#self employed worker

Explore tagged Tumblr posts

Text

I love how my unintentional excuse as to why Alestair and Idan never have to go to work is because they ran away and basically quit without notice.

#this has always been a part of the story though as the first ever thing I wrote with Alestair involved what happened#but Idan stops working there because of that#Mara's job pays a LOT and is hire based so she can do whatever#Vilissa is like the only character that has to regularly work LMAO#but also Vi wouldn't let Alestair get a job when they were dating#as for Fae she's a sex worker so she does it whenever#Fritz and Jer are employed but they don't even get heavily involved in helping until Love and that is explained away (thanks Vi)#as for other stoires#the children in Sunshine are too young to work#the parents do work and leave regularly but aren't really heavily involved#and the adults just take care of themselves with the stuff they have or work if they want (like Norie)#there is no currently running school in the castle (but there used to be)#Barle is a con artist so he would sell junk he fixed up but after getting kidnapped by Shika he doesn't really worry about that anymore#Shika and Fria have disposable income as they are just looking for Barle (Shika the princess and Fria a royal bodyguard)#and Charlie is a bounty hunter so he has freelance (and later a courier)#Flick and Millie are child and Nick is jobless and he's a bird currently so he just needs to eat a little#Ebers is a fortune teller so she does that whenever#also since Millie doesn't care about school she skips out after Flick shows up#And Flick is basically kidnapped so she doesn't got to school as she can't even go there#Seth is homeless and gets things out of making deals with others which he sometimes sell expensive items to get money#Lia and Giles leave behind their lives to adventure but were previously self employed (small businesses)#Myrtle is a Princess so she has that responsibility and disposable income#Sylas is a hunter but there isn't really any work to be done if most of the kingdom is under a sleeping spell#Nym uses the stuff that Elysa left behind in death but he was a Farmer back home not that he can get back home#Pokey runs the train station and the venue but he also isn't getting a lot of business from the inner kingdom#that's just the main stories lolll#every story has some kinda excuse about not working while the story happens

3 notes

·

View notes

Note

u should post more

Thank you! I wont!

#jk!#kidding!#I mean. I sadly am a self employed worker#so my hours are basically ALWAYS#but! I understand your point! ���#jossambird confessions

8 notes

·

View notes

Text

One of my co-workers just let out a mournful sigh and said, "God, I wish there was a Ctrl-Z button in real life," and I felt that

#wouldn't that be neat?#co-worker as in person I work alongside#we're both self-employed#but whatevs#minnie talks

22 notes

·

View notes

Text

Labour turns its back on workers’ rights

“Labour has undermined the principle of universality that underpins its entire programme for employment rights. This means a tiered system of rights and entitlements will remain in place and makes the pledge to give all workers the same rights from day one impossible.

“When the New Deal was originally developed, the Labour leader, his cabinet and the party’s affiliated trade unions shared a vision. They sought to build a dignified workplace in which workers – from the moment they took up employment – would have the ability to take time away after the birth of a child or a bereavement, to enjoy a decent work-life balance and not to be arbitrarily dismissed.

“The document was a recognition of the fact that the tiered system is one of the key drivers of low pay and insecurity, responsible for 3.7 million being trapped in ‘insecure work’ who do not know when their next shift will be or if they will be able to pay their bills ... The New Deal was designed to end the most exploitative practices in the gig economy – where workers are often paid below the minimum wage, made to work in dangerous conditions and denied rest breaks. One such example is Amazon delivery drivers, who have been forced to drive through exhaustion and urinate in bottles ...

“The lack of rights and protections is not just a problem for those in insecure forms of work. It is a problem for workers and the economy as a whole. These practices put a downward pressure on wages and terms across the board, making us all poorer and facilitating a race to the bottom that is partly responsible for Britain’s poor growth and productivity.

“The expansion of the gig economy in particular demonstrates how exploitative employment practices threaten once-secure jobs. The assault by Royal Mail against the terms and conditions of posties, for example, is a response to gig economy parcel delivery companies undercutting the postal service.”

