definitely dealing with crypto as a right-wing Republican commodity now,” says Jacob Silverman, coauthor of Easy Money: Cryptocurrency, Casino Capitalism, and the Golden Age of Fraud. “The industry is so aligned with the Republican party and they are the biggest donors of any industry this cycle.”

In the spirit of various British politicians who have retired into crypto positions, World Liberty Financial could represent an attempt by Trump to hedge against a loss in the upcoming election—to set up for himself a fallback gig.

“Maybe the raucous reception at the crypto conference in Nashville has given him an impression this is the world he wants to be in, because they love him and he can make money,” says Silverman. “For all his faults, he does understand the crowd.”

3 notes

·

View notes