#workers rights#employment rights#workers#working class#employees#self-employed#keir starmer#labour party#labour#labour rights#labor rights#maternity leave#maternity pay#paternity leave#paternity pay#redundancy pay#flexible working#amazon#gig economy#uk

6 notes

·

View notes

Text

Universal Self Employ Movement

A coercion free movement to solve all the major problems of workers now exists. Participation in the movement is anonymous and easy. Difficulty getting or changing jobs, getting paid below the market rate, invasions of privacy, discrimination, hostile work environments, untrustworthy references, blacklisting, unreliable benefits, working too many hours and unnecessarily hazardous working conditions will be eliminated or mitigated. Go to www.usemovement.ORG for all the details and join the movement.

#privacy#job#workers#discrimination#references#blackball#shirt#labor#contractor#labor movement#labor organizing#labor market#labor economy#blacklist#universal#Self#Employ#Movement

3 notes

·

View notes

Text

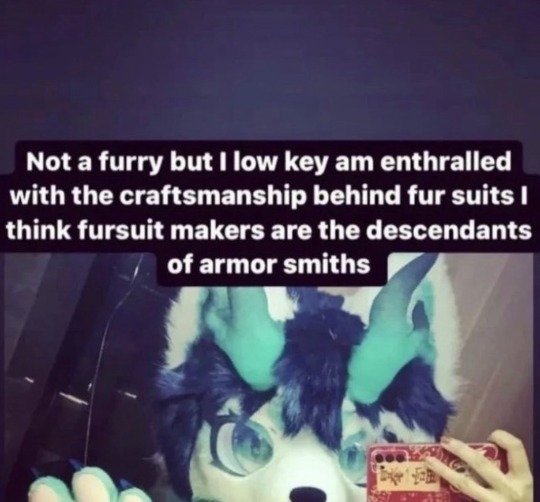

I am a furry, and let me tell you something:

fursuit makers usually undercharge for their product. And yes, I do absolutely mean they’re typically undercharging when they charge 8-10K for a full suit.

Most mascot costumes for sports and corporations usually cost in the range of 25-40K, for a very similar product and level of professional craft.

#nothing but respect for fursuit makers#and a lot of them in the USA lose most of the revenue they make to self-employment taxes#because yes you have to pay tons of extra tax money just to be self employed in this country#America hates a small business#cats of tumblr#Heads up fursuit makers there is an international union for fabric and textile workers and that includes you!!

35K notes

·

View notes

Text

Are There Personal Loans Designed for Medical Professionals?

Medical professionals, including doctors, dentists, nurses, and other healthcare workers, often require financial support for various personal and professional needs. Whether it’s setting up a private clinic, investing in medical equipment, funding higher education, or managing personal expenses, specialized personal loans for medical professionals provide tailored benefits such as higher loan amounts, flexible repayment options, and lower interest rates.

In this article, we will explore the best personal loan options for medical professionals, their eligibility criteria, benefits, and how to apply for them.

1. What Are Personal Loans for Medical Professionals?

Banks and NBFCs offer specialized personal loans for medical professionals, considering their high earning potential, job stability, and lower credit risk. These loans provide better terms compared to standard personal loans, making them ideal for healthcare professionals who need quick financing.

Unlike regular personal loans, these loans come with higher approval chances, even for self-employed doctors or medical professionals in private practice.

2. Best Personal Loan Options for Medical Professionals

2.1. Bank Loans for Medical Professionals

Many banks offer customized personal loans for doctors and healthcare workers with low-interest rates, higher loan amounts, and flexible EMIs.

Loan Amount: ₹5 lakh – ₹50 lakh

Interest Rate: 8-12% per annum

Repayment Tenure: Up to 7 years

Approval Time: 24-48 hours

🔗 Top Banks Offering Personal Loans for Medical Professionals:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

2.2. NBFC Personal Loans for Medical Professionals

Several Non-Banking Financial Companies (NBFCs) provide tailored loans for medical professionals, especially for those setting up a clinic, diagnostic center, or upgrading medical infrastructure.

Loan Amount: ₹5 lakh – ₹30 lakh

Interest Rate: 10-16% per annum

Processing Time: Instant approval available

🔗 Best NBFC Lenders for Medical Professionals:

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

2.3. Digital Loans & FinTech Lending for Medical Professionals

Digital lending platforms provide quick and hassle-free loans to medical professionals with minimal paperwork and fast disbursal.

Loan Amount: ₹50,000 – ₹10 lakh

Interest Rate: 12-20% per annum

Repayment Tenure: 12 to 60 months

🔗 Top FinTech Loan Providers for Medical Professionals:

InCred Personal Loan

2.4. Secured Loans for Medical Professionals

If a medical professional wants lower interest rates, they can opt for secured loans against assets such as property, fixed deposits, or medical equipment.

Loan Amount: 70-90% of asset value

Interest Rate: 6-10% per annum

Repayment Tenure: Up to 10 years

This is a great option for doctors setting up private clinics or diagnostic centers.

3. Eligibility Criteria for Personal Loans for Medical Professionals

Lenders offer preferential loan terms to medical professionals based on their income stability and creditworthiness. The general eligibility criteria include:

Age: 25 to 65 years

Professional Qualification: Must be a licensed doctor, dentist, nurse, or healthcare specialist

Minimum Income: ₹3-5 lakh per annum

Employment Type: Salaried or Self-Employed (Private Practice)

Credit Score: 700+ preferred for best rates

Even self-employed medical professionals with private practice experience can qualify for these loans.

4. Documents Required for a Personal Loan for Medical Professionals

Medical professionals need to submit certain documents for loan approval, including:

4.1. Identity & Address Proof

Aadhaar Card

PAN Card

Passport or Voter ID

4.2. Professional Qualification Proof

Medical Registration Certificate

Degree or Diploma in Medicine/Dentistry/Nursing

4.3. Income Proof

Latest salary slips (for salaried doctors/nurses)

Income Tax Returns (ITR) for the last 2 years (for self-employed professionals)

Bank statements for the last 6 months

4.4. Additional Documents (if required by lender)

Property papers (for secured loans)

Business license (if running a private practice)

Having these documents ready in advance can ensure faster approval and quick loan disbursement.

5. How to Apply for a Personal Loan as a Medical Professional?

Applying for a personal loan as a doctor, nurse, or healthcare professional is simple and can be done online or offline. Follow these steps:

Step 1: Compare Loan Offers

Check different lenders for interest rates, processing fees, and repayment flexibility before applying.

Step 2: Check Eligibility

Ensure you meet the minimum income, credit score, and professional qualification criteria.

Step 3: Gather Required Documents

Keep your identity proof, medical license, and income proof ready for submission.

Step 4: Submit Loan Application

Apply online through the lender’s website or visit the nearest bank branch to complete the process.

Step 5: Loan Disbursement

Once approved, the loan amount is credited to your bank account within 1-5 days.

6. Benefits of Personal Loans for Medical Professionals

Medical professionals enjoy several advantages when applying for personal loans, including:

Lower Interest Rates: Doctors and healthcare professionals often get special loan rates due to their stable income.

Higher Loan Amounts: Medical professionals can avail of loans up to ₹50 lakh, compared to regular borrowers.

Flexible Repayment: Tenures of up to 7 years allow easy EMI management.

Minimal Paperwork: Loans are approved faster with simplified documentation.

Special Pre-Approved Loan Offers: Many banks provide pre-approved loans to doctors based on their income profile.

These exclusive benefits make personal loans for medical professionals one of the best financial tools for meeting personal or professional expenses.

Best Loan Options for Medical Professionals

Personal loans designed for medical professionals provide fast and flexible financing with tailored benefits such as low-interest rates, high loan amounts, and easy repayment terms. Whether you need funds for personal use, clinic expansion, or medical equipment purchases, there are multiple lending options to suit your needs.

🔗 Apply for a Personal Loan Today:

Explore Personal Loans

With exclusive loan benefits for doctors, nurses, and healthcare professionals, securing financial assistance has never been easier!

#Personal loan for medical professionals#Loans for doctors#Personal loan for doctors#Medical professional loans#Loans for healthcare workers#Doctor loans with low interest#Personal loan for nurses#Loans for healthcare professionals#Best loans for doctors and nurses#Healthcare worker loan eligibility#finance#personal loan online#nbfc personal loan#personal loans#fincrif#bank#loan services#personal loan#personal laon#loan apps#Personal loans for self-employed doctors#Low-interest loans for doctors#Personal loan for medical practitioners#Loans for medical staff#Personal loan for doctors with flexible repayment#Best loan providers for medical professionals#Secured loans for doctors#Instant loans for doctors and medical professionals#Loan options for doctors setting up practice#Personal loan for healthcare professionals without collateral

0 notes

Text

Why Self-Employed Individuals Should Explore SETC and FFCRA Benefits

Why Self-Employed Small Business Owners Should Explore SETC and FFCRA Benefits As a self-employed small business owner, gig worker, or 1099 contractor, managing finances can often feel like walking a tightrope. Between fluctuating incomes, rising costs, and complex tax regulations, it’s easy to overlook potential benefits that could significantly ease your financial burden. Among these benefits,…

#1099 contractors#accounting firms#business growth#cash advances#cash flow#eligibility criteria#Families First Coronavirus Response Act#FFCRA#financial benefits#financial management#financial relief#gig workers#IRS regulations#securing loans#Self-Employed#Self-Employed Tax Credit#setc#small business owners#tax credits#tax software

0 notes

Text

#hmrc#uk tax#self employed#self employed workers#tax bill#tax payment#taxpayers#tax accountant#london#tax advisory

0 notes

Text

#self employed#gig worker financing#gig workers#self employed financing#instant business loans#self employed loan#gig worker loan#instant business financing#instant business funding

0 notes

Text

Ela Bhatt

A Lawyer and a Social Worker(7 September 1933 – 2 November 2022) Ela Bhatt efforts for the rights of women, particularly those in the informal sector, have left an incredible impact on society. Bhatt’s work with the Self-Employed Women’s Association (SEWA) and her work transformed the lives of countless women and communities across India. Self-Employed Women’s Association: Under Bhatt’s…

View On WordPress

#best ngo#Bhatt#Ela#girl#impact#Ramon Magsaysay#RSKS#RSKSIndia#Self-Employed Women&039;s Association#SEWA#Social Worker#support#United Nations#women

0 notes

Text

I see a lot of people talking about how great it would be for sex workers to unionize, so I want to point out that in the UK we have done so already!

We need to get the word out to sex workers in the UK who don't already know about the union, so sharing is appreciated particularly if you're a sex worker or you're in the UK and might have UK sex worker followers.

SWU is a branch of sex workers, in the UK, organising with BAFWU for better working conditions and fighting to change the industry from within.

We fight for ‘Worker’ status sex workers (strippers, full-service sex workers and more) basic worker protections while allowing them to retain the label of self-employed and the associated freedoms. We seek to improve conditions through collective negotiation and individual casework. We organise to claim basic rights at work, such as annual leave, sick pay, a guaranteed basic wage for those working at venues, and the right to organise and be represented by a trade union.

This union has been immensely valuable to me. It gives us access to other sex workers who we can get safety advice from, a huge number of resources, and the ability to push for changes to the policies of escorting websites or strip clubs or porn sites.

You can learn more on SWU's website here and join the union!

Membership to the union costs roughly £6 per month and for me personally, from help with taxes and support getting money back from clients who've refused to pay me, the union has saved me far more money than I've spend on union dues.

1K notes

·

View notes

Text

Thank you Phantom Liberty for giving us a chance to tinker w/ Crow's story... That man raised his younger brother's kids while healing from divorcing his abuser now. This man has never had a moment of peace but carries NO regret for over half of it.

#ours#V; Valentine 'Crow' Crimson#Not giving them or his brother or Sister in law tags just yet but-#- Louis Marie and Joan Sweeney would not be the people they would become without Crow.-#If anything they'd be cogs in the corpo system without Crow...#Carmen was always too busy to handle them and Rosemary was never set up to properly raise children no matter how hard she tried or wanted.#They aren't /his/ kids but those are his fucking BABIES. All three of them.#He genuinely considers them his children and their childen as his Grandkids#Louis became a small corner store owner. Marie a self employed merc and Joan a Nomad. He's so proud of all of them...#(< Insane about this family we made ourselves...)#Diana's (Crow's sister's) kids are mostly corp workers w/ the exception of Jack. One of Rogue's top merc's.#ALL THIS IS UP FOR CHANGE but the basis of it w/ exception of small details will remain the same.

1 note

·

View note

Text

Workers, Affirmative Action & the Supreme Court

You won't have to care what the supreme court says about Affirmative Action if workers join the Universal Self Employ Movement. Discrimination is prevented when job candidates are anonymous. Go to www.usemovemenT.ORG for info.

#Universal#Self#Employ#Movement.#privacy#job#workers#discrimination#references#blackball#shirt#labor#contractor#blacklist#labor market#labor movement#labor organizing#supreme court#affirmative action#labor economy

1 note

·

View note

Text

81/100.

Uggh. Tumblrrr!! I haven't posted in days!

It's not that I haven't been productive. I have. I've been very busy with work and I don't need this 100 dop challenge for paid work. It's the at-home chores and being productive on days off that I struggle with. I have nothing pressing scheduled for today, which means I've got all kinds of time today for things like laundry, yardwork, dishes, decluttering, deep cleaning, one of my many "projects", etc, etc, etc... But do I feel any motivation at all to do any of it? Nope, none at all.

I don't even feel like making a to-do list today.

I have been continuing with my foray into text-to-image AI. I am using Night Café now and they have daily "challenges", which I have been entering daily. Here's my entry for the day-before-yesterday's challenge. The theme was "wizards and warlocks".

I really feel like being productive in some capacity right now, but not doing boring chores. I want to make some sort of progress wrt my financial situation right now, I think.

The situation is that I don't quite earn enough money with my current gig and I will need to earn just a bit more in the near future to meet all my expenses. I just need another gig, another piece that will dovetail into my current schedule. I'm just not sure what that piece is.

I really would like something I can do from home, on my laptop, on a flexible schedule. I have some skills that are marketable, I think. And other skills that are not marketable but potentially could be if I hone them a bit.

I was thinking that I'd really like to tap into my hyper-local market. I can leverage my personal and professional neighbourhood network.

And so then I was thinking that probably in order to do that it would probably be a good idea to have my own website. I don't mean like a Tumblr blog, I mean my very own website.

I had already started down the path of learning how to use WordPress some time ago, and I even got my own domain and got my first very own blog up and running! It was supposed to be my hobby blog, a means to explore my hobby whilst simultaneously learning to use WordPress. However, I sort of got sidetracked with Tumblr as my hobby blog place and my very-own blog has been sorely neglected. I think it no longer has a raison d'être.

I also seem to have fallen off the wagon for trying to learn to use WordPress.

I'm thinking I want my own website in order to be like a portfolio of sorts, to showcase what I am learning. Like, I have the basics of WordPress down, building my own site with WordPress would show that I do. And this AI stuff I'm learning, I could have a blog section to post about what I'm learning and how my knowledge of prompt writing is progressing. I also have eons of experience with MS Office Suite, though I need to brush up on the newest features. It's changed a lot over the years.

Idk, I'm thinking I want my own, non-anonymous, semi-professional, personal online hub that I can refer people to and that can evolve with me.

My WordPress hobby-blog was initially a way for me to learn how it all works, buying a domain and publishing a site and all that. I kept the cost super cheap. I was hesitant to spring for a "proper" site until I "knew what I was doing". I think I need to graduate myself from newb status and accept that I now have enough knowledge to publish my own professional-looking site!

Also, I think I'm starting to see all the obstacles I'm putting in front of myself. For example, I think one fear I have is that if I have my own site and share it with my network, I'll suddenly be fielding all kinds of requests for jobs I don't want to do or don't know how to do or don't have time in my schedule to do. Another fear is that I'll have to come up with regular blog posts or updates about what professional skills I can offer or am learning. Also, I get all twisted up when I begin to think about how I would potentially offer services. Like, do I need to figure out how to set up forms or what-not to receive payment??

Omg, stahhhp!! I'm making this far more complicated than it has to be! It doesn't need to be a fancy site with all the bells and whistles. It can literally be a static one-page resume-style site with a link to my LinkedIn profile. That's it! That's all it has to be! And then I can add to it as I go along. I could add a link to my pet-sitting profile (on a third-party website) and be like, "to hire me for this, go here". Then I could do the same for other specific jobs. Like, set up a Fiverr profile for specific tasks and then link to it. Or Upwork or whatever. Something like that. But I'd only turn on my availability for these other tasks during slow season for petcare. That way I won't be fielding requests when I don't have time for them.

Yep, that's the direction I think I want to take. I think I was just getting way ahead of myself. First I need a hub that's my own, then figure out what kinds of services I want to offer, then I can promote my services to my network and send them to my hub. Eventually I'd love to be able to work remotely, anytime anywhere, and my hub will come with me.

So what's the first step?

I think first I need to revisit my WordPress hobby-blog and decide what I want to do with it.

Thanks Tumblr. Good talk. 🤜🤛

#100 days of productivity#100dop#chores#ai art generator#ai generated#to do list#wordpress#blogging#website#self employed#gig workers#side gig#virtual assistant#remote work#work from home#wfh culture

0 notes

Text

Can Gig Workers Get a Personal Loan?

The gig economy has transformed the way people work, offering flexibility and independence. Gig workers, including freelancers, delivery agents, ride-hailing drivers, consultants, and digital creators, often face difficulties in securing personal loans due to the absence of a fixed salary. However, with the rise of alternative income verification methods and digital lending platforms, many banks and NBFCs now offer personal loans for gig workers.

In this article, we will explore how gig workers can qualify for a personal loan, the best loan options available, and the documents required for approval.

1. Can Gig Workers Qualify for a Personal Loan?

Yes! Even though gig workers may not have a fixed monthly salary, they can still qualify for personal loans by providing alternative income proof, such as bank statements, invoices, tax returns, or digital payment records. Many lenders assess an applicant’s financial stability by looking at their average income over several months rather than requiring a traditional salary slip.

2. Best Personal Loan Options for Gig Workers

2.1. Unsecured Personal Loans from Banks and NBFCs

Several banks and NBFCs now offer personal loans for self-employed individuals, including gig workers. These loans are based on average monthly earnings, credit score, and banking transactions.

Loan Amount: ₹50,000 – ₹25 lakh

Interest Rate: 11-24% per annum

Repayment Tenure: 12 to 60 months

Eligibility: Minimum annual income of ₹2-3 lakh, based on bank statements

🔗 Best Lenders for Gig Workers:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Axis Finance Personal Loan

2.2. Digital Lending Platforms and FinTech Loans

Several FinTech lenders provide instant personal loans for gig workers by evaluating their digital transactions, UPI payments, and online earnings instead of traditional salary slips.

Loan Amount: ₹10,000 – ₹5 lakh

Interest Rate: 15-30% per annum

Approval Time: Within 24 hours

Repayment Tenure: 3 to 36 months

🔗 Top Digital Loan Apps for Gig Workers:

PaySense

MoneyTap

KreditBee

CASHe

These platforms offer instant loan approvals and allow repayment via EMIs, making them ideal for freelancers and gig workers who need quick access to funds.

2.3. Secured Loans Against Fixed Deposits, Gold, or Investments

For gig workers who struggle to get an unsecured loan, opting for a secured personal loan can increase approval chances. These loans are backed by collateral such as gold, a fixed deposit, or mutual funds.

Loan Amount: Up to 90% of the collateral value

Interest Rate: 7-12% per annum (lower than unsecured loans)

Repayment Tenure: Up to 7 years

Eligibility: No fixed income required; depends on asset value

🔗 Best Secured Loan Providers:

Tata Capital Personal Loan

Axis Bank Personal Loan

3. How Gig Workers Can Improve Loan Approval Chances

3.1. Maintain a High Credit Score

A credit score of 700+ significantly improves loan approval chances. Gig workers should: ✔ Pay credit card bills on time ✔ Avoid excessive loan applications ✔ Maintain a low credit utilization ratio

3.2. Show Consistent Income Proof

Lenders evaluate an applicant’s earning stability based on: ✔ Bank statements (last 6-12 months) ✔ Invoices from clients or payment platforms ✔ Income tax returns (ITR) for the last 2 years

3.3. Apply for a Loan with a Co-Applicant

Gig workers can increase their approval chances by applying with a salaried spouse, sibling, or parent as a co-applicant. This adds financial security for the lender.

3.4. Choose a Secured Loan

If a gig worker struggles with approval, opting for a loan against gold, fixed deposits, or mutual funds ensures faster approval and lower interest rates.

4. Eligibility Criteria for Gig Workers Applying for a Personal Loan

While each lender has different requirements, the general eligibility criteria for gig workers include:

Age: 21 to 60 years

Minimum Income: ₹2-3 lakh per annum

Credit Score: 650+ for unsecured loans

Work Experience: At least 1 year of self-employment or freelance work

Banking Transactions: Consistent earnings through bank transfers, UPI, or digital wallets

Lenders may also check past repayment history and existing liabilities before approving the loan.

5. Documents Required for Gig Workers to Get a Personal Loan

Since gig workers do not have salary slips, they must provide alternative documents to prove income stability and financial credibility.

5.1. Identity & Address Proof

Aadhaar Card

PAN Card

Passport or Voter ID

Utility Bill (for address verification)

5.2. Income Proof

Bank statements (last 6-12 months) showing consistent income

Payment receipts from clients, gig platforms, or apps

Income Tax Returns (ITR) for last 2 years

Profit and Loss Statement (if applicable)

5.3. Additional Documents (if required by the lender)

GST registration certificate (for self-employed individuals)

Digital earnings report from PayPal, Razorpay, or UPI transactions

Collateral documents (for secured loans)

6. How to Apply for a Personal Loan as a Gig Worker?

Applying for a personal loan as a gig worker is simple and can be done online or offline. Follow these steps:

Step 1: Compare Loan Offers

Check interest rates, loan amounts, and repayment terms from multiple lenders to find the best deal.

Step 2: Check Eligibility

Ensure you meet the income, credit score, and banking history requirements.

Step 3: Gather Required Documents

Keep identity proof, bank statements, and income proof ready for submission.

Step 4: Submit Loan Application

Apply online through the lender’s website or visit the nearest bank branch to submit a physical application.

Step 5: Loan Disbursement

Once the application is approved, the loan amount is credited to your bank account within a few days.

Best Loan Options for Gig Workers

Even though gig workers face challenges in securing traditional personal loans, many banks and NBFCs now provide flexible loan options based on digital earnings, alternative income proof, and secured collateral.

By maintaining a high credit score, showing stable income, and applying with a co-applicant, gig workers can successfully secure a personal loan to meet their financial needs.

🔗 Apply for a Personal Loan Today:

Explore Personal Loans

With the rise of digital lending solutions, getting a personal loan as a gig worker has become easier than ever!

#finance#nbfc personal loan#personal loans#loan services#personal loan online#bank#fincrif#loan apps#personal laon#personal loan#Personal loan for gig workers#Freelancer personal loan#Loan options for self-employed individuals#Personal loan for independent contractors#How gig workers can get a personal loan#Best loans for gig economy workers#Unsecured loans for freelancers#Loan eligibility for gig workers#Self-employed loan approval#Instant loans for gig workers#Personal loan without salary slip#Gig worker financial assistance#Alternative income proof for personal loans#How to qualify for a loan as a freelancer#Digital lending for self-employed#Low-interest loans for independent workers#Best banks for freelancer loans#Personal loan approval for non-salaried individuals#Gig worker income verification for loans#Loan against digital earnings

0 notes